- As the U.S. Dollar weakens, China looks to strengthen its Yuan currency.

- Investor confidence grows steadily as BTC breaks out of micro channel.

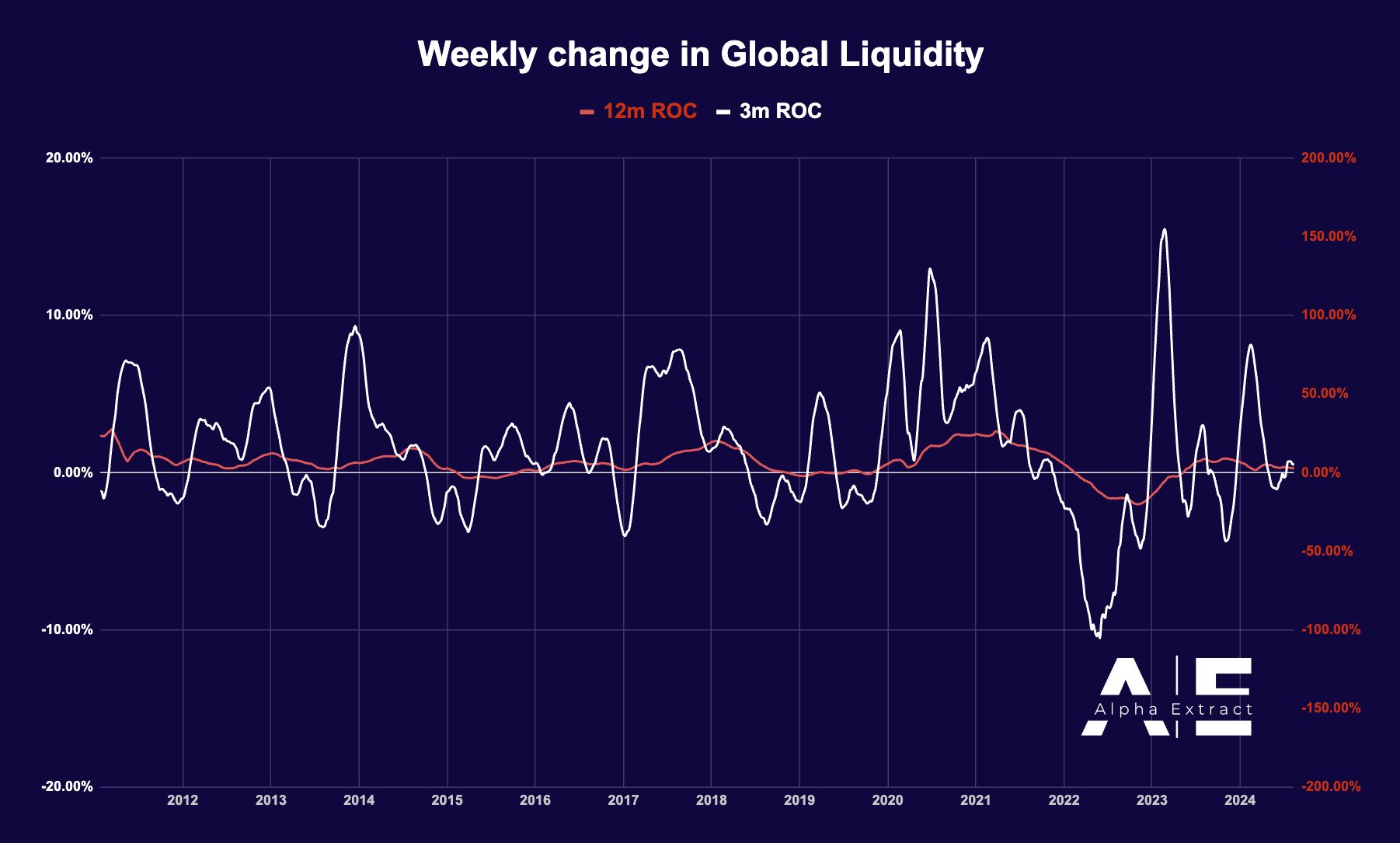

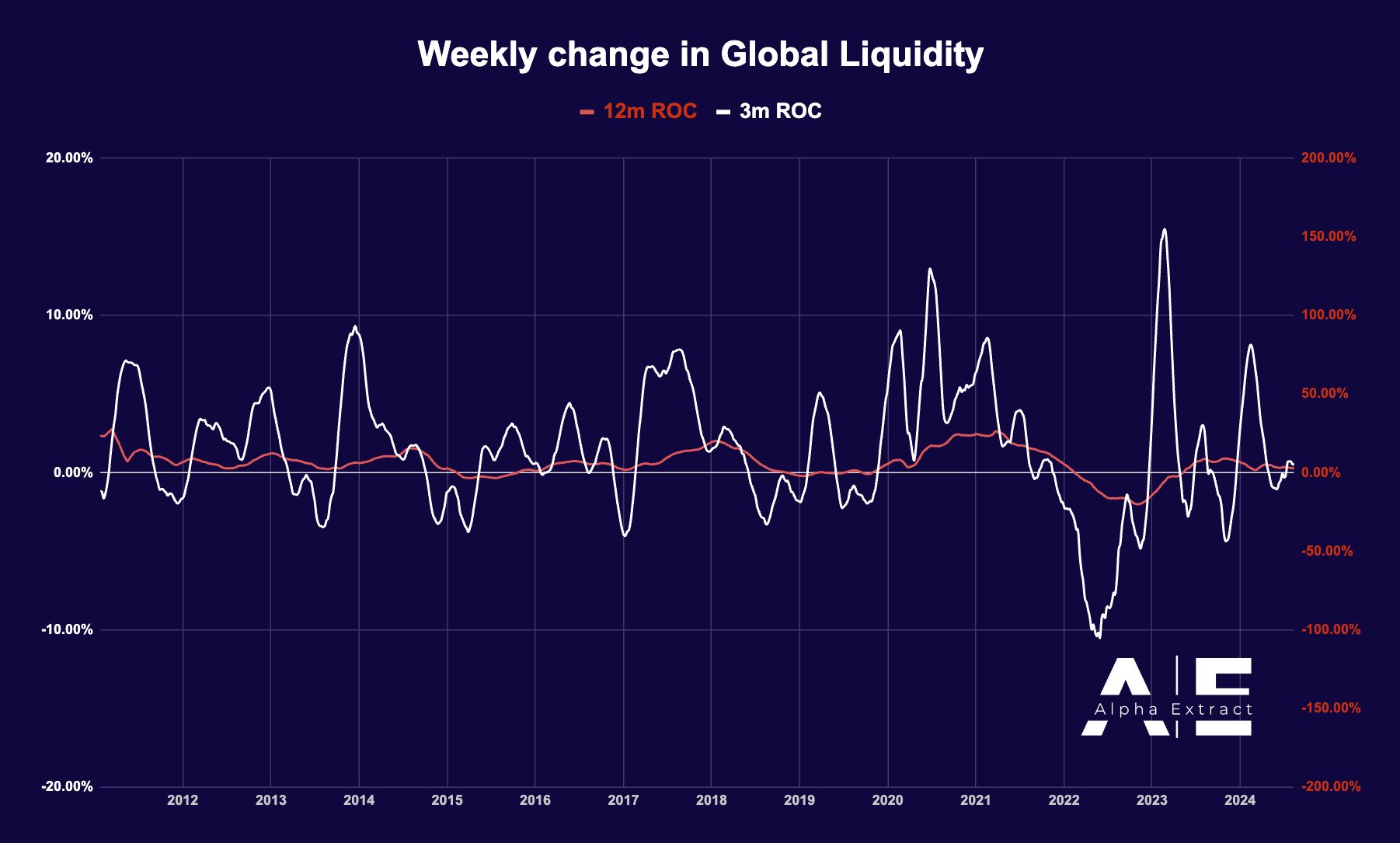

Investor risk exposure due to recession fears is decreasing, as global liquidity in crypto is still on the rise.

Alpha Extract on X (formerly Twitter), cited that China is actively stimulating its economy without significantly devaluing the Yuan against the U.S. Dollar.

The U.S. plays a crucial role in liquidity, especially with ongoing bill issuance. So, a weaker dollar can lead to increased liquidity from other central banks.

Source: Alpha Etract

The Federal Reserve’s reserve bank credit dropped by $10 billion last week, but rising collateral values caused a slight uptick in the Global Liquidity Index (GLI), now at $125.975 trillion, a 0.165% increase.

The Adjusted Economic Rate of Change (AE RoC) remained positive.

Other metrics, coupled with the interplay between China’s stimulus and U.S. dollar weakness, could impact Bitcoin [BTC] prices in the long run.

Investor confidence growing significantly Bitcoin saw a big Coinbase discount again during the sell off that happened during previous week’s market crash.

However, it recovered quickly, closing with more than 23% gain from its week’s low.

$BTC now has a Coinbase premium again, which is generally positive as it shows positive investor sentiment from the U.S. and ETFs.

This also signifies that BTC could rally as a result of China’s stimulus and a weakening USD.

Source: CryptoQuant

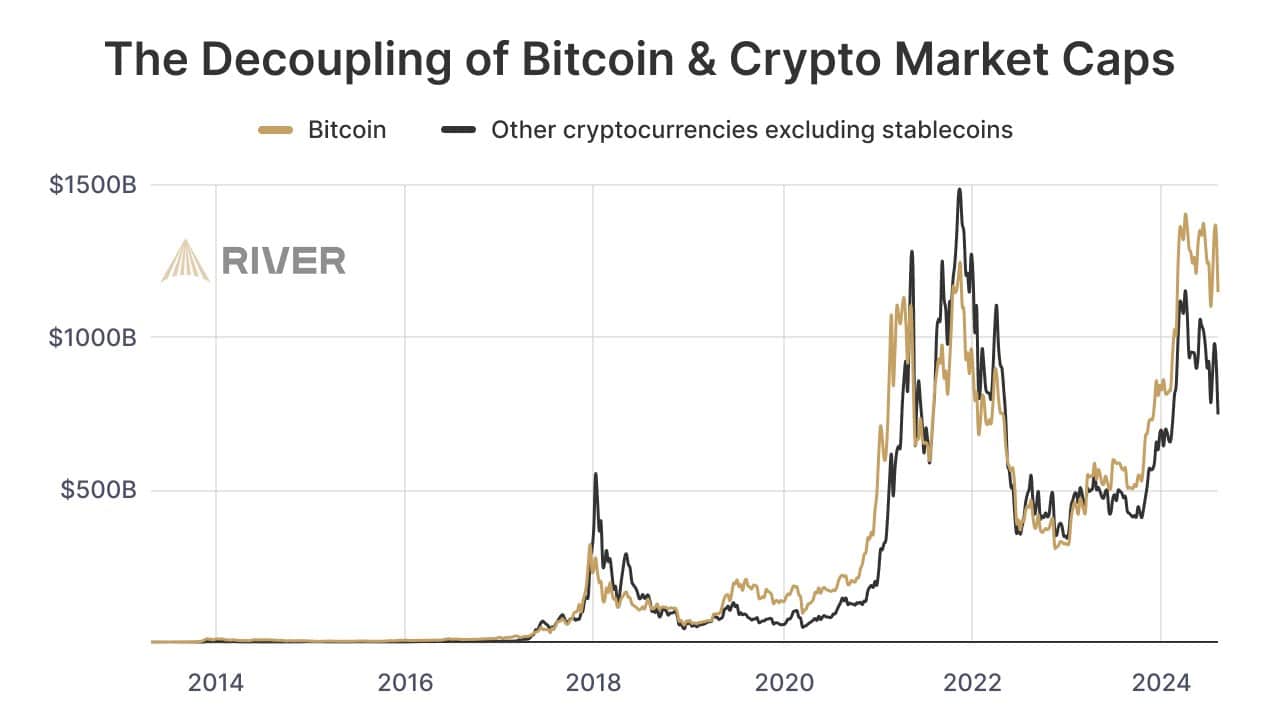

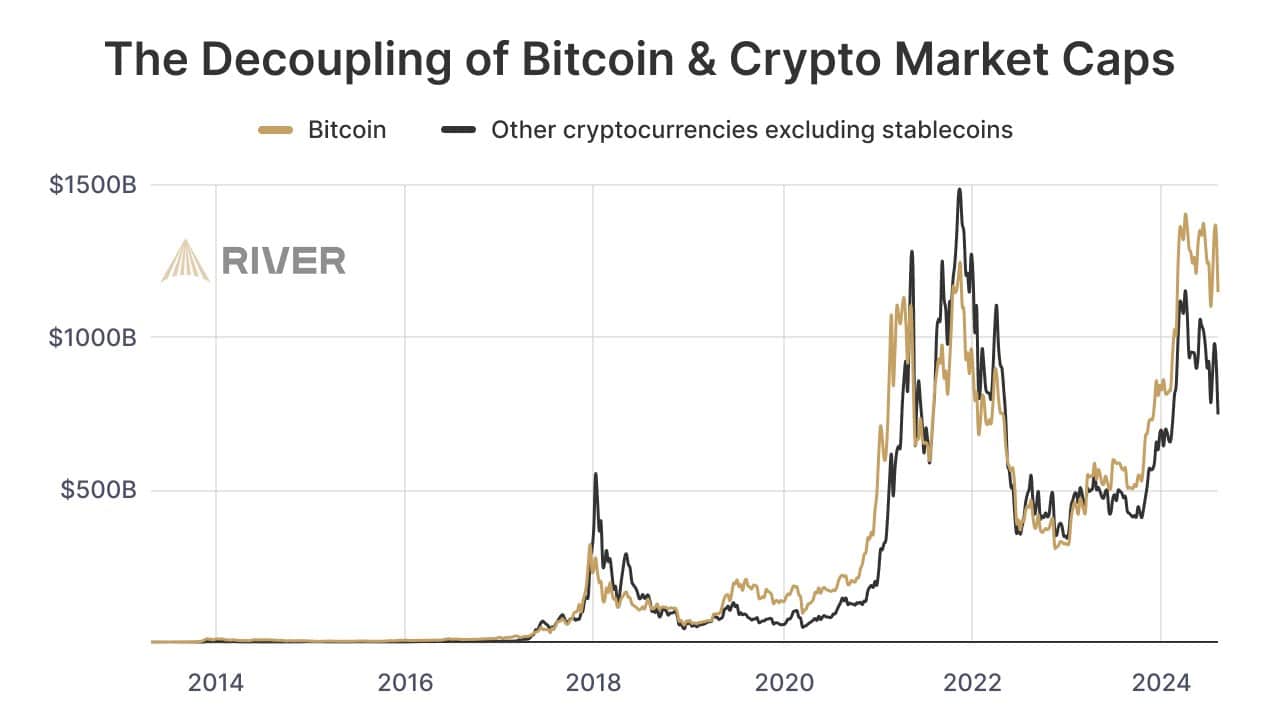

Decoupling of BTC and altcoin market caps

Three years ago, Bitcoin’s market cap was around $835 billion, while other cryptocurrencies, excluding stablecoins, matched that.

Today, Bitcoin’s market cap has risen 37% to $1.15 trillion, while other coins have dropped 11%.

This shift highlighted Bitcoin’s dominance and questioned the wisdom of those blindly diversifying in crypto.

With China’s stimulus and the U.S. dollar weakening, Bitcoin could potentially reach new all-time highs, emphasizing its strength in the market.

Source: River

Bitcoin breaks a micro downward trend

Bitcoin has broken out of its recent downward trend, and showing potential for a rally.

Is your portfolio green? Check out the BTC Profit Calculator

If Bitcoin stays above $58,000, it could rise further to $61,000, triggering short liquidations. The next key level to watch is how it reacts at $61,000.

Coupled with China’s stimulus and the weakening U.S. dollar, Bitcoin could see a significant rally in the coming days.

Source: TradingView

- As the U.S. Dollar weakens, China looks to strengthen its Yuan currency.

- Investor confidence grows steadily as BTC breaks out of micro channel.

Investor risk exposure due to recession fears is decreasing, as global liquidity in crypto is still on the rise.

Alpha Extract on X (formerly Twitter), cited that China is actively stimulating its economy without significantly devaluing the Yuan against the U.S. Dollar.

The U.S. plays a crucial role in liquidity, especially with ongoing bill issuance. So, a weaker dollar can lead to increased liquidity from other central banks.

Source: Alpha Etract

The Federal Reserve’s reserve bank credit dropped by $10 billion last week, but rising collateral values caused a slight uptick in the Global Liquidity Index (GLI), now at $125.975 trillion, a 0.165% increase.

The Adjusted Economic Rate of Change (AE RoC) remained positive.

Other metrics, coupled with the interplay between China’s stimulus and U.S. dollar weakness, could impact Bitcoin [BTC] prices in the long run.

Investor confidence growing significantly Bitcoin saw a big Coinbase discount again during the sell off that happened during previous week’s market crash.

However, it recovered quickly, closing with more than 23% gain from its week’s low.

$BTC now has a Coinbase premium again, which is generally positive as it shows positive investor sentiment from the U.S. and ETFs.

This also signifies that BTC could rally as a result of China’s stimulus and a weakening USD.

Source: CryptoQuant

Decoupling of BTC and altcoin market caps

Three years ago, Bitcoin’s market cap was around $835 billion, while other cryptocurrencies, excluding stablecoins, matched that.

Today, Bitcoin’s market cap has risen 37% to $1.15 trillion, while other coins have dropped 11%.

This shift highlighted Bitcoin’s dominance and questioned the wisdom of those blindly diversifying in crypto.

With China’s stimulus and the U.S. dollar weakening, Bitcoin could potentially reach new all-time highs, emphasizing its strength in the market.

Source: River

Bitcoin breaks a micro downward trend

Bitcoin has broken out of its recent downward trend, and showing potential for a rally.

Is your portfolio green? Check out the BTC Profit Calculator

If Bitcoin stays above $58,000, it could rise further to $61,000, triggering short liquidations. The next key level to watch is how it reacts at $61,000.

Coupled with China’s stimulus and the weakening U.S. dollar, Bitcoin could see a significant rally in the coming days.

Source: TradingView

clomid tablet price clomid or nolvadex for pct where to get cheap clomiphene without dr prescription get generic clomid without a prescription where to get cheap clomid tablets cost cheap clomid for sale can you get cheap clomid without insurance

This is the kind of content I get high on reading.

This website positively has all of the tidings and facts I needed there this participant and didn’t identify who to ask.

zithromax 500mg us – buy tinidazole generic order flagyl online

rybelsus 14mg pills – buy semaglutide generic periactin 4mg usa

domperidone 10mg oral – order tetracycline 500mg without prescription buy generic flexeril

order zithromax without prescription – bystolic price buy bystolic generic

buy generic nexium 40mg – anexamate how to buy esomeprazole

medex where to buy – https://coumamide.com/ order generic losartan 50mg

meloxicam pills – relieve pain meloxicam where to buy

purchase deltasone sale – https://apreplson.com/ order deltasone 20mg pills

buy ed meds online – new ed drugs top erection pills

cost amoxil – https://combamoxi.com/ amoxil drug

buy generic fluconazole – https://gpdifluca.com/ buy forcan generic

buy lexapro 10mg pill – https://escitapro.com/ brand lexapro 10mg

purchase cenforce generic – https://cenforcers.com/# cenforce price

cialis manufacturer coupon 2018 – https://ciltadgn.com/ cialis instructions

cialis erection – strong tadafl cialis online aust

buy ranitidine tablets – https://aranitidine.com/ buy ranitidine

order viagra no prescription – this best place to buy viagra yahoo

Greetings! Very serviceable par‘nesis within this article! It’s the scarcely changes which liking make the largest changes. Thanks a quantity towards sharing! order zithromax 250mg pills

This is the stripe of serenity I have reading. propecia generico espaГ±a

This is the amicable of content I have reading. https://ursxdol.com/augmentin-amoxiclav-pill/

This website really has all of the information and facts I needed adjacent to this subject and didn’t know who to ask. https://prohnrg.com/product/cytotec-online/

This is the compassionate of writing I positively appreciate. viagra prix france