- Bitcoin could rally up to the $62,000 level, based on historical price momentum.

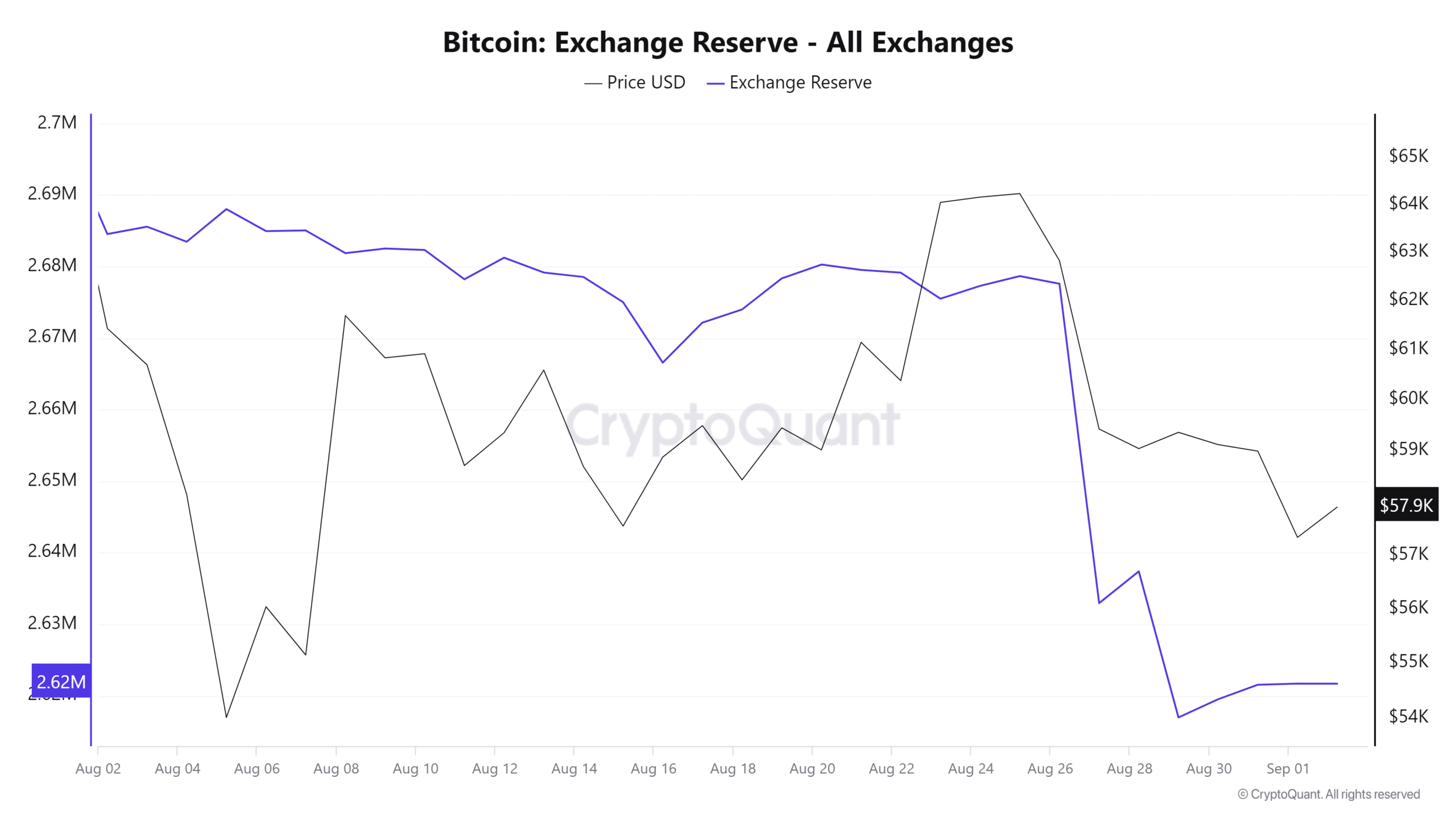

- BTC exchange reserve data showed potential buying pressure from investors, as it has significantly fallen in recent days.

In this bearish market sentiment, crypto whales were aggressively buying the dip as major cryptocurrencies, including Bitcoin [BTC] and Ethereum [ETH], saw significant price declines.

On the 2nd of September, on-chain analytic firm Spot On Chain made a post on X (formerly Twitter) that a Bitcoin whale had purchased nearly 1,000 BTC worth $57.4 million from Binance [BNB].

Bitcoin whales buy the dip

Additionally, the same whale had purchased nearly 2,000 BTC worth $117 million, from Binance in the last four days at an average price of $58,525.

With the recent purchase, the whales’ Bitcoin holding increased to 8,559 BTC worth $494 million.

Previously, the whale had dumped a massive 7,790 BTC worth $467 million of BTC in July 2024, before the market sentiment turned bearish.

Upcoming levels

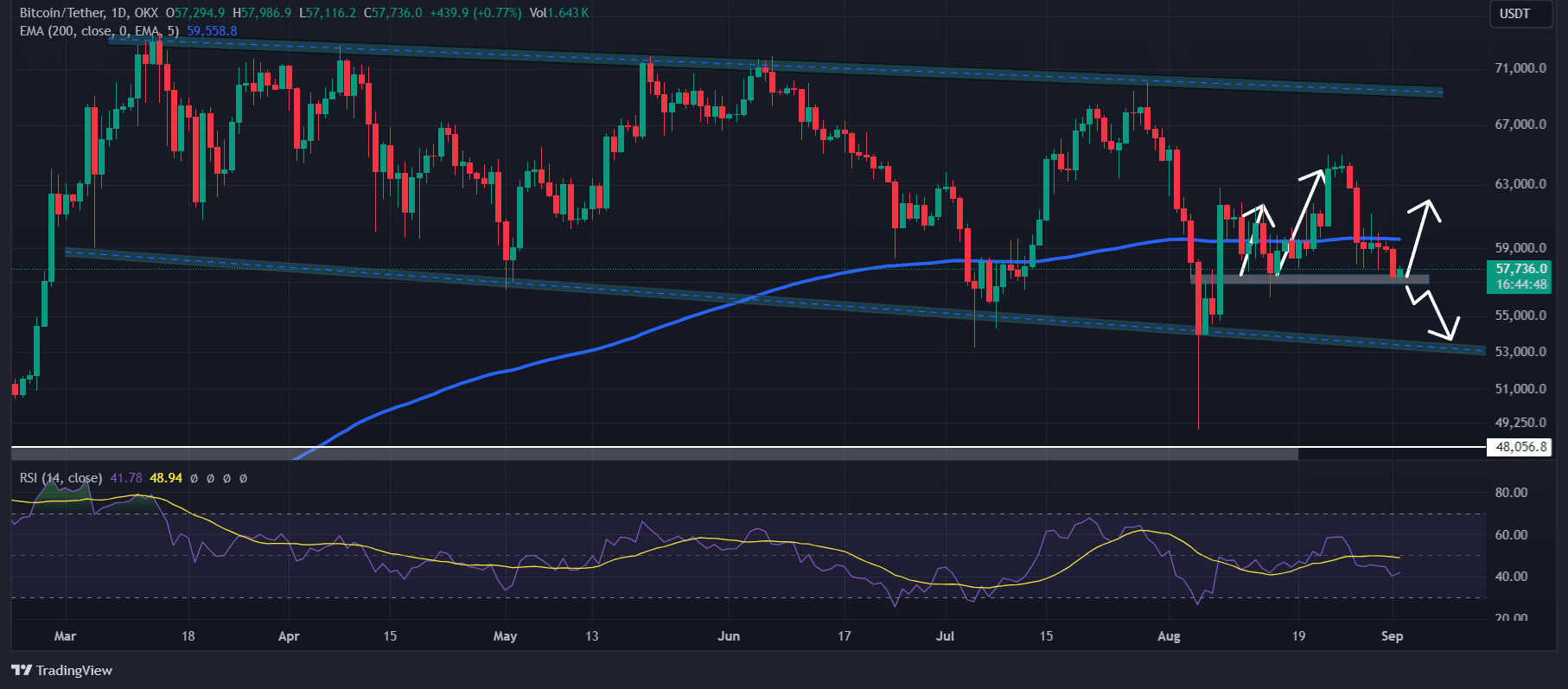

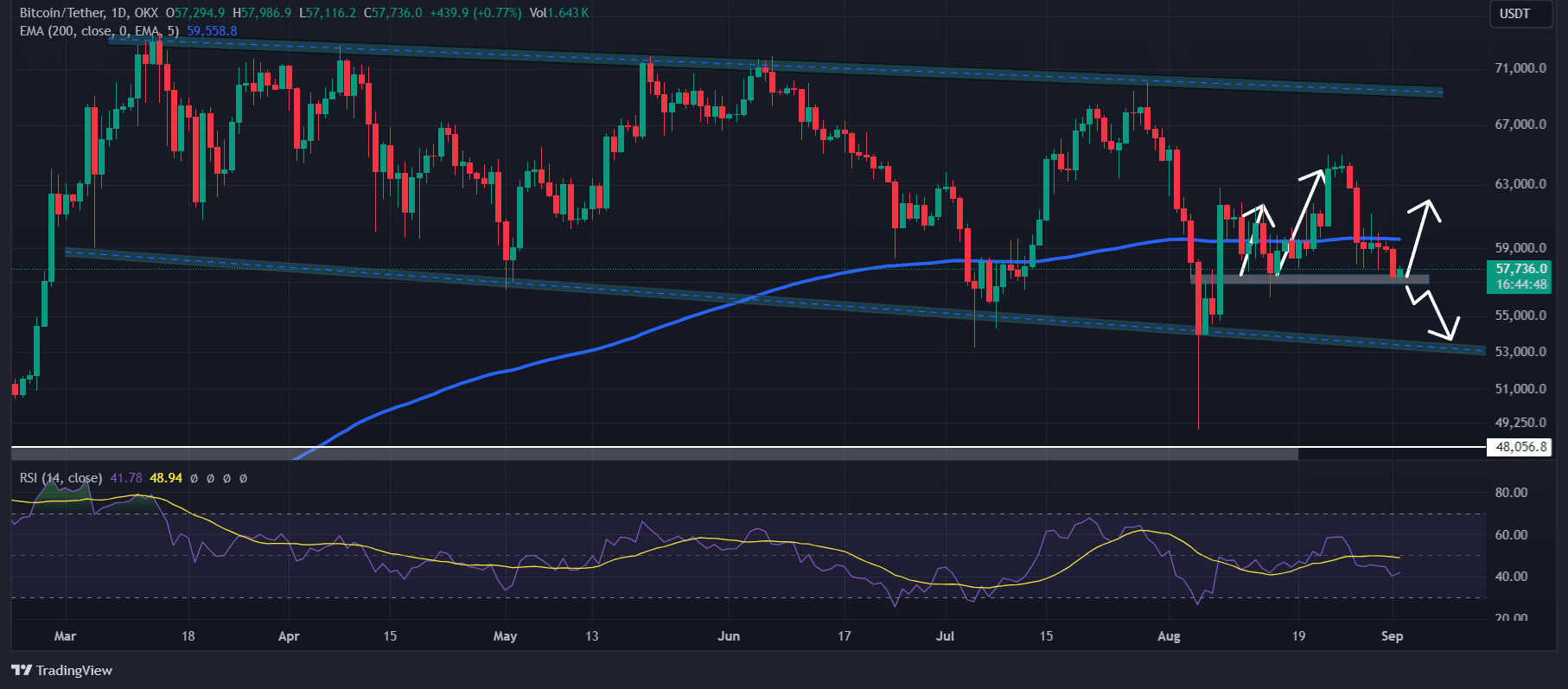

AMBCrypto’s look at TradingView’s data revealed that the king coin was at a crucial support level of $57,300 at press time. On a daily time frame, it was trading below the 200 Exponential Moving Average (EMA).

The price below the 200 EMA indicated that it was in a downtrend at this time.

Source: TradingView

In this market downturn, whenever BTC reaches this level, it experiences buying pressure and an upward rally. There is high speculation of an upside rally up to the $62,000 level this time.

Additionally, the technical indicator Relative Strength Index (RSI) was in an oversold area, indicating potential price reversal, which is a positive sign for investors and traders.

Bullish outlook emerges

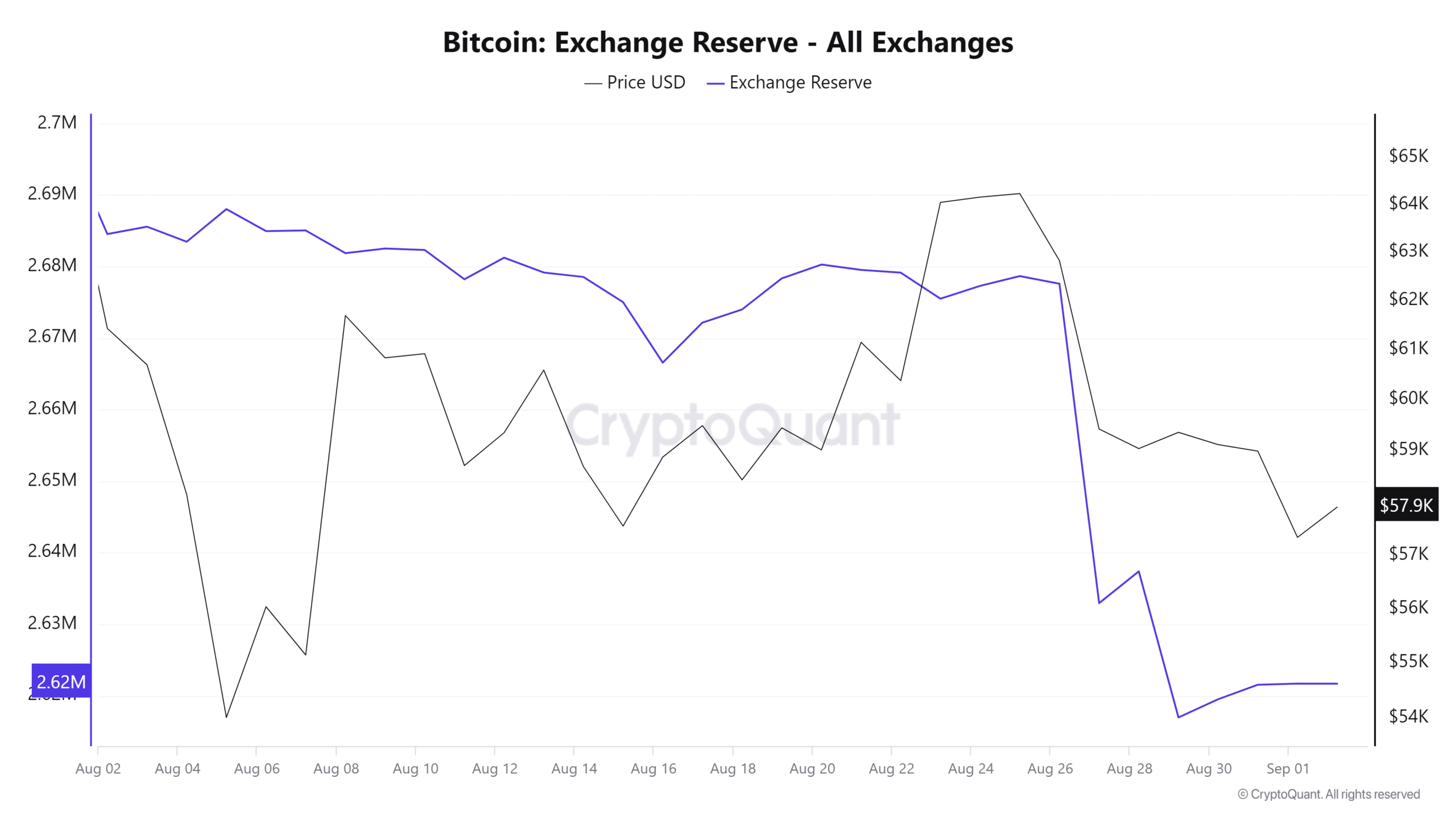

Other on-chain data also supported this bullish outlook. CryptoQuant’s BTC exchange reserve data showed potential buying pressure from investors, as the exchange reserve has significantly fallen in recent days.

Source: CryptoQuant

Meanwhile, CoinGlass’s BTC Long/Short Ratio chart stood at 1.0043 at press time, the highest level since the 26th of August, indicating bullish market sentiment.

BTC was trading near the $57,730 level at this time, having experienced a modest price drop of a decline of 0.8% in the last 24 hours. Meanwhile, its Open Interest dropped by 1% during the same period.

Key liquidation levels

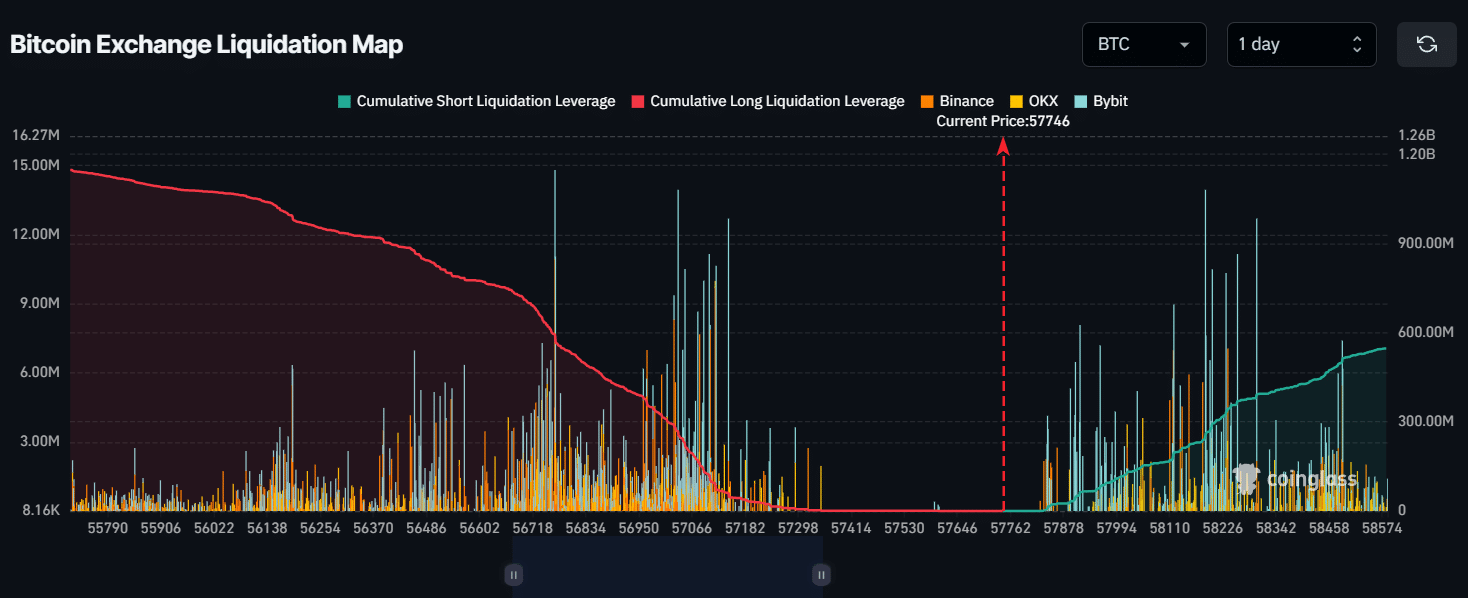

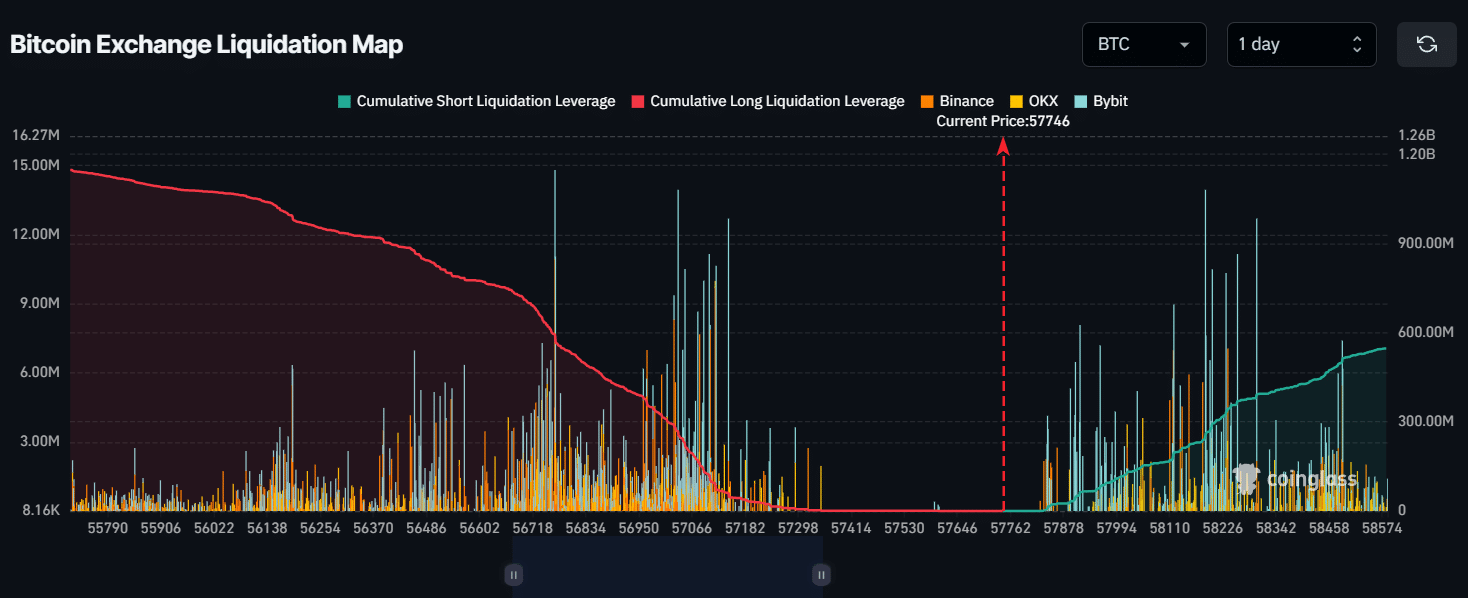

AMBCrypto’s look at CoinGlass’ Bitcoin exchange liquidation map signaled that bulls were dominating and potentially liquidating short positions at press time.

Major liquidation levels were near the $56,760 level on the lower side and the $58,300 level on the upper side, as traders are over-leveraged at these levels.

Source: CoinGlass

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If the sentiment remains bearish and the BTC price falls to the $56,760 level, nearly $600 million worth of long positions will be liquidated.

Conversely, if the sentiment shifts and the price rises to the $58,300 level, approximately $390 million in short positions will be liquidated.

- Bitcoin could rally up to the $62,000 level, based on historical price momentum.

- BTC exchange reserve data showed potential buying pressure from investors, as it has significantly fallen in recent days.

In this bearish market sentiment, crypto whales were aggressively buying the dip as major cryptocurrencies, including Bitcoin [BTC] and Ethereum [ETH], saw significant price declines.

On the 2nd of September, on-chain analytic firm Spot On Chain made a post on X (formerly Twitter) that a Bitcoin whale had purchased nearly 1,000 BTC worth $57.4 million from Binance [BNB].

Bitcoin whales buy the dip

Additionally, the same whale had purchased nearly 2,000 BTC worth $117 million, from Binance in the last four days at an average price of $58,525.

With the recent purchase, the whales’ Bitcoin holding increased to 8,559 BTC worth $494 million.

Previously, the whale had dumped a massive 7,790 BTC worth $467 million of BTC in July 2024, before the market sentiment turned bearish.

Upcoming levels

AMBCrypto’s look at TradingView’s data revealed that the king coin was at a crucial support level of $57,300 at press time. On a daily time frame, it was trading below the 200 Exponential Moving Average (EMA).

The price below the 200 EMA indicated that it was in a downtrend at this time.

Source: TradingView

In this market downturn, whenever BTC reaches this level, it experiences buying pressure and an upward rally. There is high speculation of an upside rally up to the $62,000 level this time.

Additionally, the technical indicator Relative Strength Index (RSI) was in an oversold area, indicating potential price reversal, which is a positive sign for investors and traders.

Bullish outlook emerges

Other on-chain data also supported this bullish outlook. CryptoQuant’s BTC exchange reserve data showed potential buying pressure from investors, as the exchange reserve has significantly fallen in recent days.

Source: CryptoQuant

Meanwhile, CoinGlass’s BTC Long/Short Ratio chart stood at 1.0043 at press time, the highest level since the 26th of August, indicating bullish market sentiment.

BTC was trading near the $57,730 level at this time, having experienced a modest price drop of a decline of 0.8% in the last 24 hours. Meanwhile, its Open Interest dropped by 1% during the same period.

Key liquidation levels

AMBCrypto’s look at CoinGlass’ Bitcoin exchange liquidation map signaled that bulls were dominating and potentially liquidating short positions at press time.

Major liquidation levels were near the $56,760 level on the lower side and the $58,300 level on the upper side, as traders are over-leveraged at these levels.

Source: CoinGlass

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If the sentiment remains bearish and the BTC price falls to the $56,760 level, nearly $600 million worth of long positions will be liquidated.

Conversely, if the sentiment shifts and the price rises to the $58,300 level, approximately $390 million in short positions will be liquidated.

cost clomiphene without a prescription get cheap clomid online where can i buy clomid pill cost clomid online can i order generic clomid prices can i order generic clomid prices can you get generic clomiphene without rx

The reconditeness in this ruined is exceptional.

Facts blog you possess here.. It’s intricate to find strong quality script like yours these days. I truly comprehend individuals like you! Go through mindfulness!!

buy azithromycin pill – zithromax 500mg price metronidazole for sale

rybelsus 14mg ca – periactin oral buy periactin 4mg generic

domperidone drug – purchase motilium sale buy cyclobenzaprine no prescription

order inderal generic – inderal 20mg uk buy generic methotrexate 5mg

cheap amoxicillin sale – cheap amoxicillin pills buy ipratropium 100 mcg online

azithromycin canada – how to get tinidazole without a prescription purchase nebivolol online cheap

buy augmentin 375mg sale – https://atbioinfo.com/ ampicillin generic

buy nexium without prescription – anexamate esomeprazole 40mg without prescription

order warfarin 2mg for sale – anticoagulant hyzaar over the counter

cost meloxicam – swelling meloxicam 7.5mg price

order deltasone 40mg for sale – https://apreplson.com/ deltasone 5mg drug

best erection pills – fast ed to take site home remedies for ed erectile dysfunction

oral amoxicillin – buy generic amoxil online buy amoxil online cheap

diflucan 100mg canada – https://gpdifluca.com/ buy generic forcan

cheap cenforce 100mg – https://cenforcers.com/ cenforce 100mg generic

cheap cialis 20mg – take cialis the correct way tadalafil how long to take effect

cialis softabs online – cialis max dose cheap generic cialis

order ranitidine 150mg generic – https://aranitidine.com/# ranitidine brand

viagra online generic cheap – https://strongvpls.com/# sildenafil 100 mg pill identifier

This is the description of content I get high on reading. synthroid efectos secundarios hombres

More articles like this would remedy the blogosphere richer. https://buyfastonl.com/gabapentin.html

I am actually enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://ursxdol.com/augmentin-amoxiclav-pill/

Palatable blog you possess here.. It’s hard to find high quality script like yours these days. I truly respect individuals like you! Rent care!! https://prohnrg.com/product/omeprazole-20-mg/

I am actually enchant‚e ‘ to glance at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. https://ondactone.com/spironolactone/

More posts like this would bring about the blogosphere more useful.

https://doxycyclinege.com/pro/esomeprazole/

I am in point of fact enchant‚e ‘ to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. http://www.dbgjjs.com/home.php?mod=space&uid=531849

cost forxiga 10 mg – https://janozin.com/# dapagliflozin 10mg tablet

xenical cost – order xenical pill orlistat 60mg brand