- Metaplanet boosts BTC holdings amid price recovery, reinforcing its “Asia’s MicroStrategy” reputation.

- Post-announcement surge lifts Metaplanet’s stock by 25.81%, marking a bold Bitcoin investment strategy.

Metaplanet, a prominent publicly-listed investment and consulting firm headquartered in Japan, has significantly boosted its Bitcoin [BTC] holdings.

Metaplanet’s BTC holdings

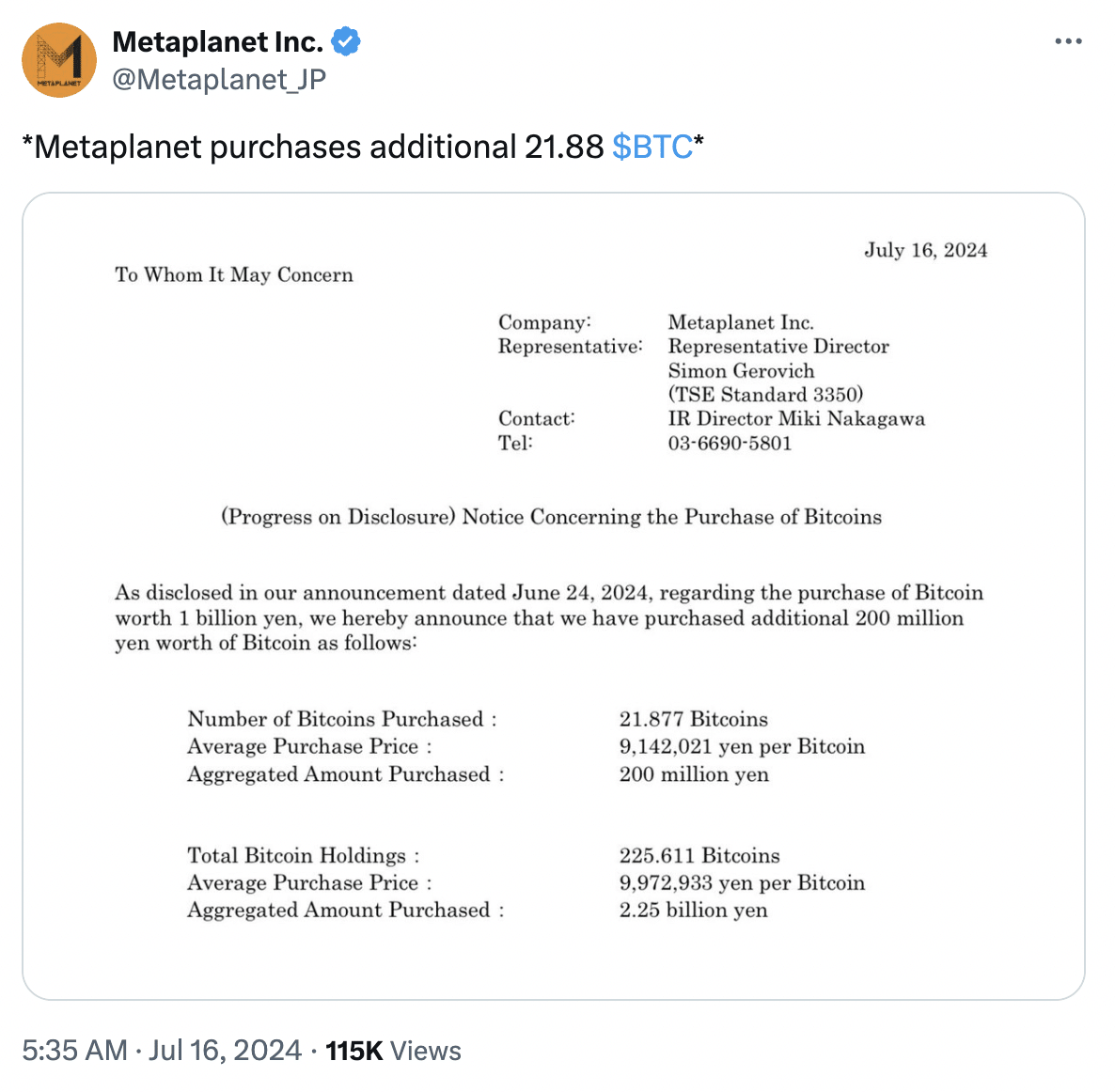

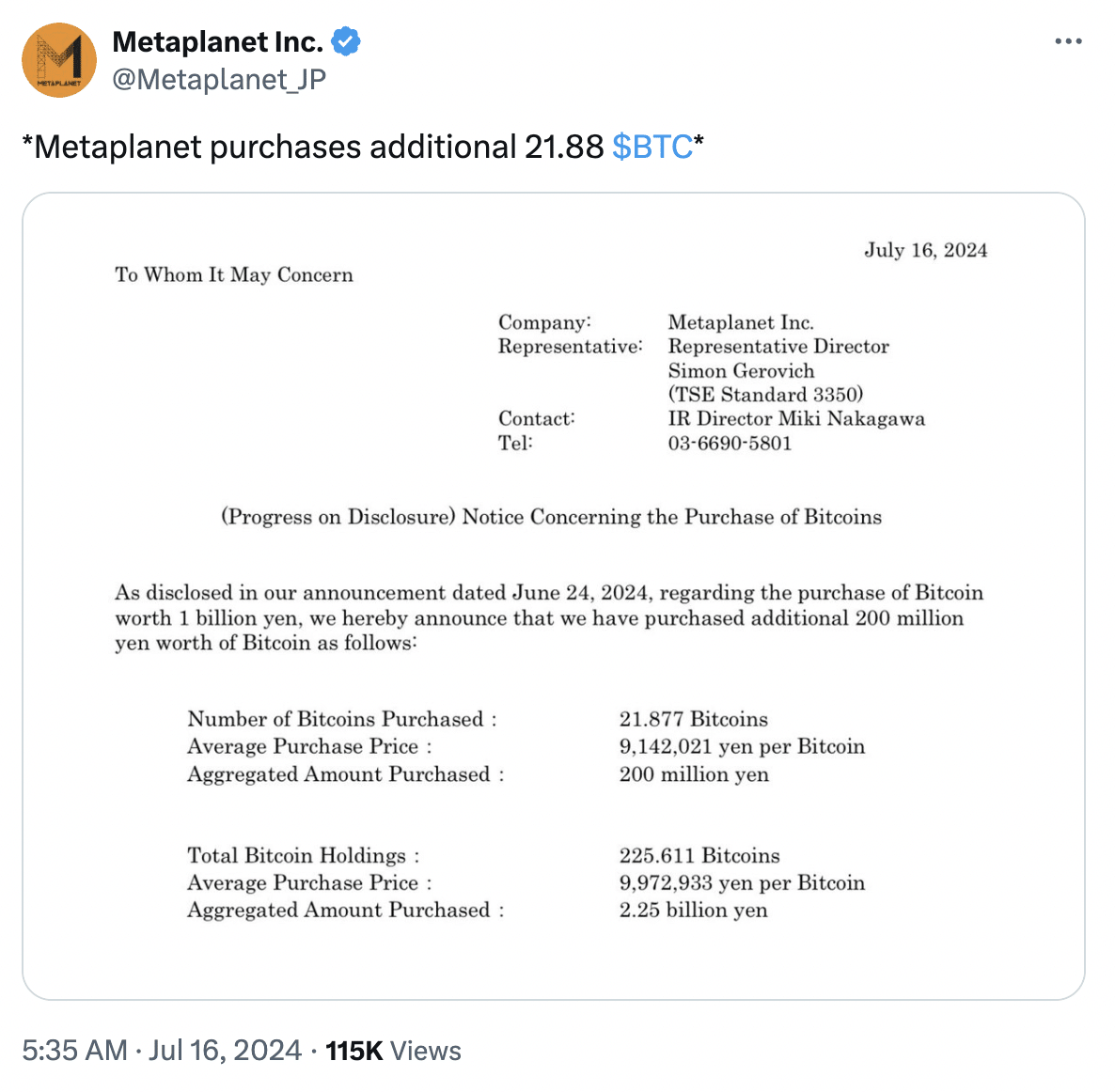

Recently, the company acquired an additional 21.88 BTC, valued at over $1.2 million (approximately 200 million Japanese yen).

Source: Metaplanet Inc/X

This move aligns with Bitcoin’s recent surge to around $65,000, marking a notable 4.5% increase following weeks of continuous decline.

In fact, at the time of writing, BTC showed bullish signs on the daily chart, marking a 1.94% increase in the past 24 hours.

Metaplanet takes cues from MicroStrategy

Interestingly, Metaplanet is often dubbed “Asia’s MicroStrategy” due to its tendency to follow MicroStrategy’s investment strategies.

For context, Metaplanet is financing its Bitcoin purchases through bond sales, similar to MicroStrategy’s approach. This highlights the growing institutional adoption of BTC.

That being said, on 16th July, Metaplanet boosted its Bitcoin holdings to over 225 BTC, valued at about $14.55 million at current prices.

Additionally, Metaplanet’s recent announcement of expanding its BTC holdings has triggered a remarkable surge in its share price, soaring by an impressive 25.81% to reach 117 JPY.

This surge reflects investor confidence in the firm’s strategic adoption of Bitcoin, which has pushed its stock by an astounding 631% since the year began.

Source: Google Finance

What’s more to it?

As of the latest update, Metaplanet’s current market capitalization stands at 17.5 billion JPY, with its BTC holdings valued at 2.25 billion JPY on its balance sheet.

As BTC’s proportion in its total assets continues to rise steadily, analysts speculate it could surpass 100% in the near future. This shows Metaplanet’s bold stance in embracing cryptocurrency as a core part of its investment strategy.

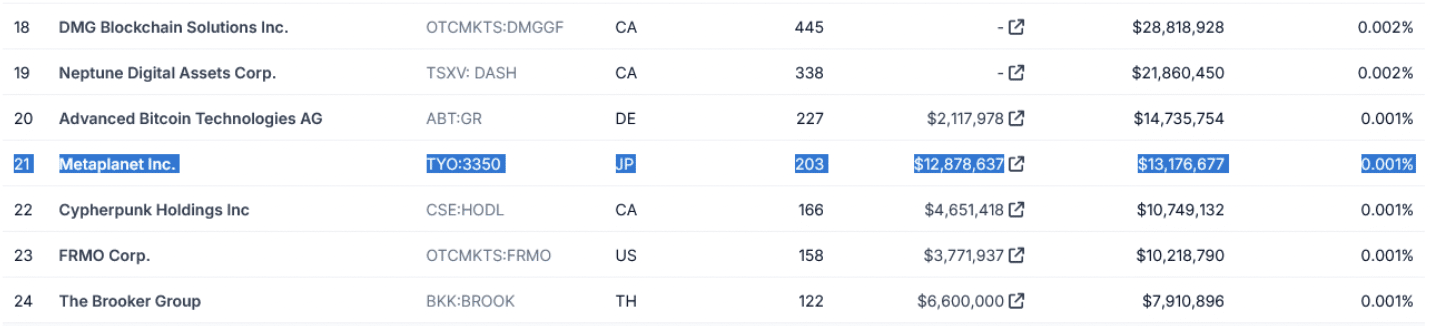

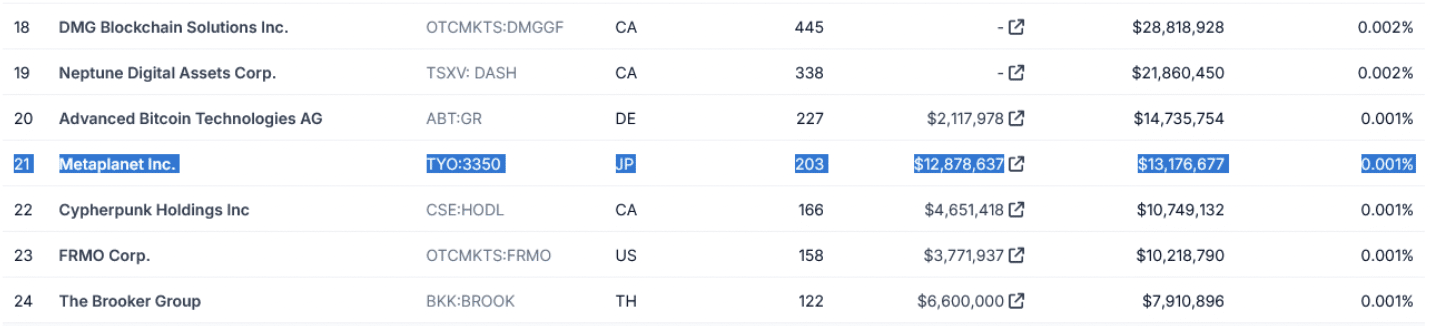

This was further confirmed by CoinGecko’s data, showing that Metaplanet currently ranks as the world’s 21st-largest corporate holder of Bitcoin.

Source: CoinGecko

This underscores Metaplanet’s proactive stance in hedging against Japan’s escalating debt crisis and the depreciating Japanese yen.

With the yen plummeting nearly 54% against the US dollar since January 2021, BTC has emerged as a robust alternative, appreciating by over 145% against the yen in the past year alone.

In conclusion, Metaplanet’s strategy reflects a growing trend where institutions are using Bitcoin alongside traditional assets for hedging and diversification.

- Metaplanet boosts BTC holdings amid price recovery, reinforcing its “Asia’s MicroStrategy” reputation.

- Post-announcement surge lifts Metaplanet’s stock by 25.81%, marking a bold Bitcoin investment strategy.

Metaplanet, a prominent publicly-listed investment and consulting firm headquartered in Japan, has significantly boosted its Bitcoin [BTC] holdings.

Metaplanet’s BTC holdings

Recently, the company acquired an additional 21.88 BTC, valued at over $1.2 million (approximately 200 million Japanese yen).

Source: Metaplanet Inc/X

This move aligns with Bitcoin’s recent surge to around $65,000, marking a notable 4.5% increase following weeks of continuous decline.

In fact, at the time of writing, BTC showed bullish signs on the daily chart, marking a 1.94% increase in the past 24 hours.

Metaplanet takes cues from MicroStrategy

Interestingly, Metaplanet is often dubbed “Asia’s MicroStrategy” due to its tendency to follow MicroStrategy’s investment strategies.

For context, Metaplanet is financing its Bitcoin purchases through bond sales, similar to MicroStrategy’s approach. This highlights the growing institutional adoption of BTC.

That being said, on 16th July, Metaplanet boosted its Bitcoin holdings to over 225 BTC, valued at about $14.55 million at current prices.

Additionally, Metaplanet’s recent announcement of expanding its BTC holdings has triggered a remarkable surge in its share price, soaring by an impressive 25.81% to reach 117 JPY.

This surge reflects investor confidence in the firm’s strategic adoption of Bitcoin, which has pushed its stock by an astounding 631% since the year began.

Source: Google Finance

What’s more to it?

As of the latest update, Metaplanet’s current market capitalization stands at 17.5 billion JPY, with its BTC holdings valued at 2.25 billion JPY on its balance sheet.

As BTC’s proportion in its total assets continues to rise steadily, analysts speculate it could surpass 100% in the near future. This shows Metaplanet’s bold stance in embracing cryptocurrency as a core part of its investment strategy.

This was further confirmed by CoinGecko’s data, showing that Metaplanet currently ranks as the world’s 21st-largest corporate holder of Bitcoin.

Source: CoinGecko

This underscores Metaplanet’s proactive stance in hedging against Japan’s escalating debt crisis and the depreciating Japanese yen.

With the yen plummeting nearly 54% against the US dollar since January 2021, BTC has emerged as a robust alternative, appreciating by over 145% against the yen in the past year alone.

In conclusion, Metaplanet’s strategy reflects a growing trend where institutions are using Bitcoin alongside traditional assets for hedging and diversification.

Thank you for the auspicious writeup It in fact was a amusement account it Look advanced to more added agreeable from you By the way how could we communicate

where to buy generic clomiphene tablets how to get cheap clomid can i purchase cheap clomid for sale clomid chart clomiphene pill can i buy clomid pill can i buy generic clomiphene without dr prescription

The depth in this serving is exceptional.

More posts like this would bring about the blogosphere more useful.

buy zithromax tablets – order flagyl online cheap buy flagyl 400mg generic

semaglutide 14 mg sale – cyproheptadine 4mg sale cyproheptadine usa

buy motilium without prescription – purchase domperidone online cheap flexeril drug

inderal 10mg brand – purchase methotrexate pills methotrexate 10mg canada

generic zithromax – buy tindamax 500mg buy bystolic generic

augmentin for sale online – atbioinfo.com buy acillin paypal

purchase esomeprazole pills – anexamate.com cost nexium

buy generic coumadin – coumamide.com cozaar over the counter

order mobic pills – mobo sin mobic 15mg over the counter

prednisone 5mg pills – https://apreplson.com/ purchase deltasone sale

pills for erection – ed pills that work quickly erection pills viagra online

buy amoxicillin pills for sale – cheap amoxicillin online purchase amoxil sale

fluconazole usa – https://gpdifluca.com/ fluconazole for sale online

cenforce 100mg over the counter – https://cenforcers.com/ buy cenforce 100mg sale

when should you take cialis – https://ciltadgn.com/# how much is cialis without insurance

buy zantac generic – https://aranitidine.com/ oral zantac 300mg

sildenafil citrate tablets 50mg – https://strongvpls.com/ sildenafil 50mg

More articles like this would make the blogosphere richer. buy amoxicillin generic

This is the gentle of writing I truly appreciate. https://prohnrg.com/

This is the kind of enter I unearth helpful. https://aranitidine.com/fr/en_france_xenical/