- BTC dropped 3.5% on Monday following Powell’s remarks on Fed rate cuts.

- The asset held above key short-term support at $63K, but will it continue to hold?

Bitcoin [BTC] and US stocks dropped during Monday’s, 30th September, intra-day trading session. BTC dropped 3% and hit $63000, which coincided with Fed chair Jerome Powell’s remarks on rate cut expectations.

During his Nashville address at the National Association for Business Economics conference, he showed no preference for a faster or slower pace of interest rate reduction.

He foresaw another two interest rate cuts, each 25 bps (basis points), before the end of the year.

“If the economy evolves as expected, that would be two more cuts by year’s end, for a total reduction of half a percentage point more.”

Market reprice Fed rate cut expectations

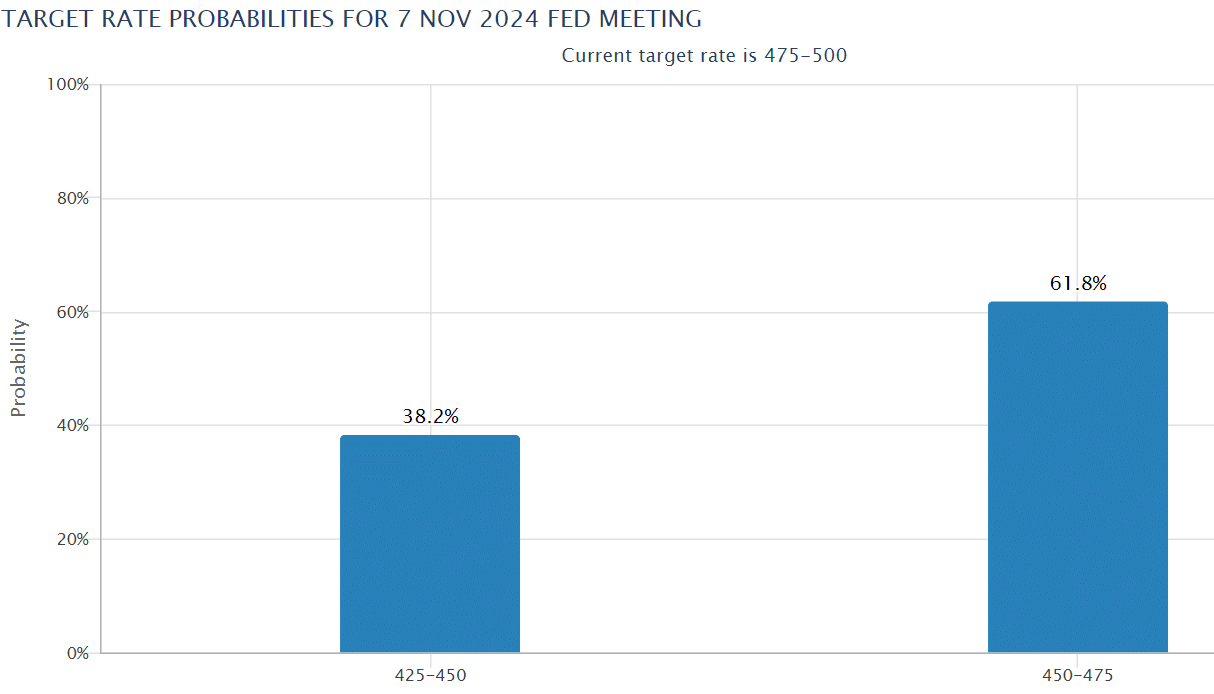

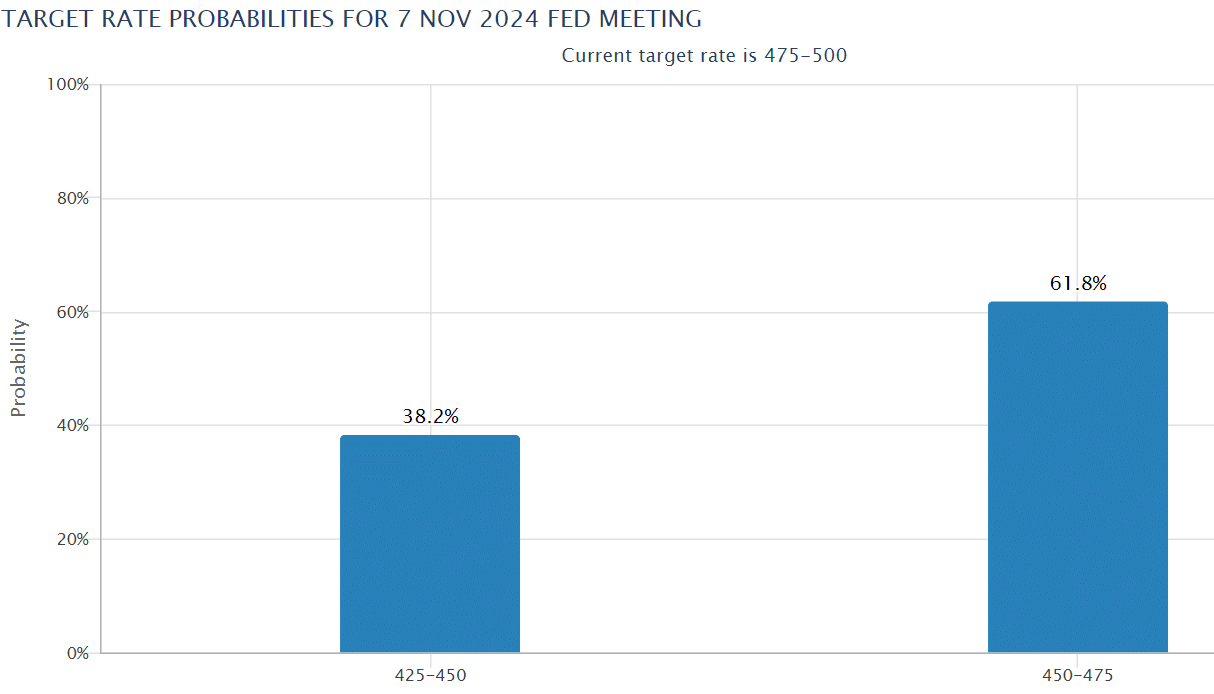

As of last week, the market expected an extra aggressive 50 bps cut in November, similar to the move seen in September.

Source: CME FedWatch

However, at press time, interest rate traders priced higher odds of 25 bps at 61.8% following Powell’s remarks.

On the contrary, the chances of a 0.50% cut dropped to 38.2% from 53% seen last Friday, 27th September.

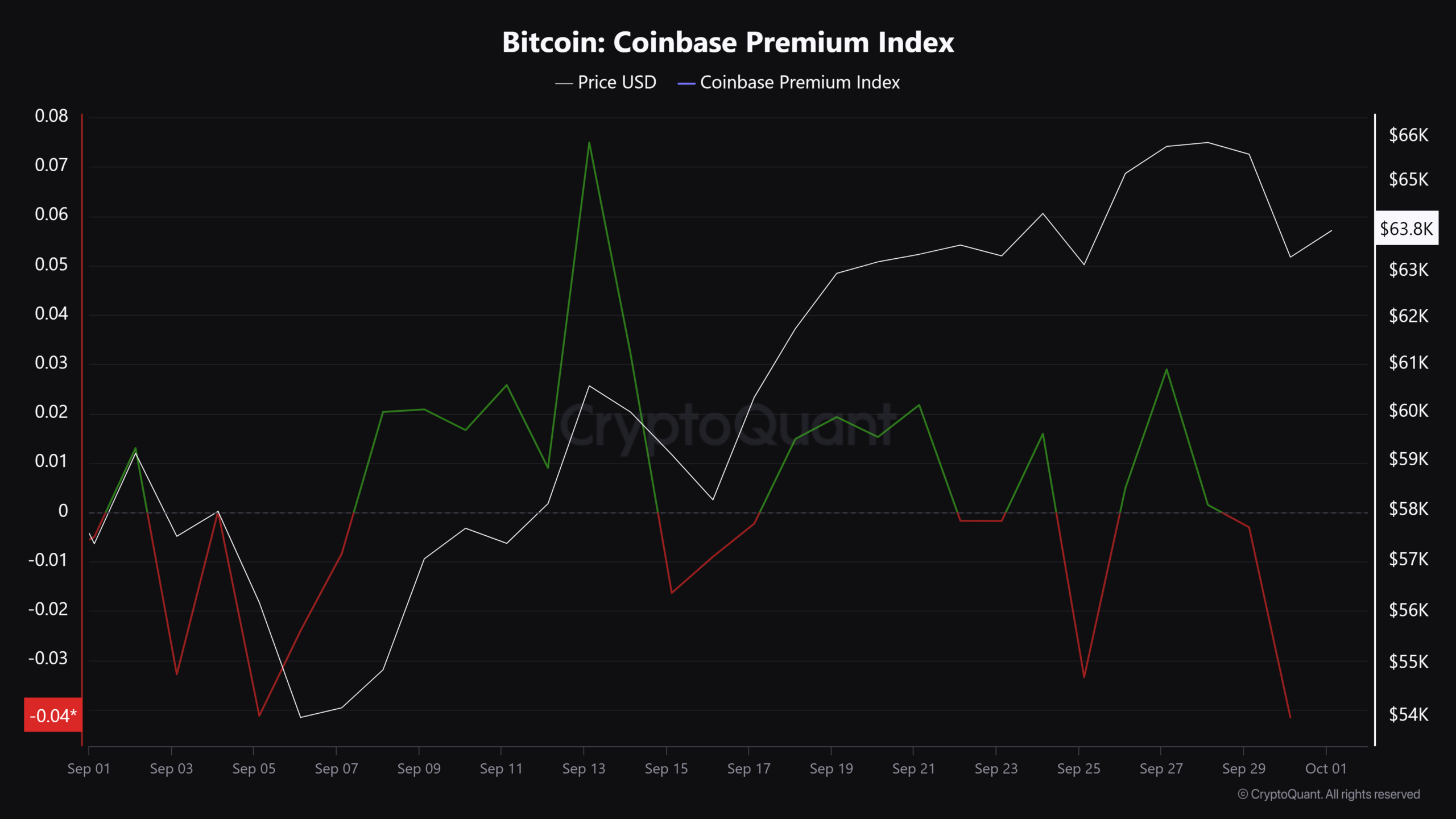

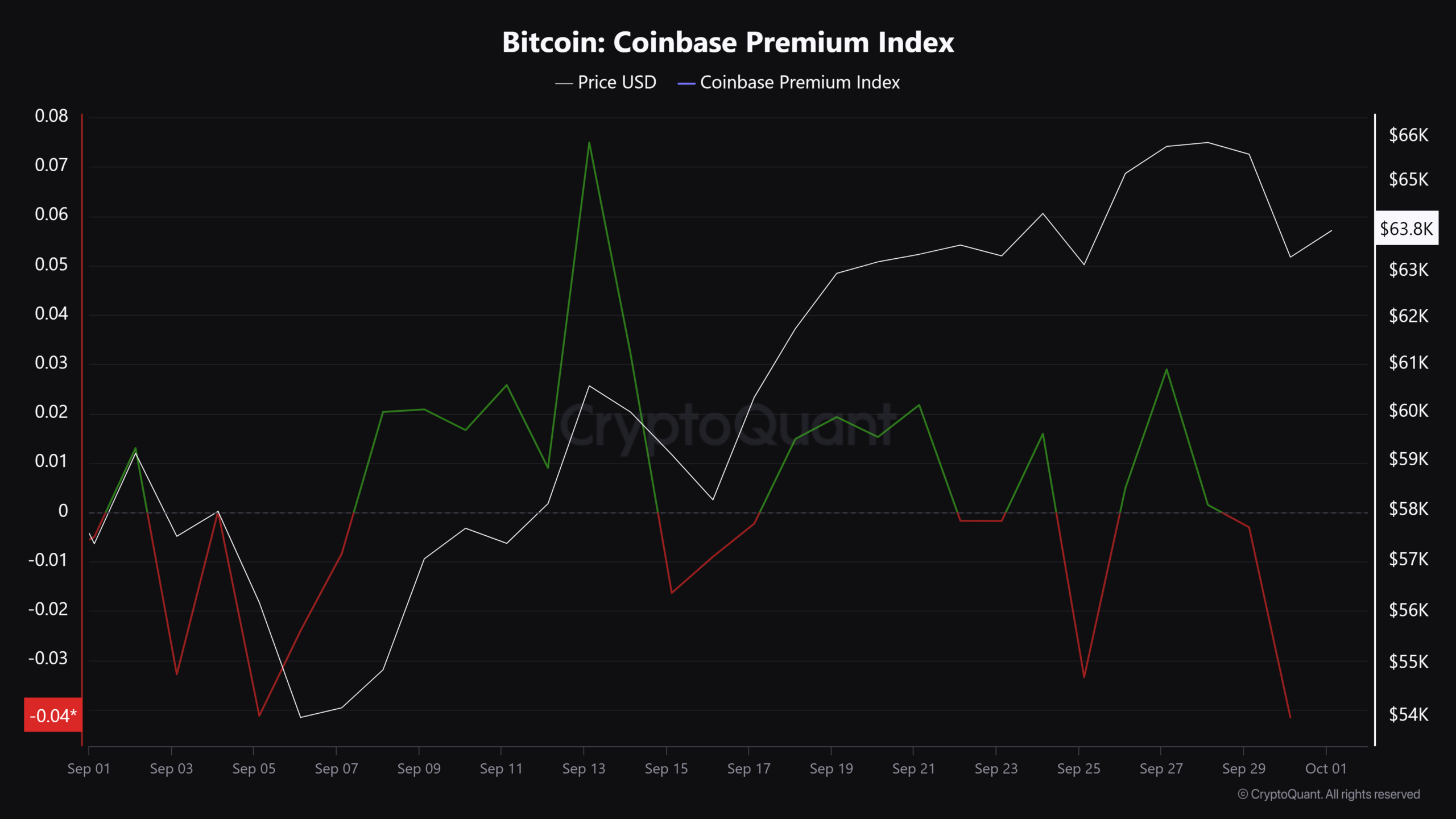

This has triggered a sentiment shift into the new week ahead of crucial US labor updates. Notably, US demand for BTC dropped from last Friday’s positive reading to a negative on 1st November, per the Coinbase Premium Index.

Source: CryptoQuant

Compared to nearly $500 million daily inflows in US spot BTC ETFs last Friday, the products netted only $61.3 million on Monday, 30 September.

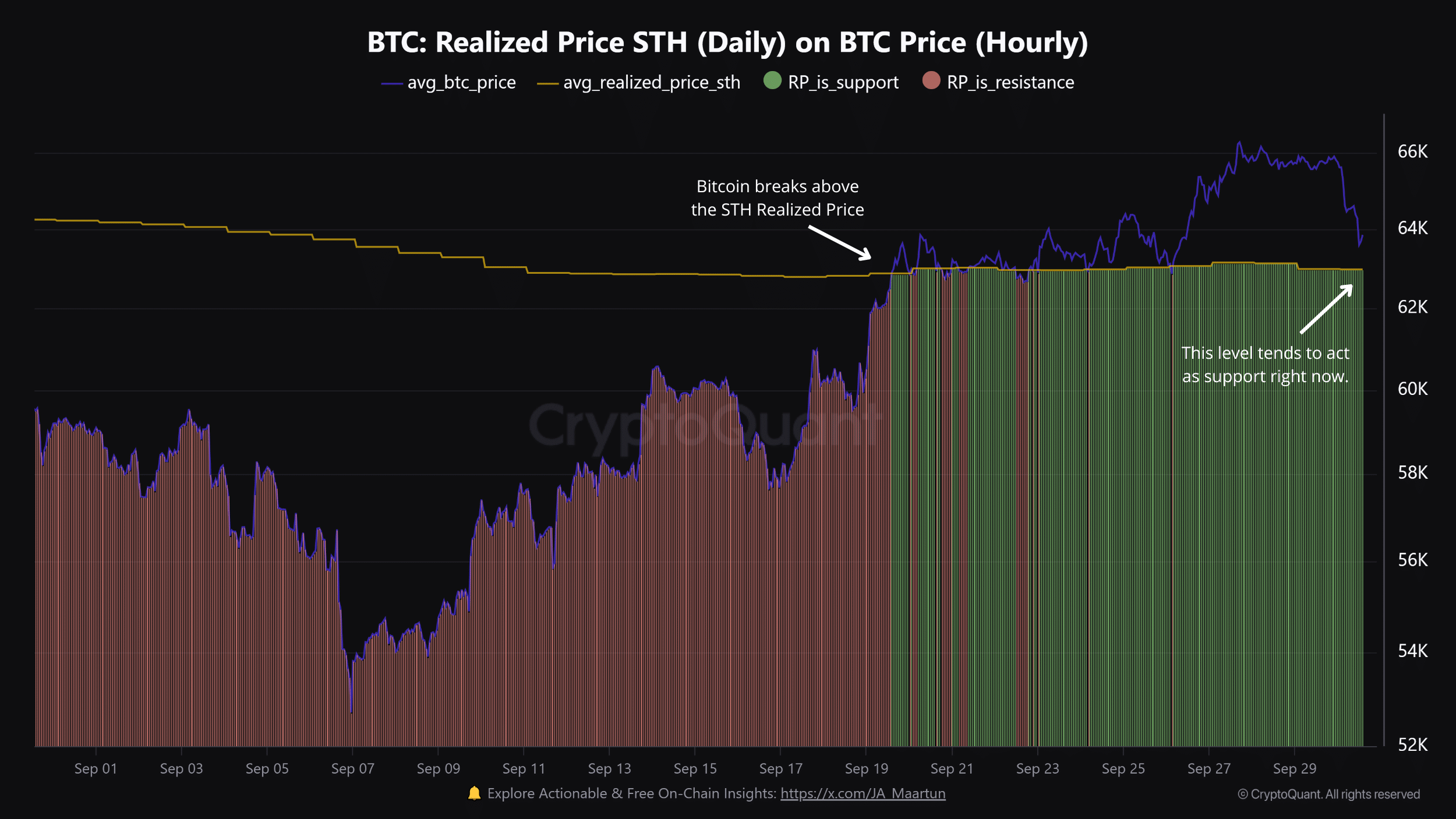

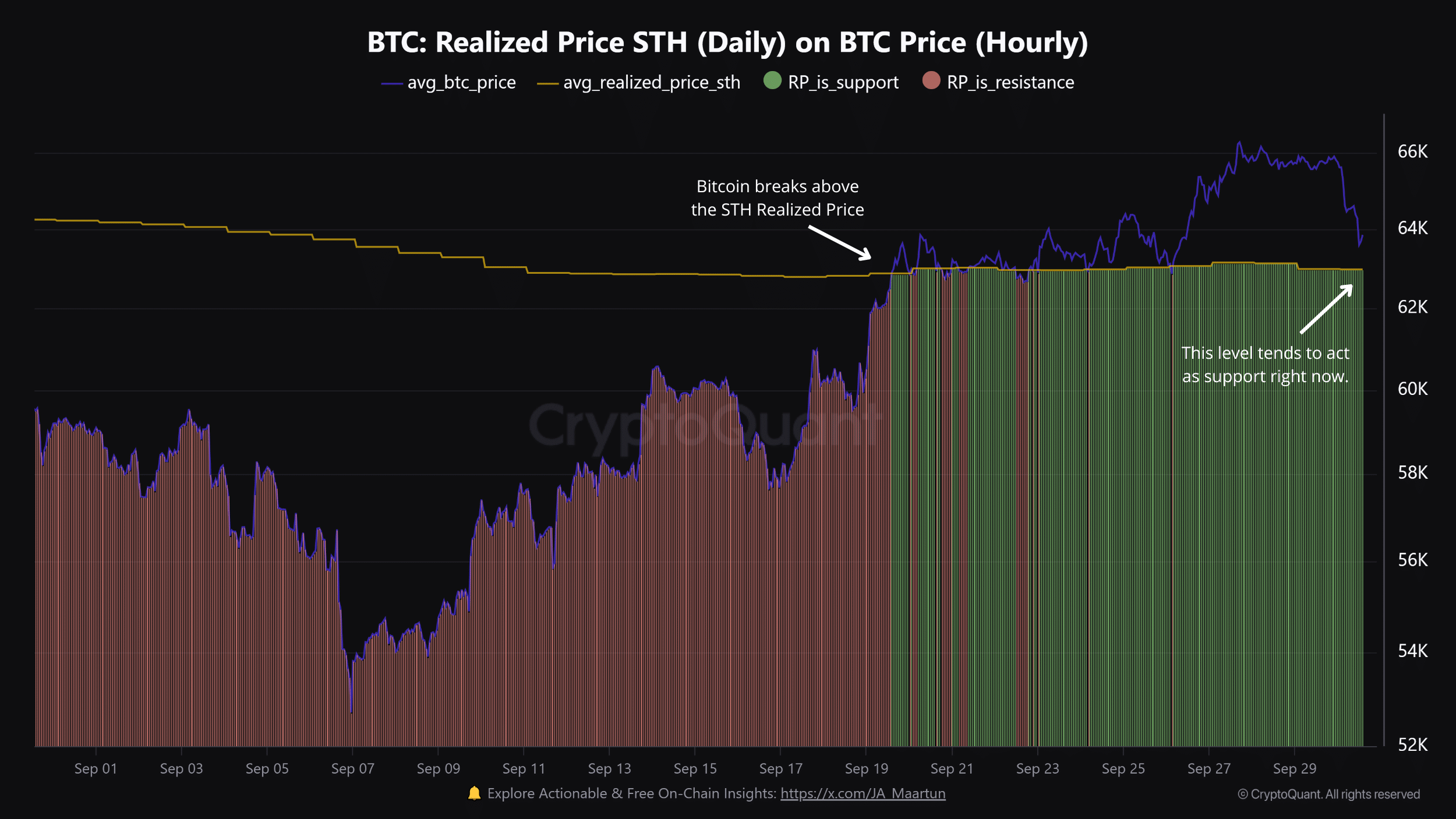

That being said, the $63K level could be crucial support in the short term. As noted by CryptoQuant, the level was the short-term holders’ (STH) realized price and has acted as support since mid-September.

Source: CryptoQuant

At press time, BTC was valued at $63.9K ahead of crucial US labor updates.

Another potential positive catalyst was an increasing signal towards an end to the Fed’s quantitative tightening (QT) as more institutions tap into the Fed’s Repo facility. This could inject more Fed liquidity and boost risk assets.

However, increasing geopolitical tension in the Middle East could also challenge BTC’s Uptober expectations and is worth tracking.

- BTC dropped 3.5% on Monday following Powell’s remarks on Fed rate cuts.

- The asset held above key short-term support at $63K, but will it continue to hold?

Bitcoin [BTC] and US stocks dropped during Monday’s, 30th September, intra-day trading session. BTC dropped 3% and hit $63000, which coincided with Fed chair Jerome Powell’s remarks on rate cut expectations.

During his Nashville address at the National Association for Business Economics conference, he showed no preference for a faster or slower pace of interest rate reduction.

He foresaw another two interest rate cuts, each 25 bps (basis points), before the end of the year.

“If the economy evolves as expected, that would be two more cuts by year’s end, for a total reduction of half a percentage point more.”

Market reprice Fed rate cut expectations

As of last week, the market expected an extra aggressive 50 bps cut in November, similar to the move seen in September.

Source: CME FedWatch

However, at press time, interest rate traders priced higher odds of 25 bps at 61.8% following Powell’s remarks.

On the contrary, the chances of a 0.50% cut dropped to 38.2% from 53% seen last Friday, 27th September.

This has triggered a sentiment shift into the new week ahead of crucial US labor updates. Notably, US demand for BTC dropped from last Friday’s positive reading to a negative on 1st November, per the Coinbase Premium Index.

Source: CryptoQuant

Compared to nearly $500 million daily inflows in US spot BTC ETFs last Friday, the products netted only $61.3 million on Monday, 30 September.

That being said, the $63K level could be crucial support in the short term. As noted by CryptoQuant, the level was the short-term holders’ (STH) realized price and has acted as support since mid-September.

Source: CryptoQuant

At press time, BTC was valued at $63.9K ahead of crucial US labor updates.

Another potential positive catalyst was an increasing signal towards an end to the Fed’s quantitative tightening (QT) as more institutions tap into the Fed’s Repo facility. This could inject more Fed liquidity and boost risk assets.

However, increasing geopolitical tension in the Middle East could also challenge BTC’s Uptober expectations and is worth tracking.

buy clomiphene without prescription cost generic clomid pills cost of cheap clomid pills buying generic clomid without prescription get cheap clomiphene without insurance can i buy cheap clomid cost of generic clomid online

Thanks on putting this up. It’s okay done.

Only wanna input that you have a very decent web site, I enjoy the layout it actually stands out.

More posts like this would bring about the blogosphere more useful.

order zithromax 250mg for sale – cost metronidazole 400mg flagyl sale

order rybelsus pill – buy rybelsus 14 mg sale cyproheptadine usa

motilium where to buy – buy sumycin 500mg pill flexeril oral

propranolol brand – cost methotrexate methotrexate over the counter

amoxicillin order – combivent 100 mcg oral ipratropium without prescription

With havin so much content do you ever run into any problems of plagorism or copyright infringement? My website has a lot of completely unique content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the web without my authorization. Do you know any solutions to help prevent content from being stolen? I’d genuinely appreciate it.

cheap zithromax – nebivolol 20mg for sale order bystolic pill

Este site é realmente fantástico. Sempre que acesso eu encontro novidades Você também vai querer acessar o nosso site e descobrir mais detalhes! conteúdo único. Venha descobrir mais agora! 🙂

augmentin brand – atbioinfo.com ampicillin cost

buy esomeprazole 40mg without prescription – nexiumtous how to buy esomeprazole

order coumadin 2mg online – blood thinner order cozaar generic

purchase meloxicam pills – https://moboxsin.com/ buy mobic 7.5mg generic

There are some interesting points in time in this article but I don’t know if I see all of them middle to heart. There’s some validity however I’ll take maintain opinion till I look into it further. Good article , thanks and we would like more! Added to FeedBurner as nicely

buy prednisone pills for sale – corticosteroid order deltasone 20mg pill

non prescription erection pills – https://fastedtotake.com/ ed pills cheap

cheap amoxicillin generic – cheap amoxicillin without prescription amoxil order online

buy diflucan no prescription – https://gpdifluca.com/ where to buy forcan without a prescription

buy lexapro cheap – escitapro.com buy generic escitalopram 10mg

cenforce tablet – cenforce rs cenforce for sale online

when does cialis patent expire – https://ciltadgn.com/ cialis 10mg ireland

tadalafil without a doctor’s prescription – https://strongtadafl.com/# cialis generic timeline

order zantac 300mg sale – https://aranitidine.com/ purchase ranitidine without prescription

viagra online order – buy viagra paypal accepted buy viagra australia online

This is a topic which is virtually to my verve… Myriad thanks! Unerringly where can I notice the connection details in the course of questions? https://gnolvade.com/

More posts like this would bring about the blogosphere more useful. https://buyfastonl.com/isotretinoin.html

More posts like this would bring about the blogosphere more useful. https://ursxdol.com/ventolin-albuterol/

I couldn’t hold back commenting. Profoundly written! https://prohnrg.com/product/cytotec-online/

Pretty great post. I simply stumbled upon your weblog and wished to mention that I have truly loved browsing your blog posts. In any case I’ll be subscribing to your rss feed and I am hoping you write again soon!

Thanks for putting this up. It’s understandably done. https://aranitidine.com/fr/sibelium/

Thanks on putting this up. It’s understandably done. https://ondactone.com/spironolactone/

The thoroughness in this section is noteworthy.

ondansetron oral

This website really has all of the tidings and facts I needed there this case and didn’t identify who to ask. http://www.zgqsz.com/home.php?mod=space&uid=846485

I am not very wonderful with English but I get hold this real leisurely to translate.

buy generic dapagliflozin over the counter – https://janozin.com/# purchase dapagliflozin generic

buy xenical pills – https://asacostat.com/# where can i buy orlistat

More content pieces like this would insinuate the web better. https://myvisualdatabase.com/forum/profile.php?id=118673