- BTC’s 2024 post-halving rally is yet to start, says Capriole Investments executive.

- Market dynamics shifting towards a possible upside later in 2024, per analysts.

Bitcoin [BTC] is in its fourth month of range trading, stuck within $60k – $71k. After Q1 2024’s incredible performance of 68% gain, the cryptocurrency hasn’t seen significant gains.

In fact, it tanked 11% after the halving event in Q2 of 2024 and has only recovered 6% in Q3 so far.

Post-halving BTC gains still likely?

Overall, BTC was up 9% since the April halving event. However, the digital asset was yet to see its parabolic rally, which is typical of post-halving events in the past.

This outlook was according to Charles Edwards, founder of crypto hedge fund Capriole Investments.

‘This Bitcoin cycle hasn’t even started yet’

Source: X/Charles Edwards

Unlike the current single-digit gain, past-halving saw BTC record triple-digit rallies after the halving event.

According to the attached chart from Capriole Investments, BTC rallied 630% after the 2020 halving event. In 2016 and 2012, the assets jumped 1,400% and 5,500%, respectively.

A similar and earnest start of 2024’s parabolic run could start in September, per some analysts.

In fact, Coinbase and JPMorgan analysts have cautioned that the recent rally above $67K might not be sustainable.

In short, the recent rally might not be the start of the much-awaited post-halving parabolic run.

Whale demand for Bitcoin surge

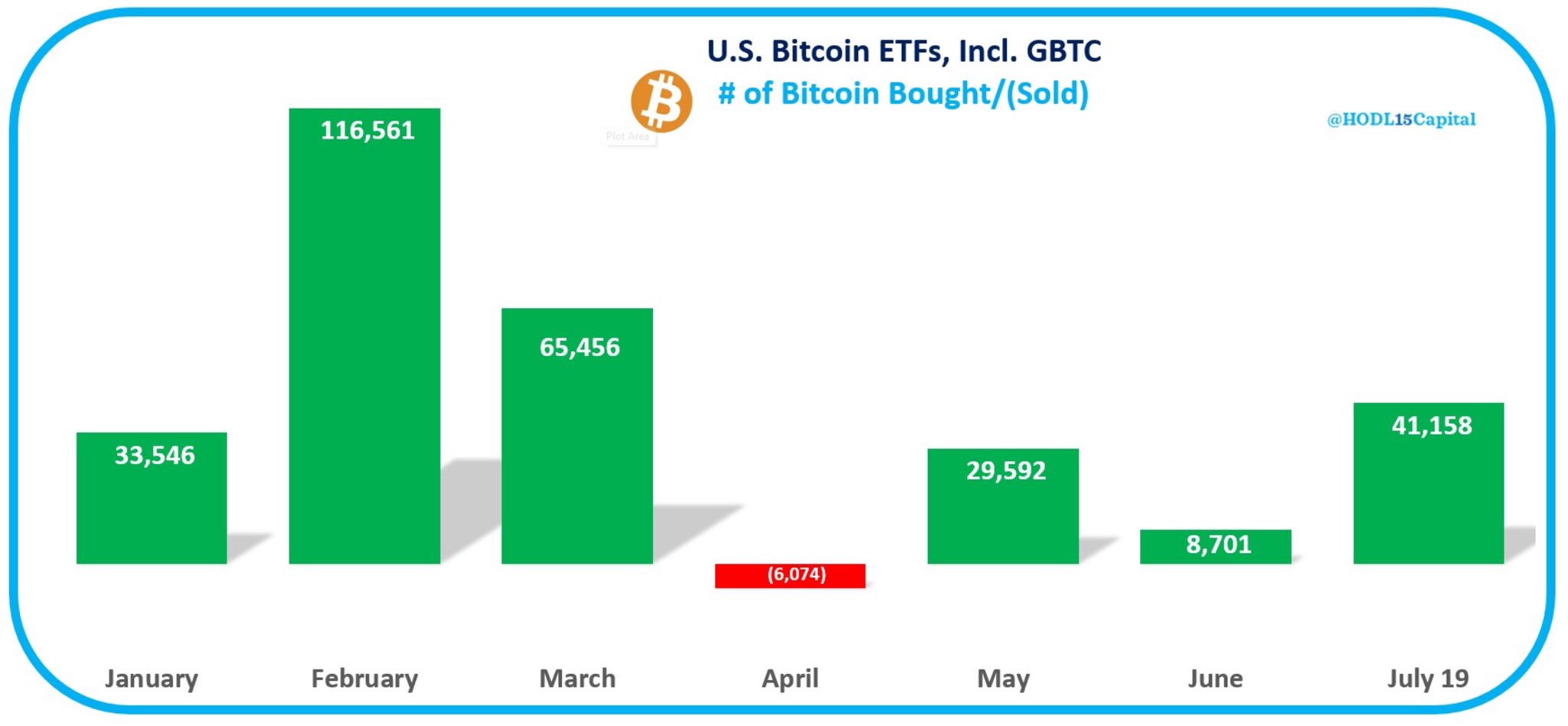

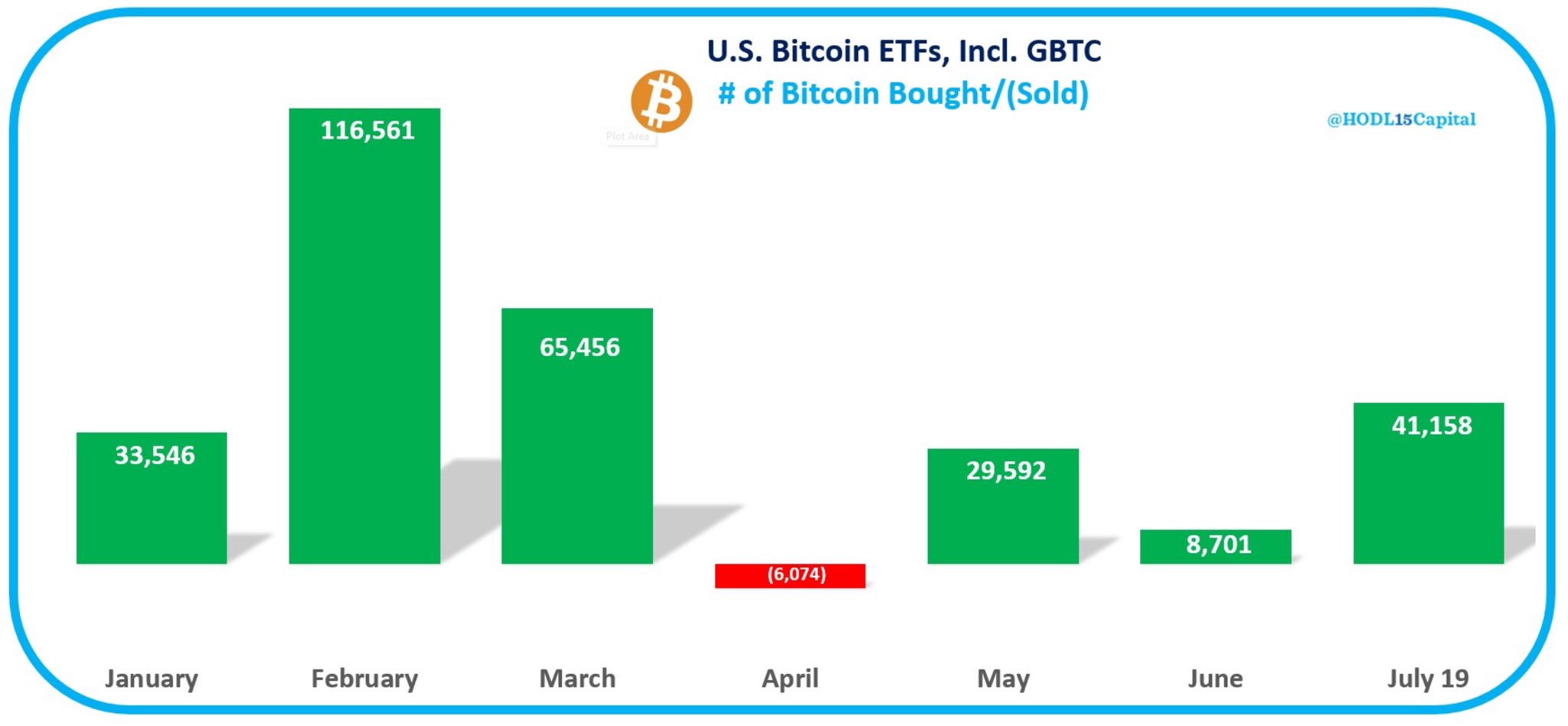

Meanwhile, demand from US spot BTC ETFs has picked up pace. The products accumulated +41K BTC in the first three weeks of July. This accumulation spree, led by BlackRock, has since tipped YTD (year-to-date) net flows of BTC ETFs to cross $17 billion.

Source: X/HOLD15 Capital

This has also pushed Bitcoin whales to a two-year high. Additionally, the overall BTC short-positions in the Chicago Mercantile Exchange (CME) have reduced significantly.

Reacting to the decline in overall CME futures short positions, CryptoQuant founder Ki Young Ju said,

‘Open interest for both long and short positions has increased, but it’s net negative. We’re less negative now, similar to the levels 10 months ago when BTC price was $27K.’

This could be another set-up for an explosive run for BTC, especially if Mt. Gox supply pressure is cleared.

In such a likely bullish scenario, market analyst Stockmoney Lizards suggested that BTC could hit $90K by Fall 2024.

Source: X/Stockmoney Lizards

- BTC’s 2024 post-halving rally is yet to start, says Capriole Investments executive.

- Market dynamics shifting towards a possible upside later in 2024, per analysts.

Bitcoin [BTC] is in its fourth month of range trading, stuck within $60k – $71k. After Q1 2024’s incredible performance of 68% gain, the cryptocurrency hasn’t seen significant gains.

In fact, it tanked 11% after the halving event in Q2 of 2024 and has only recovered 6% in Q3 so far.

Post-halving BTC gains still likely?

Overall, BTC was up 9% since the April halving event. However, the digital asset was yet to see its parabolic rally, which is typical of post-halving events in the past.

This outlook was according to Charles Edwards, founder of crypto hedge fund Capriole Investments.

‘This Bitcoin cycle hasn’t even started yet’

Source: X/Charles Edwards

Unlike the current single-digit gain, past-halving saw BTC record triple-digit rallies after the halving event.

According to the attached chart from Capriole Investments, BTC rallied 630% after the 2020 halving event. In 2016 and 2012, the assets jumped 1,400% and 5,500%, respectively.

A similar and earnest start of 2024’s parabolic run could start in September, per some analysts.

In fact, Coinbase and JPMorgan analysts have cautioned that the recent rally above $67K might not be sustainable.

In short, the recent rally might not be the start of the much-awaited post-halving parabolic run.

Whale demand for Bitcoin surge

Meanwhile, demand from US spot BTC ETFs has picked up pace. The products accumulated +41K BTC in the first three weeks of July. This accumulation spree, led by BlackRock, has since tipped YTD (year-to-date) net flows of BTC ETFs to cross $17 billion.

Source: X/HOLD15 Capital

This has also pushed Bitcoin whales to a two-year high. Additionally, the overall BTC short-positions in the Chicago Mercantile Exchange (CME) have reduced significantly.

Reacting to the decline in overall CME futures short positions, CryptoQuant founder Ki Young Ju said,

‘Open interest for both long and short positions has increased, but it’s net negative. We’re less negative now, similar to the levels 10 months ago when BTC price was $27K.’

This could be another set-up for an explosive run for BTC, especially if Mt. Gox supply pressure is cleared.

In such a likely bullish scenario, market analyst Stockmoney Lizards suggested that BTC could hit $90K by Fall 2024.

Source: X/Stockmoney Lizards

clomid tablets for sale clomiphene price where to buy clomiphene without prescription buying clomid pill how to get clomid price can you buy clomiphene online buying cheap clomiphene tablets

This is the make of delivery I unearth helpful.

Thanks recompense sharing. It’s top quality.

azithromycin ca – tetracycline order cost metronidazole 200mg

purchase semaglutide pill – purchase rybelsus online cheap cyproheptadine oral

order motilium 10mg – motilium buy online order flexeril pills

amoxiclav cheap – atbioinfo acillin without prescription

esomeprazole 20mg pills – nexiumtous buy esomeprazole 20mg pill

oral warfarin 5mg – coumamide.com cozaar 25mg tablet

how to buy mobic – https://moboxsin.com/ meloxicam brand

purchase prednisone online – https://apreplson.com/ prednisone 20mg cost

generic ed drugs – https://fastedtotake.com/ buy ed pills online

cheap amoxil for sale – comba moxi order amoxil generic

fluconazole 100mg drug – https://gpdifluca.com/ generic diflucan 100mg

cheap cenforce 100mg – https://cenforcers.com/ cenforce pill

price of cialis in pakistan – https://ciltadgn.com/# tadalafil best price 20 mg

cialis by mail – https://strongtadafl.com/# mantra 10 tadalafil tablets

zantac online order – online ranitidine 300mg usa

More posts like this would add up to the online time more useful. https://gnolvade.com/

This is the kind of topic I take advantage of reading. https://ursxdol.com/propecia-tablets-online/

I am in fact thrilled to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks object of providing such data. https://prohnrg.com/product/loratadine-10-mg-tablets/

This website exceedingly has all of the tidings and facts I needed adjacent to this case and didn’t identify who to ask. https://aranitidine.com/fr/modalert-en-france/