-

BTC rose 27% in October, the strongest performance since January when the crypto rally extended.

-

Sentiment reached “exuberant” levels, as many traders “panic bought” during the rally, Matrixport noted.

-

BTC could still move higher, with a price target of $40,000 in the coming weeks, an LMAX strategist said.

The boredom ended in October when cryptocurrency prices moved higher, with the biggest of them all, bitcoin (BTC)with the strongest monthly rally since January, as investors buzzed with optimism that bitcoin ETFs will soon be approved in the US

BTC gained more than 27% to reach a 17-month high of $35,000 after hovering around the $27,000 level in the first half of October. Rates were recently just above $34,000 ahead of the Federal Reserve’s interest rate decision on Wednesday, with market participants largely in expectation policymakers to leave interest rates unchanged.

The rally spread across the broader crypto market, a bullish sign, the CoinDesk Market Index (CMI), which tracks a broad basket of tokens, advanced 22% in October. The market capitalization of all cryptocurrencies has increased by almost 19% to $1.255 trillion, according to figures. TradingView datathe biggest increase in crypto wealth since January’s 33% jump.

ETFs would be a big deal for bitcoin because they are much easier for the average investor to buy than the cryptocurrency itself or existing bitcoin investment products, such as the Grayscale Bitcoin Trust (GBTC) with $21 billion in assets under management. The U.S. Securities and Exchange Commission rejected converting GBTC into a GBTC, but courts have overturned that decision, raising the possibility that the SEC will have to approve that shift — and likely also reject ETF filings from the likes of BlackRock, the largest asset manager in the world, will have to bless.

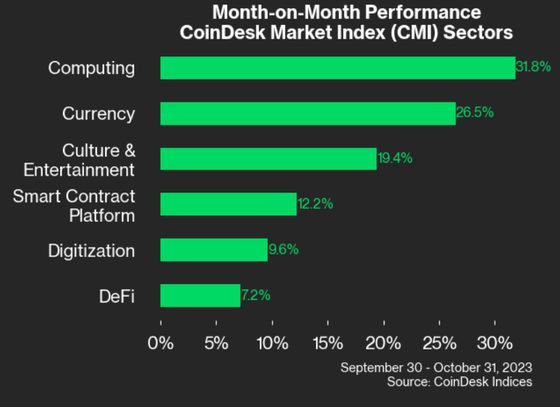

Despite being a broad crypto rally in October, not all sectors benefited equally.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/M6YSAPQALZF2DI4QZBGQPIBJGY.png)

Ethereum’s ether (ETH) posted a modest gain of 7%. The valuation fell to a level against BTC also observed in June 2022, which preceded ETH’s outperformance.

Meanwhile, the CoinDesk computer sector (CPU)an index that tracks protocols aimed at building and supporting Web3 infrastructure and distributed computing, rose nearly 32% in October.

Among the alternative cryptocurrencies is Solana (SOL) was a notable outperformer with a monthly return of over 70% amid increasing network activity and decreasing concerns about FTX tokens being dumped in a fire sale.

Read more: Sam Bankman-Fried started buying Solana’s SOL for 20 cents using ‘Alameda profits,’ he says at trial

Why did cryptocurrencies rise in October?

Investors are excited about the potential for bitcoin ETFs in the US

“A spot bitcoin ETF could generate as much as $50 billion to $100 billion in inflows over the next five years” and “could have an outsized impact on the price of bitcoin,” Ryan Rasmussen, an analyst at asset manager Bitwise, said in an interview on Tuesday with CoinDesk TV.

He said he expects the SEC to greenlight ETF filings as early as December, before the holidays. Bitwise is one of the companies looking to list one.

Crypto investment services provider Matrixport said the increased funding rates in the BTC derivatives market indicate that many traders panicked on the way up for fear of missing the rally.

In addition to ETF hype, sector-specific momentum, short liquidations and macroeconomic headwinds also contributed to the price rise, crypto analytics firm CoinMetrics said in a report on Tuesday.

“This market move signals renewed confidence and signals a potential shift in the dynamics surrounding digital asset markets,” said CoinMetrics analyst Tanay Ved.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/QDPI4GXBJFATLFOQD6YQ4S5OR4.jpeg)

Investing legend Paul Druckenmiller underscored a changing sentiment, he said at an investor meeting Robin Hood fireside chat On Monday, hedge fund manager Paul Tudor Jones said he “likes” bitcoin and gold as an investment and store of value. He said he owns gold because it’s a “5,000-year-old brand,” but young people prefer to own BTC because it’s “easier to do things with it.”

“I don’t know bitcoin, but honestly I should,” he added.

What’s next for the Bitcoin (BTC) price?

After its blockbuster month, Bitcoin hasn’t let up yet and could go even further, analysts suggested.

“October’s breakout to a new annual high has opened the door for this next major upside extension, aiming for a measured move target into the $40,000 area in the coming weeks,” said Joel Kruger, market strategist at institutional crypto exchange LMAX Group, in an e-mail.

Analysts at Matrixport noted that the company’s Bitcoin Greed & Fear Index is at 97%, indicating “buoyant” sentiment. Still, they argued that BTC is likely to “press higher and could target $40,000 as the next significant resistance level.”

-

BTC rose 27% in October, the strongest performance since January when the crypto rally extended.

-

Sentiment reached “exuberant” levels, as many traders “panic bought” during the rally, Matrixport noted.

-

BTC could still move higher, with a price target of $40,000 in the coming weeks, an LMAX strategist said.

The boredom ended in October when cryptocurrency prices moved higher, with the biggest of them all, bitcoin (BTC)with the strongest monthly rally since January, as investors buzzed with optimism that bitcoin ETFs will soon be approved in the US

BTC gained more than 27% to reach a 17-month high of $35,000 after hovering around the $27,000 level in the first half of October. Rates were recently just above $34,000 ahead of the Federal Reserve’s interest rate decision on Wednesday, with market participants largely in expectation policymakers to leave interest rates unchanged.

The rally spread across the broader crypto market, a bullish sign, the CoinDesk Market Index (CMI), which tracks a broad basket of tokens, advanced 22% in October. The market capitalization of all cryptocurrencies has increased by almost 19% to $1.255 trillion, according to figures. TradingView datathe biggest increase in crypto wealth since January’s 33% jump.

ETFs would be a big deal for bitcoin because they are much easier for the average investor to buy than the cryptocurrency itself or existing bitcoin investment products, such as the Grayscale Bitcoin Trust (GBTC) with $21 billion in assets under management. The U.S. Securities and Exchange Commission rejected converting GBTC into a GBTC, but courts have overturned that decision, raising the possibility that the SEC will have to approve that shift — and likely also reject ETF filings from the likes of BlackRock, the largest asset manager in the world, will have to bless.

Despite being a broad crypto rally in October, not all sectors benefited equally.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/M6YSAPQALZF2DI4QZBGQPIBJGY.png)

Ethereum’s ether (ETH) posted a modest gain of 7%. The valuation fell to a level against BTC also observed in June 2022, which preceded ETH’s outperformance.

Meanwhile, the CoinDesk computer sector (CPU)an index that tracks protocols aimed at building and supporting Web3 infrastructure and distributed computing, rose nearly 32% in October.

Among the alternative cryptocurrencies is Solana (SOL) was a notable outperformer with a monthly return of over 70% amid increasing network activity and decreasing concerns about FTX tokens being dumped in a fire sale.

Read more: Sam Bankman-Fried started buying Solana’s SOL for 20 cents using ‘Alameda profits,’ he says at trial

Why did cryptocurrencies rise in October?

Investors are excited about the potential for bitcoin ETFs in the US

“A spot bitcoin ETF could generate as much as $50 billion to $100 billion in inflows over the next five years” and “could have an outsized impact on the price of bitcoin,” Ryan Rasmussen, an analyst at asset manager Bitwise, said in an interview on Tuesday with CoinDesk TV.

He said he expects the SEC to greenlight ETF filings as early as December, before the holidays. Bitwise is one of the companies looking to list one.

Crypto investment services provider Matrixport said the increased funding rates in the BTC derivatives market indicate that many traders panicked on the way up for fear of missing the rally.

In addition to ETF hype, sector-specific momentum, short liquidations and macroeconomic headwinds also contributed to the price rise, crypto analytics firm CoinMetrics said in a report on Tuesday.

“This market move signals renewed confidence and signals a potential shift in the dynamics surrounding digital asset markets,” said CoinMetrics analyst Tanay Ved.

:format(jpg)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/QDPI4GXBJFATLFOQD6YQ4S5OR4.jpeg)

Investing legend Paul Druckenmiller underscored a changing sentiment, he said at an investor meeting Robin Hood fireside chat On Monday, hedge fund manager Paul Tudor Jones said he “likes” bitcoin and gold as an investment and store of value. He said he owns gold because it’s a “5,000-year-old brand,” but young people prefer to own BTC because it’s “easier to do things with it.”

“I don’t know bitcoin, but honestly I should,” he added.

What’s next for the Bitcoin (BTC) price?

After its blockbuster month, Bitcoin hasn’t let up yet and could go even further, analysts suggested.

“October’s breakout to a new annual high has opened the door for this next major upside extension, aiming for a measured move target into the $40,000 area in the coming weeks,” said Joel Kruger, market strategist at institutional crypto exchange LMAX Group, in an e-mail.

Analysts at Matrixport noted that the company’s Bitcoin Greed & Fear Index is at 97%, indicating “buoyant” sentiment. Still, they argued that BTC is likely to “press higher and could target $40,000 as the next significant resistance level.”

can i buy clomid without prescription can i order cheap clomiphene prices where to get cheap clomid where to buy clomiphene price cheap clomiphene pills where to buy cheap clomid pill how to get generic clomid tablets

This is the tolerant of enter I recoup helpful.

This is the tolerant of enter I recoup helpful.

azithromycin ca – order ofloxacin 200mg generic buy generic flagyl

semaglutide 14mg pills – buy rybelsus paypal buy periactin without prescription

cheap domperidone – cyclobenzaprine uk cyclobenzaprine tablet

inderal 20mg canada – methotrexate ca buy generic methotrexate

amoxil online – order amoxil without prescription ipratropium 100mcg ca

buy zithromax cheap – order tindamax 500mg bystolic online order

augmentin 375mg generic – atbioinfo ampicillin buy online

order esomeprazole 40mg – nexium to us buy nexium 20mg online

buy coumadin 2mg for sale – https://coumamide.com/ hyzaar pill

mobic tablet – https://moboxsin.com/ meloxicam cheap

order prednisone 10mg pill – allergic reactions buy deltasone 10mg online cheap

can you buy ed pills online – https://fastedtotake.com/ best pills for ed

buy amoxicillin medication – https://combamoxi.com/ buy amoxil

buy cheap generic fluconazole – https://gpdifluca.com/ fluconazole 100mg cost

order generic lexapro 20mg – https://escitapro.com/ lexapro 20mg ca

cenforce 50mg without prescription – https://cenforcers.com/ buy cenforce 50mg online

where to buy cialis cheap – https://strongtadafl.com/ cialis how long does it last

ranitidine 150mg cost – https://aranitidine.com/ oral ranitidine

viagra sale china – https://strongvpls.com/ buy viagra generic online

This is the compassionate of criticism I rightly appreciate. click

I’ll certainly return to skim more. https://buyfastonl.com/furosemide.html

Palatable blog you have here.. It’s obdurate to espy elevated quality belles-lettres like yours these days. I truly appreciate individuals like you! Go through mindfulness!! https://ursxdol.com/get-cialis-professional/

More articles like this would pretence of the blogosphere richer. https://prohnrg.com/product/get-allopurinol-pills/

More posts like this would add up to the online play more useful. https://aranitidine.com/fr/acheter-fildena/

The vividness in this piece is exceptional. https://ondactone.com/product/domperidone/