- Miner profit/loss sustainability sank to lows not seen since June 2021.

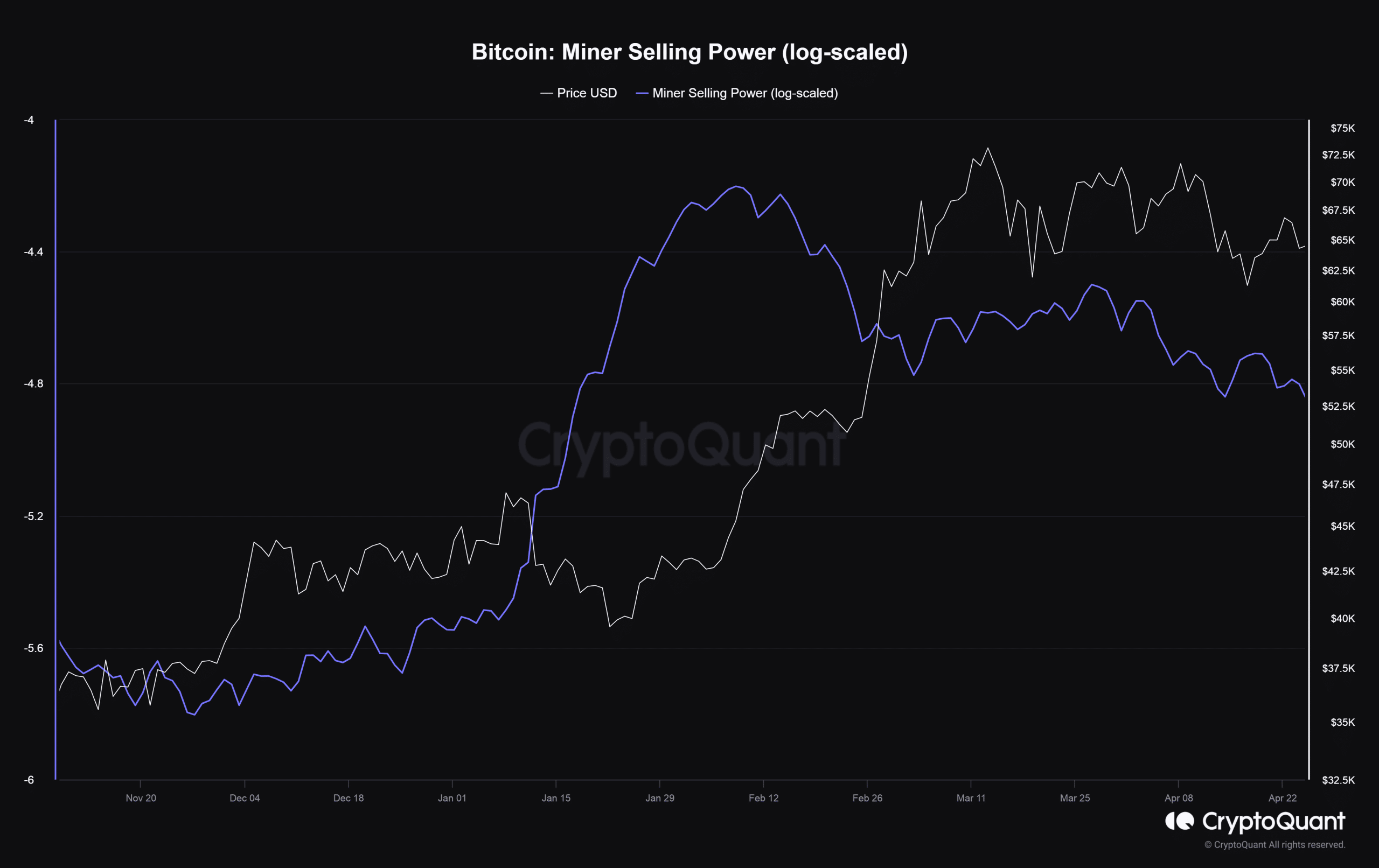

- Due to the dip in profitability, selling pressure from miners dipped further.

Bitcoin [BTC] miners’ earnings have been dealt a big blow since the halving earlier this month, creating pain for the industry critical for the smooth functioning of the world’s largest digital asset.

Miners face losses

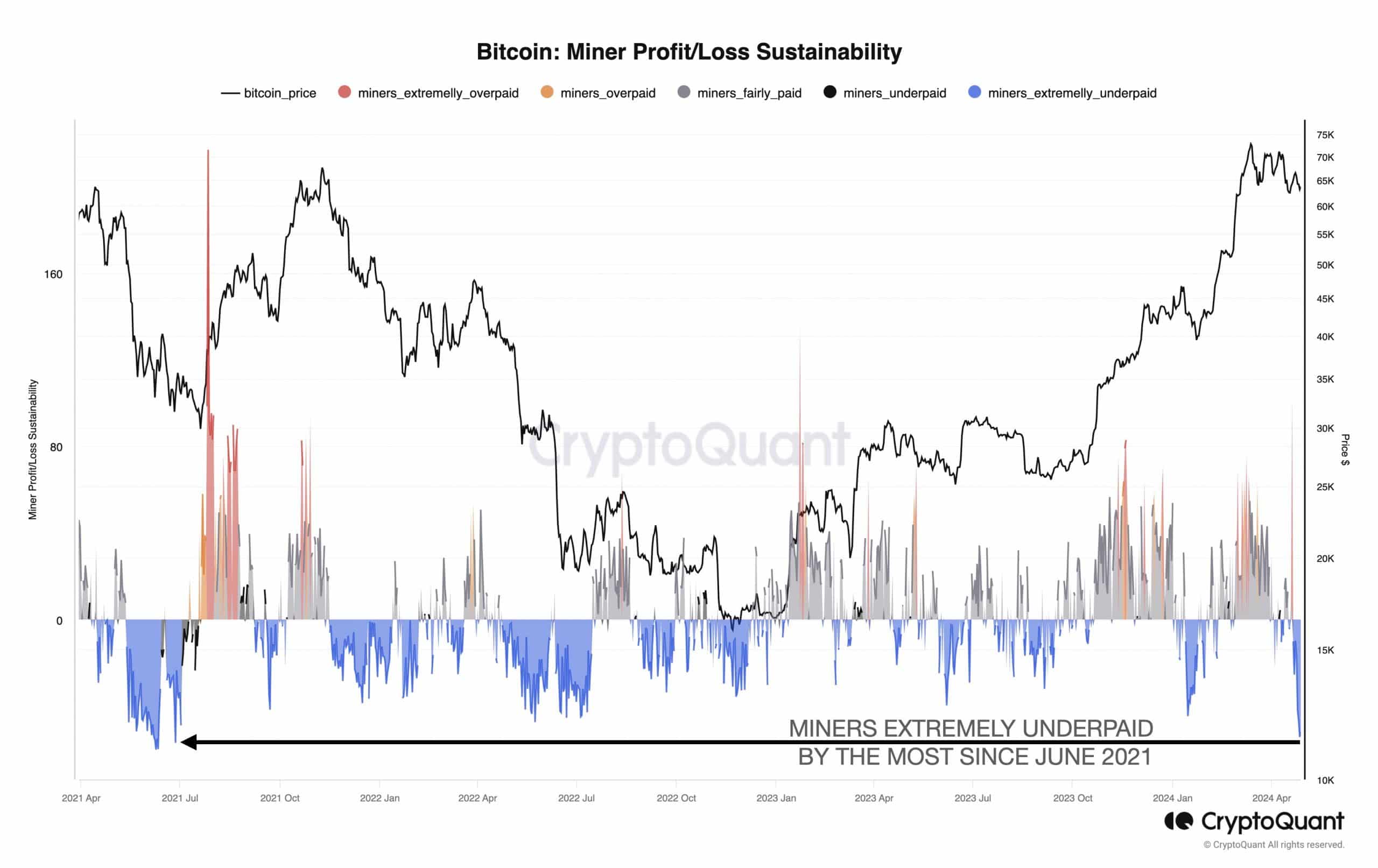

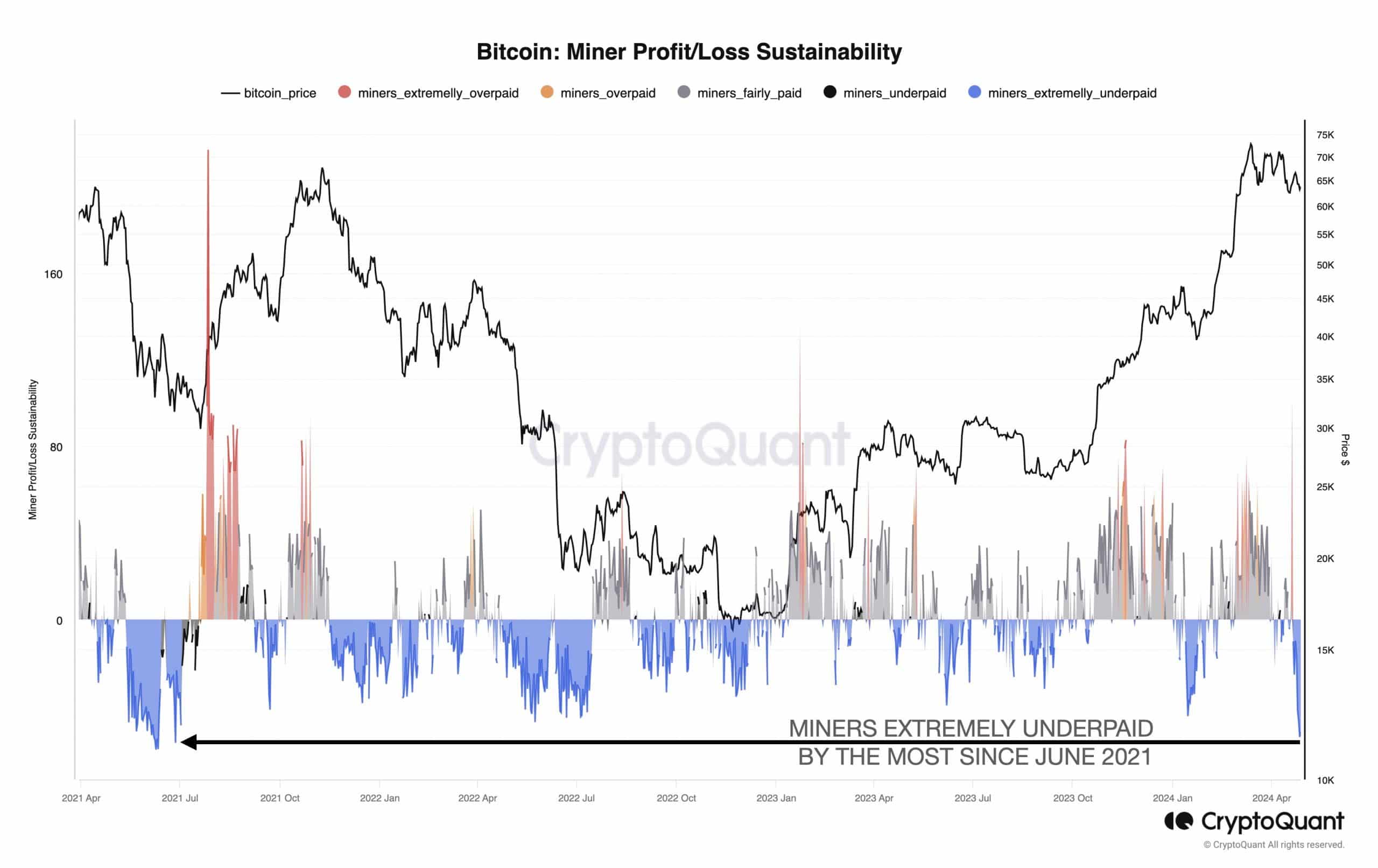

In an X post dated 29th April, Julio Moreno, Head of Research at on-chain analytics firm CryptoQuant revealed that miner profit/loss sustainability has sunk to lows not seen since June 2021.

Source: CryptoQuant

For the curious, the aforementioned metric measures the growth of block rewards – a critical revenue stream for miners – against the growth in mining difficulty, which is an indicator of their costs. The sharp dip indicated that miners were “extremely underpaid” at the time of writing.

Moreover, relative to the price of Bitcoin, daily miner revenues were significantly low, additional data showed.

The recent halving slashed the block rewards from 6.25 BTC to 3.125 BTC per block, leading to a situation where miners would have to double their mining investments just to break-even.

While large miners with deep pockets might find it easier to weather the storm, the small miners would eventually bow out.

Selling pressure dips

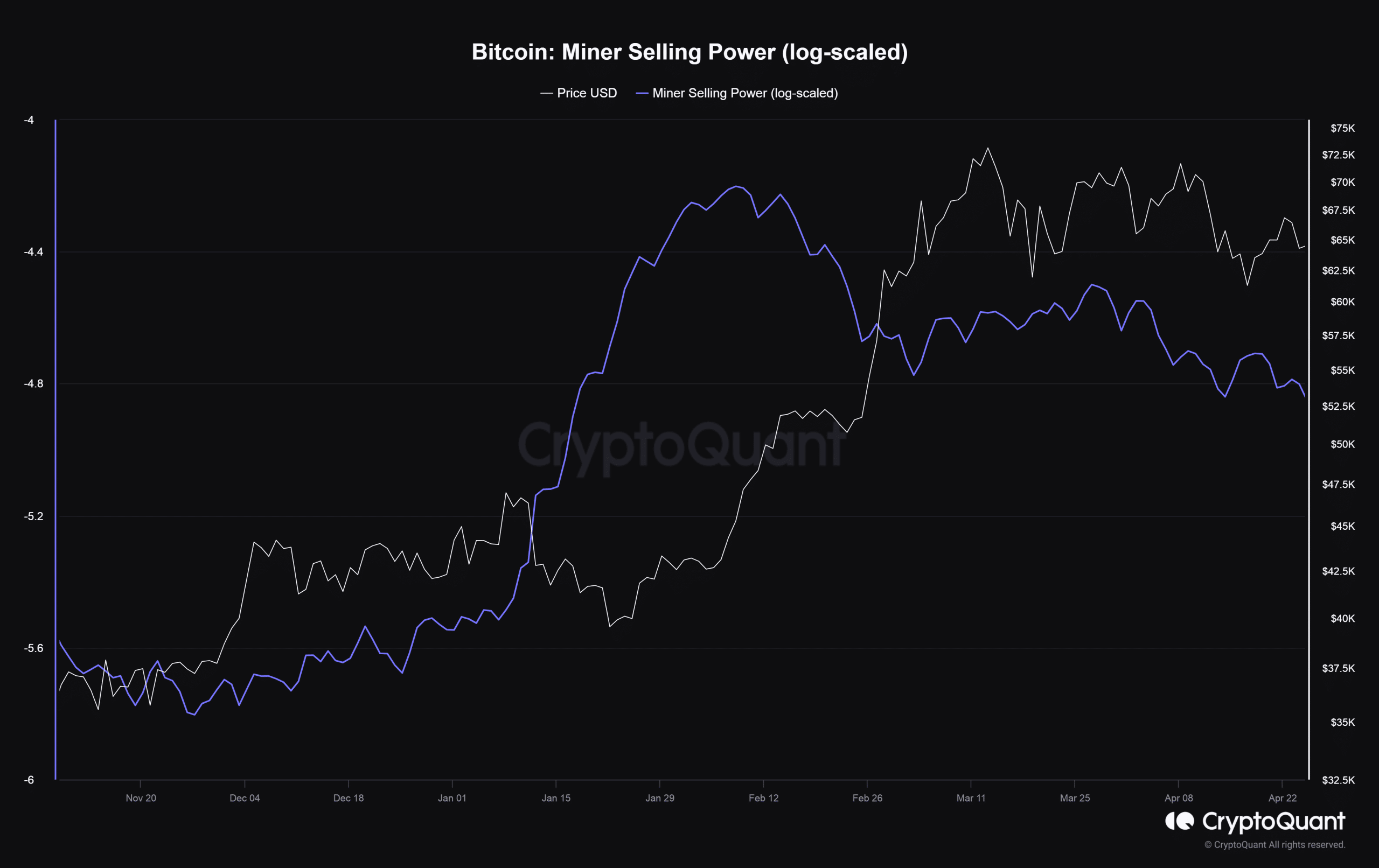

Due to the dip in profitability, most miners have resisted the urge to sell their Bitcoins and generate cash. As per AMBCrypto’s analysis of CryptoQuant data, the selling pressure from miners has dropped further since halving.

Source: CryptoQuant

The reduced sell pressure was also apparent in the lower number of coins transferred to exchanges. Since the halving, 7-day moving average of miner to exchange flows tanked 70%.

Is your portfolio green? Check out the BTC Profit Calculator

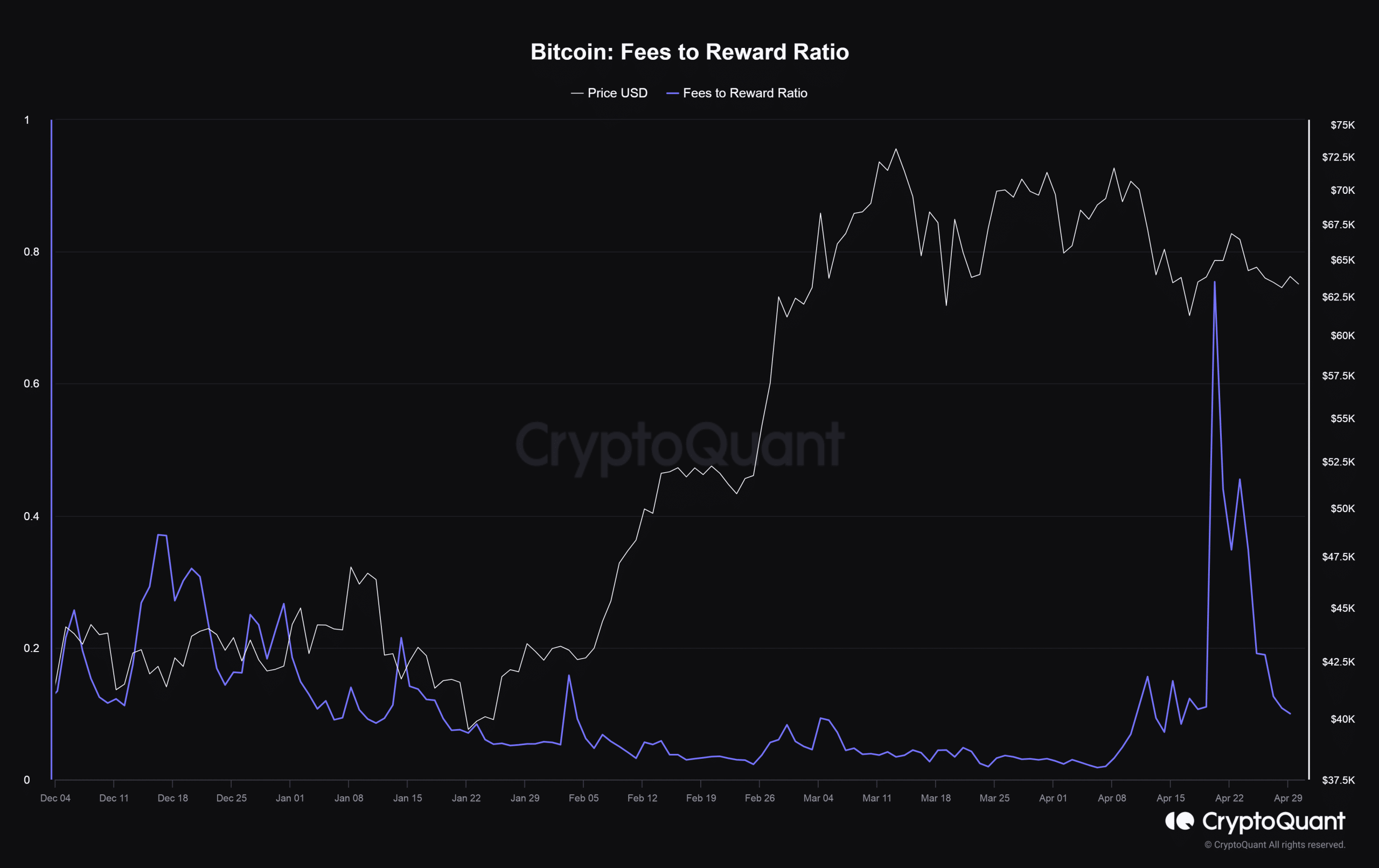

Fees not coming to the rescue

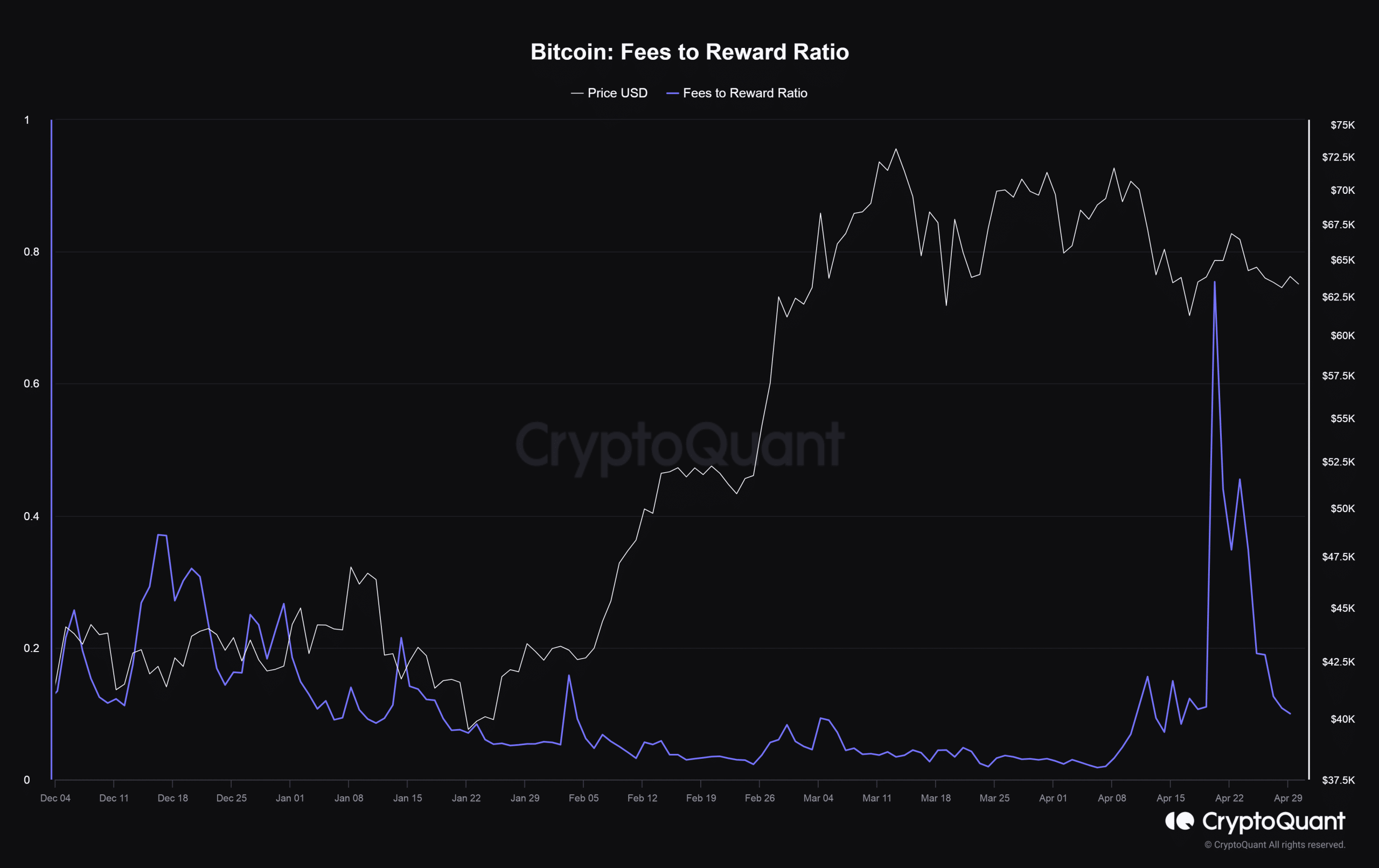

Miners were also hit by a sharp fall in transaction fees since the halving day frenzy.

The percentage of fee in total block rewards fell progressively from 75% on the 20th of April to 9% on the 29th of April.

Source: CryptoQuant

- Miner profit/loss sustainability sank to lows not seen since June 2021.

- Due to the dip in profitability, selling pressure from miners dipped further.

Bitcoin [BTC] miners’ earnings have been dealt a big blow since the halving earlier this month, creating pain for the industry critical for the smooth functioning of the world’s largest digital asset.

Miners face losses

In an X post dated 29th April, Julio Moreno, Head of Research at on-chain analytics firm CryptoQuant revealed that miner profit/loss sustainability has sunk to lows not seen since June 2021.

Source: CryptoQuant

For the curious, the aforementioned metric measures the growth of block rewards – a critical revenue stream for miners – against the growth in mining difficulty, which is an indicator of their costs. The sharp dip indicated that miners were “extremely underpaid” at the time of writing.

Moreover, relative to the price of Bitcoin, daily miner revenues were significantly low, additional data showed.

The recent halving slashed the block rewards from 6.25 BTC to 3.125 BTC per block, leading to a situation where miners would have to double their mining investments just to break-even.

While large miners with deep pockets might find it easier to weather the storm, the small miners would eventually bow out.

Selling pressure dips

Due to the dip in profitability, most miners have resisted the urge to sell their Bitcoins and generate cash. As per AMBCrypto’s analysis of CryptoQuant data, the selling pressure from miners has dropped further since halving.

Source: CryptoQuant

The reduced sell pressure was also apparent in the lower number of coins transferred to exchanges. Since the halving, 7-day moving average of miner to exchange flows tanked 70%.

Is your portfolio green? Check out the BTC Profit Calculator

Fees not coming to the rescue

Miners were also hit by a sharp fall in transaction fees since the halving day frenzy.

The percentage of fee in total block rewards fell progressively from 75% on the 20th of April to 9% on the 29th of April.

Source: CryptoQuant

Simply desire to say your article is as surprising The clearness in your post is simply excellent and i could assume you are an expert on this subject Fine with your permission let me to grab your feed to keep up to date with forthcoming post Thanks a million and please carry on the gratifying work

order clomiphene online can i get cheap clomid without prescription cost cheap clomiphene without a prescription get clomiphene without a prescription cost cheap clomiphene pills how to get cheap clomiphene without prescription how can i get clomiphene pill

Valuable forum posts, Thank you!

casino en ligne France

Appreciate it! Lots of tips!

casino en ligne francais

Seriously a good deal of superb information!

casino en ligne France

Thank you, An abundance of forum posts!

casino en ligne

You’ve made your stand pretty well.!

casino en ligne

Wow quite a lot of valuable knowledge!

casino en ligne

Regards! Loads of info!

casino en ligne francais

You actually expressed it superbly.

casino en ligne

Great posts. Regards!

meilleur casino en ligne

Seriously all kinds of very good info.

casino en ligne

This website really has all of the low-down and facts I needed to this case and didn’t positive who to ask.

More articles like this would frame the blogosphere richer.

buy cheap generic zithromax – order azithromycin 500mg for sale buy metronidazole 400mg without prescription

semaglutide online order – rybelsus where to buy buy generic periactin 4mg

generic motilium 10mg – order domperidone 10mg for sale order flexeril pill

buy augmentin 375mg generic – atbioinfo buy generic acillin

order nexium 40mg pill – https://anexamate.com/ esomeprazole 20mg uk

warfarin 2mg uk – anticoagulant cozaar for sale online

order meloxicam 7.5mg pill – https://moboxsin.com/ order mobic 7.5mg online

prednisone 5mg price – corticosteroid order prednisone 5mg pills

online ed pills – https://fastedtotake.com/ red ed pill

amoxil online – comba moxi amoxil price

diflucan online order – fluconazole 100mg price buy forcan for sale

cenforce without prescription – https://cenforcers.com/# order cenforce 100mg online cheap

cialis las vegas – https://ciltadgn.com/ does tadalafil lower blood pressure

great white peptides tadalafil – https://strongtadafl.com/# cialis 100mg from china

zantac online – https://aranitidine.com/ ranitidine 300mg us

sildenafil 100 mg oral jelly – herbal viagra sale ireland viagra sale ottawa

Proof blog you have here.. It’s severely to on great quality script like yours these days. I honestly recognize individuals like you! Go through vigilance!! buy nolvadex medication

More posts like this would create the online time more useful. https://buyfastonl.com/

I’ll certainly bring to skim more. https://ursxdol.com/get-cialis-professional/

This is the tolerant of advise I find helpful. https://prohnrg.com/product/lisinopril-5-mg/