- Bitcoin’s buying pressure on Binance increased sharply.

- However, BTC might face headwinds ahead as a few indicators turned bearish.

After a short pullback, Bitcoin [BTC] has once again started to inch towards its all-time high.

Investors took the opportunity to buy the dip during BTC’s price fall in the recent past, which could have played a role in helping BTC gain momentum again.

Will this increase in buying pressure propel BTC to a new ATH soon?

Investors are stockpiling Bitcoin

Ali, a popular crypto analyst, recently posted a tweet pointing out that there was a significant spike in BTC buying pressure on Binance.

This clearly signaled growing bullish sentiment, suggesting upward price movement could be ahead.

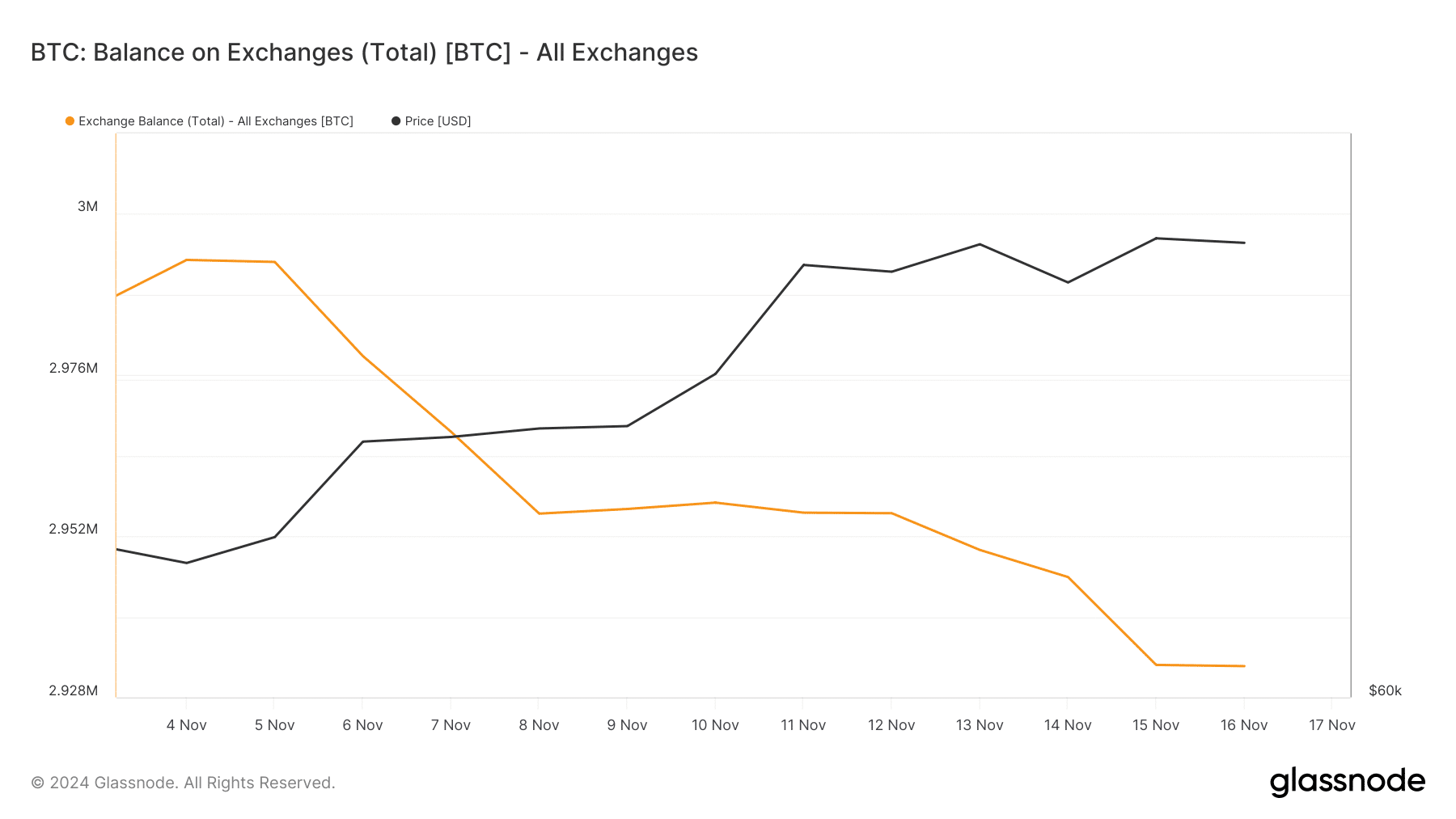

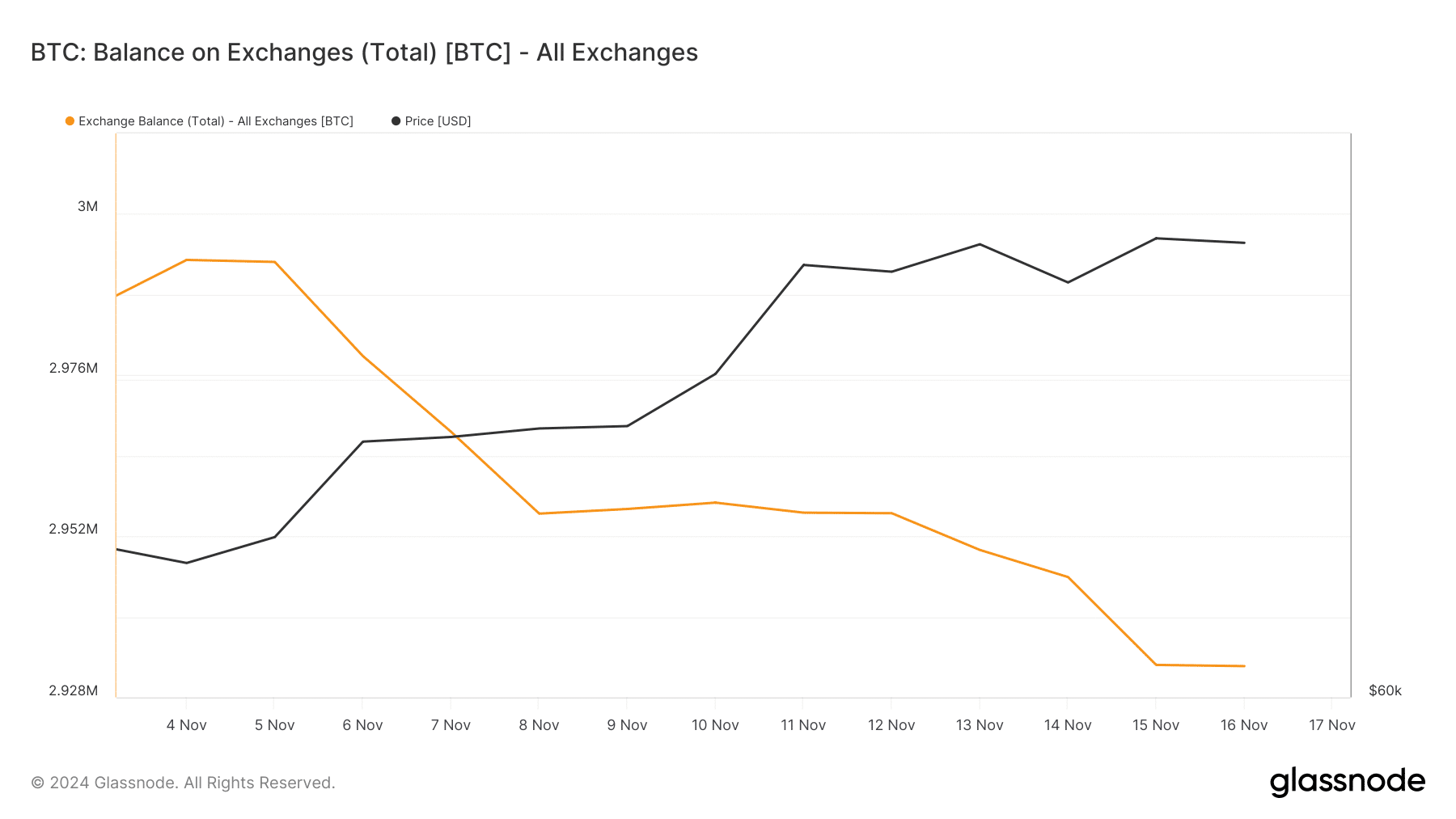

The fact that buying pressure was high in the overall market was further proven by BTC’s exchange balance.

The metric dropped sharply over the last two weeks, indicating that investors were stockpiling the king of cryptos.

Source: Glassnode

CryptoQuant’s data revealed that Bitcoin’s Coinbase premium was green. This meant that buying sentiment was strong among U.S. investors.

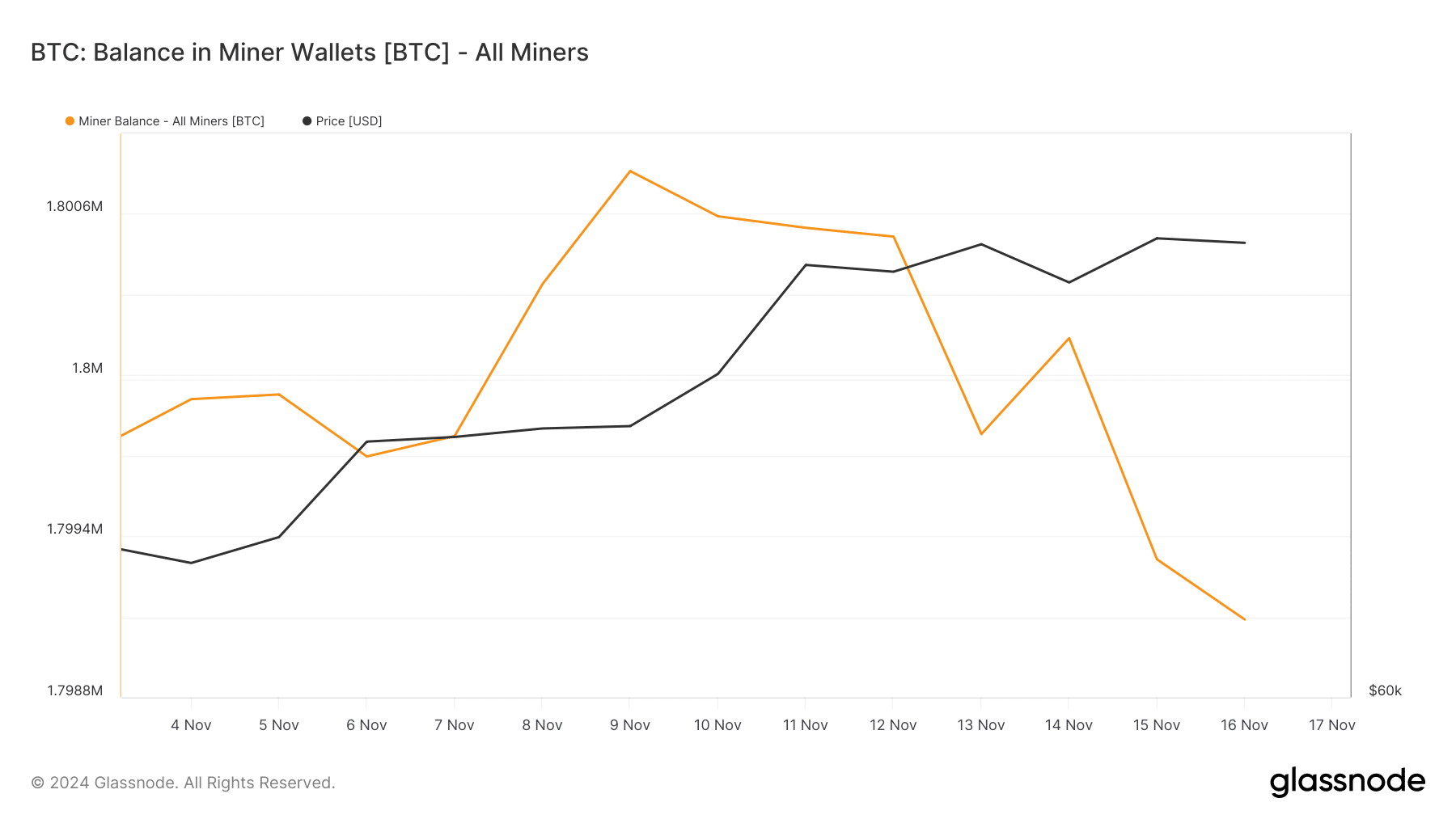

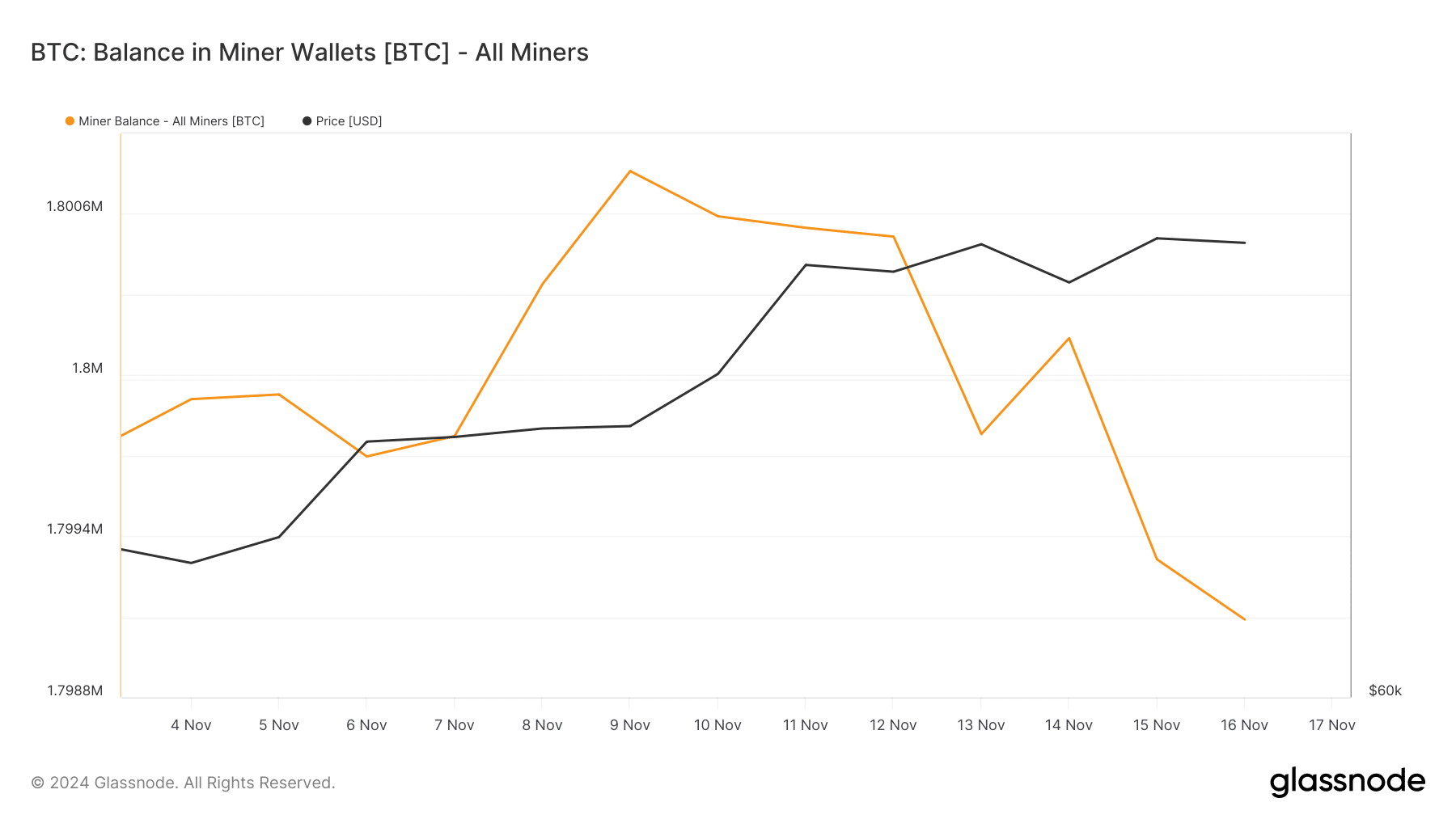

Nonetheless, Bitcoin miners didn’t show confidence in the king coin. This was evident from the considerable drop in BTC’s miners balance—a sign of miners’ sell-off.

Source: Glassnode

Will this be enough for a new ATH?

The hike in buying pressure from investors has propelled 14% price growth over the last week, allowing BTC to reach closer to $91k again.

If the accumulation trend continues, it won’t be surprising to see Bitcoin reaching a new high soon.

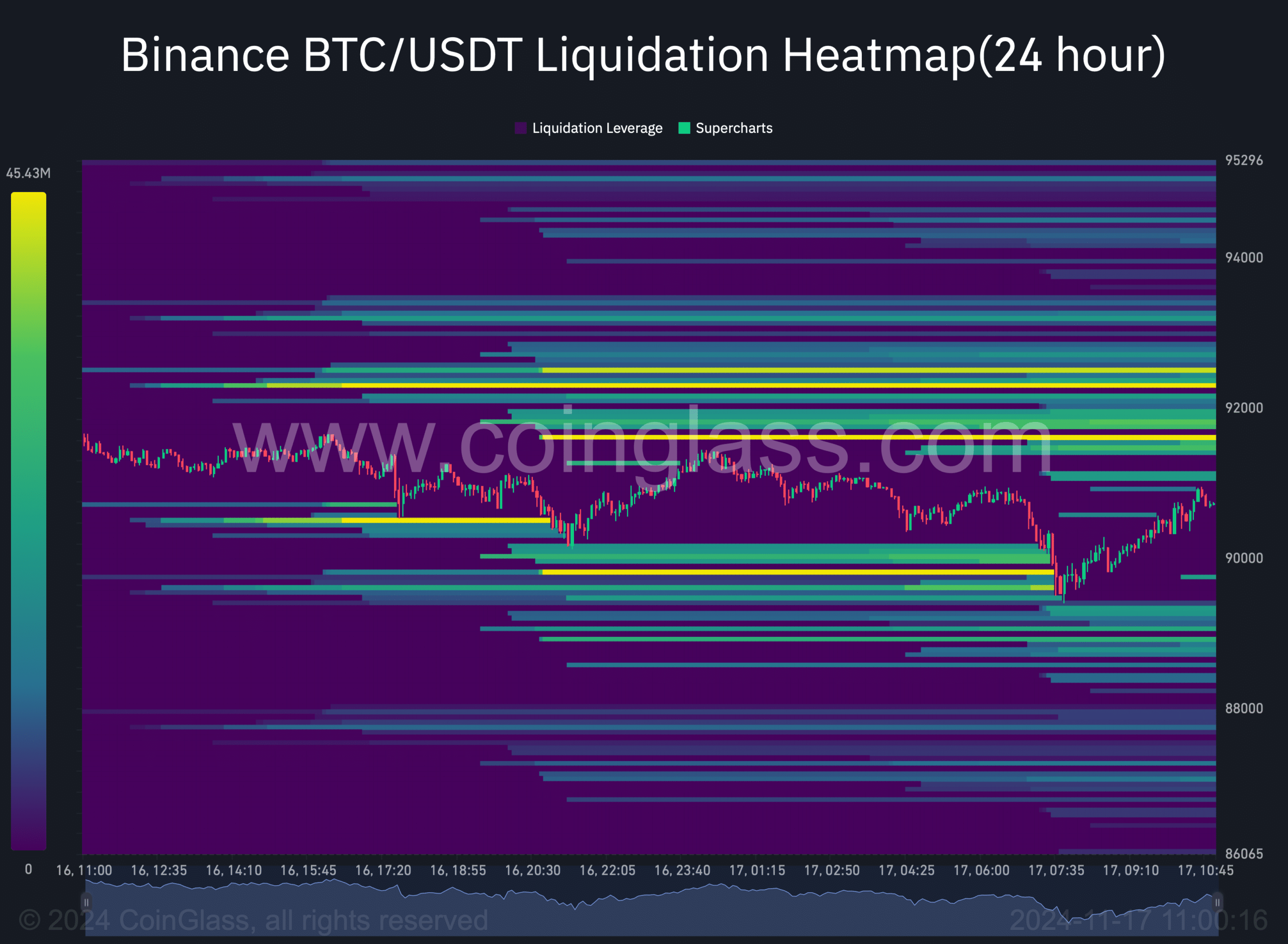

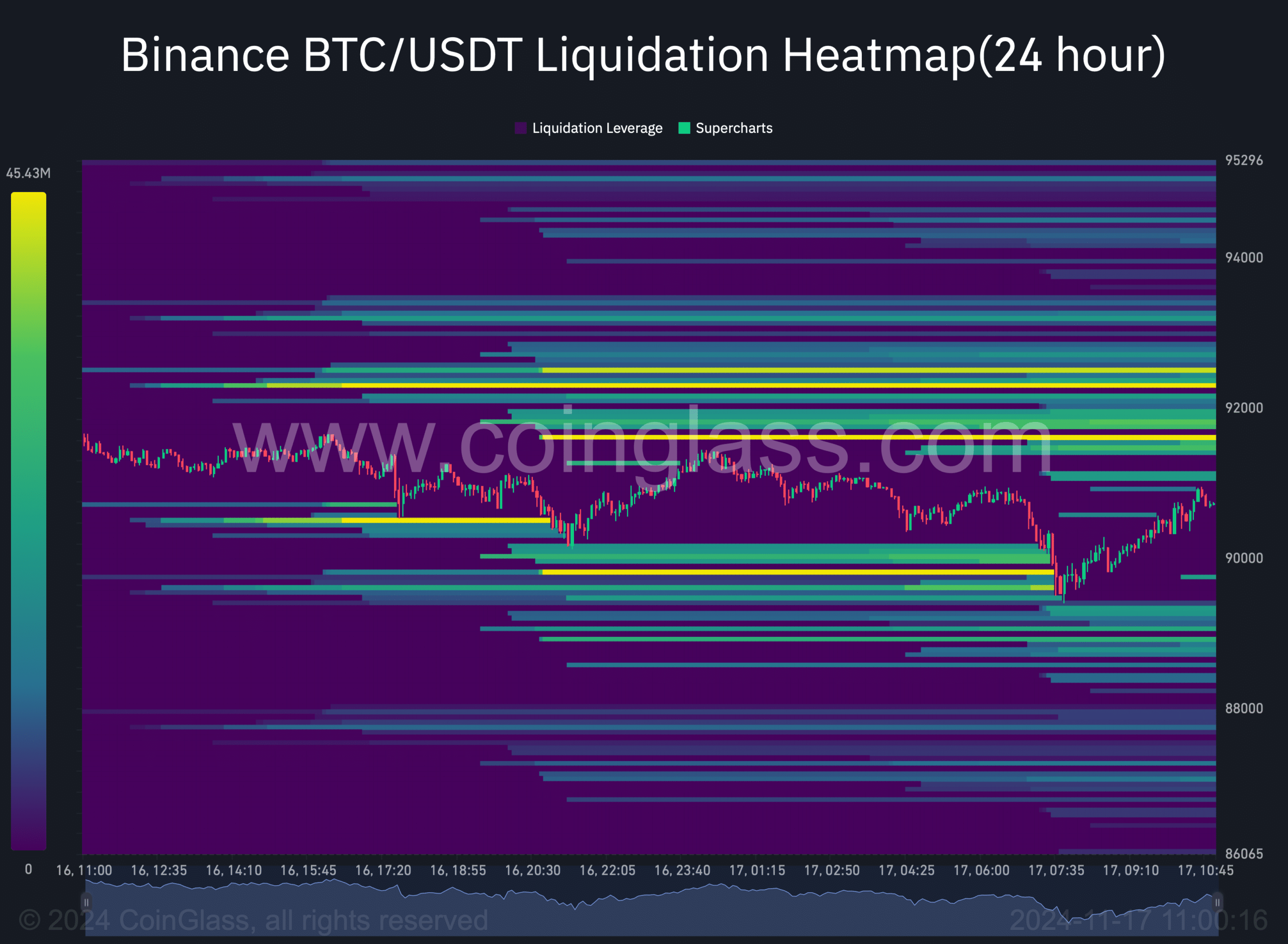

In the short-term, it didn’t seem much of a problem for BTC to retest $91k. This was the case as BTC’s liquidation will rise above the $91.6k mark.

Whenever liquidation rises, it indicates that the chances of a price correction are high.

Source: Coinglass

However, not everything favored a price rise. For instance, BTC’s aSORP turned red, meaning that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

The king coin’s Binary CDD suggested that the movement of long-term holders during the past seven days was higher than typical. If they were moved for the purpose of selling, it may have a negative impact.

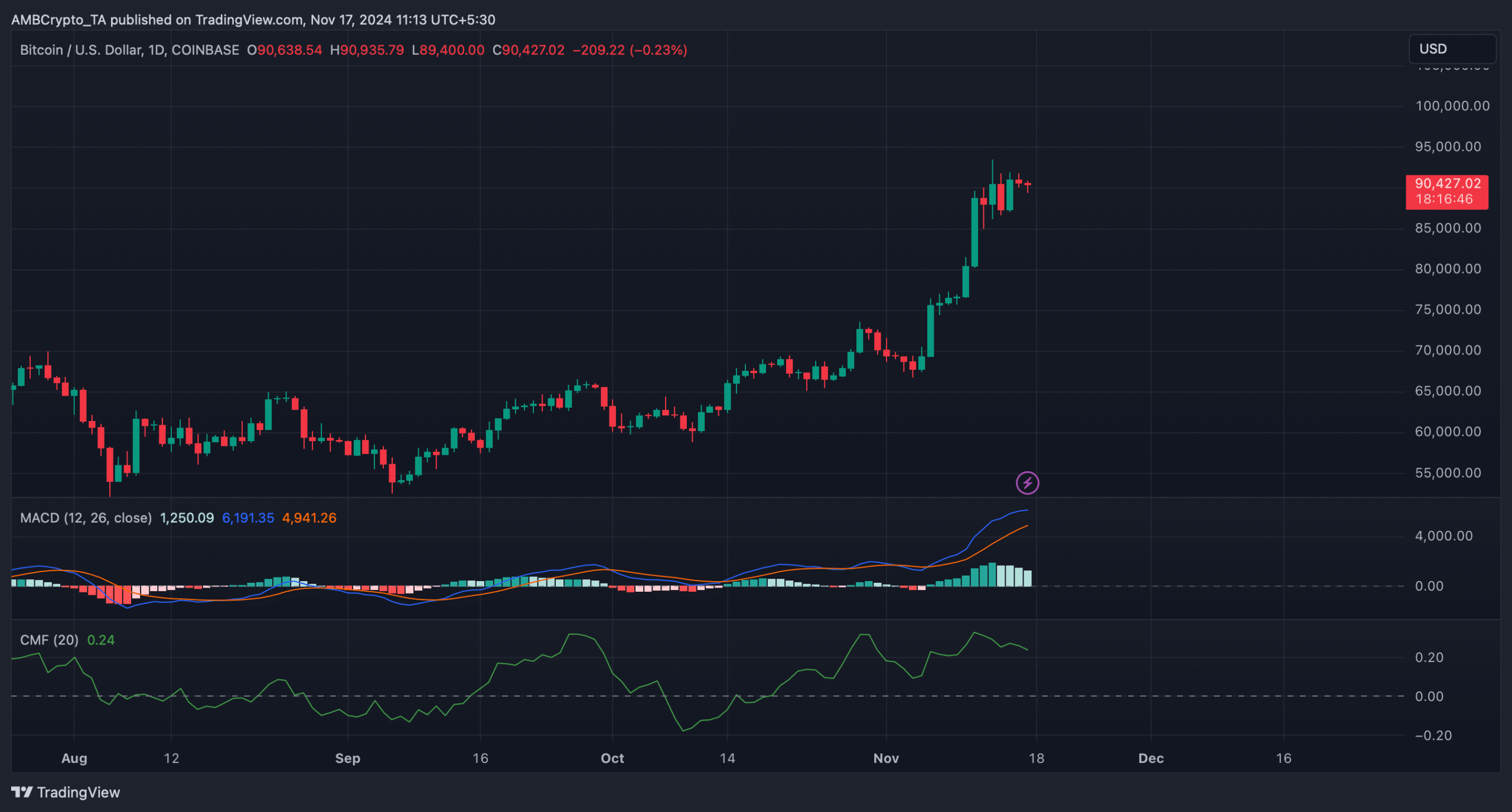

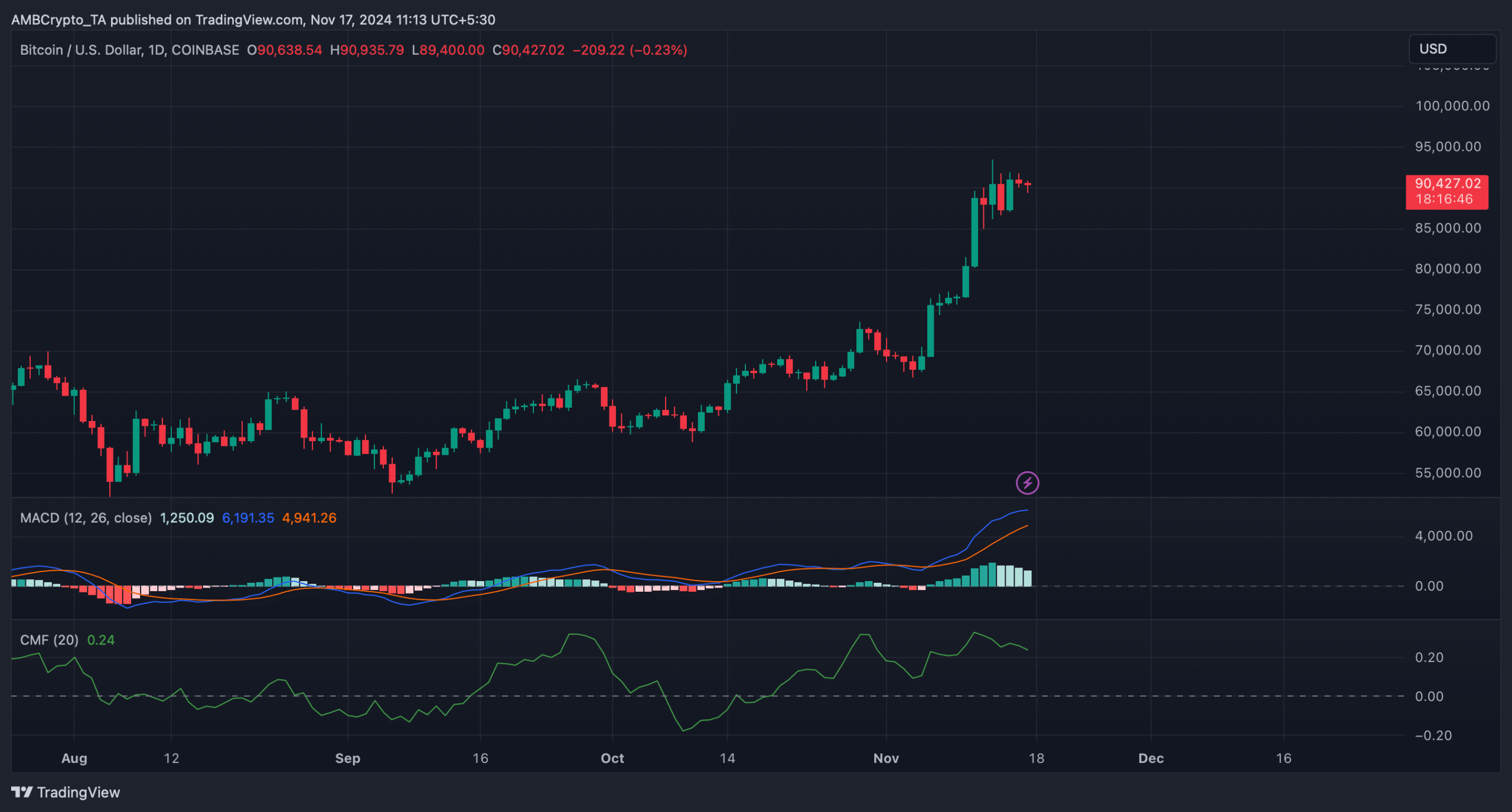

Supplementing the aSORP, Bitcoin’s Chaikin Money Flow (CMF) registered a downtick. The indicator measures the buying and selling pressure of an asset.

Read Bitcoin (BTC) Price Prediction 2023-24

A falling CMF confirms a downtrend, which, on this occasion, could create problems on BTC’s roads to $91k.

Nonetheless, the MACD continued to show a bullish advantage in the market, suggesting that the possibility of BTC retesting its ATH can’t be ruled out yet.

Source: TradingView

- Bitcoin’s buying pressure on Binance increased sharply.

- However, BTC might face headwinds ahead as a few indicators turned bearish.

After a short pullback, Bitcoin [BTC] has once again started to inch towards its all-time high.

Investors took the opportunity to buy the dip during BTC’s price fall in the recent past, which could have played a role in helping BTC gain momentum again.

Will this increase in buying pressure propel BTC to a new ATH soon?

Investors are stockpiling Bitcoin

Ali, a popular crypto analyst, recently posted a tweet pointing out that there was a significant spike in BTC buying pressure on Binance.

This clearly signaled growing bullish sentiment, suggesting upward price movement could be ahead.

The fact that buying pressure was high in the overall market was further proven by BTC’s exchange balance.

The metric dropped sharply over the last two weeks, indicating that investors were stockpiling the king of cryptos.

Source: Glassnode

CryptoQuant’s data revealed that Bitcoin’s Coinbase premium was green. This meant that buying sentiment was strong among U.S. investors.

Nonetheless, Bitcoin miners didn’t show confidence in the king coin. This was evident from the considerable drop in BTC’s miners balance—a sign of miners’ sell-off.

Source: Glassnode

Will this be enough for a new ATH?

The hike in buying pressure from investors has propelled 14% price growth over the last week, allowing BTC to reach closer to $91k again.

If the accumulation trend continues, it won’t be surprising to see Bitcoin reaching a new high soon.

In the short-term, it didn’t seem much of a problem for BTC to retest $91k. This was the case as BTC’s liquidation will rise above the $91.6k mark.

Whenever liquidation rises, it indicates that the chances of a price correction are high.

Source: Coinglass

However, not everything favored a price rise. For instance, BTC’s aSORP turned red, meaning that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

The king coin’s Binary CDD suggested that the movement of long-term holders during the past seven days was higher than typical. If they were moved for the purpose of selling, it may have a negative impact.

Supplementing the aSORP, Bitcoin’s Chaikin Money Flow (CMF) registered a downtick. The indicator measures the buying and selling pressure of an asset.

Read Bitcoin (BTC) Price Prediction 2023-24

A falling CMF confirms a downtrend, which, on this occasion, could create problems on BTC’s roads to $91k.

Nonetheless, the MACD continued to show a bullish advantage in the market, suggesting that the possibility of BTC retesting its ATH can’t be ruled out yet.

Source: TradingView

![How Bitcoin crashed Aptos’ [APT] token unlock party](https://coininsights.com/wp-content/uploads/2024/04/aptos-price-and-volume-120x86.png)

cost generic clomiphene for sale clomid tablets clomiphene without dr prescription where can i get clomiphene no prescription cost clomiphene without insurance buy cheap clomiphene where to get cheap clomid without dr prescription

This is the compassionate of literature I rightly appreciate.

This website really has all of the information and facts I needed about this thesis and didn’t know who to ask.

order zithromax 500mg online cheap – buy floxin 400mg generic buy metronidazole 200mg for sale

order rybelsus 14mg pill – buy cyproheptadine generic cyproheptadine 4mg generic

buy domperidone medication – order motilium 10mg pill flexeril price

generic inderal 10mg – buy cheap generic inderal order methotrexate 5mg

order augmentin 375mg without prescription – atbioinfo.com buy generic ampicillin online

nexium over the counter – anexamate nexium 20mg over the counter

coumadin 5mg for sale – anticoagulant purchase losartan pill

meloxicam medication – https://moboxsin.com/ buy meloxicam online

order prednisone 10mg – apreplson.com cheap deltasone 20mg

erection pills – https://fastedtotake.com/ pills erectile dysfunction

brand amoxicillin – combamoxi amoxicillin order

The thoroughness in this section is noteworthy.

I am in fact thrilled to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks representing providing such data.

fluconazole online buy – https://gpdifluca.com/# buy fluconazole 200mg pill

cenforce buy online – cenforcers.com cost cenforce

cialis com free sample – https://ciltadgn.com/ cialis before and after pictures

zantac for sale – zantac 150mg cost ranitidine 150mg over the counter

viagra 50mg coupon – https://strongvpls.com/# best place buy viagra online yahoo

Palatable blog you possess here.. It’s hard to assign high status writing like yours these days. I truly appreciate individuals like you! Go through care!! https://ursxdol.com/cialis-tadalafil-20/

More posts like this would create the online play more useful. https://buyfastonl.com/azithromycin.html

This is the compassionate of scribble literary works I in fact appreciate. https://prohnrg.com/product/diltiazem-online/

I am in fact enchant‚e ‘ to glance at this blog posts which consists of tons of worthwhile facts, thanks object of providing such data. online

Greetings! Utter serviceable recommendation within this article! It’s the crumb changes which liking obtain the largest changes. Thanks a a quantity towards sharing! https://ondactone.com/simvastatin/

More posts like this would make the blogosphere more useful.

https://doxycyclinege.com/pro/topiramate/

Cannabis cartridges, commonly known as “carts,” have revolutionized the way enthusiasts enjoy their favorite strains. These convenient and discreet devices come pre-filled with high-quality cannabis oil, offering a hassle-free vaping experience. From Muha Meds Disposables and wyld gummies to Coldfire Carts and PlugPlay Carts, there’s a wide range of options to suit every preference. Brands like Clean Carts, Whole Melts Carts, and Moon Chocolate Bars provide unique flavors and potent effects, while Mad Labs, Raz Vapes, and Ace Ultra Premium ensure premium quality. Whether you prefer the smooth hits of Geek Bars, the flavorful Lost Marys, Boutiq Carts, or the rich experience of Fryd Carts, there’s a cart for everyone. Explore this diverse lineup and discover the perfect option for your cannabis journey!

Thanks on sharing. It’s top quality. https://image.google.md/url?sa=j&rct=j&url=http://https://doselect.com/@decab16353abf074be022fa5f

Greetings! Extremely useful advice within this article! It’s the scarcely changes which choice obtain the largest changes. Thanks a lot towards sharing! https://www.forum-joyingauto.com/member.php?action=profile&uid=47847

This site just makes sense.

buy forxiga online – https://janozin.com/ dapagliflozin 10 mg without prescription

buy xenical cheap – https://asacostat.com/# xenical 60mg pill

Love the eco-friendly approach, clean and safe simultaneously. This is responsible cleaning. Appreciate the consciousness.

More content pieces like this would create the web better. https://sportavesti.ru/forums/users/fqdde-2/

We are looking for partnerships with other businesses for mutual promotion. Please contact us for more information!

Business Name: Sparkly Maid NYC Cleaning Services

Address: 447 Broadway 2nd floor #523, New York, NY 10013, United States

Phone Number: +1 646-585-3515

Website: https://sparklymaidnyc.com

We pay $10 for a google review and We are looking for partnerships with other businesses for Google Review Exchange. Please contact us for more information!

Business Name: Sparkly Maid NYC Cleaning Services

Address: 447 Broadway 2nd floor #523, New York, NY 10013, United States

Phone Number: +1 646-585-3515

Website: https://sparklymaidnyc.com

We pay $10 for a google review and We are looking for partnerships with other businesses for Google Review Exchange. Please contact us for more information!

Business Name: Sparkly Maid NYC Cleaning Services

Address: 447 Broadway 2nd floor #523, New York, NY 10013, United States

Phone Number: +1 646-585-3515

Website: https://sparklymaidnyc.com

We pay $10 for a google review and We are looking for partnerships with other businesses for Google Review Exchange. Please contact us for more information!

Business Name: Sparkly Maid NYC Cleaning Services

Address: 447 Broadway 2nd floor #523, New York, NY 10013, United States

Phone Number: +1 646-585-3515

Website: https://sparklymaidnyc.com