- CryptoQuant CEO Ki Young Ju also noted that whales are accumulating Bitcoin and we’re in the middle of the bull cycle.

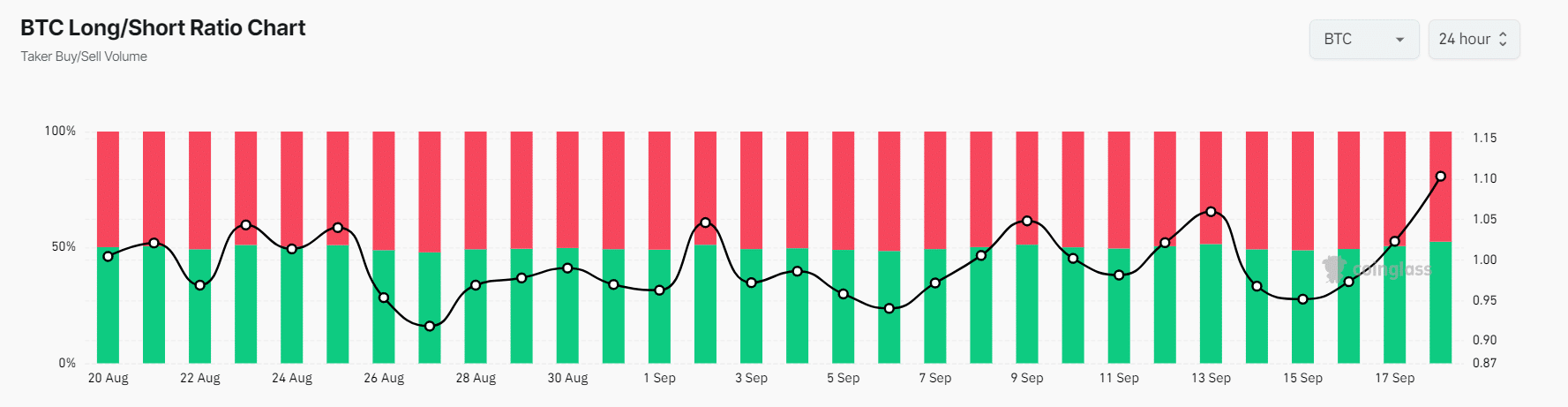

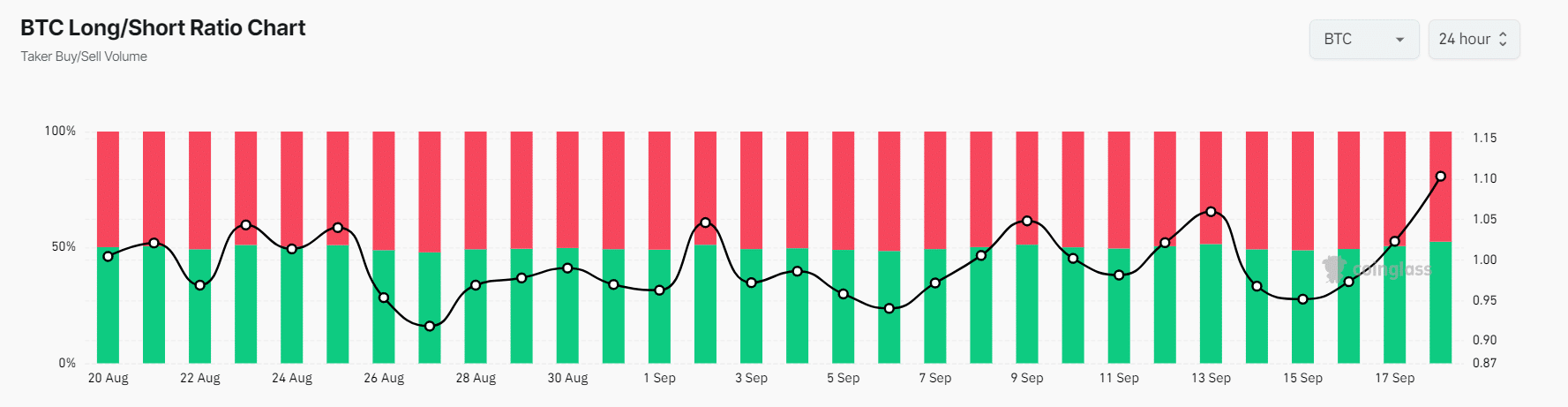

- BTC’s Long/Short ratio currently stands at 1.1048 (a value of ratio above 1 indicates bullish market sentiment among traders).

Despite significant volatility in the cryptocurrency market, Bitcoin [BTC] whales and institutions appear to be capitalizing on the current sentiment by heavily accumulating coins.

In recent days, the overall cryptocurrency market sentiment has been challenging, with major cryptocurrencies like Ethereum, Solana, and XRP struggling to gain momentum.

Whales and institutional accumulation

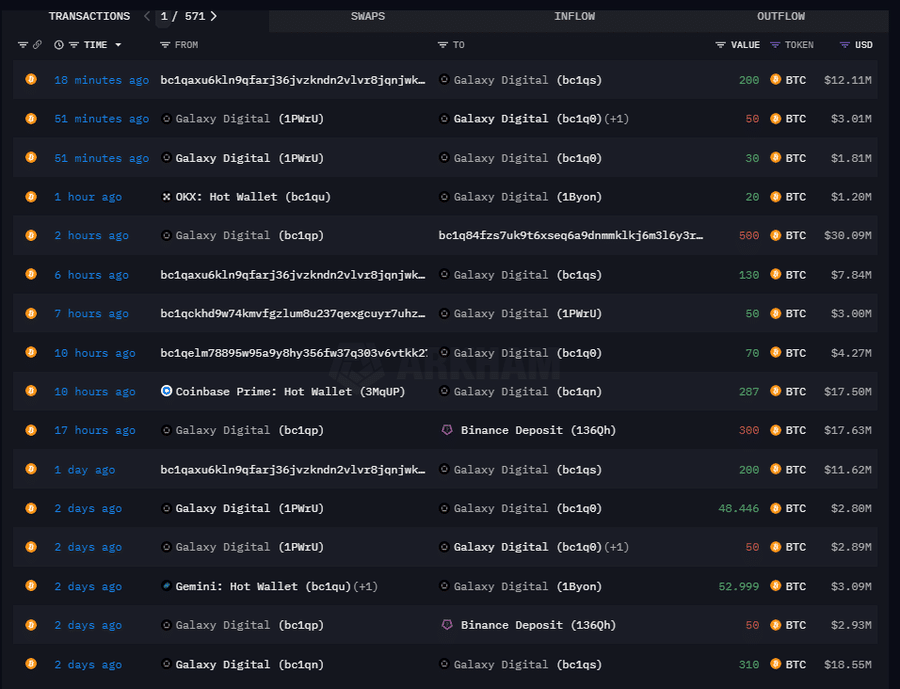

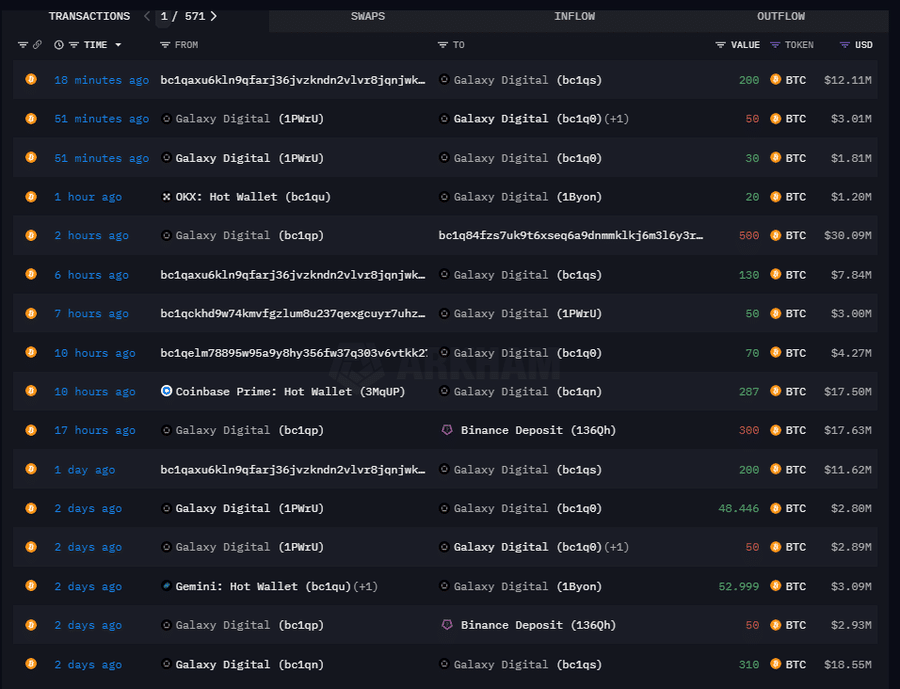

On-chain analytics firm made a post on X (previously Twitter) that digital asset and blockchain leader Galaxy Digital had accumulated a significant 4,491 BTC, worth $267.03 million, within a week from the exchanges including OKX, Coinbase, and Gemini.

With this recent accumulation, the firm now holds a massive 8,790 BTC, worth $532.38 million.

In addition to this post on X, CryptoQuant CEO Ki Young Ju also shared data supporting the same perspective on Bitcoin whales. In a post on X, Ki Young noted that whales are accumulating Bitcoin.

He added, “Six days of accumulation alerts in a row, primarily from custody wallet inflows. Nothing has changed for Bitcoin; we’re in the middle of the bull cycle.”

Ideal buying opportunity?

Bitcoin accumulation in this challenging condition is a positive sign and potentially signals an ideal buying opportunity.

Despite the significant accumulation and the bullish outlook of whales, Bitcoin remains steady and has been consolidating between $58,000 and $60,000.

At press time, BTC is trading near the $60,550 level and has experienced a price surge of over 3.35% in the past 24 hours. During the same period, its trading volume has increased by 40%, indicating higher participation among traders.

BTC’s bullish on-chain metrics

Currently, Bitcoin’s on-chain metrics are flashing bullish signals. According to the on-chain analytic firm Coinglass, BTC’s Long/Short ratio currently stands at 1.1048 (a value of ratio above 1 indicates bullish market sentiment among traders), the highest since August 2024.

Source: Coinglass

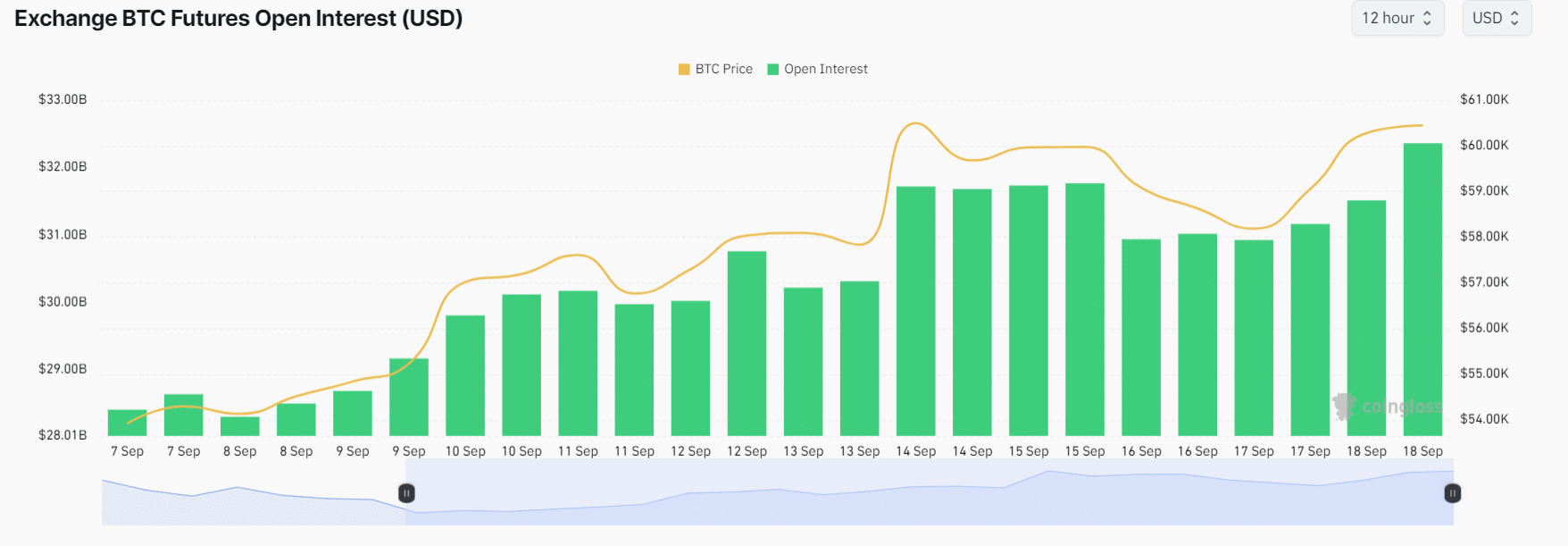

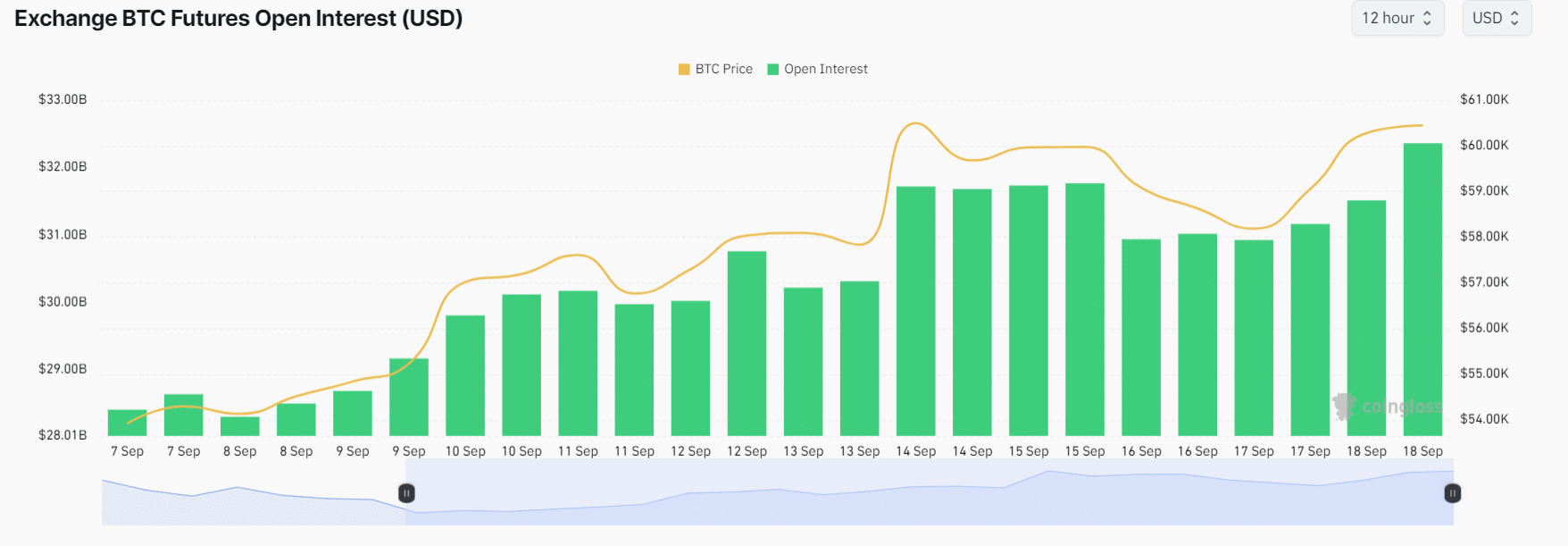

Additionally, BTC’s future open interest has increased by 6% in the last 24 hours and continues to grow, indicating rising interest from traders and investors.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, 52.5% of top Bitcoin traders hold long positions, while 47.5% hold short positions, indicating that bulls are back and dominating the asset.

Meanwhile, the BTC OI-weighted funding rate stands at +0.0053% and is in the green, reflecting bullish sentiment among traders and investors.

- CryptoQuant CEO Ki Young Ju also noted that whales are accumulating Bitcoin and we’re in the middle of the bull cycle.

- BTC’s Long/Short ratio currently stands at 1.1048 (a value of ratio above 1 indicates bullish market sentiment among traders).

Despite significant volatility in the cryptocurrency market, Bitcoin [BTC] whales and institutions appear to be capitalizing on the current sentiment by heavily accumulating coins.

In recent days, the overall cryptocurrency market sentiment has been challenging, with major cryptocurrencies like Ethereum, Solana, and XRP struggling to gain momentum.

Whales and institutional accumulation

On-chain analytics firm made a post on X (previously Twitter) that digital asset and blockchain leader Galaxy Digital had accumulated a significant 4,491 BTC, worth $267.03 million, within a week from the exchanges including OKX, Coinbase, and Gemini.

With this recent accumulation, the firm now holds a massive 8,790 BTC, worth $532.38 million.

In addition to this post on X, CryptoQuant CEO Ki Young Ju also shared data supporting the same perspective on Bitcoin whales. In a post on X, Ki Young noted that whales are accumulating Bitcoin.

He added, “Six days of accumulation alerts in a row, primarily from custody wallet inflows. Nothing has changed for Bitcoin; we’re in the middle of the bull cycle.”

Ideal buying opportunity?

Bitcoin accumulation in this challenging condition is a positive sign and potentially signals an ideal buying opportunity.

Despite the significant accumulation and the bullish outlook of whales, Bitcoin remains steady and has been consolidating between $58,000 and $60,000.

At press time, BTC is trading near the $60,550 level and has experienced a price surge of over 3.35% in the past 24 hours. During the same period, its trading volume has increased by 40%, indicating higher participation among traders.

BTC’s bullish on-chain metrics

Currently, Bitcoin’s on-chain metrics are flashing bullish signals. According to the on-chain analytic firm Coinglass, BTC’s Long/Short ratio currently stands at 1.1048 (a value of ratio above 1 indicates bullish market sentiment among traders), the highest since August 2024.

Source: Coinglass

Additionally, BTC’s future open interest has increased by 6% in the last 24 hours and continues to grow, indicating rising interest from traders and investors.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, 52.5% of top Bitcoin traders hold long positions, while 47.5% hold short positions, indicating that bulls are back and dominating the asset.

Meanwhile, the BTC OI-weighted funding rate stands at +0.0053% and is in the green, reflecting bullish sentiment among traders and investors.

how to buy cheap clomid tablets where can i get generic clomid without dr prescription clomiphene price at clicks cost cheap clomid without insurance where can i buy clomiphene without dr prescription can i order clomiphene prices can i get cheap clomid price

I am in truth delighted to glitter at this blog posts which consists of tons of of use facts, thanks towards providing such data.

Greetings! Extremely productive suggestion within this article! It’s the scarcely changes which liking turn the largest changes. Thanks a quantity for sharing!

azithromycin 250mg tablet – azithromycin 500mg sale order flagyl 200mg generic

order generic rybelsus 14mg – cyproheptadine 4mg usa buy generic cyproheptadine online

buy domperidone 10mg online – buy motilium for sale cyclobenzaprine generic

oral zithromax 250mg – buy generic azithromycin 250mg order bystolic sale

oral clavulanate – atbioinfo.com buy ampicillin online

order esomeprazole 20mg generic – https://anexamate.com/ order generic nexium 20mg

buy coumadin pills – coumamide.com cozaar 50mg price

meloxicam oral – https://moboxsin.com/ purchase meloxicam online cheap

order prednisone 10mg pill – apreplson.com prednisone 5mg over the counter

ed pills – fast ed to take buy ed pills cheap

cheap amoxicillin online – cheap amoxil pills purchase amoxicillin online

buy diflucan generic – https://gpdifluca.com/ purchase fluconazole online cheap

cenforce medication – https://cenforcers.com/# cenforce price

what is the difference between cialis and tadalafil? – cialis prices at walmart cialis copay card

cialis medicine – click canada drugs cialis

This is the gentle of writing I in fact appreciate. sitio web

cheap viagra quick delivery – https://strongvpls.com/# generic viagra for cheap

Greetings! Extremely useful suggestion within this article! It’s the petty changes which choice obtain the largest changes. Thanks a quantity towards sharing! https://ursxdol.com/levitra-vardenafil-online/

Greetings! Very productive recommendation within this article! It’s the scarcely changes which wish turn the largest changes. Thanks a lot for sharing! https://prohnrg.com/product/get-allopurinol-pills/

The reconditeness in this piece is exceptional. https://aranitidine.com/fr/en_ligne_kamagra/

This is a theme which is near to my callousness… Diverse thanks! Exactly where can I find the connection details for questions? https://ondactone.com/simvastatin/

The thoroughness in this break down is noteworthy.

https://doxycyclinege.com/pro/dutasteride/

This is the description of glad I have reading. http://3ak.cn/home.php?mod=space&uid=229259

buy forxiga pills for sale – click order forxiga online