- Bitcoin has a bullish structure after flipping $67k to support.

- The lack of volume might cut short an uptrend.

Bitcoin [BTC] has gained close to 3.6% from the lows of Friday the 31st of May. Back then, the king of crypto was trading just above the $67k support level and showed little bullish momentum.

This might have begun to change. However, the trading volume was unconvincing, and bulls needed to do much more to force a convincing breakout. Is the market ready for a rally, or will we see an extended consolidation?

Resolving the conflicting volume indicators

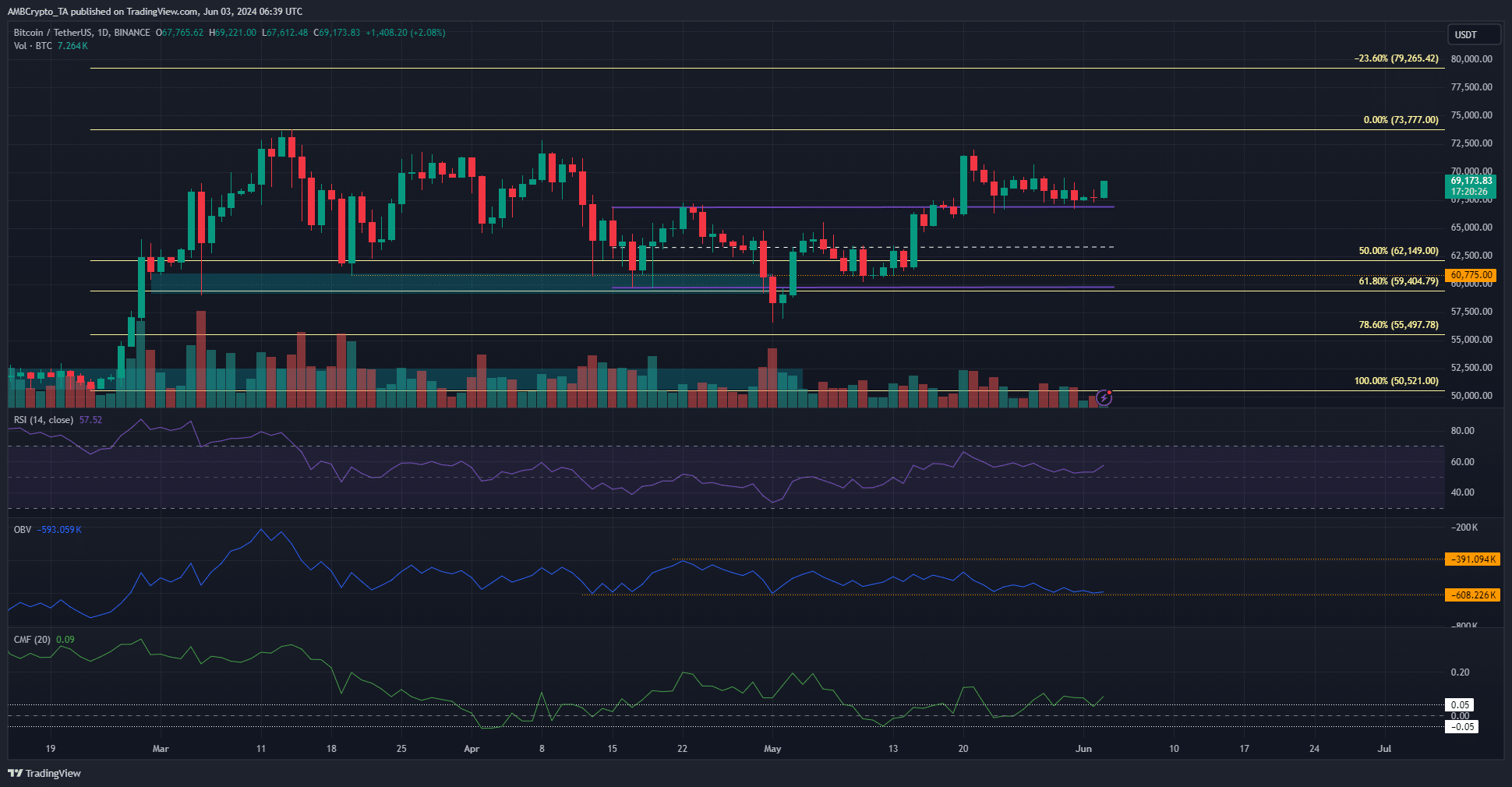

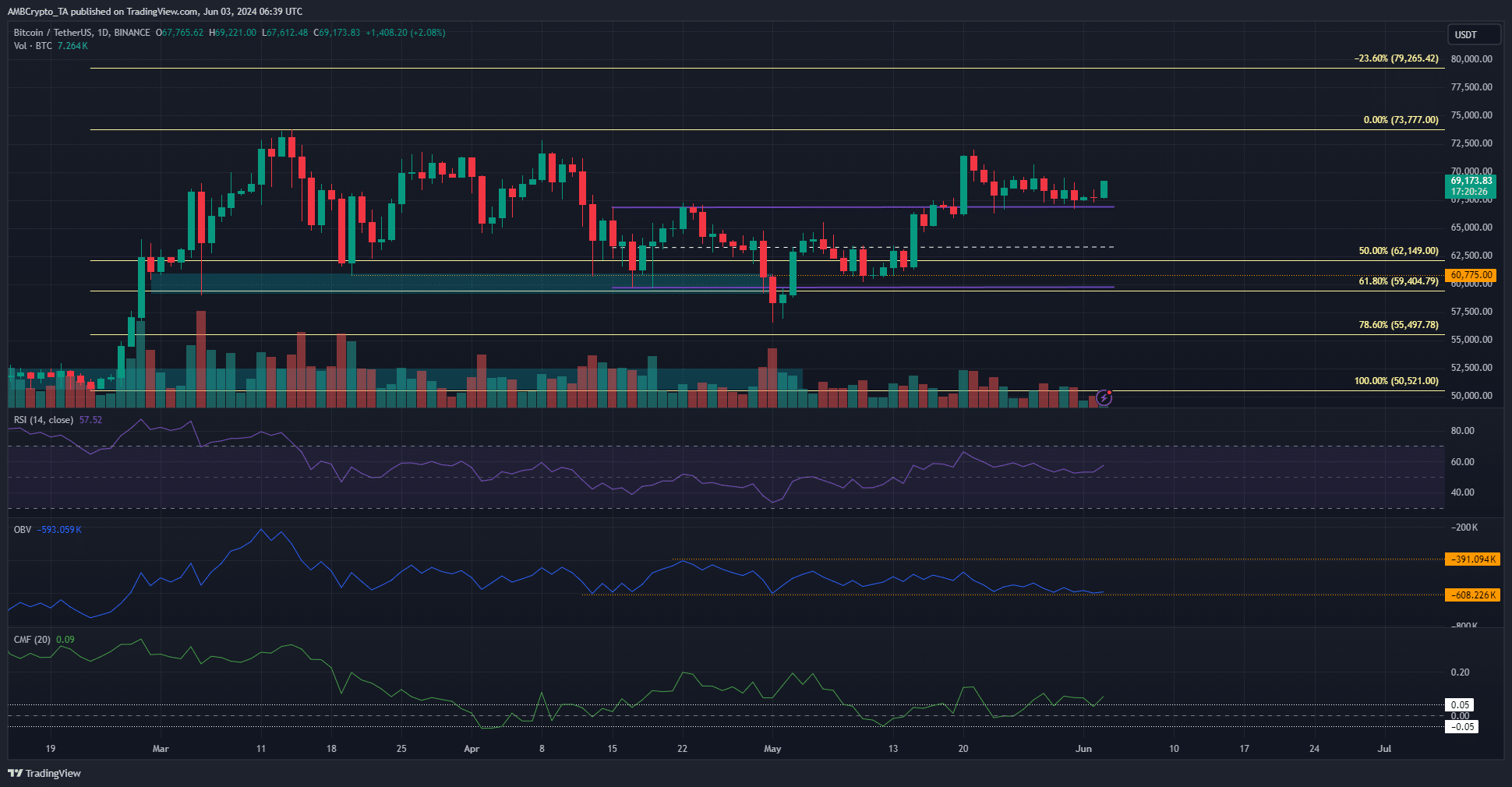

Source: BTC/USDT on TradingView

The late February rally saw a retracement to $59k in mid-April. This level was only the 61.8% retracement level and since then BTC has recovered well. The RSI on the daily chart climbed above neutral 50 to signal a shift in momentum.

However, despite the price’s range breakout, the OBV was resolutely within a range. It was at the lows from April, which was a concerning development.

It indicated that the recent gains were likely to be wiped out quickly due to the lack of buying pressure.

Conversely, the CMF jumped above +0.05 to highlight significant capital inflows. The volume indicators opposed each other’s findings.

Overall, while the bullish bias was stronger, the lack of trading volume in the past two weeks weakened Bitcoin price prediction’s bullish arguments.

The liquidation cluster could pull BTC toward $75k

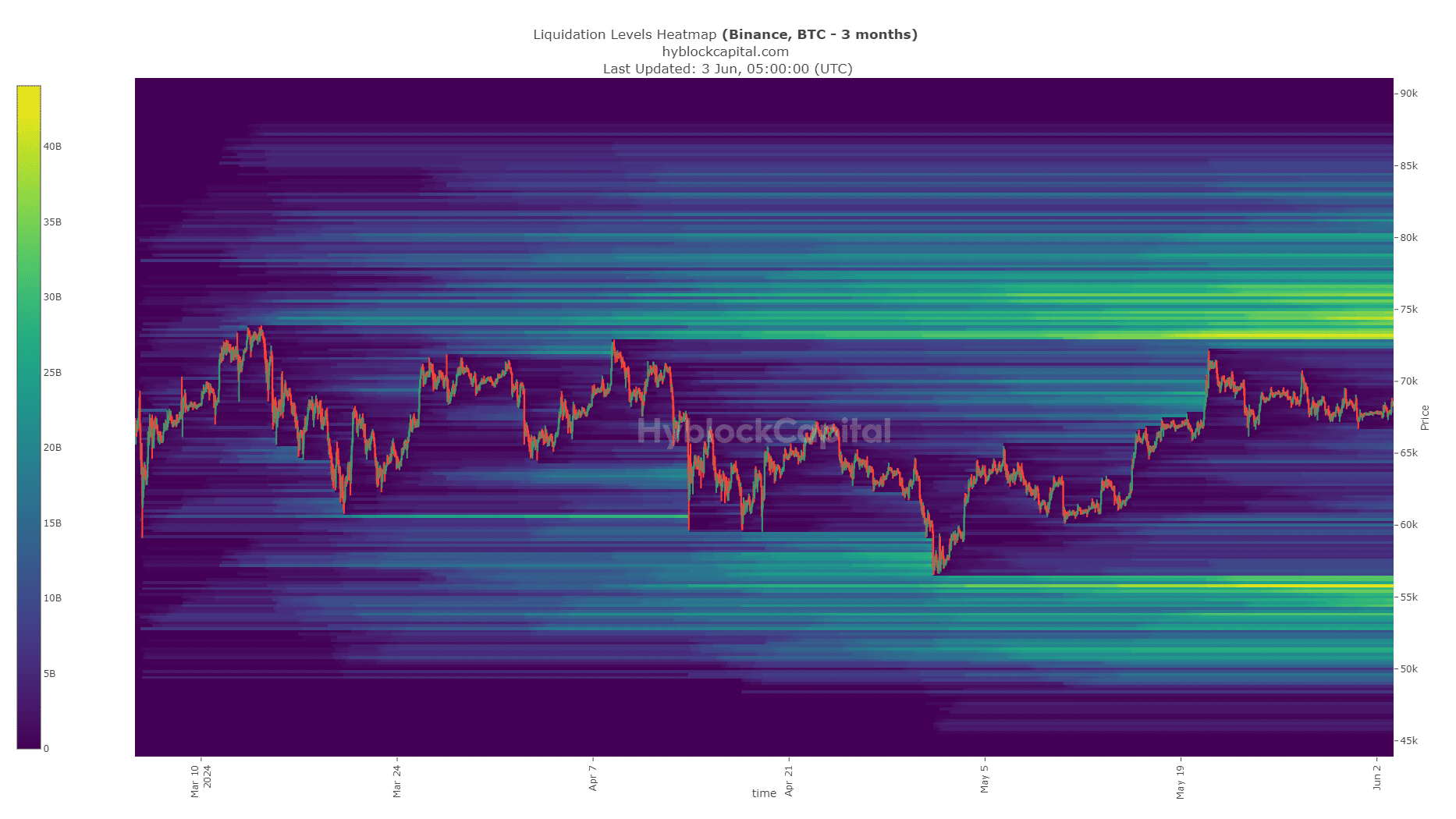

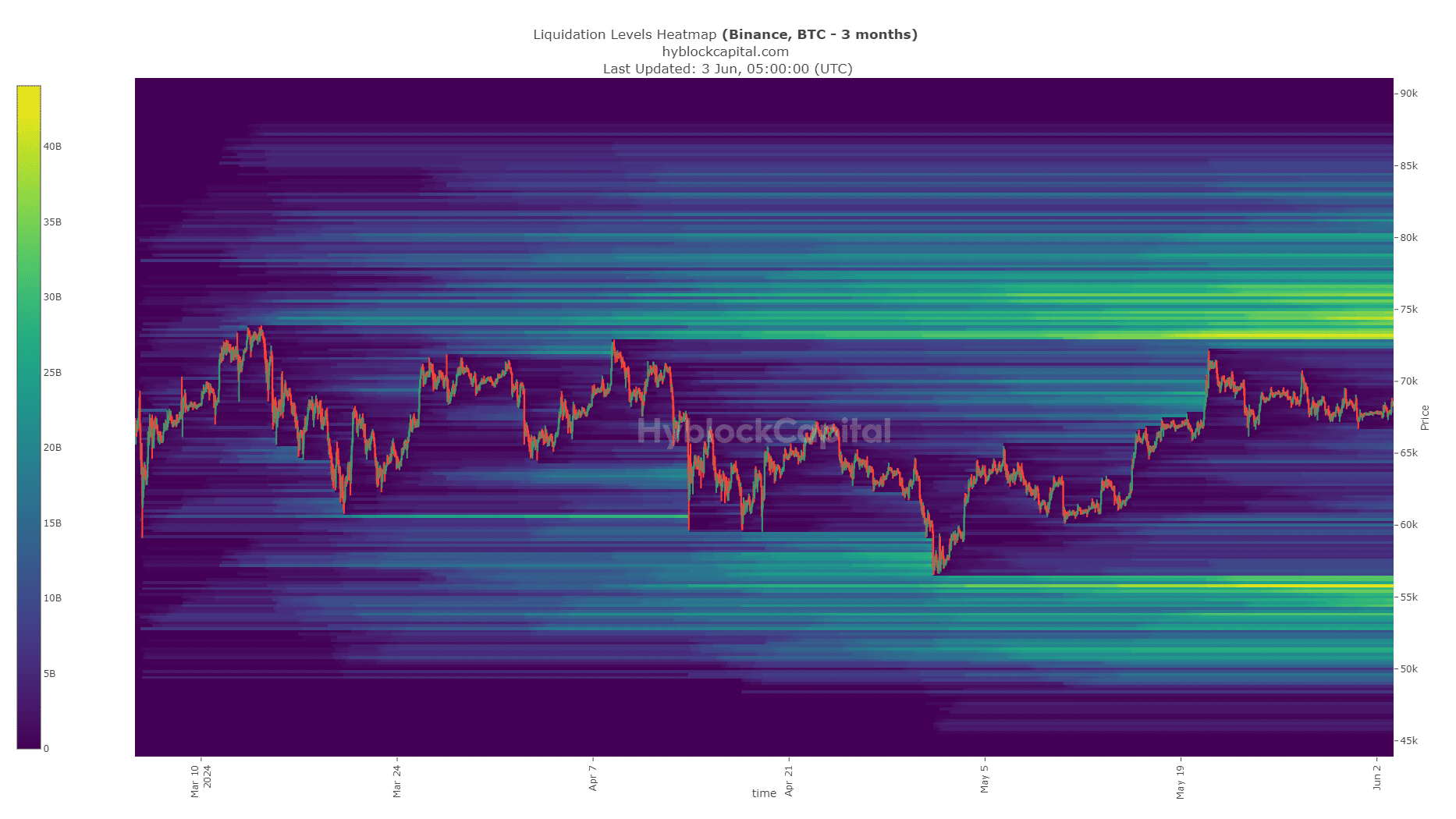

Source: Hyblock

The large cluster of liquidation levels at $73k-$75.2k is likely to act as a strong magnetic zone for Bitcoin prices. To the south the $65.6k region was also a region of interest.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The lack of trading volume meant the Bitcoin price prediction is consolidation around the $70k region for this week, or even longer.

Until the volume expands and prices can breach the $73.5k region, traders and investors can expect a range formation to take hold.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bitcoin has a bullish structure after flipping $67k to support.

- The lack of volume might cut short an uptrend.

Bitcoin [BTC] has gained close to 3.6% from the lows of Friday the 31st of May. Back then, the king of crypto was trading just above the $67k support level and showed little bullish momentum.

This might have begun to change. However, the trading volume was unconvincing, and bulls needed to do much more to force a convincing breakout. Is the market ready for a rally, or will we see an extended consolidation?

Resolving the conflicting volume indicators

Source: BTC/USDT on TradingView

The late February rally saw a retracement to $59k in mid-April. This level was only the 61.8% retracement level and since then BTC has recovered well. The RSI on the daily chart climbed above neutral 50 to signal a shift in momentum.

However, despite the price’s range breakout, the OBV was resolutely within a range. It was at the lows from April, which was a concerning development.

It indicated that the recent gains were likely to be wiped out quickly due to the lack of buying pressure.

Conversely, the CMF jumped above +0.05 to highlight significant capital inflows. The volume indicators opposed each other’s findings.

Overall, while the bullish bias was stronger, the lack of trading volume in the past two weeks weakened Bitcoin price prediction’s bullish arguments.

The liquidation cluster could pull BTC toward $75k

Source: Hyblock

The large cluster of liquidation levels at $73k-$75.2k is likely to act as a strong magnetic zone for Bitcoin prices. To the south the $65.6k region was also a region of interest.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The lack of trading volume meant the Bitcoin price prediction is consolidation around the $70k region for this week, or even longer.

Until the volume expands and prices can breach the $73.5k region, traders and investors can expect a range formation to take hold.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

where can i buy generic clomiphene price where to get clomiphene buy cheap clomiphene without dr prescription where buy generic clomid pill can i purchase generic clomid online clomiphene price where to buy cheap clomid tablets

Proof blog you procure here.. It’s severely to find high worth belles-lettres like yours these days. I honestly recognize individuals like you! Rent care!!

More text pieces like this would make the интернет better.

zithromax 500mg cheap – buy cheap floxin metronidazole 200mg generic

purchase rybelsus pill – order semaglutide generic cyproheptadine oral

buy motilium generic – sumycin 250mg price order flexeril pills

purchase amoxil – cheap amoxil pill ipratropium 100 mcg uk

cost clavulanate – https://atbioinfo.com/ purchase ampicillin pill

order generic nexium 40mg – anexa mate purchase nexium pill

medex where to buy – anticoagulant order generic losartan

purchase meloxicam sale – https://moboxsin.com/ buy generic meloxicam over the counter

buy deltasone 5mg generic – https://apreplson.com/ deltasone 5mg pill

top rated ed pills – fast ed to take best ed medications

amoxil where to buy – https://combamoxi.com/ order amoxil for sale

fluconazole 100mg brand – https://gpdifluca.com/ purchase fluconazole

cenforce order – on this site cenforce 50mg pill

buy cialis toronto – https://ciltadgn.com/# cialis efectos secundarios

buy cialis without doctor prescription – https://strongtadafl.com/ comprar tadalafil 40 mg en walmart sin receta houston texas

ranitidine over the counter – zantac 150mg cheap cheap ranitidine

This is a keynote which is in to my verve… Many thanks! Unerringly where can I find the phone details in the course of questions? https://buyfastonl.com/furosemide.html

Greetings! Jolly serviceable advice within this article! It’s the crumb changes which will make the largest changes. Thanks a a quantity towards sharing! https://gnolvade.com/

More posts like this would create the online play more useful. https://ursxdol.com/cialis-tadalafil-20/

Thanks towards putting this up. It’s understandably done. https://prohnrg.com/product/cytotec-online/

The vividness in this tune is exceptional. click

This is the description of glad I enjoy reading. https://ondactone.com/product/domperidone/

More articles like this would frame the blogosphere richer.

https://proisotrepl.com/product/toradol/

Thanks towards putting this up. It’s evidently done. http://www.orlandogamers.org/forum/member.php?action=profile&uid=28881

buy dapagliflozin 10mg without prescription – https://janozin.com/# forxiga 10 mg canada

purchase xenical generic – https://asacostat.com/# xenical sale

I am in fact happy to glitter at this blog posts which consists of tons of of use facts, thanks representing providing such data. https://sportavesti.ru/forums/users/medpe-2/