- Implied volatility for Bitcoin options around US elections has hiked by nearly 50%.

- Options traders priced a 20% chance of BTC hitting $80K by end-November.

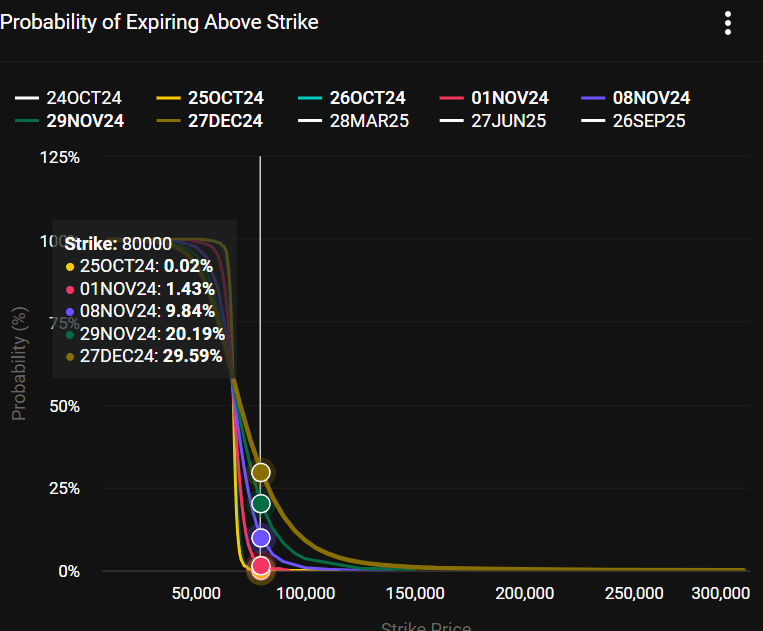

With only two weeks to the US presidential elections, Bitcoin [BTC] options traders remained bullish and eyed a $80K target by November.

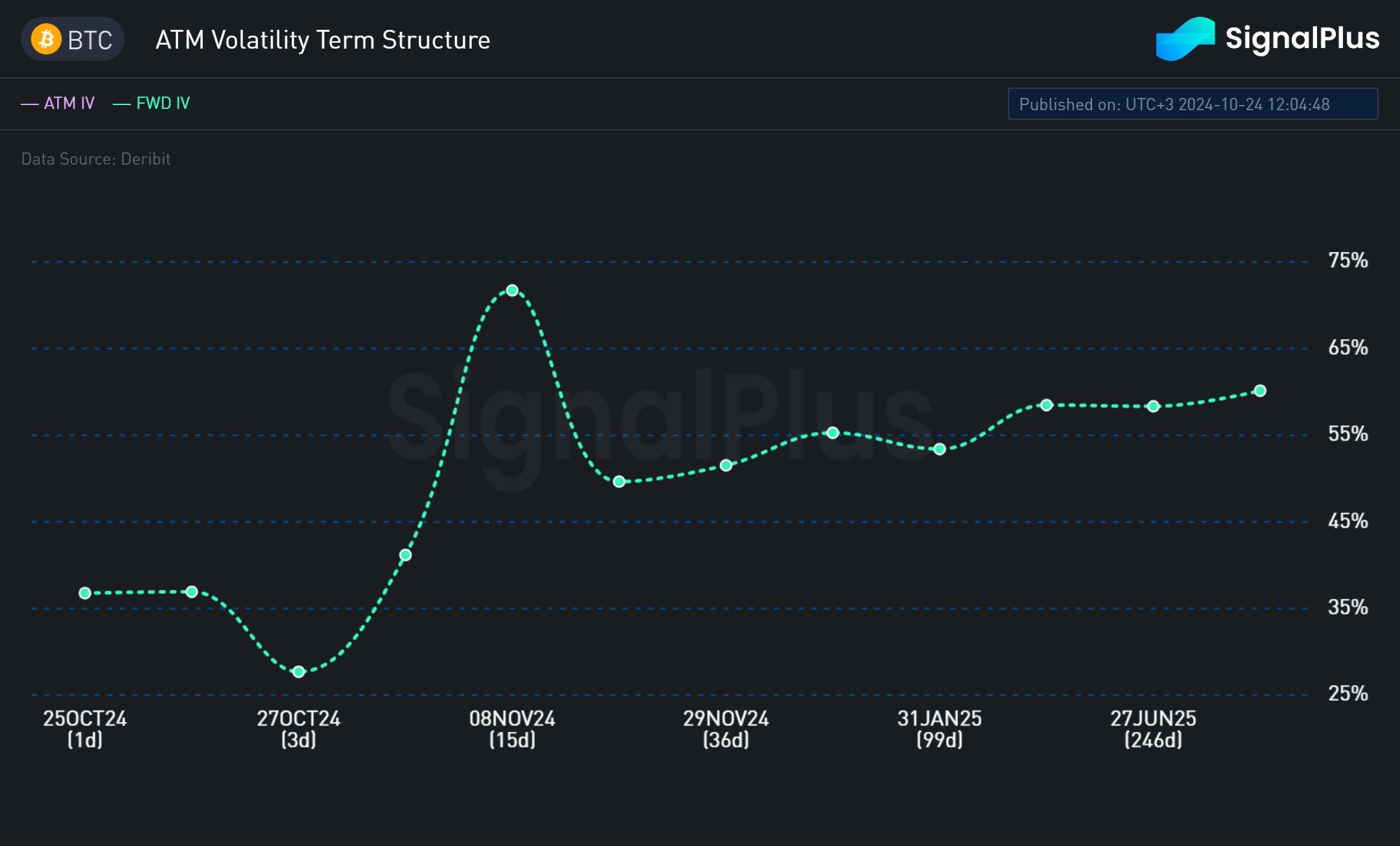

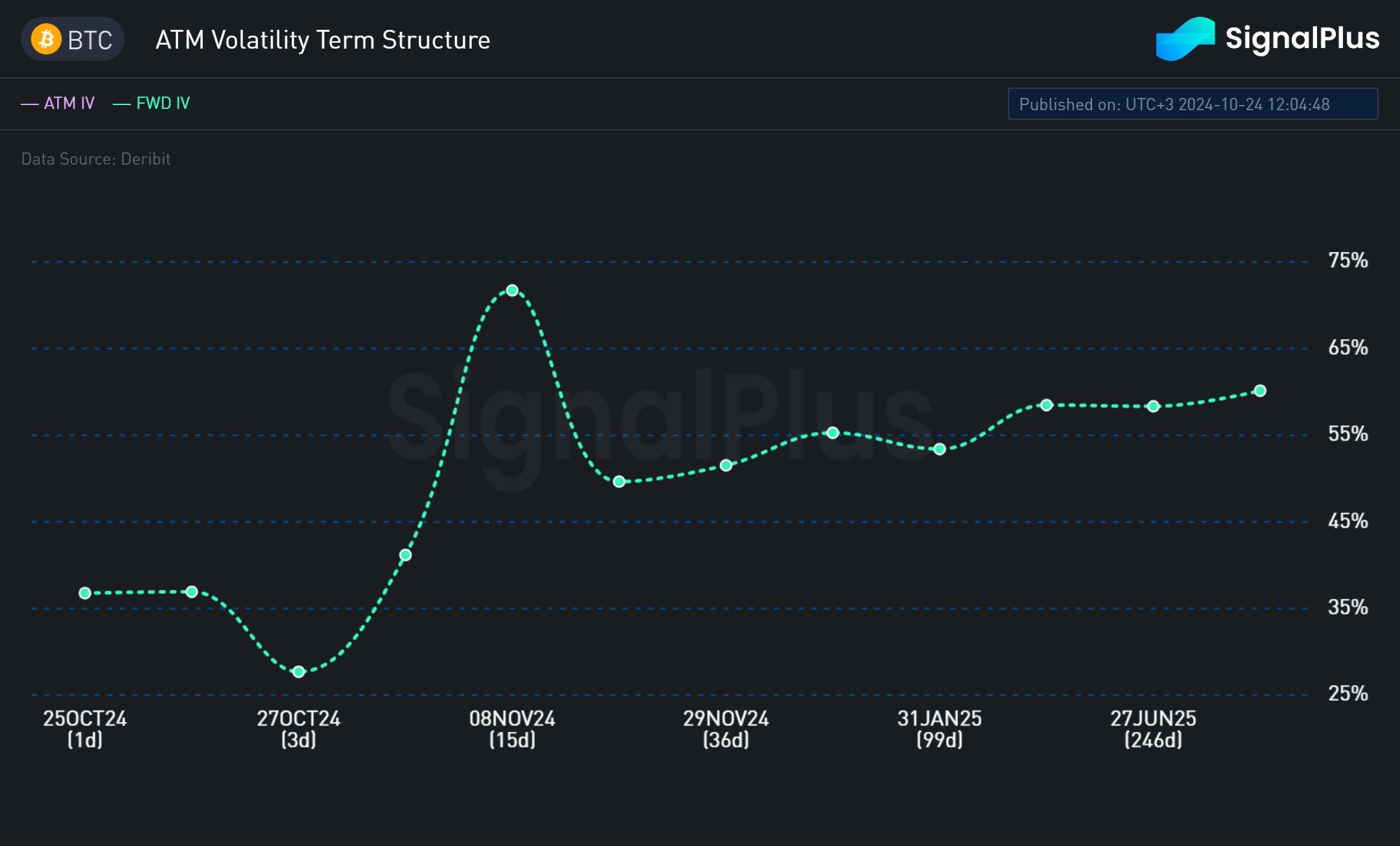

The election was a key market uncertainty, as noted by a nearly 71% peak in FWD IV (forward implied volatility) by November 8th.

This meant that the market expected wild price swings around the US elections. Therefore, the swings could be upside or downside as institutional investors hedge their positions against the risk.

Source: SignalPlus

Market volatility was expected to taper off after two key events: the elections (5th Nov.) and the Fed rate decision (8th Nov.). The FWD IV south-bound movement after November 8th illustrated this.

Options bullish bets

However, despite the election concerns, the BTC options market has maintained a bullish outlook, as recently noted by crypto trading firm QCP Capital. It stated,

“Short-term implied volatility is peaking at election day expiry, with a 10-vol spread over the prior expiry and skews favouring calls over puts, despite BTC being about 8% below its all-time highs.”

At press time, Deribit data painted a similar outlook, with call options (bullish bets on BTC future price rally) dominating put options (bearish bets) for contracts expiring by 29 November.

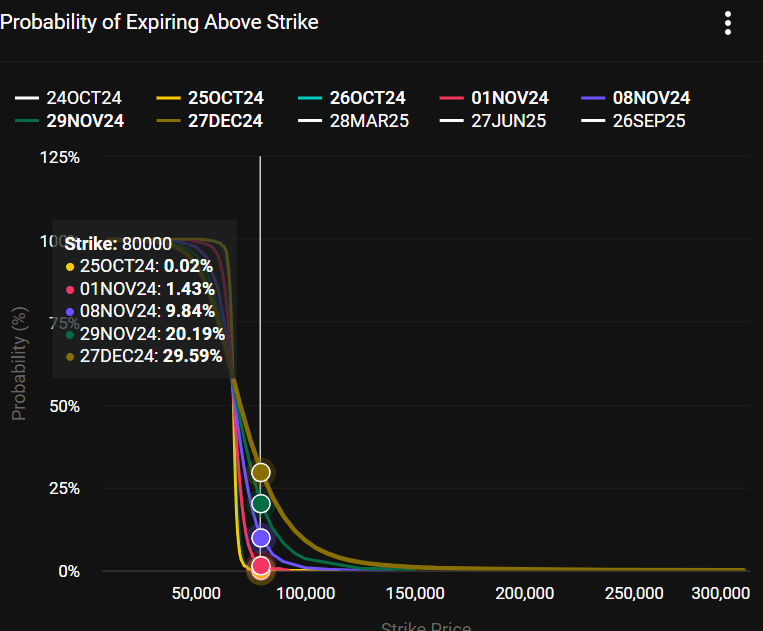

The options traders were pricing a 20% chance of BTC hitting $80K by the end of November.

Source: Deribit

Reacting to the positioning, Bitwise’s head of European research, André Dragosch, termed it as an expectation of a ‘bullish outcome.’

“This is supporting the hypothesis that bitcoin options traders are generally positioning for a bullish outcome.”

Well, Donald Trump has been arguably the most pro-crypto candidate. He has maintained a 20-point lead against Kamala Harris in polls and prediction site Polymarket.

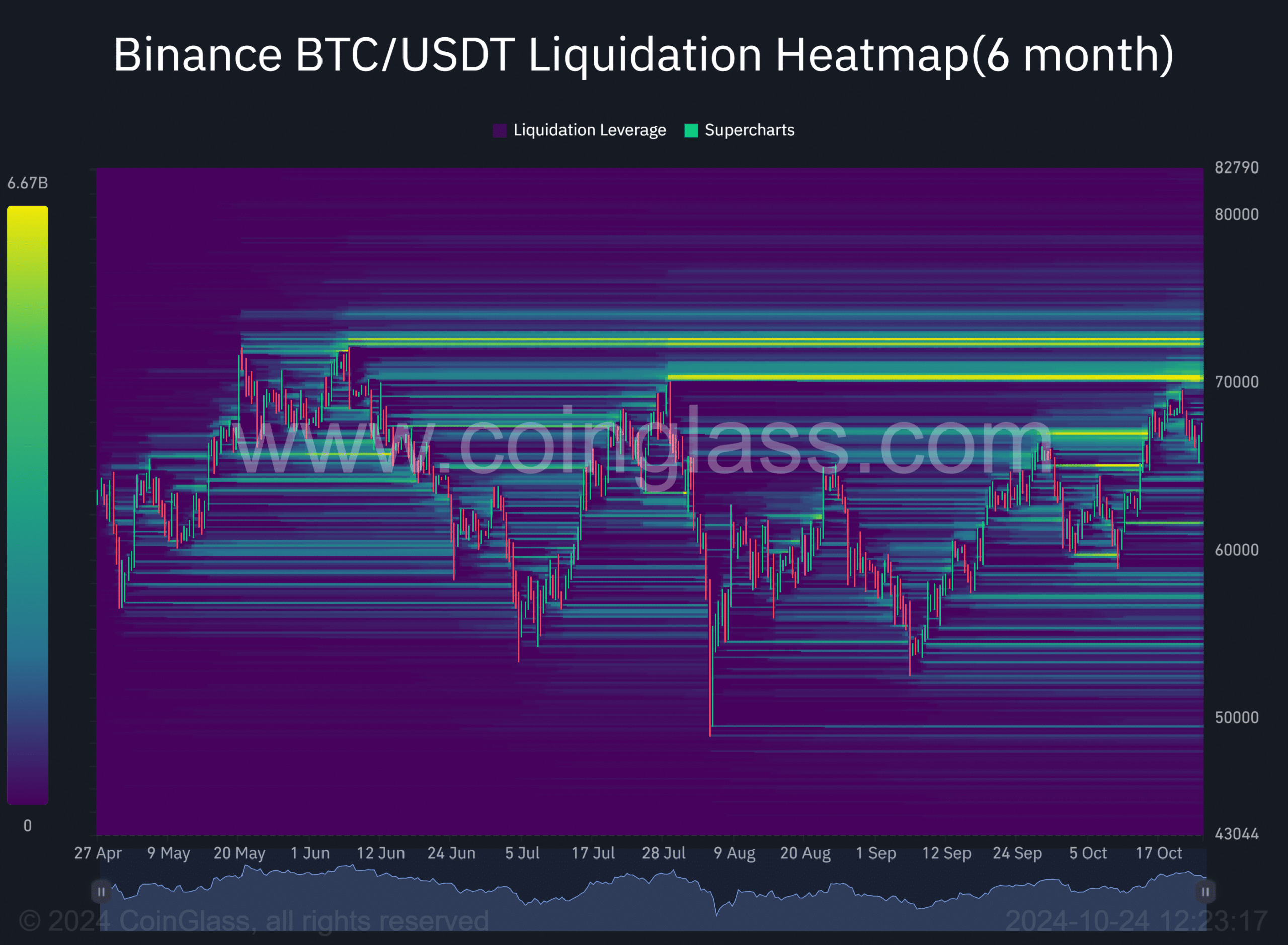

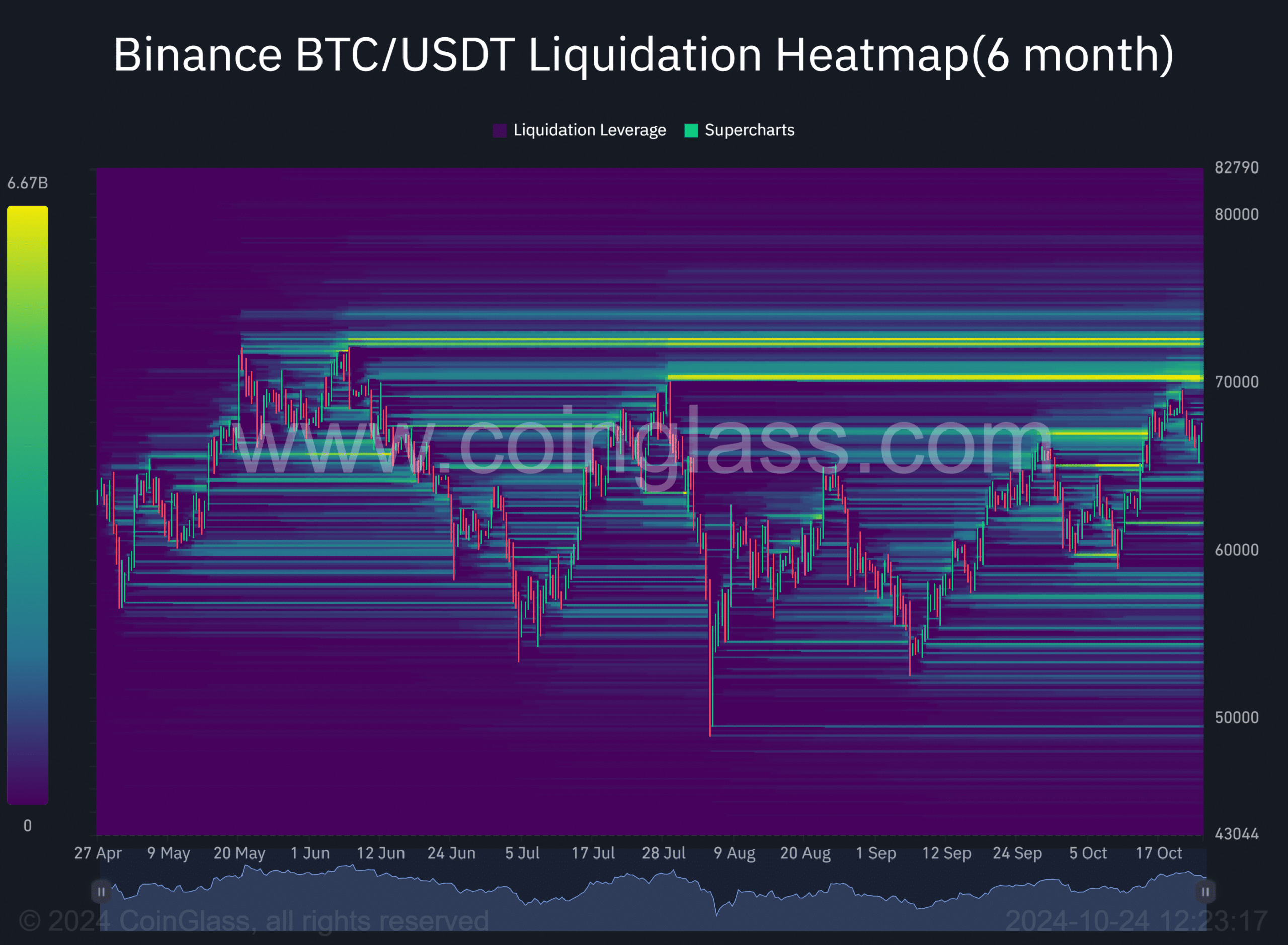

That said, should BTC pump to $80K and clear the $70K psychological level, nearly $7 billion in short positions would be squeezed.

Source: Coinglass

However, BTC has seen short-term weakening amid the ongoing US earnings season. At the time of writing, BTC’s value was $67K, about 10% away from its all-time high (ATH) of $73.7K.

- Implied volatility for Bitcoin options around US elections has hiked by nearly 50%.

- Options traders priced a 20% chance of BTC hitting $80K by end-November.

With only two weeks to the US presidential elections, Bitcoin [BTC] options traders remained bullish and eyed a $80K target by November.

The election was a key market uncertainty, as noted by a nearly 71% peak in FWD IV (forward implied volatility) by November 8th.

This meant that the market expected wild price swings around the US elections. Therefore, the swings could be upside or downside as institutional investors hedge their positions against the risk.

Source: SignalPlus

Market volatility was expected to taper off after two key events: the elections (5th Nov.) and the Fed rate decision (8th Nov.). The FWD IV south-bound movement after November 8th illustrated this.

Options bullish bets

However, despite the election concerns, the BTC options market has maintained a bullish outlook, as recently noted by crypto trading firm QCP Capital. It stated,

“Short-term implied volatility is peaking at election day expiry, with a 10-vol spread over the prior expiry and skews favouring calls over puts, despite BTC being about 8% below its all-time highs.”

At press time, Deribit data painted a similar outlook, with call options (bullish bets on BTC future price rally) dominating put options (bearish bets) for contracts expiring by 29 November.

The options traders were pricing a 20% chance of BTC hitting $80K by the end of November.

Source: Deribit

Reacting to the positioning, Bitwise’s head of European research, André Dragosch, termed it as an expectation of a ‘bullish outcome.’

“This is supporting the hypothesis that bitcoin options traders are generally positioning for a bullish outcome.”

Well, Donald Trump has been arguably the most pro-crypto candidate. He has maintained a 20-point lead against Kamala Harris in polls and prediction site Polymarket.

That said, should BTC pump to $80K and clear the $70K psychological level, nearly $7 billion in short positions would be squeezed.

Source: Coinglass

However, BTC has seen short-term weakening amid the ongoing US earnings season. At the time of writing, BTC’s value was $67K, about 10% away from its all-time high (ATH) of $73.7K.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Aroma Sensei I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

where buy clomid pill can i purchase cheap clomid without rx order clomiphene without a prescription where can i buy clomiphene tablets where can i get generic clomid where can i get cheap clomiphene tablets where can i get cheap clomid without prescription

Thanks towards putting this up. It’s well done.

This website absolutely has all of the low-down and facts I needed adjacent to this thesis and didn’t identify who to ask.

order zithromax 250mg pill – ciprofloxacin pill metronidazole 200mg drug

semaglutide 14mg drug – generic rybelsus 14 mg cyproheptadine buy online

purchase domperidone for sale – tetracycline 250mg over the counter buy cyclobenzaprine without prescription

oral inderal – inderal 20mg sale order methotrexate 2.5mg generic