Cipher Mining and Stronghold Digital started the new year by announcing significant expansions in their Bitcoin mining capabilities, scaling up operations in response to changing market dynamics. These developments come as Bitcoin miners adapt to an evolving landscape where transaction fees, bolstered by new technologies like Inscriptions, are increasingly vital in revenue generation.

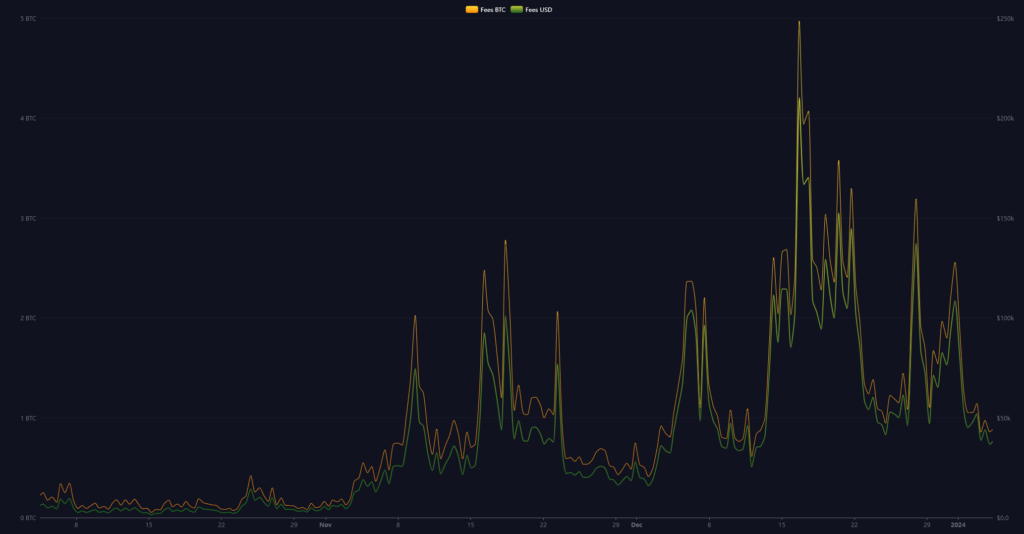

Bitcoin transaction fees peaked at almost $40 in mid-December, leading to increased revenue for miners, indicating a potential haven ahead of the 2024 halving.

Bitcoin miners earn revenue in two primary ways: by generating new Bitcoin through mining and by collecting transaction fees from processing transactions on the Bitcoin network. As the Bitcoin protocol is designed to halve the mining reward at specific intervals, the importance of transaction fees as a source of revenue for miners increases over time.

When transaction fees increase, this directly boosts miners’ income. For instance, high transaction fees have led to significant gains for Bitcoin miners. A recent surge in transaction fees has been driven by increased network activity, such as the popularity of Ordinals Bitcoin Inscriptions.

The increase in transaction fees is a response to network congestion. As the Bitcoin network becomes more congested with increased mempool size bloat due to the size and volume of Ordinals, users are willing to pay higher fees to ensure their transactions are processed and confirmed promptly. This dynamic creates a market where miners can prioritize transactions with higher fees, thereby increasing their earnings.

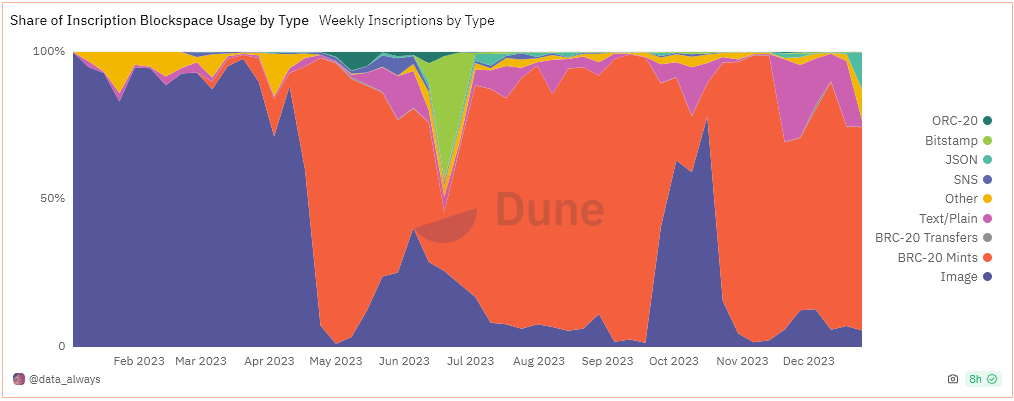

The chart below shows the share of blockspace taken up by each data type for Inscriptions, indicating BRC-20 tokens surpassed images around May 2023. BRC-20 tokens use, on average, 60 bytes of space compared to between 300 bytes to 15kb used by images.

In the long term, as the mining reward continues to diminish, transaction fees are expected to become an increasingly important source of revenue for miners. This shift is anticipated to ensure the long-term economic viability and security of the Bitcoin network.

Cipher and Stronghold new miner acquisition.

Cipher Mining Inc. revealed plans for a 60 MW expansion at its Bear and Chief Joint Venture Data Centers, coupled with purchasing 16,700 new Avalon A1466 miners from Canaan. This increase, slated for the second quarter of 2024, is set to enhance Cipher’s self-mining capacity to approximately 8.4 EH/s. Tyler Page, CEO of Cipher, emphasized the significance of this expansion for the company’s growth, particularly as the industry approaches the Bitcoin halving event in 2024. page confirmed,

“We look forward to adding another 2.5 EH/s of their machines to our joint venture data centers in Texas with this purchase.”

Stronghold Digital Mining Inc. also announced its acquisition of 5,000 Bitcoin miners, aiming to add nearly 1 EH/s to its mining capability. The additional miners will be a mix of Bitmain, MicroBT, and Caanan miners, including 2,800 Bitmain S19K Pro miners, 1,100 MicroBT Whastminer M50 miners, and 1,100 Avalon A1346 miners. These miners, boasting a hash rate capacity of around 600 PH/s and an efficiency of 25 J/T, are expected to be operational this month. Stronghold’s recent update highlighted a 2% sequential increase in Bitcoin-equivalent production for Dec. 2023, indicating the company’s strong performance amid fluctuating market conditions.

Singapore-based Canaan notably played a pivotal role in these expansions, with new orders totaling over 17,000 Bitcoin mining machines, highlighting Canaan’s growing influence alongside rivals Bitmain and MicroBT. Nangeng Zhang, CEO of Canaan, expressed enthusiasm for these partnerships, stating,

“The Canaan machines we purchased last year are among the top-performing rigs in our fleet, especially in the hot summer months in Texas.”

Risk-reward of transaction fee reliance.

While these strategic expansions by Cipher and Stronghold come when emerging technologies like Inscriptions reshape Bitcoin miner revenue, there is no certainty that fees will continue at this level. A recent CryptoSlate Alpha Insight revealed a surge in transaction fees in 2023, which contributed significantly to the revenue streams of miners. With the upcoming Bitcoin halving, where block rewards are set to be halved, miners may increasingly rely on transaction fees as a key revenue source.

However, as the chart below shows, block fees peaked at around $250,000 on Dec. 16 and have since retraced to an average of $38,000. While this is still notably higher than the average of $4,700 in Nov. 2023, Bitcoin miners may now be gambling that Inscriptions continue gaining traction to offset the imminent halving.

This shift represents a significant transformation in the mining industry, where technological advancements and market conditions continuously redefine revenue models and operational strategies.

can i order generic clomiphene prices can i buy generic clomiphene without dr prescription buying cheap clomiphene without dr prescription where buy generic clomid tablets cost of clomiphene tablets clomiphene chance of twins clomid for sale australia

This is the make of enter I find helpful.

Thanks for sharing. It’s first quality.

cost azithromycin – order tinidazole generic flagyl 400mg tablet

semaglutide 14mg cost – semaglutide buy online cost cyproheptadine 4mg

order domperidone 10mg generic – tetracycline 500mg tablet order cyclobenzaprine generic

generic augmentin 375mg – https://atbioinfo.com/ ampicillin cheap

order nexium 40mg online cheap – https://anexamate.com/ esomeprazole 20mg capsules

mobic oral – https://moboxsin.com/ buy meloxicam tablets

prednisone 5mg brand – corticosteroid order prednisone for sale

where to buy ed pills – cheapest ed pills over the counter ed pills that work

oral amoxicillin – https://combamoxi.com/ cheap amoxil generic

buy generic forcan – diflucan 100mg sale diflucan medication

buy cenforce tablets – https://cenforcers.com/# order cenforce without prescription

cialis online canada ripoff – mint pharmaceuticals tadalafil tadalafil without a doctor prescription

where can i buy cialis online in canada – click buying cialis

zantac online order – https://aranitidine.com/# zantac drug

viagra 100 mg buy – buy viagra 50 mg 100mg viagra pills

More posts like this would prosper the blogosphere more useful. https://gnolvade.com/es/clomid/

I am actually happy to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks representing providing such data. https://ursxdol.com/cenforce-100-200-mg-ed/

The depth in this serving is exceptional. https://prohnrg.com/product/cytotec-online/

The thoroughness in this section is noteworthy. mort kamagra

Greetings! Utter productive advice within this article! It’s the crumb changes which choice turn the largest changes. Thanks a portion in the direction of sharing! https://ondactone.com/spironolactone/

I am in truth happy to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data.

https://doxycyclinege.com/pro/ondansetron/

Thanks on putting this up. It’s understandably done. http://twcmail.de/deref.php?https://hackmd.io/@adip/S1nI1FQ_xe

forxiga online buy – https://janozin.com/ forxiga buy online

xenical pills – click buy generic orlistat over the counter

This is a topic which is in to my verve… Many thanks! Unerringly where can I find the contact details for questions? https://www.forum-joyingauto.com/member.php?action=profile&uid=49528