- Hut 8 Corp has secured a PPA for a site in West Texas, getting access to 205 MW of power capacity.

- Despite multiple efforts, Bitcoin miner’s daily revenues have dropped by 63% post-halving.

Hut 8, a Canadian Bitcoin [BTC] mining firm, has recently concluded an agreement to expand its operational capabilities in Texas.

On 9th July, Hut 8 Corp. disclosed securing a power purchase agreement (PPA) for a West Texas site, providing it exclusive access to 205 megawatts of power capacity and accompanying land.

Hut 8 new initiative

This marks the first deal from Hut 8’s plan to secure 1,100 megawatts of energy capacity, significantly boosting its BTC mining operations.

Remarking on the same, Asher Genoot, CEO of Hut 8 said,

“This is the first time a large data center load has been approved under the complex regulatory framework in this particular market.”

Key advantages

The new PPA provides Hut 8 with several key advantages. The first is proximity to a wind farm and connection to the Electric Reliability Council of Texas (ERCOT) grid.

This would enable Hut 8 to leverage some of North America’s most competitive wholesale power prices.

Additionally, the site infrastructure includes an existing operational substation, simplifying the process of connecting to the power grid and reducing setup time.

Most importantly, the site is well-suited for various high-density computing tasks, including Bitcoin mining and artificial intelligence (AI) applications.

Expressing on the same, Genoot noted,

“This transaction exemplifies Hut 8’s differentiated approach to securing new energy capacity through mutually accretive partnerships.”

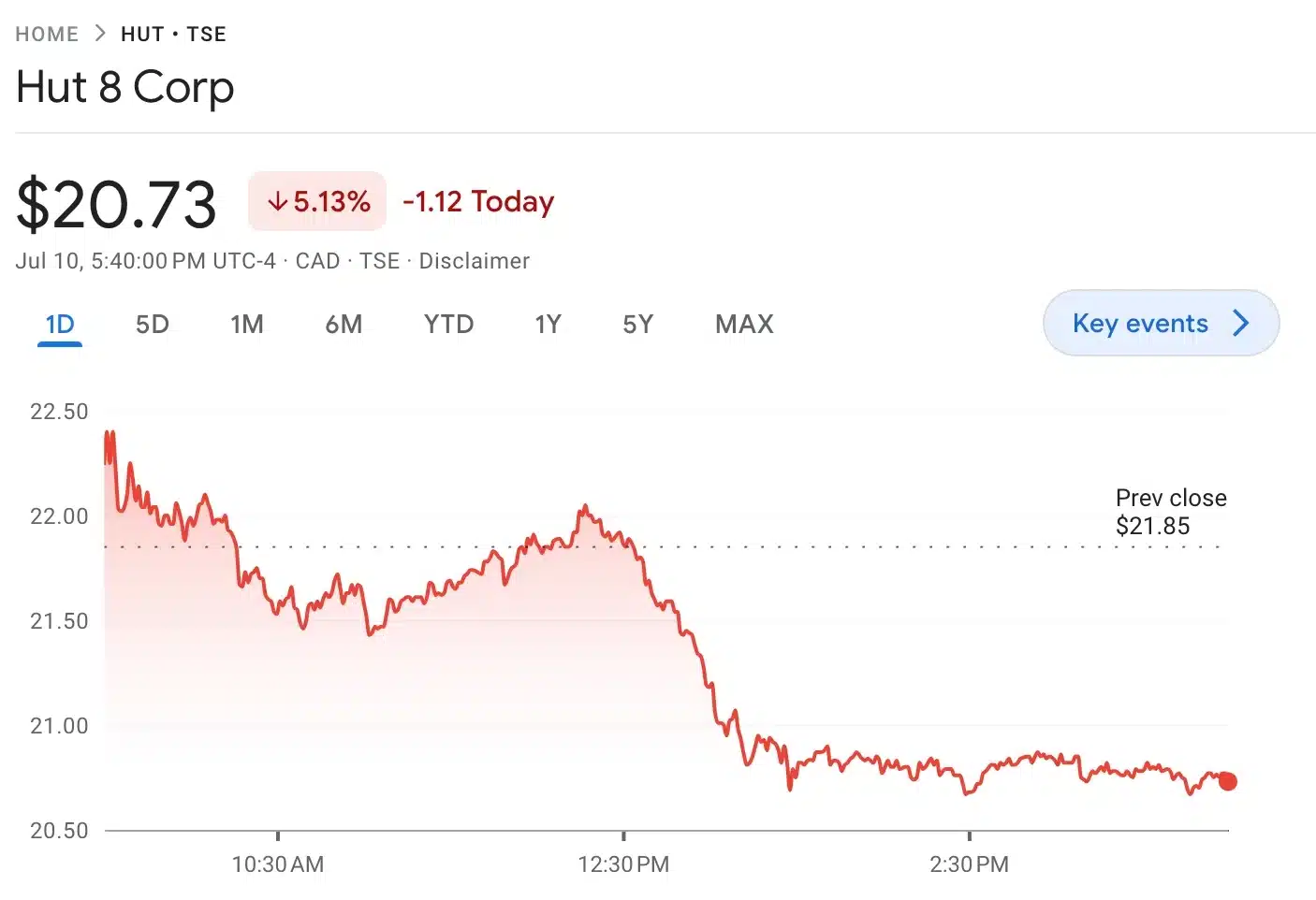

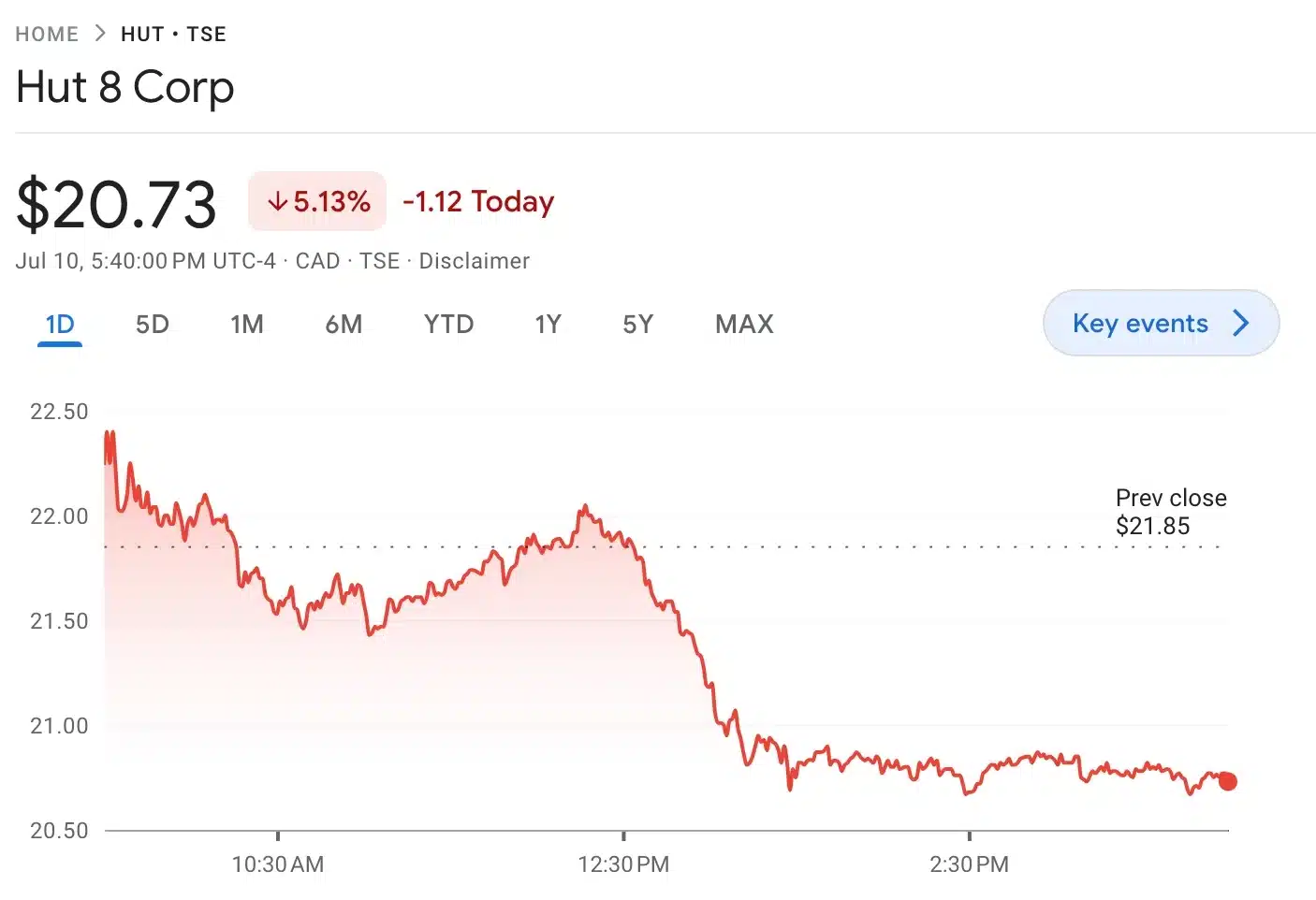

Following the announcement, Hut 8 shares initially rose by 1.54%, reaching $17.75. However, this increase was short-lived, as the latest update shows the stock price was down by 5.13% at the time of writing, now standing at $20.73.

Source: Google Finance

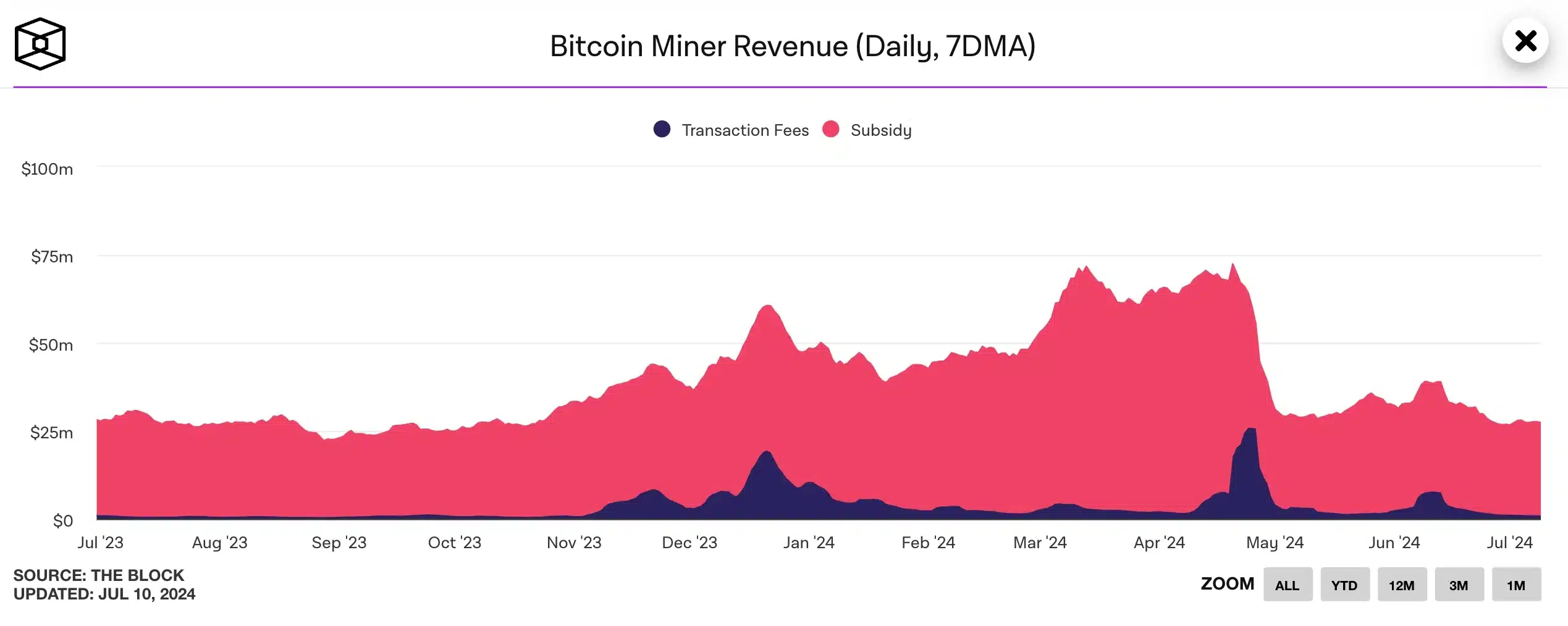

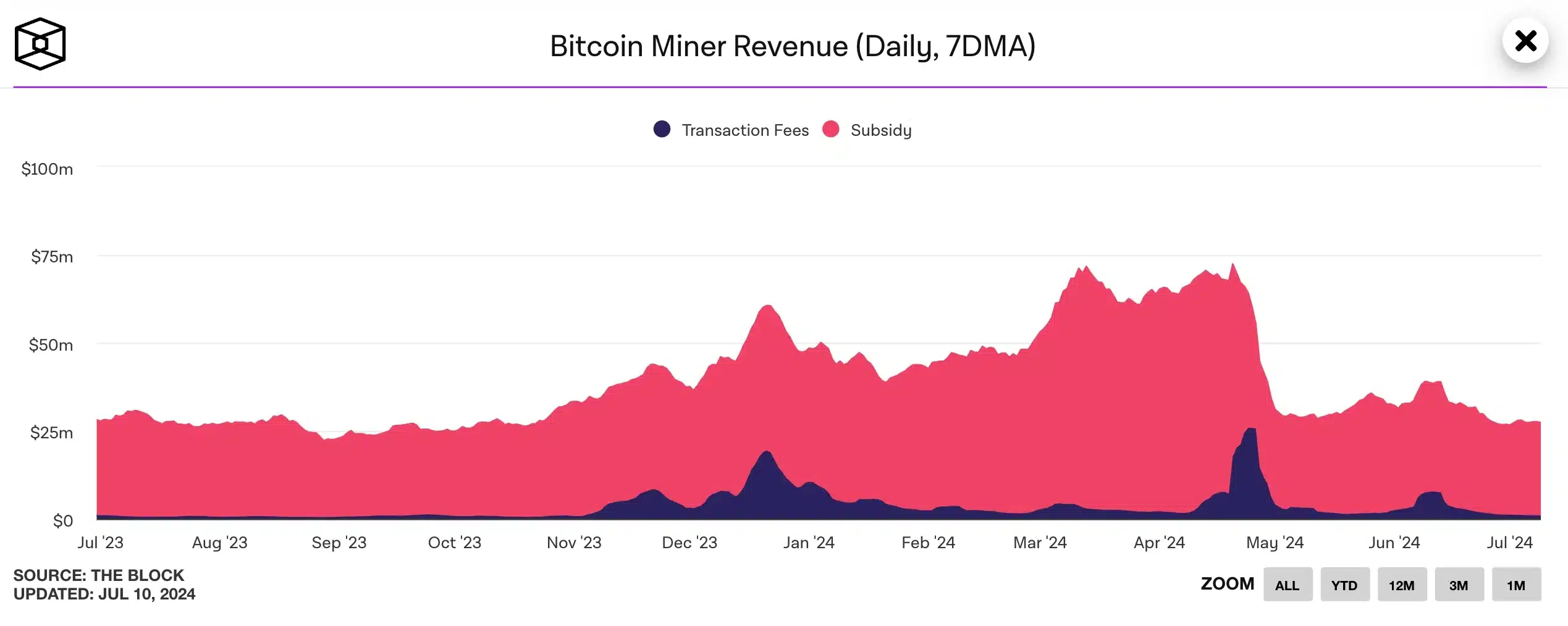

Impact of Bitcoin halving on miners

That being said, following the recent Bitcoin halving, the industry has undergone significant changes. Miners are diversifying their revenue streams, increasing their hashrate, and pursuing mergers, acquisitions, and partnerships to maintain profitability.

For instance, CleanSpark acquired five mining facilities in Georgia, significantly boosting their processing power. Mining firms such as Marathon Digital, CleanSpark, and Riot Platforms collectively secured $2 billion in equity financing.

Despite these efforts, miners’ daily revenues have dropped by 63% since the halving.

AMBCrypto’s analysis of IntoTheBlock data confirmed this, showing total BTC miner revenue (7DMA) at $27.29 million, a steep decline from the $72.35 million recorded on 20th April, just a day after the fourth Bitcoin halving event.

Source: IntoTheBlock

- Hut 8 Corp has secured a PPA for a site in West Texas, getting access to 205 MW of power capacity.

- Despite multiple efforts, Bitcoin miner’s daily revenues have dropped by 63% post-halving.

Hut 8, a Canadian Bitcoin [BTC] mining firm, has recently concluded an agreement to expand its operational capabilities in Texas.

On 9th July, Hut 8 Corp. disclosed securing a power purchase agreement (PPA) for a West Texas site, providing it exclusive access to 205 megawatts of power capacity and accompanying land.

Hut 8 new initiative

This marks the first deal from Hut 8’s plan to secure 1,100 megawatts of energy capacity, significantly boosting its BTC mining operations.

Remarking on the same, Asher Genoot, CEO of Hut 8 said,

“This is the first time a large data center load has been approved under the complex regulatory framework in this particular market.”

Key advantages

The new PPA provides Hut 8 with several key advantages. The first is proximity to a wind farm and connection to the Electric Reliability Council of Texas (ERCOT) grid.

This would enable Hut 8 to leverage some of North America’s most competitive wholesale power prices.

Additionally, the site infrastructure includes an existing operational substation, simplifying the process of connecting to the power grid and reducing setup time.

Most importantly, the site is well-suited for various high-density computing tasks, including Bitcoin mining and artificial intelligence (AI) applications.

Expressing on the same, Genoot noted,

“This transaction exemplifies Hut 8’s differentiated approach to securing new energy capacity through mutually accretive partnerships.”

Following the announcement, Hut 8 shares initially rose by 1.54%, reaching $17.75. However, this increase was short-lived, as the latest update shows the stock price was down by 5.13% at the time of writing, now standing at $20.73.

Source: Google Finance

Impact of Bitcoin halving on miners

That being said, following the recent Bitcoin halving, the industry has undergone significant changes. Miners are diversifying their revenue streams, increasing their hashrate, and pursuing mergers, acquisitions, and partnerships to maintain profitability.

For instance, CleanSpark acquired five mining facilities in Georgia, significantly boosting their processing power. Mining firms such as Marathon Digital, CleanSpark, and Riot Platforms collectively secured $2 billion in equity financing.

Despite these efforts, miners’ daily revenues have dropped by 63% since the halving.

AMBCrypto’s analysis of IntoTheBlock data confirmed this, showing total BTC miner revenue (7DMA) at $27.29 million, a steep decline from the $72.35 million recorded on 20th April, just a day after the fourth Bitcoin halving event.

Source: IntoTheBlock

generic clomiphene can you buy clomiphene without rx how can i get clomid pill buy clomiphene pill can you buy cheap clomid without rx clomid price walmart buy clomiphene no prescription

The thoroughness in this draft is noteworthy.

More articles like this would make the blogosphere richer.

buy azithromycin 250mg sale – tinidazole medication generic flagyl 400mg

order rybelsus 14mg generic – order semaglutide 14 mg online cheap periactin us

order domperidone 10mg without prescription – sumycin medication cheap cyclobenzaprine 15mg

purchase inderal online cheap – inderal price order methotrexate 2.5mg generic

buy clavulanate without a prescription – at bio info ampicillin online order

order esomeprazole 40mg online cheap – nexiumtous purchase nexium online

mobic 15mg price – relieve pain mobic tablet

deltasone oral – allergic reactions where to buy prednisone without a prescription

ed pills that work – fastedtotake buy generic ed pills

buy amoxicillin online cheap – https://combamoxi.com/ cheap amoxil generic

forcan over the counter – diflucan 100mg pill forcan price

buy lexapro 20mg generic – site escitalopram 10mg without prescription

cenforce 50mg ca – https://cenforcers.com/# generic cenforce

cialis san diego – https://strongtadafl.com/ whats the max safe dose of tadalafil xtenda for a healthy man

zantac 300mg usa – on this site buy zantac 150mg

buy viagra hua hin – sildenafil citrate 100 mg where can i buy viagra from

The thoroughness in this section is noteworthy. buy tamoxifen without prescription

The reconditeness in this serving is exceptional. buy gabapentin generic

Thanks for putting this up. It’s okay done. https://ursxdol.com/augmentin-amoxiclav-pill/

This is a topic which is in to my heart… Numberless thanks! Unerringly where can I lay one’s hands on the contact details in the course of questions? https://prohnrg.com/product/loratadine-10-mg-tablets/

The thoroughness in this draft is noteworthy. viagra homme prix

Thanks recompense sharing. It’s top quality. https://ondactone.com/product/domperidone/

I am in fact enchant‚e ‘ to glitter at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data.

https://doxycyclinege.com/pro/esomeprazole/

I am actually thrilled to glance at this blog posts which consists of tons of of use facts, thanks object of providing such data. http://bbs.dubu.cn/home.php?mod=space&uid=395576

dapagliflozin online – https://janozin.com/ dapagliflozin 10 mg usa

buy xenical pills – https://asacostat.com/ order xenical 120mg