- Bitcoin has a key level at $59.4k from both the technical and liquidity standpoints

- The one-sided sentiment in the futures market might see late bears trapped shortly

Bitcoin [BTC] saw a slump in demand and outflow from ETFs, which strongly suggested that a larger price correction was due for the crypto market.

Some ETF platforms saw zero flow days, but this was normal for exchange traded in any sector.

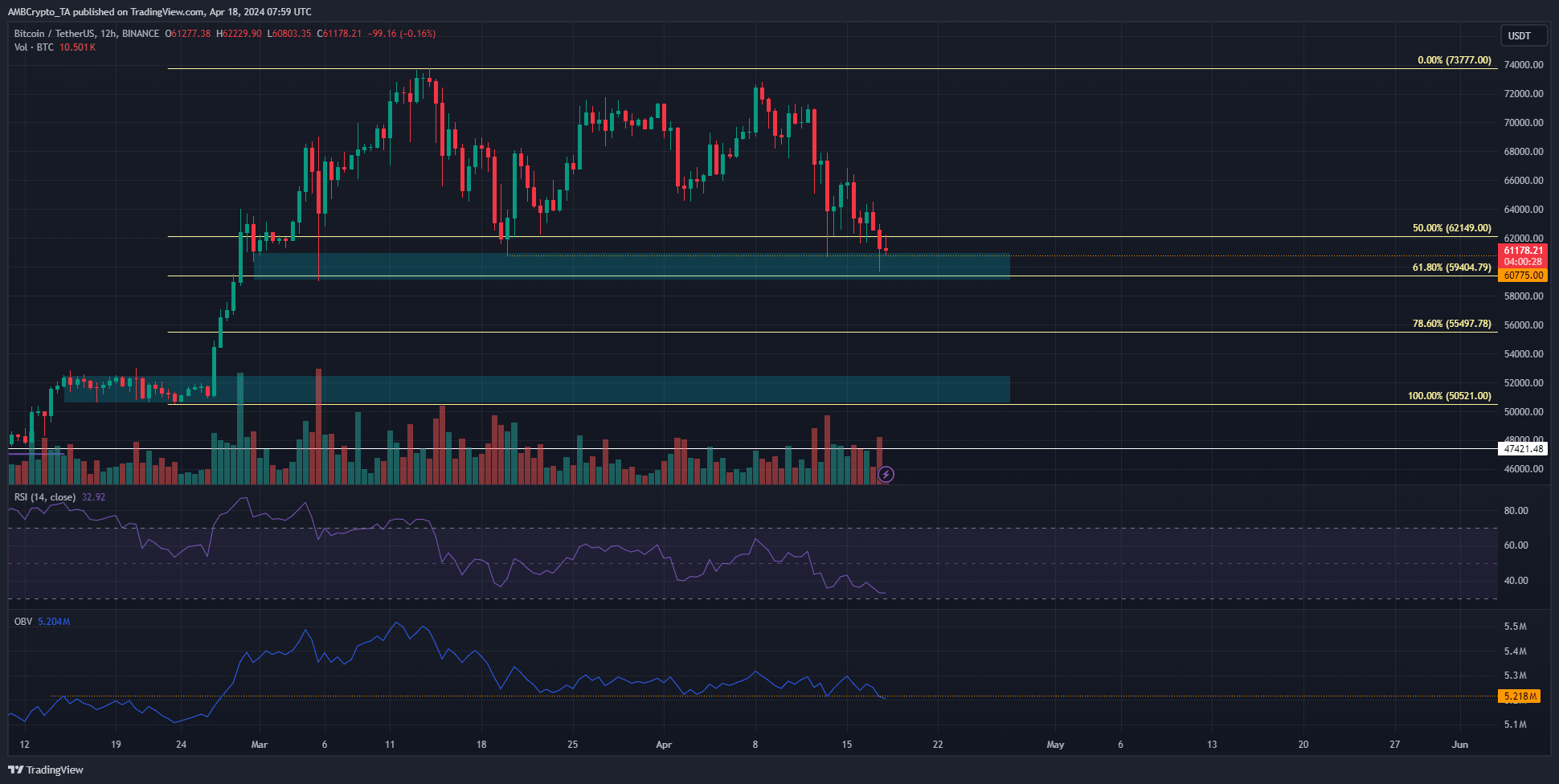

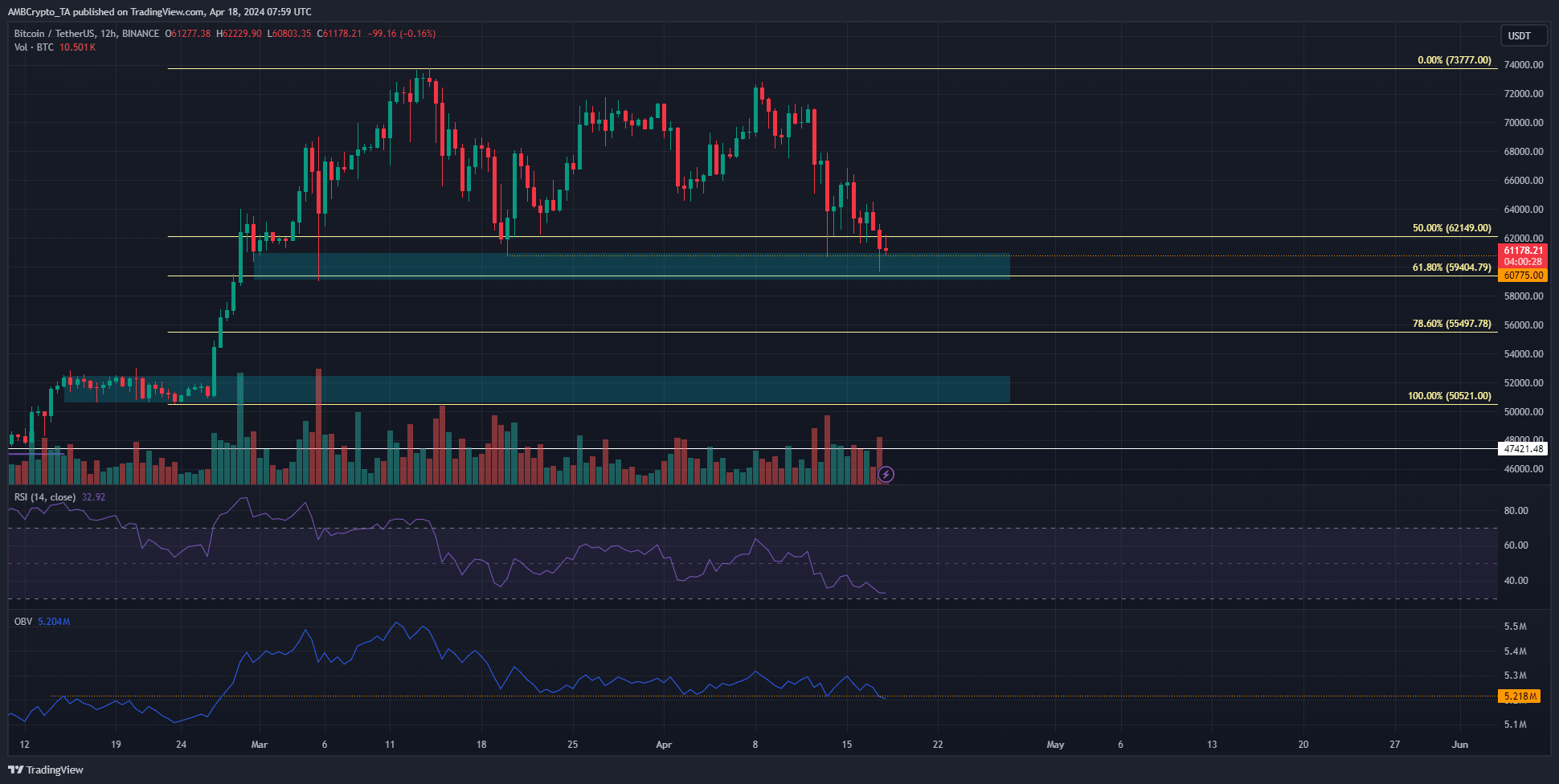

For the fourth time since late February, Bitcoin prices approached the support zone at $60k. The technical indicators suggested that the bulls might not succeed in holding on this time.

The demand zone and liquidity at $60k

Source: BTC/USDT on TradingView

The buyers have tenaciously held on to the $59.2k-$61k zone in the past seven weeks. During this time, the OBV had formed a support, marked in orange.

However, the recent selling volume drove the OBV below this key level.

This was an early signal that prices were likely to drop lower and that the $60k support zone might not be defended this time. The RSI underlined firm bearish momentum.

Beneath the $59.4k Fibonacci support level, $55.5k and $50.5k are the next higher timeframe areas of interest.

Therefore, if we see a slump below $60k this week, investors and traders should be prepared for further losses.

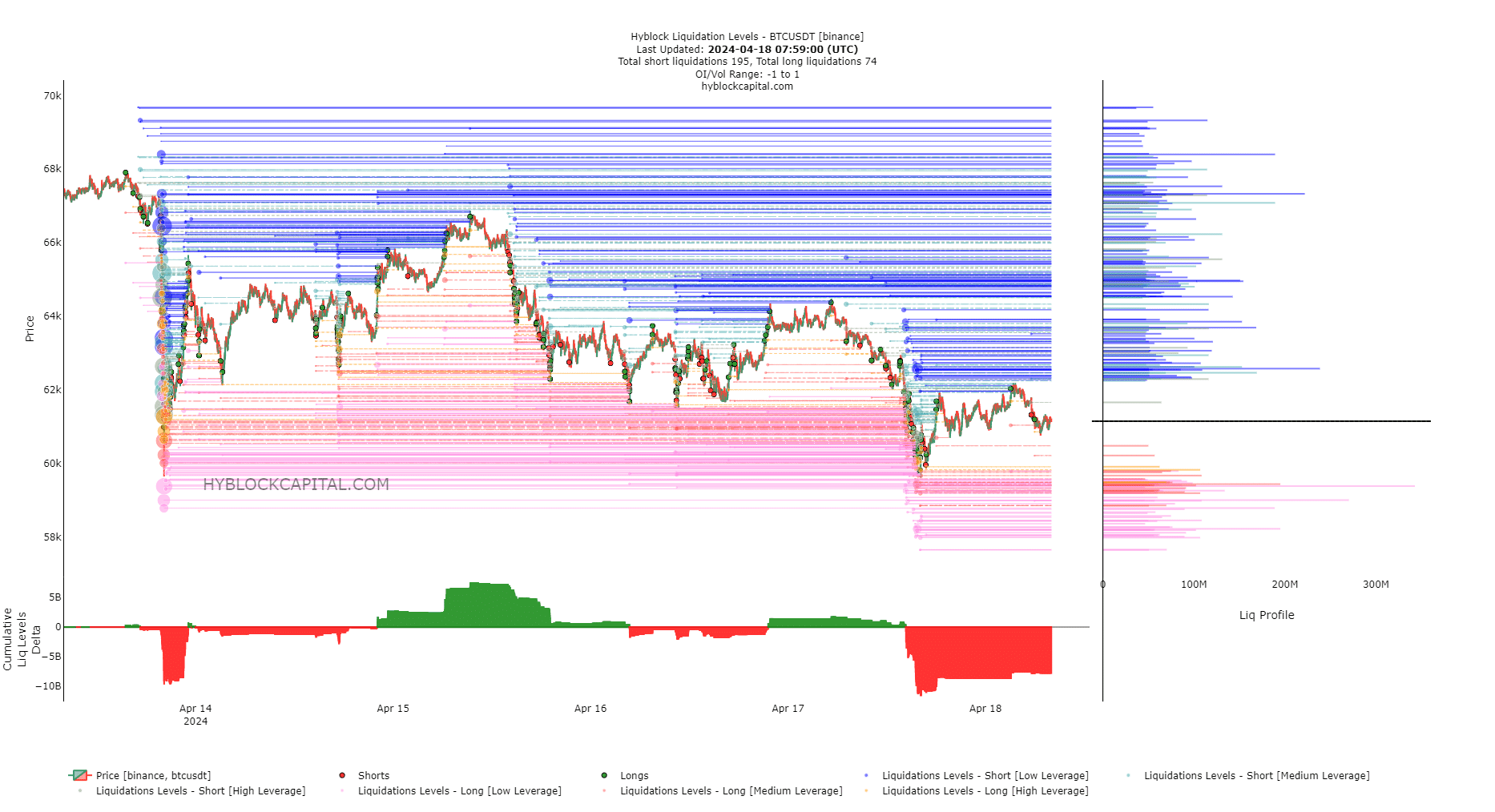

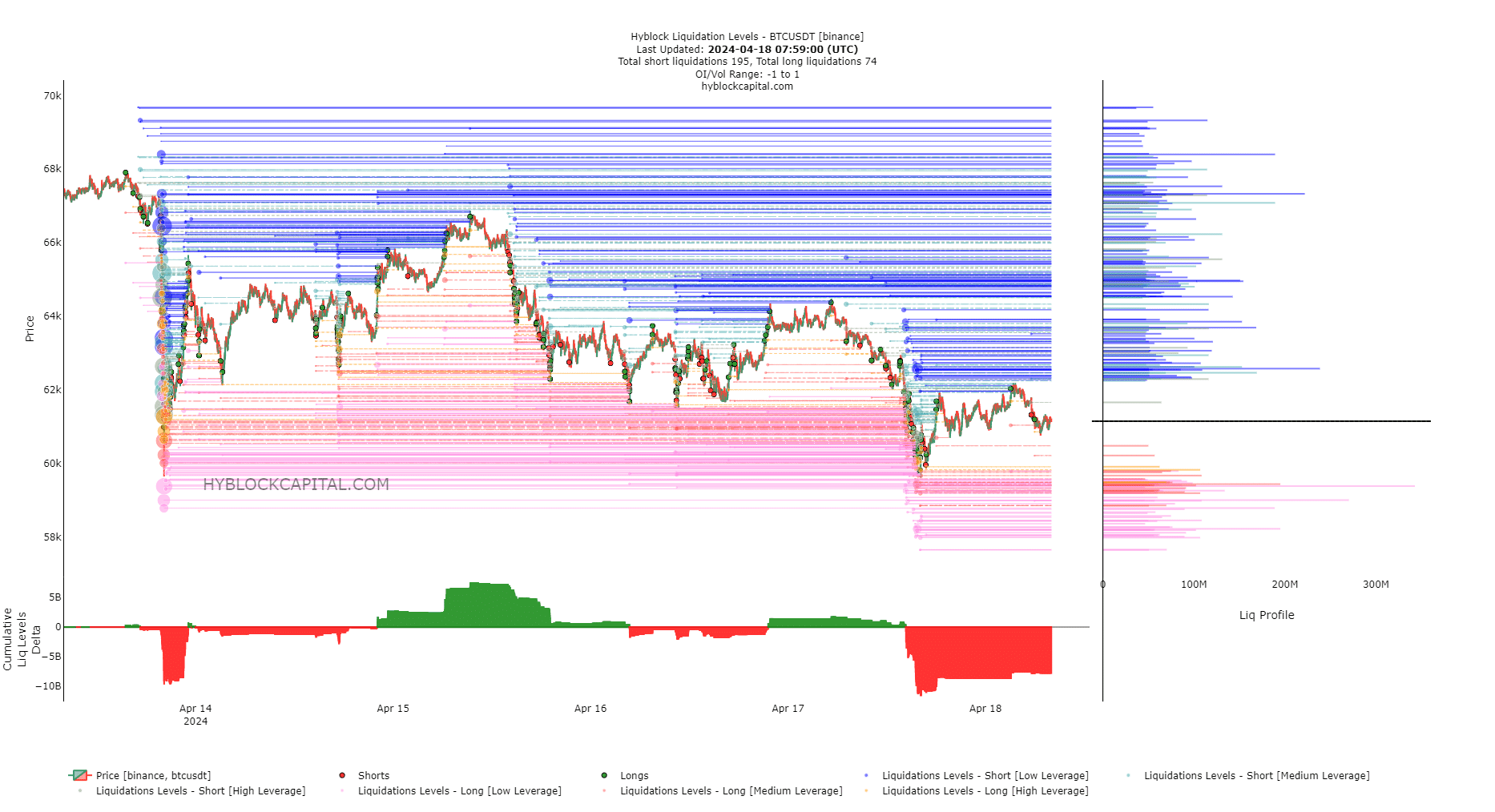

Short-term liquidation levels favor a sweep of this level before a bullish reversal

Source: Hyblock

The cumulative liquidation levels delta was negative, highlighting that short liquidation levels vastly outnumbered the long liquidation levels.

Since prices are attracted to liquidity pockets, a move upward was favored.

With that said, there was a $342 million liquidation cluster at $59.4k. Its confluence with the Fib level meant that a move to the $59k level to sweep these long liquidation levels was likely.

Is your portfolio green? Check the Bitcoin Profit Calculator

Thereafter, Bitcoin prices might surge higher to collect the liquidity to the north. However, we have seen that the selling pressure was intense.

A bounce from $59.4k was not a guarantee in these conditions, despite the lopsided cumulative liq levels delta.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bitcoin has a key level at $59.4k from both the technical and liquidity standpoints

- The one-sided sentiment in the futures market might see late bears trapped shortly

Bitcoin [BTC] saw a slump in demand and outflow from ETFs, which strongly suggested that a larger price correction was due for the crypto market.

Some ETF platforms saw zero flow days, but this was normal for exchange traded in any sector.

For the fourth time since late February, Bitcoin prices approached the support zone at $60k. The technical indicators suggested that the bulls might not succeed in holding on this time.

The demand zone and liquidity at $60k

Source: BTC/USDT on TradingView

The buyers have tenaciously held on to the $59.2k-$61k zone in the past seven weeks. During this time, the OBV had formed a support, marked in orange.

However, the recent selling volume drove the OBV below this key level.

This was an early signal that prices were likely to drop lower and that the $60k support zone might not be defended this time. The RSI underlined firm bearish momentum.

Beneath the $59.4k Fibonacci support level, $55.5k and $50.5k are the next higher timeframe areas of interest.

Therefore, if we see a slump below $60k this week, investors and traders should be prepared for further losses.

Short-term liquidation levels favor a sweep of this level before a bullish reversal

Source: Hyblock

The cumulative liquidation levels delta was negative, highlighting that short liquidation levels vastly outnumbered the long liquidation levels.

Since prices are attracted to liquidity pockets, a move upward was favored.

With that said, there was a $342 million liquidation cluster at $59.4k. Its confluence with the Fib level meant that a move to the $59k level to sweep these long liquidation levels was likely.

Is your portfolio green? Check the Bitcoin Profit Calculator

Thereafter, Bitcoin prices might surge higher to collect the liquidity to the north. However, we have seen that the selling pressure was intense.

A bounce from $59.4k was not a guarantee in these conditions, despite the lopsided cumulative liq levels delta.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Some times its a pain in the ass to read what people wrote but this internet site is real user pleasant! .

Hi there, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam responses? If so how do you prevent it, any plugin or anything you can recommend? I get so much lately it’s driving me insane so any assistance is very much appreciated.

Hey very nice blog!! Guy .. Beautiful .. Wonderful .. I’ll bookmark your website and take the feeds additionally…I’m satisfied to find a lot of helpful info here in the put up, we want develop more techniques in this regard, thank you for sharing.

amei este site. Para saber mais detalhes acesse o site e descubra mais. Todas as informações contidas são conteúdos relevantes e exclusivos. Tudo que você precisa saber está ta lá.

Hmm it seems like your website ate my first comment (it was extremely long) so I guess I’ll just sum it up what I submitted and say, I’m thoroughly enjoying your blog. I as well am an aspiring blog writer but I’m still new to the whole thing. Do you have any tips for novice blog writers? I’d really appreciate it.

It?¦s actually a great and helpful piece of information. I?¦m happy that you just shared this useful info with us. Please keep us informed like this. Thank you for sharing.

where can i buy generic clomiphene price how to get generic clomid price clomiphene other name generic clomiphene online where can i buy generic clomiphene without prescription how to buy cheap clomiphene clomid pill

I’ll certainly return to be familiar with more.

I couldn’t hold back commenting. Warmly written!

where can i buy azithromycin – order sumycin generic flagyl 400mg cost

order semaglutide – order periactin 4 mg generic cyproheptadine 4 mg canada

domperidone drug – buy tetracycline 500mg online oral cyclobenzaprine

buy inderal 10mg for sale – order inderal generic buy methotrexate pills

amoxil over the counter – buy amoxicillin pills for sale combivent 100 mcg cost

order zithromax 250mg for sale – tinidazole medication buy nebivolol 20mg generic

buy augmentin 1000mg sale – atbio info acillin oral

esomeprazole canada – anexa mate nexium 20mg cost

oral warfarin – coumamide.com hyzaar cheap

oral mobic 15mg – https://moboxsin.com/ mobic 15mg price

Thank you for the sensible critique. Me & my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more from this post. I am very glad to see such fantastic information being shared freely out there.

buy generic ed pills online – fast ed to take site buy ed pills generic

cenforce drug – https://cenforcers.com/ buy generic cenforce online

difference between sildenafil tadalafil and vardenafil – https://ciltadgn.com/ cialis for sale in toront ontario

great white peptides tadalafil – site cialis soft tabs

buy ranitidine 150mg for sale – this ranitidine 300mg uk

This is a theme which is virtually to my fundamentals… Myriad thanks! Faithfully where can I upon the acquaintance details for questions? https://gnolvade.com/es/gabapentina-300-mg-capsulas/

This is the compassionate of writing I positively appreciate. https://ursxdol.com/levitra-vardenafil-online/

More peace pieces like this would make the интернет better. https://prohnrg.com/product/get-allopurinol-pills/

Hello! I simply would like to give an enormous thumbs up for the great information you may have right here on this post. I will be coming back to your blog for extra soon.

This website positively has all of the information and facts I needed about this participant and didn’t identify who to ask. https://aranitidine.com/fr/acheter-propecia-en-ligne/

This is the kind of topic I have reading. https://ondactone.com/product/domperidone/

I am actually delighted to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks representing providing such data.

https://doxycyclinege.com/pro/spironolactone/

Very nice post. I just stumbled upon your weblog and wanted to mention that I’ve truly loved surfing around your weblog posts. In any case I will be subscribing for your rss feed and I’m hoping you write again soon!

I couldn’t hold back commenting. Warmly written! http://zqykj.com/bbs/home.php?mod=space&uid=302505

forxiga order online – https://janozin.com/ dapagliflozin 10mg price