- One expert points to historical trends as a strong indicator of an impending BTC rally.

- Several key metrics support the potential for Bitcoin to climb higher, backed by multiple confluences in the data.

Last week, Bitcoin [BTC] faced considerable downward pressure, resulting in a 1.67% price drop. However, the market has since shown signs of recovery, with BTC gaining 1.30% in the last 24 hours.

Analysts expect these gains to continue, with historical data and multiple metrics suggesting Bitcoin could surpass its recent 15.27% rise and push higher in the coming weeks.

Historical data shows a 7% drop followed by a massive price surge

According to crypto analyst Carl Runefelt in a recent post on X (formerly Twitter), Bitcoin is currently at a historic crossroads similar to October 2023.

He noted:

“Bitcoin dropped 7% at the beginning of October 2023, and now it’s dropped about the same!”

Source: X

Based on the chart he shared, if this historical pattern repeats, BTC could rise by approximately 66.76%, potentially reaching $100,000. However, it’s worth noting that in 2023, the rally before consolidation only gained 35.43%.

Whether BTC will see a similar upward surge remains uncertain. AMBCrypto has analyzed various metrics to gauge market participants’ activities and provide insight into what might unfold in the upcoming trading sessions.

Traders exit exchanges, increasing demand for Bitcoin

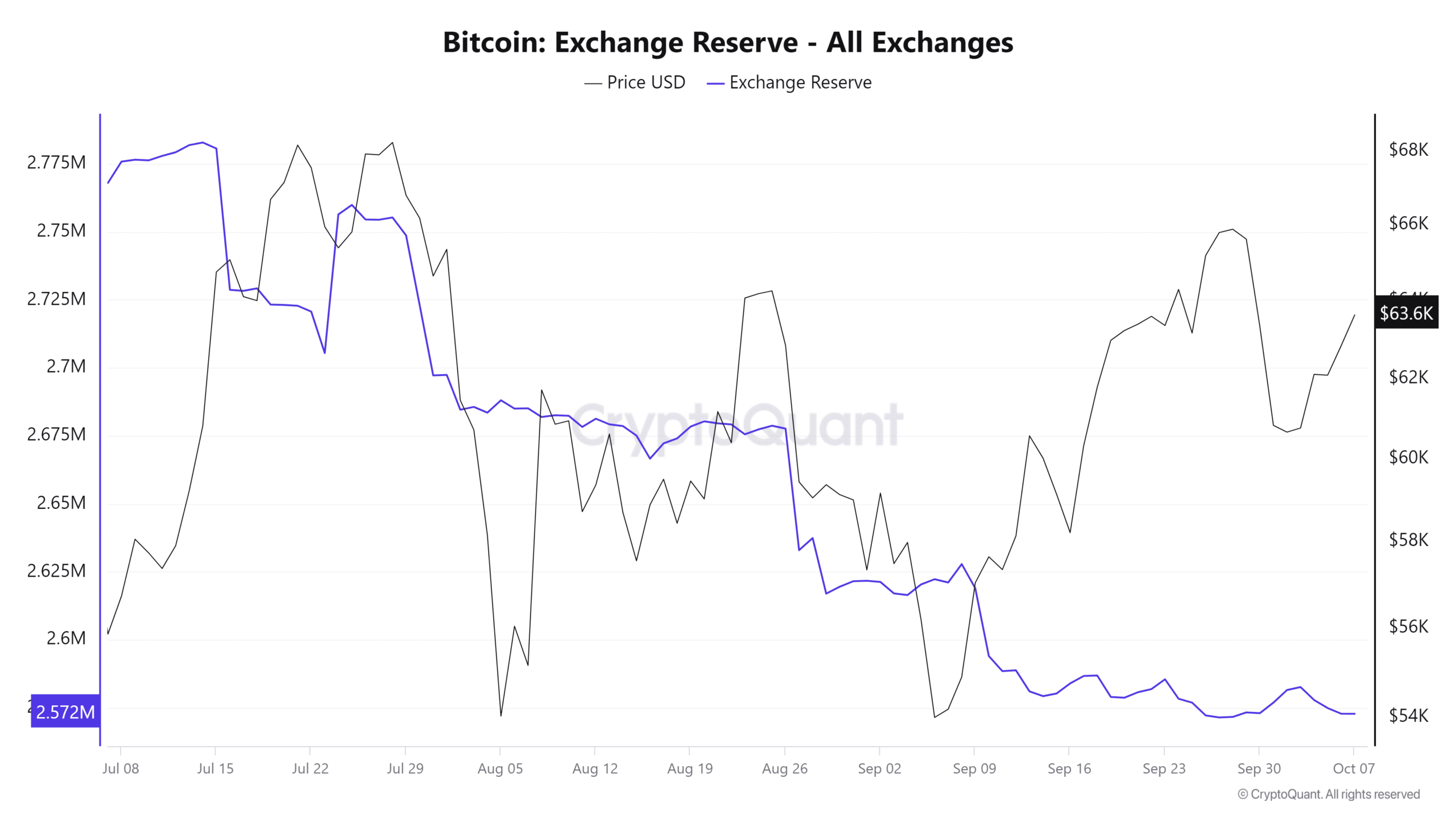

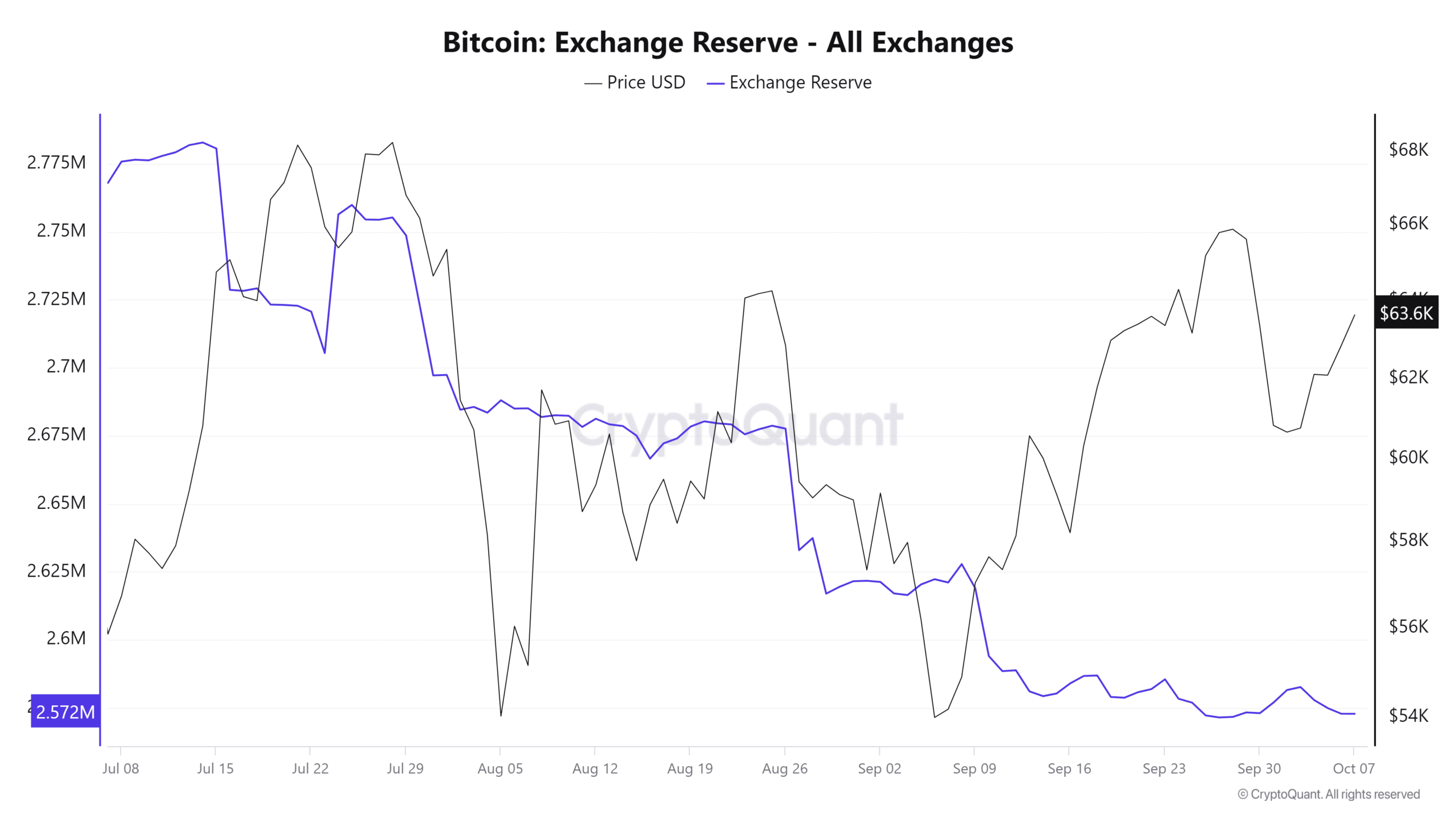

At press time, the total supply of BTC across multiple crypto exchanges, as measured by the Exchange Reserve, has been in steady decline since 3rd October.

Currently, only 2.57 million BTC remain on exchanges, down from 2.58 million, indicating that traders are increasingly opting to store their Bitcoin off-exchange, signaling growing confidence in the asset. This shift is also driving higher demand for BTC.

Source: CryptoQuant

This buying pressure is further confirmed by CryptoQuant’s Exchange Stablecoin Ratio. When this metric is low, as it is for BTC, it suggests that available stablecoins are likely being used to buy Bitcoin, pushing its price higher. The current reading of the ratio stands at 0.00009506 and is continuing to trend downward.

If these metrics maintain their downward trajectory, it’s likely that BTC will continue its upward momentum, as market sentiment increasingly favors the bulls.

While these are strong bullish indicators, AMBCrypto has also identified additional metrics pointing to the same conclusion.

Short traders face losses as BTC rises

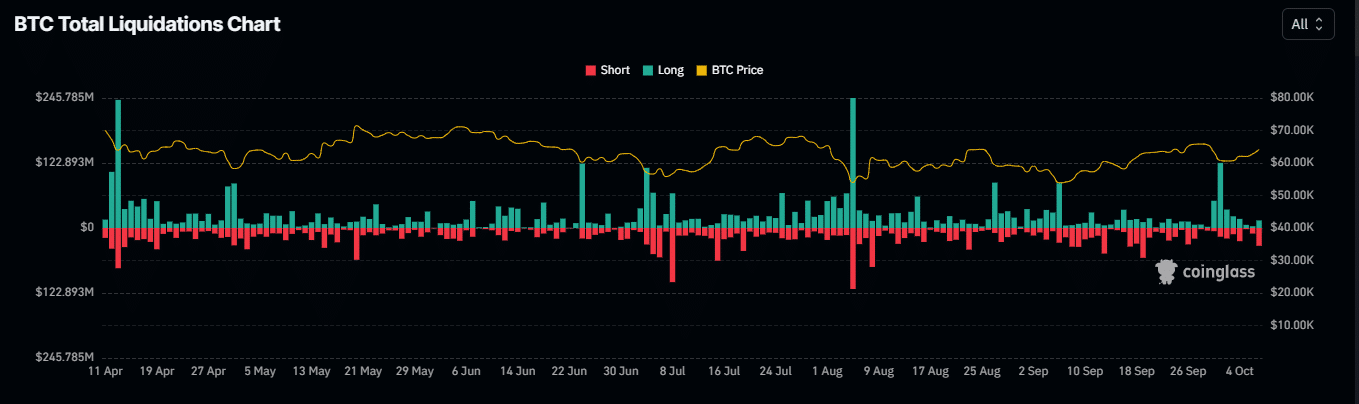

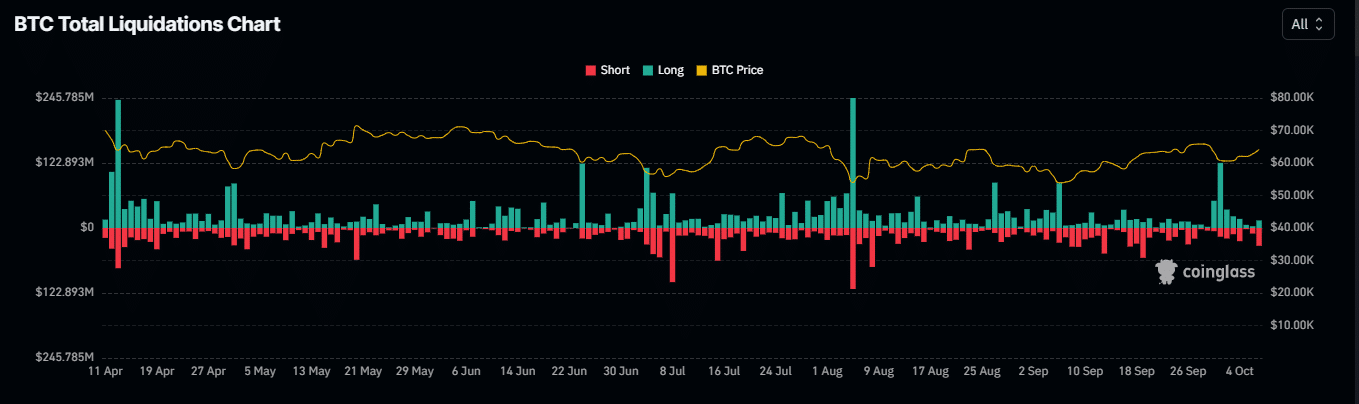

In the past 24 hours, numerous short traders have been liquidated as Bitcoin’s price moved against their bearish predictions.

Data from Coinglass reveals that approximately $41.80 million worth of short contracts on BTC were wiped out, highlighting a strong bullish shift in the market.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Additionally, Open Interest, a key metric that measures trader activity, indicates a bullish trend, with a 3.66% increase pushing the total to $34.08 billion.

If this trend continues, BTC’s upward momentum is likely to persist, confirming the bullish sentiment among traders.

- One expert points to historical trends as a strong indicator of an impending BTC rally.

- Several key metrics support the potential for Bitcoin to climb higher, backed by multiple confluences in the data.

Last week, Bitcoin [BTC] faced considerable downward pressure, resulting in a 1.67% price drop. However, the market has since shown signs of recovery, with BTC gaining 1.30% in the last 24 hours.

Analysts expect these gains to continue, with historical data and multiple metrics suggesting Bitcoin could surpass its recent 15.27% rise and push higher in the coming weeks.

Historical data shows a 7% drop followed by a massive price surge

According to crypto analyst Carl Runefelt in a recent post on X (formerly Twitter), Bitcoin is currently at a historic crossroads similar to October 2023.

He noted:

“Bitcoin dropped 7% at the beginning of October 2023, and now it’s dropped about the same!”

Source: X

Based on the chart he shared, if this historical pattern repeats, BTC could rise by approximately 66.76%, potentially reaching $100,000. However, it’s worth noting that in 2023, the rally before consolidation only gained 35.43%.

Whether BTC will see a similar upward surge remains uncertain. AMBCrypto has analyzed various metrics to gauge market participants’ activities and provide insight into what might unfold in the upcoming trading sessions.

Traders exit exchanges, increasing demand for Bitcoin

At press time, the total supply of BTC across multiple crypto exchanges, as measured by the Exchange Reserve, has been in steady decline since 3rd October.

Currently, only 2.57 million BTC remain on exchanges, down from 2.58 million, indicating that traders are increasingly opting to store their Bitcoin off-exchange, signaling growing confidence in the asset. This shift is also driving higher demand for BTC.

Source: CryptoQuant

This buying pressure is further confirmed by CryptoQuant’s Exchange Stablecoin Ratio. When this metric is low, as it is for BTC, it suggests that available stablecoins are likely being used to buy Bitcoin, pushing its price higher. The current reading of the ratio stands at 0.00009506 and is continuing to trend downward.

If these metrics maintain their downward trajectory, it’s likely that BTC will continue its upward momentum, as market sentiment increasingly favors the bulls.

While these are strong bullish indicators, AMBCrypto has also identified additional metrics pointing to the same conclusion.

Short traders face losses as BTC rises

In the past 24 hours, numerous short traders have been liquidated as Bitcoin’s price moved against their bearish predictions.

Data from Coinglass reveals that approximately $41.80 million worth of short contracts on BTC were wiped out, highlighting a strong bullish shift in the market.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Additionally, Open Interest, a key metric that measures trader activity, indicates a bullish trend, with a 3.66% increase pushing the total to $34.08 billion.

If this trend continues, BTC’s upward momentum is likely to persist, confirming the bullish sentiment among traders.

casino-crazy-time.ru

last news about casino crazy time

https://casino-crazy-time.ru

can i purchase generic clomiphene for sale can i purchase generic clomiphene online clomid generic cost clomid for sale uk how to get clomiphene without dr prescription order clomid prices order clomiphene pill

The thoroughness in this break down is noteworthy.

With thanks. Loads of erudition!

buy azithromycin for sale – order ofloxacin pill brand flagyl 200mg

semaglutide cost – rybelsus 14mg cheap order cyproheptadine 4 mg online

order amoxil pills – buy valsartan 80mg pills combivent price

buy augmentin 625mg online – atbioinfo.com acillin where to buy

purchase nexium capsules – anexa mate nexium 40mg oral

coumadin 2mg without prescription – https://coumamide.com/ brand cozaar 25mg

buy generic meloxicam 15mg – https://moboxsin.com/ meloxicam generic

order prednisone online – corticosteroid order deltasone 5mg pills

gnc ed pills – fastedtotake buy generic ed pills for sale

purchase amoxicillin – where to buy amoxil without a prescription amoxil usa

buy forcan without a prescription – https://gpdifluca.com/# order diflucan 200mg for sale

escitalopram 10mg us – https://escitapro.com/ buy generic lexapro

purchase cenforce for sale – https://cenforcers.com/# order cenforce 50mg sale

tadalafil without a doctor’s prescription – https://ciltadgn.com/# canadian pharmacy cialis 20mg

cialis coupon walgreens – strong tadafl cialis coupon 2019

order ranitidine 150mg – https://aranitidine.com/ cost zantac 150mg

The reconditeness in this tune is exceptional. synthroid post ciclo como tomar

This website absolutely has all of the low-down and facts I needed there this participant and didn’t know who to ask. prednisone and copd exacerbation

More articles like this would remedy the blogosphere richer. https://ursxdol.com/synthroid-available-online/

More delight pieces like this would create the интернет better. online

The thoroughness in this section is noteworthy. https://ondactone.com/simvastatin/

This is a keynote which is near to my fundamentals… Many thanks! Quite where can I find the phone details due to the fact that questions?

https://doxycyclinege.com/pro/ranitidine/

I’ll certainly bring back to review more. https://www.forum-joyingauto.com/member.php?action=profile&uid=48099

pill forxiga 10mg – this forxiga us

buy orlistat without a prescription – xenical price buy xenical 60mg online

This is the make of advise I turn up helpful. http://pokemonforever.com/User-Sskjba