- Long term Bitcoin holders refuse to sell their holdings.

- Short term holders showcase a similar perspective, causing BTC’s price to surge.

Bitcoin [BTC] has been stagnating at the $62,000 level for quite some time, causing restlessness amongst traders hoping for a positive jump in price.

Long term holders show faith

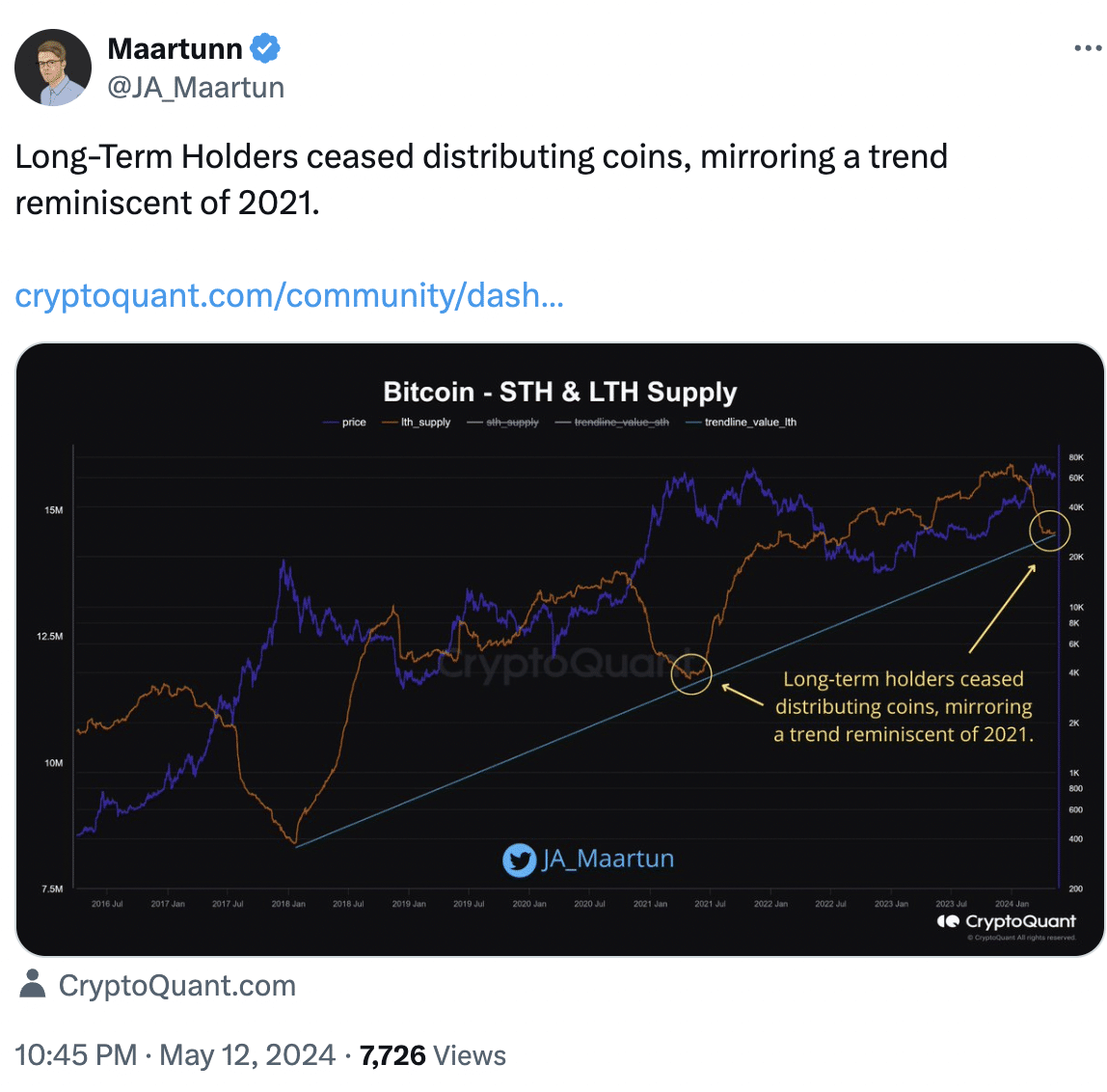

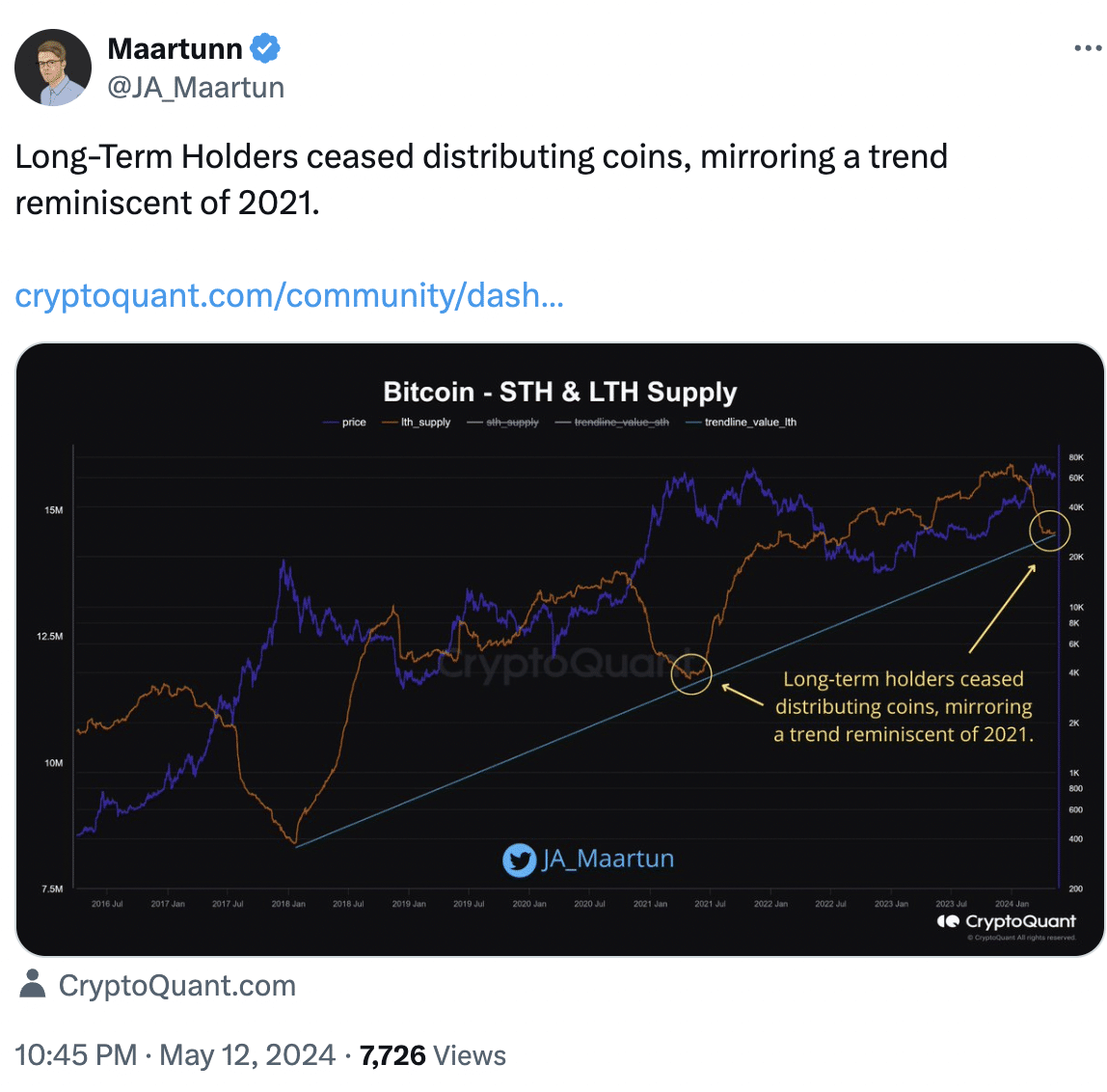

However, it was seen that long-term holders refused to sell their holdings despite the stagnancy of the market.

These are investors who have held onto their Bitcoins for a significant period, typically defined as over 155 days (or five months).

They are generally considered believers in the long-term potential of Bitcoin and are less likely to be swayed by short-term price fluctuations.

The current behavior of LTHs is similar to what was observed in 2021. Back then, LTHs also held onto their coins for extended periods, which coincided with a significant bull run in the Bitcoin price.

Historically, periods of LTH accumulation have been associated with price rises in Bitcoin. This is because if fewer coins are available for sale, it can drive up the price if there is increased demand.

Source: X

Its HODLing season

However, it wasn’t just short-term holders that were displaying faith in the king coin.

Traditionally known for selling quickly at a loss during price dips, data suggests they might be holding onto their coins even during pullbacks.

This shift, with only a small amount of Bitcoin being sent to exchanges at a loss recently, could have positive implications for Bitcoin’s stability.

By panicking less and holding during downturns, short-term investors could contribute to a less volatile market and potentially pave the way for price increases.

Source: Glassnode

The interplay between LTH and STH behavior can determine the overall direction of the market.

If LTHs are accumulating and STHs are holding during pullbacks, it can create a bullish environment with potential for price increases. A market with a balance between LTHs and STHs tends to be more stable.

LTHs provide long-term stability by holding onto their coins, while STHs can add liquidity through their trading activity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, an overabundance of STHs prone to panic selling can increase volatility in the future.

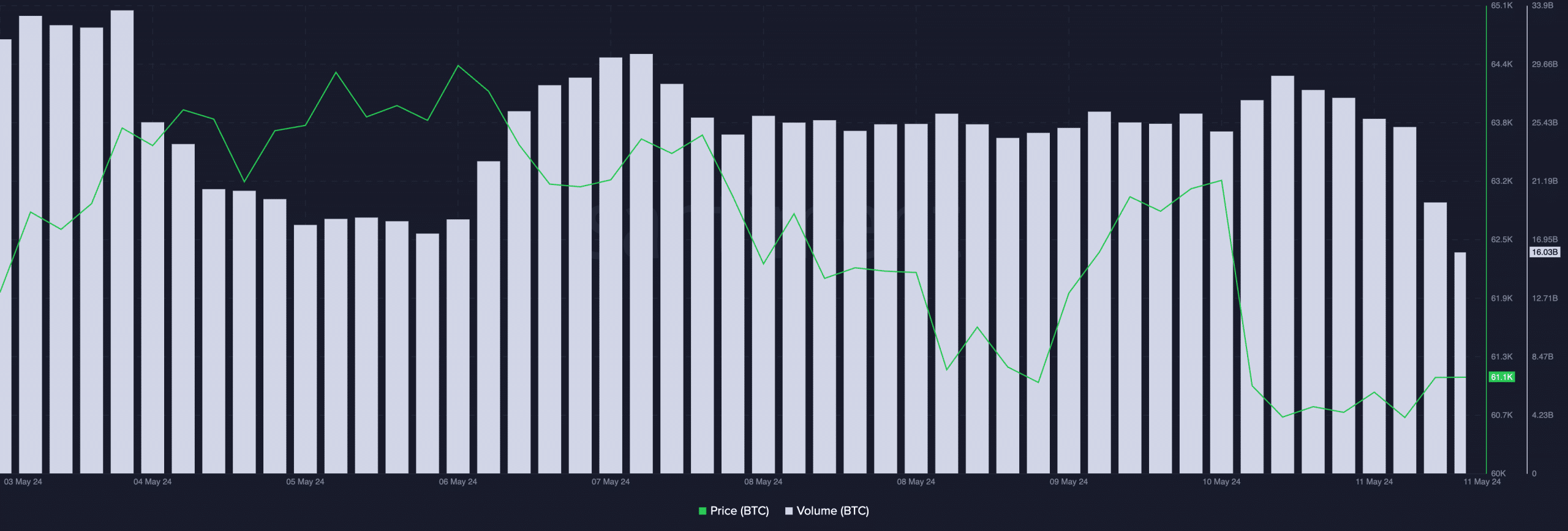

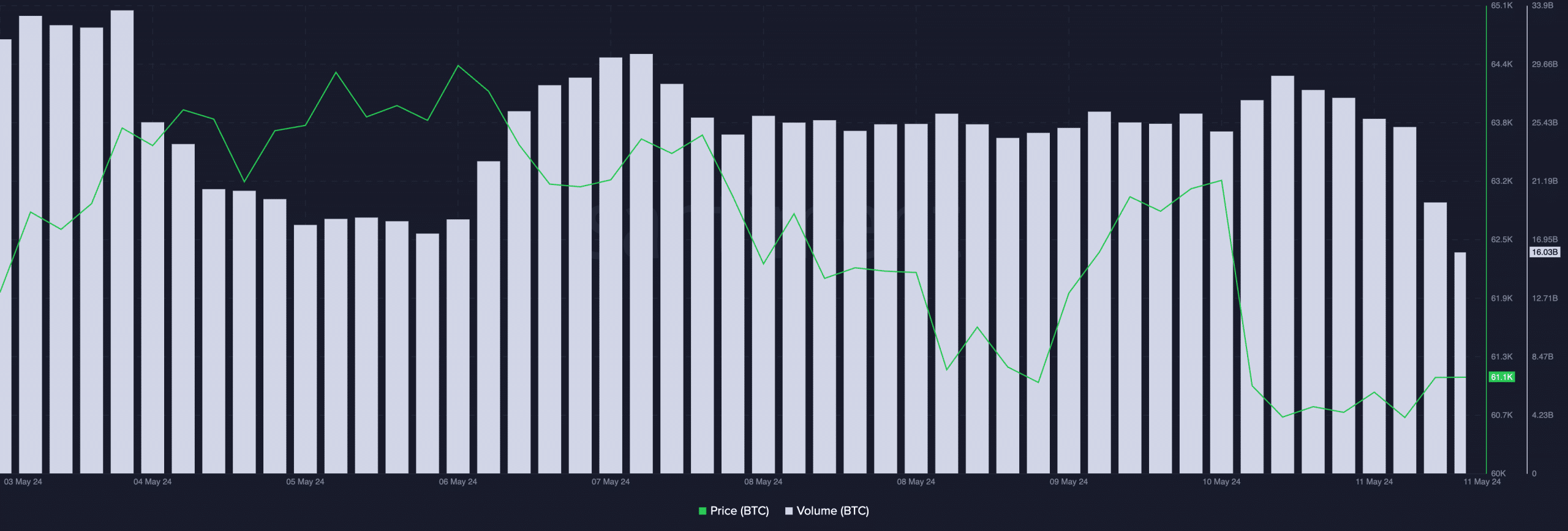

At press time, BTC was trading at $63,113.08 and its price had grown by 3.38% in the last 24 hours, the volume at which it had traded had also grown by 69.49% in the last few days.

Source: Santiment

- Long term Bitcoin holders refuse to sell their holdings.

- Short term holders showcase a similar perspective, causing BTC’s price to surge.

Bitcoin [BTC] has been stagnating at the $62,000 level for quite some time, causing restlessness amongst traders hoping for a positive jump in price.

Long term holders show faith

However, it was seen that long-term holders refused to sell their holdings despite the stagnancy of the market.

These are investors who have held onto their Bitcoins for a significant period, typically defined as over 155 days (or five months).

They are generally considered believers in the long-term potential of Bitcoin and are less likely to be swayed by short-term price fluctuations.

The current behavior of LTHs is similar to what was observed in 2021. Back then, LTHs also held onto their coins for extended periods, which coincided with a significant bull run in the Bitcoin price.

Historically, periods of LTH accumulation have been associated with price rises in Bitcoin. This is because if fewer coins are available for sale, it can drive up the price if there is increased demand.

Source: X

Its HODLing season

However, it wasn’t just short-term holders that were displaying faith in the king coin.

Traditionally known for selling quickly at a loss during price dips, data suggests they might be holding onto their coins even during pullbacks.

This shift, with only a small amount of Bitcoin being sent to exchanges at a loss recently, could have positive implications for Bitcoin’s stability.

By panicking less and holding during downturns, short-term investors could contribute to a less volatile market and potentially pave the way for price increases.

Source: Glassnode

The interplay between LTH and STH behavior can determine the overall direction of the market.

If LTHs are accumulating and STHs are holding during pullbacks, it can create a bullish environment with potential for price increases. A market with a balance between LTHs and STHs tends to be more stable.

LTHs provide long-term stability by holding onto their coins, while STHs can add liquidity through their trading activity.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, an overabundance of STHs prone to panic selling can increase volatility in the future.

At press time, BTC was trading at $63,113.08 and its price had grown by 3.38% in the last 24 hours, the volume at which it had traded had also grown by 69.49% in the last few days.

Source: Santiment

where can i buy generic clomid pill clomiphene tablets can you get clomid pills clomiphene generic brand can i purchase generic clomid prices order clomiphene without rx name brand for clomid

Thanks an eye to sharing. It’s outstrip quality.

I was wondering if you ever considered changing the structure of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or 2 images. Maybe you could space it out better?

More text pieces like this would make the интернет better.

azithromycin brand – brand metronidazole flagyl 400mg cheap

motilium 10mg canada – sumycin generic buy flexeril 15mg pill

buy inderal 20mg generic – plavix 75mg pill purchase methotrexate without prescription

azithromycin cost – order tindamax 300mg for sale nebivolol price

Este site é realmente incrível. Sempre que acesso eu encontro novidades Você também vai querer acessar o nosso site e descobrir mais detalhes! Conteúdo exclusivo. Venha saber mais agora! 🙂

amoxiclav order online – atbioinfo ampicillin order

buy esomeprazole 20mg online – https://anexamate.com/ purchase nexium for sale

order medex online – coumamide.com order cozaar 50mg for sale

generic mobic – https://moboxsin.com/ buy mobic for sale

This site is my inhalation, really fantastic design and perfect content material.

buy deltasone without prescription – corticosteroid deltasone 5mg for sale

buy ed meds – best ed drugs male ed pills

buy amoxil – combamoxi.com buy amoxicillin pill

buy fluconazole 100mg for sale – flucoan diflucan 200mg price

cenforce order – https://cenforcers.com/# generic cenforce 50mg

cialis patent expiration 2016 – https://ciltadgn.com/# what is cialis taken for

zantac online – purchase zantac for sale buy zantac 150mg

cialis black in australia – https://strongtadafl.com/ canadian cialis no prescription

More articles like this would remedy the blogosphere richer. https://gnolvade.com/

buy viagra women – https://strongvpls.com/ buy viagra sweden

Thanks towards putting this up. It’s evidently done. copd prednisone

More posts like this would make the online space more useful. ventolin over the counter

The reconditeness in this ruined is exceptional. prohnrg.com

Thank you for the good writeup. It in fact used to be a amusement account it. Glance advanced to far added agreeable from you! However, how can we keep in touch?

More posts like this would prosper the blogosphere more useful. https://aranitidine.com/fr/en_france_xenical/

The reconditeness in this serving is exceptional. https://ondactone.com/spironolactone/

Thanks on sharing. It’s outstrip quality.

baclofen drug

Hi my friend! I wish to say that this article is awesome, nice written and come with almost all significant infos. I would like to peer more posts like this .

This is the description of content I take advantage of reading. http://web.symbol.rs/forum/member.php?action=profile&uid=1171369

I don’t commonly comment but I gotta say appreciate it for the post on this great one : D.

Hello, i believe that i saw you visited my blog thus i came to “go back the desire”.I’m trying to to find things to enhance my web site!I guess its adequate to use some of your ideas!!

It is really a great and helpful piece of information. I?¦m glad that you simply shared this helpful information with us. Please stay us informed like this. Thank you for sharing.

dapagliflozin 10mg pills – https://janozin.com/ order dapagliflozin 10 mg for sale

buy xenical no prescription – https://asacostat.com/ buy xenical cheap

This is the kind of content I get high on reading. http://www.kiripo.com/forum/member.php?action=profile&uid=1193171