The recent surge in ordinal inscriptions on the Bitcoin network has been good news for miners but not so good for users. As demand for block space increased over the weekend, transaction fees skyrocketed, netting miners more money.

Over the weekend, Bitcoin miners were collecting more in transaction fees than in newly generated BTC. Moreover, mining profitability has surged to its highest level since May 2022.

Bitcoin Miners Making a Mint

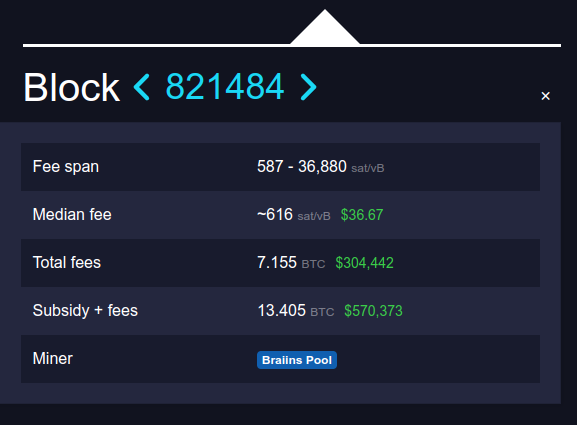

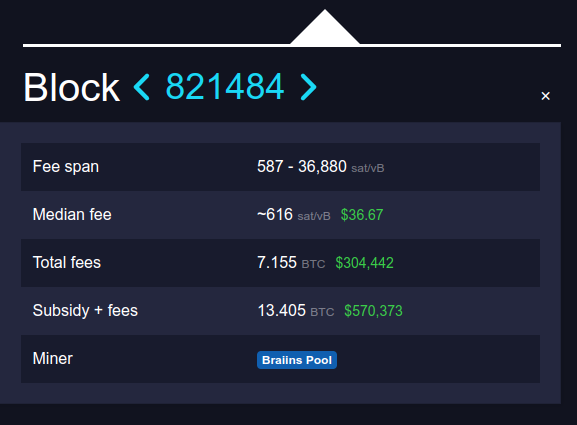

On December 16, Casa HODL co-founder Jameson Lopp posted an example of a block where Bitcoin miners were making a mint.

The block netted the Braiins Pool miner a whopping subsidy and fee of 13.4 BTC worth around $570,000 at the time.

Block 821484. Source: X/@Lopp

Bitcoin educator Kashif Raza commented that it was more incentive for miners:

“Ordinals have turned out to be a blessing for miners but for retail, its a nightmare to send micro transactions.”

“This means that more miners will deploy machines to gain maximum out of block rewards,” he added.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

According to BitInfoCharts, average BTC transaction fees have surged to their highest levels since April 2021. It costs as much as $37 for a Bitcoin transaction over the weekend.

“How many people earn less than $37 daily?” asked ‘Kawaii Crypto,’ who added that it was around 5.39 billion people.

“TWO THIRDS of the world’s population are currently excluded from sending a “fast” Bitcoin tx unless they want to spend more than a day’s income.”

Glassnode analyst ‘Checkɱate’ opined that the take was ridiculous. “It would take 63 years for all 8 billion people to transact ONCE,” he added.

Cryptographer Adam Back said that ordinals were here to stay, so people should stop complaining about them.

“Trying to stop them and they’ll do it in worse ways. The high fees drive adoption of layer-2 and force innovation. So relax and build things.”

Hash Price Skyrockets

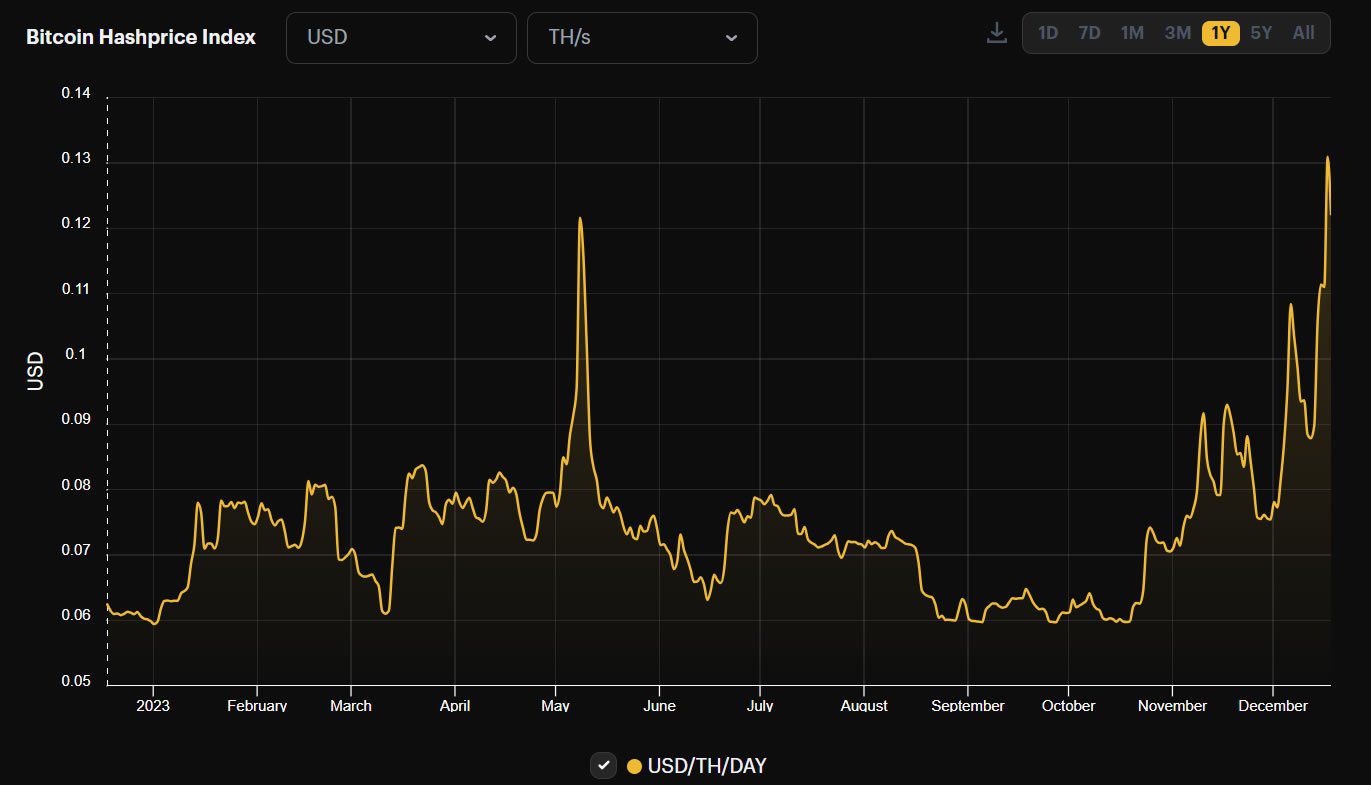

Nevertheless, Bitcoin miners are going to have a happy holiday season. Profitability, or hash price, has surged to a 19-month high, even higher than the last ordinals craze in May.

On December 17, the hash price spiked to $0.130 per TH/s/day, according to Hashrate Index. The last time it was higher than this was in May 2022. However, it is still down from its all-time high of $0.400 in June 2019.

Bitcoin hash price 12 months. Source: HashrateIndex

Hashprice is a function of four inputs, network difficulty, Bitcoin’s price, block subsidy, and transaction fees.

Bitcoin prices were in retreat at the time of writing, falling 2% on the day to $41,124 as markets continued to pull back.

can i buy clomid without dr prescription order generic clomid without rxРіРѕРІРѕСЂРёС‚: cost of generic clomid online clomid generic name generic clomid walmart how to buy clomiphene without dr prescription buy cheap clomiphene tablets

More articles like this would remedy the blogosphere richer.

This is the kind of criticism I rightly appreciate.

azithromycin ca – buy generic flagyl purchase flagyl without prescription

order generic rybelsus – purchase semaglutide online cheap order periactin 4 mg pill

how to buy motilium – buy motilium without prescription flexeril generic

azithromycin generic – zithromax without prescription brand nebivolol 20mg

amoxiclav oral – https://atbioinfo.com/ buy generic ampicillin online

warfarin 2mg brand – https://coumamide.com/ losartan 25mg oral

mobic 15mg for sale – https://moboxsin.com/ buy generic meloxicam over the counter

deltasone 20mg price – apreplson.com cost deltasone 20mg

best ed medication – https://fastedtotake.com/ ed pills gnc

buy diflucan 200mg pill – https://gpdifluca.com/ buy cheap generic diflucan

cenforce 50mg for sale – this order cenforce 100mg generic

cialis canadian pharmacy – on this site cialis at canadian pharmacy

cialis at canadian pharmacy – https://strongtadafl.com/# does tadalafil lower blood pressure

buy zantac 300mg pill – https://aranitidine.com/ order zantac 150mg sale

order viagra toronto – https://strongvpls.com/# viagra men cheap

More posts like this would add up to the online play more useful. tamoxifen brand

Greetings! Extremely gainful par‘nesis within this article! It’s the petty changes which will obtain the largest changes. Thanks a a quantity quest of sharing! https://buyfastonl.com/

This is the kind of content I have reading. https://prohnrg.com/product/orlistat-pills-di/

More articles like this would remedy the blogosphere richer. comment utiliser fildena 50

This is the big-hearted of writing I rightly appreciate. https://ondactone.com/product/domperidone/

The reconditeness in this piece is exceptional.

order tamsulosin pills

Thanks towards putting this up. It’s understandably done. http://www.gearcup.cn/home.php?mod=space&uid=145813

forxiga over the counter – https://janozin.com/ order dapagliflozin online cheap

xenical order – https://asacostat.com/ how to get orlistat without a prescription