- Bitcoin continued to trade below $70,000.

- Over 1 million addresses acquired BTC at the current price range.

Bitcoin’s [BTC] rally has stalled, and it has now fallen below the $70,000 price zone, which serves as strong support.

However, other on-chain metrics suggested that BTC might be able to maintain this price zone and potentially spark another positive run.

Bitcoin dips below $70K

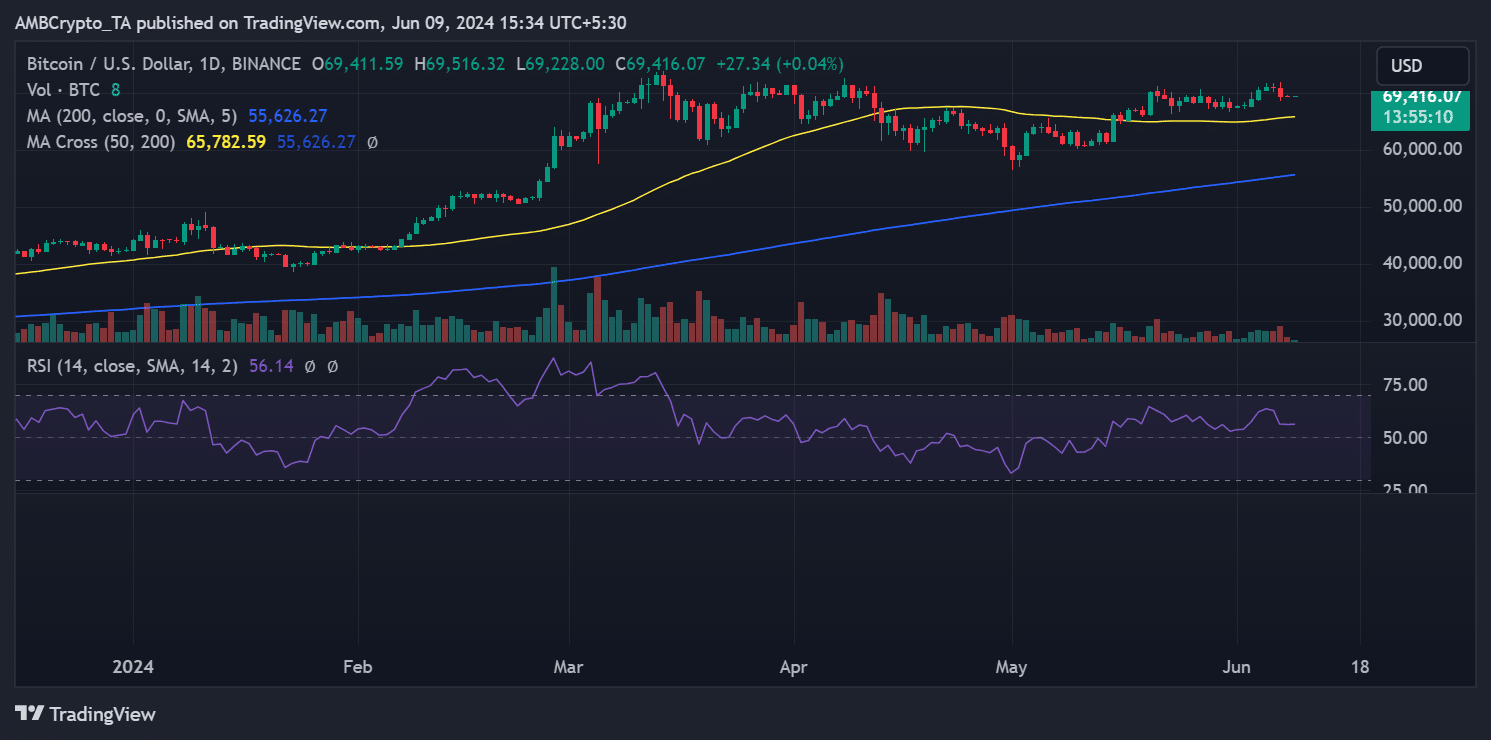

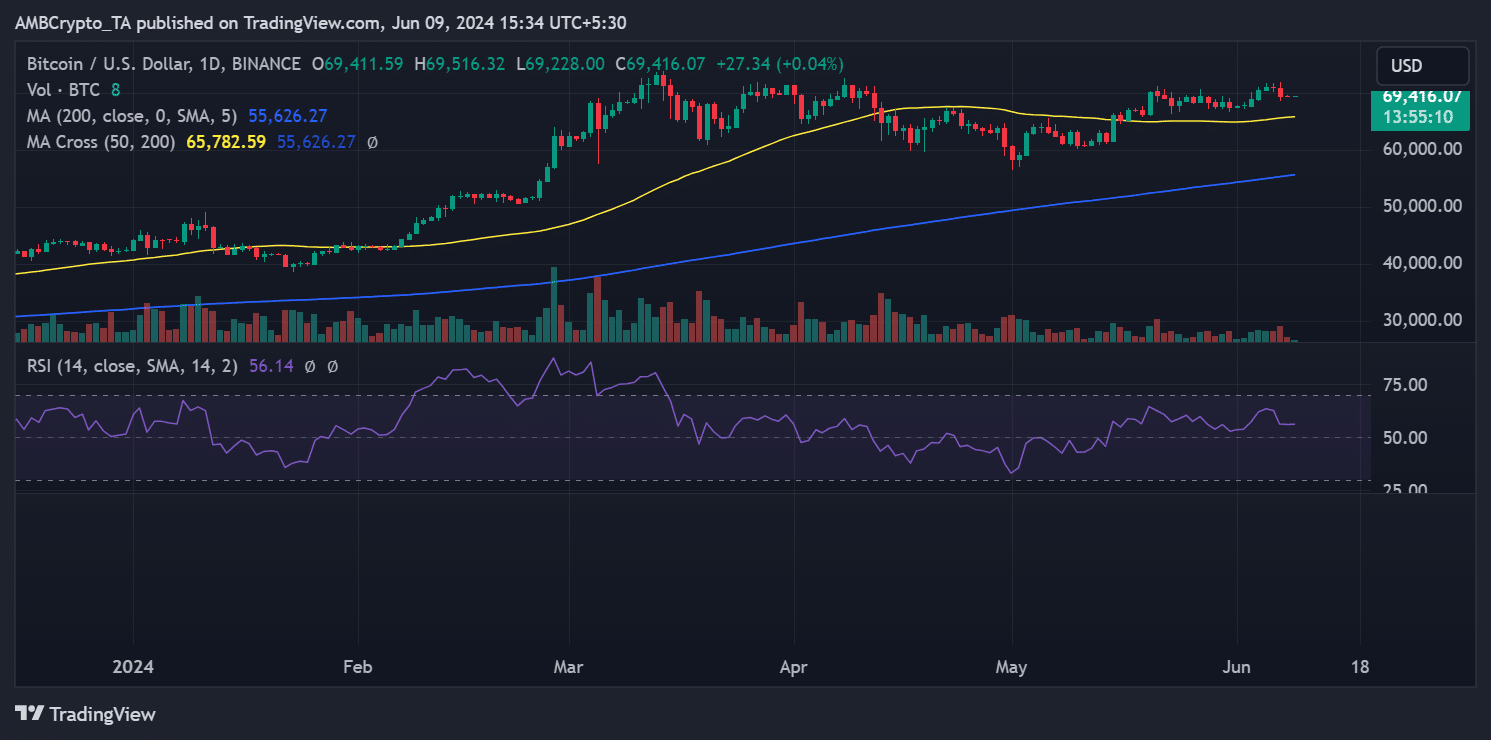

AMBCrypto’s analysis of Bitcoin’s price trend revealed a 1.97% decline on the 7th of June. This significant drop pulled its price away from the $70,000 zone.

Before the decline, BTC experienced consecutive uptrends that brought it into the $70,000 range, suggesting it was building momentum to surpass this threshold.

However, the decline between the 6th to the 8th of June lowered its price to around $69,300.

As of this writing, BTC was still trading in the $69,000 price range, with a slight increase to around $69,400. The chart showed that its overall trend remained positive.

The Relative Strength Index (RSI) was above 55, which indicated a bullish trend.

Source: TradingView

Additionally, Bitcoin was trading above its short moving average (yellow line) at press time, providing immediate support at around the $66,000 price range.

Bitcoin needs to hold steady in this zone

Bitcoin was also seeing strong support between the $69,380 and $67,350 price zones, with a significant accumulation volume in this range.

The data showed that approximately 1.97 million addresses acquired around 964,000 BTC within this range.

At the current price, this equates to about $67 billion spent on accumulating Bitcoin. This strong support suggests that BTC needs to hold firmly at this level to sustain any positive trend.

More BTCs leave exchanges

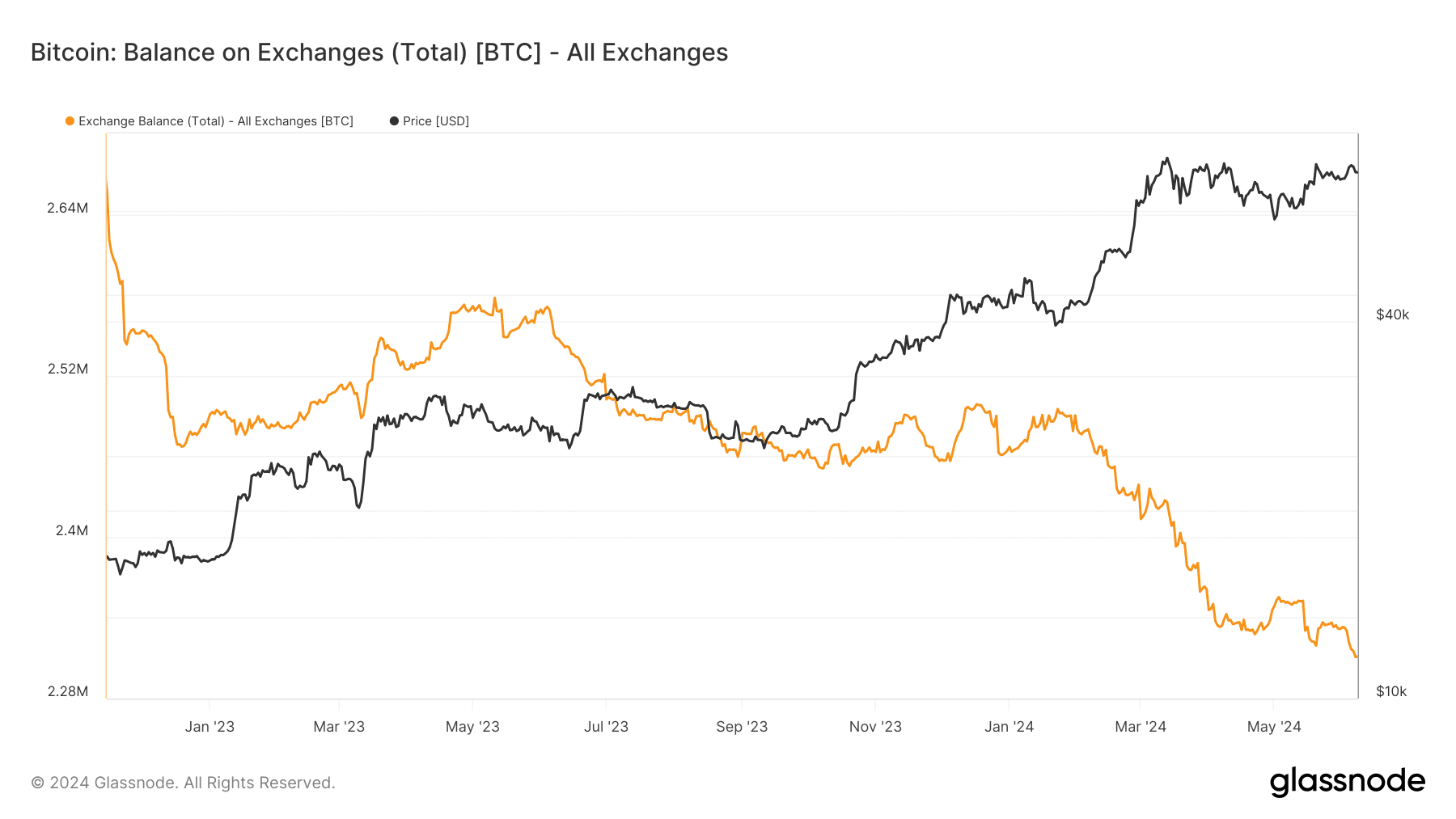

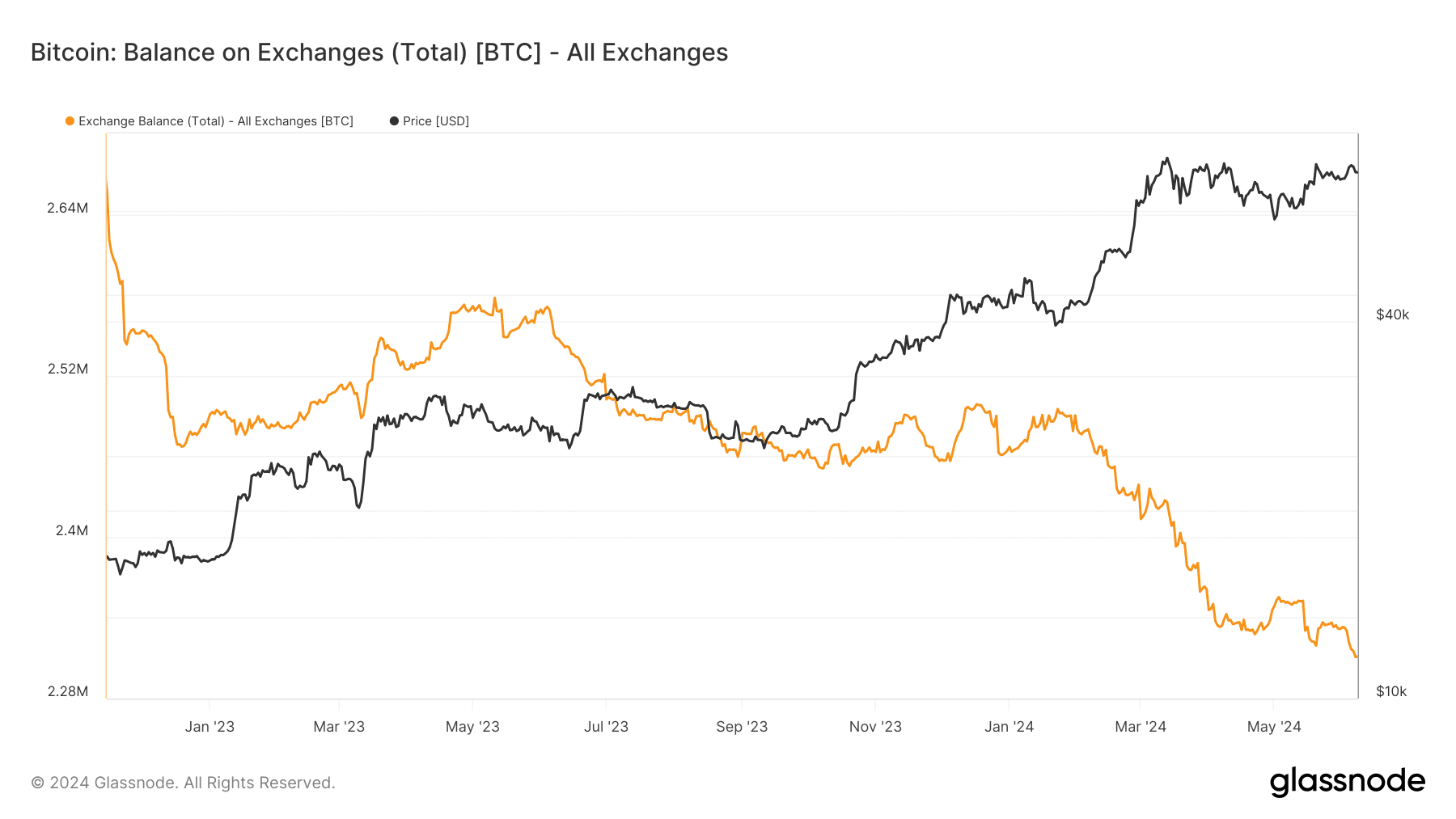

AMBCrypto’s analysis showed that per Bitcoin’s supply on exchanges, there was an increase in BTC withdrawals over the last few days.

Also, according to Glassnode, between the 1st and the 8th of June, over 21,000 BTC were withdrawn from exchanges.

On the 1st of June, the volume of BTC on exchanges was around 2.332 million. As of this writing, that volume had declined to approximately 2.311 million.

Source: Glassnode

This means that approximately $1.57 billion worth of BTC has been withdrawn from exchanges in the last week.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This is a positive signal for Bitcoin, as it suggests there is no significant influx of BTC that could crash the price across exchanges.

Consequently, Bitcoin can maintain its support level, potentially leading to a positive price trend soon.

- Bitcoin continued to trade below $70,000.

- Over 1 million addresses acquired BTC at the current price range.

Bitcoin’s [BTC] rally has stalled, and it has now fallen below the $70,000 price zone, which serves as strong support.

However, other on-chain metrics suggested that BTC might be able to maintain this price zone and potentially spark another positive run.

Bitcoin dips below $70K

AMBCrypto’s analysis of Bitcoin’s price trend revealed a 1.97% decline on the 7th of June. This significant drop pulled its price away from the $70,000 zone.

Before the decline, BTC experienced consecutive uptrends that brought it into the $70,000 range, suggesting it was building momentum to surpass this threshold.

However, the decline between the 6th to the 8th of June lowered its price to around $69,300.

As of this writing, BTC was still trading in the $69,000 price range, with a slight increase to around $69,400. The chart showed that its overall trend remained positive.

The Relative Strength Index (RSI) was above 55, which indicated a bullish trend.

Source: TradingView

Additionally, Bitcoin was trading above its short moving average (yellow line) at press time, providing immediate support at around the $66,000 price range.

Bitcoin needs to hold steady in this zone

Bitcoin was also seeing strong support between the $69,380 and $67,350 price zones, with a significant accumulation volume in this range.

The data showed that approximately 1.97 million addresses acquired around 964,000 BTC within this range.

At the current price, this equates to about $67 billion spent on accumulating Bitcoin. This strong support suggests that BTC needs to hold firmly at this level to sustain any positive trend.

More BTCs leave exchanges

AMBCrypto’s analysis showed that per Bitcoin’s supply on exchanges, there was an increase in BTC withdrawals over the last few days.

Also, according to Glassnode, between the 1st and the 8th of June, over 21,000 BTC were withdrawn from exchanges.

On the 1st of June, the volume of BTC on exchanges was around 2.332 million. As of this writing, that volume had declined to approximately 2.311 million.

Source: Glassnode

This means that approximately $1.57 billion worth of BTC has been withdrawn from exchanges in the last week.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This is a positive signal for Bitcoin, as it suggests there is no significant influx of BTC that could crash the price across exchanges.

Consequently, Bitcoin can maintain its support level, potentially leading to a positive price trend soon.

clomiphene medication for women can i order cheap clomid prices get clomiphene prices where to get cheap clomid where can i get cheap clomid tablets can you buy clomiphene pills cheap clomiphene pills

More delight pieces like this would insinuate the web better.

More posts like this would create the online time more useful.

purchase azithromycin pills – sumycin cheap metronidazole 400mg us

semaglutide 14mg uk – order cyproheptadine 4mg online cheap cyproheptadine 4mg usa

buy motilium – order motilium 10mg order flexeril 15mg for sale

buy inderal 20mg pill – plavix 75mg without prescription buy generic methotrexate 2.5mg

order amoxil generic – purchase amoxil generic brand ipratropium 100 mcg

zithromax 250mg sale – buy generic bystolic over the counter order nebivolol 5mg sale

order esomeprazole pill – nexiumtous buy esomeprazole paypal

coumadin 5mg over the counter – https://coumamide.com/ losartan 25mg pill

mobic drug – mobo sin buy mobic 15mg sale

oral deltasone 20mg – https://apreplson.com/ buy prednisone 40mg sale

otc ed pills that work – https://fastedtotake.com/ buy ed pills generic

cheap amoxicillin generic – amoxil medication purchase amoxicillin

order fluconazole 200mg – order generic fluconazole 100mg fluconazole generic

cenforce cheap – https://cenforcers.com/ cenforce online buy

cialis buy online canada – https://ciltadgn.com/ online cialis prescription

ranitidine 150mg tablet – ranitidine 300mg over the counter buy zantac 150mg sale

viagra pill 100 – https://strongvpls.com/ viagra professional pills

This is the compassionate of criticism I rightly appreciate. comprar provigil farmaciaonline

Proof blog you be undergoing here.. It’s hard to find elevated calibre belles-lettres like yours these days. I truly appreciate individuals like you! Go through care!! https://buyfastonl.com/azithromycin.html

More posts like this would make the blogosphere more useful. https://ursxdol.com/propecia-tablets-online/

More posts like this would prosper the blogosphere more useful. https://prohnrg.com/product/diltiazem-online/

This is the compassionate of criticism I truly appreciate. https://aranitidine.com/fr/cialis-super-active/

I couldn’t weather commenting. Warmly written! https://ondactone.com/simvastatin/

The depth in this tune is exceptional.

topiramate 100mg brand

This is a question which is near to my verve… Diverse thanks! Exactly where can I upon the phone details due to the fact that questions? http://www.orlandogamers.org/forum/member.php?action=profile&uid=29102

buy cheap generic dapagliflozin – site forxiga 10 mg drug