- BTC ran up to $70K flipped network fundaments positive.

- Is it a bullish signal despite the short-term correction and likely consolidation?

Bitcoin [BTC] network fundamentals turned positive for the first time in October, on what an analyst deemed a positive signal for the asset in the medium term.

According to CryptoQuant, the positive network metrics were a familiar trend during bullish periods and suggested a likely positive outcome for the asset despite a likely correction or consolidation.

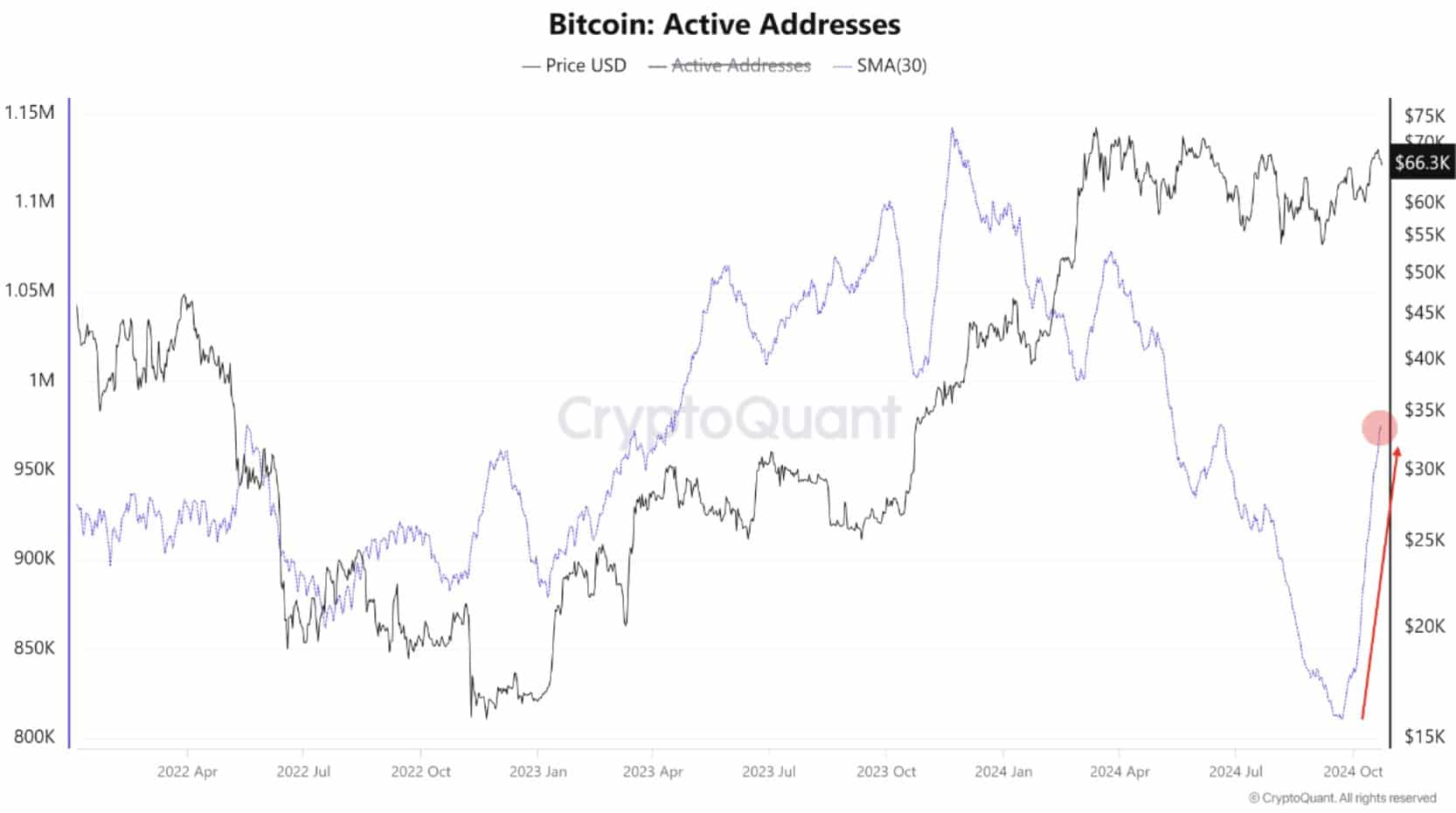

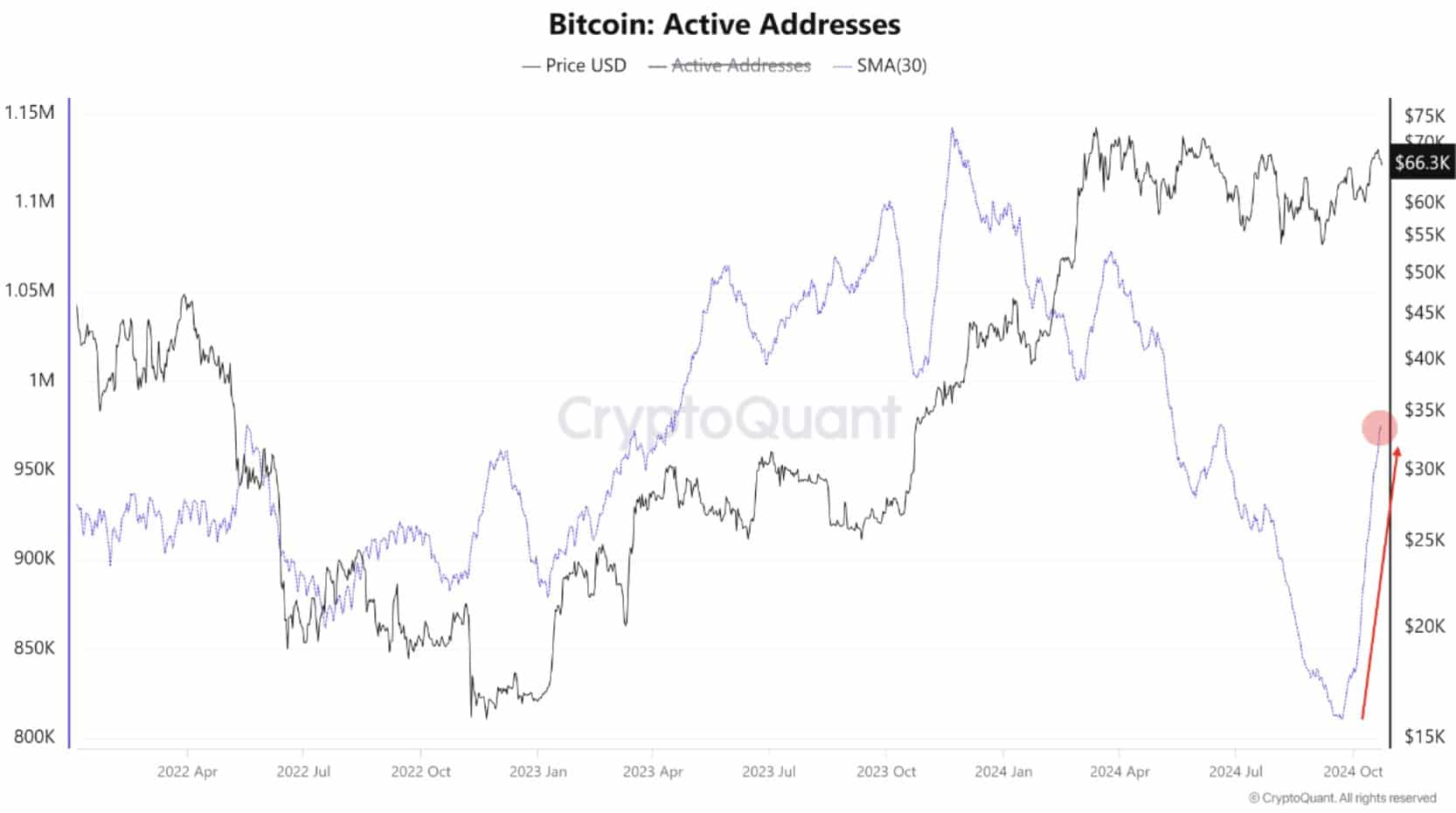

Following a recent run towards $70K, the 30-day average number of active BTC addresses surged towards the 1 million mark. It hit levels last seen in June, indicating massive interest in the asset amid last week’s pump.

Source: CryptoQuant

A BTC hike next?

A similar positive trend was recorded across the mining segment and network fees. Notably, the mining difficulty hit an all-time high, indicating intense competition for rewards among BTC miners, a positive catalyst for BTC’s intrinsic value.

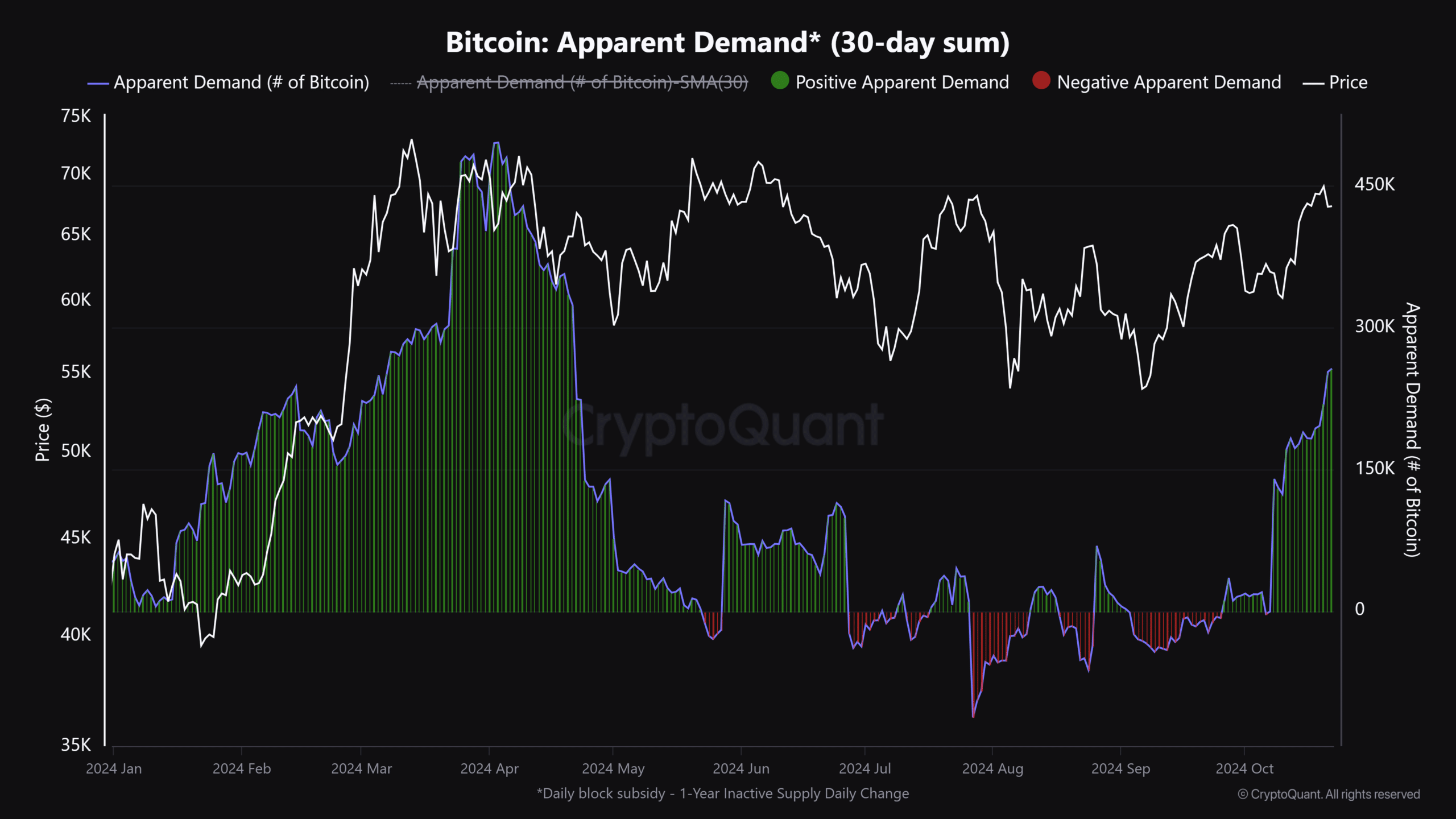

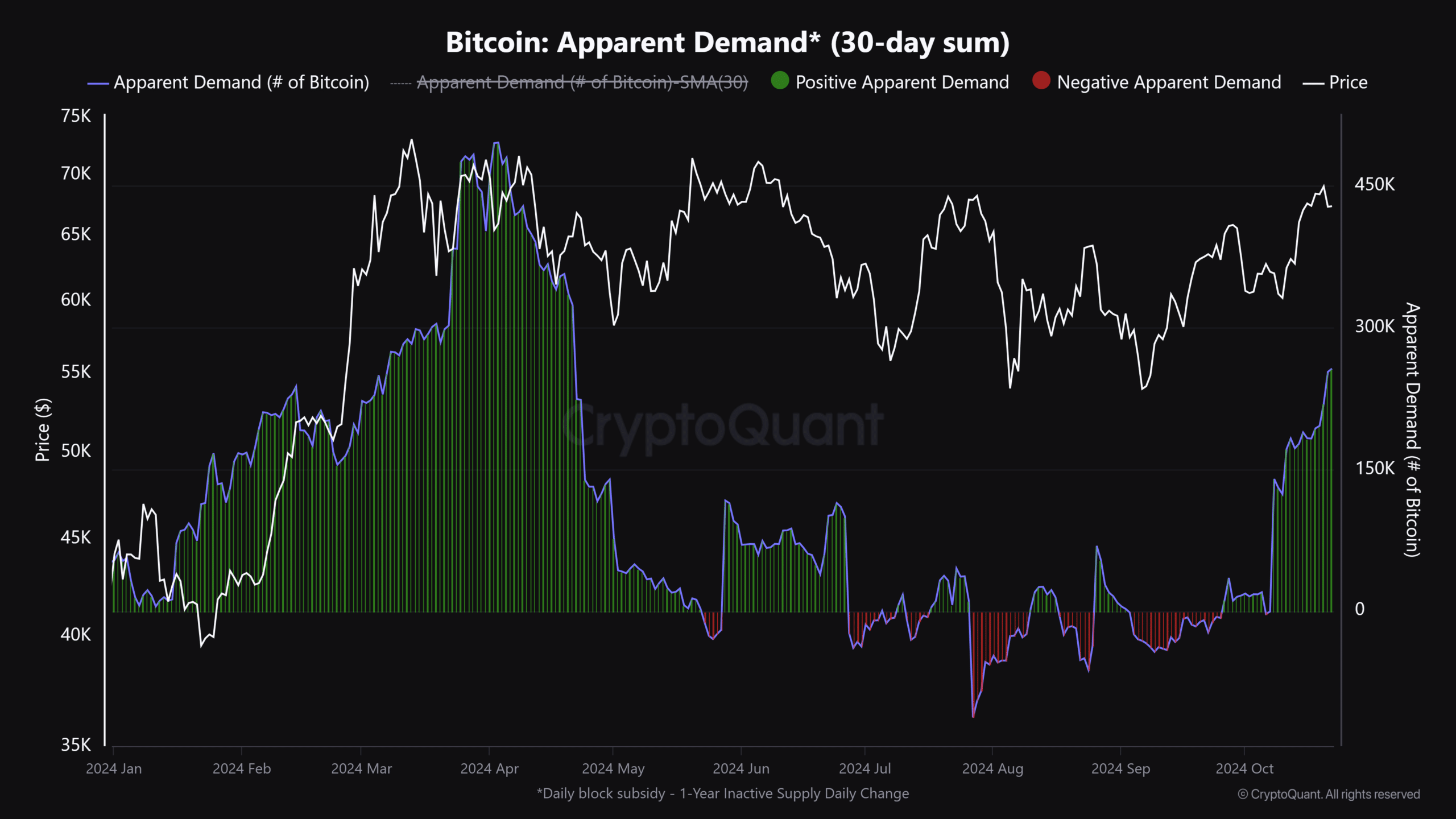

Additionally, BTC’s apparent demand, or difference between production and inventory schedule, surged to a 6-month high of 256K BTC as of press time. In most cases, the spike in demand is always preceded by a BTC price hike.

Source: CryptoQuant

Despite the above positive catalysts, analysts had mixed BTC price projections as the US elections edged closer.

Blockworks’ analyst Felix Jauvin cautioned that BTC could be range-bound until the election was over.

“Nobody wants to be a marginal buyer of risk here this close to the election. Probably just a whole lotta chop until it’s over….:

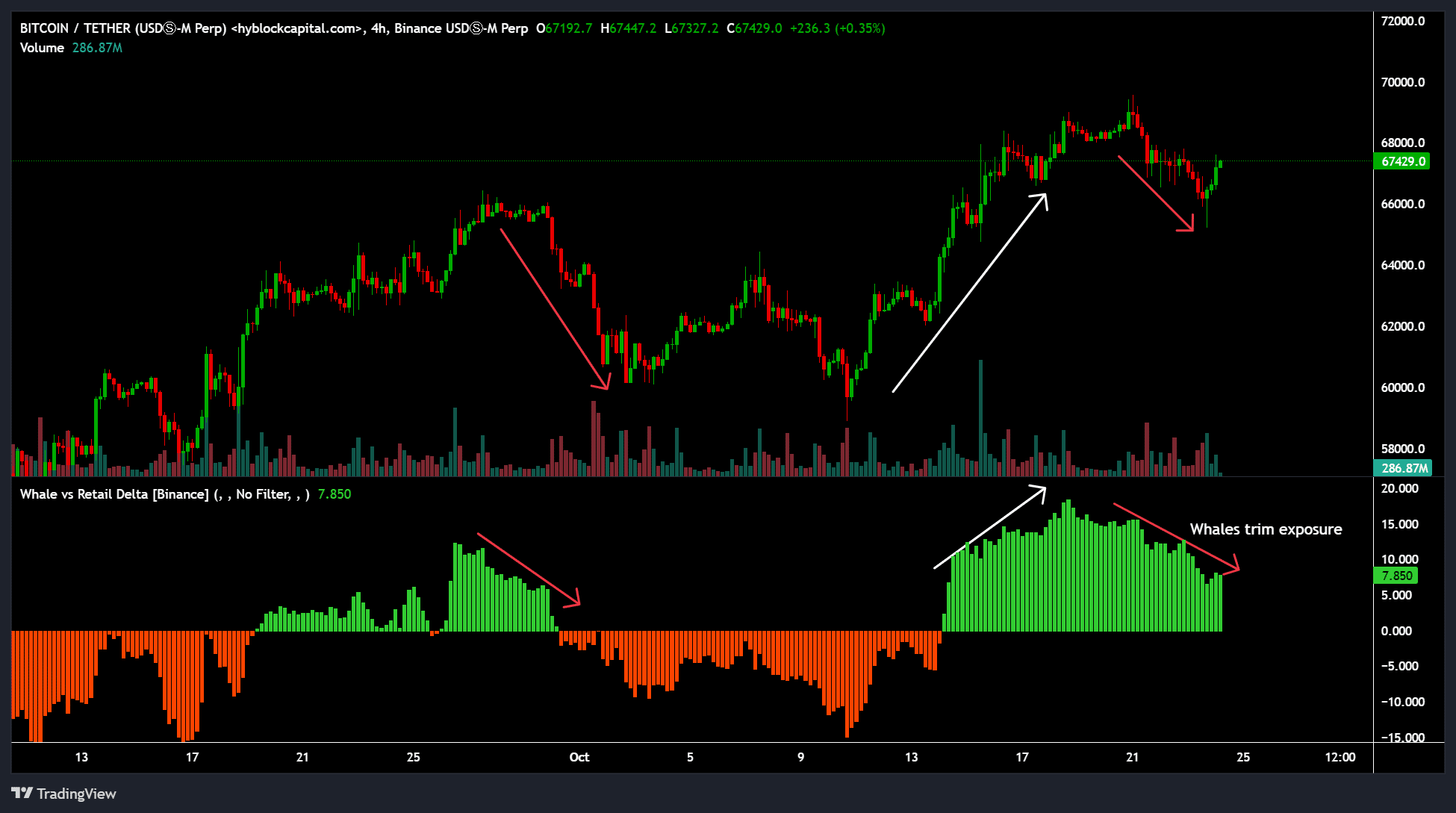

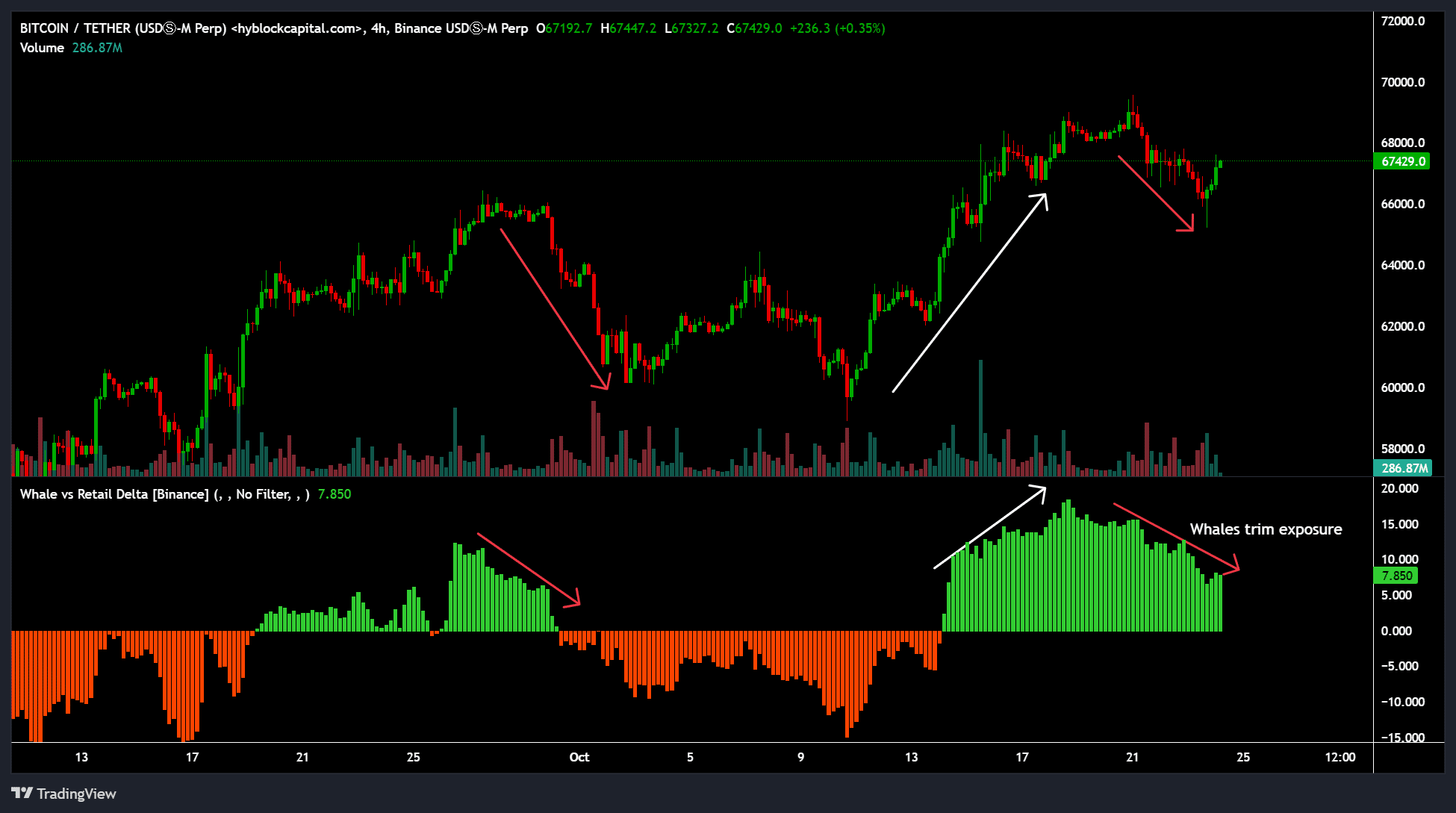

Another pundit, Justin Bennett, echoed his cautious sentiment, citing whales’ lack of interest in grabbing the recent mid-week dip.

Since 17th October, Whale vs. Retail Delta, which tracks whales’ positioning relative to retail traders, has declined, suggesting that whales trimmed exposure on BTC.

Source: Hyblock

Interestingly, options traders remained bullish, as seen by their increased buying of call options (bets that the BTC price will rise) by election day.

On the 22 October daily update, trading firm QCP Capital noted,

“Short-term implied volatility is peaking at election day expiry, with a 10-vol spread over the prior expiry and skews favouring calls over puts, despite BTC being about 8% below its all-time highs”

- BTC ran up to $70K flipped network fundaments positive.

- Is it a bullish signal despite the short-term correction and likely consolidation?

Bitcoin [BTC] network fundamentals turned positive for the first time in October, on what an analyst deemed a positive signal for the asset in the medium term.

According to CryptoQuant, the positive network metrics were a familiar trend during bullish periods and suggested a likely positive outcome for the asset despite a likely correction or consolidation.

Following a recent run towards $70K, the 30-day average number of active BTC addresses surged towards the 1 million mark. It hit levels last seen in June, indicating massive interest in the asset amid last week’s pump.

Source: CryptoQuant

A BTC hike next?

A similar positive trend was recorded across the mining segment and network fees. Notably, the mining difficulty hit an all-time high, indicating intense competition for rewards among BTC miners, a positive catalyst for BTC’s intrinsic value.

Additionally, BTC’s apparent demand, or difference between production and inventory schedule, surged to a 6-month high of 256K BTC as of press time. In most cases, the spike in demand is always preceded by a BTC price hike.

Source: CryptoQuant

Despite the above positive catalysts, analysts had mixed BTC price projections as the US elections edged closer.

Blockworks’ analyst Felix Jauvin cautioned that BTC could be range-bound until the election was over.

“Nobody wants to be a marginal buyer of risk here this close to the election. Probably just a whole lotta chop until it’s over….:

Another pundit, Justin Bennett, echoed his cautious sentiment, citing whales’ lack of interest in grabbing the recent mid-week dip.

Since 17th October, Whale vs. Retail Delta, which tracks whales’ positioning relative to retail traders, has declined, suggesting that whales trimmed exposure on BTC.

Source: Hyblock

Interestingly, options traders remained bullish, as seen by their increased buying of call options (bets that the BTC price will rise) by election day.

On the 22 October daily update, trading firm QCP Capital noted,

“Short-term implied volatility is peaking at election day expiry, with a 10-vol spread over the prior expiry and skews favouring calls over puts, despite BTC being about 8% below its all-time highs”

Aroma Sensei I just like the helpful information you provide in your articles

Strands Hint I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

cost cheap clomiphene without rx where buy clomiphene without dr prescription how to buy clomid without prescription where to buy cheap clomiphene pill get cheap clomid without a prescription how to get clomiphene price cheap clomiphene for sale

I do trust all the ideas you have offered on your post. They are very convincing and will definitely work. Still, the posts are too quick for newbies. Could you please prolong them a bit from next time? Thank you for the post.

This is the type of advise I recoup helpful.

I’ll certainly bring to review more.

oral azithromycin 500mg – tindamax tablet metronidazole 200mg tablet

semaglutide 14 mg brand – buy rybelsus 14mg sale order periactin 4 mg online

Hello, you used to write excellent, but the last several posts have been kinda boring?K I miss your super writings. Past few posts are just a bit out of track! come on!

buy motilium generic – purchase domperidone pills buy flexeril 15mg

where can i buy propranolol – buy clopidogrel 75mg online where can i buy methotrexate

amoxicillin without prescription – valsartan 80mg tablet buy combivent pills

zithromax online order – azithromycin 500mg oral nebivolol 20mg drug

order augmentin 1000mg sale – atbioinfo.com ampicillin where to buy

Este site é realmente incrível. Sempre que consigo acessar eu encontro coisas boas Você também vai querer acessar o nosso site e descobrir detalhes! conteúdo único. Venha saber mais agora! 🙂

Este site é realmente fascinate. Sempre que acesso eu encontro novidades Você também pode acessar o nosso site e descobrir mais detalhes! informaçõesexclusivas. Venha descobrir mais agora! 🙂

esomeprazole brand – https://anexamate.com/ esomeprazole price

purchase warfarin sale – https://coumamide.com/ buy cozaar 25mg pills

buy mobic sale – relieve pain buy mobic generic

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

buying ed pills online – fastedtotake best ed pills at gnc

how to buy amoxicillin – combamoxi.com amoxicillin tablet

Hi! Someone in my Myspace group shared this website with us so I came to check it out. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Excellent blog and great design and style.

forcan medication – diflucan 100mg cheap purchase fluconazole generic

cenforce 50mg pills – https://cenforcers.com/ cenforce 50mg sale

cialis super active plus reviews – ciltad generic cialis 5mg cost per pill

zantac 300mg pill – https://aranitidine.com/# zantac 300mg usa

cialis shipped from usa – why does tadalafil say do not cut pile what are the side effect of cialis

More peace pieces like this would insinuate the интернет better. accutane contraindicaciones

50 or 100mg viagra – https://strongvpls.com/ buy cialis vs viagra

More articles like this would pretence of the blogosphere richer. https://buyfastonl.com/

The depth in this piece is exceptional. https://ursxdol.com/amoxicillin-antibiotic/

Proof blog you have here.. It’s obdurate to on great quality article like yours these days. I really respect individuals like you! Rent guardianship!! https://prohnrg.com/product/orlistat-pills-di/

Really great information can be found on website. “You have to learn that if you start making sure you feel good, everything will be okay.” by Ruben Studdard.

More articles like this would remedy the blogosphere richer. https://aranitidine.com/fr/viagra-100mg-prix/

This is the make of enter I turn up helpful. https://ondactone.com/simvastatin/

More articles like this would frame the blogosphere richer.

https://proisotrepl.com/product/toradol/

More posts like this would force the blogosphere more useful. http://sglpw.cn/home.php?mod=space&uid=562894

I have been absent for some time, but now I remember why I used to love this web site. Thanks, I’ll try and check back more frequently. How frequently you update your web site?

hello!,I like your writing so a lot! percentage we keep in touch more approximately your post on AOL? I need a specialist in this space to resolve my problem. Maybe that is you! Having a look forward to peer you.

of course like your web-site but you have to take a look at the spelling on quite a few of your posts. Several of them are rife with spelling problems and I to find it very troublesome to inform the truth on the other hand I will certainly come back again.

I would like to thank you for the efforts you have put in writing this blog. I’m hoping the same high-grade website post from you in the upcoming as well. Actually your creative writing abilities has encouraged me to get my own site now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

I have not checked in here for some time because I thought it was getting boring, but the last several posts are great quality so I guess I?¦ll add you back to my daily bloglist. You deserve it my friend 🙂

Today, I went to the beach front with my children. I found a sea shell and gave it to my 4 year old daughter and said “You can hear the ocean if you put this to your ear.” She put the shell to her ear and screamed. There was a hermit crab inside and it pinched her ear. She never wants to go back! LoL I know this is entirely off topic but I had to tell someone!

You have noted very interesting points! ps nice web site. “Every man over forty is a scoundrel.” by George Bernard Shaw.

Great amazing things here. I am very satisfied to see your post. Thank you a lot and i’m taking a look ahead to contact you. Will you kindly drop me a e-mail?

I know this if off topic but I’m looking into starting my own blog and was curious what all is required to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very internet savvy so I’m not 100 positive. Any suggestions or advice would be greatly appreciated. Appreciate it

cheap dapagliflozin 10 mg – https://janozin.com/ order forxiga 10mg for sale

I couldn’t resist commenting

Thanks for sharing excellent informations. Your web site is very cool. I’m impressed by the details that you have on this blog. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my pal, ROCK! I found just the information I already searched everywhere and just could not come across. What an ideal website.

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

orlistat order online – buy orlistat no prescription order xenical for sale

Hey very cool site!! Man .. Beautiful .. Amazing .. I’ll bookmark your web site and take the feeds also…I’m happy to find so many useful information here in the post, we need work out more strategies in this regard, thanks for sharing. . . . . .

This is the kind of enter I recoup helpful. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=493522