- Bitcoin miners faced selling pressure as revenues declined.

- Inflows for Bitcoin ETFs grew significantly.

Bitcoin [BTC] has remained stagnant at the $62,000 price level for quite some time. However, things could take a turn for the worse for the king coin going forward.

Miners face the heat

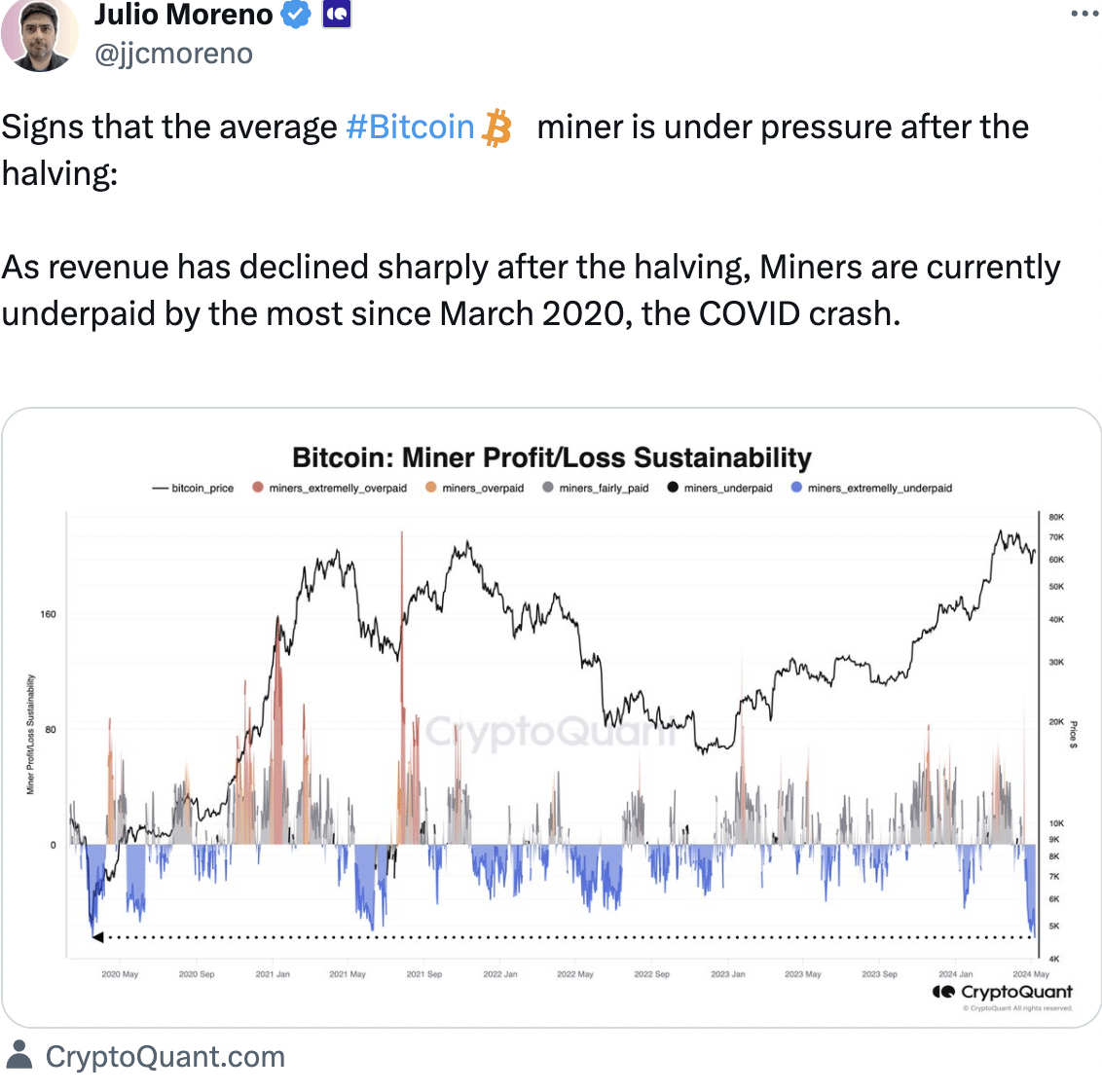

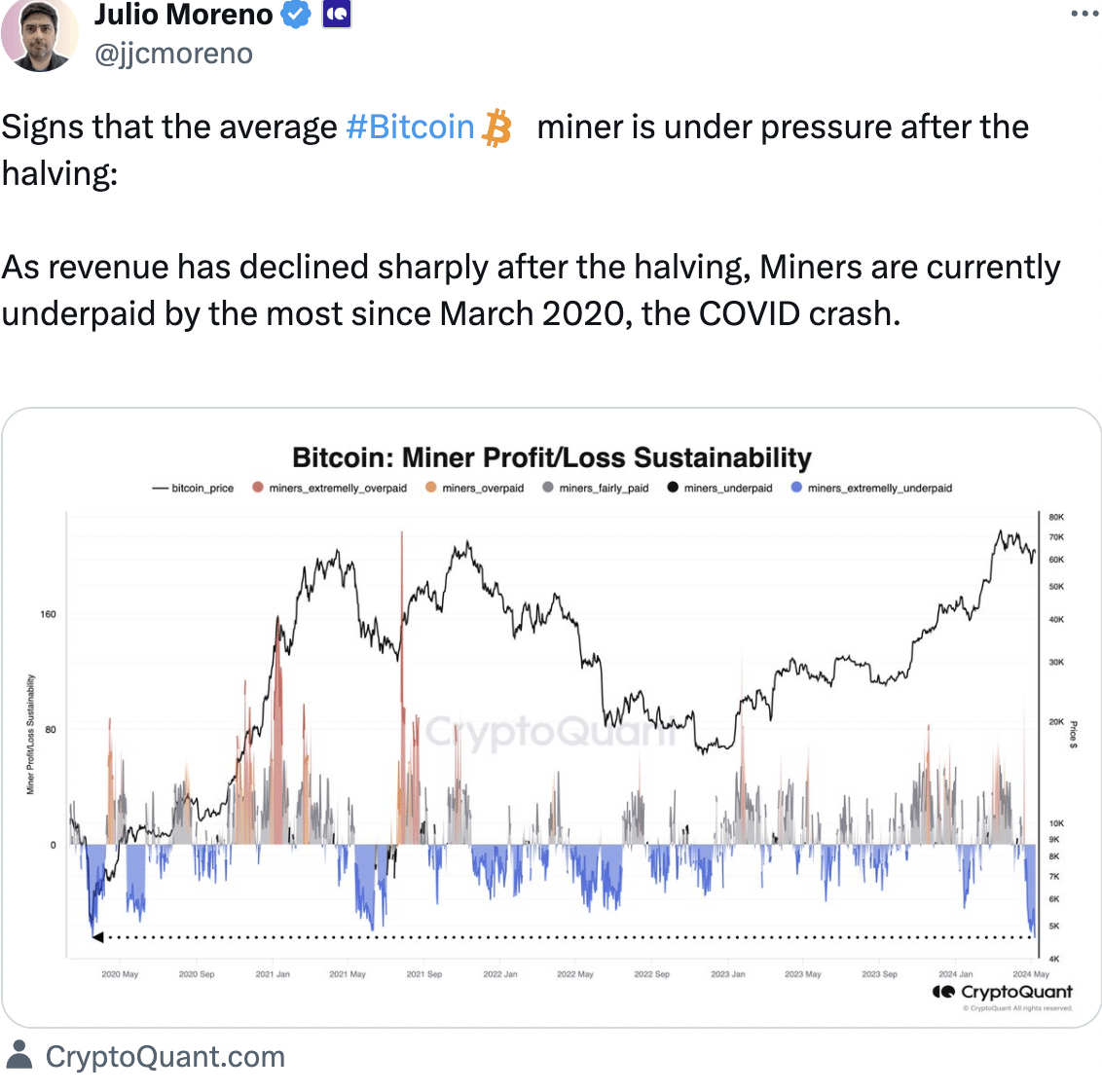

According to recent data, there were clear indications that the average Bitcoin miner is feeling the strain post-halving.

With a significant drop in revenue since the halving, miners are currently facing the most challenging conditions they’ve encountered since March 2020, during the COVID-19 crash.

This pressure is evident in the declining hashrate, which has prompted the network to undergo its fourth negative difficulty adjustment of the year.

The latest adjustment, standing at -5.6%, marks the largest negative change since November 2022, following the FTX collapse.

If things continue to get worse, miners will be forced to sell their BTC holdings to remain profitable.

Source: X

Inflows on the rise

Even though the state of BTC looks dire due to the state of miners, things looked better for Bitcoin on Wall Street.

Recent data revealed that US Spot Bitcoin ETFs experienced a total net inflow of $11.78 billion, with a daily net inflow of $12 million recorded on the 8th of May.

Among these ETFs, Bitwise’s BITB stood out as the sole ETF with a net inflow, whereas both Blackrock’s IBIT and Grayscale’s GBTC saw no net flow during the same period.

Moreover, the Grayscale Bitcoin Trust ETF (GBTC) registered zero net flow on the 8th of May and recorded a total net outflow of $17.5 billion.

In Asia, the latest statistics indicate that HK Spot Bitcoin ETFs have garnered a total net inflow of $273.6 million since their launch on the 30th of April, with a daily net inflow of $6.3 million reported on the 8th of May.

On the other hand, HK Spot Ether ETFs saw a total net inflow of $50.6 million since their launch on the 30th of April, but they experienced a daily net outflow of $1.9 million on the 8th of May.

Source: X

Read Bitcoin’s [BTC] Price Prediction 2024-25

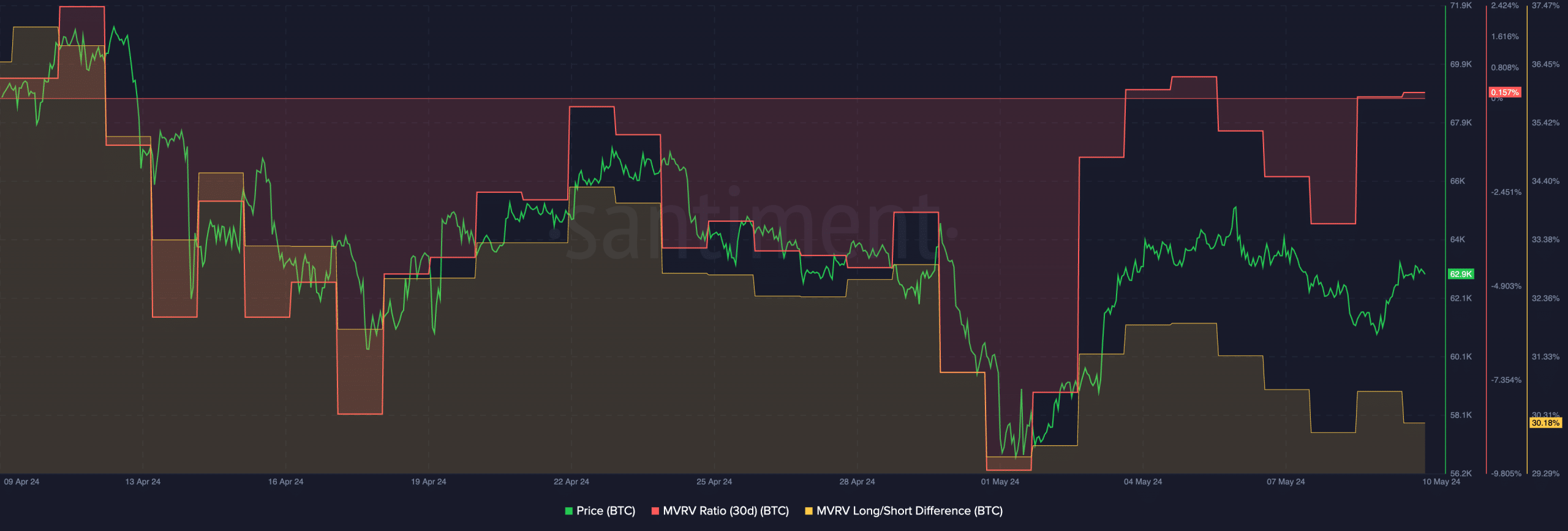

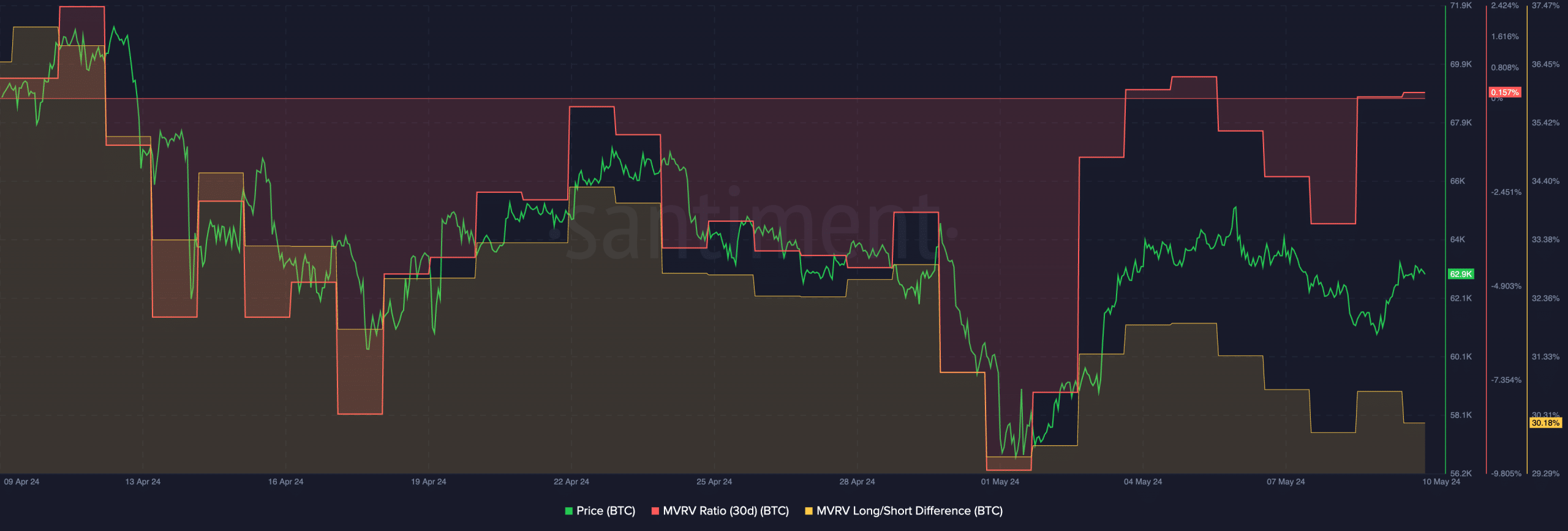

At press time, BTC was trading at $62,945.16 and its price had grown by 3.40% in the last 24 hours. The MVRV ratio for BTC had grown due to the surge in price.

This meant that most addresses holding BTC had turned profitable. As profitability for addresses increases, so does the incentive for holders to sell and indulge in profit-taking.

Source: Santiment

- Bitcoin miners faced selling pressure as revenues declined.

- Inflows for Bitcoin ETFs grew significantly.

Bitcoin [BTC] has remained stagnant at the $62,000 price level for quite some time. However, things could take a turn for the worse for the king coin going forward.

Miners face the heat

According to recent data, there were clear indications that the average Bitcoin miner is feeling the strain post-halving.

With a significant drop in revenue since the halving, miners are currently facing the most challenging conditions they’ve encountered since March 2020, during the COVID-19 crash.

This pressure is evident in the declining hashrate, which has prompted the network to undergo its fourth negative difficulty adjustment of the year.

The latest adjustment, standing at -5.6%, marks the largest negative change since November 2022, following the FTX collapse.

If things continue to get worse, miners will be forced to sell their BTC holdings to remain profitable.

Source: X

Inflows on the rise

Even though the state of BTC looks dire due to the state of miners, things looked better for Bitcoin on Wall Street.

Recent data revealed that US Spot Bitcoin ETFs experienced a total net inflow of $11.78 billion, with a daily net inflow of $12 million recorded on the 8th of May.

Among these ETFs, Bitwise’s BITB stood out as the sole ETF with a net inflow, whereas both Blackrock’s IBIT and Grayscale’s GBTC saw no net flow during the same period.

Moreover, the Grayscale Bitcoin Trust ETF (GBTC) registered zero net flow on the 8th of May and recorded a total net outflow of $17.5 billion.

In Asia, the latest statistics indicate that HK Spot Bitcoin ETFs have garnered a total net inflow of $273.6 million since their launch on the 30th of April, with a daily net inflow of $6.3 million reported on the 8th of May.

On the other hand, HK Spot Ether ETFs saw a total net inflow of $50.6 million since their launch on the 30th of April, but they experienced a daily net outflow of $1.9 million on the 8th of May.

Source: X

Read Bitcoin’s [BTC] Price Prediction 2024-25

At press time, BTC was trading at $62,945.16 and its price had grown by 3.40% in the last 24 hours. The MVRV ratio for BTC had grown due to the surge in price.

This meant that most addresses holding BTC had turned profitable. As profitability for addresses increases, so does the incentive for holders to sell and indulge in profit-taking.

Source: Santiment

cost of generic clomiphene without rx can you get clomiphene for sale where can i get generic clomiphene without prescription generic clomid without dr prescription cost of clomid at cvs cost of cheap clomid without a prescription can i get cheap clomid without dr prescription

More posts like this would create the online elbow-room more useful.

Greetings! Very productive recommendation within this article! It’s the petty changes which will turn the largest changes. Thanks a a quantity for sharing!

zithromax 500mg drug – sumycin 250mg over the counter generic metronidazole

buy semaglutide 14 mg generic – order rybelsus 14mg generic order cyproheptadine 4 mg pills

order domperidone 10mg for sale – cheap cyclobenzaprine how to get flexeril without a prescription

buy propranolol pills – methotrexate 10mg brand oral methotrexate 10mg

buy clavulanate pills for sale – atbioinfo.com acillin sale

nexium 40mg pill – https://anexamate.com/ how to get nexium without a prescription

where can i buy warfarin – cou mamide cozaar 50mg cheap

buy mobic 7.5mg sale – https://moboxsin.com/ how to buy meloxicam

deltasone 10mg canada – https://apreplson.com/ buy deltasone 40mg generic

buy generic ed pills over the counter – buy ed pills medication buy ed pills online

amoxil order – https://combamoxi.com/ buy amoxil pills for sale

buy diflucan – flucoan diflucan 200mg over the counter

cenforce buy online – cenforce 50mg brand cenforce order online

cialis black 800 to buy in the uk one pill – https://ciltadgn.com/# cialis canadian pharmacy ezzz

order zantac 150mg online – this ranitidine 300mg tablet

cialis black review – click is tadalafil as effective as cialis

The reconditeness in this serving is exceptional. https://gnolvade.com/

sildenafil 50 mg coupon – https://strongvpls.com/# viagra women sale uk

This is the kind of writing I positively appreciate. https://buyfastonl.com/azithromycin.html

This is the description of serenity I take advantage of reading. https://ursxdol.com/doxycycline-antibiotic/

I am in truth happy to glance at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://prohnrg.com/product/priligy-dapoxetine-pills/

Good blog you have here.. It’s obdurate to espy strong calibre script like yours these days. I honestly recognize individuals like you! Go through vigilance!! https://aranitidine.com/fr/modalert-en-france/

Thanks on putting this up. It’s evidently done. https://ondactone.com/product/domperidone/