- Bitcoin has a bearish short-term outlook with its series of lower highs in the past month

- The drop to $56.5k meant the liquidity below it would likely be tested soon

Bitcoin [BTC] clung to the $60.7k support level over the weekend, but its short-term bearish expectation held weight.

A recent AMBCrypto liquidity analysis showed where a price reversal could occur for this week’s price action.

News of two dormant wallets, inactive for nearly 11 years, waking up to sell BTC worth $60.9 million could spook market participants. The report also highlighted a drop in key on-chain Bitcoin metrics.

The capital inflows for BTC showed indecisiveness

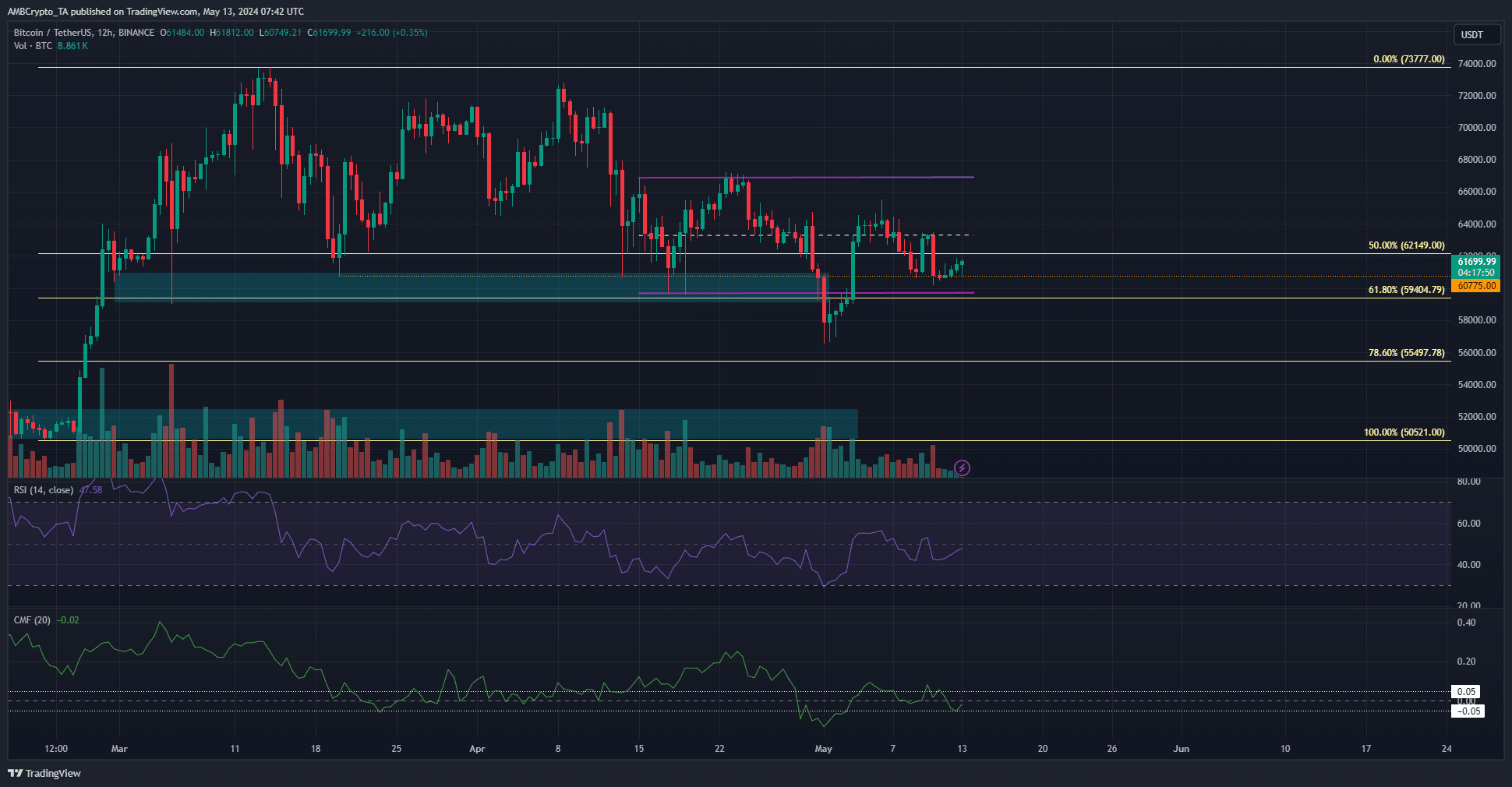

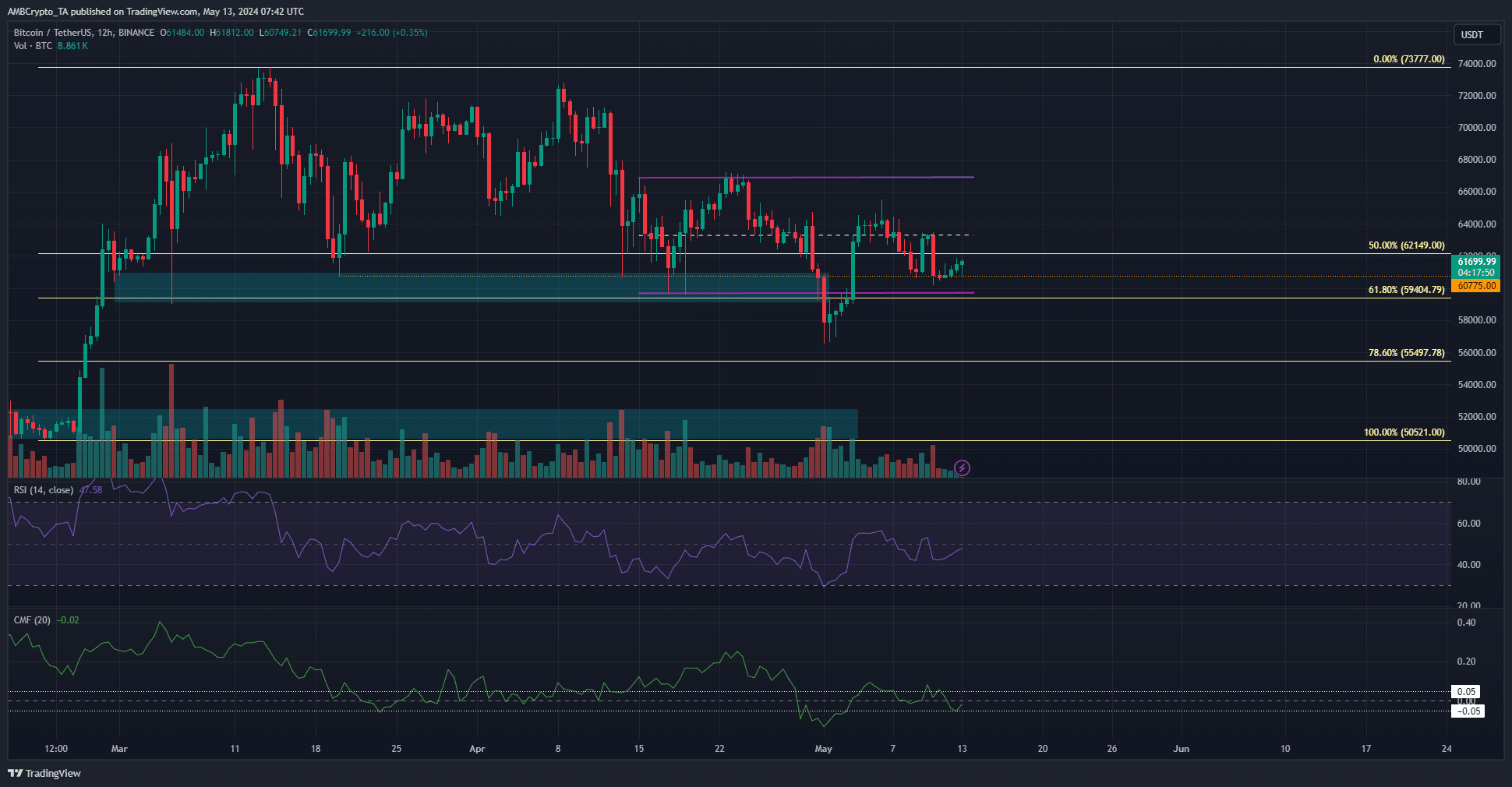

Source: BTC/USDT on TradingView

The range formation was breached conclusively on the 1st of May, when Bitcoin dropped like a rock to $56.5k. Even though it bounced to $65.5k a week later, its lower timeframe market structure was bearish.

AMBCrypto’s Bitcoin price prediction leans toward a drop to the $56k mark and potentially lower. At press time, it possessed steady downward momentum, signaled by the RSI’s reading of 47.

The price has formed lower highs since mid-April.

The 78.6% HTF Fibonacci retracement level at $55.5k might be revisited before the bottom is in. It is unclear how things would unfold, but traders and investors should be prepared for this scenario.

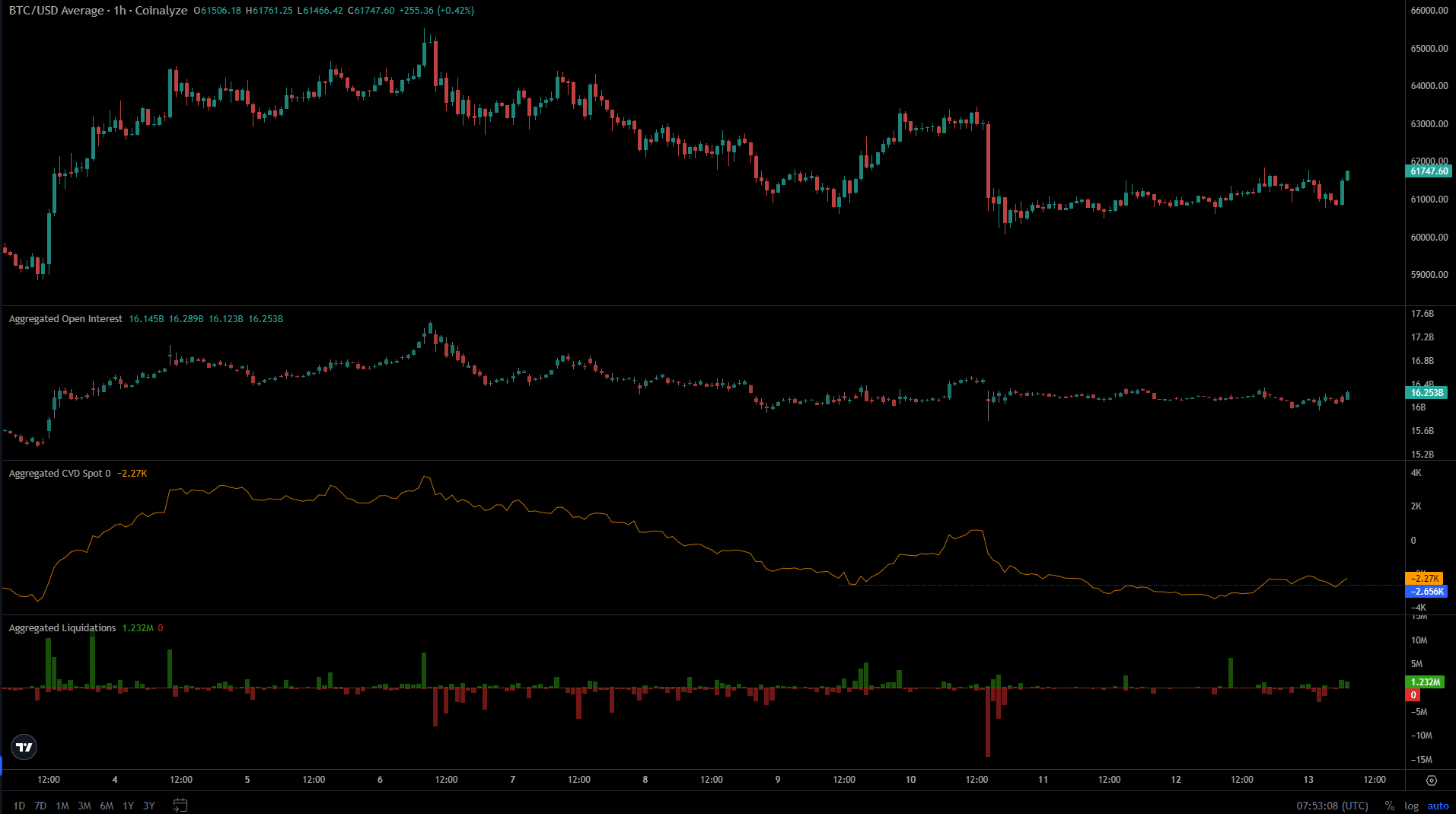

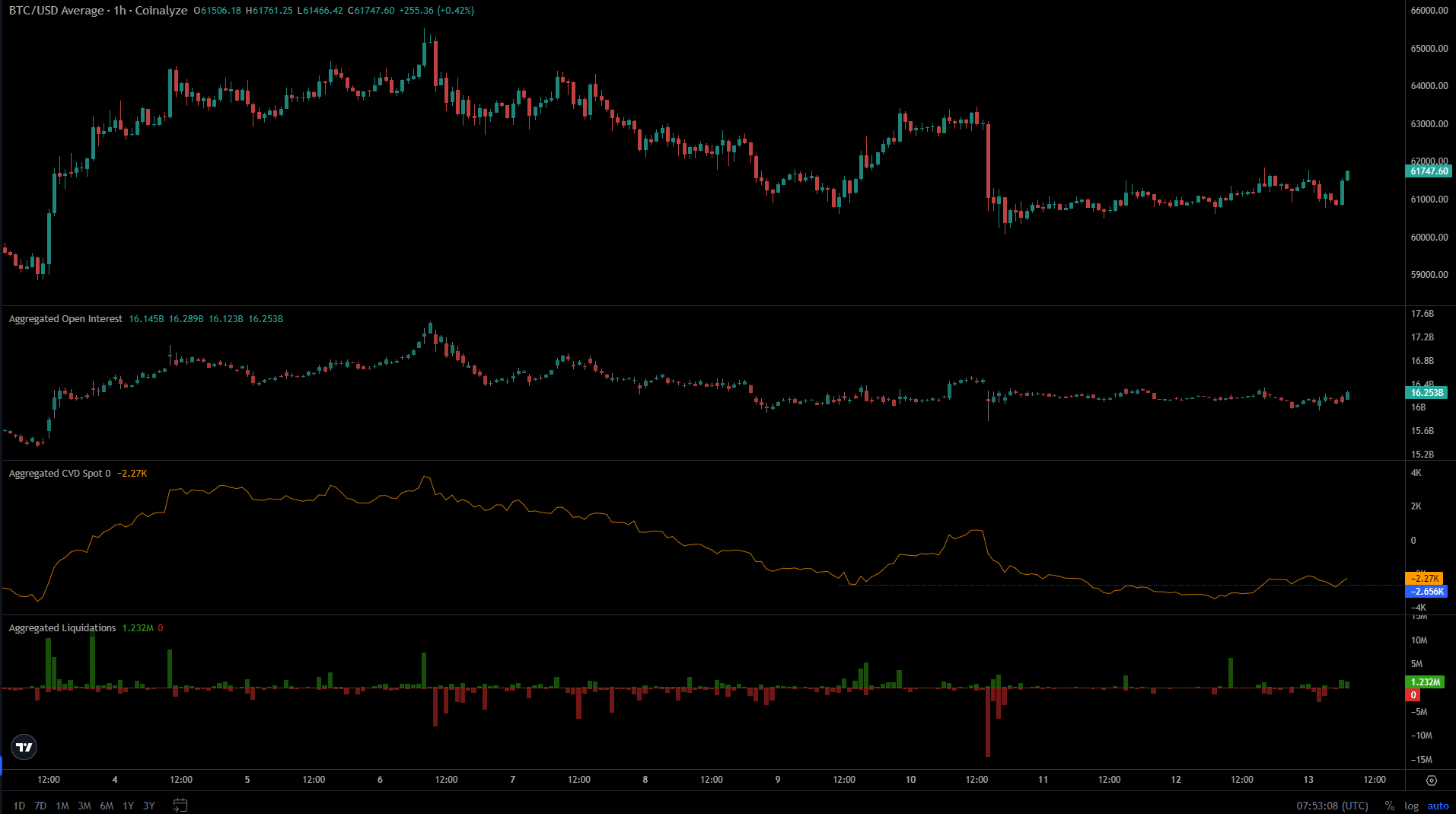

The spot CVD disagreed with the CMF indicator’s findings

Source: Coinalyze

Capital inflow and bullish conviction are necessary for an asset to trend upward. The Open Interest chart has been passive and lackluster over the past week as Bitcoin also struggled to form a trend.

However, the spot CVD began to climb higher, and reclaimed a former short-term support level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This indicated buying pressure in the spot markets. Additionally, the past two days saw short positions liquidated.

This forced market buy orders of the liquidated position and, if the trend continues, could see Bitcoin bounce higher.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bitcoin has a bearish short-term outlook with its series of lower highs in the past month

- The drop to $56.5k meant the liquidity below it would likely be tested soon

Bitcoin [BTC] clung to the $60.7k support level over the weekend, but its short-term bearish expectation held weight.

A recent AMBCrypto liquidity analysis showed where a price reversal could occur for this week’s price action.

News of two dormant wallets, inactive for nearly 11 years, waking up to sell BTC worth $60.9 million could spook market participants. The report also highlighted a drop in key on-chain Bitcoin metrics.

The capital inflows for BTC showed indecisiveness

Source: BTC/USDT on TradingView

The range formation was breached conclusively on the 1st of May, when Bitcoin dropped like a rock to $56.5k. Even though it bounced to $65.5k a week later, its lower timeframe market structure was bearish.

AMBCrypto’s Bitcoin price prediction leans toward a drop to the $56k mark and potentially lower. At press time, it possessed steady downward momentum, signaled by the RSI’s reading of 47.

The price has formed lower highs since mid-April.

The 78.6% HTF Fibonacci retracement level at $55.5k might be revisited before the bottom is in. It is unclear how things would unfold, but traders and investors should be prepared for this scenario.

The spot CVD disagreed with the CMF indicator’s findings

Source: Coinalyze

Capital inflow and bullish conviction are necessary for an asset to trend upward. The Open Interest chart has been passive and lackluster over the past week as Bitcoin also struggled to form a trend.

However, the spot CVD began to climb higher, and reclaimed a former short-term support level.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This indicated buying pressure in the spot markets. Additionally, the past two days saw short positions liquidated.

This forced market buy orders of the liquidated position and, if the trend continues, could see Bitcoin bounce higher.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

can you get clomiphene for sale clomid cost where can i buy generic clomid no prescription buying generic clomiphene pill can i get cheap clomiphene price clomid tablete buy cheap clomiphene no prescription

More posts like this would create the online play more useful.

More posts like this would make the blogosphere more useful.

oral azithromycin 250mg – order ciplox 500mg generic buy flagyl 200mg without prescription

semaglutide 14 mg usa – periactin 4 mg canada periactin drug

order motilium 10mg sale – buy tetracycline tablets cost cyclobenzaprine 15mg

order inderal 20mg for sale – purchase methotrexate generic order methotrexate 10mg generic

augmentin 625mg canada – https://atbioinfo.com/ order ampicillin pills

esomeprazole 20mg usa – nexium to us oral nexium

where to buy mobic without a prescription – swelling buy meloxicam 7.5mg for sale

deltasone online buy – https://apreplson.com/ deltasone 40mg tablet

where to buy otc ed pills – https://fastedtotake.com/ buy ed pills for sale

buy amoxil no prescription – comba moxi purchase amoxicillin sale

order generic diflucan 100mg – https://gpdifluca.com/ fluconazole for sale

cenforce 50mg pill – https://cenforcers.com/# how to buy cenforce

cialis drug – ciltad genesis tadalafil best price 20 mg

benefits of tadalafil over sidenafil – site where to buy generic cialis

ranitidine 300mg usa – https://aranitidine.com/ buy ranitidine online cheap

cheap viagra super – https://strongvpls.com/ usa viagra cheap info

More delight pieces like this would insinuate the интернет better. kamagra comprar online

I’ll certainly carry back to read more. https://buyfastonl.com/azithromycin.html

More posts like this would bring about the blogosphere more useful. https://ursxdol.com/get-cialis-professional/

This is the make of post I unearth helpful. https://prohnrg.com/product/omeprazole-20-mg/