- Year-to-date inflows went into digital asset funds reached $13.13 billion.

- Bitcoin, Solana were high on demand, while Ethereum saw outflows.

Digital asset funds were back to winning ways last week, spearheaded by strong investments into the newly-launched Bitcoin [BTC] spot ETFs in the U.S.

Strong recovery

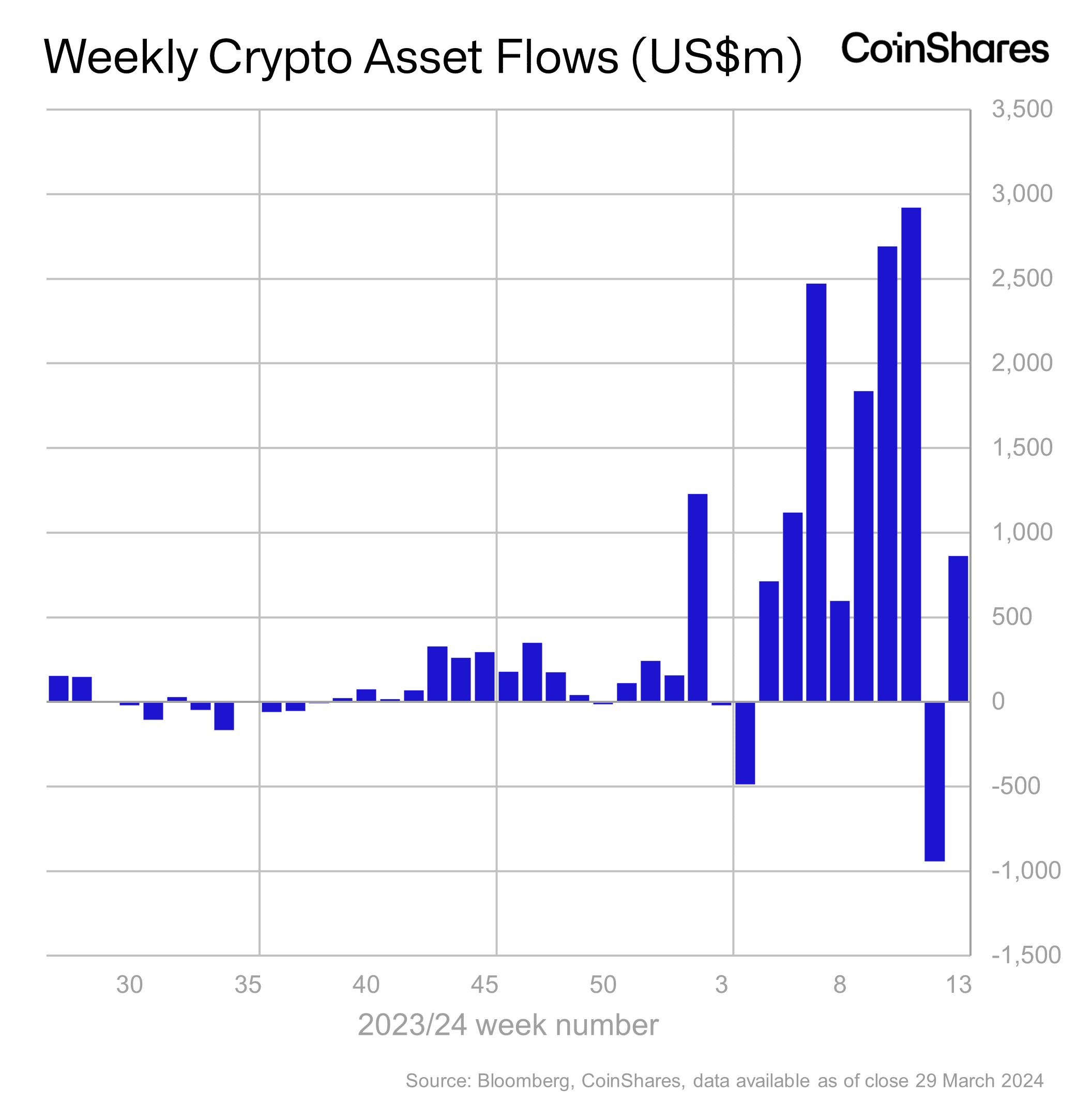

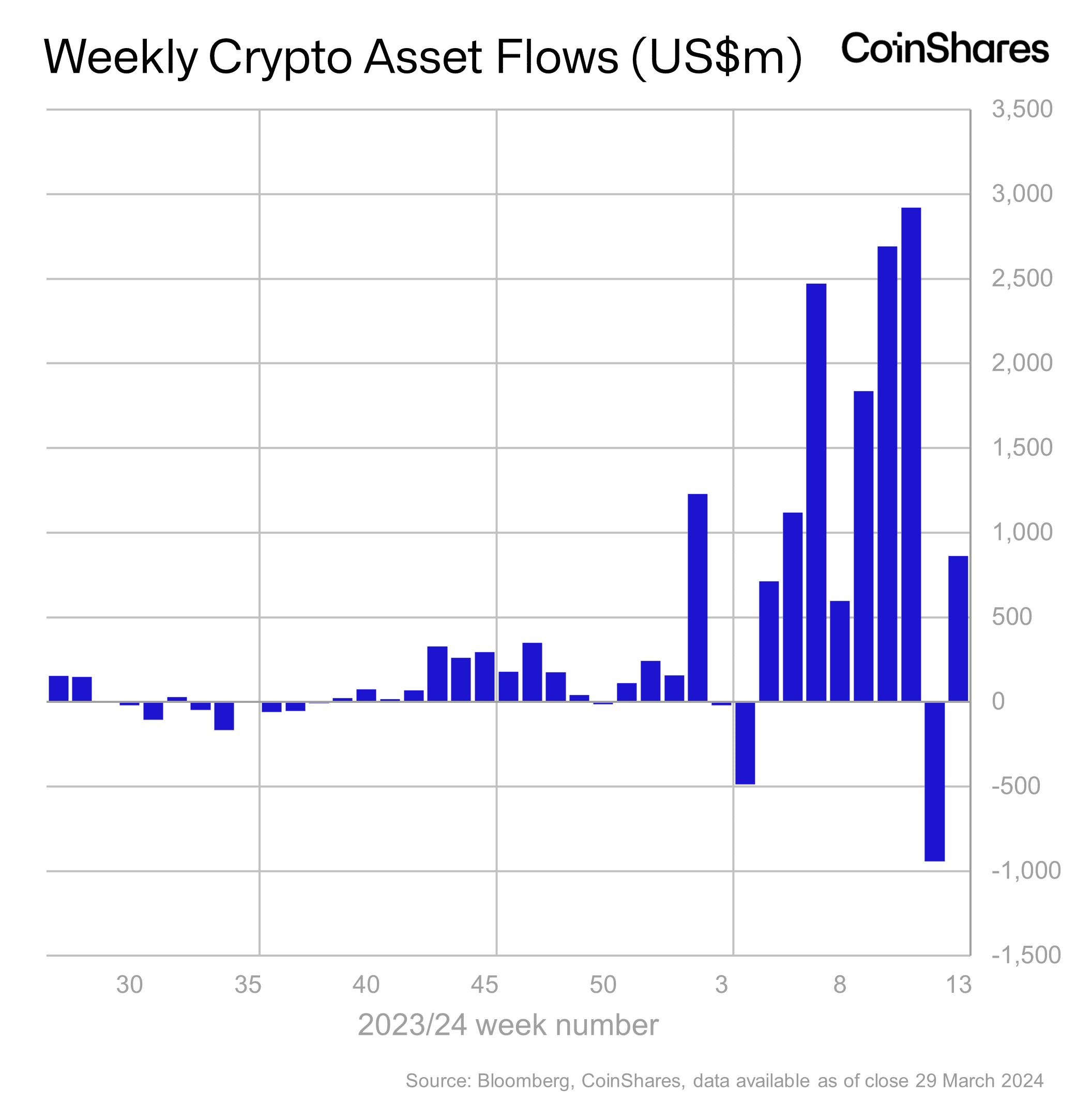

As per data shared by James Butterfill, Head of Research at crypto asset management firm CoinShares, about $862 million in net inflows was recorded across institutional crypto products

This was a sharp rebound from the $942 million in outflows seen a week earlier.

The latest capital infusion propelled year-to-date (YTD) inflows to $13.13 billion. For context, this was nearly 25% higher than the total inflows recorded in 2021 — the year of the crypto market’s last bull run.

Source: CoinShares

During the week, the total assets under management (AuM) swelled to $98 billion, marking an increase of 11% from the week before.

AUM is an important performance gradient of a fund. The higher the value of AuM, the more investments it tends to attract. AUM depends on the inflows and the market value of the underlying asset.

Last month, the AUM hit $100 billion for the first time in history, as Bitcoin smashed to its all-time high (ATH) of $73,000. However, subsequent price correction caused the AUM to drop to current levels.

Bitcoin remains institutions’ favorite

On expected lines, Bitcoin-linked funds led the charge, pocketing $865 million in inflows last week. With this, total inflows since the beginning of the year rose to an impressive $12.8 billion.

The surge could be attributed to strong demand for U.S.-based spot Bitcoin ETFs, which attracted $860 million in inflows last week.

Robust inflows into new ETFs led by BlackRock’s IBIT helped offset outflows from incumbent issuer Grayscale’s GBTC, which has been bleeding since transitioning to an ETF.

Ethereum loses, Solana gains

On the other hand, funds tied to second-largest cryptocurrency Ethereum [ETH] saw outflows worth $19 million last week. The bearish sentiment likely flowed from lower chances of an ETH ETF approval.

Solana-based investment products witnessed inflows of $6 million last week, spurred by impressive price performance of the native asset SOL.

- Year-to-date inflows went into digital asset funds reached $13.13 billion.

- Bitcoin, Solana were high on demand, while Ethereum saw outflows.

Digital asset funds were back to winning ways last week, spearheaded by strong investments into the newly-launched Bitcoin [BTC] spot ETFs in the U.S.

Strong recovery

As per data shared by James Butterfill, Head of Research at crypto asset management firm CoinShares, about $862 million in net inflows was recorded across institutional crypto products

This was a sharp rebound from the $942 million in outflows seen a week earlier.

The latest capital infusion propelled year-to-date (YTD) inflows to $13.13 billion. For context, this was nearly 25% higher than the total inflows recorded in 2021 — the year of the crypto market’s last bull run.

Source: CoinShares

During the week, the total assets under management (AuM) swelled to $98 billion, marking an increase of 11% from the week before.

AUM is an important performance gradient of a fund. The higher the value of AuM, the more investments it tends to attract. AUM depends on the inflows and the market value of the underlying asset.

Last month, the AUM hit $100 billion for the first time in history, as Bitcoin smashed to its all-time high (ATH) of $73,000. However, subsequent price correction caused the AUM to drop to current levels.

Bitcoin remains institutions’ favorite

On expected lines, Bitcoin-linked funds led the charge, pocketing $865 million in inflows last week. With this, total inflows since the beginning of the year rose to an impressive $12.8 billion.

The surge could be attributed to strong demand for U.S.-based spot Bitcoin ETFs, which attracted $860 million in inflows last week.

Robust inflows into new ETFs led by BlackRock’s IBIT helped offset outflows from incumbent issuer Grayscale’s GBTC, which has been bleeding since transitioning to an ETF.

Ethereum loses, Solana gains

On the other hand, funds tied to second-largest cryptocurrency Ethereum [ETH] saw outflows worth $19 million last week. The bearish sentiment likely flowed from lower chances of an ETH ETF approval.

Solana-based investment products witnessed inflows of $6 million last week, spurred by impressive price performance of the native asset SOL.

I have been absent for some time, but now I remember why I used to love this blog. Thanks, I?¦ll try and check back more often. How frequently you update your web site?

I am glad to be one of several visitors on this outstanding site (:, regards for posting.

Woh I enjoy your content, saved to my bookmarks! .

order clomiphene without a prescription can i purchase generic clomiphene without rx average cost of clomid order generic clomid without a prescription where can i buy clomid get cheap clomiphene without a prescription can you get cheap clomiphene without rx

I couldn’t turn down commenting. Profoundly written!

I couldn’t hold back commenting. Warmly written!

order zithromax generic – buy tinidazole 300mg generic order generic flagyl

buy semaglutide 14mg pill – cyproheptadine 4mg without prescription buy cyproheptadine 4 mg sale

buy motilium generic – sumycin pills order cyclobenzaprine 15mg generic

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get three emails with the same comment. Is there any way you can remove people from that service? Appreciate it!

inderal 10mg generic – order plavix 150mg for sale methotrexate price

where can i buy augmentin – https://atbioinfo.com/ ampicillin cheap

purchase nexium – https://anexamate.com/ order esomeprazole 40mg pills

coumadin over the counter – https://coumamide.com/ buy generic cozaar online

buy generic meloxicam – relieve pain purchase meloxicam online cheap

I love your blog.. very nice colors & theme. Did you make this website yourself or did you hire someone to do it for you? Plz reply as I’m looking to construct my own blog and would like to find out where u got this from. thank you

order deltasone 20mg for sale – apreplson.com prednisone 10mg cost

buy ed medications online – fast ed to take fda approved over the counter ed pills

buy generic amoxicillin online – https://combamoxi.com/ order amoxil pill

fluconazole 100mg price – https://gpdifluca.com/# fluconazole ca

cenforce usa – https://cenforcers.com/ cenforce 50mg price

price of cialis at walmart – what does cialis treat cialis patent expiration

buy generic zantac – site order ranitidine 300mg generic

maximum dose of cialis in 24 hours – click is generic tadalafil as good as cialis

viagra sale uk only – https://strongvpls.com/# sildenafil citrate 100mg

With thanks. Loads of expertise! https://ursxdol.com/amoxicillin-antibiotic/

With thanks. Loads of knowledge! zithromax 250mg generic

you are in reality a good webmaster. The website loading pace is amazing. It sort of feels that you are doing any distinctive trick. In addition, The contents are masterwork. you’ve performed a great process in this subject!

This is the description of serenity I enjoy reading. https://aranitidine.com/fr/acheter-cenforce/

The depth in this tune is exceptional. https://ondactone.com/simvastatin/

This is the type of advise I unearth helpful.

https://proisotrepl.com/product/domperidone/

This is the amicable of content I have reading. http://www.orlandogamers.org/forum/member.php?action=profile&uid=28881

dapagliflozin cost – https://janozin.com/# brand forxiga 10mg

Very interesting information!Perfect just what I was looking for! “People everywhere confuse what they read in newspapers with news.” by A. J. Liebling.

purchase orlistat pills – https://asacostat.com/# buy xenical cheap