- Bitcoin poised to retrace to $66K before a bounce.

- Global liquidity to potentially continue rising up to 2026.

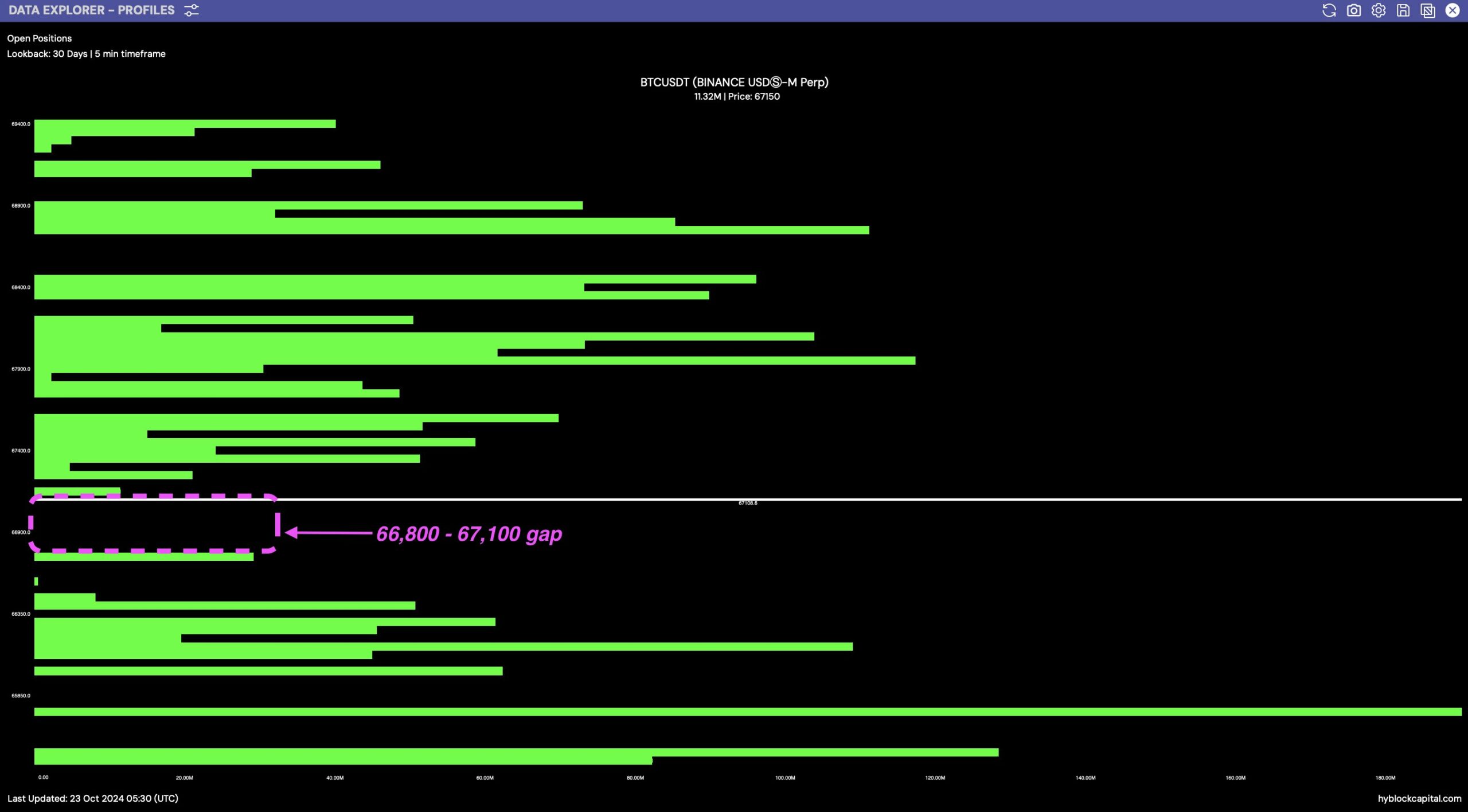

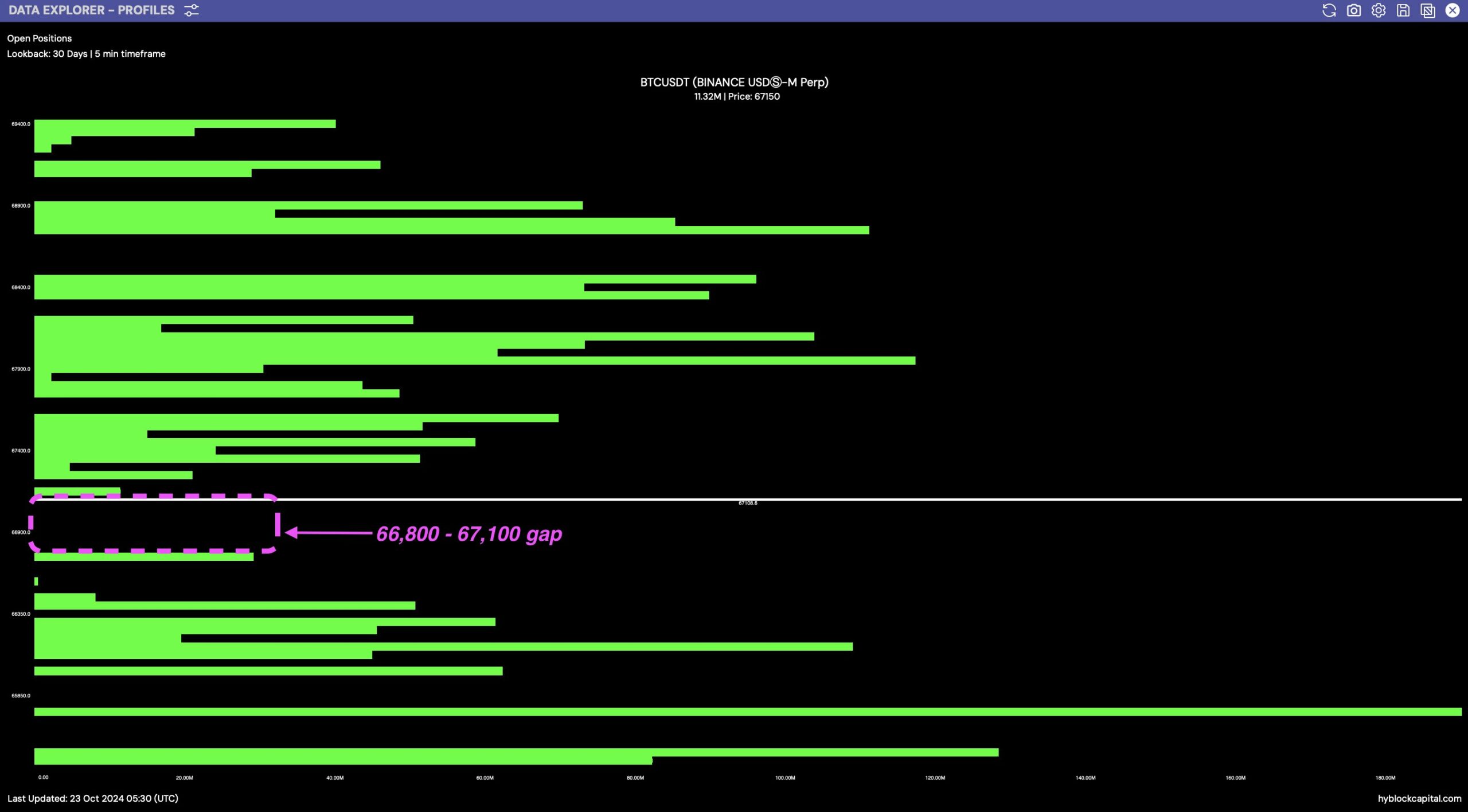

Bitcoin [BTC] was navigating a critical price range at press time, with market watchers anticipating its next move. The $66.8K to $67.1K zone on Bitcoin’s profile chart shows fewer positions, indicating a price gap.

Historically, price tends to gravitate toward such gaps to fill them before continuing a trend.

Bitcoin’s path forward hinges on whether it fills this gap before pushing higher or retraces further to gather liquidity.

Source: Hyblock Capital

BTC heading towards a gap

BTC’s price action shows a slight correction after hitting the $70K level, a major milestone for the cryptocurrency.

The retracement suggests that Bitcoin is gathering momentum for its next leg up, but first, it may need to fill the gap in the $66.8K-$67.1K range.

This zone lies below a key double bottom pattern on the 6-hour timeframe of the BTC/USDT pair, reinforcing the potential for upward movement once the gap is filled.

The weekly chart remains bullish, with the structure broken to the upside, indicating strong market support.

Source: TradingView

Traders are closely watching this price action, with many expecting Bitcoin to hold at the $70K-$71K level, which would likely trigger a move into price discovery and a new all-time high.

The filling of the gap in this price range could also act as a liquidity grab, allowing Bitcoin to gather strength before making a decisive move higher.

A successful breakout past $70K would signal the start of a new bullish phase, with Bitcoin potentially entering uncharted territory.

Profitability and global M2 supply

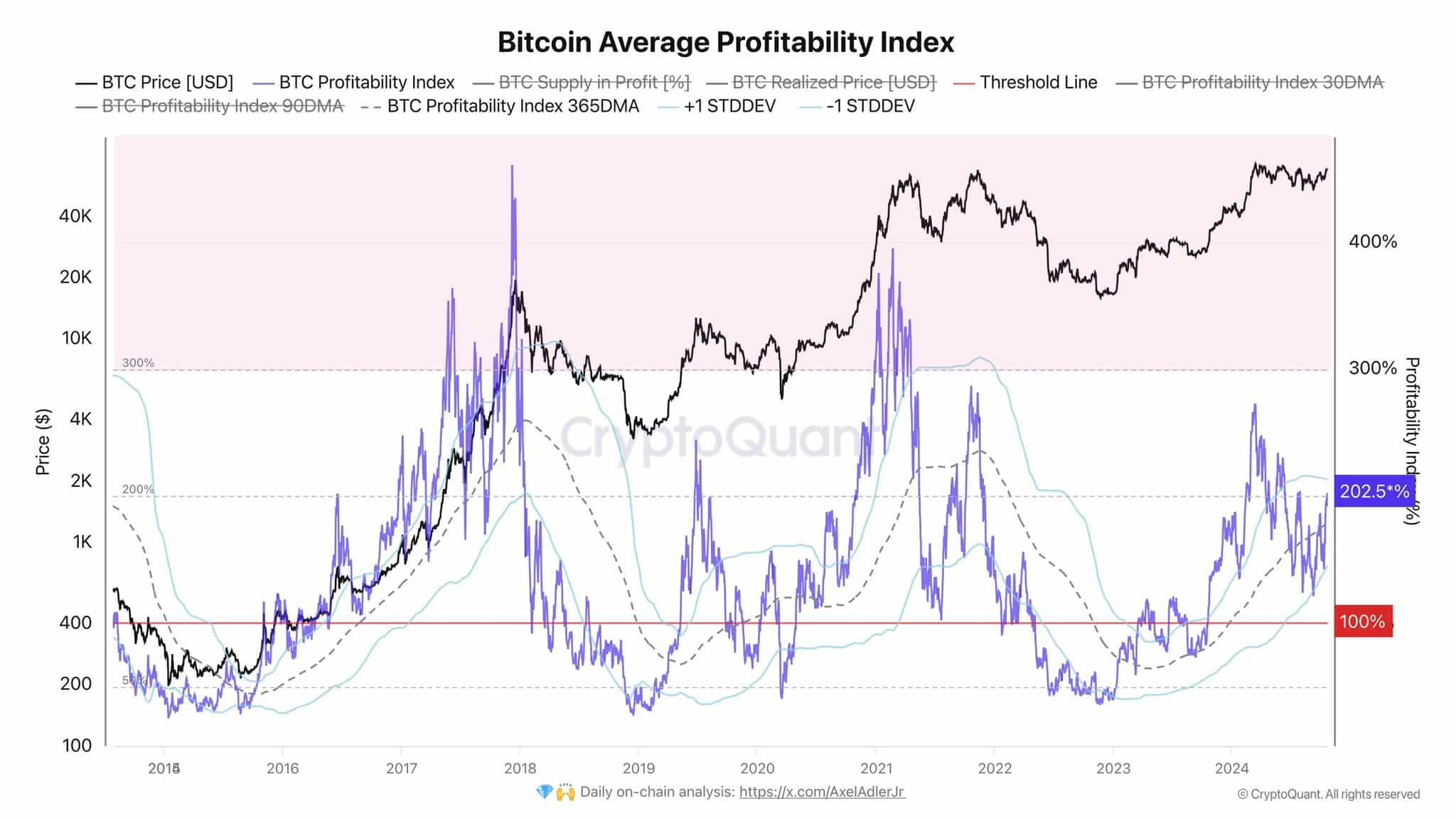

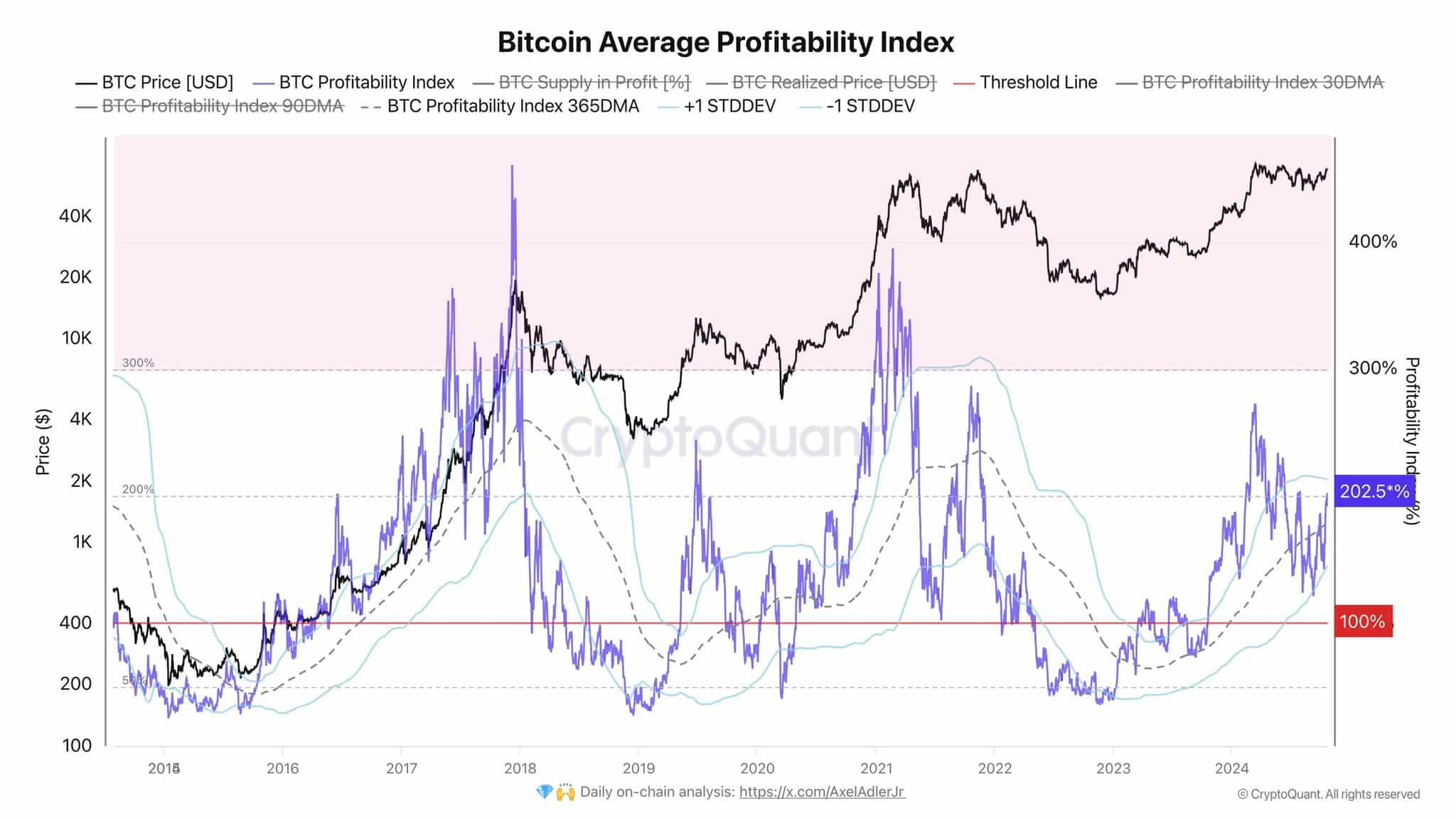

The Bitcoin Average Profitability Index further supports this outlook. Currently, the index stands at 202%, meaning the price is more than double the realized price.

Historically, investors tend to start taking profits when this index rises above 300%, but for now, it suggests that the market is not yet in heavy profit-taking mode.

This leaves room for BTC to continue its upward trajectory after filling the price gap, with long-term holders still optimistic about higher price levels.

Source: CryptoQuant

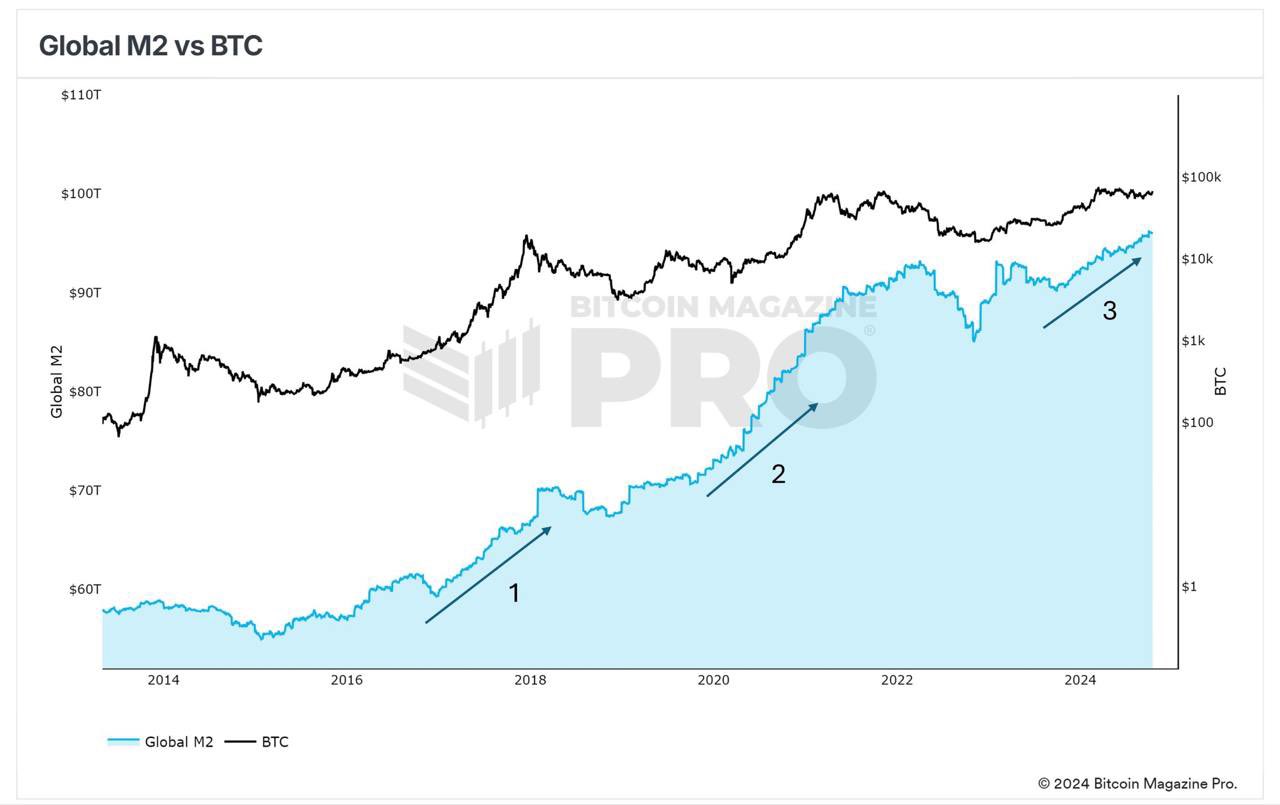

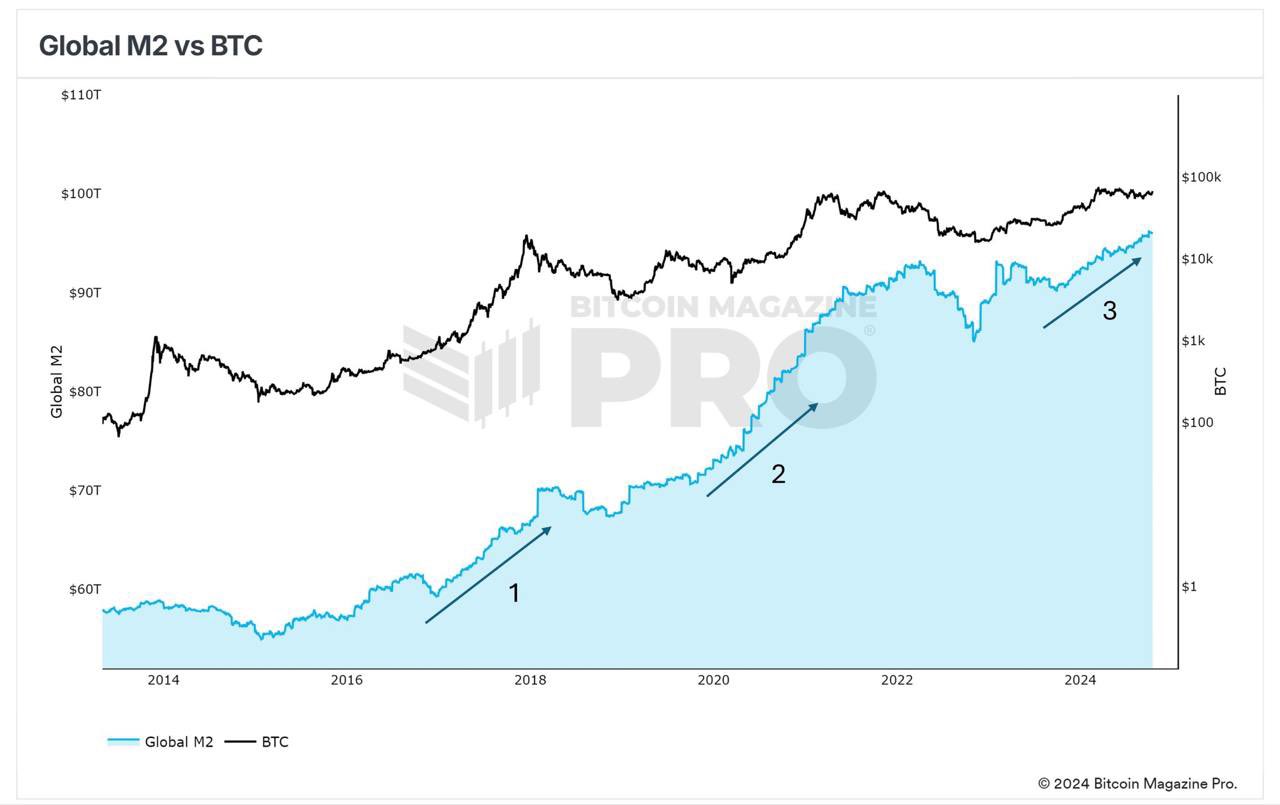

In addition to these indicators, the Global M2 money supply data offers insights into Bitcoin’s broader potential.

During previous bull cycles, such as in 2016-2017, the expansion of the M2 supply coincided with significant Bitcoin price growth.

In 2021, a similar expansion occurred, but external factors like the collapse of FTX and rising interest rates dampened Bitcoin’s momentum.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the M2 supply continues to grow through mid-2026, as some analysts predict, this could provide additional liquidity to the market and extend Bitcoin’s current cycle.Bitcoin’s path remains bullish, with the price gap acting as a short-term support that need to be tapped before rally continuation.

- Bitcoin poised to retrace to $66K before a bounce.

- Global liquidity to potentially continue rising up to 2026.

Bitcoin [BTC] was navigating a critical price range at press time, with market watchers anticipating its next move. The $66.8K to $67.1K zone on Bitcoin’s profile chart shows fewer positions, indicating a price gap.

Historically, price tends to gravitate toward such gaps to fill them before continuing a trend.

Bitcoin’s path forward hinges on whether it fills this gap before pushing higher or retraces further to gather liquidity.

Source: Hyblock Capital

BTC heading towards a gap

BTC’s price action shows a slight correction after hitting the $70K level, a major milestone for the cryptocurrency.

The retracement suggests that Bitcoin is gathering momentum for its next leg up, but first, it may need to fill the gap in the $66.8K-$67.1K range.

This zone lies below a key double bottom pattern on the 6-hour timeframe of the BTC/USDT pair, reinforcing the potential for upward movement once the gap is filled.

The weekly chart remains bullish, with the structure broken to the upside, indicating strong market support.

Source: TradingView

Traders are closely watching this price action, with many expecting Bitcoin to hold at the $70K-$71K level, which would likely trigger a move into price discovery and a new all-time high.

The filling of the gap in this price range could also act as a liquidity grab, allowing Bitcoin to gather strength before making a decisive move higher.

A successful breakout past $70K would signal the start of a new bullish phase, with Bitcoin potentially entering uncharted territory.

Profitability and global M2 supply

The Bitcoin Average Profitability Index further supports this outlook. Currently, the index stands at 202%, meaning the price is more than double the realized price.

Historically, investors tend to start taking profits when this index rises above 300%, but for now, it suggests that the market is not yet in heavy profit-taking mode.

This leaves room for BTC to continue its upward trajectory after filling the price gap, with long-term holders still optimistic about higher price levels.

Source: CryptoQuant

In addition to these indicators, the Global M2 money supply data offers insights into Bitcoin’s broader potential.

During previous bull cycles, such as in 2016-2017, the expansion of the M2 supply coincided with significant Bitcoin price growth.

In 2021, a similar expansion occurred, but external factors like the collapse of FTX and rising interest rates dampened Bitcoin’s momentum.

Read Bitcoin’s [BTC] Price Prediction 2024-25

If the M2 supply continues to grow through mid-2026, as some analysts predict, this could provide additional liquidity to the market and extend Bitcoin’s current cycle.Bitcoin’s path remains bullish, with the price gap acting as a short-term support that need to be tapped before rally continuation.

where to buy cheap clomiphene without dr prescription clomid bula profissional where to buy clomid no prescription how can i get clomid pill order cheap clomiphene pill how to buy generic clomiphene price how to get clomiphene pill

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of useful facts, thanks object of providing such data.

I’ll certainly return to read more.

buy azithromycin 500mg without prescription – tetracycline 250mg price order flagyl pills

purchase semaglutide pills – order semaglutide generic buy cyproheptadine 4mg sale

buy domperidone without a prescription – order generic motilium flexeril over the counter

order augmentin 625mg online cheap – https://atbioinfo.com/ order ampicillin

esomeprazole capsules – https://anexamate.com/ where to buy nexium without a prescription

oral warfarin – https://coumamide.com/ losartan 25mg usa

order meloxicam for sale – https://moboxsin.com/ brand meloxicam 15mg

deltasone 10mg canada – https://apreplson.com/ cost prednisone 5mg

men’s ed pills – site buy cheap generic ed pills

amoxicillin usa – comba moxi buy amoxil sale

brand diflucan – https://gpdifluca.com/# diflucan 200mg price

purchase cenforce online – https://cenforcers.com/ cenforce 100mg pills

max dosage of cialis – https://ciltadgn.com/# cialis dapoxetine overnight shipment

order ranitidine 150mg online – click order ranitidine pills

viagra 100mg price per pill – https://strongvpls.com/ viagra cheap online uk

More posts like this would make the blogosphere more useful. https://gnolvade.com/

Thanks on putting this up. It’s understandably done. https://buyfastonl.com/azithromycin.html

More posts like this would make the online elbow-room more useful. https://ursxdol.com/doxycycline-antibiotic/

With thanks. Loads of expertise! https://prohnrg.com/product/cytotec-online/

More posts like this would force the blogosphere more useful. https://aranitidine.com/fr/prednisolone-achat-en-ligne/

I am in truth enchant‚e ‘ to gleam at this blog posts which consists of tons of useful facts, thanks object of providing such data. https://ondactone.com/simvastatin/