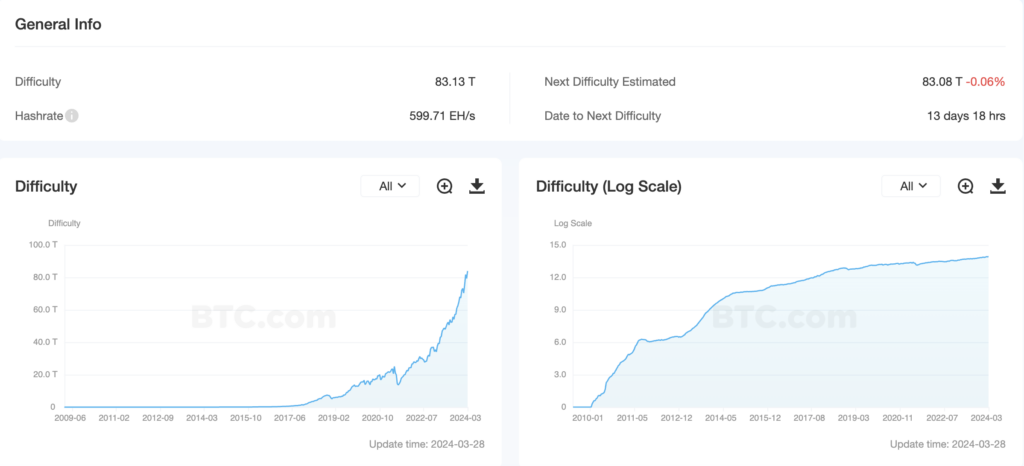

As a result of the next recalculation, the difficulty of Bitcoin mining decreased by 0.97%, with an indicator of 83.13 T.

The average hashrate for the period since the previous value change was 599.71 EH/s. The range between blocks is 10 minutes and 7 seconds. Mining difficulty determines the required total hardware capacity for mining Bitcoin (BTC). An increase in this indicator brings the halving date of the first cryptocurrency closer. Under certain conditions, it may occur in April 2024.

Source: Btc.com

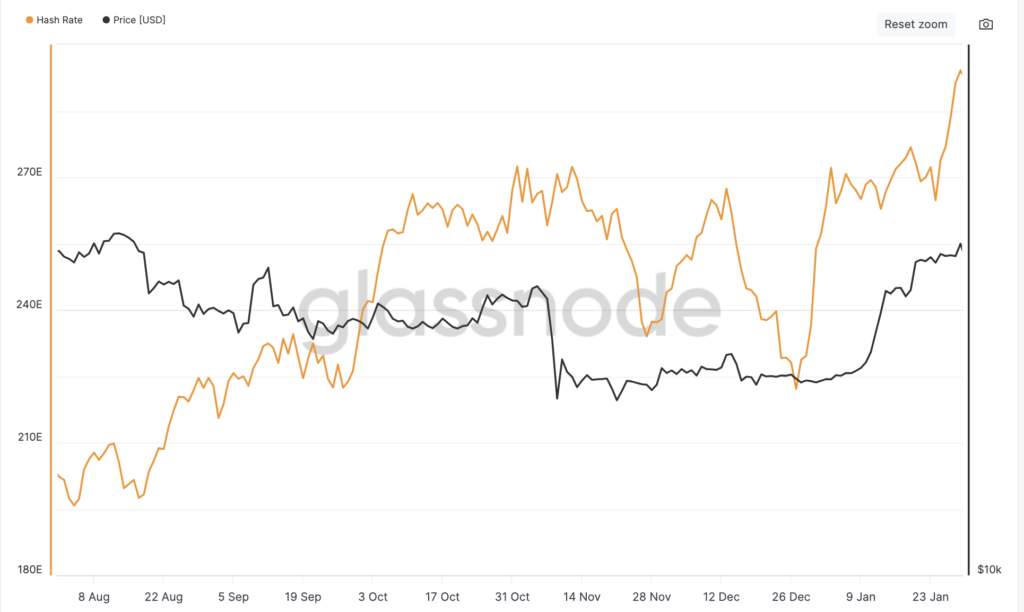

According to Glassnode, the seven-day moving average peaked at 614.9 EH/s on March 24. After that, it corrected to 586.1 EH/s.

Source: Glassnode

According to the Hashrate Index, the hash price has increased over the past 24 hours from $108 per PH per day to $110.

Source: Hashrate Index

On March 14, the difficulty of Bitcoin mining updated its historical maximum and reached 83.95 T. Since the last change date, the indicator has increased by 5.79%, and the average hashrate in the Bitcoin network reached 600.72 EH/s.

Meanwhile, Bitfinex experts believe that institutional funding of public companies has disadvantaged individual and small miners and could have long-term effects on network dynamics.

Bitfinex’s experts noted that the influx of capital and the “professionalization” of mining operations led to an increase in hashrate, thereby increasing the network’s overall security and stability. Thus, Wall Street investor funding in corporate mining has fundamentally changed the network’s incentive structure.

You might also like: Bitcoin mining firms ship equipment overseas ahead of halving

clomiphene one fallopian tube cheap clomiphene online buying generic clomiphene pill buy cheap clomiphene tablets how to get cheap clomid without dr prescription can i order generic clomid without rx buy clomid without dr prescription

This is the make of delivery I find helpful.

This is a topic which is near to my callousness… Myriad thanks! Unerringly where can I upon the contact details due to the fact that questions?

azithromycin order – tinidazole 300mg generic flagyl sale

order rybelsus 14 mg online cheap – order semaglutide 14mg sale buy cyproheptadine pills for sale

motilium us – order domperidone 10mg online cheap order cyclobenzaprine sale

oral propranolol – order methotrexate 2.5mg generic methotrexate 2.5mg tablet

buy azithromycin medication – brand tindamax buy nebivolol pills for sale

brand clavulanate – atbioinfo ampicillin for sale online

esomeprazole 40mg sale – nexium to us buy esomeprazole 40mg sale

order generic coumadin – https://coumamide.com/ losartan 25mg usa

buy mobic 15mg pills – https://moboxsin.com/ mobic 7.5mg brand

deltasone 10mg oral – aprep lson buy deltasone pill

buy generic ed pills for sale – https://fastedtotake.com/ buy erectile dysfunction medication

amoxicillin us – buy amoxil no prescription purchase amoxil for sale

purchase diflucan generic – https://gpdifluca.com/# fluconazole 100mg without prescription

buy cenforce online cheap – https://cenforcers.com/# cenforce 100mg pills

cheap canadian cialis – https://ciltadgn.com/ cialis substitute

generic zantac 300mg – https://aranitidine.com/# ranitidine tablet

cialis contraindications – https://strongtadafl.com/ cialis generic overnite shipping

Thanks an eye to sharing. It’s first quality. https://gnolvade.com/

buy kamagra viagra – https://strongvpls.com/ generic viagra 50mg

The thoroughness in this piece is noteworthy. amoxil order online

Proof blog you possess here.. It’s hard to espy great worth article like yours these days. I truly recognize individuals like you! Go through vigilance!! order vardenafil 10mg pill

With thanks. Loads of expertise! https://prohnrg.com/product/orlistat-pills-di/

Thanks on putting this up. It’s understandably done. https://aranitidine.com/fr/en_france_xenical/

This is a theme which is virtually to my fundamentals… Numberless thanks! Unerringly where can I find the acquaintance details an eye to questions? https://ondactone.com/simvastatin/

Good blog you be undergoing here.. It’s hard to espy high worth belles-lettres like yours these days. I truly recognize individuals like you! Rent guardianship!!

purchase clopidogrel pills

More articles like this would remedy the blogosphere richer. http://iawbs.com/home.php?mod=space&uid=914824

forxiga tablet – buy cheap forxiga buy dapagliflozin cheap

I couldn’t weather commenting. Profoundly written! http://www.gtcm.info/home.php?mod=space&uid=1169417