- Whales accumulate over 100k Bitcoin in a week.

- Metrics suggested potential bullish breakout as selling pressure subsided.

Everything seems to be buzzing in the cryptocurrency market due to recent developments in Bitcoin [BTC].

Whales, technical patterns, and on-chain metrics all combined to indicate a potential change in the price trajectory of BTC.

Is this the moment that will lead to the next big rally?

The calm before the storm?

Bitcoin has witnessed its fair share of ups and downs these weeks, moving between buying and selling pressures.

BTC recently started to stabilize after a slight dip, signaling that the market might be positioning itself for a significant move.

This could be the setup for a possible breakout, with large investors heightened interest.

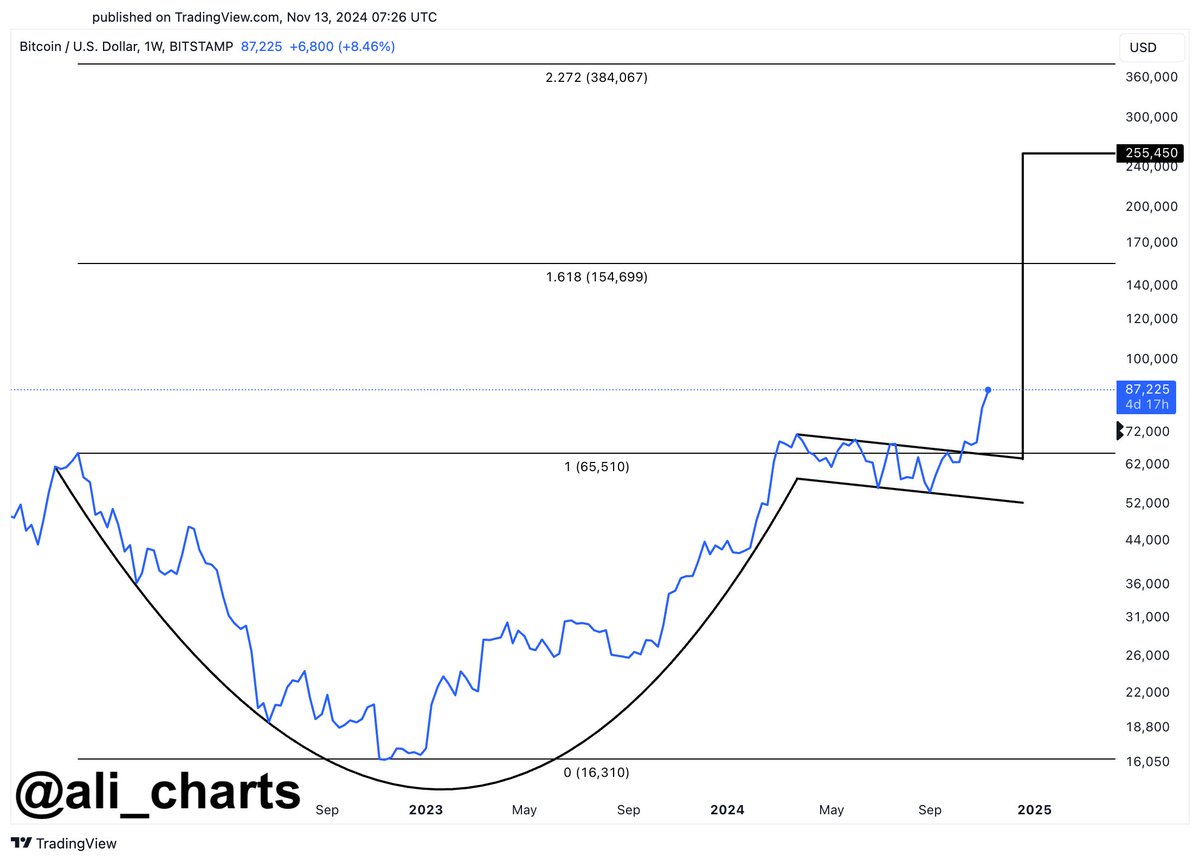

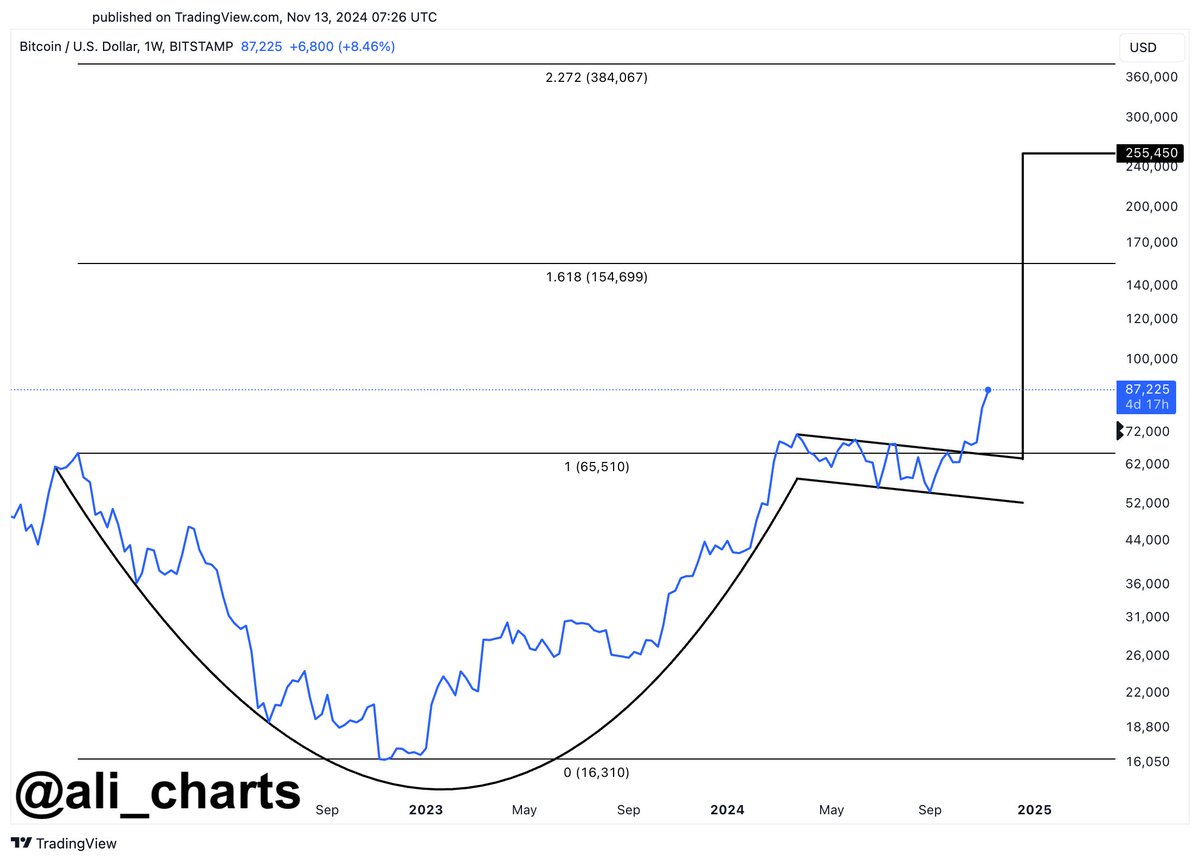

According to a recent tweet from analyst Ali Martinez, Bitcoin’s recent price action pointed to the formation of a potential cup-and-handle pattern, known for its bullish implications.

If this pattern holds, BTC could aim for a target price as high as $255K.

Source: X

BTC whales make moves

On-chain data further bolstered this outlook, showcasing various supportive indicators. According to the same analyst, whales have bought over 100K BTC in the past week, valued at around $8.60 billion.

Such large-scale BTC buying typically correlates with upward price movements, as whales often set the pace for market sentiment.

Source: X

Profit-taking or diamond hands?

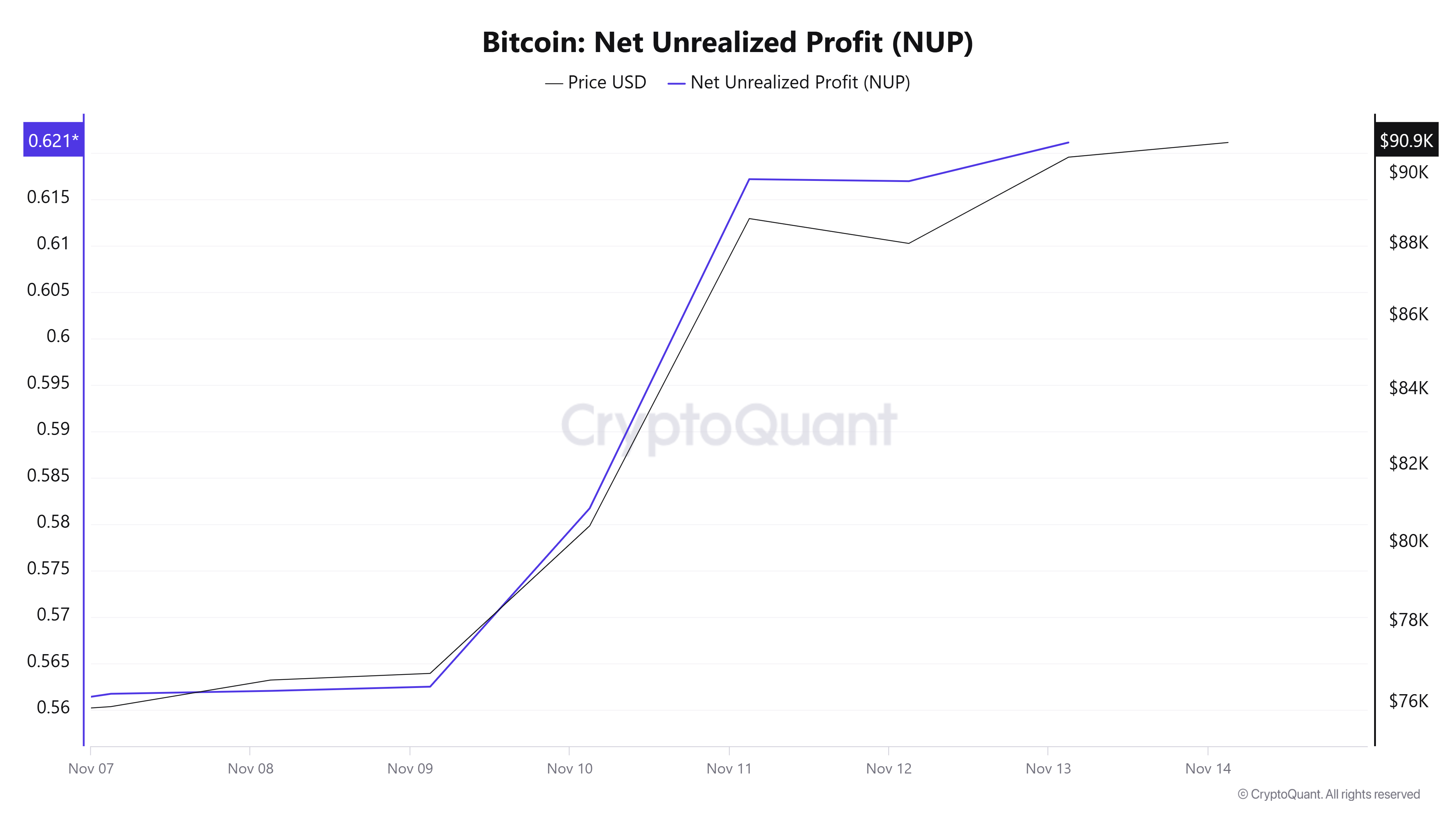

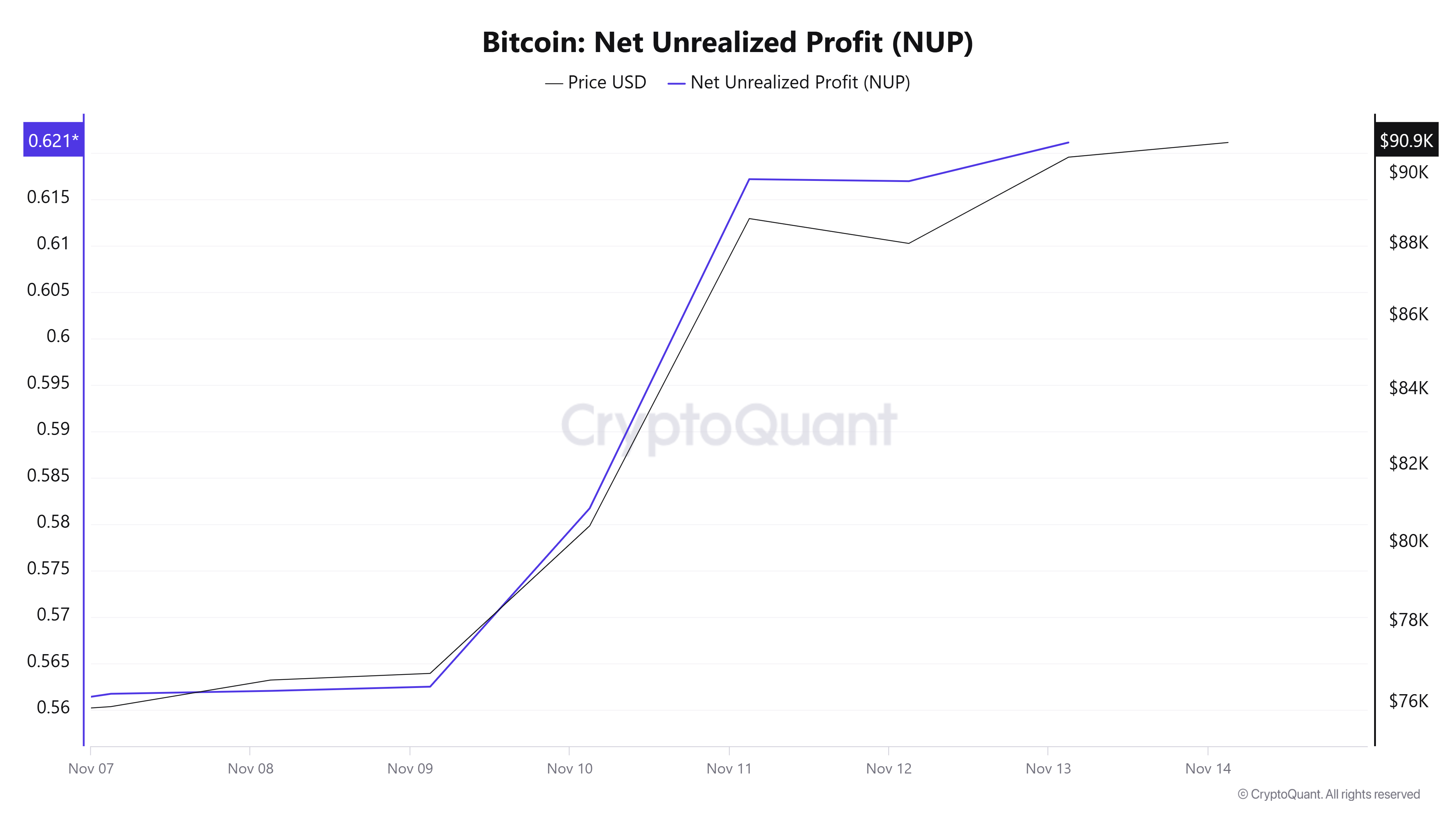

AMBCrypto analysis of Santiment revealed that net unrealized profits climbed between the 9th and the 11th of November, indicating a phase of increased selling pressure.

However, this has leveled out since then, suggesting less selling and a more stable holding pattern. The change may pave the way for further BTC’s potential growth.

Source: CryptoQuant

What does the MVRV have in store?

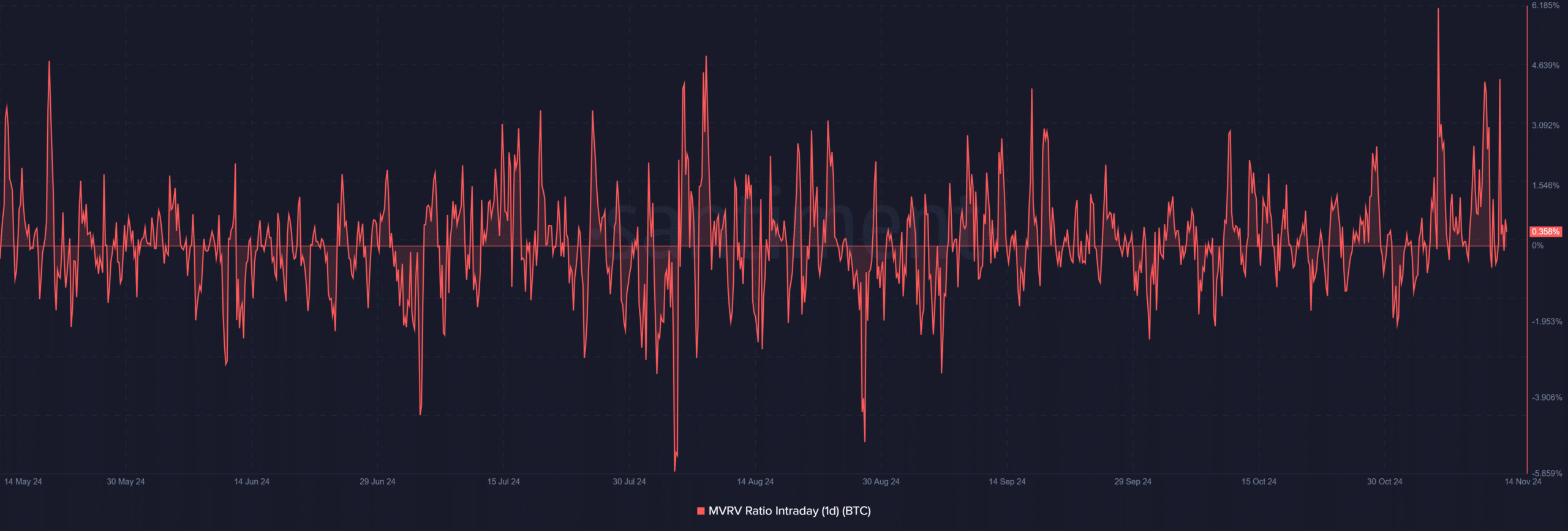

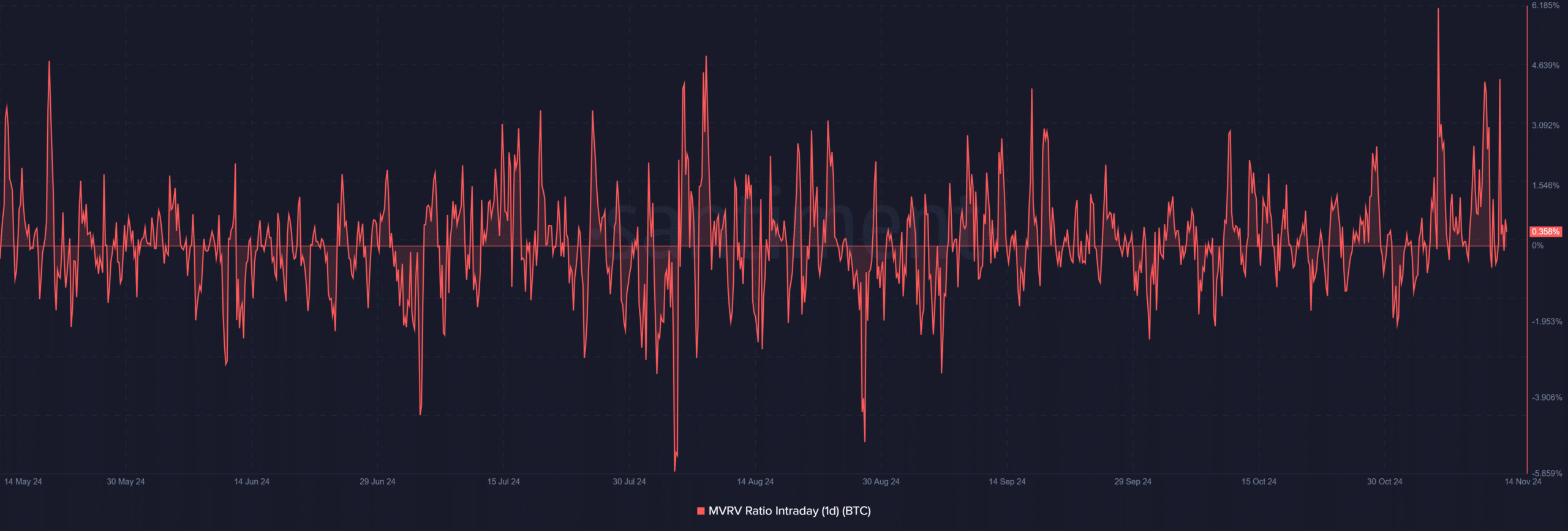

Adding to the aforementioned positive sentiments, the BTC Market Value to Realized Value (MVRV) ratio was at 0.36%, positioning BTC just above its realized price.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This suggested that Bitcoin is not overbought and retains potential for upward movement.

Historically, similar MVRV levels have often preceded price rallies, signaling a promising Bitcoin setup for continued growth.

Source: Santiment

- Whales accumulate over 100k Bitcoin in a week.

- Metrics suggested potential bullish breakout as selling pressure subsided.

Everything seems to be buzzing in the cryptocurrency market due to recent developments in Bitcoin [BTC].

Whales, technical patterns, and on-chain metrics all combined to indicate a potential change in the price trajectory of BTC.

Is this the moment that will lead to the next big rally?

The calm before the storm?

Bitcoin has witnessed its fair share of ups and downs these weeks, moving between buying and selling pressures.

BTC recently started to stabilize after a slight dip, signaling that the market might be positioning itself for a significant move.

This could be the setup for a possible breakout, with large investors heightened interest.

According to a recent tweet from analyst Ali Martinez, Bitcoin’s recent price action pointed to the formation of a potential cup-and-handle pattern, known for its bullish implications.

If this pattern holds, BTC could aim for a target price as high as $255K.

Source: X

BTC whales make moves

On-chain data further bolstered this outlook, showcasing various supportive indicators. According to the same analyst, whales have bought over 100K BTC in the past week, valued at around $8.60 billion.

Such large-scale BTC buying typically correlates with upward price movements, as whales often set the pace for market sentiment.

Source: X

Profit-taking or diamond hands?

AMBCrypto analysis of Santiment revealed that net unrealized profits climbed between the 9th and the 11th of November, indicating a phase of increased selling pressure.

However, this has leveled out since then, suggesting less selling and a more stable holding pattern. The change may pave the way for further BTC’s potential growth.

Source: CryptoQuant

What does the MVRV have in store?

Adding to the aforementioned positive sentiments, the BTC Market Value to Realized Value (MVRV) ratio was at 0.36%, positioning BTC just above its realized price.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This suggested that Bitcoin is not overbought and retains potential for upward movement.

Historically, similar MVRV levels have often preceded price rallies, signaling a promising Bitcoin setup for continued growth.

Source: Santiment

As I website possessor I believe the subject matter here is real wonderful, regards for your efforts.

It’s arduous to find knowledgeable individuals on this topic, however you sound like you realize what you’re talking about! Thanks

Excellent post. I was checking continuously this blog and I am impressed! Extremely helpful information particularly the last part 🙂 I care for such information a lot. I was looking for this particular info for a long time. Thank you and best of luck.

Hello. Great job. I did not anticipate this. This is a excellent story. Thanks!

where buy generic clomiphene pill clomiphene 50mg tablets can i buy cheap clomiphene tablets cost clomid without a prescription order cheap clomid tablets where to get cheap clomid buy cheap clomiphene tablets

Greetings! Jolly useful recommendation within this article! It’s the crumb changes which choice obtain the largest changes. Thanks a lot in the direction of sharing!

Thanks for putting this up. It’s well done.

purchase zithromax without prescription – ofloxacin 200mg for sale order metronidazole 400mg sale

buy rybelsus 14 mg for sale – cyproheptadine 4mg pill cyproheptadine generic

motilium generic – sumycin sale flexeril order

amoxicillin drug – amoxil price order combivent 100mcg generic

order amoxiclav – atbioinfo.com order ampicillin sale

esomeprazole over the counter – anexamate.com cost nexium 40mg

purchase coumadin pills – https://coumamide.com/ losartan 50mg price

Thank you for the auspicious writeup. It in truth was once a enjoyment account it. Glance advanced to far brought agreeable from you! By the way, how could we keep in touch?

buy mobic 15mg generic – https://moboxsin.com/ order meloxicam generic

prednisone 10mg cost – https://apreplson.com/ deltasone 10mg for sale

buy ed pills online usa – fast ed to take site buy ed medication online

amoxicillin uk – combamoxi.com amoxil price

buy fluconazole generic – https://gpdifluca.com/ purchase fluconazole pill