- U.S inflation was steady in July, raising Fed rate cut odds

- However, BTC’s price remained subdued and could stay range-bound

U.S inflation continues to be steady, reinforcing market expectations of a likely Fed rate cut in September. This rate cut is expected to help boost Bitcoin [BTC] and other risk assets. According to the U.S Bureau of Economic Analysis (BEA), the July Core PCE (Personal Consumption Expenditure) Price Index came in at 2.5% on a yearly basis.

The PCE Price Index hiked by 0.2% last month, similar to June’s reading, and matched analysts’ estimates. The data measures price changes for goods and services, excluding food and energy, and is the Fed’s favorite variable for tracking inflation and making monetary policy decisions.

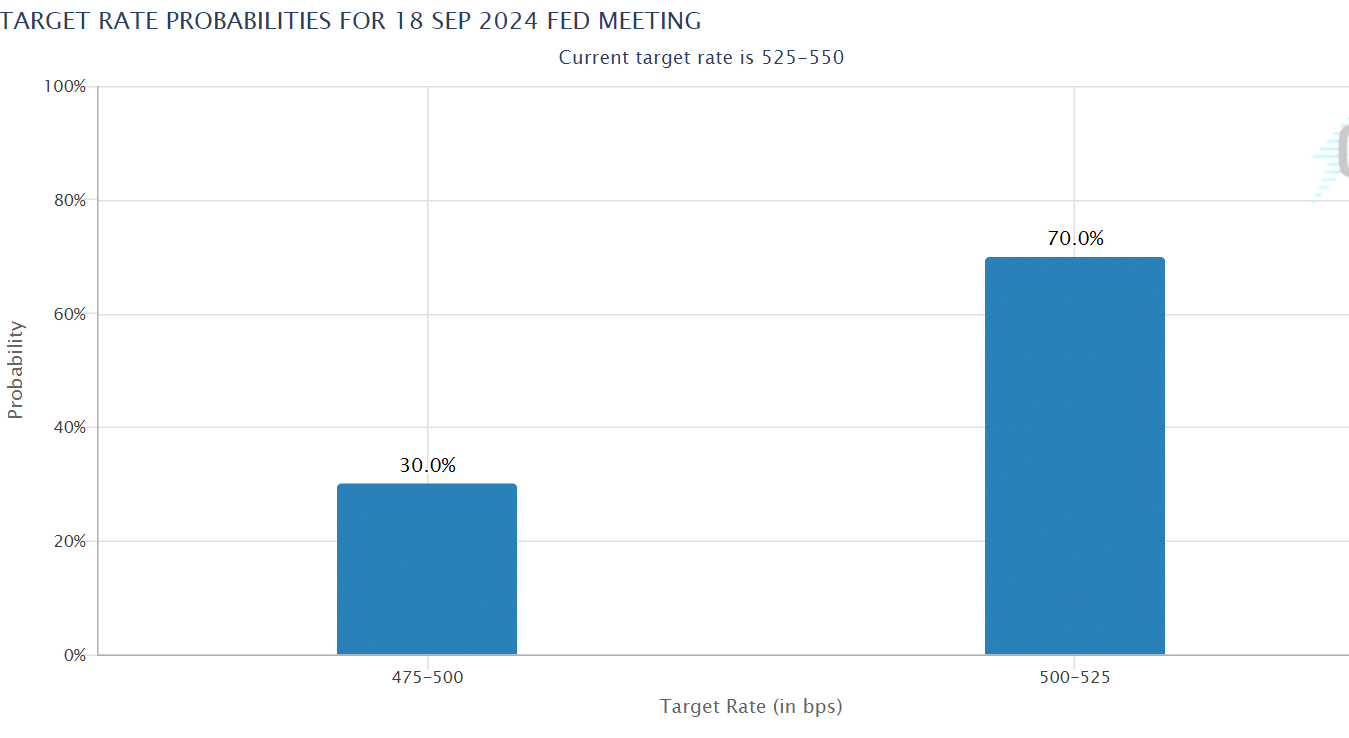

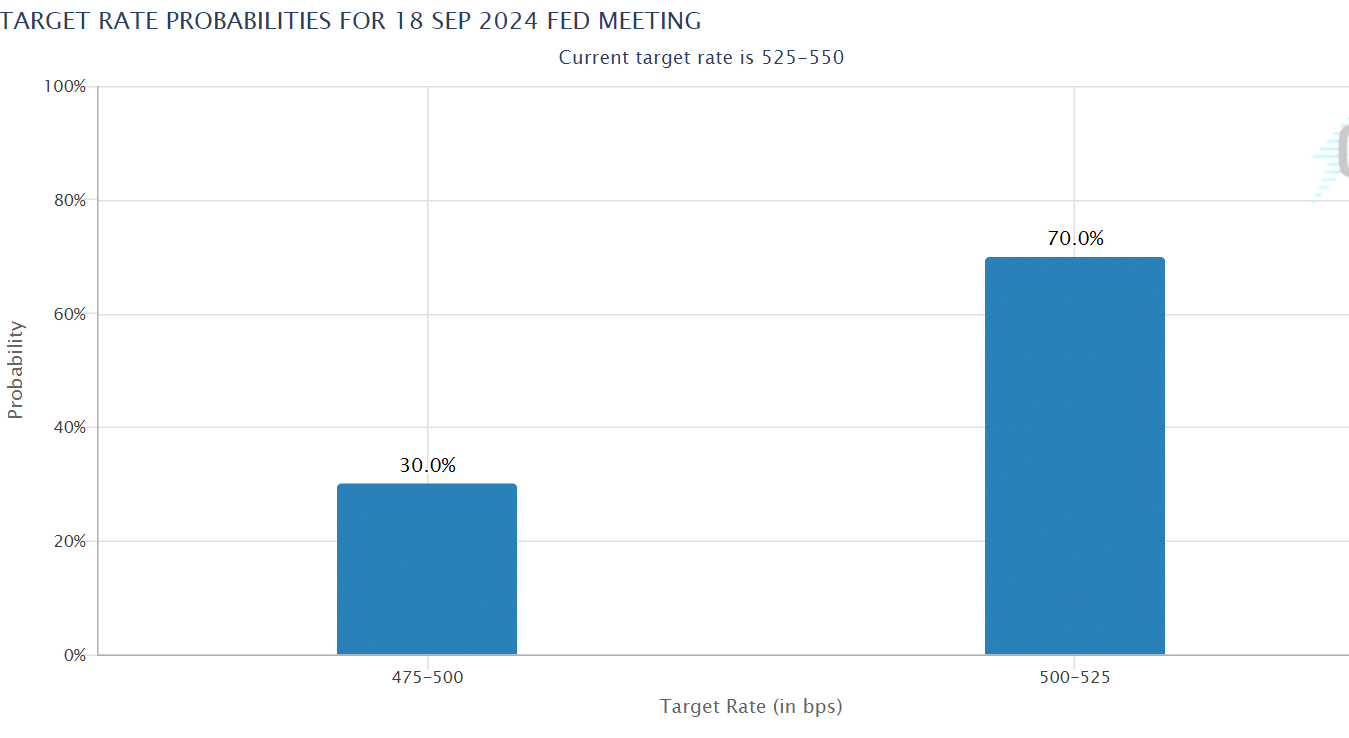

September Fed rate cuts jump to 70%

That being said, the steady July inflation data reinforced the market’s conviction of a likely 25 basis point (bps) Fed rate cut in September. According to the CME FedWatch tool, interest traders are now pricing odds of 70% on a September rate cut.

Source: CME FedWatch Tool

That would translate to a 4% jump from the 66% odds seen before the July inflation data was released. Meanwhile, some traders have been pricing a 30% chance for a 50 bps rate cut during next month’s Fed meeting.

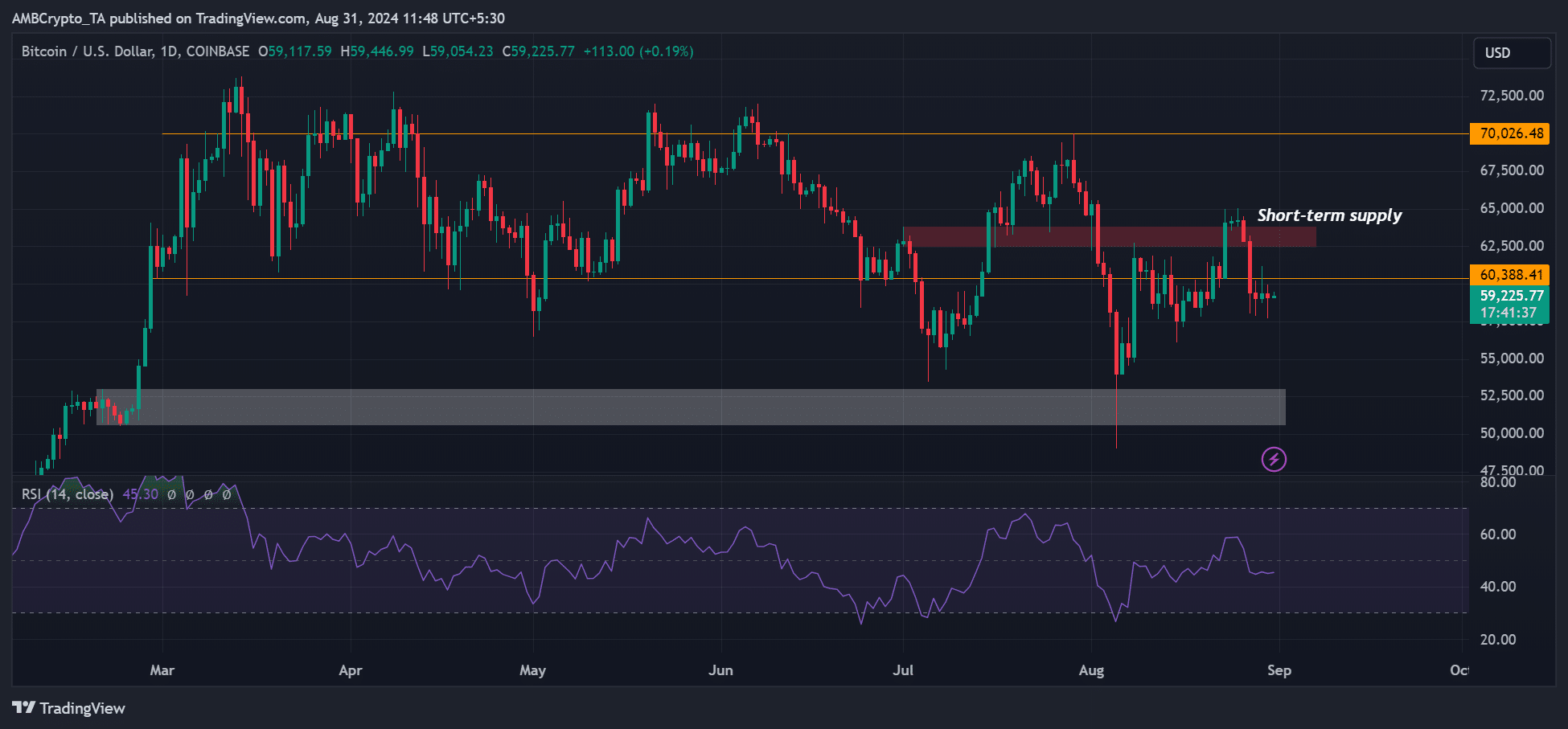

Bitcoin’s price remains muted

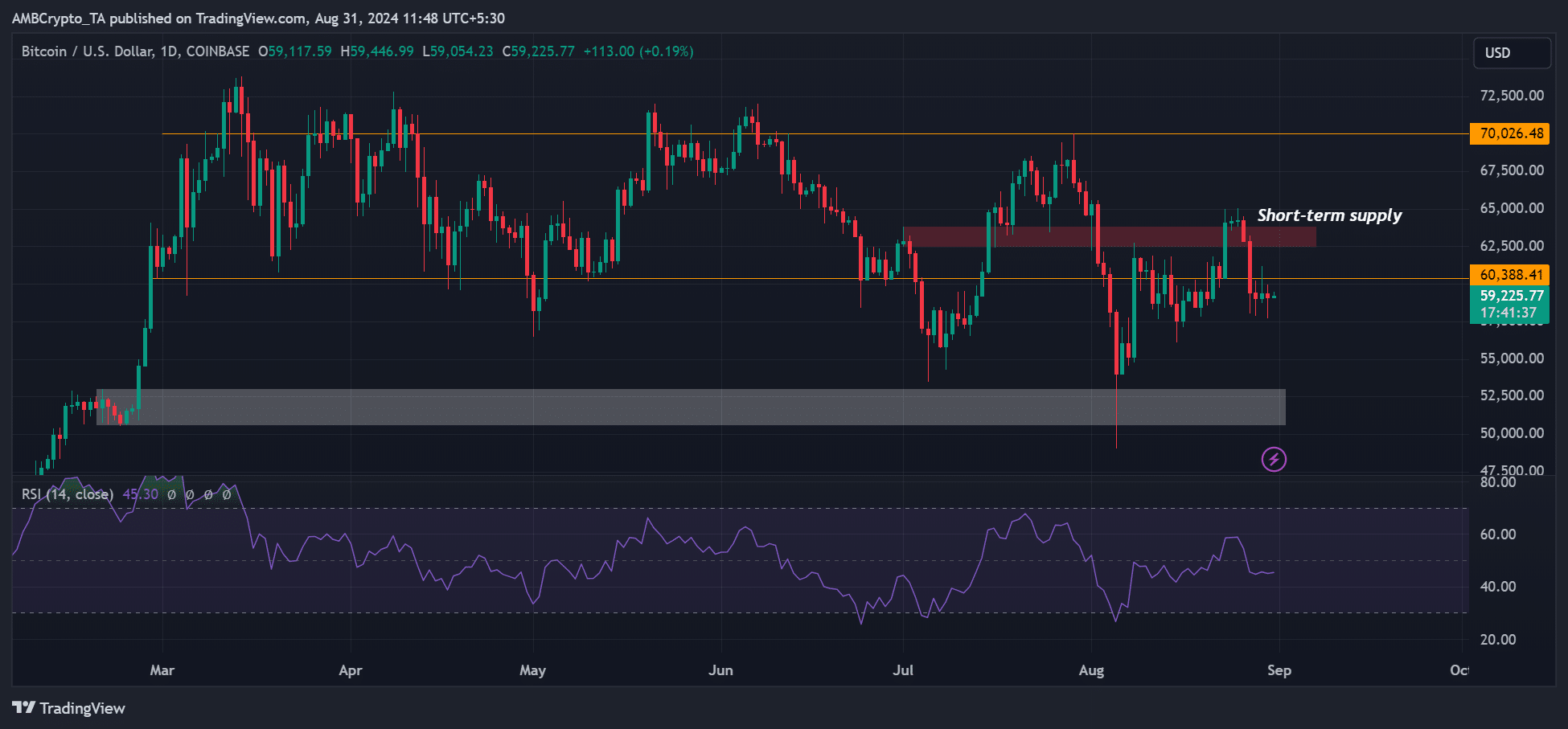

The data tipped U.S equities to edge higher while BTC and the crypto markets tanked and consolidated. BTC moved slightly to $59.9k, before dropping to $57k on Friday after the inflation data was first released.

Source: BTC/USD, TradingView

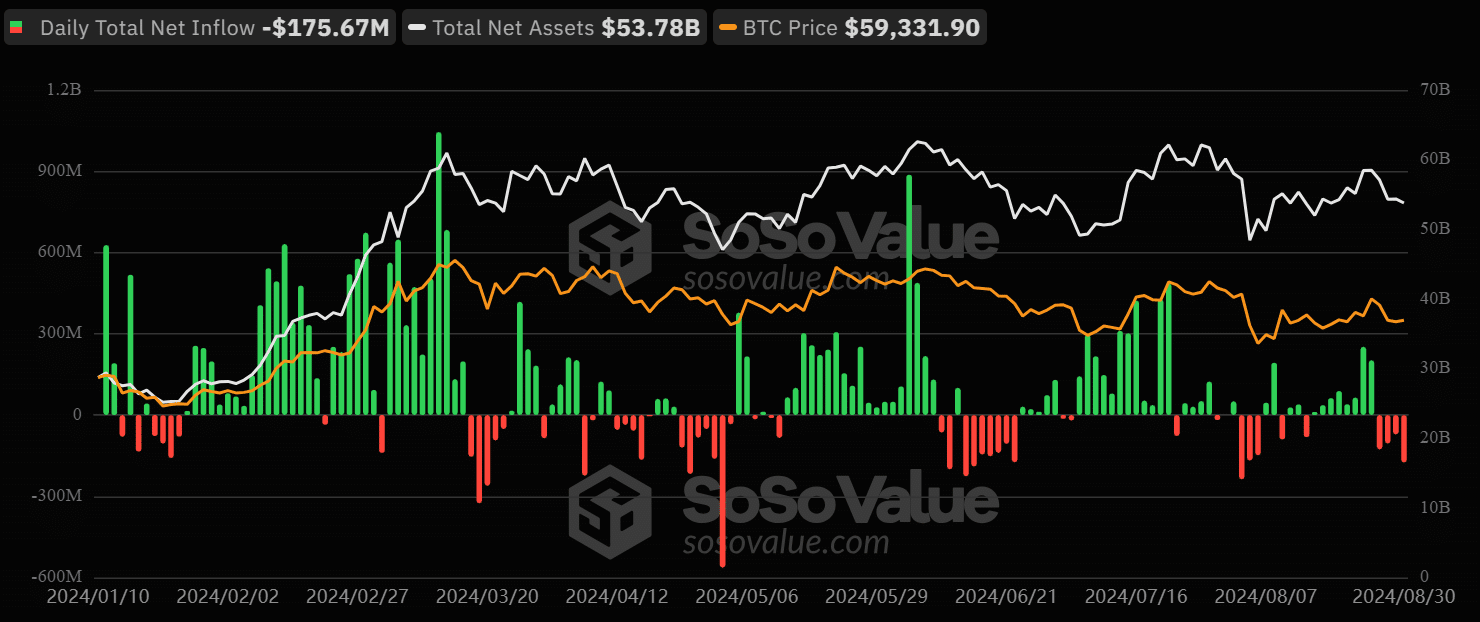

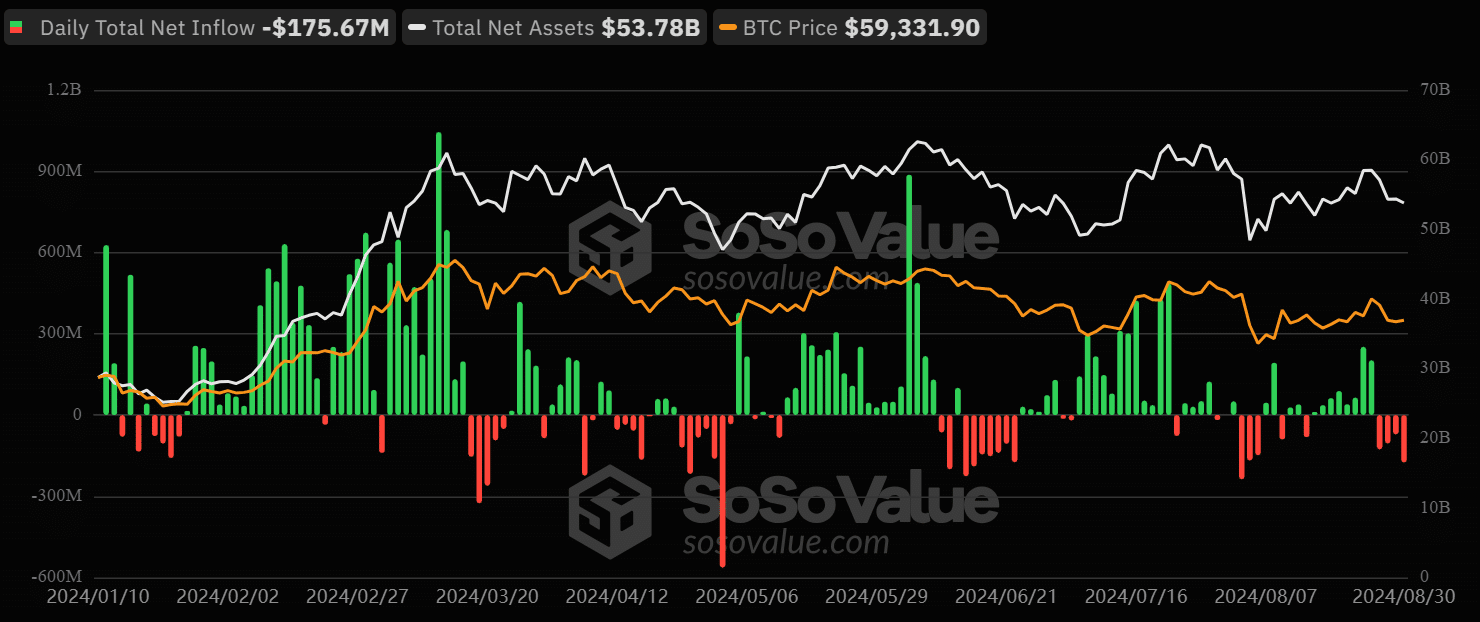

At the time of writing, the cryptocurrency was trading at $59.2k, marking the fourth day it has remained below $60k. The weak sentiment and risk-off investors’ approach was also evident across U.S spot BTC ETFs.

Since Tuesday, the products have recorded net outflows of $277 million, illustrating that the steady July inflation wasn’t enough to break the weak trend.

Source: Soso Value

However, crypto trading firm QCP Capital noted that a possibly weaker U.S jobs report next week could confirm a ‘strong case’ for a Fed rate cut in September. In the meantime, the trading firm projected that BTC could remain range-bound.

“With the recent macro news proving to have little effect on the crypto market, we believe BTC is likely to remain range-bound within 58k-65k in the short term as the market awaits positive catalysts to break out of this range.”

- U.S inflation was steady in July, raising Fed rate cut odds

- However, BTC’s price remained subdued and could stay range-bound

U.S inflation continues to be steady, reinforcing market expectations of a likely Fed rate cut in September. This rate cut is expected to help boost Bitcoin [BTC] and other risk assets. According to the U.S Bureau of Economic Analysis (BEA), the July Core PCE (Personal Consumption Expenditure) Price Index came in at 2.5% on a yearly basis.

The PCE Price Index hiked by 0.2% last month, similar to June’s reading, and matched analysts’ estimates. The data measures price changes for goods and services, excluding food and energy, and is the Fed’s favorite variable for tracking inflation and making monetary policy decisions.

September Fed rate cuts jump to 70%

That being said, the steady July inflation data reinforced the market’s conviction of a likely 25 basis point (bps) Fed rate cut in September. According to the CME FedWatch tool, interest traders are now pricing odds of 70% on a September rate cut.

Source: CME FedWatch Tool

That would translate to a 4% jump from the 66% odds seen before the July inflation data was released. Meanwhile, some traders have been pricing a 30% chance for a 50 bps rate cut during next month’s Fed meeting.

Bitcoin’s price remains muted

The data tipped U.S equities to edge higher while BTC and the crypto markets tanked and consolidated. BTC moved slightly to $59.9k, before dropping to $57k on Friday after the inflation data was first released.

Source: BTC/USD, TradingView

At the time of writing, the cryptocurrency was trading at $59.2k, marking the fourth day it has remained below $60k. The weak sentiment and risk-off investors’ approach was also evident across U.S spot BTC ETFs.

Since Tuesday, the products have recorded net outflows of $277 million, illustrating that the steady July inflation wasn’t enough to break the weak trend.

Source: Soso Value

However, crypto trading firm QCP Capital noted that a possibly weaker U.S jobs report next week could confirm a ‘strong case’ for a Fed rate cut in September. In the meantime, the trading firm projected that BTC could remain range-bound.

“With the recent macro news proving to have little effect on the crypto market, we believe BTC is likely to remain range-bound within 58k-65k in the short term as the market awaits positive catalysts to break out of this range.”

where to get cheap clomid tablets where to buy generic clomid price get cheap clomid for sale can you get cheap clomid without insurance where can i get generic clomiphene tablets cost generic clomid without a prescription rx clomiphene

Thank you for another informative website. Where else could I get that kind of info written in such a perfect way? I have a project that I’m just now working on, and I have been on the look out for such information.

Facts blog you be undergoing here.. It’s hard to find elevated calibre script like yours these days. I honestly respect individuals like you! Withstand care!!

order azithromycin 250mg pills – buy ofloxacin pill flagyl 400mg for sale

buy generic rybelsus – periactin 4mg usa order cyproheptadine 4mg online

order generic domperidone 10mg – buy flexeril pill flexeril uk

Hey, I think your blog might be having browser compatibility issues. When I look at your blog in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, excellent blog!

Perfectly pent written content, Really enjoyed reading.

Este site é realmente demais. Sempre que acesso eu encontro coisas incríveis Você também pode acessar o nosso site e descobrir mais detalhes! informaçõesexclusivas. Venha saber mais agora! 🙂

augmentin 1000mg oral – https://atbioinfo.com/ order ampicillin pills

Este site é realmente demais. Sempre que acesso eu encontro coisas boas Você também pode acessar o nosso site e saber mais detalhes! Conteúdo exclusivo. Venha saber mais agora! 🙂

order warfarin 2mg generic – coumamide order losartan 25mg online cheap

buy mobic 15mg sale – https://moboxsin.com/ brand mobic 7.5mg

I like this blog its a master peace ! Glad I detected this on google .

deltasone 40mg over the counter – corticosteroid cost deltasone 5mg

non prescription ed drugs – cheap ed drugs buy erectile dysfunction drugs

order fluconazole sale – order fluconazole for sale fluconazole 200mg pills

buy cenforce 100mg for sale – fast cenforce rs buy cenforce 100mg generic

cialis free trial phone number – https://ciltadgn.com/ cialis male enhancement

where to buy liquid cialis – strong tadafl typical cialis prescription strength

With thanks. Loads of conception! site

buy viagra houston – https://strongvpls.com/# sildenafil 50mg coupon

This is a question which is near to my verve… Many thanks! Faithfully where can I find the contact details for questions? https://buyfastonl.com/azithromycin.html

Thanks on putting this up. It’s well done. https://ursxdol.com/cenforce-100-200-mg-ed/

With thanks. Loads of knowledge! https://prohnrg.com/product/acyclovir-pills/

Greetings from Colorado! I’m bored to death at work so I decided to browse your website on my iphone during lunch break. I love the knowledge you provide here and can’t wait to take a look when I get home. I’m amazed at how quick your blog loaded on my cell phone .. I’m not even using WIFI, just 3G .. Anyways, excellent site!

I couldn’t turn down commenting. Profoundly written! combien de kms entre lasix et bugares de la roumanie

This is a keynote which is near to my callousness… Myriad thanks! Faithfully where can I find the phone details due to the fact that questions? https://ondactone.com/simvastatin/

I am in point of fact enchant‚e ‘ to gleam at this blog posts which consists of tons of profitable facts, thanks towards providing such data.

cozaar online

Thanks on sharing. It’s first quality. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=488149

I’m really impressed with your writing skills as well as with the layout on your blog. Is this a paid theme or did you modify it yourself? Anyway keep up the nice quality writing, it’s rare to see a nice blog like this one today..

I simply had to say thanks once again. I am not sure what I would’ve used without the type of points shared by you about such topic. It became the alarming dilemma in my circumstances, however , viewing your expert mode you solved that forced me to leap over delight. I’m grateful for your work and thus pray you are aware of an amazing job you have been undertaking educating the rest by way of your websites. Most probably you haven’t met all of us.

This actually answered my downside, thank you!

I’m not that much of a online reader to be honest but your blogs really nice, keep it up! I’ll go ahead and bookmark your site to come back later on. Many thanks

I am impressed with this internet site, real I am a fan.

buy forxiga paypal – https://janozin.com/ generic forxiga