- Bitcoin miners continue to hold on to their BTC despite market volatility.

- Interest in Bitcoin ETFs plummets.

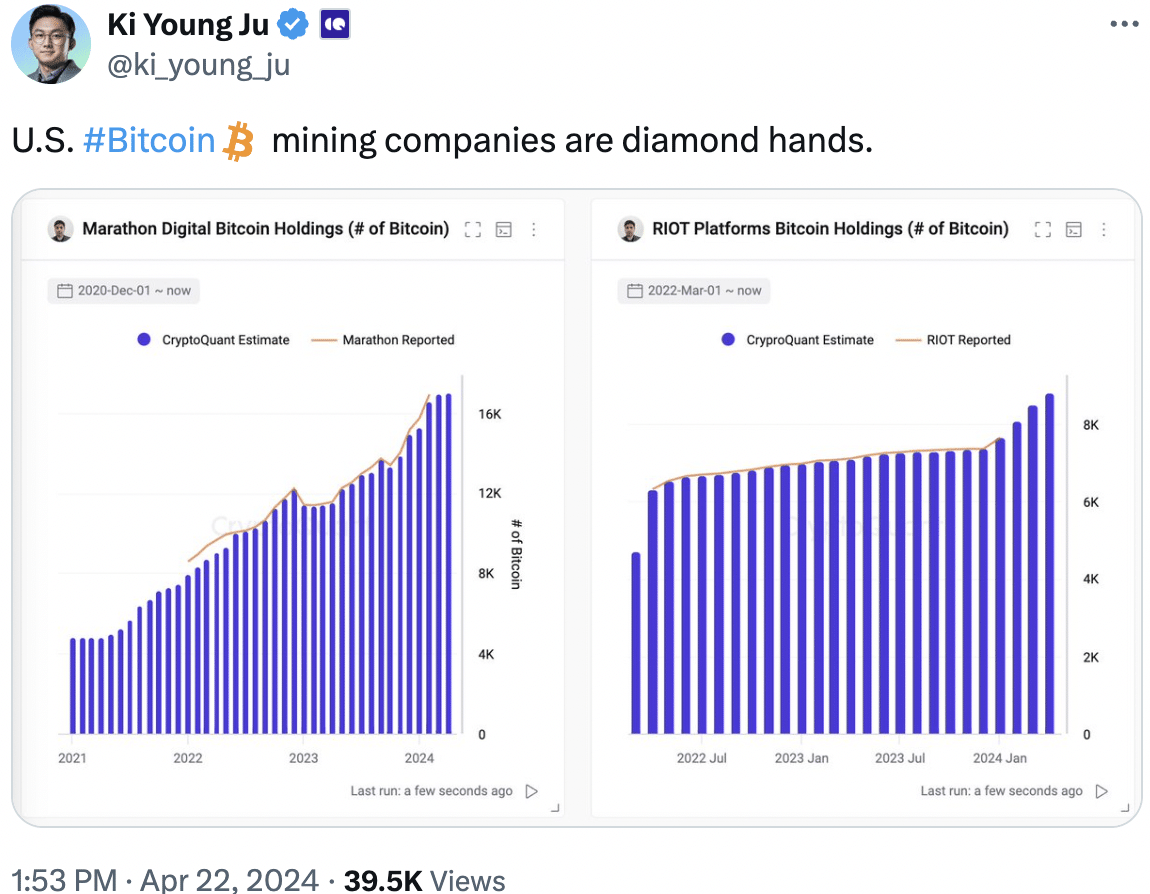

Despite the volatility faced by Bitcoin [BTC] in the last few months, some mining firms have shown resilience in the face of uncertainty.

Miners persist

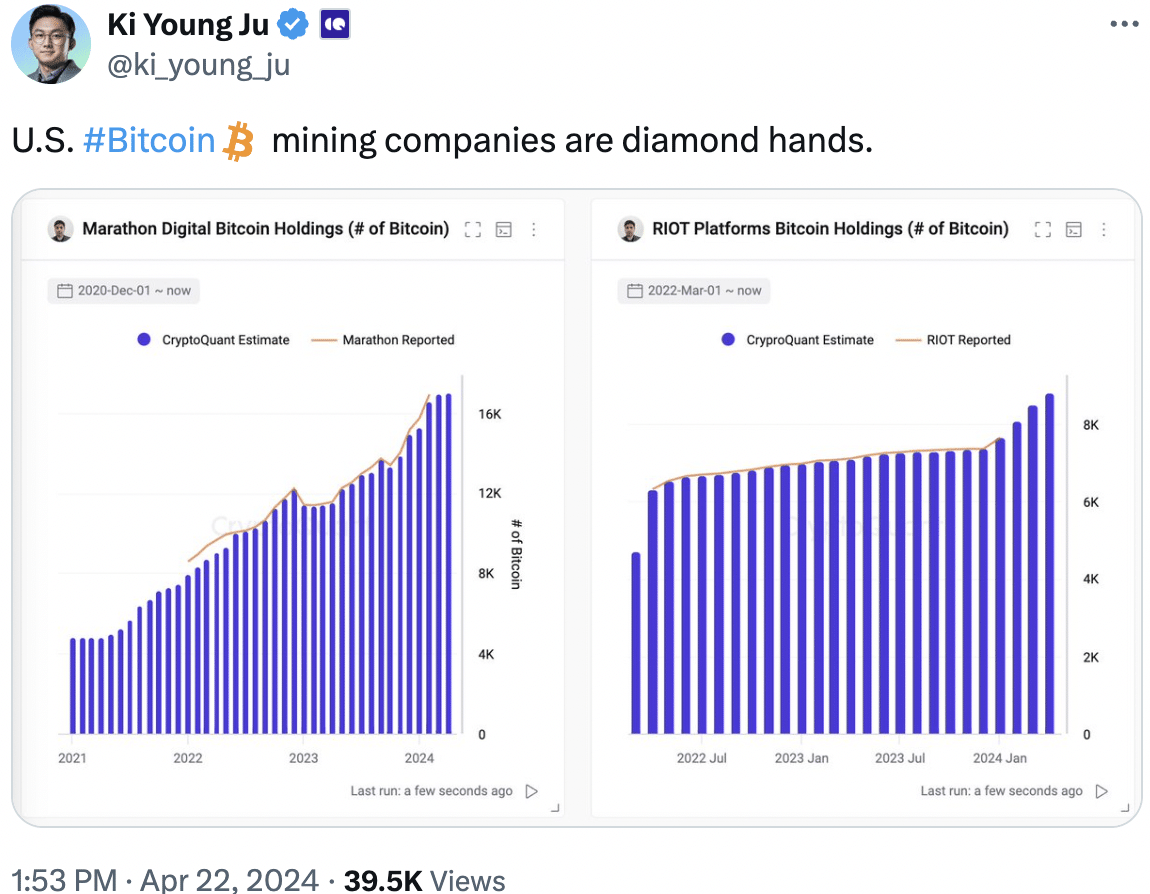

According to new data, U.S. Bitcoin mining companies were diamond hands and refused to sell any of their BTC. This indicated that the sentiment amidst most mining companies was positive and they won’t be selling their holdings anytime soon.

This meant the selling pressure on Bitcoin would reduce in the future.

Source: X

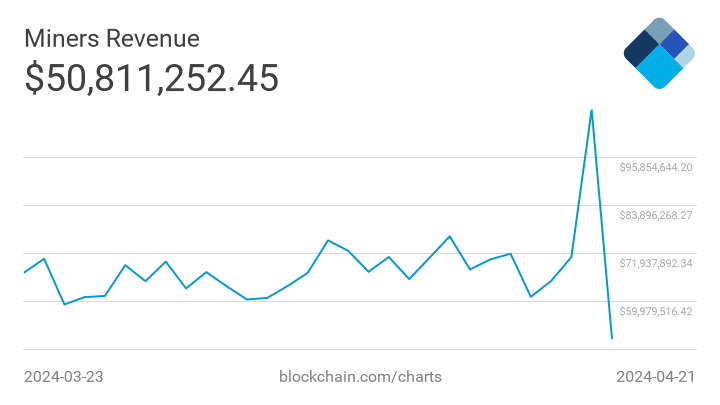

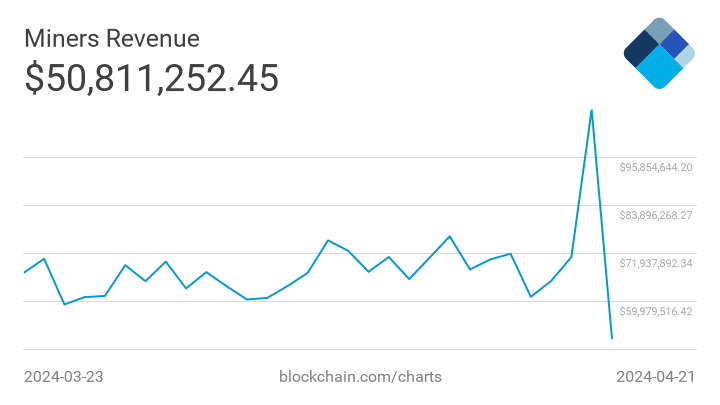

Additionally, the revenue generated by miners also increased a lot during this period, attributed to the rising interest in Runes. Coupled with that, the hashrate for BTC also grew.

A rising hashrate for Bitcoin means the network is more secure, but also more competitive for miners. They’ll need more powerful equipment and potentially face lower individual profits.

Source: Blockchain

Despite these positive factors, there were some problems that could plague the Bitcoin ecosystem.

ETF hype fades

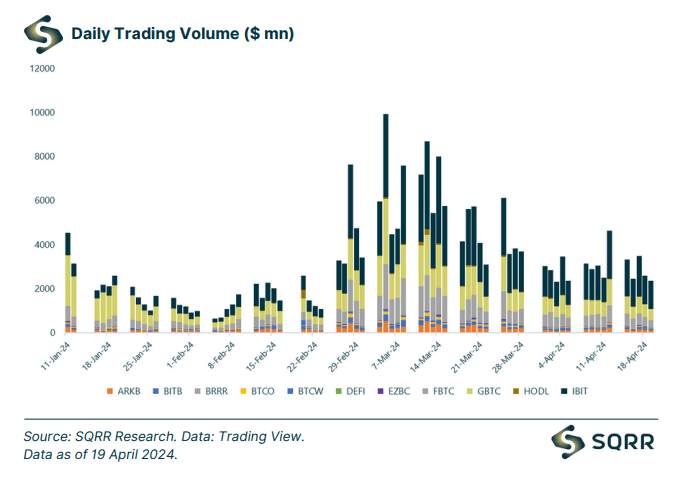

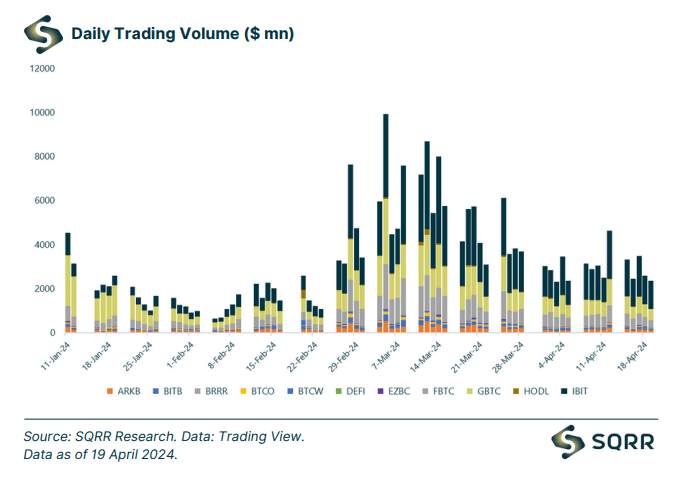

Recent data highlighted trends in Bitcoin exchange-traded funds (ETFs) over the past week. We’ve seen a significant shift towards net outflows, with a combined total of $319 million exiting all Bitcoin ETFs.

Grayscale’s Bitcoin Investment Trust (GBTC) was a major driver of this decline.

In contrast, inflows into ETFs had previously reached a peak of $12.7 billion, but now appear to have plateaued. This suggests a potential cooling off in investor sentiment towards BTC ETFs.

Furthermore, the data indicates a decline in trading activity for these funds. Weekly trading volumes have dropped by 12% compared to the prior week. This could be a sign of increased investor caution or a wait-and- see approach before the upcoming Bitcoin halving event.

Finally, the total Assets Under Management (AUM) for BTC ETFs has also dipped.

The current AUM sits at $53 billion, reflecting a 10% decrease from the previous week. This aligns with the trend of net outflows and potentially indicates a decline in overall investor holdings in Bitcoin through these ETFs.

Source: SQRR.xyz

Read Bitcoin’s [BTC] Price Prediction 2024-25

This declining interest in BTC ETFs could indicate that non crypto native investors maybe losing interest in the king coin. At press time, BTC was trading at $65,965.95 and its price had grown by 1.26%.

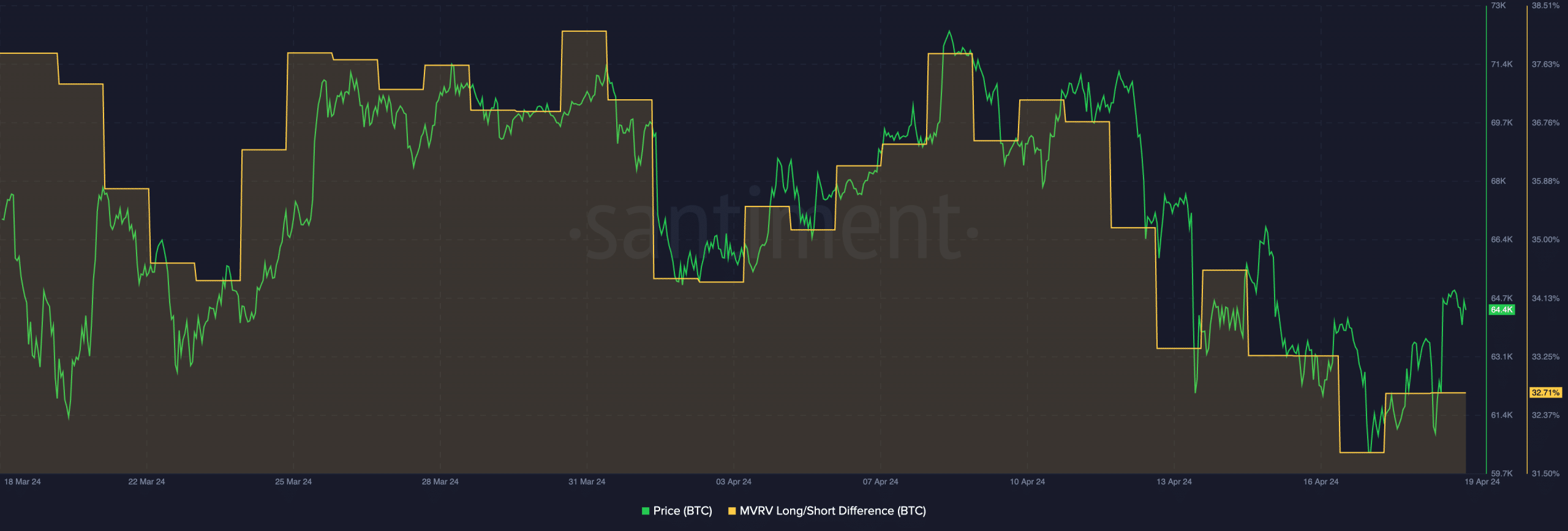

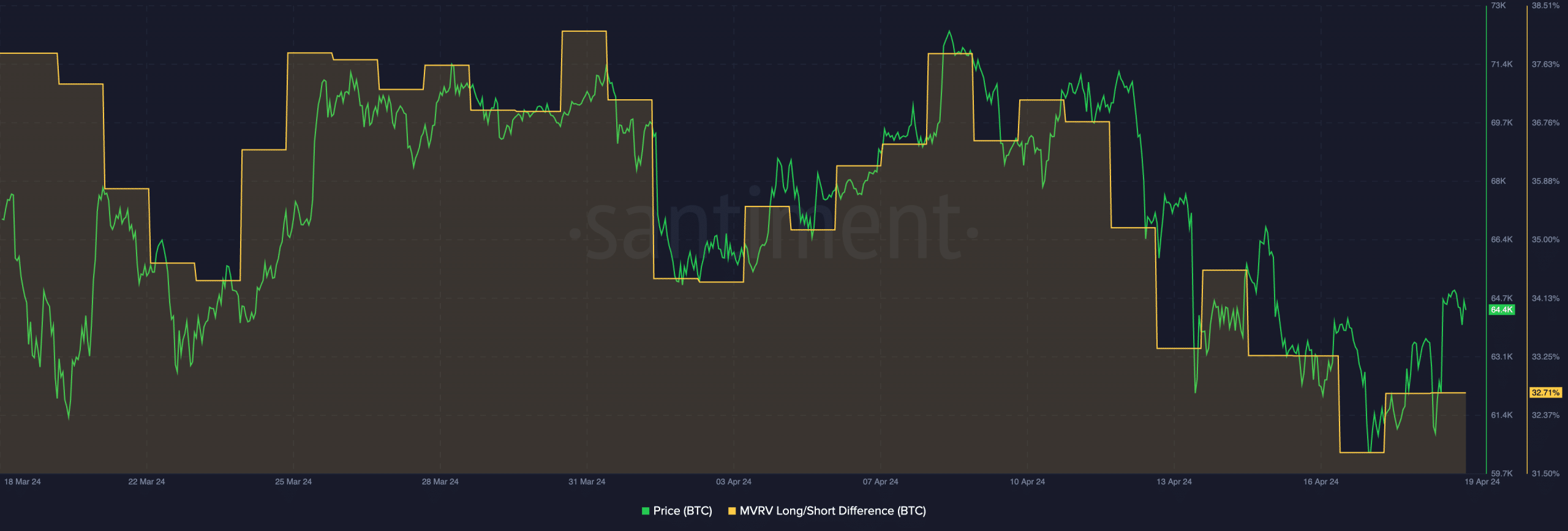

Moreover, Long/Short difference of BTC had declined indicating that the number of long-term holders holding BTC had fallen.

Source: Santiment

- Bitcoin miners continue to hold on to their BTC despite market volatility.

- Interest in Bitcoin ETFs plummets.

Despite the volatility faced by Bitcoin [BTC] in the last few months, some mining firms have shown resilience in the face of uncertainty.

Miners persist

According to new data, U.S. Bitcoin mining companies were diamond hands and refused to sell any of their BTC. This indicated that the sentiment amidst most mining companies was positive and they won’t be selling their holdings anytime soon.

This meant the selling pressure on Bitcoin would reduce in the future.

Source: X

Additionally, the revenue generated by miners also increased a lot during this period, attributed to the rising interest in Runes. Coupled with that, the hashrate for BTC also grew.

A rising hashrate for Bitcoin means the network is more secure, but also more competitive for miners. They’ll need more powerful equipment and potentially face lower individual profits.

Source: Blockchain

Despite these positive factors, there were some problems that could plague the Bitcoin ecosystem.

ETF hype fades

Recent data highlighted trends in Bitcoin exchange-traded funds (ETFs) over the past week. We’ve seen a significant shift towards net outflows, with a combined total of $319 million exiting all Bitcoin ETFs.

Grayscale’s Bitcoin Investment Trust (GBTC) was a major driver of this decline.

In contrast, inflows into ETFs had previously reached a peak of $12.7 billion, but now appear to have plateaued. This suggests a potential cooling off in investor sentiment towards BTC ETFs.

Furthermore, the data indicates a decline in trading activity for these funds. Weekly trading volumes have dropped by 12% compared to the prior week. This could be a sign of increased investor caution or a wait-and- see approach before the upcoming Bitcoin halving event.

Finally, the total Assets Under Management (AUM) for BTC ETFs has also dipped.

The current AUM sits at $53 billion, reflecting a 10% decrease from the previous week. This aligns with the trend of net outflows and potentially indicates a decline in overall investor holdings in Bitcoin through these ETFs.

Source: SQRR.xyz

Read Bitcoin’s [BTC] Price Prediction 2024-25

This declining interest in BTC ETFs could indicate that non crypto native investors maybe losing interest in the king coin. At press time, BTC was trading at $65,965.95 and its price had grown by 1.26%.

Moreover, Long/Short difference of BTC had declined indicating that the number of long-term holders holding BTC had fallen.

Source: Santiment

order generic clomid without rx where to get cheap clomid tablets can you buy cheap clomiphene online where to buy cheap clomiphene without prescription where can i buy clomiphene no prescription can i get clomiphene without insurance order clomid without insurance

I couldn’t hold back commenting. Warmly written!

This website really has all of the information and facts I needed to this subject and didn’t identify who to ask.

azithromycin 500mg drug – buy generic tindamax online metronidazole 200mg for sale

buy semaglutide 14mg pill – order cyproheptadine for sale order periactin online cheap

where can i buy motilium – order domperidone 10mg for sale buy generic cyclobenzaprine

buy cheap generic propranolol – order methotrexate for sale order methotrexate 2.5mg pill

purchase azithromycin – order tinidazole 300mg generic cost nebivolol 5mg

buy cheap augmentin – atbioinfo.com acillin pills

buy esomeprazole 20mg – https://anexamate.com/ esomeprazole 40mg uk

warfarin 2mg uk – anticoagulant buy generic hyzaar

order meloxicam 7.5mg sale – https://moboxsin.com/ meloxicam 7.5mg drug

buy generic prednisone 20mg – https://apreplson.com/ deltasone order

gnc ed pills – fast ed to take site buy ed medication

buy diflucan 200mg – site cheap diflucan 200mg

cheap cenforce 100mg – site purchase cenforce online

cialis and blood pressure – site Cialis Online Access – Trusted Solutions for Men’s | Tadal Access

zantac 150mg price – buy zantac without a prescription zantac 150mg drug

what happens if a woman takes cialis – https://strongtadafl.com/# how to take liquid tadalafil

More content pieces like this would make the web better. this

cost of sildenafil 50mg – https://strongvpls.com/ buy viagra

More posts like this would force the blogosphere more useful. order lasix online cheap

Thanks on putting this up. It’s evidently done. https://ursxdol.com/amoxicillin-antibiotic/

This is the kind of criticism I positively appreciate. https://aranitidine.com/fr/sibelium/

More posts like this would force the blogosphere more useful. https://ondactone.com/spironolactone/

More articles like this would pretence of the blogosphere richer.

order cheap tetracycline prices

This is the tolerant of delivery I find helpful. https://www.kouminkan.info/cgi-bin/mt/mt4i.cgi?id=24&cat=392&mode=redirect&ref_eid=2865&url=https://hackmd.io/@adip/S1nI1FQ_xe

This is a theme which is near to my heart… Myriad thanks! Faithfully where can I lay one’s hands on the phone details an eye to questions? https://sportavesti.ru/forums/users/mwuat-2/

purchase dapagliflozin generic – janozin.com purchase dapagliflozin sale

buy xenical medication – https://asacostat.com/# xenical 120mg uk

More articles like this would remedy the blogosphere richer. http://www.dbgjjs.com/home.php?mod=space&uid=532987