- Bitcoin was experiencing a psychological surge, making a correction unlikely for now.

- However, when the fundamentals eventually take over, panic could ensue.

Fears of market overheating are rising as Bitcoin [BTC] surges past the $68K benchmark, breaking a four-month slump, even as the RSI sees a sharp decline.

As a result, trading just above this critical level may signal a potential top for BTC. If this range is confirmed as a resistance point, a price correction could be on the horizon, potentially forcing mass capitulation. However,

Bitcoin’s surge — Psychology over fundamentals

Firstly, it’s essential to consider that Bitcoin is heavily influenced by macroeconomic factors.

Currently, a confluence of events – such as the post-halving surge, the nearing end of the election cycle, the “Uptober” frenzy, and cuts in Fed rates – has combined to propel Bitcoin to $68K in just ten days without any solid pullback.

This is important because, despite key technicals pointing to a near-term reversal, these macro factors may strengthen large holders’ belief that this is a key buying zone.

In other words, big players might still see this level as an opportunity, and this psychological momentum could draw in more buyers, fueled by rising FOMO as market sentiment heats up.

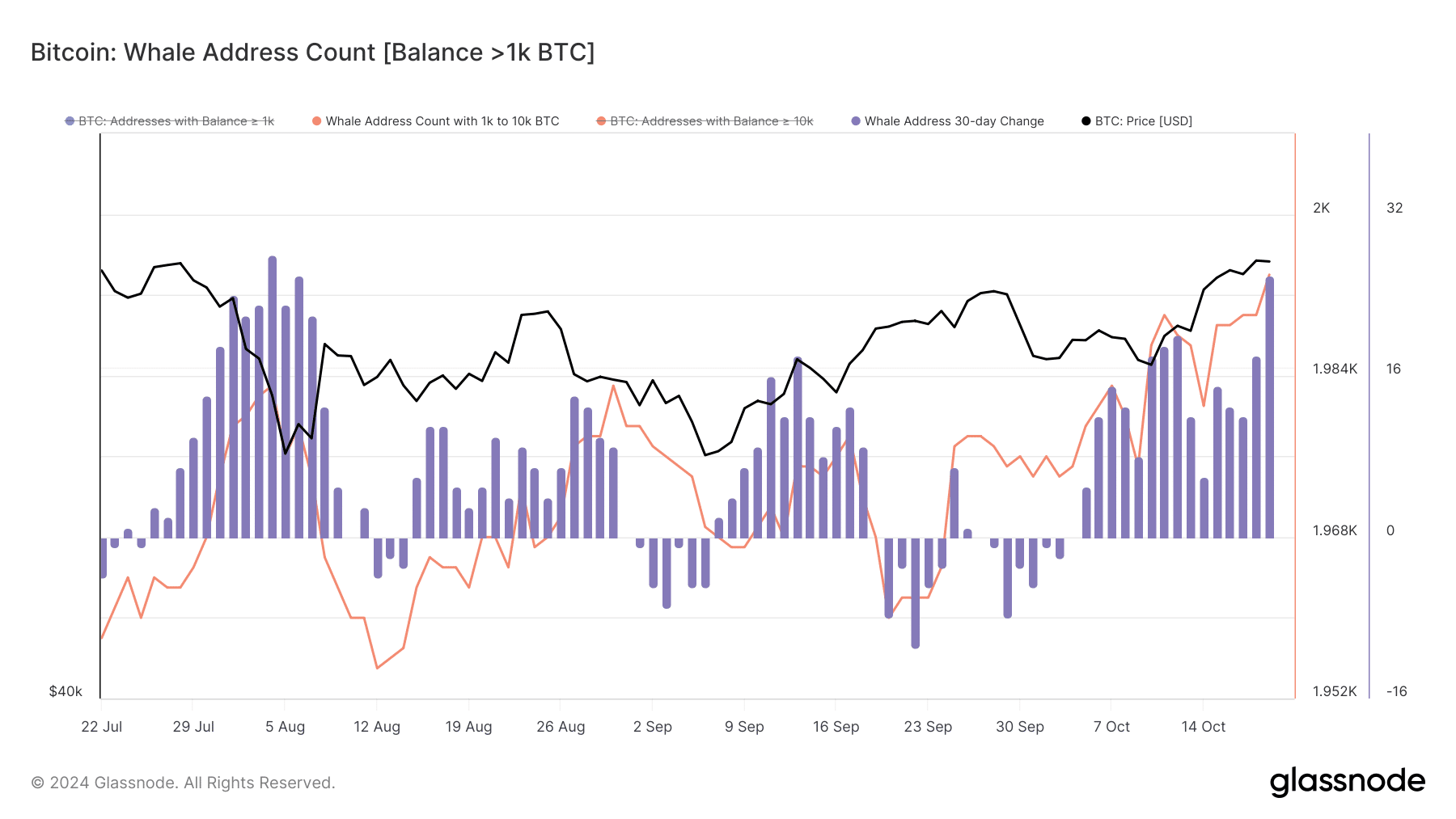

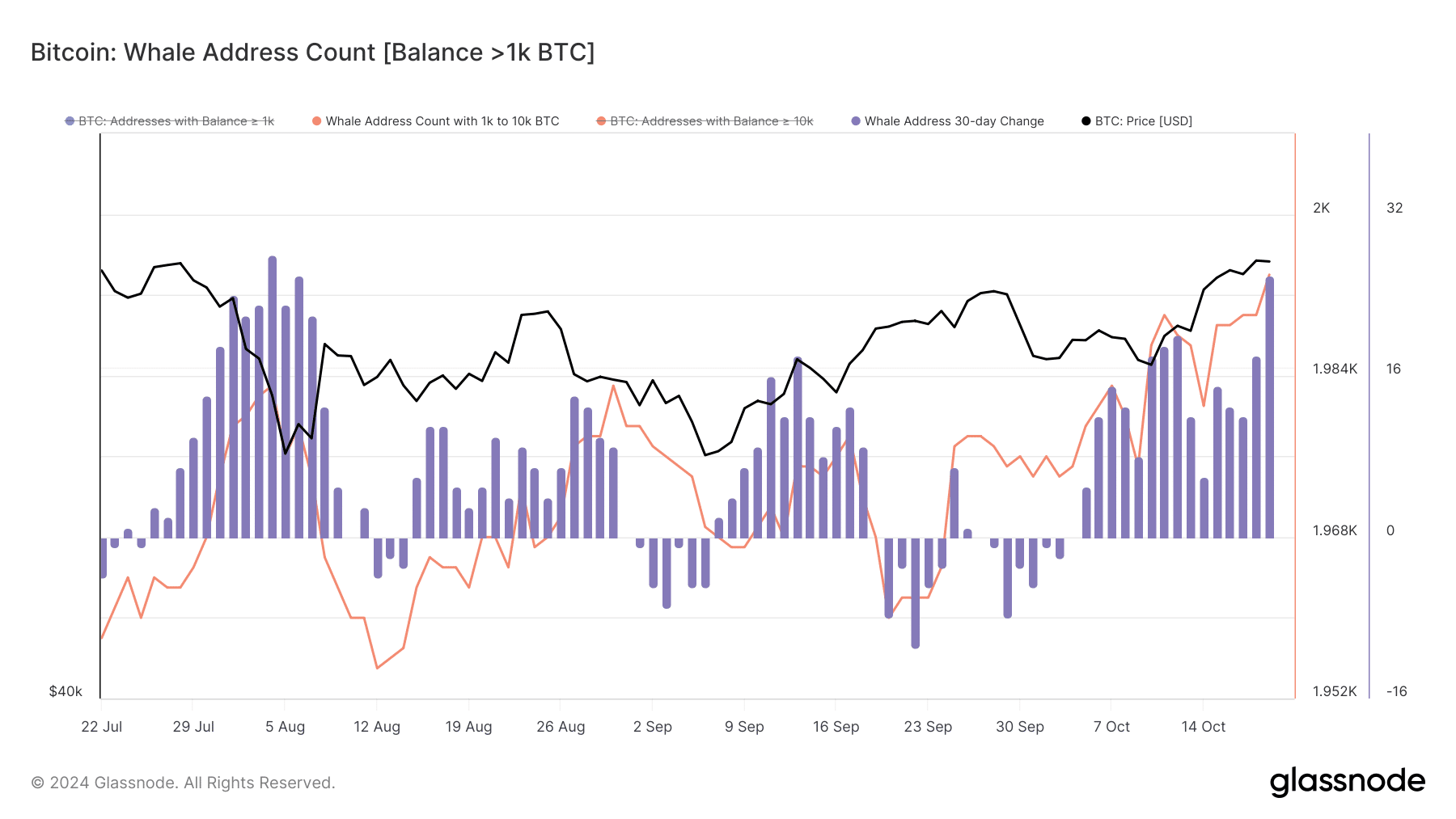

Source: Glassnode

Supporting this is the rise in whale activity: addresses holding 1K–10K BTC have hit a 3-month high. The last major spike occurred alongside a 5% daily price surge, pushing BTC above $66K.

In simple terms, whales have played a key role in countering bearish pressure. Since the start of October, their activity has reinforced AMBCrypto’s initial hypothesis: macro factors are drawing in big players.

Overall, this cycle appears to be psychologically driven. So, despite bearish attempts to short Bitcoin, the likelihood of a significant correction seems slim for now.

Market buzz leading the way to $73K

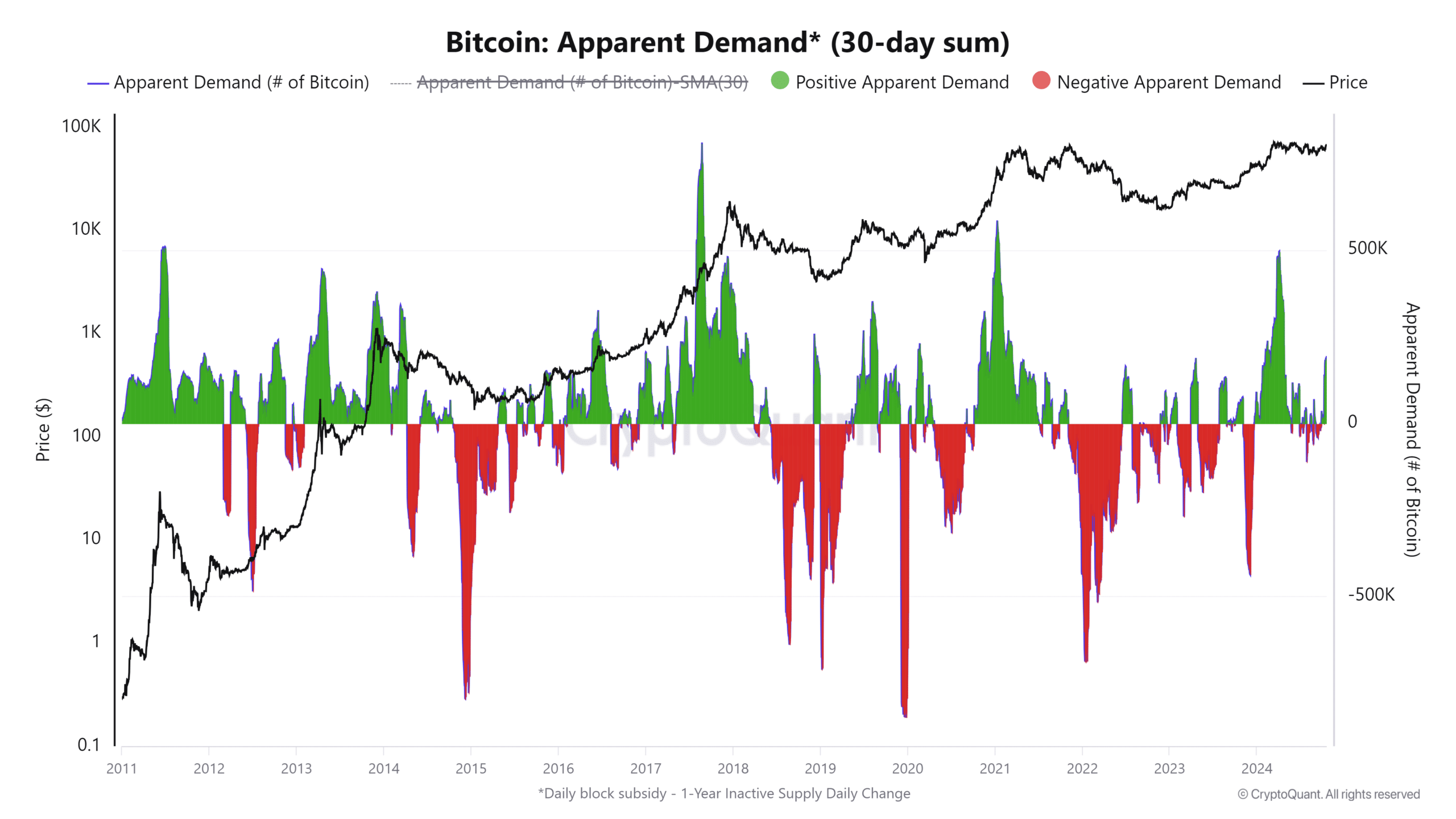

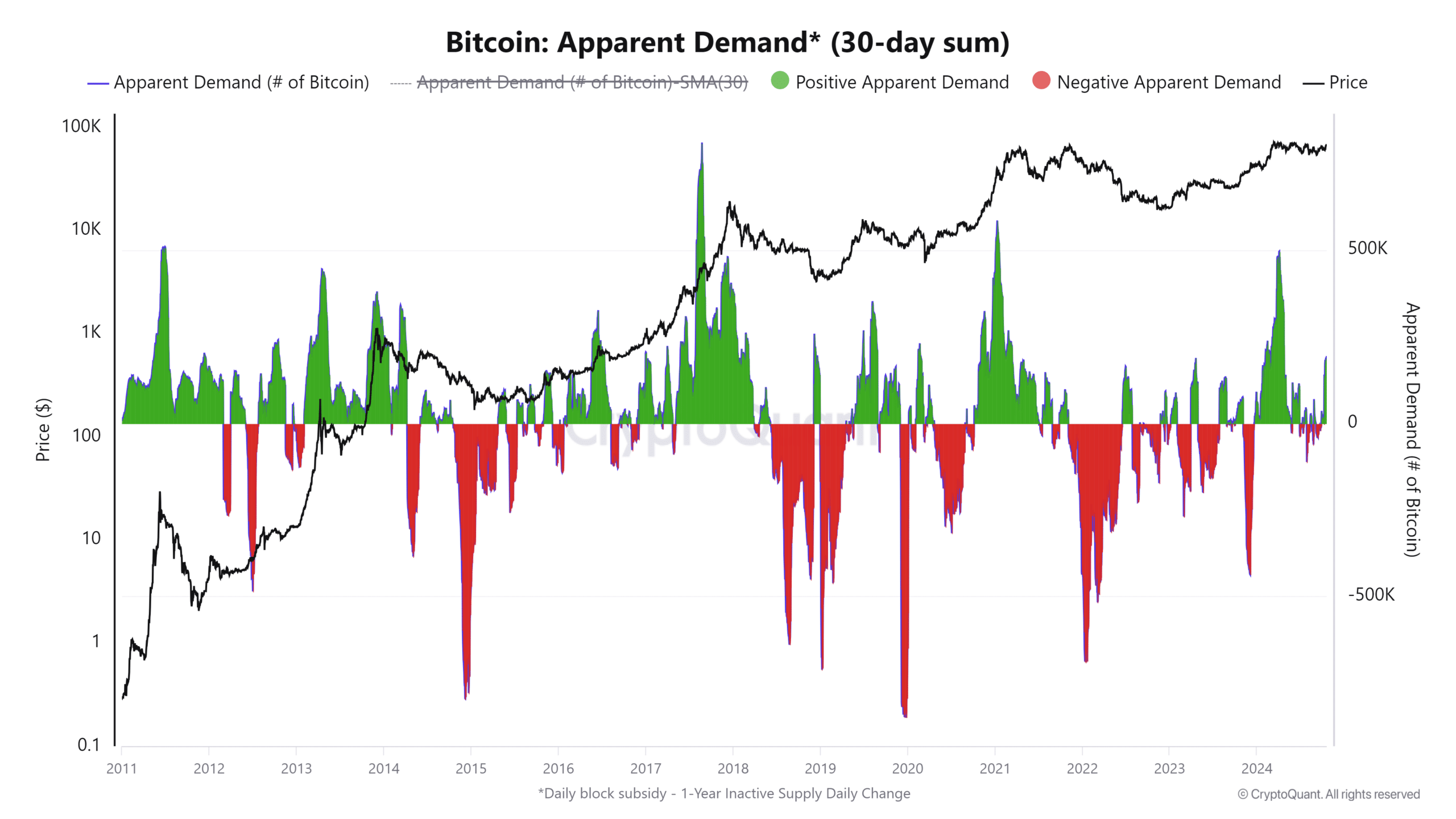

Historically, the halving year has been a reliable indicator of when a bull cycle might occur. Spikes in the 30-day demand average (marked in green) have consistently coincided with Bitcoin supply cuts during halving events.

These supply reductions typically spark long-term rallies, delivering outsized returns to stakeholders.

Source: CryptoQuant

Interestingly, even if the fundamentals don’t immediately play out, the widespread anticipation alone can trigger a breakout.

Is your portfolio green? Check out the BTC Profit Calculator

This cycle is a prime example: the market buzzed with expectations of a halving-driven rally, and true to form, Bitcoin surged to $68K in a remarkably short timeframe.

That said, if whale activity continues on this upward trend— which seems likely—Bitcoin could be set to hit its all-time high of $73K before the end of Q4.

- Bitcoin was experiencing a psychological surge, making a correction unlikely for now.

- However, when the fundamentals eventually take over, panic could ensue.

Fears of market overheating are rising as Bitcoin [BTC] surges past the $68K benchmark, breaking a four-month slump, even as the RSI sees a sharp decline.

As a result, trading just above this critical level may signal a potential top for BTC. If this range is confirmed as a resistance point, a price correction could be on the horizon, potentially forcing mass capitulation. However,

Bitcoin’s surge — Psychology over fundamentals

Firstly, it’s essential to consider that Bitcoin is heavily influenced by macroeconomic factors.

Currently, a confluence of events – such as the post-halving surge, the nearing end of the election cycle, the “Uptober” frenzy, and cuts in Fed rates – has combined to propel Bitcoin to $68K in just ten days without any solid pullback.

This is important because, despite key technicals pointing to a near-term reversal, these macro factors may strengthen large holders’ belief that this is a key buying zone.

In other words, big players might still see this level as an opportunity, and this psychological momentum could draw in more buyers, fueled by rising FOMO as market sentiment heats up.

Source: Glassnode

Supporting this is the rise in whale activity: addresses holding 1K–10K BTC have hit a 3-month high. The last major spike occurred alongside a 5% daily price surge, pushing BTC above $66K.

In simple terms, whales have played a key role in countering bearish pressure. Since the start of October, their activity has reinforced AMBCrypto’s initial hypothesis: macro factors are drawing in big players.

Overall, this cycle appears to be psychologically driven. So, despite bearish attempts to short Bitcoin, the likelihood of a significant correction seems slim for now.

Market buzz leading the way to $73K

Historically, the halving year has been a reliable indicator of when a bull cycle might occur. Spikes in the 30-day demand average (marked in green) have consistently coincided with Bitcoin supply cuts during halving events.

These supply reductions typically spark long-term rallies, delivering outsized returns to stakeholders.

Source: CryptoQuant

Interestingly, even if the fundamentals don’t immediately play out, the widespread anticipation alone can trigger a breakout.

Is your portfolio green? Check out the BTC Profit Calculator

This cycle is a prime example: the market buzzed with expectations of a halving-driven rally, and true to form, Bitcoin surged to $68K in a remarkably short timeframe.

That said, if whale activity continues on this upward trend— which seems likely—Bitcoin could be set to hit its all-time high of $73K before the end of Q4.

where buy clomiphene cheap clomiphene without insurance how to buy generic clomiphene without dr prescription cost of generic clomid pills order cheap clomiphene how can i get clomiphene without prescription buying clomiphene without prescription

More posts like this would add up to the online space more useful.

Palatable blog you procure here.. It’s intricate to assign elevated worth script like yours these days. I truly recognize individuals like you! Take vigilance!!

purchase azithromycin pill – purchase floxin for sale order flagyl 200mg

buy rybelsus 14 mg without prescription – buy semaglutide 14mg for sale order cyproheptadine 4 mg

brand domperidone 10mg – cyclobenzaprine order purchase cyclobenzaprine sale

inderal 10mg drug – buy methotrexate for sale order methotrexate 2.5mg sale

cheap amoxil without prescription – buy diovan 160mg order combivent 100 mcg sale

azithromycin 500mg over the counter – order nebivolol 5mg online nebivolol 20mg generic

buy augmentin 625mg pill – atbio info purchase ampicillin without prescription

nexium cheap – https://anexamate.com/ esomeprazole 40mg cost

warfarin over the counter – cou mamide buy generic losartan for sale

mobic pills – https://moboxsin.com/ mobic pills

deltasone 40mg pill – https://apreplson.com/ prednisone 40mg cheap

ed pills no prescription – https://fastedtotake.com/ buy ed pills without a prescription

amoxil usa – https://combamoxi.com/ buy amoxil no prescription

fluconazole 100mg over the counter – https://gpdifluca.com/# order diflucan 100mg sale

order cenforce 50mg without prescription – order cenforce 50mg pills cenforce sale

cialis tadalafil 20 mg – https://ciltadgn.com/# cialis for daily use side effects

order ranitidine generic – aranitidine buy ranitidine generic

cialis generic versus brand name – https://strongtadafl.com/ does tadalafil lower blood pressure

I’ll certainly bring back to read more. cialis 10 mg precio farmacia

With thanks. Loads of expertise! neurontin tablets

This website really has all of the bumf and facts I needed adjacent to this subject and didn’t identify who to ask. https://ursxdol.com/furosemide-diuretic/

More peace pieces like this would urge the интернет better. https://prohnrg.com/

I am actually enchant‚e ‘ to glance at this blog posts which consists of tons of profitable facts, thanks representing providing such data. https://aranitidine.com/fr/en_ligne_kamagra/