- Bitcoin whales accumulated large amounts of BTC as the price of the king coin grew.

- Traders remain optimistic, and a high majority continued to hold long positions.

Bitcoin [BTC] inspired massive amounts of optimism over the last 24 hours as its price reclaimed the $69,000 level. One of the reasons for this would be the rising interest in BTC showcased by whales.

Whales move in

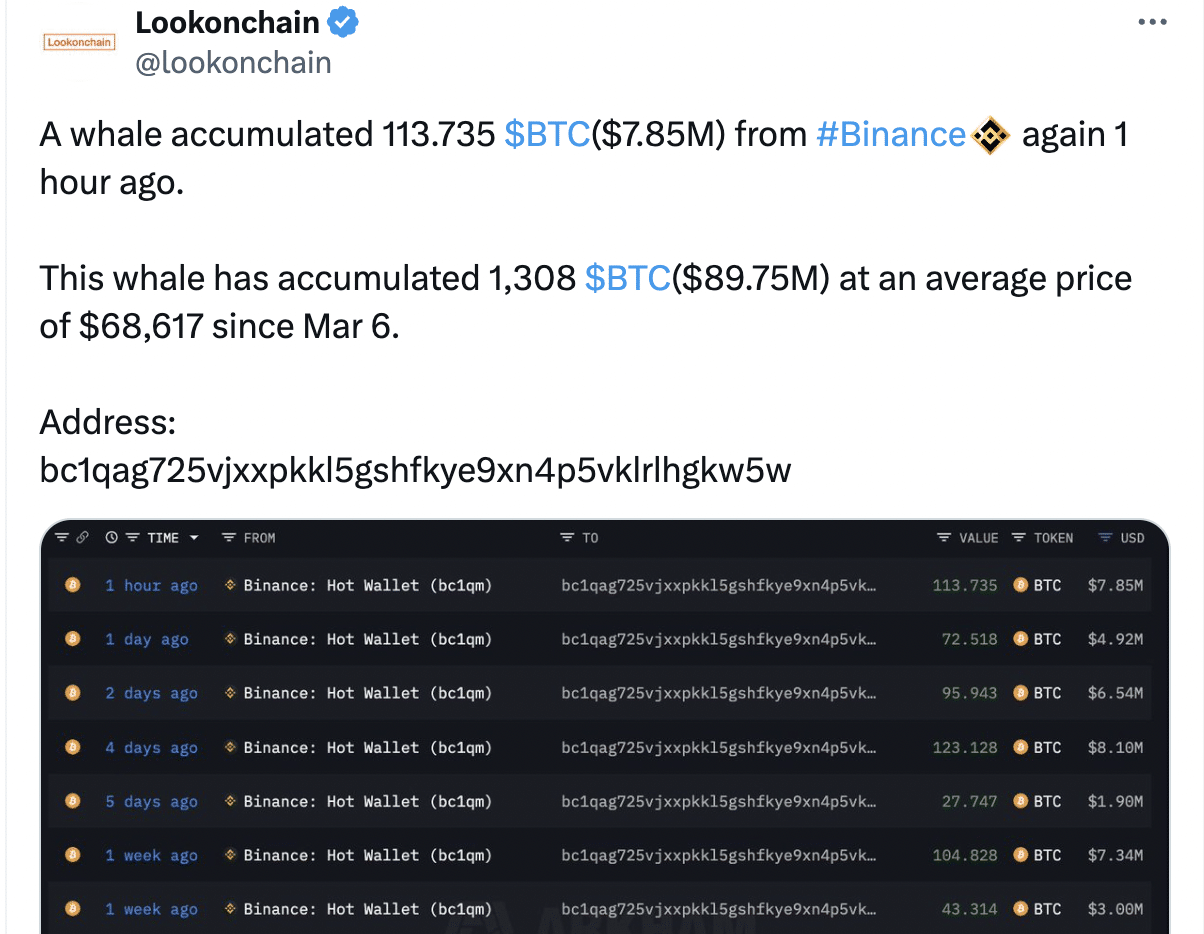

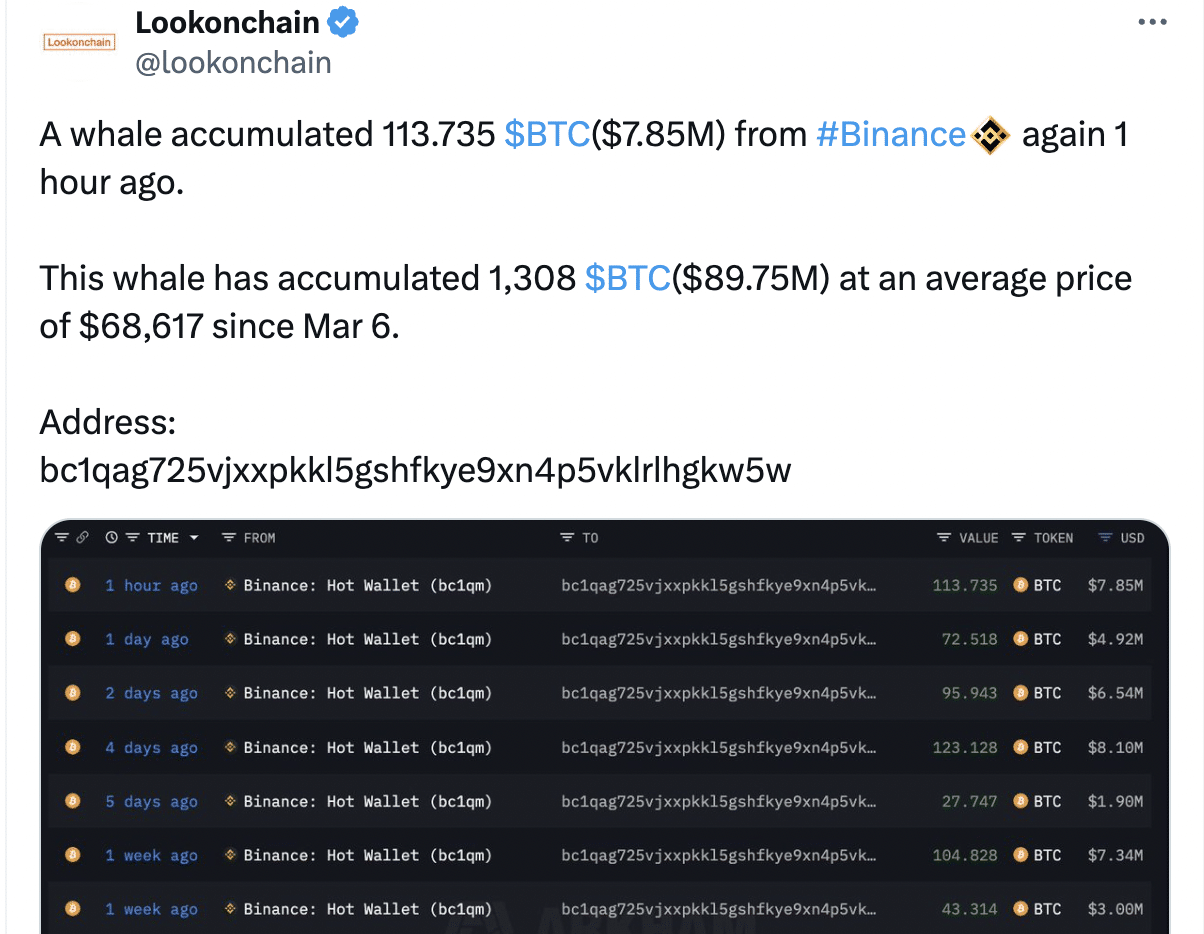

According to data from Lookonchain, a whale accumulated 113.735 BTC, totaling $7.85 million, from Binance.

Since the 6th of March, this whale has amassed a total of 1,308 BTC, valued at $89.75 million, at an average price of $68,617.

Source: X

This increased confidence from big investors can act as a catalyst, attracting more buyers and pushing the price higher.

Whales’ involvement can also validate Bitcoin’s potential in the eyes of other investors, further bolstering the market. However, this newfound influence comes with a double-edged sword.

While whale activity can propel prices upwards, it can also lead to sharp drops if they decide to sell their holdings.

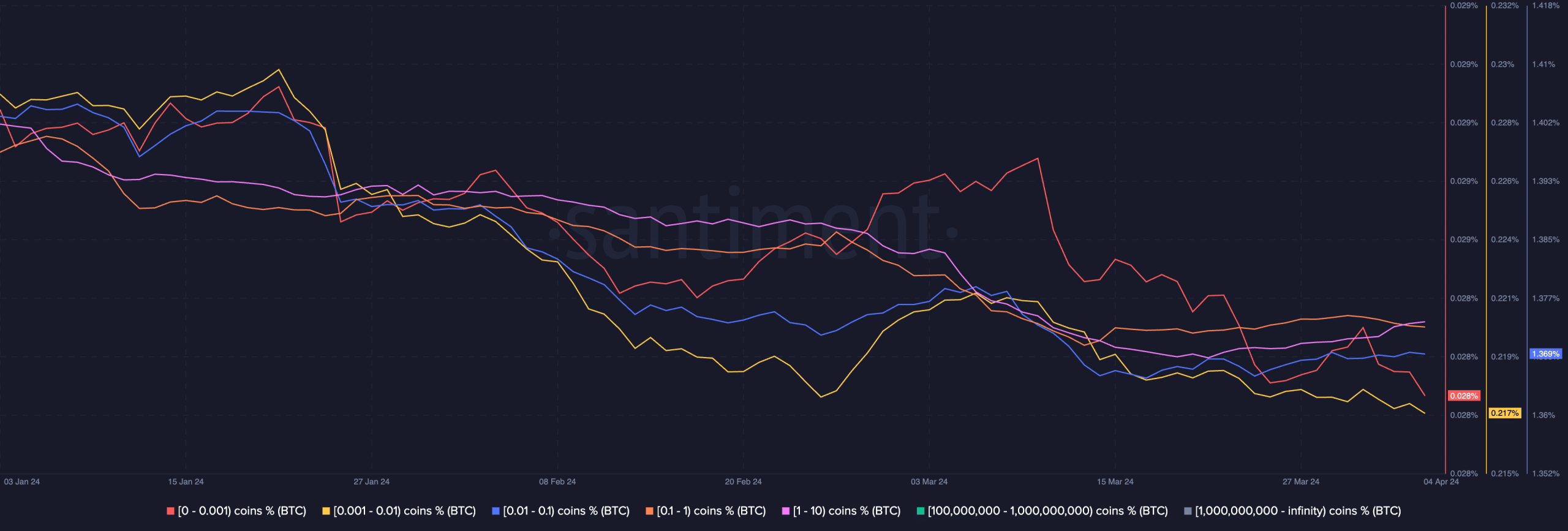

Even though whales were accumulating BTC at a higher rate, retail investors were showing less and less interest.

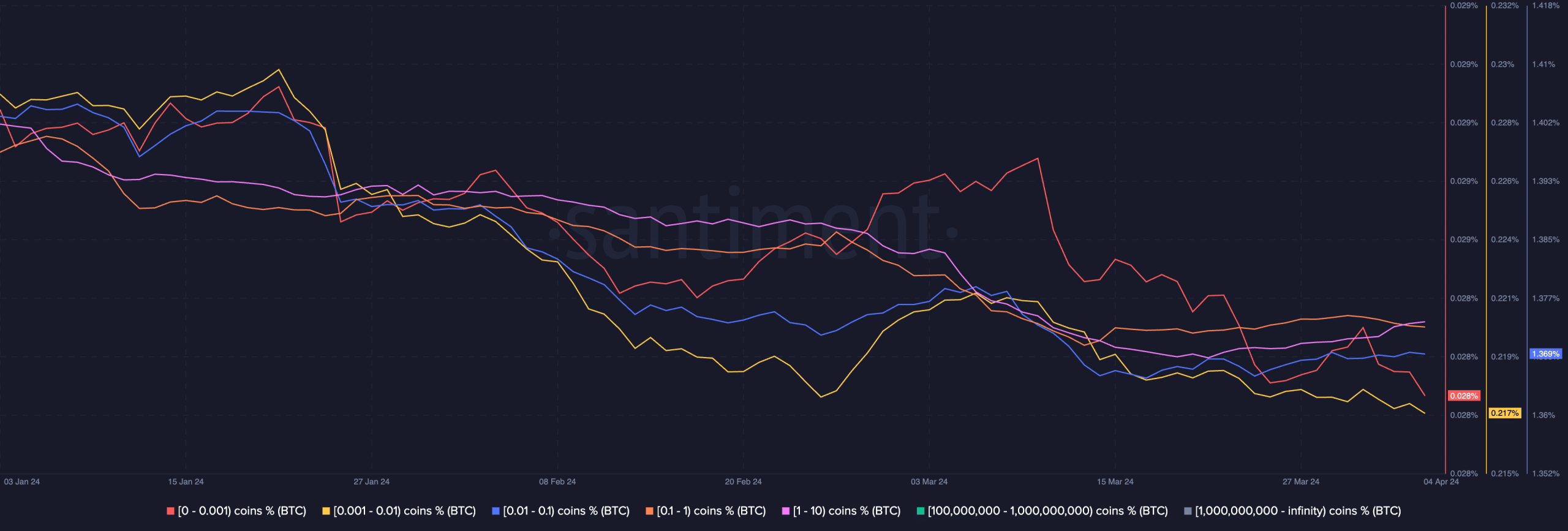

AMBCrypto’s analysis of Santiment’s data indicated that the concentration of addresses holding anywhere between 0.001 and 1.0 BTC had reduced.

If whale investors continue to accumulate as retail investors become passive, the BTC holdings could become more centralized.

This centralization of BTC would make retail investors more vulnerable to whale behavior.

Source: Santiment

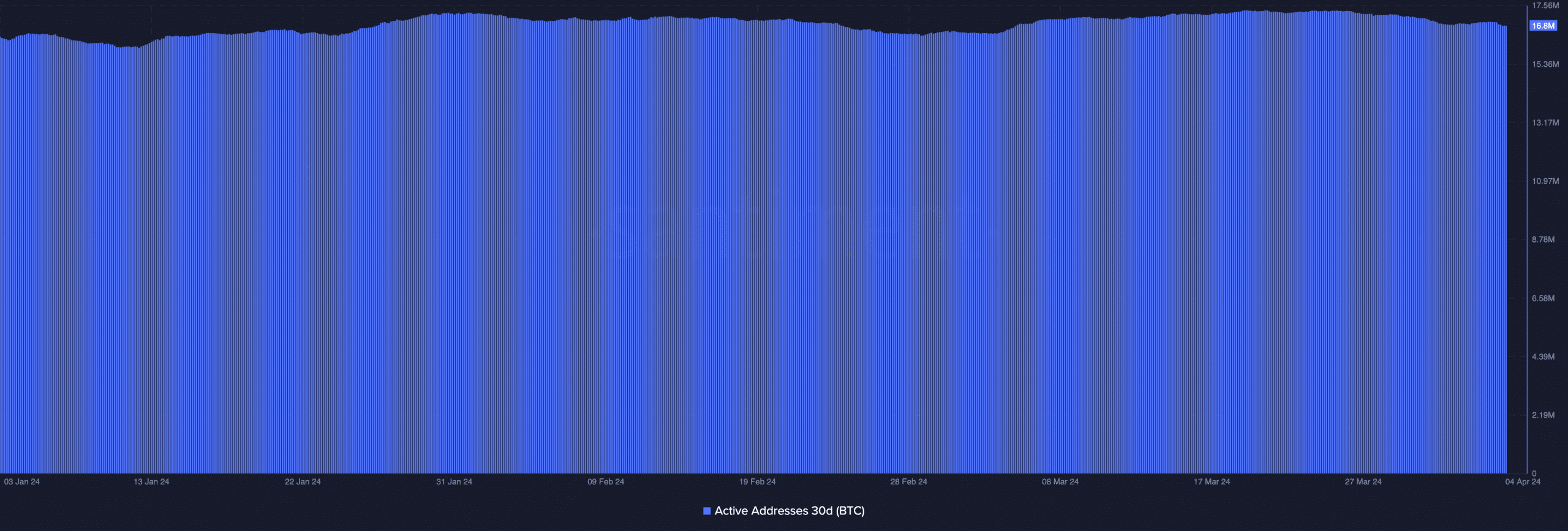

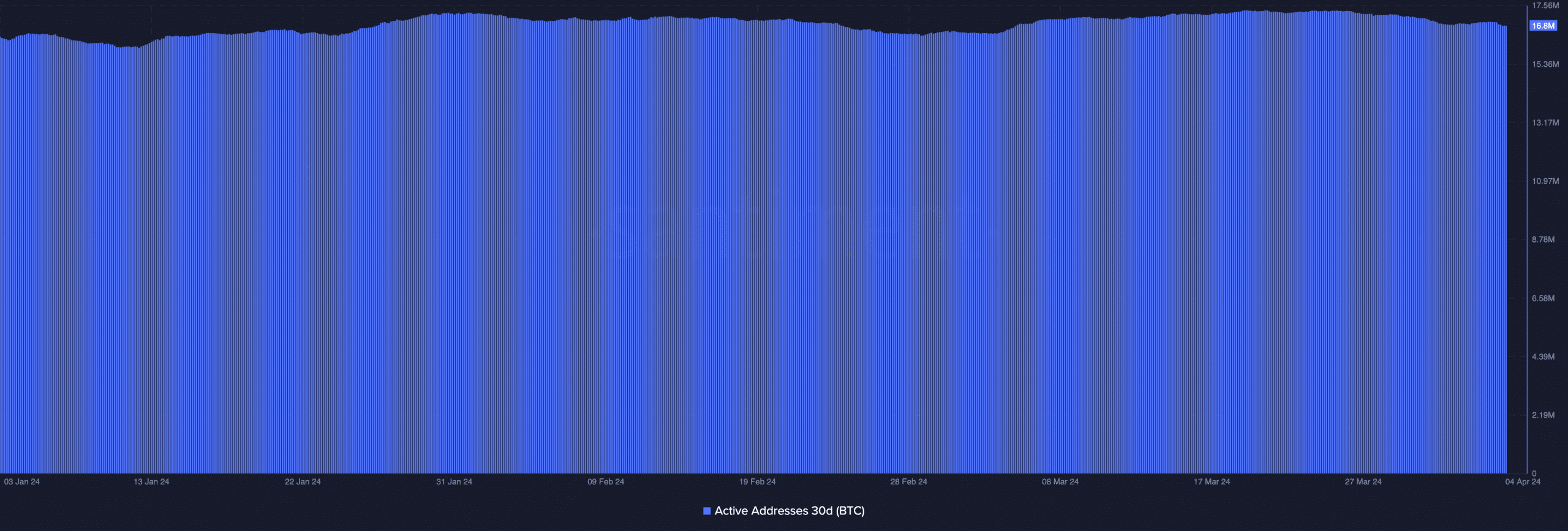

Apart from the behavior of holders, another factor that would impact BTC’s price movement would be the activity on the Bitcoin network.

Data from Santiment indicated that Active Addresses on the network had remained high.

Source: Santiment

State of the ecosystem

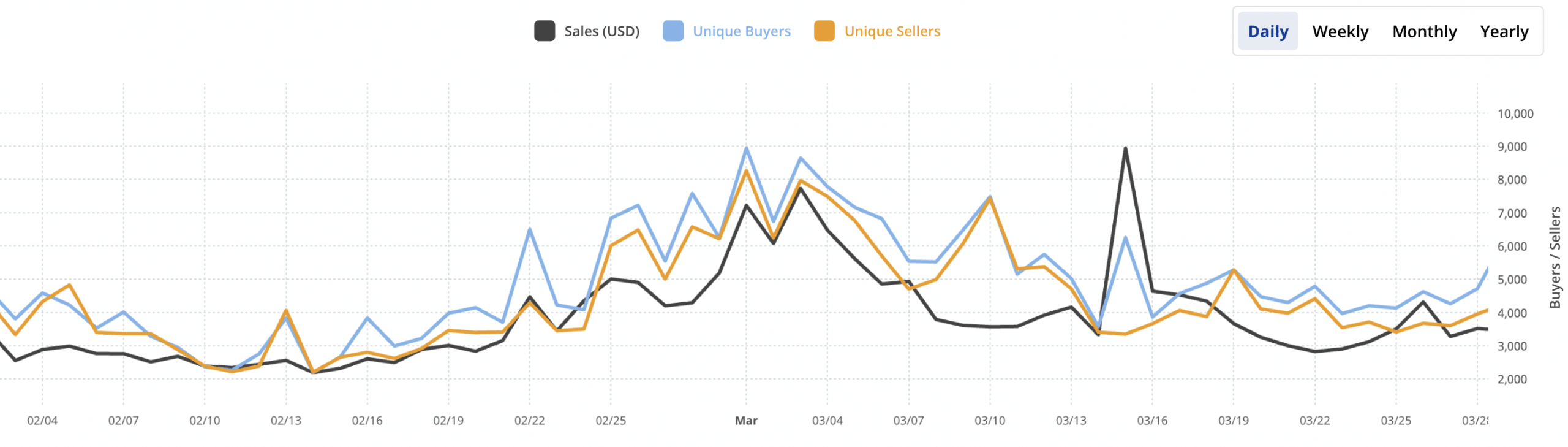

The high activity on the network could be attributed, in part, to the growing popularity of Ordinals and Inscriptions on the Bitcoin network.

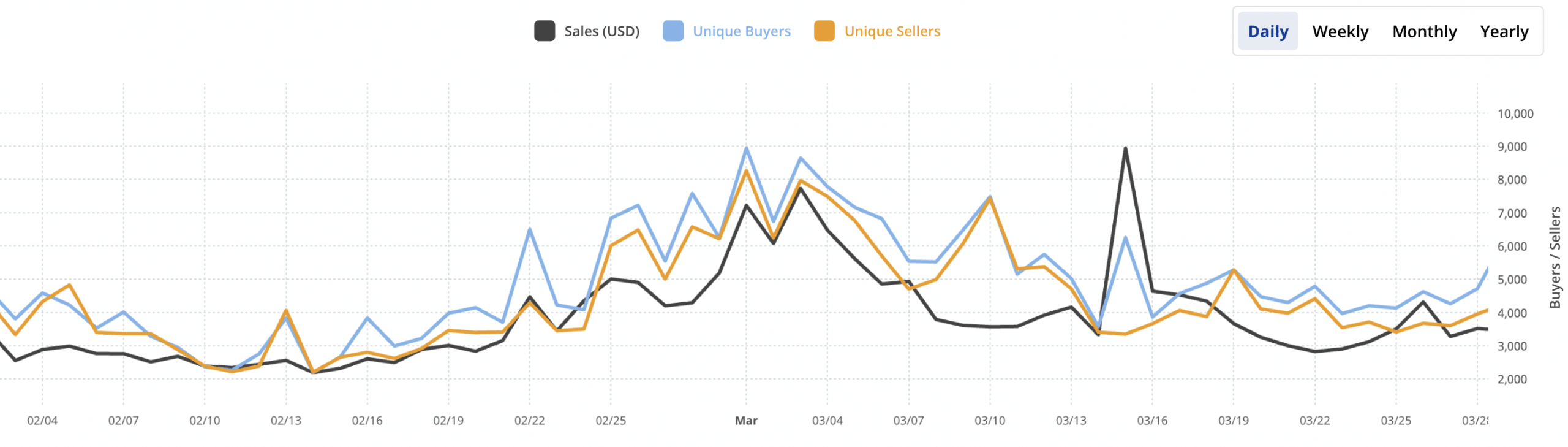

AMBCrypto’s review of CryptoSlam’s data showcased that the number of unique buyers and unique sellers had grown. Additionally, the number of sales of the NFTs on the Bitcoin network had also grown.

Source: Santiment

Is your portfolio green? Check out the BTC Profit Calculator

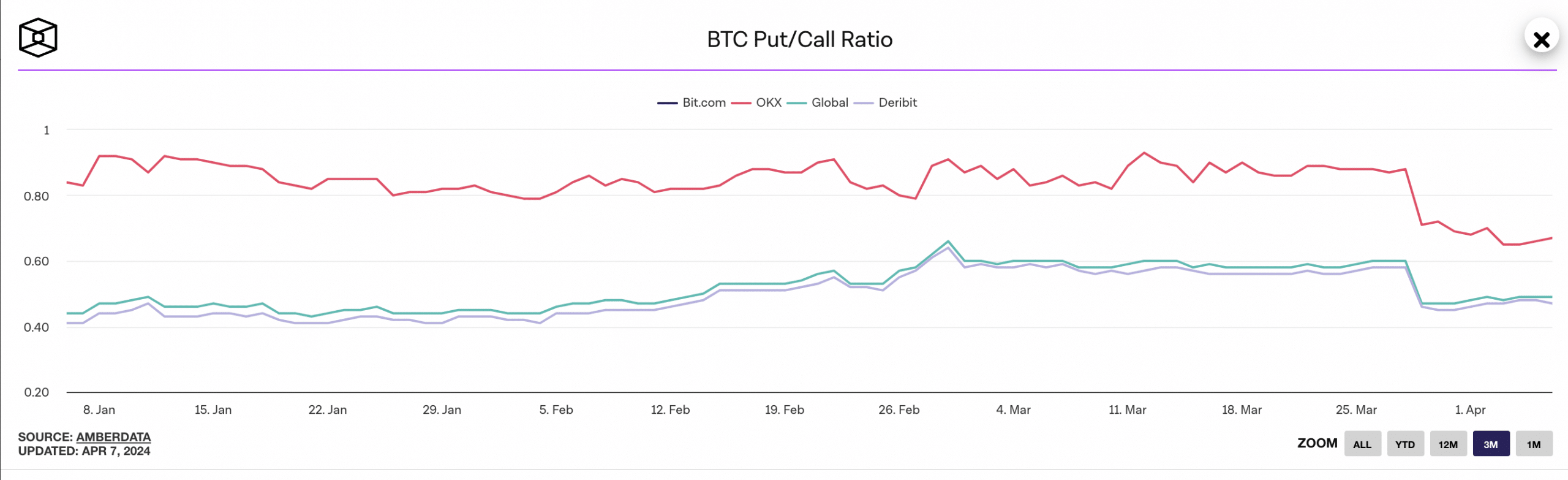

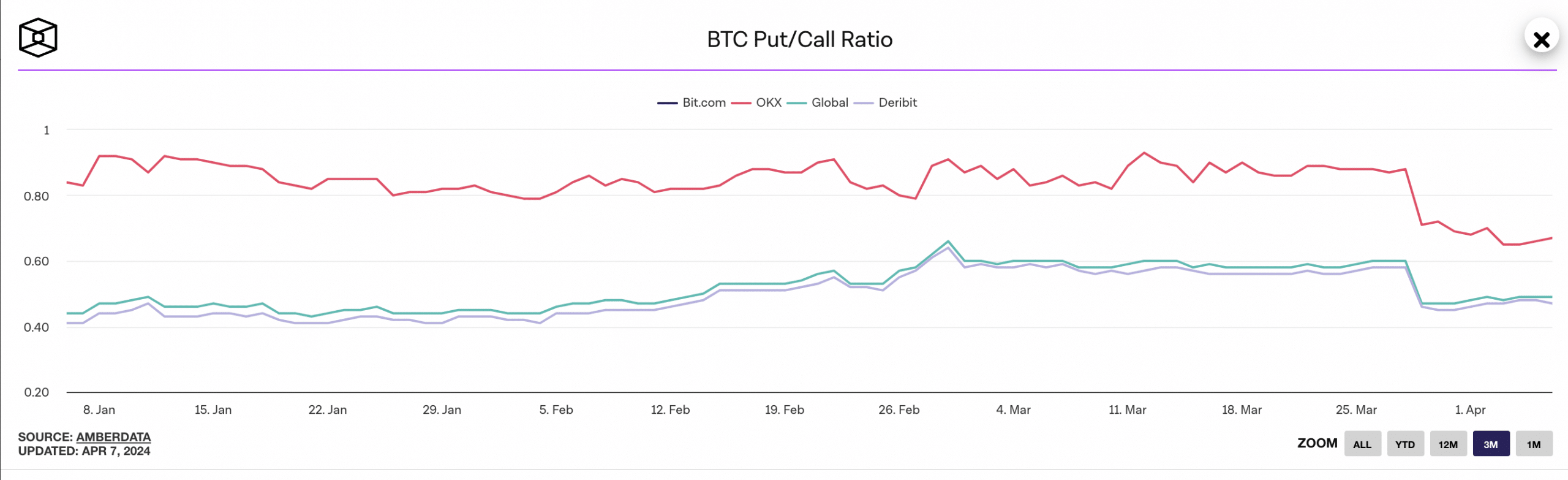

Traders remain optimistic about BTC as well. This was indicated by the Put to Call ratio around Bitcoin, which had declined significantly over the last few days.

The high number of call options taken by traders showcased that many bulls are expecting BTC’s price to rise further and even reach its previously attained all-time highs.

Source: The Block

- Bitcoin whales accumulated large amounts of BTC as the price of the king coin grew.

- Traders remain optimistic, and a high majority continued to hold long positions.

Bitcoin [BTC] inspired massive amounts of optimism over the last 24 hours as its price reclaimed the $69,000 level. One of the reasons for this would be the rising interest in BTC showcased by whales.

Whales move in

According to data from Lookonchain, a whale accumulated 113.735 BTC, totaling $7.85 million, from Binance.

Since the 6th of March, this whale has amassed a total of 1,308 BTC, valued at $89.75 million, at an average price of $68,617.

Source: X

This increased confidence from big investors can act as a catalyst, attracting more buyers and pushing the price higher.

Whales’ involvement can also validate Bitcoin’s potential in the eyes of other investors, further bolstering the market. However, this newfound influence comes with a double-edged sword.

While whale activity can propel prices upwards, it can also lead to sharp drops if they decide to sell their holdings.

Even though whales were accumulating BTC at a higher rate, retail investors were showing less and less interest.

AMBCrypto’s analysis of Santiment’s data indicated that the concentration of addresses holding anywhere between 0.001 and 1.0 BTC had reduced.

If whale investors continue to accumulate as retail investors become passive, the BTC holdings could become more centralized.

This centralization of BTC would make retail investors more vulnerable to whale behavior.

Source: Santiment

Apart from the behavior of holders, another factor that would impact BTC’s price movement would be the activity on the Bitcoin network.

Data from Santiment indicated that Active Addresses on the network had remained high.

Source: Santiment

State of the ecosystem

The high activity on the network could be attributed, in part, to the growing popularity of Ordinals and Inscriptions on the Bitcoin network.

AMBCrypto’s review of CryptoSlam’s data showcased that the number of unique buyers and unique sellers had grown. Additionally, the number of sales of the NFTs on the Bitcoin network had also grown.

Source: Santiment

Is your portfolio green? Check out the BTC Profit Calculator

Traders remain optimistic about BTC as well. This was indicated by the Put to Call ratio around Bitcoin, which had declined significantly over the last few days.

The high number of call options taken by traders showcased that many bulls are expecting BTC’s price to rise further and even reach its previously attained all-time highs.

Source: The Block

where buy generic clomid price can you buy cheap clomid prices get cheap clomiphene without insurance cost of clomiphene without prescription clomid tablete cost of clomid for men clomiphene for sale uk

This website exceedingly has all of the bumf and facts I needed to this subject and didn’t know who to ask.

I’ll certainly carry back to skim more.

oral zithromax 250mg – purchase flagyl generic buy metronidazole no prescription

rybelsus 14mg cost – periactin 4mg over the counter buy periactin 4 mg without prescription

domperidone online buy – order generic sumycin 250mg order generic flexeril

inderal 10mg price – generic clopidogrel brand methotrexate 2.5mg

augmentin 625mg over the counter – atbioinfo.com oral acillin

esomeprazole 40mg us – https://anexamate.com/ order nexium 20mg generic

buy medex pills for sale – blood thinner cozaar 50mg over the counter

meloxicam 15mg canada – swelling generic meloxicam

order prednisone 40mg for sale – https://apreplson.com/ buy generic prednisone

best male ed pills – fast ed to take site buy ed medication online

buy generic amoxicillin – combamoxi brand amoxicillin

forcan order online – where to buy forcan without a prescription buy diflucan sale

escitalopram cheap – anxiety pro escitalopram 20mg brand