- The Bitcoin Rainbow Chart and other key metrics signaled ‘BUY’ at press time.

- Market pundits expect bullish Q4 and 2025 — Should you hold on or jump in?

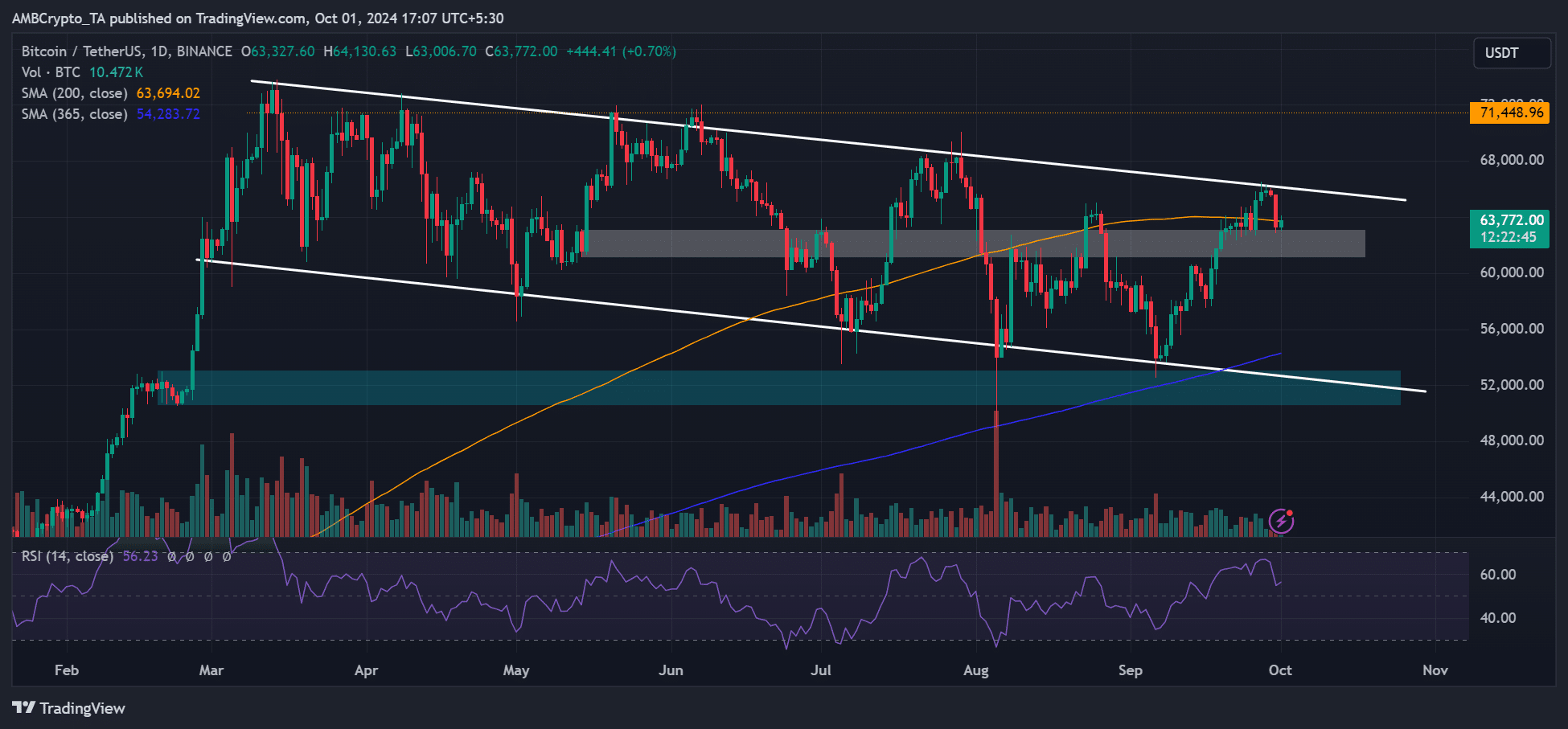

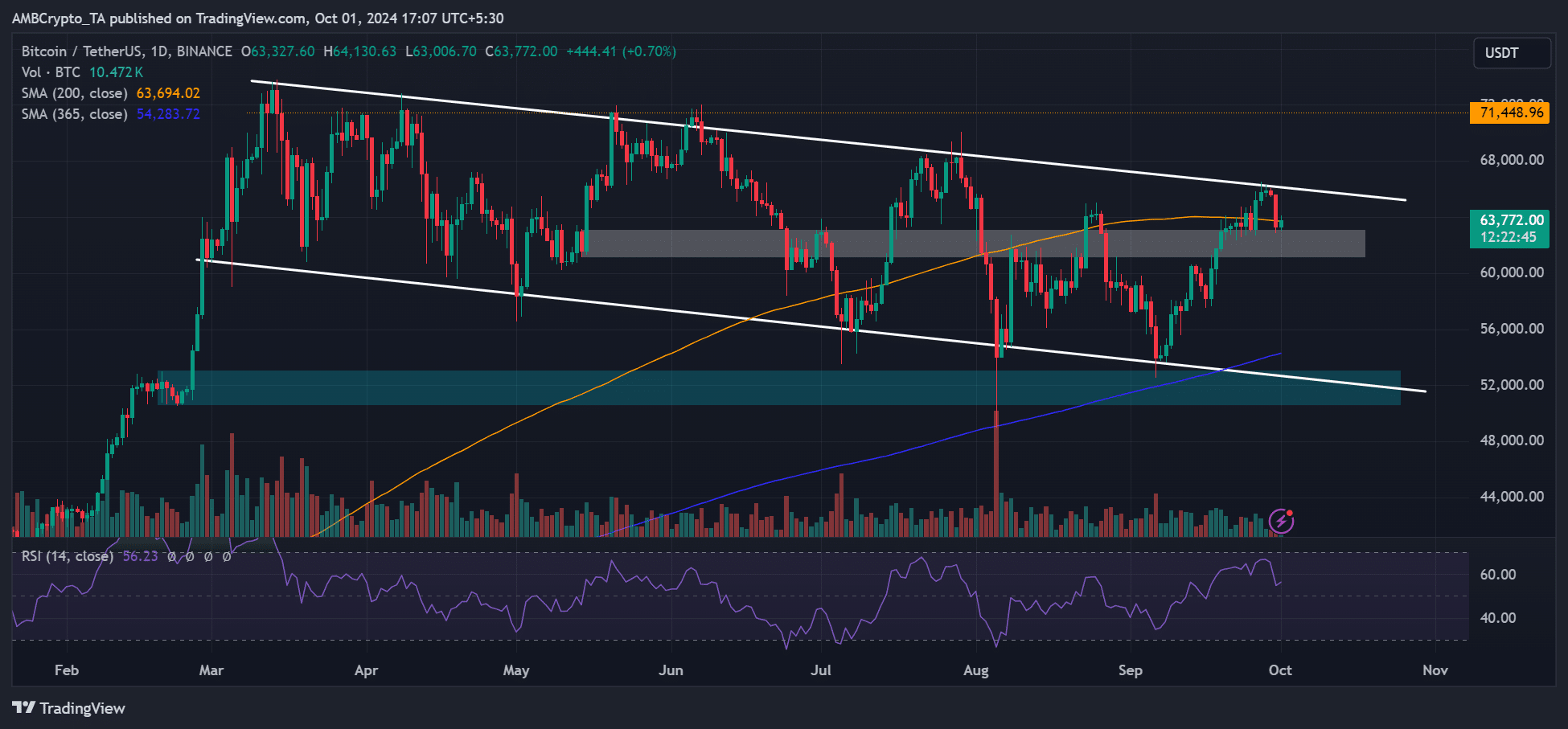

Bitcoin [BTC] has been consolidating within $60K—$70K for the past seven months. Despite the boring price action, the current BTC value was still a great buy opportunity ahead of a historically bullish Q4.

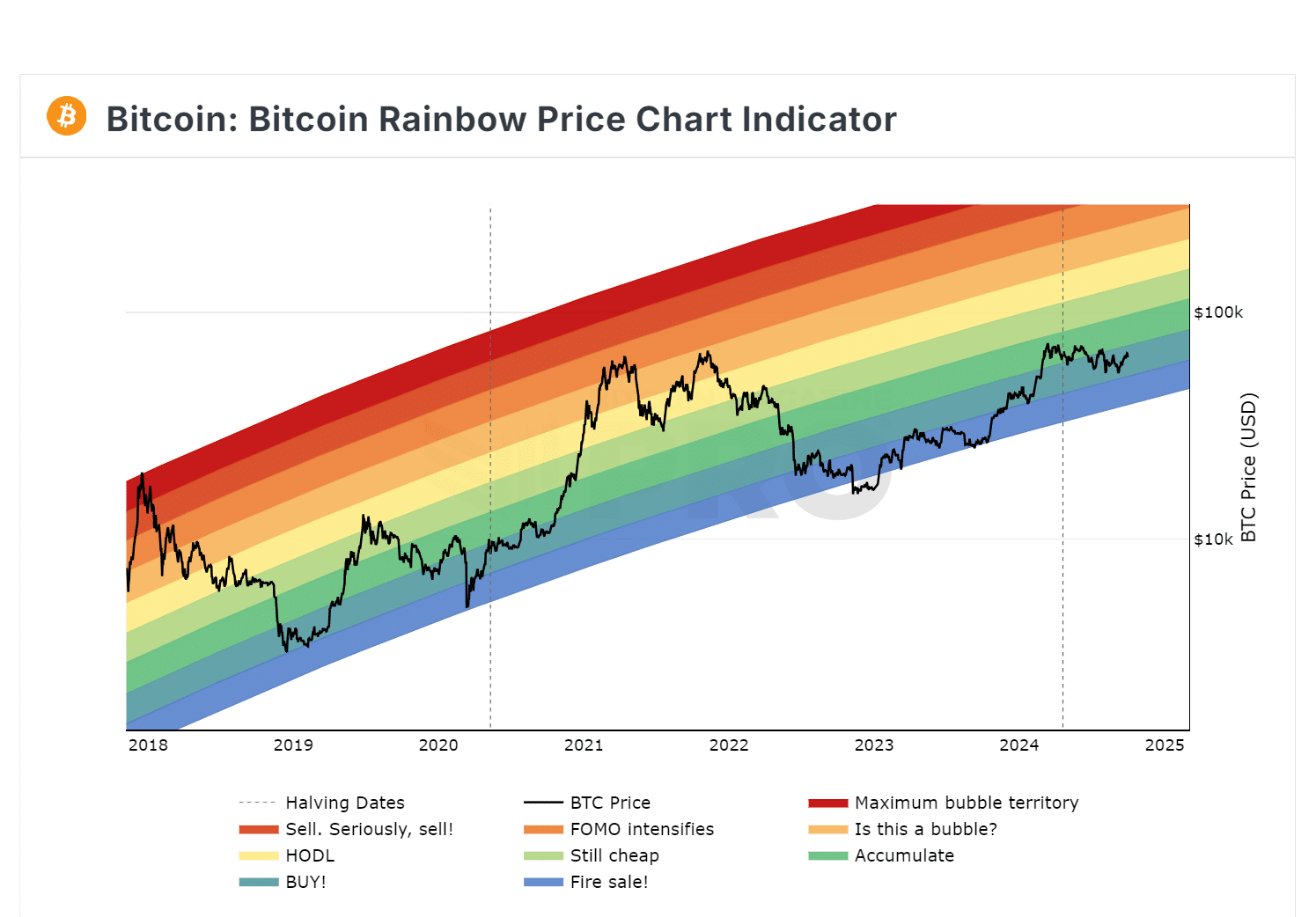

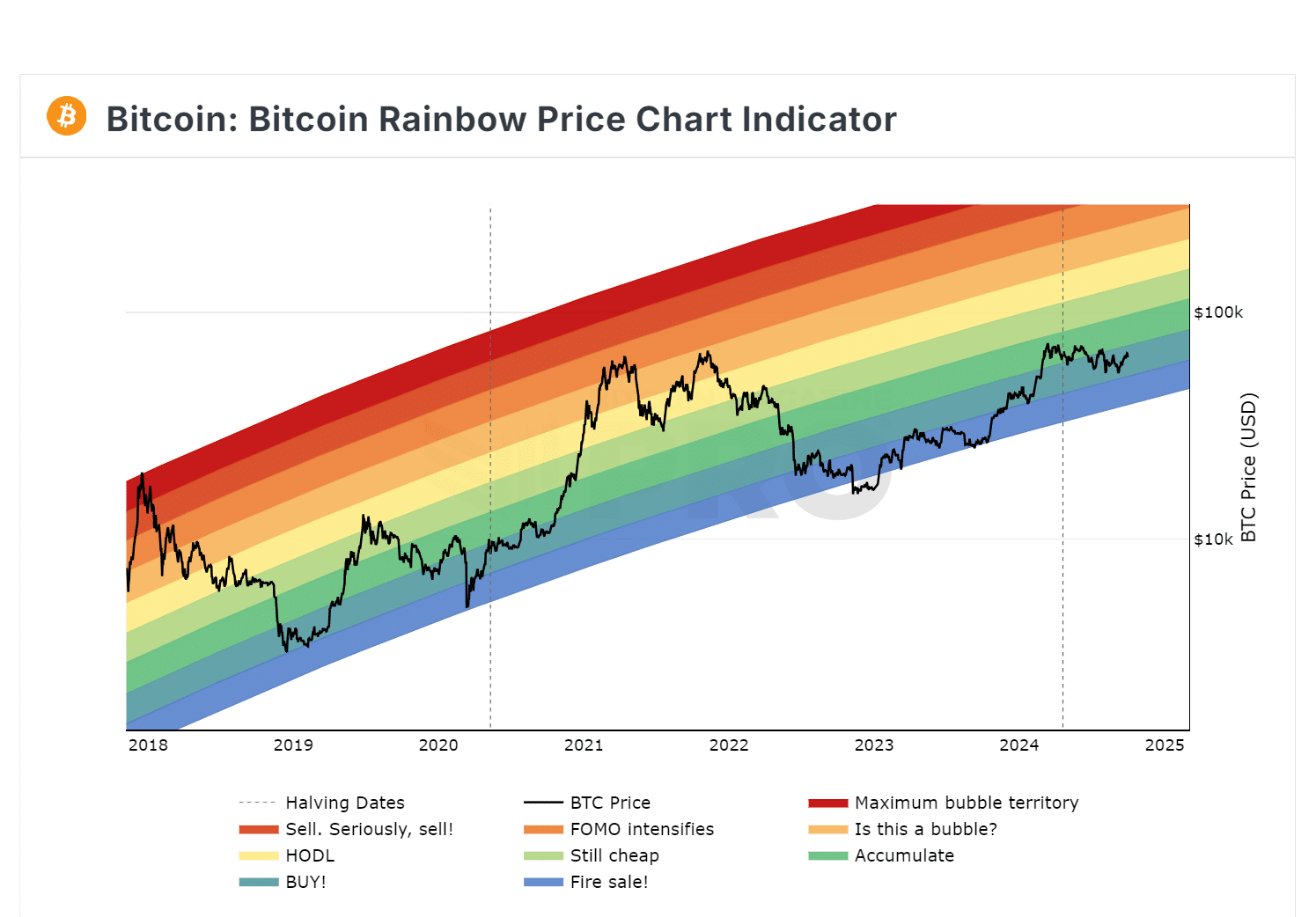

According to the Bitcoin Rainbow Chart, BTC’s current value was still within the ‘buy’ zone.

In fact, since its March and subsequent retracement, the asset has been firmly within the ‘accumulate’ and ‘buy’ zones.

Source: BM Pro

For context, the Rainbow Chart gauges BTC valuation based on historical prices but is presented visually through rainbow colors.

Lower color bands signal undervalued BTC, while higher bands denote overheated market and potential corrections.

Is BTC still discounted?

Other key valuation metrics also signaled that BTC was relatively ‘cheap’ at press time value.

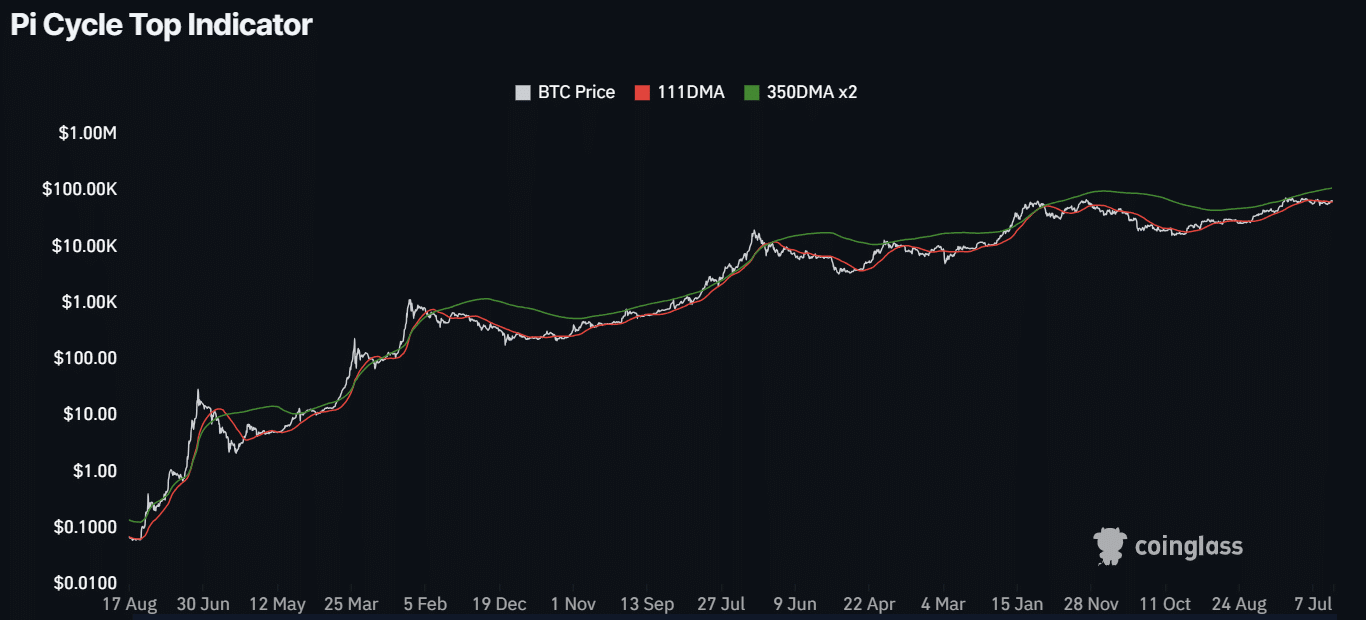

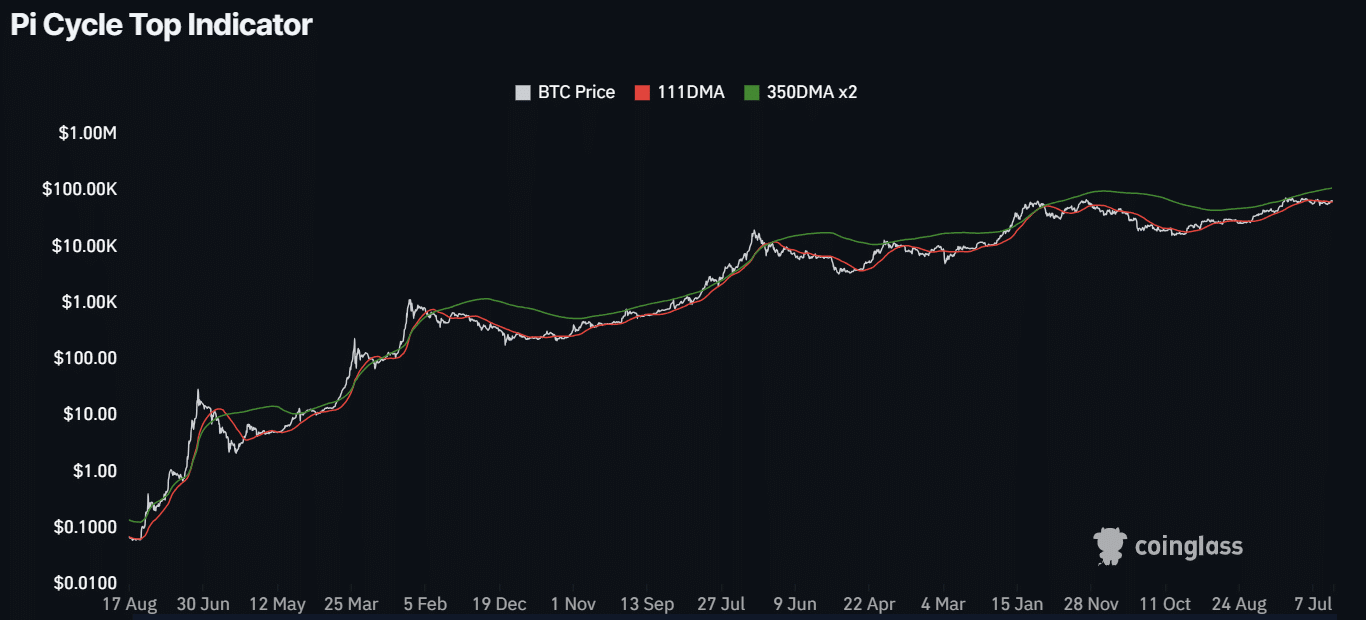

According to the Pi Cycle Top indicator, BTC was far from hitting this cycle’s top, as denoted by the wide gap between the 111-day MA (Moving Average) and 350-day MA multiple (350 DMAx2).

Source: Coinglass

For the unfamiliar, the Pi Cycle Top metric has effectively captured BTC cycle tops with a 3-day accuracy. Historically, cycle tops have been hit after 111 DMA hiked and crossed 350DMAx2.

The wide gap at press time meant BTC’s bull run could extend.

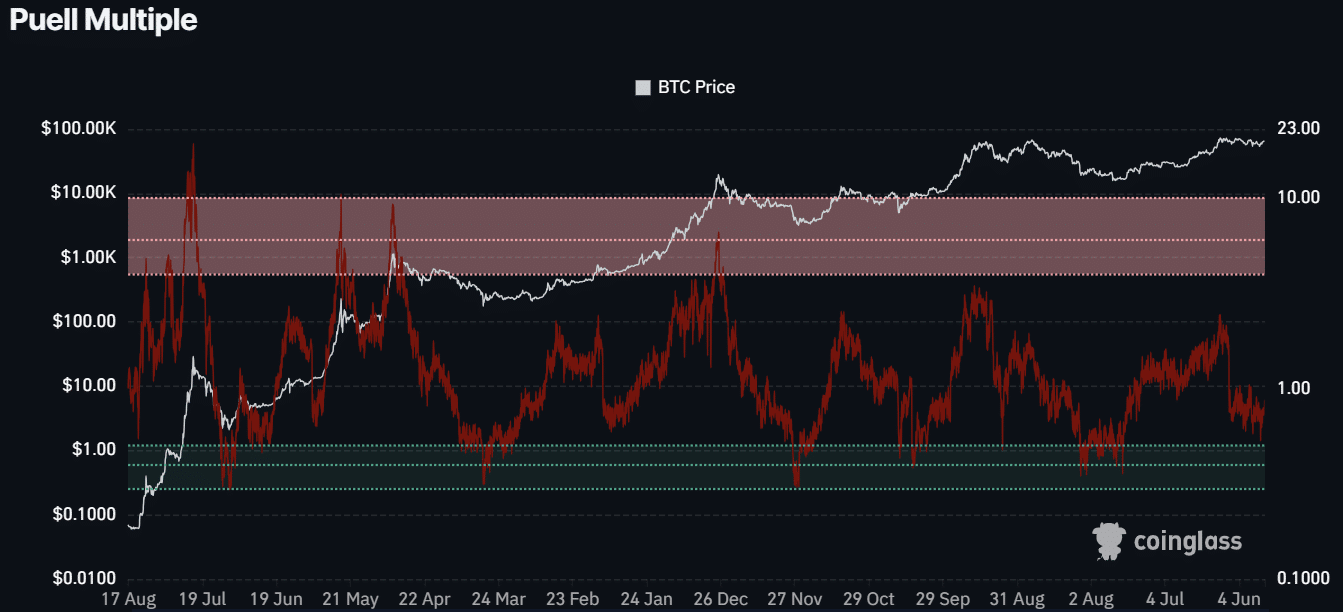

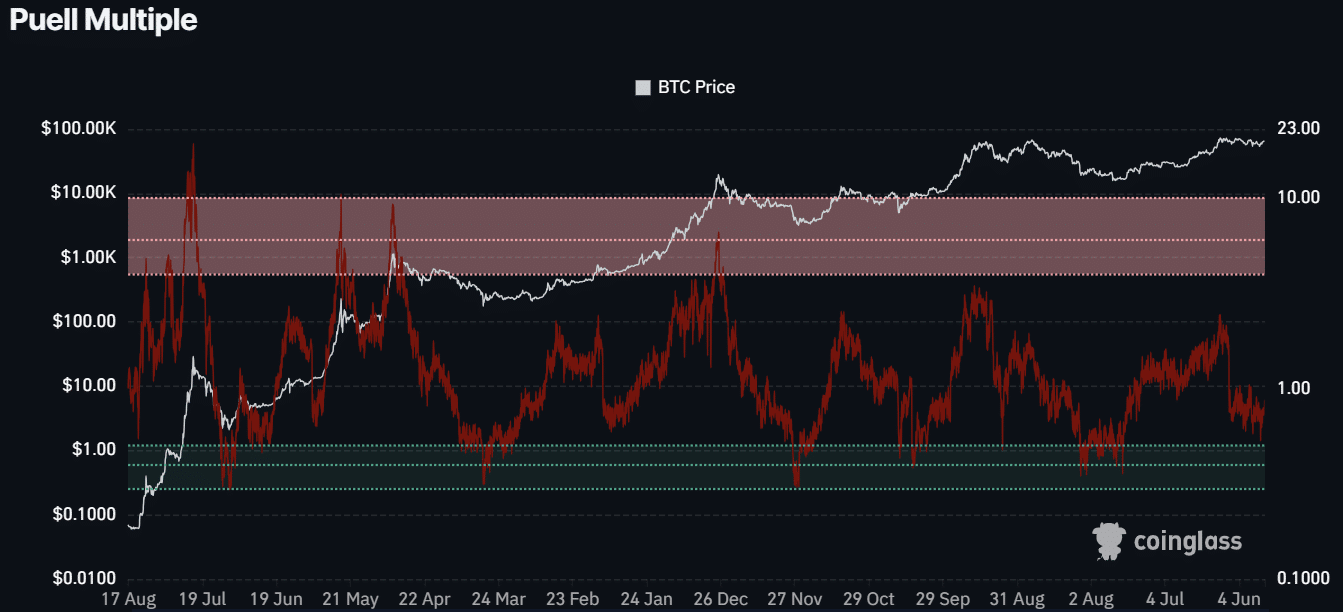

In short, BTC was relatively undervalued at press time. A similar outlook was illustrated by the Puell Multiple, which evaluates whether BTC is overpriced using BTC miners’ profitability.

The green zone is synonymous with undervalued BTC, while the overhead zone signals an overheated market.

Based on the press time reading, 0.73, BTC was grossly underpriced, suggesting a great buying opportunity for investors.

Source: Coinglass

Besides the above valuation metrics, key industry figures and firms have made high BTC price targets for end-2024 and 2025. Standard Chartered Bank predicted the asset could hit $250K by 2025.

On his part, CK Zheng, founder of crypto-focused hedge fund ZX Squared Capital, BTC, would hit an ATH in Q4 2024, regardless of who wins the US elections.

The executive cited high US national debts and fiscal deficits as reasons why BTC would become more lucrative amid the Fed rate cut cycle.

If the predictions come true, Q4 2024 and 2025 would offer huge BTC returns, potentially breaking above the 7-month long price range. If so, the current BTC value could be deemed grossly discounted.

Source: BTC/USD, TradingView

- The Bitcoin Rainbow Chart and other key metrics signaled ‘BUY’ at press time.

- Market pundits expect bullish Q4 and 2025 — Should you hold on or jump in?

Bitcoin [BTC] has been consolidating within $60K—$70K for the past seven months. Despite the boring price action, the current BTC value was still a great buy opportunity ahead of a historically bullish Q4.

According to the Bitcoin Rainbow Chart, BTC’s current value was still within the ‘buy’ zone.

In fact, since its March and subsequent retracement, the asset has been firmly within the ‘accumulate’ and ‘buy’ zones.

Source: BM Pro

For context, the Rainbow Chart gauges BTC valuation based on historical prices but is presented visually through rainbow colors.

Lower color bands signal undervalued BTC, while higher bands denote overheated market and potential corrections.

Is BTC still discounted?

Other key valuation metrics also signaled that BTC was relatively ‘cheap’ at press time value.

According to the Pi Cycle Top indicator, BTC was far from hitting this cycle’s top, as denoted by the wide gap between the 111-day MA (Moving Average) and 350-day MA multiple (350 DMAx2).

Source: Coinglass

For the unfamiliar, the Pi Cycle Top metric has effectively captured BTC cycle tops with a 3-day accuracy. Historically, cycle tops have been hit after 111 DMA hiked and crossed 350DMAx2.

The wide gap at press time meant BTC’s bull run could extend.

In short, BTC was relatively undervalued at press time. A similar outlook was illustrated by the Puell Multiple, which evaluates whether BTC is overpriced using BTC miners’ profitability.

The green zone is synonymous with undervalued BTC, while the overhead zone signals an overheated market.

Based on the press time reading, 0.73, BTC was grossly underpriced, suggesting a great buying opportunity for investors.

Source: Coinglass

Besides the above valuation metrics, key industry figures and firms have made high BTC price targets for end-2024 and 2025. Standard Chartered Bank predicted the asset could hit $250K by 2025.

On his part, CK Zheng, founder of crypto-focused hedge fund ZX Squared Capital, BTC, would hit an ATH in Q4 2024, regardless of who wins the US elections.

The executive cited high US national debts and fiscal deficits as reasons why BTC would become more lucrative amid the Fed rate cut cycle.

If the predictions come true, Q4 2024 and 2025 would offer huge BTC returns, potentially breaking above the 7-month long price range. If so, the current BTC value could be deemed grossly discounted.

Source: BTC/USD, TradingView

https://angel-dimariaar.biz

last news about angel dimaria

http://www.angel-dimariaar.biz

cost cheap clomid pills how to buy cheap clomid tablets can i get cheap clomiphene tablets how can i get clomid without dr prescription how to buy generic clomiphene pill where to get cheap clomiphene no prescription cost clomiphene pills

This is the amicable of glad I take advantage of reading.

zithromax oral – buy azithromycin 500mg for sale order flagyl 200mg online cheap

buy semaglutide generic – buy semaglutide online cyproheptadine 4 mg pill

cost motilium 10mg – cost sumycin 250mg order cyclobenzaprine 15mg generic

inderal 20mg usa – brand clopidogrel buy methotrexate 2.5mg online cheap

oral azithromycin 500mg – buy azithromycin 250mg bystolic 20mg for sale

order amoxiclav pill – atbioinfo buy ampicillin online cheap

order esomeprazole 20mg capsules – anexa mate buy nexium no prescription

medex generic – https://coumamide.com/ buy hyzaar for sale

purchase meloxicam generic – https://moboxsin.com/ meloxicam without prescription

generic prednisone – corticosteroid prednisone where to buy

buy ed pills for sale – https://fastedtotake.com/ buy ed pills us

buy amoxil tablets – cheap amoxil tablets buy amoxicillin cheap

purchase fluconazole without prescription – click order diflucan 100mg generic

oral cenforce – site buy cenforce 50mg pills

ranitidine 300mg cost – buy generic zantac order generic zantac 150mg

tadalafil tablets 20 mg global – https://strongtadafl.com/ what possible side effect should a patient taking tadalafil report to a physician quizlet

With thanks. Loads of erudition! este sitio

viagra half pill – strongvpls safe buy generic viagra online

Greetings! Utter serviceable advice within this article! It’s the scarcely changes which liking turn the largest changes. Thanks a quantity in the direction of sharing! generic prednisone names

I am in point of fact delighted to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. https://ursxdol.com/amoxicillin-antibiotic/

This website absolutely has all of the bumf and facts I needed about this subject and didn’t identify who to ask. click

More articles like this would pretence of the blogosphere richer. https://aranitidine.com/fr/levitra_francaise/

This is the make of advise I unearth helpful. https://ondactone.com/spironolactone/

buy forxiga 10 mg generic – https://janozin.com/# buy dapagliflozin

xenical medication – https://asacostat.com/# xenical pill