- Marathon’s hash rate surged 78%, but Bitcoin production fell by 30%.

- Despite higher revenue, earnings missed forecasts due to rising costs and technical issues.

Following its recent acquisition of $100 million in Bitcoin [BTC], Marathon Digital Holdings [MARA], the largest BTC mining firm, reported its second-quarter earnings, which fell short of Wall Street projections.

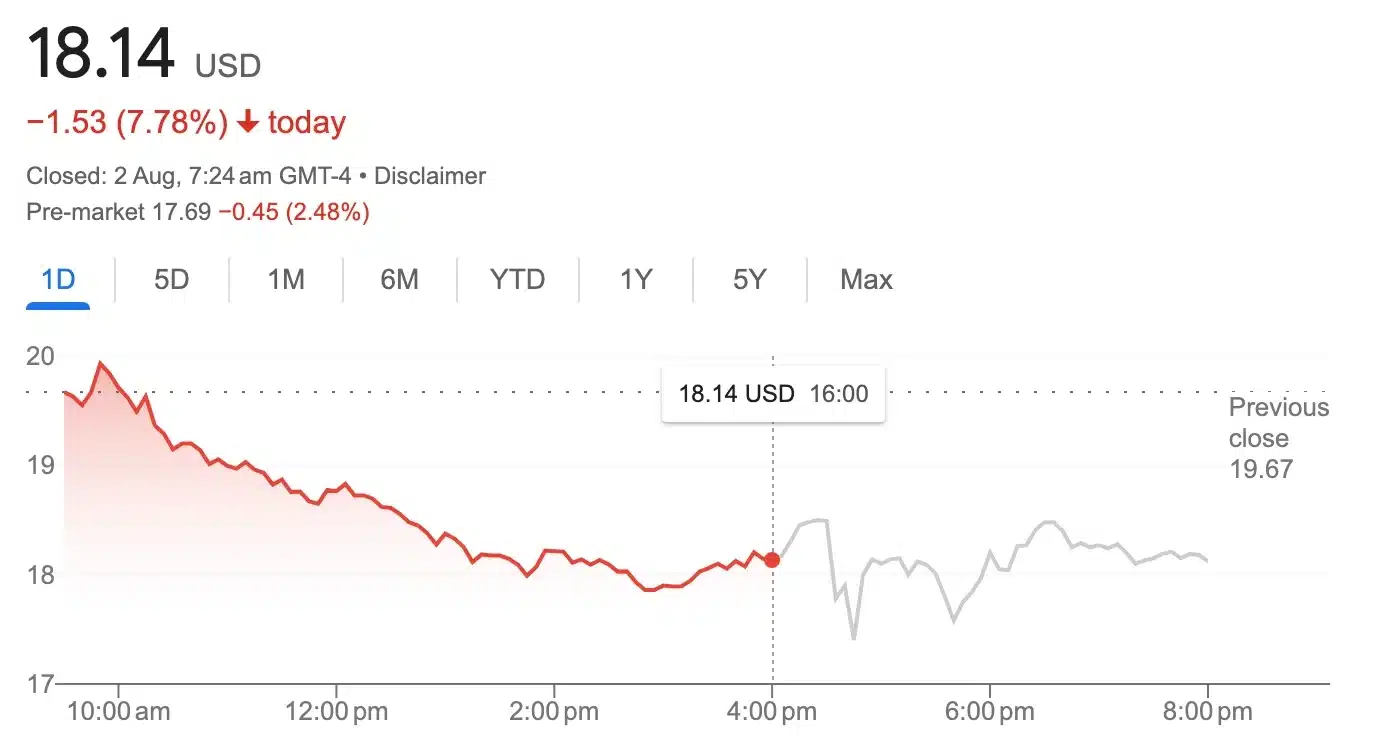

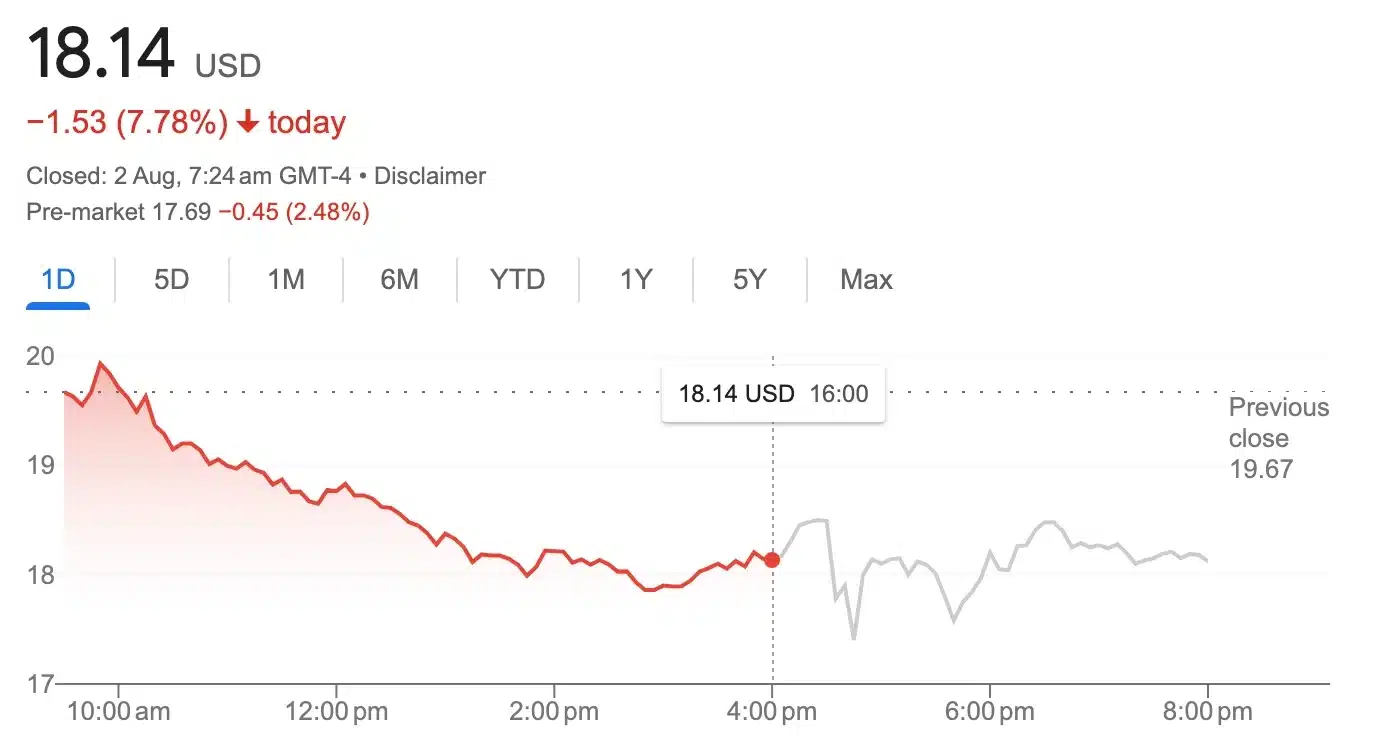

This led to an 8% drop in its share price.

Marathon Digital Q2 results

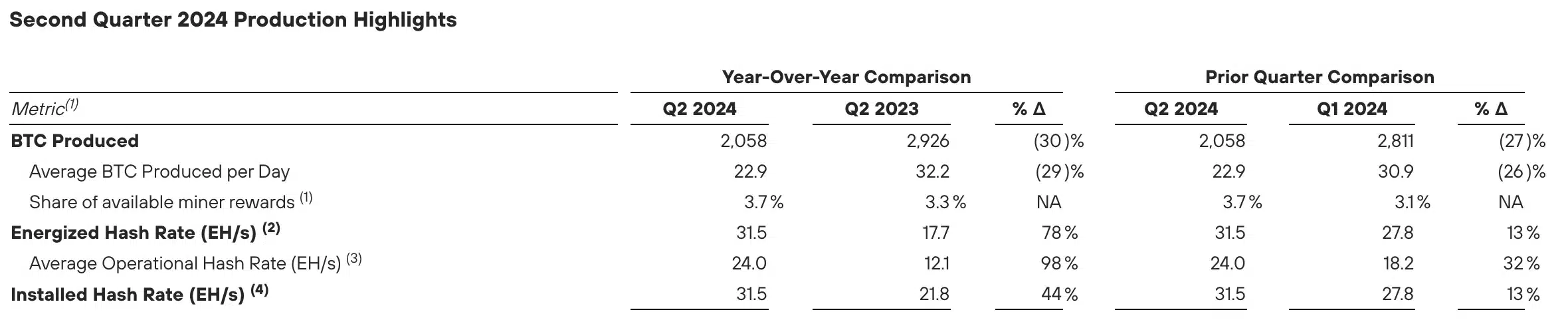

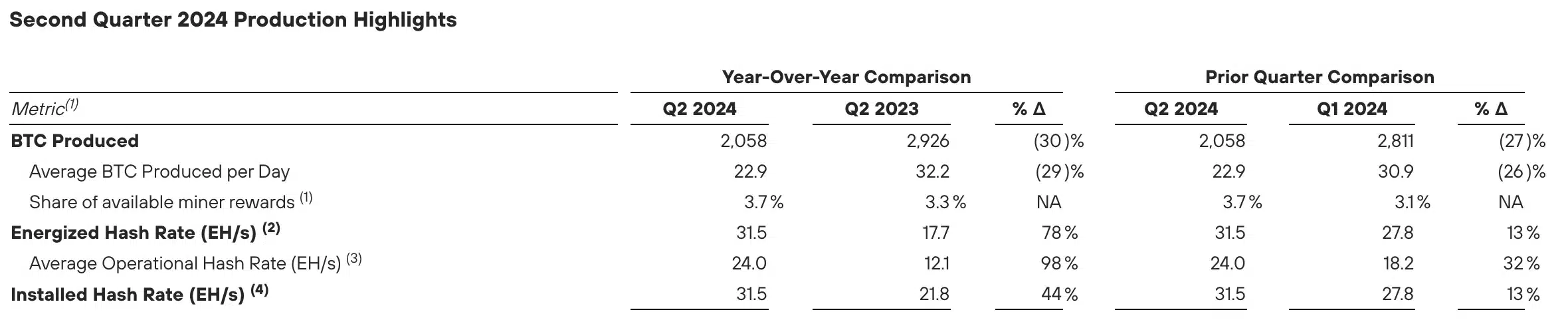

The company’s press release highlighted a notable 78% increase in hash rate, reaching 31.5 EH/s in Q2 2024 compared to 17.7 EH/s in Q2 2023.

Despite this growth in computing power, Marathon Digital’s Bitcoin production decreased by 30%, with 2,058 BTC mined in Q2 2024, down from 2,941 BTC the previous year.

However, in terms of revenue, the firm noted,

“Revenues increased 78% to $145.1 million in Q2 2024 from $81.8 million in Q2 2023.”

Surprisingly, Yahoo Finance data revealed that this figure was approximately 9% below the anticipated $157.9 million forecast by analysts.

As of the latest update, the company’s stock had dropped 7.78%, trading at $18.14.

Source: Google Finance

What happened so far?

That being said, during the quarter, Marathon Digital faced financial pressures due to increased operational costs following the Bitcoin halving event in April.

To manage these costs, the company sold over half of its mined BTC.

Despite a significant increase in the average price of Bitcoin mining compared to the previous year, Marathon’s daily BTC production decreased by 9.3 BTC.

Source: ir.mara.com

This suggests that, although the value of Bitcoin was higher, operational challenges and rising costs impacted their overall mining output and financial strategy.

Execs weighing in

Remarking on the same, Fred Thiel, MARA’s chairman and chief executive officer, said,

“During the second quarter of 2024, our BTC production was impacted by unexpected equipment failures and transmission line maintenance at the Ellendale site operated by Applied Digital, increased global hash rate, and the April halving event.”

He further added,

“However, I’m pleased to report that transformer issues at the Ellendale site were mitigated and remediated post-quarter end, and our hash rate recovery effort is complete.”

According to Thiel, the company has reached an all-time high installed hash rate of 31.5 exahash in the second quarter and continues to target 50 exahash of energized hash rate by the end of 2024 with additional growth in 2025.

What lies ahead?

As Marathon Digital adjusts to higher costs and technical issues, its ability to innovate while managing these challenges will be crucial.

Henceforth, the company’s future success will depend on how well it balances these factors in the evolving crypto market.

- Marathon’s hash rate surged 78%, but Bitcoin production fell by 30%.

- Despite higher revenue, earnings missed forecasts due to rising costs and technical issues.

Following its recent acquisition of $100 million in Bitcoin [BTC], Marathon Digital Holdings [MARA], the largest BTC mining firm, reported its second-quarter earnings, which fell short of Wall Street projections.

This led to an 8% drop in its share price.

Marathon Digital Q2 results

The company’s press release highlighted a notable 78% increase in hash rate, reaching 31.5 EH/s in Q2 2024 compared to 17.7 EH/s in Q2 2023.

Despite this growth in computing power, Marathon Digital’s Bitcoin production decreased by 30%, with 2,058 BTC mined in Q2 2024, down from 2,941 BTC the previous year.

However, in terms of revenue, the firm noted,

“Revenues increased 78% to $145.1 million in Q2 2024 from $81.8 million in Q2 2023.”

Surprisingly, Yahoo Finance data revealed that this figure was approximately 9% below the anticipated $157.9 million forecast by analysts.

As of the latest update, the company’s stock had dropped 7.78%, trading at $18.14.

Source: Google Finance

What happened so far?

That being said, during the quarter, Marathon Digital faced financial pressures due to increased operational costs following the Bitcoin halving event in April.

To manage these costs, the company sold over half of its mined BTC.

Despite a significant increase in the average price of Bitcoin mining compared to the previous year, Marathon’s daily BTC production decreased by 9.3 BTC.

Source: ir.mara.com

This suggests that, although the value of Bitcoin was higher, operational challenges and rising costs impacted their overall mining output and financial strategy.

Execs weighing in

Remarking on the same, Fred Thiel, MARA’s chairman and chief executive officer, said,

“During the second quarter of 2024, our BTC production was impacted by unexpected equipment failures and transmission line maintenance at the Ellendale site operated by Applied Digital, increased global hash rate, and the April halving event.”

He further added,

“However, I’m pleased to report that transformer issues at the Ellendale site were mitigated and remediated post-quarter end, and our hash rate recovery effort is complete.”

According to Thiel, the company has reached an all-time high installed hash rate of 31.5 exahash in the second quarter and continues to target 50 exahash of energized hash rate by the end of 2024 with additional growth in 2025.

What lies ahead?

As Marathon Digital adjusts to higher costs and technical issues, its ability to innovate while managing these challenges will be crucial.

Henceforth, the company’s future success will depend on how well it balances these factors in the evolving crypto market.

what is clomid medication order cheap clomiphene price how to buy generic clomiphene clomid generic brand can i get clomiphene without insurance how to buy generic clomid without dr prescription how can i get generic clomid no prescription

With thanks. Loads of erudition!

I’ll certainly bring to review more.

cost semaglutide 14mg – order cyproheptadine 4 mg pills buy periactin 4 mg without prescription

purchase domperidone – order tetracycline 500mg without prescription order flexeril generic

buy inderal sale – clopidogrel buy online buy methotrexate 5mg generic

buy amoxil paypal – buy valsartan no prescription combivent 100 mcg price

how to buy zithromax – buy zithromax cheap order nebivolol 20mg pills

buy augmentin generic – https://atbioinfo.com/ buy acillin online

buy esomeprazole 20mg online – anexa mate nexium 20mg pills

coumadin 2mg usa – https://coumamide.com/ buy hyzaar generic

order mobic 15mg for sale – https://moboxsin.com/ mobic 15mg for sale

oral deltasone 40mg – https://apreplson.com/ order prednisone generic

male ed pills – fastedtotake ed pills that work

buy amoxil medication – https://combamoxi.com/ cheap amoxil tablets

fluconazole 100mg sale – purchase diflucan generic buy forcan pill

cenforce 100mg for sale – https://cenforcers.com/ brand cenforce 100mg

india pharmacy cialis – https://ciltadgn.com/# pastillas cialis

cialis and grapefruit enhance – https://strongtadafl.com/ tadalafil liquid fda approval date

buy zantac tablets – https://aranitidine.com/# order ranitidine online

sildenafil 100mg price – viagra 100mg street price 100mg viagra cost

This website exceedingly has all of the bumf and facts I needed to this case and didn’t comprehend who to ask. prednisone treatment for asthma

This is a theme which is in to my heart… Many thanks! Quite where can I notice the connection details for questions? que es clomid

Thanks for sharing. It’s top quality. https://ursxdol.com/get-metformin-pills/

More posts like this would prosper the blogosphere more useful. purchase prilosec pills

More delight pieces like this would create the интернет better. aranitidine.com

This is the kind of topic I take advantage of reading. https://ondactone.com/product/domperidone/

Palatable blog you have here.. It’s obdurate to find strong status article like yours these days. I justifiably respect individuals like you! Take guardianship!!

buy ketorolac cheap

Greetings! Jolly gainful recommendation within this article! It’s the scarcely changes which liking make the largest changes. Thanks a portion quest of sharing! https://myvisualdatabase.com/forum/profile.php?id=118017

buy dapagliflozin 10 mg online – on this site how to buy dapagliflozin

buy orlistat for sale – https://asacostat.com/ buy orlistat 120mg generic