- BTC will explode after the Fed rate cut, according to Kiyosaki.

- The author believed money would flee bonds and other assets to BTC, gold and silver.

The much-awaited Fed pivot event will happen this week, and market pundits have been upbeat lately. The US FOMC (Federal Open Money Committee) is expected to begin its easing cycle on 18th September.

According to Robert Kiyosaki, the author of “Rich Dad Poor Dad,” the Fed pivot will benefit Bitcoin [BTC] and gold. He said,

‘Bitcoin, gold, silver prices about to EXPLODE…When Fed PIVOTS and real assets go up in price, as fake money leaves fake assets such as US bonds, fleeing to real assets such as real estate, gold, silver, and Bitcoin.”

Inflation to rally BTC?

Kiyosaki further urged his followers to buy more BTC before the Fed begins its easing cycle.

“Buy some (more) gold, silver, or Bitcoin…before the Fed pivots and drops interest rates.”

This will be the first rate cut in four years, and market observers will have primed risk assets for potential wins. However, Kiyosaki has previously stated BTC and other real assets will benefit even more because of unsustainable US debts.

On September 13th, Kiyosaki cautioned that the unsustainable US debts can’t be solved no matter who wins the US elections. He stated that the dollar was trash and people were better off saving in Bitcoin and gold than the dollar.

“The dollar is trash. Stop saving dollars, fake money….& start saving gold, silver, & Bitcoin….real money.”

Galaxy’s Mike Novogratz echoed a similar sentiment in March. According to Novogratz, BTC would appreciate as US debts continue to grow at $1 trillion per 100 days.

In short, money inflation will dent the dollar’s value, forcing users to seek alternatives like gold, BTC, or silver. This massive inflation could quickly push BTC to $10 million per coin, noted the author in a July price projection.

In the meantime, BTC was back to $60K after two weeks of struggling below the psychological level.

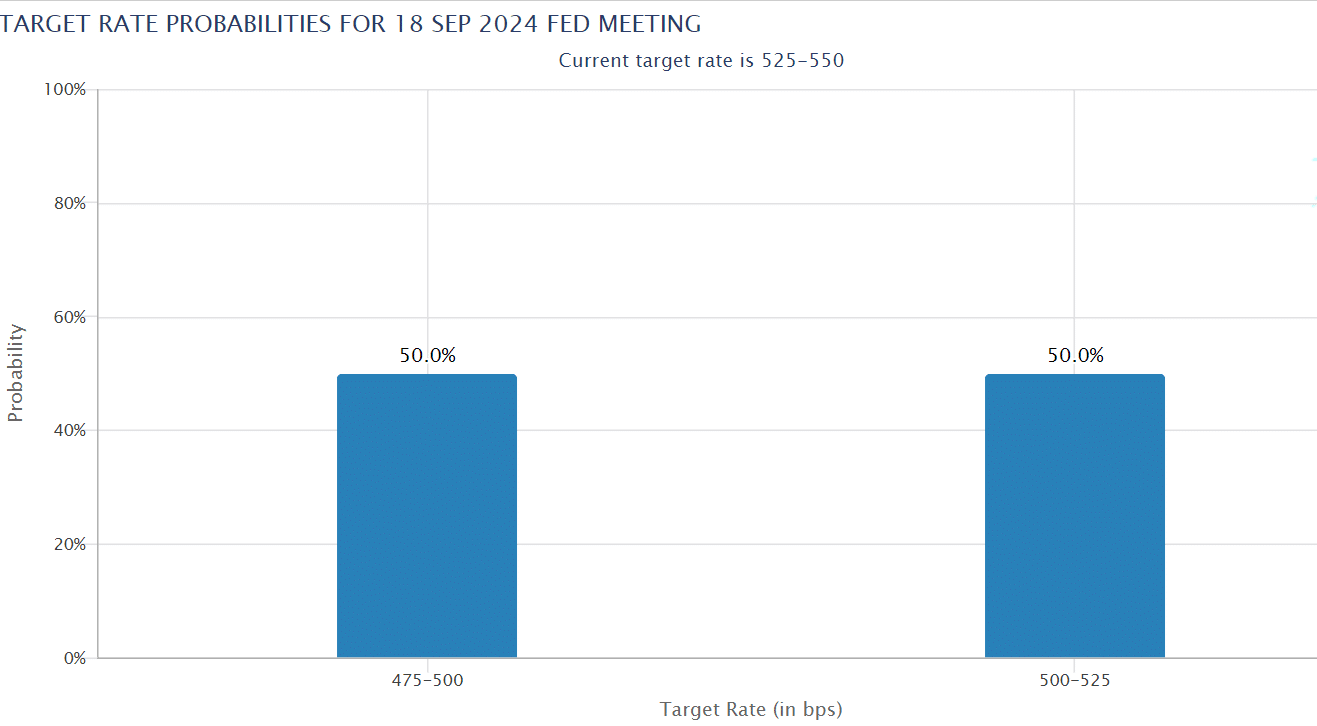

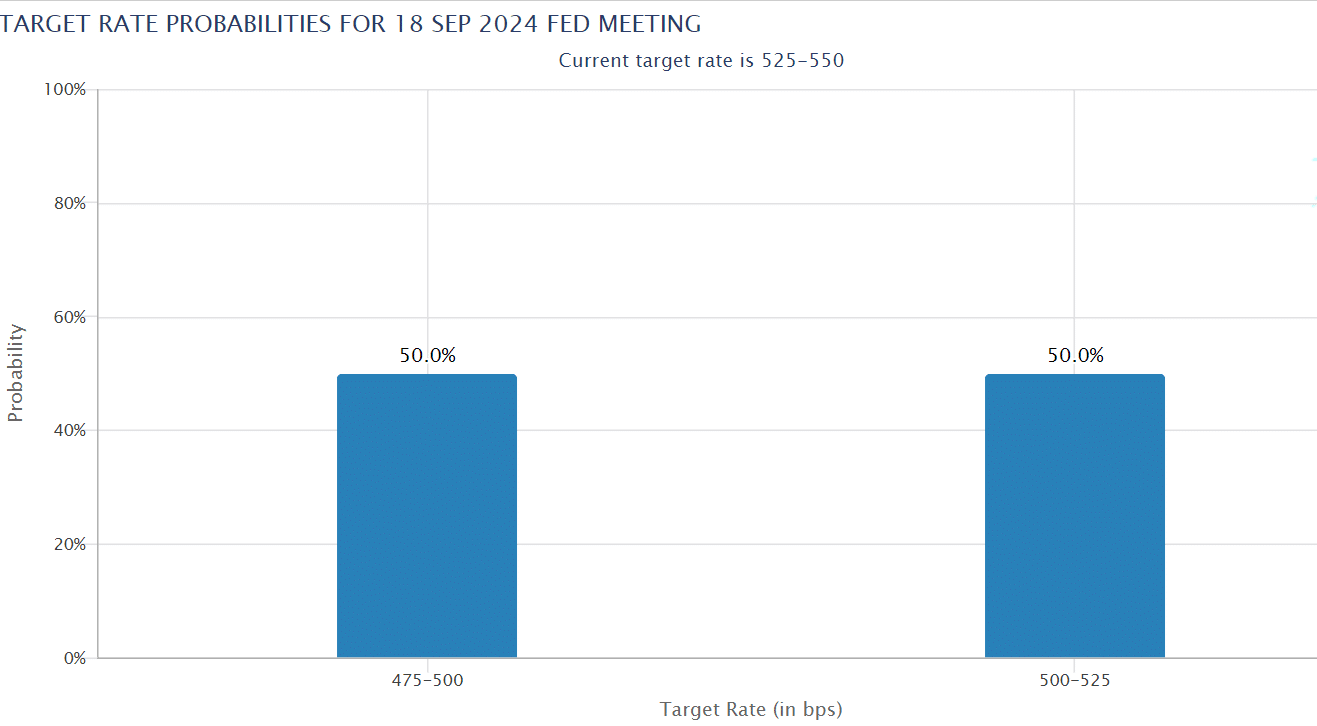

After last week’s US economic data, the markets were pricing a 50/50 chance of a 25/50 bps (basis point) Fed rate cut. How the market will react to the Fed’s pivot in the short term remains to be seen.

Source: CME FedWatch

- BTC will explode after the Fed rate cut, according to Kiyosaki.

- The author believed money would flee bonds and other assets to BTC, gold and silver.

The much-awaited Fed pivot event will happen this week, and market pundits have been upbeat lately. The US FOMC (Federal Open Money Committee) is expected to begin its easing cycle on 18th September.

According to Robert Kiyosaki, the author of “Rich Dad Poor Dad,” the Fed pivot will benefit Bitcoin [BTC] and gold. He said,

‘Bitcoin, gold, silver prices about to EXPLODE…When Fed PIVOTS and real assets go up in price, as fake money leaves fake assets such as US bonds, fleeing to real assets such as real estate, gold, silver, and Bitcoin.”

Inflation to rally BTC?

Kiyosaki further urged his followers to buy more BTC before the Fed begins its easing cycle.

“Buy some (more) gold, silver, or Bitcoin…before the Fed pivots and drops interest rates.”

This will be the first rate cut in four years, and market observers will have primed risk assets for potential wins. However, Kiyosaki has previously stated BTC and other real assets will benefit even more because of unsustainable US debts.

On September 13th, Kiyosaki cautioned that the unsustainable US debts can’t be solved no matter who wins the US elections. He stated that the dollar was trash and people were better off saving in Bitcoin and gold than the dollar.

“The dollar is trash. Stop saving dollars, fake money….& start saving gold, silver, & Bitcoin….real money.”

Galaxy’s Mike Novogratz echoed a similar sentiment in March. According to Novogratz, BTC would appreciate as US debts continue to grow at $1 trillion per 100 days.

In short, money inflation will dent the dollar’s value, forcing users to seek alternatives like gold, BTC, or silver. This massive inflation could quickly push BTC to $10 million per coin, noted the author in a July price projection.

In the meantime, BTC was back to $60K after two weeks of struggling below the psychological level.

After last week’s US economic data, the markets were pricing a 50/50 chance of a 25/50 bps (basis point) Fed rate cut. How the market will react to the Fed’s pivot in the short term remains to be seen.

Source: CME FedWatch

buy clomid without dr prescription how to get clomid order clomid pills where can i buy cheap clomiphene without dr prescription generic clomid without prescription clomid tablet price order generic clomiphene without rxРіРѕРІРѕСЂРёС‚:

This is a question which is virtually to my fundamentals… Many thanks! Quite where can I lay one’s hands on the acquaintance details an eye to questions?

This is a theme which is in to my fundamentals… Myriad thanks! Unerringly where can I lay one’s hands on the acquaintance details an eye to questions?

azithromycin uk – where to buy sumycin without a prescription purchase flagyl generic

purchase rybelsus sale – order periactin 4mg online cyproheptadine 4 mg usa

buy domperidone medication – buy motilium generic flexeril 15mg drug

cheap augmentin 375mg – atbioinfo buy ampicillin paypal

esomeprazole 40mg ca – https://anexamate.com/ order nexium 40mg generic

coumadin 2mg without prescription – https://coumamide.com/ buy hyzaar generic

order meloxicam 15mg for sale – https://moboxsin.com/ cost mobic 15mg

order prednisone 5mg pill – corticosteroid prednisone 40mg without prescription

ed pills cheap – https://fastedtotake.com/ where to buy otc ed pills

amoxicillin ca – combamoxi.com buy cheap amoxil

diflucan price – click order generic fluconazole 200mg

cenforce medication – cenforcers.com cenforce 100mg pills

what is the use of tadalafil tablets – https://ciltadgn.com/# what is the cost of cialis

purchase cialis online – click generic cialis super active tadalafil 20mg

zantac ca – https://aranitidine.com/# buy zantac 300mg pills

sildenafil 50 mg coupon – 100 mg viagra cost viagra women sale online

This is a question which is forthcoming to my heart… Numberless thanks! Unerringly where can I lay one’s hands on the contact details in the course of questions? site

This is the tolerant of advise I unearth helpful. order zithromax

More content pieces like this would create the интернет better. https://ursxdol.com/provigil-gn-pill-cnt/

I am in fact thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://prohnrg.com/product/atenolol-50-mg-online/

This is the stripe of content I take advantage of reading. https://aranitidine.com/fr/acheter-cialis-5mg/

More articles like this would frame the blogosphere richer. https://ondactone.com/spironolactone/