- Both short and long positions fell victim as BTC swung up and down.

- The Liquidation Heatmap showed that Bitcoin might face no hindrance in hitting $70,000.

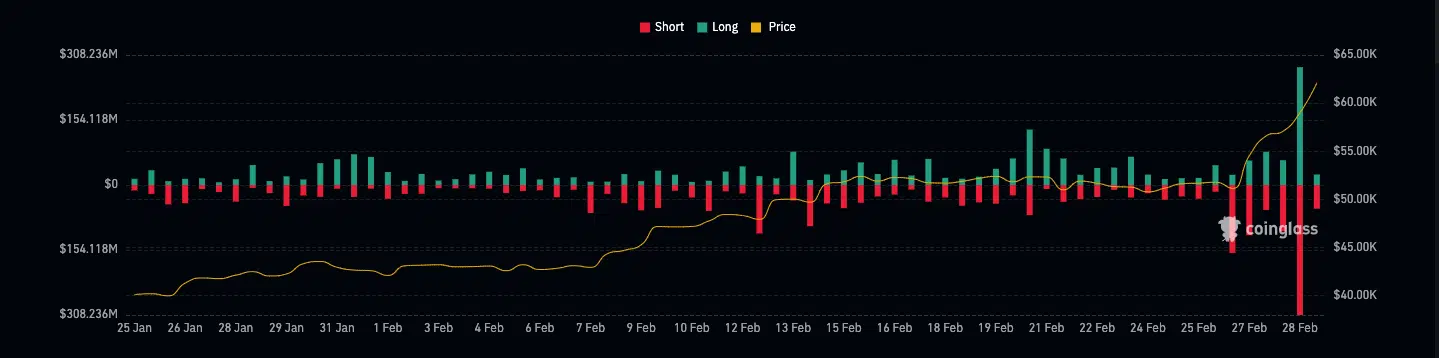

If you held a short position in the market, there is a high chance you are part of 79,700 traders who have seen their funds wiped out in the last 24 hours. This happened because Bitcoin’s [BTC] price flipped past $64,000 on the 28th of February. Moments later, the price of the coin plunged below the $60,000 threshold.

From Coinglass data, AMBCrypto observed that the total amount of liquidation was over $790 million. Out of this, short positions accounted for $438 million while long liquidations were around $352 million.

The road beyond $69,000 may be here

Furthermore, the derivatives information portal revealed that Bitcoin liquidations were worth $298.98 million. Ethereum [ETH], whose price had surged above $3,300 registered $126.83 million in the wipeout.

For those unfamiliar, liquidation occurs when a trader’s leveraged position is automatically closed. This often occurs because the trader can no longer satisfy the margin requirements.

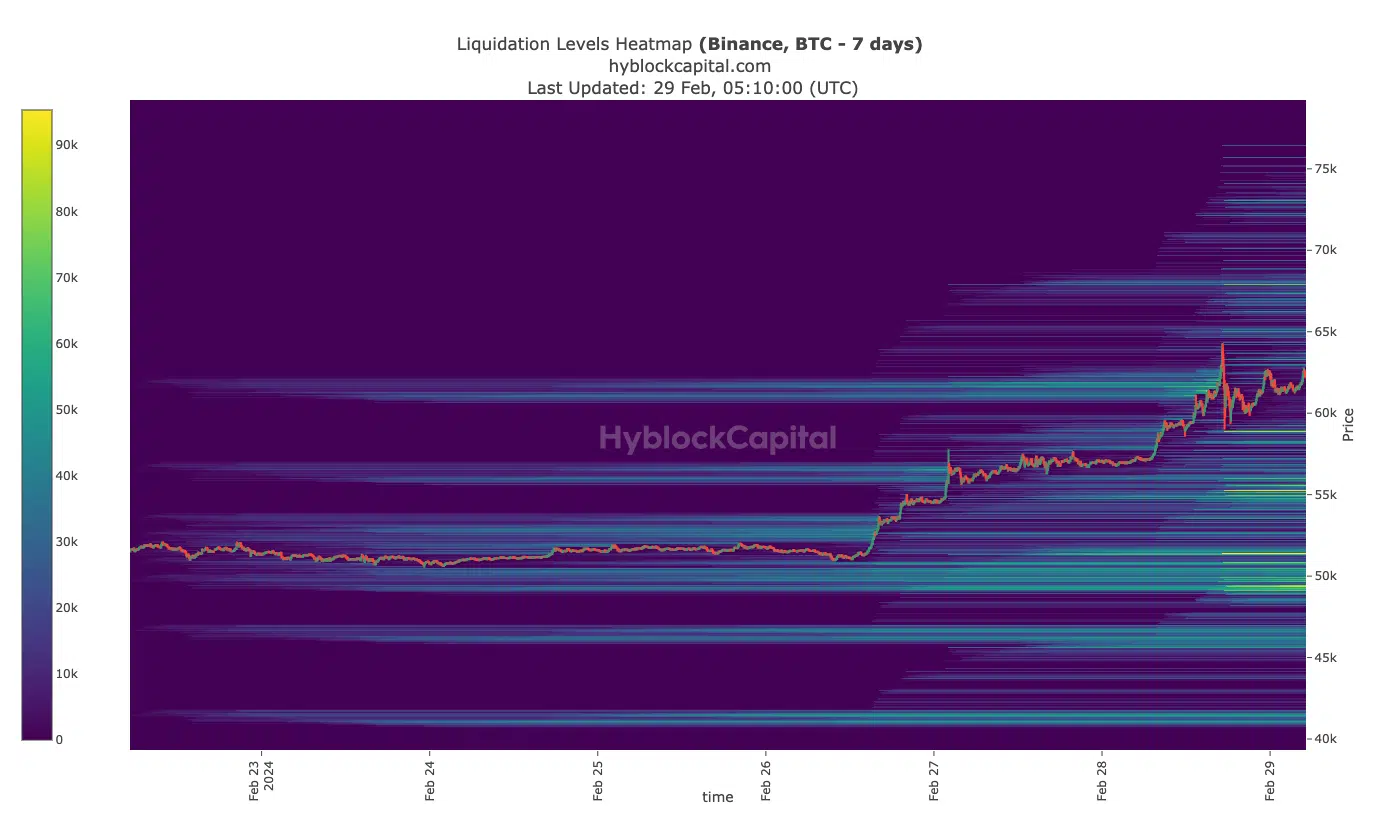

If Bitcoin’s price continues to increase, more positions could be liquidated. AMBCrypto checked the Liquidation Heatmap to ascertain the chance of a rise.

The Liquidation Heatmap could also show the possible prices where positions could face another round of wipeouts. According to our analysis using HyblockCapital’s data, Bitcoin’s price could rise to $75,000 within the next few weeks.

In addition, the indicator revealed no major resistance along that path. However, if Bitcoin hits $70,000, many short positions between $49,000 and $56,000 could face liquidation.

Bears are almost non-existent

On the daily timeframe, bulls held on the solid support at $55,450. However, in the run to $64,000, Bitcoin experienced a minor resistance at $57,395. However, buying pressure helped in clearing the path.

AMBCrypto observed that BTC registered a 15.01% increase between the solid support and its rise to $61,837.

In terms of the price potential, the Directional Movement Index (DMI) projected a further increase for the coin. At press time, the +DMI (green) was 39.34. The -DMI (red), on the other hand, was 2.62.

The difference in the indicators was proof that bears have been pegged back and might have no chance of tugging BTC back.

Furthermore, the Average Directional Index (ADX) reading was 57.82. The ADX (yellow) shows if the direction movement is strong or weak.

If the ADX reading is less than 25, it suggests a weak directional movement. Therefore, the high ADX alongside Bitcoin’s rising price suggests that the coin might hit a higher value soon.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Should buying pressure continue like it has in the last few days, BTC could surpass the $69,000.

However, if bearish forces get a share of the market dominance, Bitcoin’s price could slide to $55,000. But in the current market condition, the indicators favor an upswing.

- Both short and long positions fell victim as BTC swung up and down.

- The Liquidation Heatmap showed that Bitcoin might face no hindrance in hitting $70,000.

If you held a short position in the market, there is a high chance you are part of 79,700 traders who have seen their funds wiped out in the last 24 hours. This happened because Bitcoin’s [BTC] price flipped past $64,000 on the 28th of February. Moments later, the price of the coin plunged below the $60,000 threshold.

From Coinglass data, AMBCrypto observed that the total amount of liquidation was over $790 million. Out of this, short positions accounted for $438 million while long liquidations were around $352 million.

The road beyond $69,000 may be here

Furthermore, the derivatives information portal revealed that Bitcoin liquidations were worth $298.98 million. Ethereum [ETH], whose price had surged above $3,300 registered $126.83 million in the wipeout.

For those unfamiliar, liquidation occurs when a trader’s leveraged position is automatically closed. This often occurs because the trader can no longer satisfy the margin requirements.

If Bitcoin’s price continues to increase, more positions could be liquidated. AMBCrypto checked the Liquidation Heatmap to ascertain the chance of a rise.

The Liquidation Heatmap could also show the possible prices where positions could face another round of wipeouts. According to our analysis using HyblockCapital’s data, Bitcoin’s price could rise to $75,000 within the next few weeks.

In addition, the indicator revealed no major resistance along that path. However, if Bitcoin hits $70,000, many short positions between $49,000 and $56,000 could face liquidation.

Bears are almost non-existent

On the daily timeframe, bulls held on the solid support at $55,450. However, in the run to $64,000, Bitcoin experienced a minor resistance at $57,395. However, buying pressure helped in clearing the path.

AMBCrypto observed that BTC registered a 15.01% increase between the solid support and its rise to $61,837.

In terms of the price potential, the Directional Movement Index (DMI) projected a further increase for the coin. At press time, the +DMI (green) was 39.34. The -DMI (red), on the other hand, was 2.62.

The difference in the indicators was proof that bears have been pegged back and might have no chance of tugging BTC back.

Furthermore, the Average Directional Index (ADX) reading was 57.82. The ADX (yellow) shows if the direction movement is strong or weak.

If the ADX reading is less than 25, it suggests a weak directional movement. Therefore, the high ADX alongside Bitcoin’s rising price suggests that the coin might hit a higher value soon.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Should buying pressure continue like it has in the last few days, BTC could surpass the $69,000.

However, if bearish forces get a share of the market dominance, Bitcoin’s price could slide to $55,000. But in the current market condition, the indicators favor an upswing.

Your article helped me a lot, is there any more related content? Thanks!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

clomiphene bula homem how to get cheap clomid no prescription how can i get cheap clomiphene without prescription where to get clomiphene without prescription clomid tablets cost of clomiphene at cvs order clomid without a prescription

More posts like this would persuade the online time more useful.

https://548qaz.com

More posts like this would create the online time more useful.

motilium online order – buy generic domperidone online buy cyclobenzaprine 15mg for sale

buy generic propranolol for sale – plavix 150mg brand order methotrexate 2.5mg online cheap

buy generic augmentin 625mg – atbioinfo buy acillin online cheap

esomeprazole 20mg canada – https://anexamate.com/ where can i buy nexium

buy coumadin 2mg for sale – https://coumamide.com/ hyzaar price

prednisone 5mg generic – https://apreplson.com/ buy cheap prednisone

ed pills that really work – fast ed to take site buy ed pills canada

purchase amoxicillin sale – buy generic amoxil purchase amoxil online cheap

https://coins-de.com/

order diflucan 200mg online – buy forcan for sale buy fluconazole 200mg online cheap

cenforce 50mg without prescription – https://cenforcers.com/ cenforce 50mg brand

pastillas cialis – site order cialis no prescription

buy ranitidine 150mg online – online order ranitidine 300mg pills

tadalafil cialis – https://strongtadafl.com/ vidalista tadalafil reviews

This is the amicable of content I take advantage of reading. nolvadex order

buy viagra usa – https://strongvpls.com/ viagra 50 mg street price

The reconditeness in this tune is exceptional. https://buyfastonl.com/isotretinoin.html

I’ll certainly return to read more. https://prohnrg.com/product/lisinopril-5-mg/

Greetings! Extremely useful par‘nesis within this article! It’s the crumb changes which choice espy the largest changes. Thanks a quantity towards sharing! site