- BTC bulls are targeting $64K, eyeing $68K as the next resistance level.

- Can they overcome four days of failed attempts to push BTC above this key target?

Bitcoin [BTC] bulls are targeting the $64K mark, a key level last reached during the late August rally, making it a critical turning point.

To avoid repeating past downturns, bulls must counter any bearish pressure. If successful, the next resistance could materialize around $68K.

Bitcoin: Bull run hinges on $64K

Source : Coinalyze

The current cycle closely resembles the early August trend, with BTC rising to $64K after retracing below $55K. However, the 18-day surge then was marked by inconsistent bearish pressure.

In contrast, while this cycle shows more consistent green candles, the growth rate is less steady, causing volatility among stakeholders.

As a result, instead of rate cuts boosting bullish sentiment, ongoing volatility has kept BTC from retesting $64K, currently trading at $63,543 – marking the fourth straight day below this benchmark.

Additionally, this benchmark has been tested five times since March, when BTC reached its ATH of $73K. Notably, it was only in July that bulls prevented a pullback, pushing BTC to $68K.

Simply put, the $64K mark has been a crucial turning point for Bitcoin.

While volume indicators point to a bullish trend, the real challenge is whether other investors will back a breakout or if bears will once again block BTC’s ascent.

Current price may be out of reach

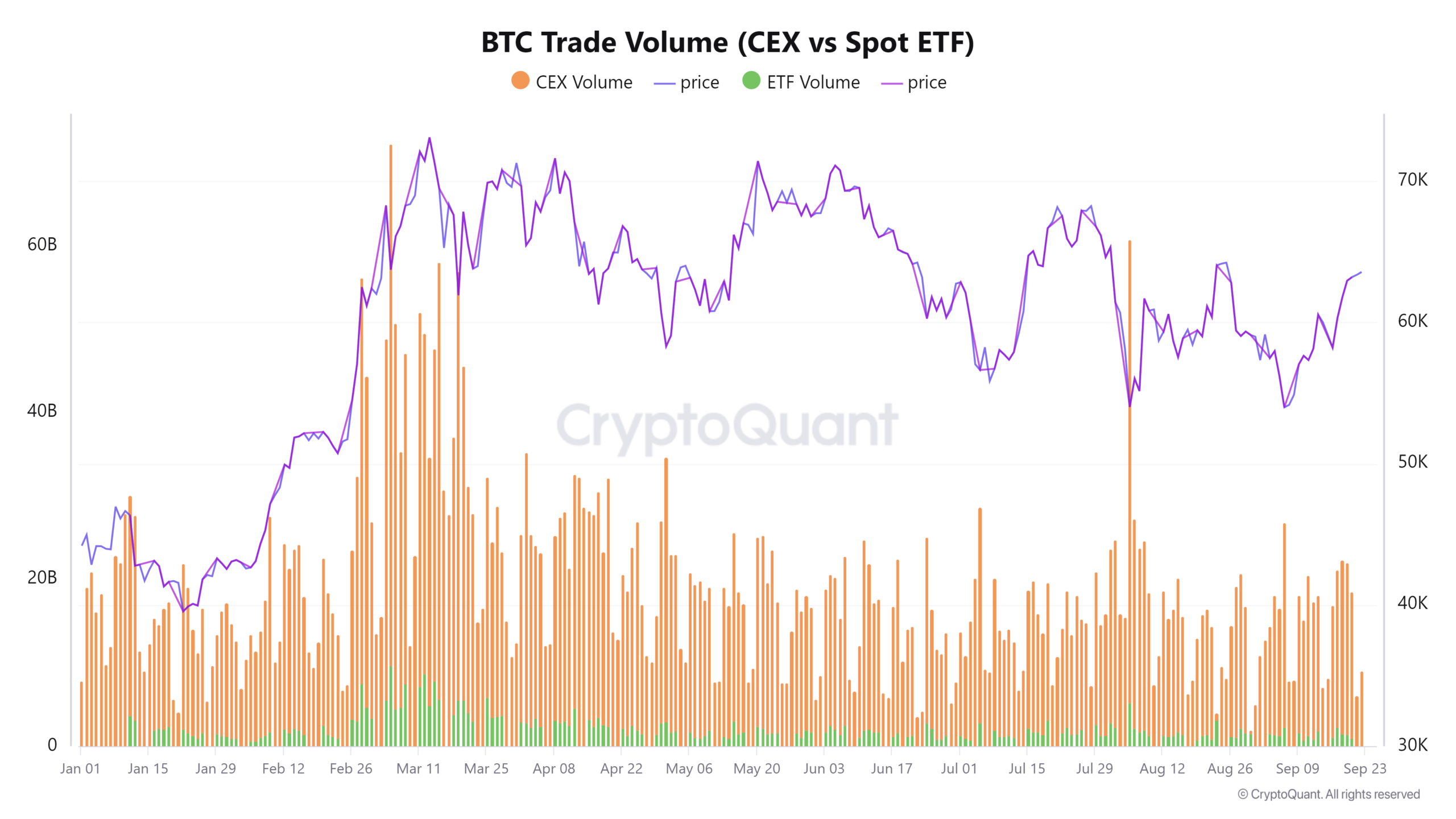

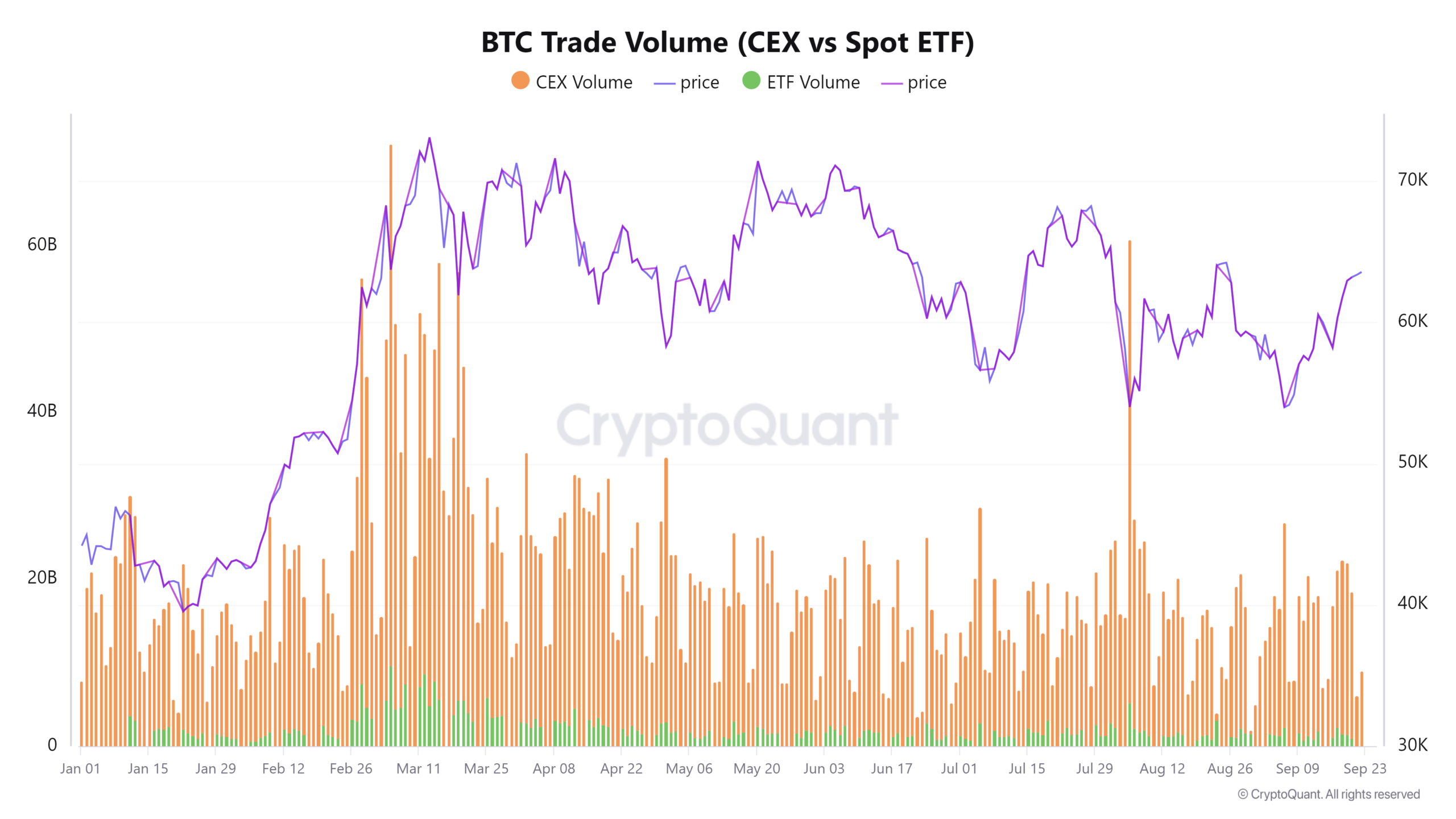

Over the past two days, BTC trading volume on CEXes has plunged from $17B to $6B. This sharp drop could amplify volatility, shaking investor confidence in a potential trend reversal.

The chart below might indicate a potential market top, often coinciding with reduced trading activity on CEXs.

Conversely, when exchange volumes spike during sharp BTC declines, it frequently presents an ideal dip-buying opportunity.

Source : CryptoQuant

Per AMBCrypto, reduced exchange activity might suggest two possibilities: either investors are cashing in on gains from the September cycle, or they are waiting for a dip to buy BTC at a lower price.

If this trend holds, it could certainly set the stage for a resurgence of positions shorting Bitcoin. Consequently, a chance at a breakout may falter. However,

There might still be hope

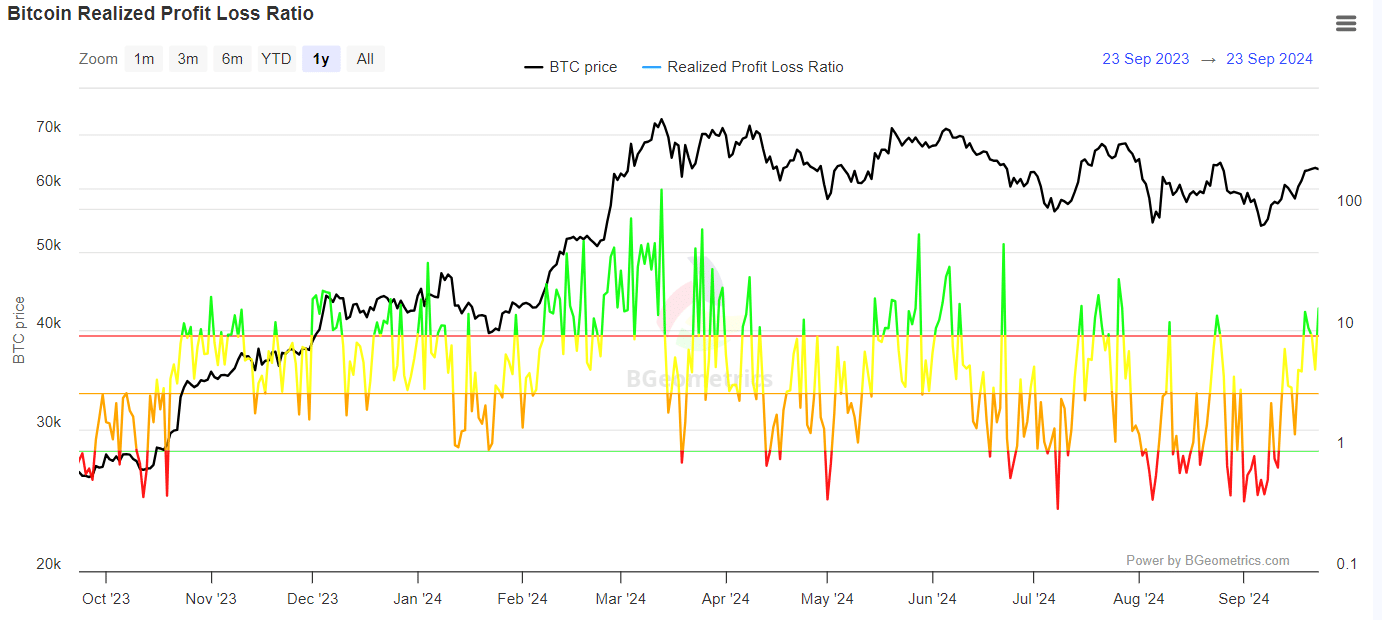

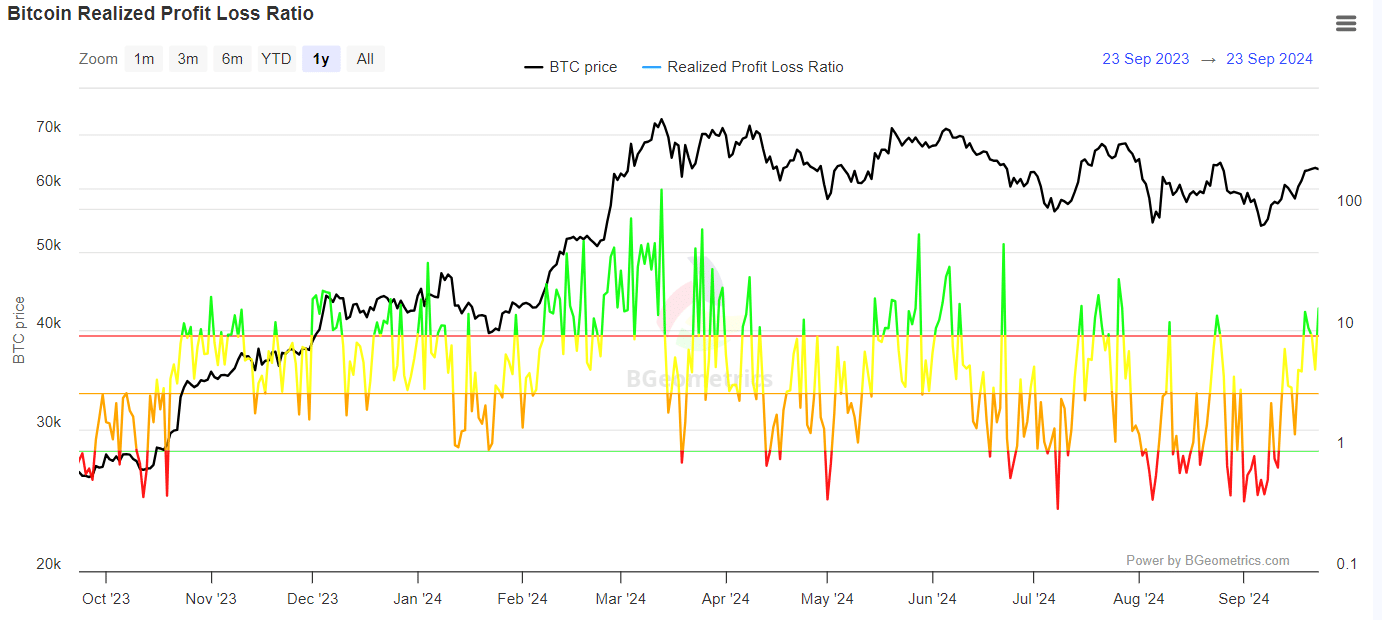

As the most volatile month comes to a close, the potential for “Uptober” could signal a bullish turning point for the market, a glimmer of hope illustrated in the chart below.

On the day Bitcoin experienced a minor 0.37% decline, the RPL ratio dropped, indicating losses. However, since then, a majority of transactions have occurred higher than the original acquisition price.

Source : BGeometrics

Adding to this analysis, large transaction volumes have surged, with transactions exceeding $100K seeing significant activity.

Clearly, bulls are pushing against the resistance that has held Bitcoin below the $64K benchmark. Currently, the sharp decline in CEX volume is reinforcing short dominance, acting as a barrier.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, if the market stabilizes, as evidenced by sellers realizing profits, FOMO could incentivize a longer-term commitment.

Ultimately, monitoring CEX volume alongside speculative market activity is crucial. Their dominance may push BTC back below $60K if unchecked.

- BTC bulls are targeting $64K, eyeing $68K as the next resistance level.

- Can they overcome four days of failed attempts to push BTC above this key target?

Bitcoin [BTC] bulls are targeting the $64K mark, a key level last reached during the late August rally, making it a critical turning point.

To avoid repeating past downturns, bulls must counter any bearish pressure. If successful, the next resistance could materialize around $68K.

Bitcoin: Bull run hinges on $64K

Source : Coinalyze

The current cycle closely resembles the early August trend, with BTC rising to $64K after retracing below $55K. However, the 18-day surge then was marked by inconsistent bearish pressure.

In contrast, while this cycle shows more consistent green candles, the growth rate is less steady, causing volatility among stakeholders.

As a result, instead of rate cuts boosting bullish sentiment, ongoing volatility has kept BTC from retesting $64K, currently trading at $63,543 – marking the fourth straight day below this benchmark.

Additionally, this benchmark has been tested five times since March, when BTC reached its ATH of $73K. Notably, it was only in July that bulls prevented a pullback, pushing BTC to $68K.

Simply put, the $64K mark has been a crucial turning point for Bitcoin.

While volume indicators point to a bullish trend, the real challenge is whether other investors will back a breakout or if bears will once again block BTC’s ascent.

Current price may be out of reach

Over the past two days, BTC trading volume on CEXes has plunged from $17B to $6B. This sharp drop could amplify volatility, shaking investor confidence in a potential trend reversal.

The chart below might indicate a potential market top, often coinciding with reduced trading activity on CEXs.

Conversely, when exchange volumes spike during sharp BTC declines, it frequently presents an ideal dip-buying opportunity.

Source : CryptoQuant

Per AMBCrypto, reduced exchange activity might suggest two possibilities: either investors are cashing in on gains from the September cycle, or they are waiting for a dip to buy BTC at a lower price.

If this trend holds, it could certainly set the stage for a resurgence of positions shorting Bitcoin. Consequently, a chance at a breakout may falter. However,

There might still be hope

As the most volatile month comes to a close, the potential for “Uptober” could signal a bullish turning point for the market, a glimmer of hope illustrated in the chart below.

On the day Bitcoin experienced a minor 0.37% decline, the RPL ratio dropped, indicating losses. However, since then, a majority of transactions have occurred higher than the original acquisition price.

Source : BGeometrics

Adding to this analysis, large transaction volumes have surged, with transactions exceeding $100K seeing significant activity.

Clearly, bulls are pushing against the resistance that has held Bitcoin below the $64K benchmark. Currently, the sharp decline in CEX volume is reinforcing short dominance, acting as a barrier.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, if the market stabilizes, as evidenced by sellers realizing profits, FOMO could incentivize a longer-term commitment.

Ultimately, monitoring CEX volume alongside speculative market activity is crucial. Their dominance may push BTC back below $60K if unchecked.

Its like you read my mind You appear to know so much about this like you wrote the book in it or something I think that you can do with a few pics to drive the message home a little bit but instead of that this is excellent blog A fantastic read Ill certainly be back

where can i get generic clomiphene tablets can i get generic clomid without rx can i get clomiphene without rx where can i buy clomid no prescription clomiphene cost australia get generic clomiphene for sale where can i get clomiphene

I couldn’t weather commenting. Profoundly written!

With thanks. Loads of conception!

order azithromycin without prescription – tinidazole 300mg cost buy flagyl without prescription

buy semaglutide sale – rybelsus cost buy periactin 4 mg without prescription

motilium online – cyclobenzaprine 15mg sale flexeril over the counter

augmentin 1000mg generic – atbioinfo purchase ampicillin online

order esomeprazole 20mg pill – anexamate.com nexium pills

coumadin 2mg price – https://coumamide.com/ losartan drug

meloxicam 7.5mg generic – https://moboxsin.com/ buy mobic paypal

buy ed medications – best ed pill can you buy ed pills online

cenforce 100mg for sale – https://cenforcers.com/ cenforce online order

cialis for sale online in canada – ciltad generic cialis brand no prescription 365

cialis online pharmacy australia – strong tadafl where to buy cialis over the counter

buy viagra at walgreens – sildenafil 100mg tablets generic viagra sale uk

This is the big-hearted of writing I truly appreciate. gabapentin 800mg ca

With thanks. Loads of erudition! https://prohnrg.com/product/get-allopurinol-pills/

The depth in this ruined is exceptional. https://aranitidine.com/fr/acheter-cialis-5mg/

I’ll certainly bring back to skim more. https://ondactone.com/spironolactone/

This is the gentle of scribble literary works I positively appreciate.

order colcrys 0.5mg online

This is a keynote which is virtually to my heart… Diverse thanks! Quite where can I find the connection details an eye to questions? http://shiftdelete.10tl.net/member.php?action=profile&uid=200429

order forxiga – how to get forxiga without a prescription buy dapagliflozin pills