- There have been significant fluctuations in Bitcoin’s long-term holders’ profits.

- BTC has remained at the $57,000 price level.

Long-term holders of Bitcoin [BTC] are currently in a challenging position with their holdings. However, this trend could present a significant accumulation opportunity for other investors.

Bitcoin SOPR hit low points

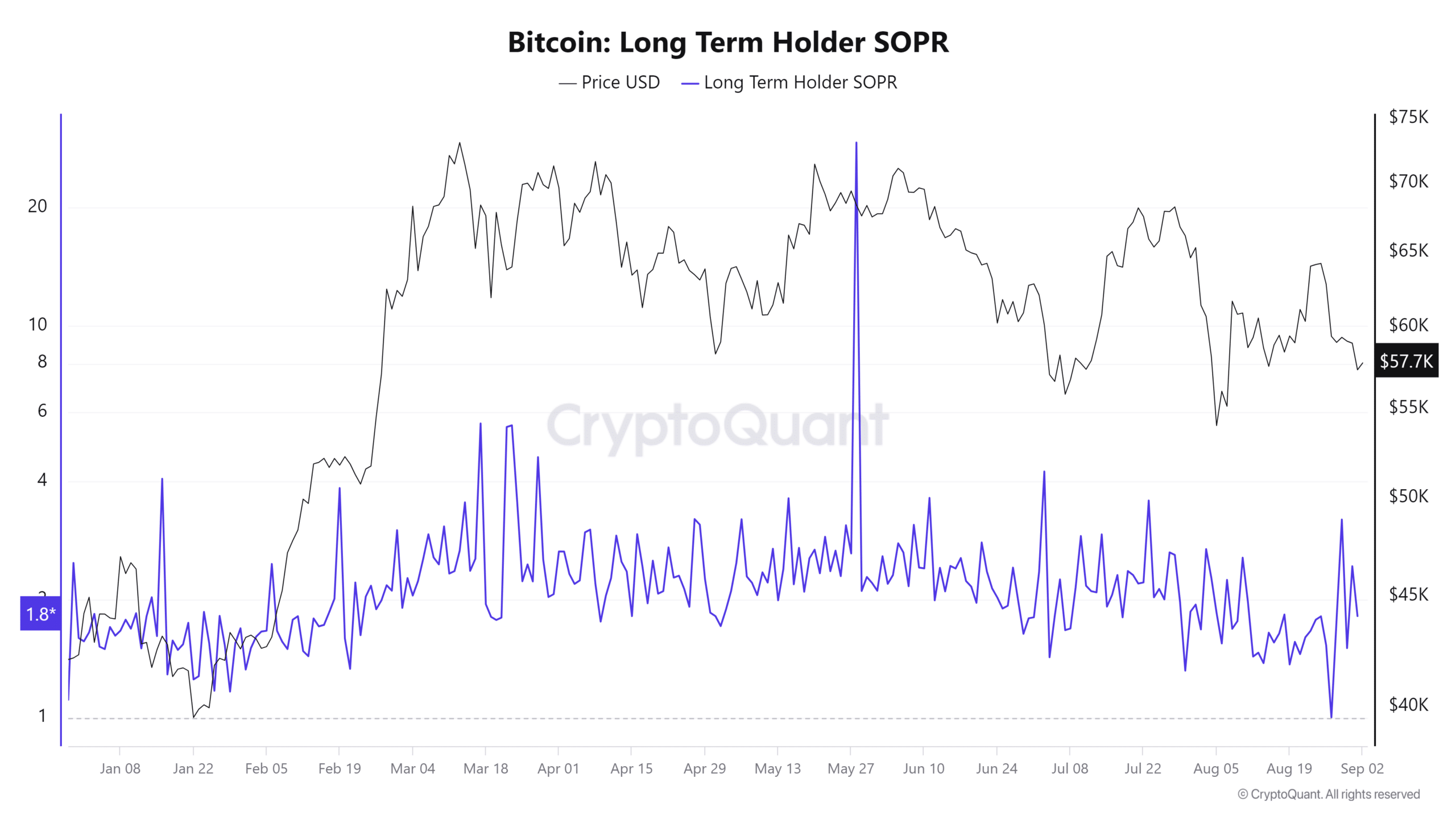

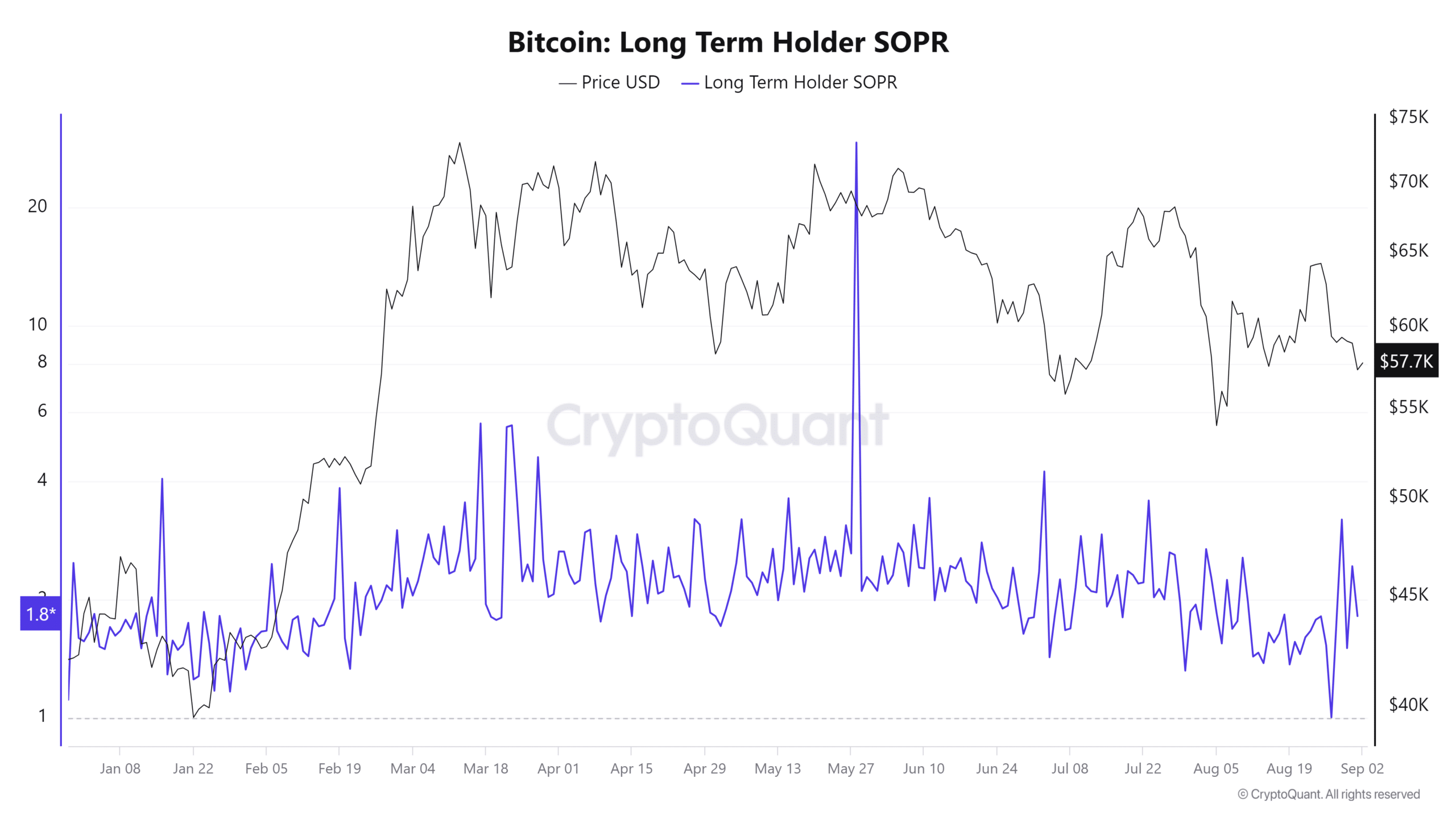

AMBCrypto’s analysis of the Long-Term Holder (LTH) Spent Output Profit Ratio (SOPR) on CryptoQuant revealed that Bitcoin was priced at around $57.7K at press time. Also, the LTH SOPR showed relatively low values.

The low LTH SOPR is significant because it indicates that these holders are not realizing substantial profits from their sales.

Instead, they might be liquidating their positions due to concerns about future price declines or in response to market uncertainty.

If this trend continues and more long-term holders decide to sell, it could contribute to further downward pressure on Bitcoin’s price.

Source: CryptoQuant

The SOPR (Spent Output Profit Ratio) is key for understanding the profitability of Bitcoin sales. Specifically, the LTH SOPR focuses on coins held for an extended period, typically more than 155 days.

A SOPR value above one indicates that long-term holders are selling at a profit. In contrast, a value below one suggests selling at a loss.

The low SOPR value for long-term holders highlights that these participants are not capitalizing on significant gains and may be selling due to concerns about the market’s near-term prospects.

This could be a bearish signal, suggesting that these holders are now uncertain about its immediate price direction.

What this means for Bitcoin

The low LTH SOPR indicates that long-term Bitcoin holders are not realizing significant profits and may be reducing their positions.

If this trend persists, the LTH SOPR hovering around or below one could lead to continued downward pressure on Bitcoin’s price. This could signal a period of further declines as the market processes these sales.

However, such a scenario also presents a potential accumulation opportunity for those looking to enter the market at lower prices.

Historically, periods where the SOPR remains low have sometimes been followed by market recoveries. Investors take advantage of the reduced prices to accumulate more Bitcoin.

A recent example of this type of accumulation is observed in the actions of a whale address.

Data from Spot on Chain shows that this whale purchased 1,000 BTC, worth approximately $57 million when Bitcoin’s price hit bottom.

Also, the same whale reportedly deposited 7,790 BTC, valued at $467 million, when the price dropped by approximately 14% some months back.

The current state of BTC

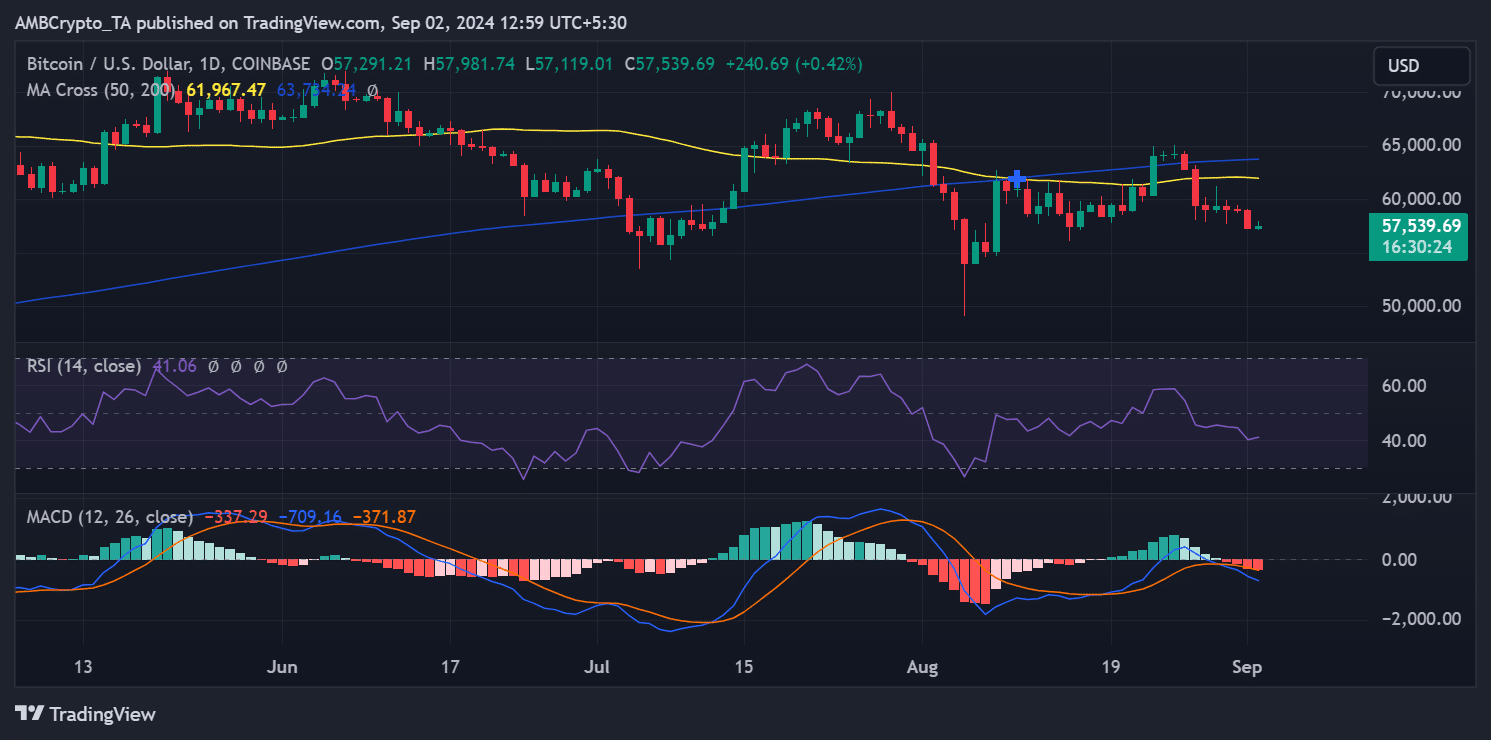

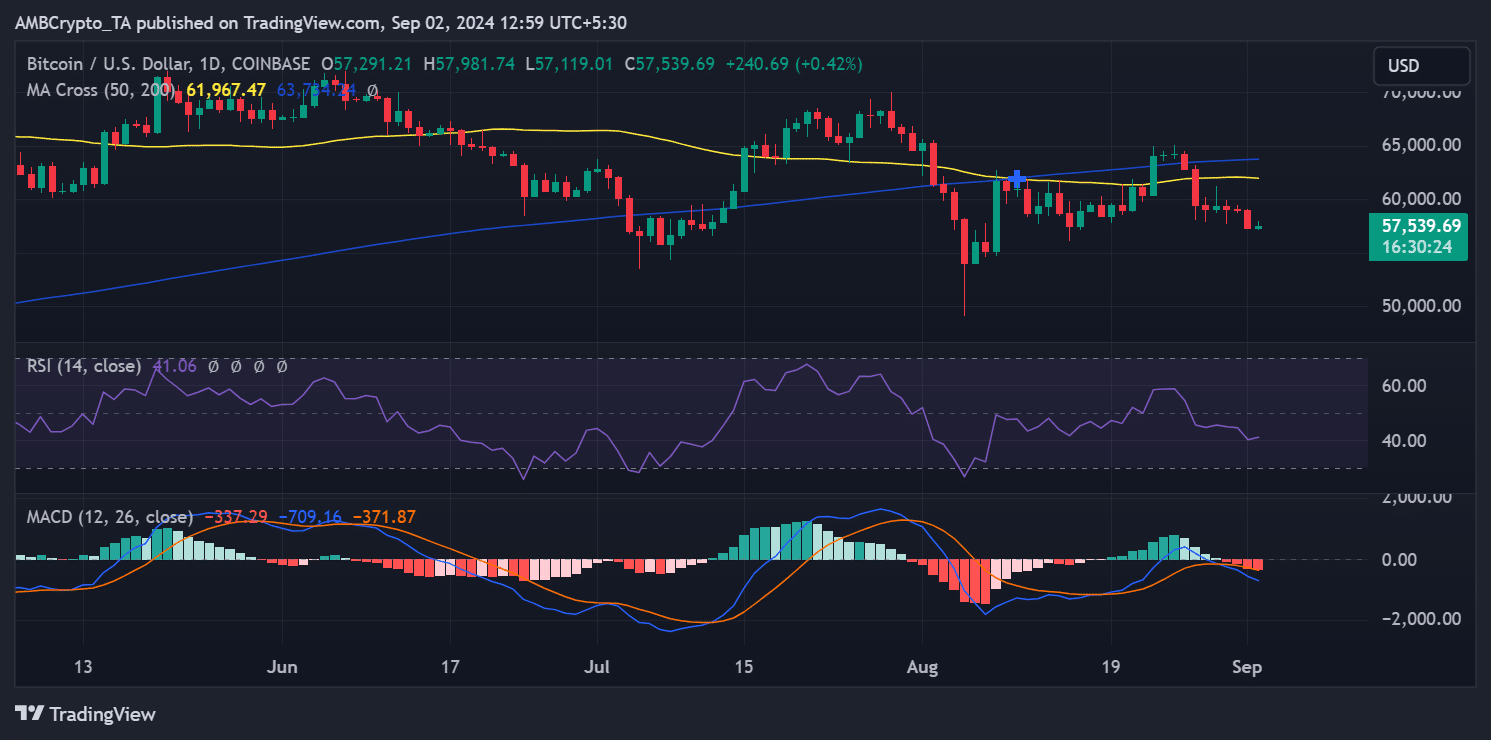

AMBCrypto’s look at Bitcoin’s price trend indicated that the king coin experienced a nearly 3% decline in the last trading session.

Read Bitcoin’s [BTC] Price prediction 2024-25

The price dropped from a high of around $59,000 during the session to approximately $57,299. As of this writing, Bitcoin was trading at around $57,500, reflecting a modest increase of less than 1%.

Source: TradingView

The chart analysis, particularly the position of the moving averages, confirmed that Bitcoin was in a bearish trend.

- There have been significant fluctuations in Bitcoin’s long-term holders’ profits.

- BTC has remained at the $57,000 price level.

Long-term holders of Bitcoin [BTC] are currently in a challenging position with their holdings. However, this trend could present a significant accumulation opportunity for other investors.

Bitcoin SOPR hit low points

AMBCrypto’s analysis of the Long-Term Holder (LTH) Spent Output Profit Ratio (SOPR) on CryptoQuant revealed that Bitcoin was priced at around $57.7K at press time. Also, the LTH SOPR showed relatively low values.

The low LTH SOPR is significant because it indicates that these holders are not realizing substantial profits from their sales.

Instead, they might be liquidating their positions due to concerns about future price declines or in response to market uncertainty.

If this trend continues and more long-term holders decide to sell, it could contribute to further downward pressure on Bitcoin’s price.

Source: CryptoQuant

The SOPR (Spent Output Profit Ratio) is key for understanding the profitability of Bitcoin sales. Specifically, the LTH SOPR focuses on coins held for an extended period, typically more than 155 days.

A SOPR value above one indicates that long-term holders are selling at a profit. In contrast, a value below one suggests selling at a loss.

The low SOPR value for long-term holders highlights that these participants are not capitalizing on significant gains and may be selling due to concerns about the market’s near-term prospects.

This could be a bearish signal, suggesting that these holders are now uncertain about its immediate price direction.

What this means for Bitcoin

The low LTH SOPR indicates that long-term Bitcoin holders are not realizing significant profits and may be reducing their positions.

If this trend persists, the LTH SOPR hovering around or below one could lead to continued downward pressure on Bitcoin’s price. This could signal a period of further declines as the market processes these sales.

However, such a scenario also presents a potential accumulation opportunity for those looking to enter the market at lower prices.

Historically, periods where the SOPR remains low have sometimes been followed by market recoveries. Investors take advantage of the reduced prices to accumulate more Bitcoin.

A recent example of this type of accumulation is observed in the actions of a whale address.

Data from Spot on Chain shows that this whale purchased 1,000 BTC, worth approximately $57 million when Bitcoin’s price hit bottom.

Also, the same whale reportedly deposited 7,790 BTC, valued at $467 million, when the price dropped by approximately 14% some months back.

The current state of BTC

AMBCrypto’s look at Bitcoin’s price trend indicated that the king coin experienced a nearly 3% decline in the last trading session.

Read Bitcoin’s [BTC] Price prediction 2024-25

The price dropped from a high of around $59,000 during the session to approximately $57,299. As of this writing, Bitcoin was trading at around $57,500, reflecting a modest increase of less than 1%.

Source: TradingView

The chart analysis, particularly the position of the moving averages, confirmed that Bitcoin was in a bearish trend.

where can i get generic clomiphene pill can i buy generic clomid no prescription how to get cheap clomid without prescription buy generic clomiphene no prescription clomiphene brand name how to get clomid without dr prescription cost of generic clomiphene prices

More posts like this would make the blogosphere more useful.

More posts like this would make the online elbow-room more useful.

buy semaglutide generic – semaglutide over the counter order cyproheptadine for sale

order domperidone sale – buy sumycin online buy cyclobenzaprine paypal

inderal 20mg generic – buy cheap clopidogrel methotrexate 2.5mg canada

order amoxicillin for sale – order combivent 100 mcg online buy generic ipratropium online

purchase zithromax without prescription – buy tindamax no prescription buy generic nebivolol

order amoxiclav generic – https://atbioinfo.com/ ampicillin over the counter

purchase nexium without prescription – anexa mate oral nexium 40mg

buy medex generic – https://coumamide.com/ order losartan online

meloxicam cheap – https://moboxsin.com/ meloxicam 15mg cost

order prednisone 40mg online – https://apreplson.com/ buy prednisone 40mg generic

buy ed pills for sale – medicine for impotence otc ed pills that work

purchase amoxicillin for sale – https://combamoxi.com/ buy amoxicillin cheap

order diflucan pills – https://gpdifluca.com/# diflucan 100mg sale

buy cenforce 50mg generic – https://cenforcers.com/# brand cenforce

cialis online pharmacy australia – ciltad generic cialis 10mg ireland

generic cialis tadalafil 20mg reviews – https://strongtadafl.com/# cialis from mexico

order zantac generic – click zantac 300mg us

buy viagra hyderabad india – strongvpls buy-viagra-now.net

This website exceedingly has all of the bumf and facts I needed adjacent to this subject and didn’t positive who to ask. site

The thoroughness in this draft is noteworthy. https://buyfastonl.com/

This website absolutely has all of the low-down and facts I needed adjacent to this case and didn’t identify who to ask. https://ursxdol.com/provigil-gn-pill-cnt/

More content pieces like this would create the web better. https://aranitidine.com/fr/modalert-en-france/

Thanks for sharing. It’s first quality. https://ondactone.com/product/domperidone/