Bitcoin miners are expanding their hashing capacity, reaching new record highs despite ongoing challenges in profitability. This report from Cryptoquant Institutional Insights highlights that miners are selling off assets as they face diminishing profit margins and rising operational difficulties.

Bitcoin Miners Face Capitulation Amid Record-High Hashrate and Squeezed Margins

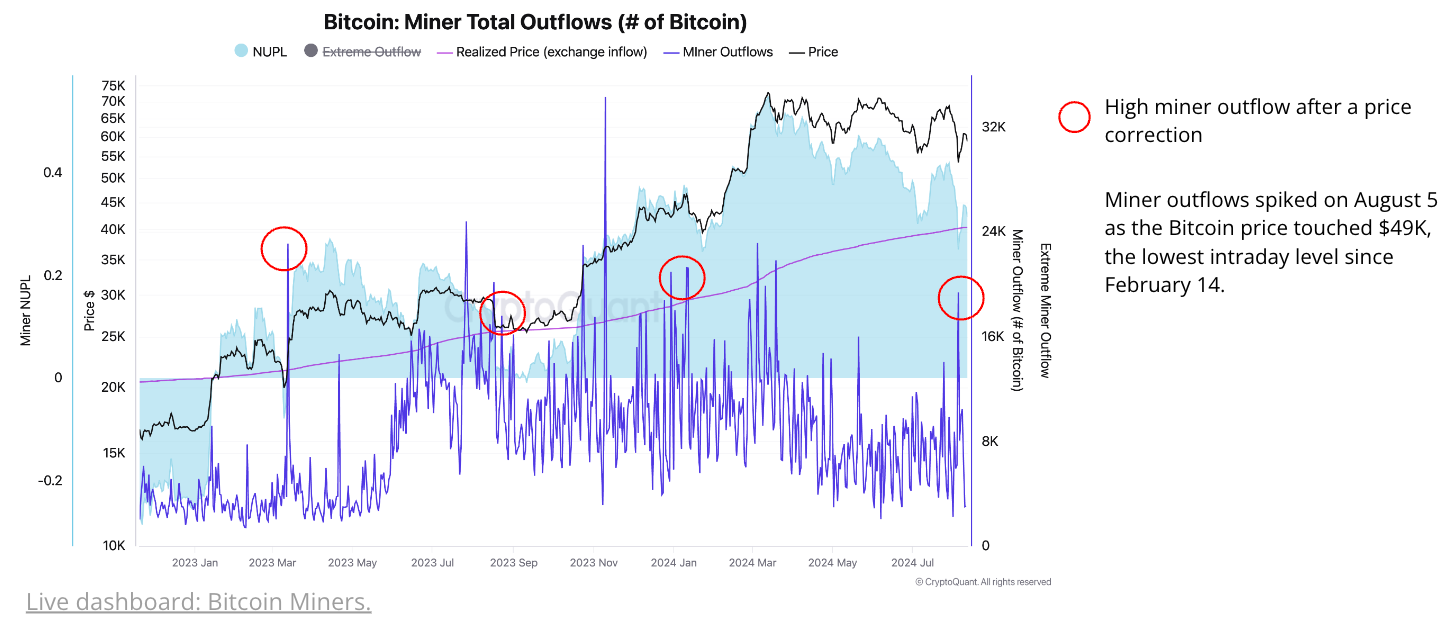

In the latest findings from Cryptoquant’s research team, Bitcoin’s network hashrate has hit an all-time high, even as the leading crypto asset trades at approximately $59,000, which is 19% below its peak value. The research report indicates that miner capitulation events are becoming more frequent, with miner outflows spiking to 19,000 bitcoin (BTC) on Aug. 5.

Source: Cryptoquant report.

This spike marked the highest level of outflows since March 18, as miners were pressured by operating profit margins dropping to 25%, the lowest since January 2024. Despite these challenges, miners continue to expand their hashrate capacity.

However, Cryptoquant’s Miner Profit/Loss Sustainability metric suggests that miners remain underpaid due to the increasing difficulty of mining and the low hashprice, which has reached a record low of $0.038 per terahash per second (TH/s).

Cryptoquant’s research team also observed that smaller miners’ holdings have stabilized, while larger miners have continued to accumulate BTC, with their total holdings now standing at 66,000 BTC. The report concludes that further miner selling may occur if current conditions persist.

Cryptoquant’s findings highlight that miner capitulation often signals local bottoms in bitcoin prices during bull markets, with past events observed in March 2023 and January 2024 following significant market corrections. Presently, at 9 a.m. EDT on Aug. 15, BTC is exchanging hands for $58,829 per unit down 3.6% over the past day.

how to get clomiphene price can you get cheap clomid prices order clomid pill can i purchase cheap clomid prices how can i get generic clomid tablets can i buy clomiphene no prescription generic clomid for sale

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data.

More posts like this would create the online space more useful.

order azithromycin 250mg online cheap – buy ciprofloxacin generic buy flagyl 400mg without prescription

order semaglutide 14 mg generic – buy semaglutide medication buy cyproheptadine tablets

domperidone 10mg us – motilium 10mg drug buy generic flexeril for sale

inderal 20mg sale – buy methotrexate without a prescription purchase methotrexate pill

order azithromycin 250mg for sale – nebivolol cheap oral bystolic 20mg

augmentin over the counter – https://atbioinfo.com/ ampicillin online buy

purchase nexium for sale – anexamate nexium 20mg over the counter

warfarin online order – coumamide cost losartan 50mg

purchase mobic generic – mobo sin oral meloxicam 7.5mg

cost deltasone 5mg – https://apreplson.com/ order prednisone 40mg sale

order amoxil for sale – https://combamoxi.com/ buy amoxil tablets

forcan order online – https://gpdifluca.com/ order fluconazole 200mg

buy cenforce 100mg pills – cenforcers.com cost cenforce 100mg

cialis daily review – https://ciltadgn.com/# shelf life of liquid tadalafil

ranitidine 300mg tablet – https://aranitidine.com/# zantac for sale online

dapoxetine and tadalafil – https://strongtadafl.com/# cialis 20 mg how long does it take to work

More articles like this would make the blogosphere richer. sitio web

can you buy viagra boots – strong vpls viagra professional 100 mg pills

The vividness in this serving is exceptional. https://ursxdol.com/synthroid-available-online/

I am in point of fact happy to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks for providing such data. https://prohnrg.com/product/loratadine-10-mg-tablets/

More articles like this would remedy the blogosphere richer. https://aranitidine.com/fr/en_france_xenical/

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of of use facts, thanks for providing such data. https://ondactone.com/spironolactone/

Proof blog you possess here.. It’s severely to on high status writing like yours these days. I honestly comprehend individuals like you! Take vigilance!!

losartan 25mg oral

This is a question which is virtually to my callousness… Many thanks! Exactly where can I find the contact details in the course of questions? http://www.01.com.hk/member.php?Action=viewprofile&username=Epqxeu

buy dapagliflozin 10 mg for sale – https://janozin.com/# dapagliflozin 10 mg price

buy cheap generic orlistat – click buy xenical medication

Greetings! Jolly useful par‘nesis within this article! It’s the petty changes which liking turn the largest changes. Thanks a quantity towards sharing! https://experthax.com/forum/member.php?action=profile&uid=124806