- Bitcoin’s price uptick contrasted with traders closing positions, indicating market caution.

- Analysis suggested a short-term surge to $65K before a potential downtrend.

Bitcoin’s [BTC] market performance has recently shown a notable uptick, with a 2.8% increase in the past 24 hours and a 6.8% rise over the week, pushing its price to hover above the $63,000 mark.

This upward movement in price comes amidst various market activities that suggest a more complex scenario than a straightforward bullish trend.

Bitcoin: Strategic movements

Despite the positive price action, deeper market analysis revealed significant behavior changes among traders.

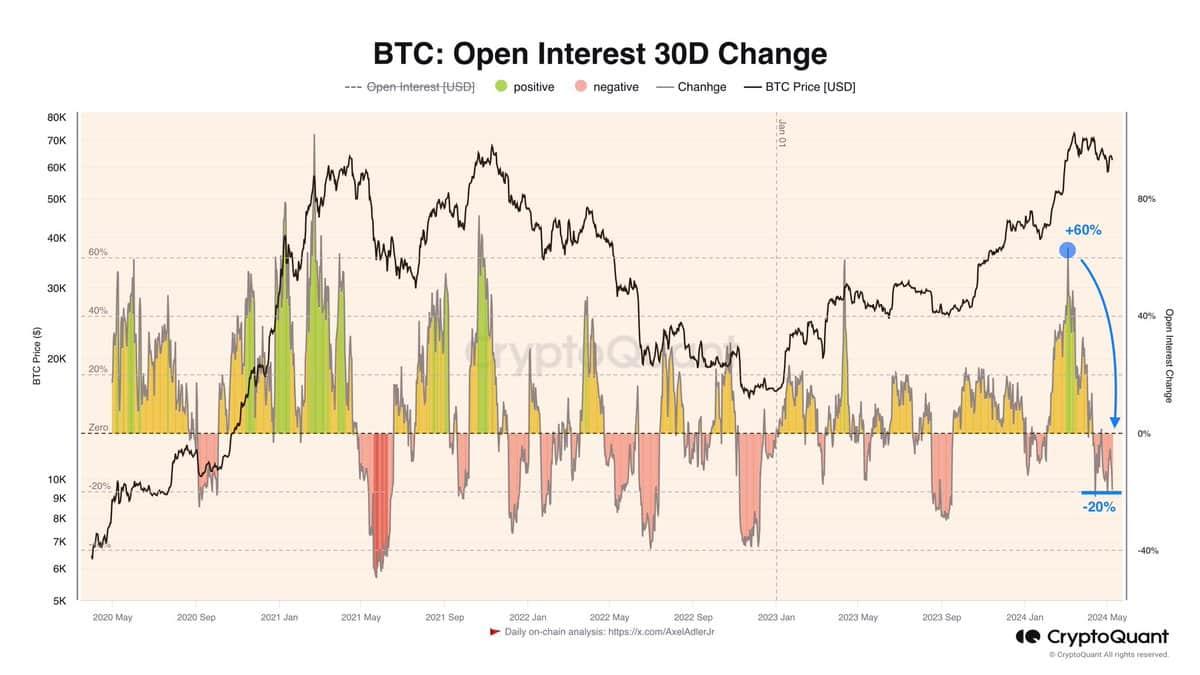

Axel Adler Jr, an analyst on the social media platform X (formerly Twitter), utilizing CryptoQuant data, has observed that leveraged traders on perpetual trading platforms like Binance [BNB] are increasingly closing their positions.

This trend was highlighted by a -20% monthly change in Open Interest, indicating a cautious approach where more traders are opting to close positions to wait and see how prices will evolve.

Source: Axel Adler Jr/X

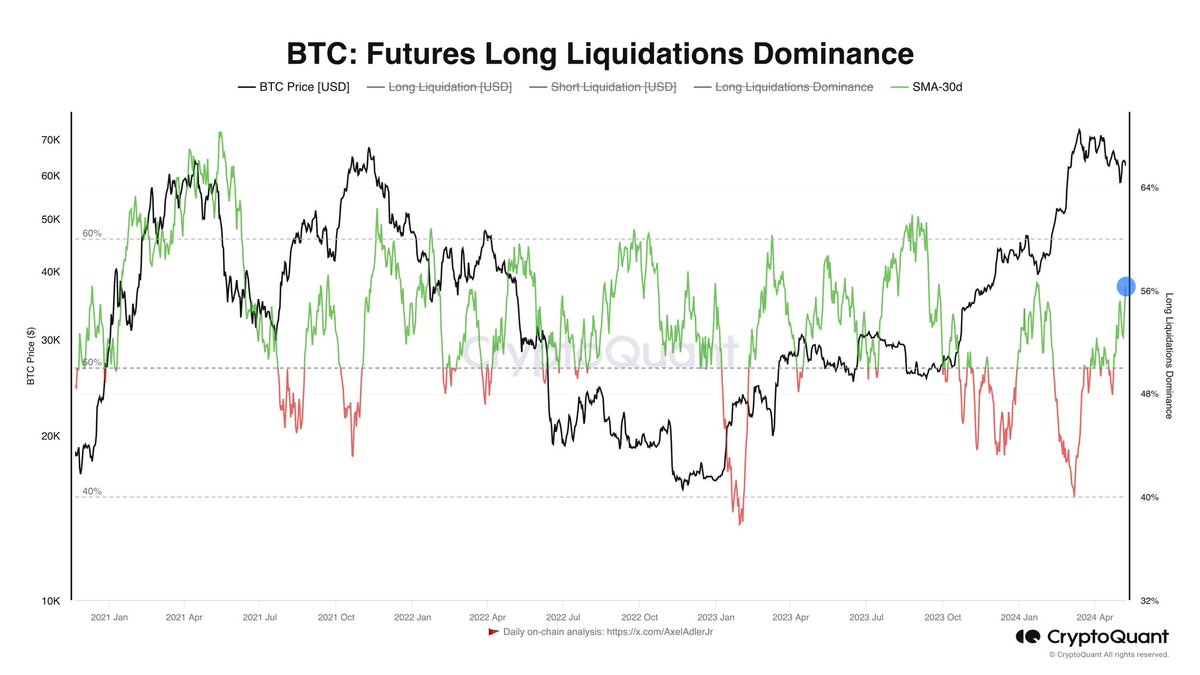

This cautious behavior among traders is not necessarily indicative of a bearish outlook for Bitcoin.

Instead, Adler suggested that this contraction in open positions reflected a strategic, cautiously optimistic stance by traders who are not exiting the market but are instead waiting for clearer signals.

Source: Axel Adler Jr/X

The analyst noted,

“I think the market needs this negativity for short positions to accumulate, which could then be used to push upwards.”

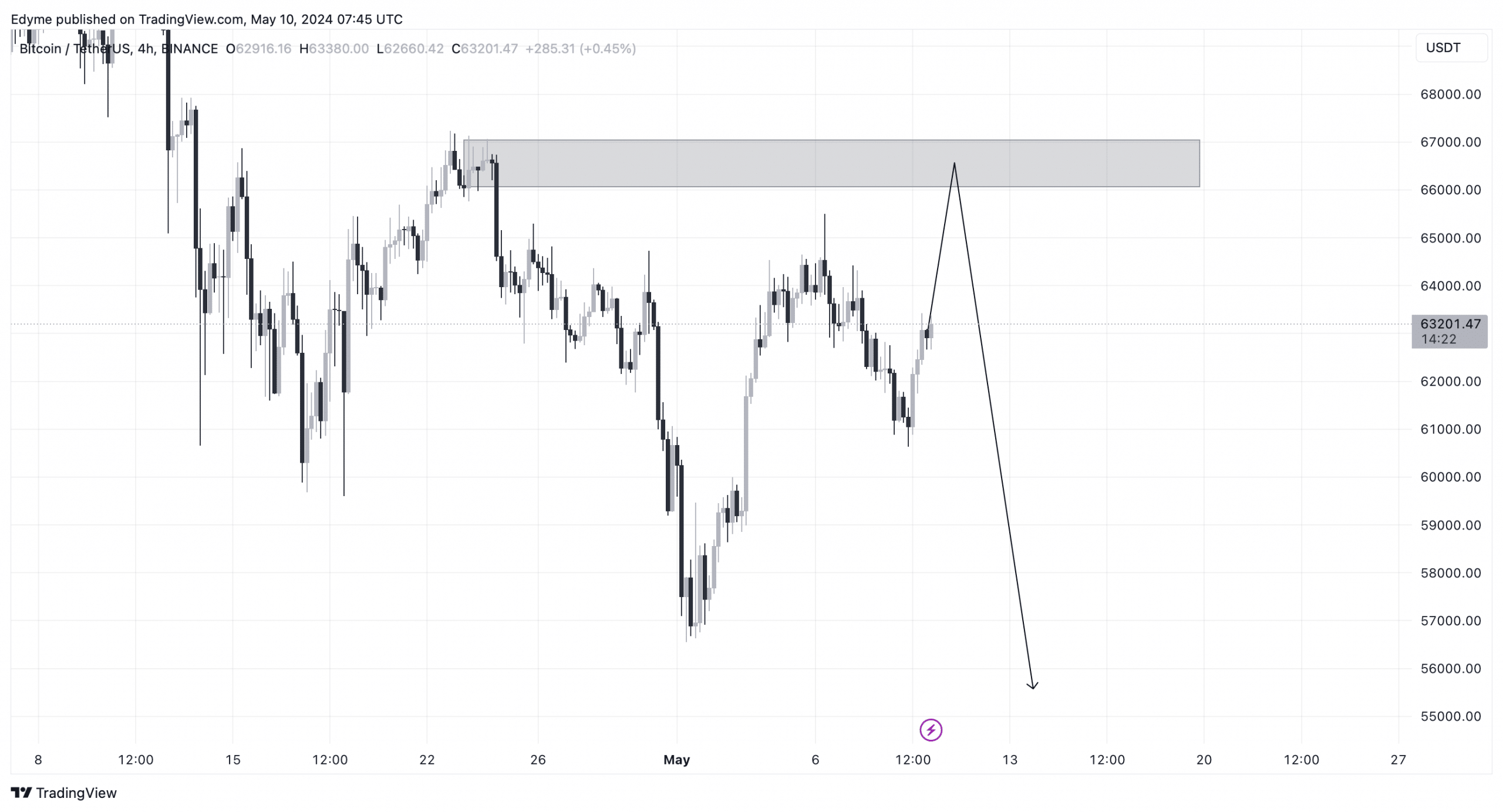

AMBCrypto’s look into Bitcoin’s market sentiment showed that while the king coin was bearish on the daily chart, there might be a short-term upward movement to around the $65,000 level first.

Source: TradingView

This potential rise could be a strategic play by the market to take out liquidity at higher levels before a more significant downturn, possibly going below the $56,000 region.

What do liquidation patterns suggest?

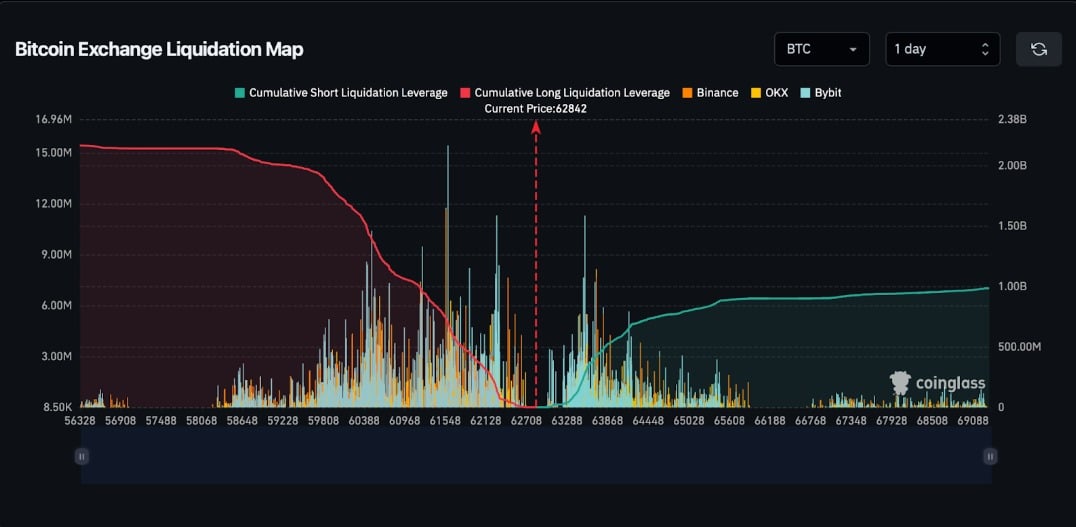

The market’s current state is also reflected in the liquidation patterns observed.

Data from Coinglass showed that Bitcoin short traders outnumbered long traders at press time, with cumulative short liquidations standing at $2.16 billion, compared to $984.31 million in long liquidations.

Source: Coinglass

This imbalance showed a prevailing expectation of further price drops among a substantial portion of market participants.

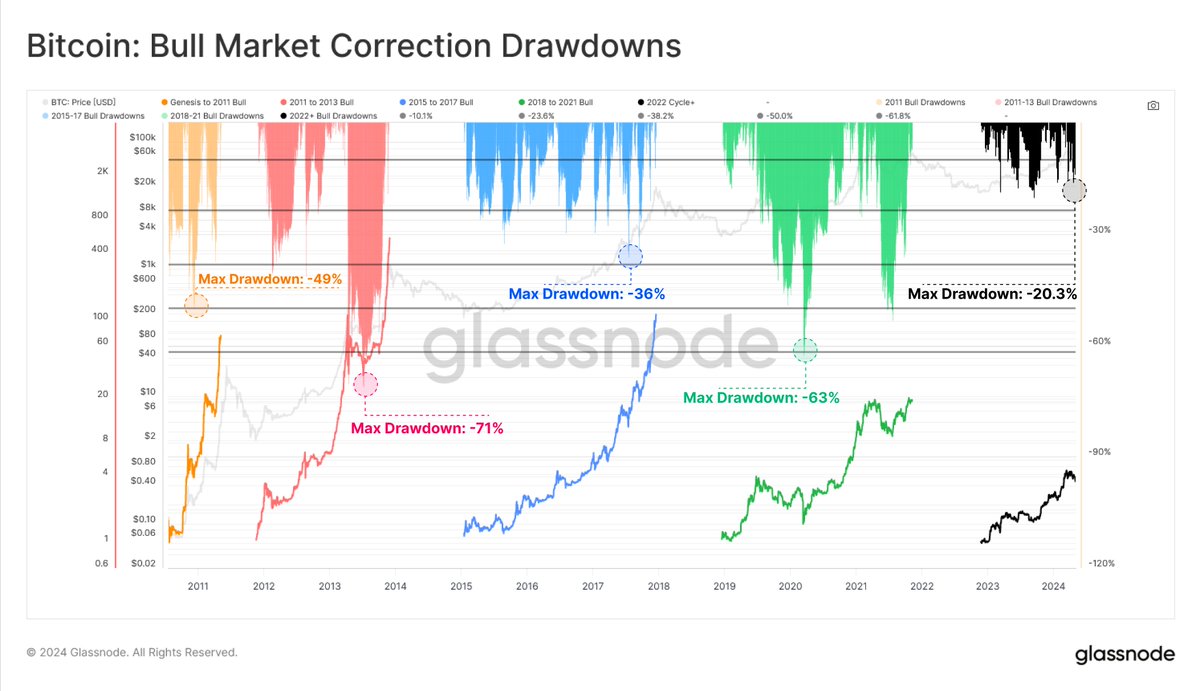

AMBCrypto’s look at Glassnode also added context to this sentiment, which noted that Bitcoin has so far recorded a 20.3% correction from its all-time high of $73,000.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This correction is the deepest on a closing basis since the lows following the FTX crisis in November 2022.

Source: Glassnode

However, Glassnode pointed out that the current macro uptrend remained resilient, with shallower corrections than in previous cycles, indicating underlying market strength despite short-term fluctuations.

There are some fascinating points in time in this article however I don’t know if I see all of them heart to heart. There may be some validity but I will take hold opinion till I look into it further. Good article , thanks and we wish more! Added to FeedBurner as nicely

I am glad to be a visitant of this perfect blog! , thankyou for this rare information! .

I genuinely enjoy reading through on this internet site, it has got good blog posts.

I couldn’t resist commenting

how can i get clomid pill where can i buy generic clomiphene without prescription can i buy clomid no prescription where can i buy clomid without dr prescription where can i get clomid tablets can i purchase generic clomiphene prices buy cheap clomid pill

With thanks. Loads of conception!

This is a topic which is near to my verve… Myriad thanks! Unerringly where can I find the contact details due to the fact that questions?

rybelsus without prescription – purchase periactin without prescription cyproheptadine medication

You actually make it seem so easy together with your presentation however I to find this matter to be really something which I believe I would by no means understand. It seems too complicated and extremely wide for me. I am taking a look forward on your subsequent post, I will try to get the dangle of it!

buy motilium 10mg online cheap – order flexeril 15mg pill flexeril cheap

amoxiclav canada – https://atbioinfo.com/ where to buy acillin without a prescription

order nexium for sale – anexamate.com order nexium 20mg online cheap

coumadin 5mg canada – blood thinner oral hyzaar

mobic pill – https://moboxsin.com/ purchase mobic without prescription

Great site. A lot of useful info here. I’m sending it to some friends ans also sharing in delicious. And of course, thanks for your sweat!

cost prednisone 40mg – https://apreplson.com/ buy prednisone for sale

top ed drugs – cheap ed drugs buy erectile dysfunction medicine

where can i buy amoxicillin – combamoxi.com amoxil order

order fluconazole 200mg pills – click buy forcan medication

cenforce cheap – order cenforce 50mg without prescription cenforce pills

how to buy tadalafil – https://ciltadgn.com/ buy cialis/canada

what is the cost of cialis – click tadalafil with latairis

cost zantac 150mg – https://aranitidine.com/# buy ranitidine online cheap

viagra for men for sale – buy viagra australia best place order viagra

The thoroughness in this draft is noteworthy. propecia online espaГ±a

This is the kind of serenity I get high on reading. buy zithromax sale

The sagacity in this tune is exceptional. https://ursxdol.com/augmentin-amoxiclav-pill/

This is the description of glad I enjoy reading. https://prohnrg.com/product/metoprolol-25-mg-tablets/

I precisely wished to say thanks all over again. I do not know the things I would’ve sorted out in the absence of the type of creative concepts discussed by you over this problem. Entirely was a real distressing difficulty in my opinion, however , seeing a specialized way you treated that took me to leap over gladness. Extremely happy for the information and thus trust you know what a powerful job that you’re providing educating men and women through the use of a site. Most likely you have never got to know all of us.

I am in fact delighted to glance at this blog posts which consists of tons of profitable facts, thanks representing providing such data. acheter lasix en belgique

More text pieces like this would make the web better. https://ondactone.com/spironolactone/

I am in point of fact happy to coup d’oeil at this blog posts which consists of tons of of use facts, thanks representing providing such data. domperidone online buy

This is a topic which is forthcoming to my fundamentals… Many thanks! Exactly where can I upon the contact details in the course of questions? http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4708

purchase dapagliflozin sale – order forxiga online cheap dapagliflozin without prescription

Wow! This can be one particular of the most beneficial blogs We have ever arrive across on this subject. Actually Fantastic. I’m also an expert in this topic therefore I can understand your effort.

buy orlistat tablets – https://asacostat.com/ xenical brand

Some truly fantastic content on this web site, regards for contribution. “Better shun the bait, than struggle in the snare.” by John Dryden.