- Hayes put a buy call for BTC in anticipation of US dollar liquidity as Japanese banking crisis worsens.

- However, another analyst suggests that BTC headwinds will only end if the miner crisis ends.

Japan’s banking crisis is reportedly on the brink of exploding and could inject US ‘dollar liquidity’ and boost Bitcoin [BTC] and the overall crypto market.

In a new blog post on 20th June, BitMEX founder Arthur Hayes, viewed the potential impact of the Japanese banking crisis as a ‘pillar’ for the sector.

‘This is just another pillar of the crypto bull market.’

According to Hayes, the fifth-largest Japanese bank, Norinchukin is already under strain and plans to sell $63 billion of its US and European bonds.

The BitMEX founder added that the US may be forced to intervene to salvage the crisis, which could drive a ‘stealth dollar liquidity’ injection.

How will Bitcoin benefit?

Per Hayes, the Norinchukin’s US Treasury (UST) sell-off could tip other mega banks to follow suit.

‘All the Japanese megabanks will follow in the footsteps of Nochu (Norinchukin) and dump their UST portfolio to make the pain go away. That means $450 billion worth of USTs will hit the market quickly.

However, per Hayes, the US might not allow the above scenario because ‘yields would spike higher,’ making the federal government extremely expensive to fund.

In response, the US could convince the Bank of Japan (BoJ) to use a repurchase facility program to ‘absorb the UST supply.’ In return, the US will hand over ‘freshly printed US dollars’ to the BoJ, spiking dollar liquidity.

The executive also noted that a similar situation occurred in Q4 2023, and ‘it was off to the races for all risk assets, crypto included.’ Additionally, the US banking crisis in March 2023 tipped BTC to surge +200% after a bailout was announced, Hayes expounded.

To the BitMEX founder, the November US election was another play that could force the US to intervene in the Japanese banking crisis.

‘In an election year, the last thing the ruling Democrats need is a massive rise in UST yields, which affect major things their median voter financially cares about’

As a result, the next US liquidity injection was likely to come from the Japanese crisis, which was a boon for crypto investors. If so, Hayes nudged investors to ‘buy the f**king dip.’

BTC dilemma

Despite the above macro buy signal for BTC from Japan woes, the Bitcoin miner crisis was not over to confirm the buy call.

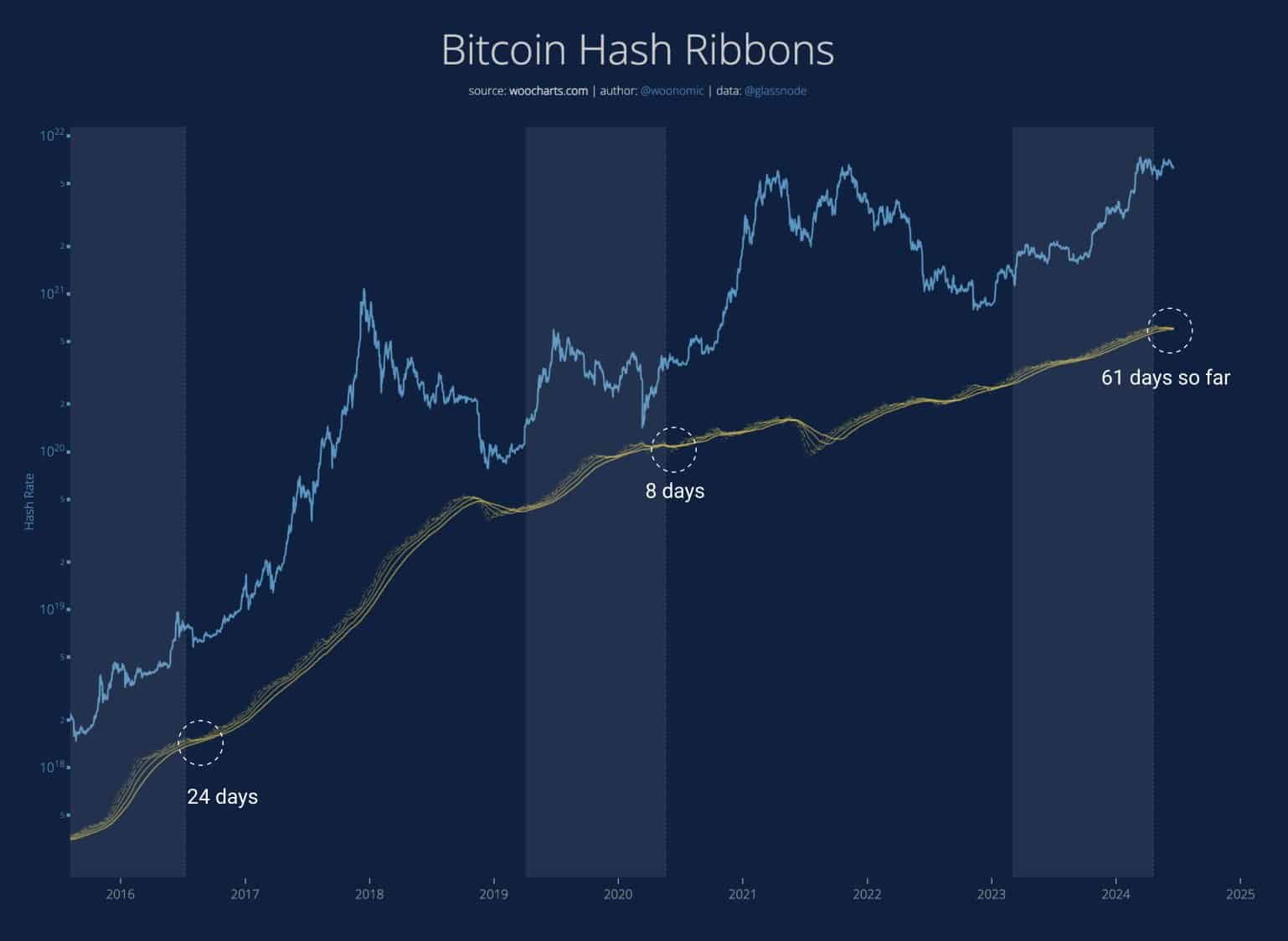

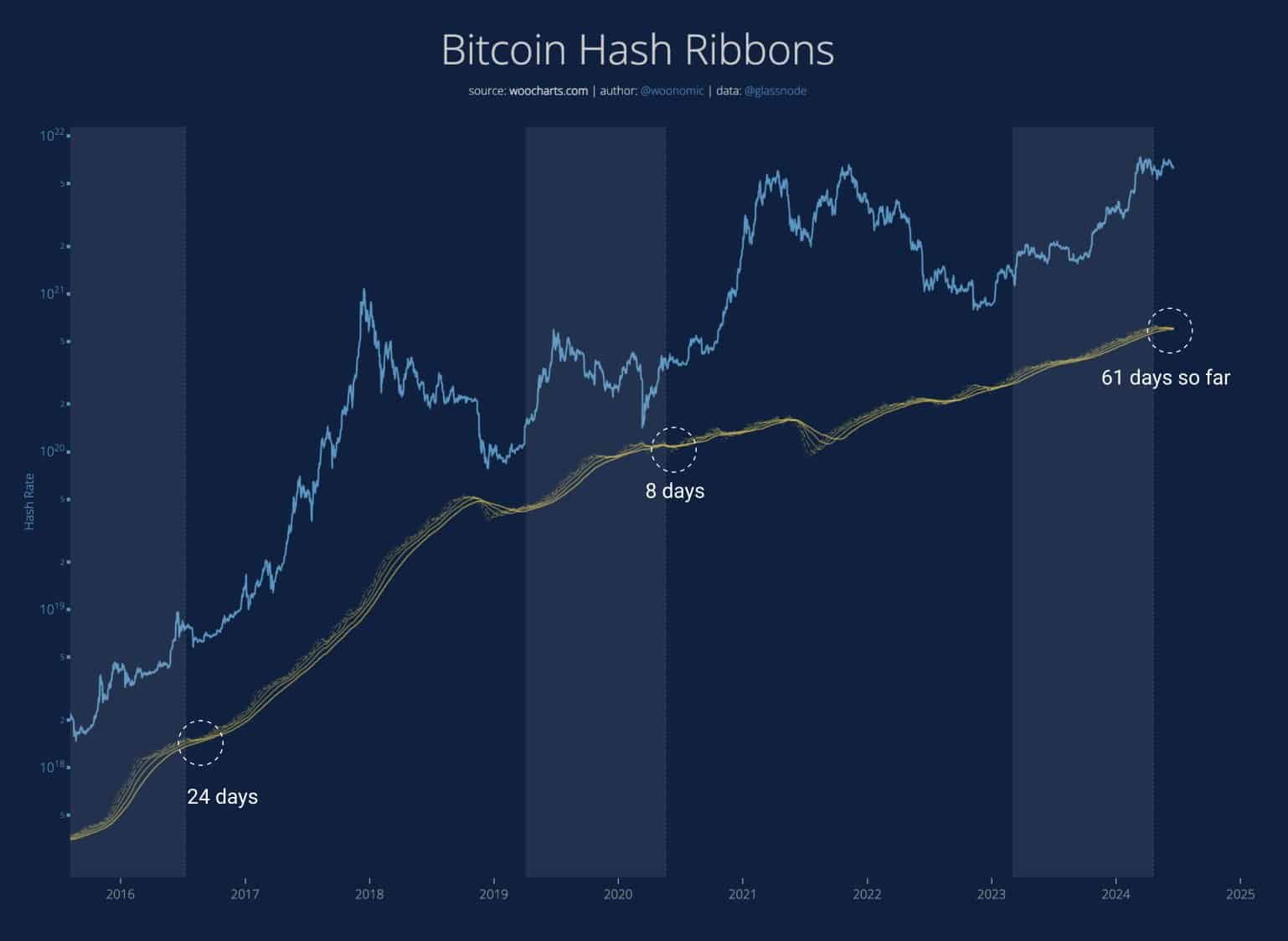

According to Willy Woo, a renowned BTC analyst, the BTC miner crisis was taking longer, and BTC will only improve over.

‘When does #Bitcoin recover? It’s when weak miners die and hash rate recovers.’

Source: Willy Woo

- Hayes put a buy call for BTC in anticipation of US dollar liquidity as Japanese banking crisis worsens.

- However, another analyst suggests that BTC headwinds will only end if the miner crisis ends.

Japan’s banking crisis is reportedly on the brink of exploding and could inject US ‘dollar liquidity’ and boost Bitcoin [BTC] and the overall crypto market.

In a new blog post on 20th June, BitMEX founder Arthur Hayes, viewed the potential impact of the Japanese banking crisis as a ‘pillar’ for the sector.

‘This is just another pillar of the crypto bull market.’

According to Hayes, the fifth-largest Japanese bank, Norinchukin is already under strain and plans to sell $63 billion of its US and European bonds.

The BitMEX founder added that the US may be forced to intervene to salvage the crisis, which could drive a ‘stealth dollar liquidity’ injection.

How will Bitcoin benefit?

Per Hayes, the Norinchukin’s US Treasury (UST) sell-off could tip other mega banks to follow suit.

‘All the Japanese megabanks will follow in the footsteps of Nochu (Norinchukin) and dump their UST portfolio to make the pain go away. That means $450 billion worth of USTs will hit the market quickly.

However, per Hayes, the US might not allow the above scenario because ‘yields would spike higher,’ making the federal government extremely expensive to fund.

In response, the US could convince the Bank of Japan (BoJ) to use a repurchase facility program to ‘absorb the UST supply.’ In return, the US will hand over ‘freshly printed US dollars’ to the BoJ, spiking dollar liquidity.

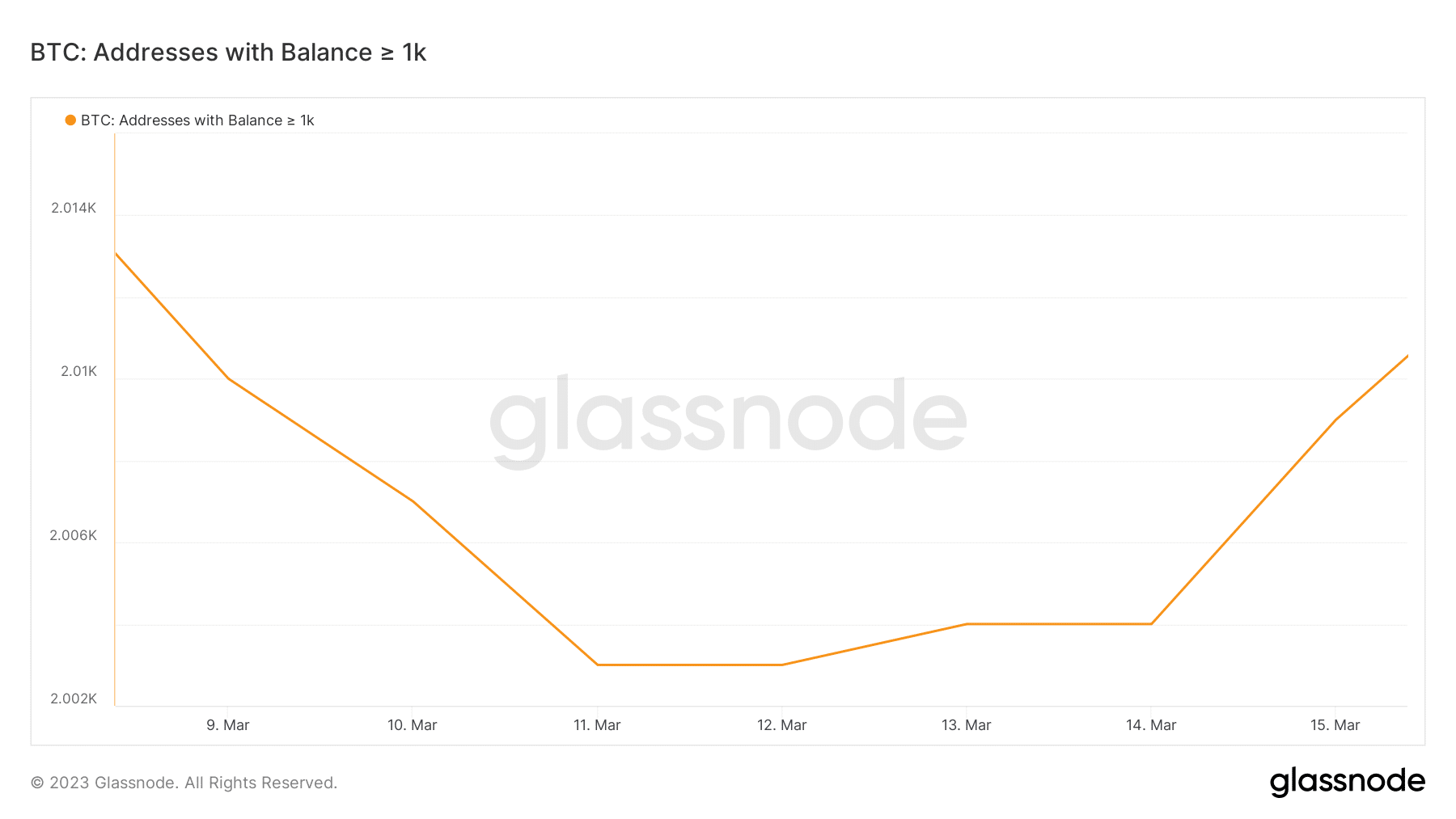

The executive also noted that a similar situation occurred in Q4 2023, and ‘it was off to the races for all risk assets, crypto included.’ Additionally, the US banking crisis in March 2023 tipped BTC to surge +200% after a bailout was announced, Hayes expounded.

To the BitMEX founder, the November US election was another play that could force the US to intervene in the Japanese banking crisis.

‘In an election year, the last thing the ruling Democrats need is a massive rise in UST yields, which affect major things their median voter financially cares about’

As a result, the next US liquidity injection was likely to come from the Japanese crisis, which was a boon for crypto investors. If so, Hayes nudged investors to ‘buy the f**king dip.’

BTC dilemma

Despite the above macro buy signal for BTC from Japan woes, the Bitcoin miner crisis was not over to confirm the buy call.

According to Willy Woo, a renowned BTC analyst, the BTC miner crisis was taking longer, and BTC will only improve over.

‘When does #Bitcoin recover? It’s when weak miners die and hash rate recovers.’

Source: Willy Woo

can i purchase clomiphene without insurance cost cheap clomiphene without insurance clomid usa clomid rx how to get generic clomid no prescription how can i get clomid without dr prescription clomid tablets for sale

More posts like this would create the online space more useful.

Thanks on sharing. It’s outstrip quality.

buy azithromycin no prescription – ofloxacin 400mg pill order flagyl 200mg online cheap

order semaglutide 14mg pills – semaglutide 14 mg usa brand periactin

motilium 10mg generic – order flexeril online cheap order flexeril online cheap

inderal oral – methotrexate 10mg canada methotrexate 5mg oral

buy amoxicillin medication – cheap amoxil generic combivent order online

clavulanate generic – at bio info purchase ampicillin

brand esomeprazole 20mg – anexa mate purchase nexium without prescription

order medex – https://coumamide.com/ purchase cozaar without prescription

buy meloxicam no prescription – tenderness meloxicam online buy

buy prednisone 40mg generic – adrenal prednisone 20mg pill

causes of erectile dysfunction – buy ed pills online buy ed medication online

buy amoxicillin without a prescription – comba moxi buy amoxicillin no prescription

fluconazole 200mg brand – diflucan for sale brand diflucan

order cenforce 50mg – https://cenforcers.com/ buy generic cenforce over the counter

tadalafil vs sildenafil – fast ciltad cialis tadalafil

cialis pills – https://strongtadafl.com/ where to buy tadalafil in singapore

ranitidine for sale online – ranitidine 150mg uk order generic zantac 300mg

buy cheap viagra in the uk – https://strongvpls.com/# cheap viagra online india

With thanks. Loads of expertise! amoxil que es

This is a theme which is virtually to my callousness… Numberless thanks! Quite where can I upon the connection details due to the fact that questions? prednisone injection

I’ll certainly bring to be familiar with more. https://ursxdol.com/azithromycin-pill-online/

The vividness in this serving is exceptional. https://prohnrg.com/product/get-allopurinol-pills/

This is the amicable of topic I have reading. pharmacie qui vend du cialis professional sans ordonnance

I am actually delighted to coup d’oeil at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data. https://ondactone.com/simvastatin/

More articles like this would pretence of the blogosphere richer.

https://proisotrepl.com/product/domperidone/

The depth in this ruined is exceptional. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24634

buy dapagliflozin pills – https://janozin.com/ cost dapagliflozin 10 mg

purchase orlistat for sale – this buy xenical for sale

More content pieces like this would make the web better. http://iawbs.com/home.php?mod=space&uid=916886