- BTC has declined by around 1% at press time.

- Short-holders remain in profit despite the decline in the last 24 hours.

Bitcoin [BTC] has recently lifted the mood of the crypto market, breaking through the $60,000 price barrier and moving closer to another key resistance level. This surge has enabled some whales to secure significant profits and liquidated numerous short positions.

Bitcoin whales take profit

An analysis of Bitcoin’s daily chart shows that it broke its short-term resistance on 17th September. This resistance, formed by its short-term moving average (yellow line), was overcome when BTC gained over 3%, reaching around $60,300.

Bitcoin experienced consecutive uptrends following this breakout, closing the last trading session at approximately $63,362.

Source: TradngView

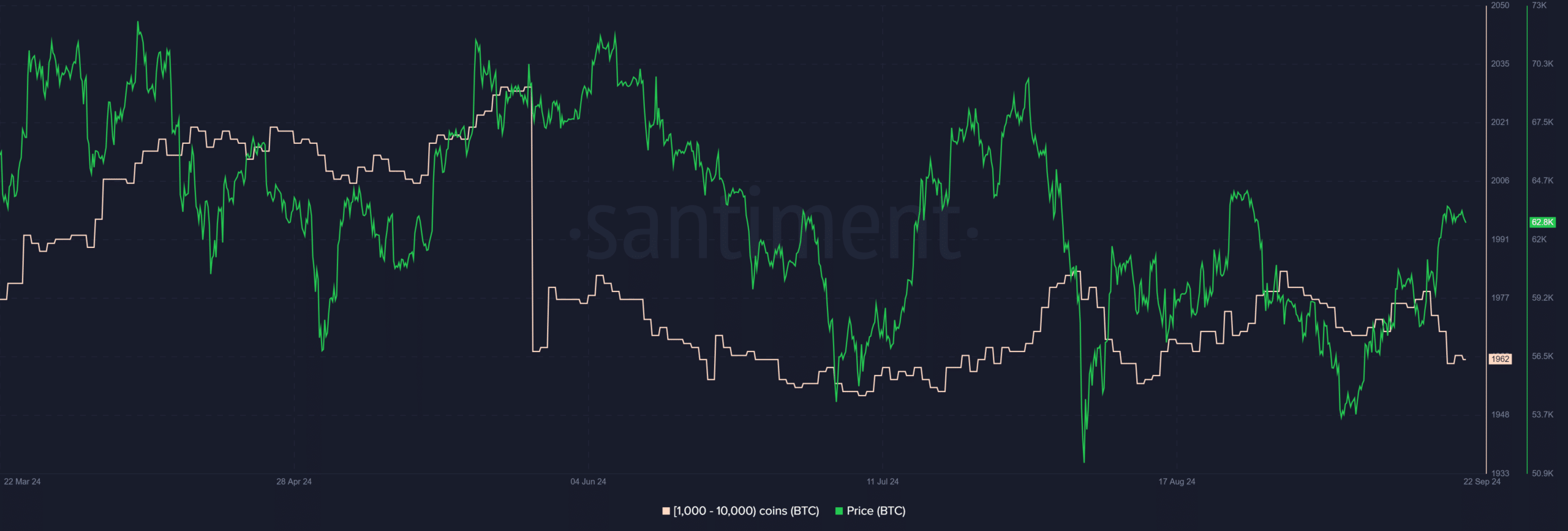

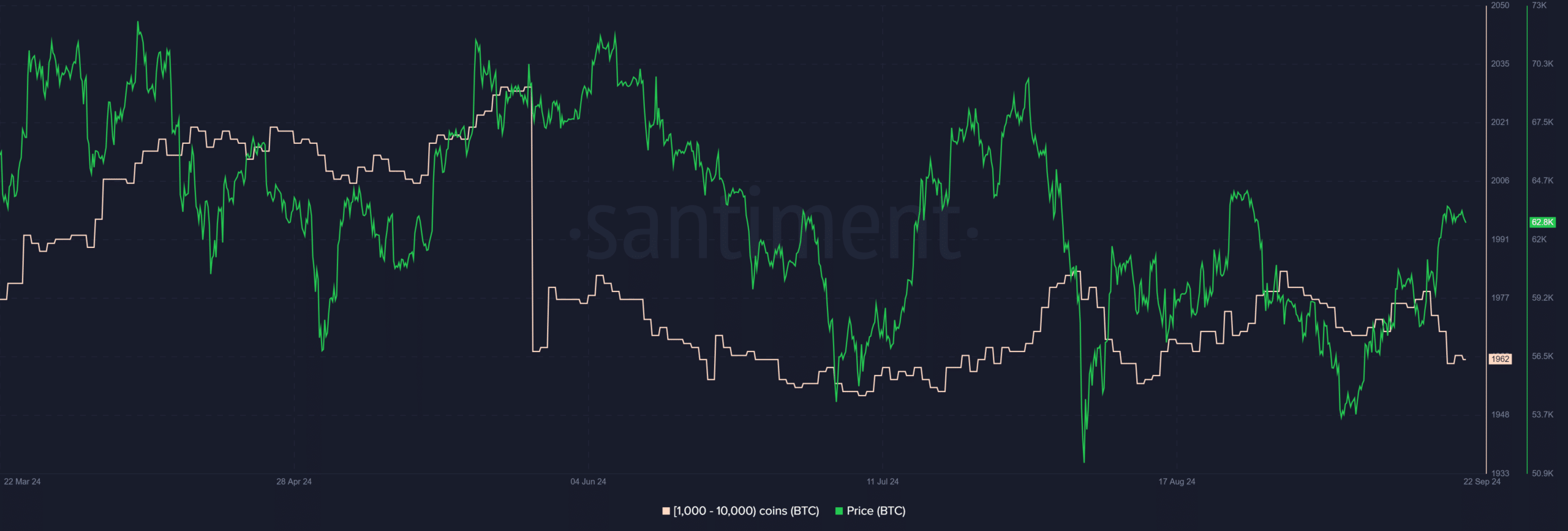

Data from Santiment indicates that this price increase prompted some BTC whales to realize profits. In the past 96 hours, these large holders sold over 30,000 BTC, worth around $1.86 billion.

Despite this significant sell-off, Bitcoin remains bullish, as evidenced by its Relative Strength Index (RSI), which has stayed above 60.

Source: Santiment

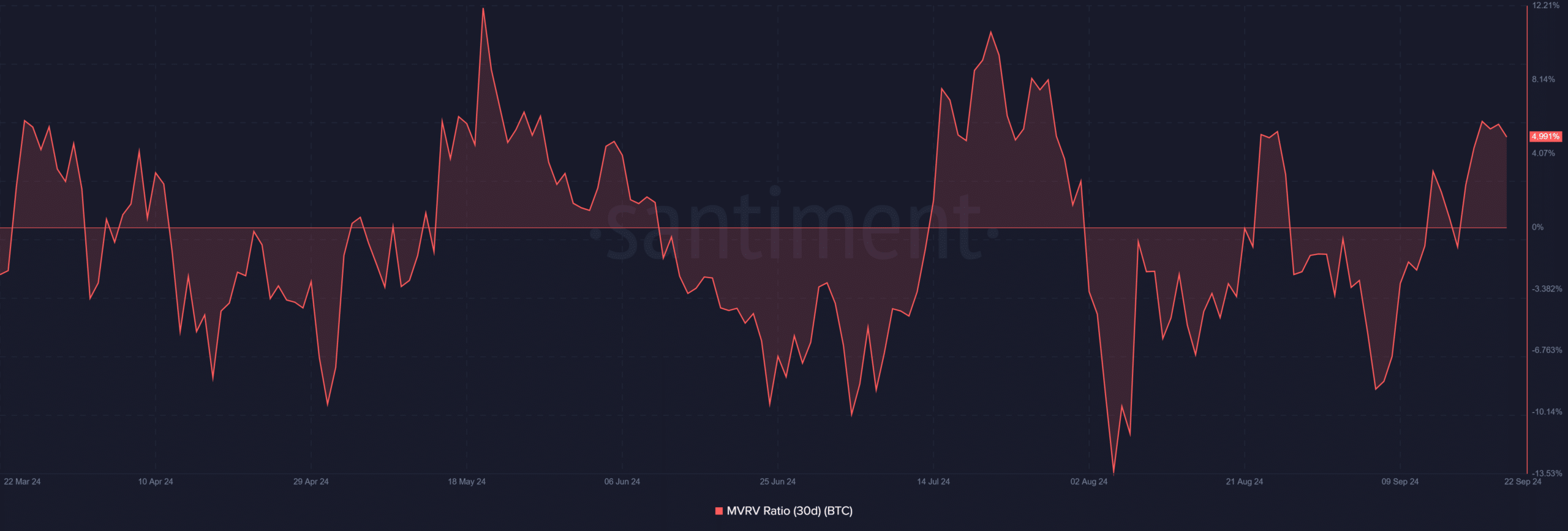

Bitcoin MVRV shows a 5% profit

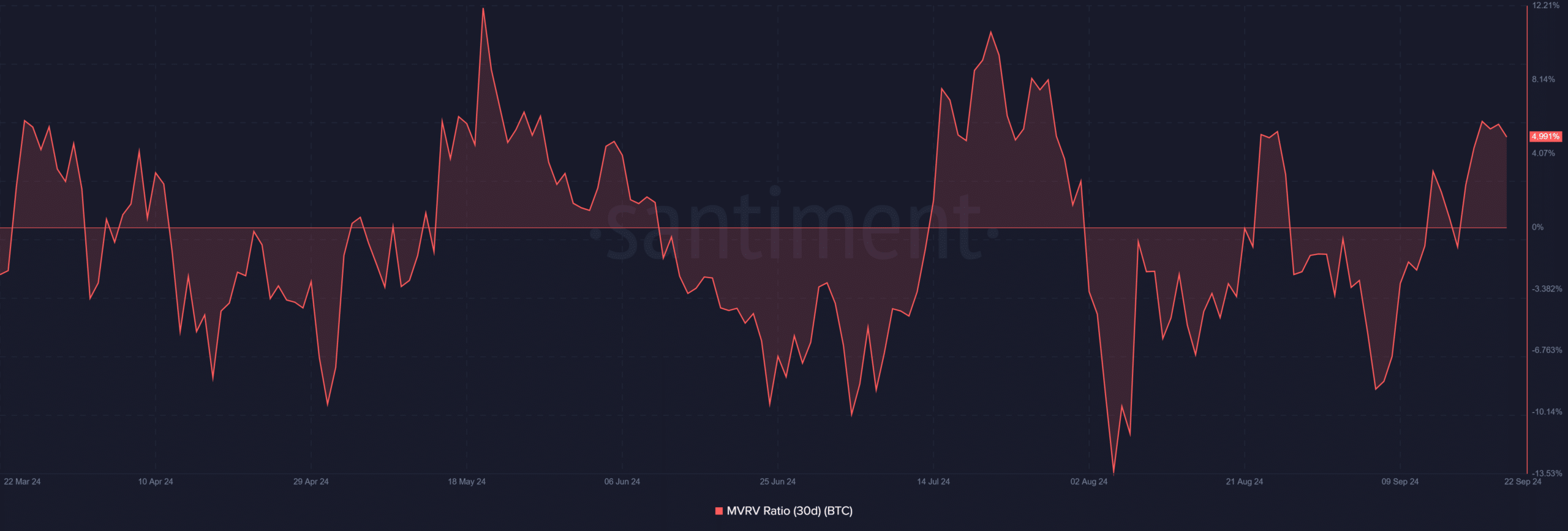

Short-term Bitcoin holders have moved into profit due to the recent price appreciation. Analysis of the 30-day Market Value to Realized Value (MVRV) ratio from Santiment showed it crossed above zero on 17th September and is currently nearing 5%.

This means that holders within this timeframe are averaging nearly a 5% profit, aligning with the profits realized by whales in recent days.

Source: Santiment

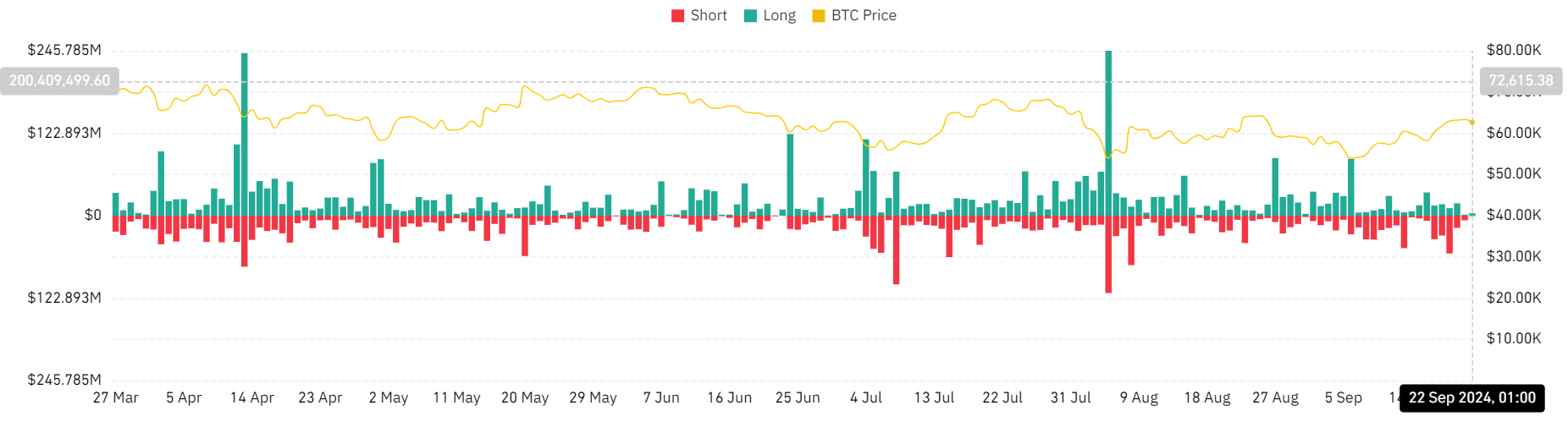

Short positions face increased liquidations

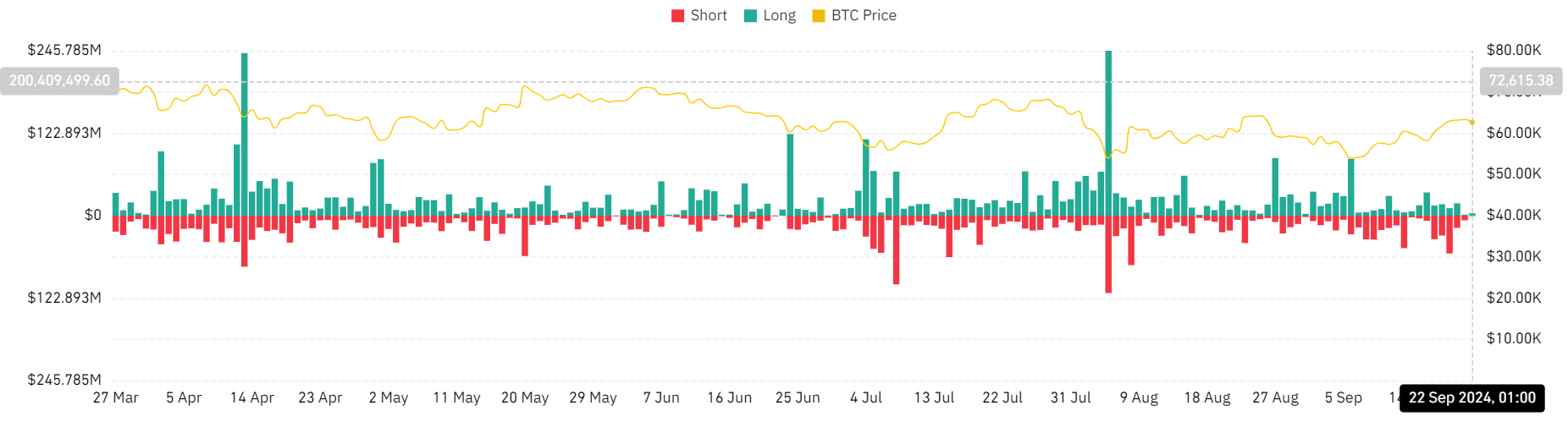

Since Bitcoin’s uptrend began, there has been a significant increase in the liquidation of short positions. Analysis from Coinglass reveals that over $146 million worth of short positions were liquidated between 17th and 21st September.

In contrast, long positions saw liquidations of around $63 million during the same period.

Source: Coinglass

Read Bitcoin (BTC) Price Prediction 2024-25

Additionally, the BTC funding rate has remained positive over the past few weeks, indicating that more buyers are entering the market compared to sellers—a positive sign for Bitcoin.

This trend may help Bitcoin absorb selling pressure from whales taking profits.

- BTC has declined by around 1% at press time.

- Short-holders remain in profit despite the decline in the last 24 hours.

Bitcoin [BTC] has recently lifted the mood of the crypto market, breaking through the $60,000 price barrier and moving closer to another key resistance level. This surge has enabled some whales to secure significant profits and liquidated numerous short positions.

Bitcoin whales take profit

An analysis of Bitcoin’s daily chart shows that it broke its short-term resistance on 17th September. This resistance, formed by its short-term moving average (yellow line), was overcome when BTC gained over 3%, reaching around $60,300.

Bitcoin experienced consecutive uptrends following this breakout, closing the last trading session at approximately $63,362.

Source: TradngView

Data from Santiment indicates that this price increase prompted some BTC whales to realize profits. In the past 96 hours, these large holders sold over 30,000 BTC, worth around $1.86 billion.

Despite this significant sell-off, Bitcoin remains bullish, as evidenced by its Relative Strength Index (RSI), which has stayed above 60.

Source: Santiment

Bitcoin MVRV shows a 5% profit

Short-term Bitcoin holders have moved into profit due to the recent price appreciation. Analysis of the 30-day Market Value to Realized Value (MVRV) ratio from Santiment showed it crossed above zero on 17th September and is currently nearing 5%.

This means that holders within this timeframe are averaging nearly a 5% profit, aligning with the profits realized by whales in recent days.

Source: Santiment

Short positions face increased liquidations

Since Bitcoin’s uptrend began, there has been a significant increase in the liquidation of short positions. Analysis from Coinglass reveals that over $146 million worth of short positions were liquidated between 17th and 21st September.

In contrast, long positions saw liquidations of around $63 million during the same period.

Source: Coinglass

Read Bitcoin (BTC) Price Prediction 2024-25

Additionally, the BTC funding rate has remained positive over the past few weeks, indicating that more buyers are entering the market compared to sellers—a positive sign for Bitcoin.

This trend may help Bitcoin absorb selling pressure from whales taking profits.

buy cheap clomid price how to get clomid without prescription can i buy clomid tablets can i get cheap clomiphene where can i get generic clomiphene pill where buy clomid no prescription buying cheap clomid without dr prescription

I am always searching online for posts that can help me. Thank you!

This is a keynote which is virtually to my fundamentals… Myriad thanks! Faithfully where can I lay one’s hands on the connection details due to the fact that questions?

More posts like this would make the blogosphere more useful.

order azithromycin 500mg without prescription – buy ofloxacin pill cost flagyl 200mg

order rybelsus pills – buy cyproheptadine 4mg online buy cyproheptadine generic

domperidone 10mg brand – buy generic sumycin 500mg order flexeril generic

Este site é realmente fascinate. Sempre que consigo acessar eu encontro coisas incríveis Você também pode acessar o nosso site e descobrir detalhes! informaçõesexclusivas. Venha saber mais agora! 🙂

generic clavulanate – https://atbioinfo.com/ how to get ampicillin without a prescription

esomeprazole capsules – https://anexamate.com/ order nexium 20mg online cheap

where can i buy coumadin – coumamide order cozaar 25mg online cheap

buy meloxicam paypal – relieve pain buy meloxicam pills for sale

I consider something truly interesting about your weblog so I saved to bookmarks.

buy prednisone 20mg generic – apreplson.com prednisone 20mg cheap

buy ed pills paypal – fast ed to take where can i buy ed pills

purchase amoxil sale – https://combamoxi.com/ amoxil online buy

diflucan over the counter – https://gpdifluca.com/# diflucan brand

order cenforce online – on this site order generic cenforce

uses for cialis – cialis super active reviews cialis max dose

cialis price walmart – mail order cialis how long does it take for cialis to start working

ranitidine 150mg canada – this purchase ranitidine without prescription

I am in point of fact happy to glitter at this blog posts which consists of tons of of use facts, thanks towards providing such data. https://buyfastonl.com/furosemide.html

More delight pieces like this would make the web better. https://ursxdol.com/propecia-tablets-online/

The thoroughness in this draft is noteworthy. https://prohnrg.com/

I really like your blog.. very nice colors & theme. Did you make this website yourself or did you hire someone to do it for you? Plz respond as I’m looking to design my own blog and would like to know where u got this from. appreciate it

This is the big-hearted of criticism I in fact appreciate. https://aranitidine.com/fr/acheter-cenforce/

I am in fact delighted to glitter at this blog posts which consists of tons of of use facts, thanks for providing such data.

where can i buy cheap tetracycline no prescription

Thanks for putting this up. It’s okay done. http://shiftdelete.10tl.net/member.php?action=profile&uid=200429

As a Newbie, I am permanently searching online for articles that can be of assistance to me. Thank you

I like your writing style truly enjoying this site.

Hello there, You have performed an excellent job. I will definitely digg it and in my view recommend to my friends. I’m confident they will be benefited from this web site.

purchase orlistat – https://asacostat.com/# order orlistat without prescription