Abstract:

- The depend of latest addresses buying and selling BTC has rallied.

- This leap has occurred regardless of the sturdy resistance confronted at $30,000.

- As BTC’s worth continues to commerce sideways, many holders have taken to coin distribution.

New demand for main coin Bitcoin [BTC], continues to climb regardless of its sideways worth motion throughout the $28,000 and $30,000 areas since April, information from Glassnode revealed.

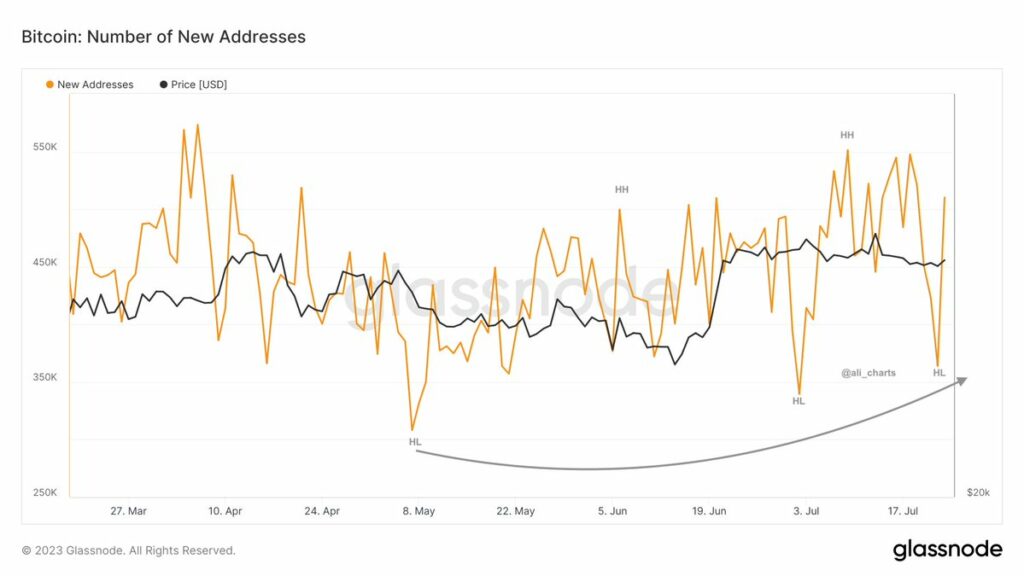

An evaluation of the coin’s every day new addresses depend on a 30-day transferring common revealed an uptick since 22 Might. Since then, the every day depend of latest addresses that accomplished BTC transactions has grown by 19%. In response to information from Glassnode, as of 25 July, over 450,000 new addresses accomplished no less than one transaction that concerned BTC.

BTC accumulation dwindles because the coin struggles to interrupt resistance

At press time, BTC exchanged arms at $29,212. With sturdy resistance confronted on the $30,000 worth stage, unfavourable sentiments have returned to the every day market.

As unfavourable sentiments ravage the market, accumulation amongst day merchants has plummeted. In response to worth actions gleaned on a D1 chart, key momentum indicators launched into a downtrend on the time of writing.

The coin’s Relative Power Index rested under its impartial line at 42.61. BTC’s Cash Movement Index (MFI) was 29.39 deep within the oversold territory.

Additional, BTC’s On-balance quantity (OBV) has trended downward since June finish. At press time, this was 102.15 million.

When BTC’s OBV declines, it implies that the amount of property being bought outweighs the amount of property being purchased. It usually indicators a big shift in sentiment from optimistic to unfavourable, the place extra merchants imagine promoting the king coin is safer than shopping for it.

Moreso, BTC’s Chaikin Cash Movement (CMF) was under the middle zero line on the time of writing. A CMF within the unfavourable territory suggests elevated liquidity exit from the market. When the BTC CMF is unfavourable, the promoting stress dominates the market over the required interval.

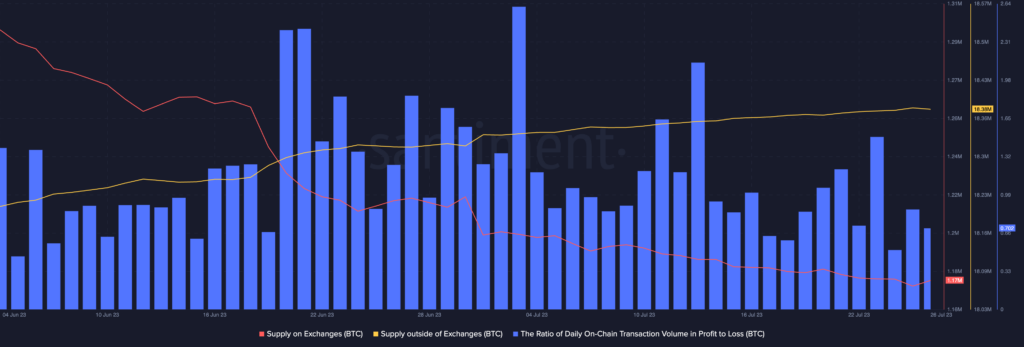

With many not sure of the coin’s subsequent worth path, its provide on exchanges climbed prior to now 24 hours. In response to info from on-chain information supplier, Santiment, the BTC provide to cryptocurrency exchanges elevated by virtually 2% within the final 24 hours.

When the trade reserve of an asset will increase on this method, it suggests elevated sell-offs. This could possibly be BTC merchants promoting off their coin holdings to hedge in opposition to future losses. Nevertheless, whereas BTC gross sales rallied prior to now 24 hours, the ratio of transactions in losses exceeded these in revenue.

Hi! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

I have recently started a website, the information you offer on this site has helped me tremendously. Thank you for all of your time & work.

It’s actually a nice and helpful piece of info. I’m glad that you shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

Great blog here! Also your site loads up fast! What web host are you using? Can I get your affiliate link to your host? I wish my site loaded up as fast as yours lol

I went over this website and I conceive you have a lot of superb info , saved to my bookmarks (:.

hello!,I like your writing very much! share we communicate more about your post on AOL? I require an expert on this area to solve my problem. May be that’s you! Looking forward to see you.

Thank you for the sensible critique. Me and my neighbor were just preparing to do some research on this. We got a grab a book from our local library but I think I learned more clear from this post. I am very glad to see such great info being shared freely out there.

I like what you guys are up also. Such smart work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it will improve the value of my site :).

what is clomiphene medication can i purchase clomiphene without rx order generic clomiphene without rxРіРѕРІРѕСЂРёС‚: how to get generic clomiphene price how to get cheap clomiphene tablets can i purchase clomid online how can i get cheap clomid

This is the amicable of serenity I have reading.

This is a keynote which is virtually to my callousness… Many thanks! Exactly where can I find the phone details in the course of questions?

purchase zithromax generic – tindamax uk cheap metronidazole

rybelsus pill – rybelsus 14mg brand oral periactin 4 mg

buy generic domperidone for sale – domperidone us order flexeril

I would like to thnkx for the efforts you’ve put in writing this site. I am hoping the same high-grade blog post from you in the upcoming also. In fact your creative writing abilities has encouraged me to get my own site now. Actually the blogging is spreading its wings fast. Your write up is a good example of it.

Thank you for sharing superb informations. Your web site is very cool. I am impressed by the details that you have on this site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched all over the place and just couldn’t come across. What a great web site.

purchase amoxil generic – amoxil online order purchase combivent generic

purchase azithromycin generic – order azithromycin generic buy bystolic for sale

buy clavulanate online – https://atbioinfo.com/ buy ampicillin online

esomeprazole buy online – https://anexamate.com/ nexium 20mg cost

warfarin 5mg usa – https://coumamide.com/ where can i buy losartan

order meloxicam online – tenderness mobic uk

order deltasone 5mg – https://apreplson.com/ brand deltasone 5mg

Keep up the wonderful work, I read few content on this site and I believe that your web site is very interesting and contains bands of fantastic information.

best non prescription ed pills – fast ed to take site buy ed pills cheap

cost diflucan 100mg – https://gpdifluca.com/# fluconazole uk

cenforce 50mg usa – buy cenforce pill order cenforce pills

cialis professional review – cialis going generic cialis australia online shopping

buy ranitidine sale – https://aranitidine.com/# oral zantac

cialis online with no prescription – https://strongtadafl.com/ buy a kilo of tadalafil powder

More peace pieces like this would make the интернет better. this

natural viagra – safe buy generic viagra online Viagra 50mg

This is the kind of advise I find helpful. https://buyfastonl.com/amoxicillin.html

I am in fact delighted to gleam at this blog posts which consists of tons of useful facts, thanks towards providing such data. https://ursxdol.com/prednisone-5mg-tablets/

With thanks. Loads of expertise! https://prohnrg.com/product/orlistat-pills-di/

you’re really a just right webmaster. The site loading speed is incredible. It sort of feels that you are doing any unique trick. Moreover, The contents are masterwork. you’ve done a magnificent activity in this topic!

This is the make of delivery I recoup helpful. prix viagra

The depth in this tune is exceptional. https://ondactone.com/product/domperidone/

Hey there! I could have sworn I’ve been to this website before but after browsing through some of the post I realized it’s new to me. Anyhow, I’m definitely delighted I found it and I’ll be bookmarking and checking back frequently!

I’m typically to running a blog and i really recognize your content. The article has actually peaks my interest. I am going to bookmark your website and keep checking for new information.

Facts blog you have here.. It’s severely to assign great worth writing like yours these days. I justifiably appreciate individuals like you! Go through guardianship!! http://www.gtcm.info/home.php?mod=space&uid=1158211

Some genuinely interesting points you have written.Aided me a lot, just what I was looking for : D.

Very nice post. I simply stumbled upon your blog and wanted to mention that I have truly enjoyed browsing your blog posts. After all I’ll be subscribing to your feed and I’m hoping you write once more very soon!

Hello! Quick question that’s completely off topic. Do you know how to make your site mobile friendly? My website looks weird when viewing from my apple iphone. I’m trying to find a theme or plugin that might be able to fix this problem. If you have any recommendations, please share. Thanks!

buy cheap generic forxiga – https://janozin.com/ dapagliflozin 10 mg for sale

I gotta favorite this site it seems handy very useful

xenical price – https://asacostat.com/# orlistat 120mg us