- Bitcoin’s price increased by more than 2% in the last seven days.

- Most metrics looked bullish on Bitcoin.

Bitcoin [BTC] has not performed per expectations, as the king of cryptos continued to trade under $70k at press time, despite a positive weekly chart.

But there was more to the story, as BTC’s slow-moving price action might be a prelude to a massive price hike in the coming days.

Bitcoin is set to pump

CoinMarketCap’s data revealed that BTC’s price had increased by more than 2% in the last seven days. At the time of writing, BTC was trading at $69,329.89 with a market capitalization of over $1.3 trillion.

Though BTC continued to trade under $70k, the king of cryptos had a trick up its sleeves, which might soon result in a massive bull rally.

Trader Tradigrade, a popular crypto analyst, recently posted a tweet highlighting an interesting development. As per the tweet, BTC’s price was consolidating inside a bullish pennant pattern.

A breakout above could allow BTC to touch new highs.

So, the recent sluggish price movement could just be a result of this consolidation phase.

BTC to $88k?

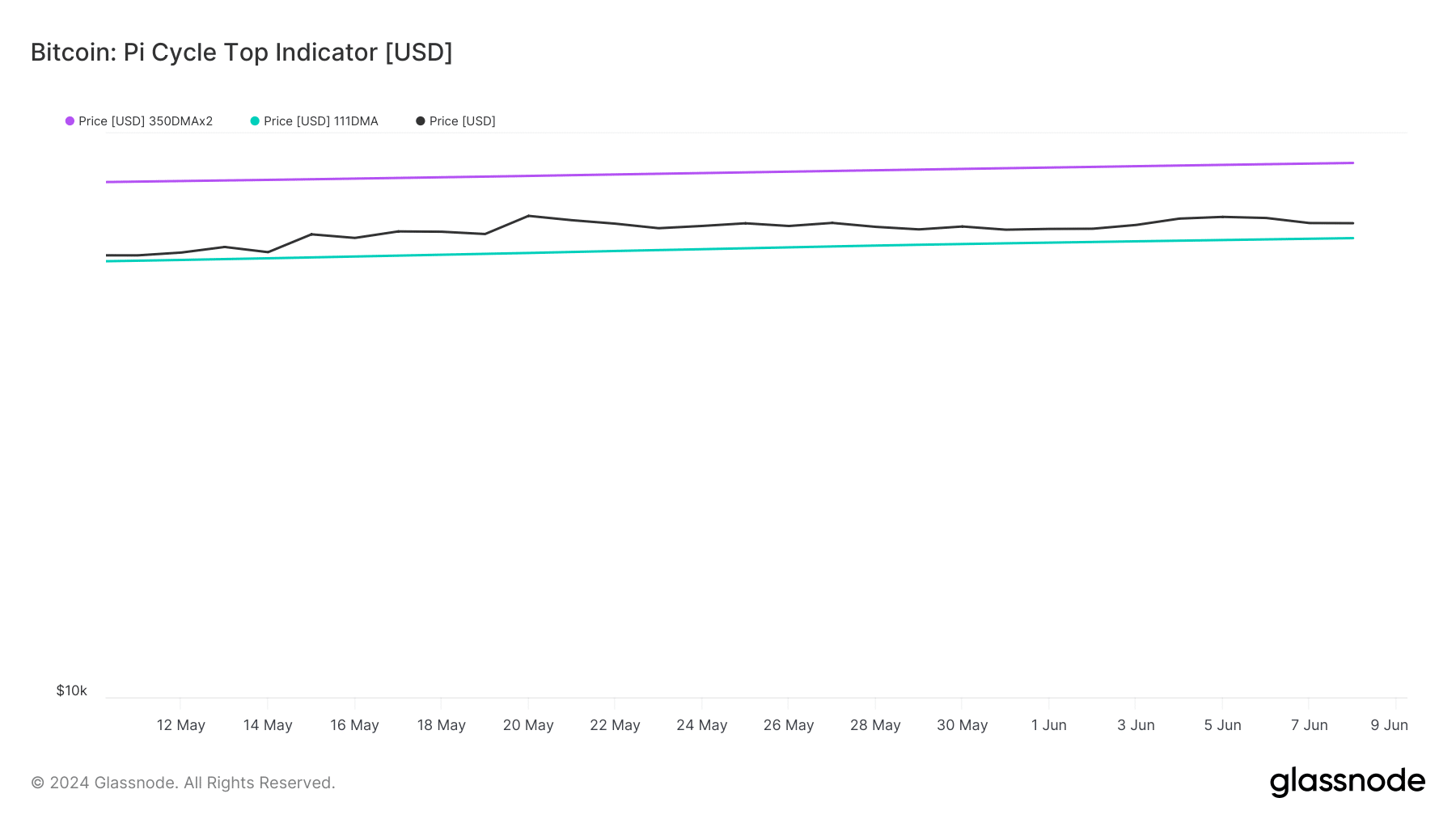

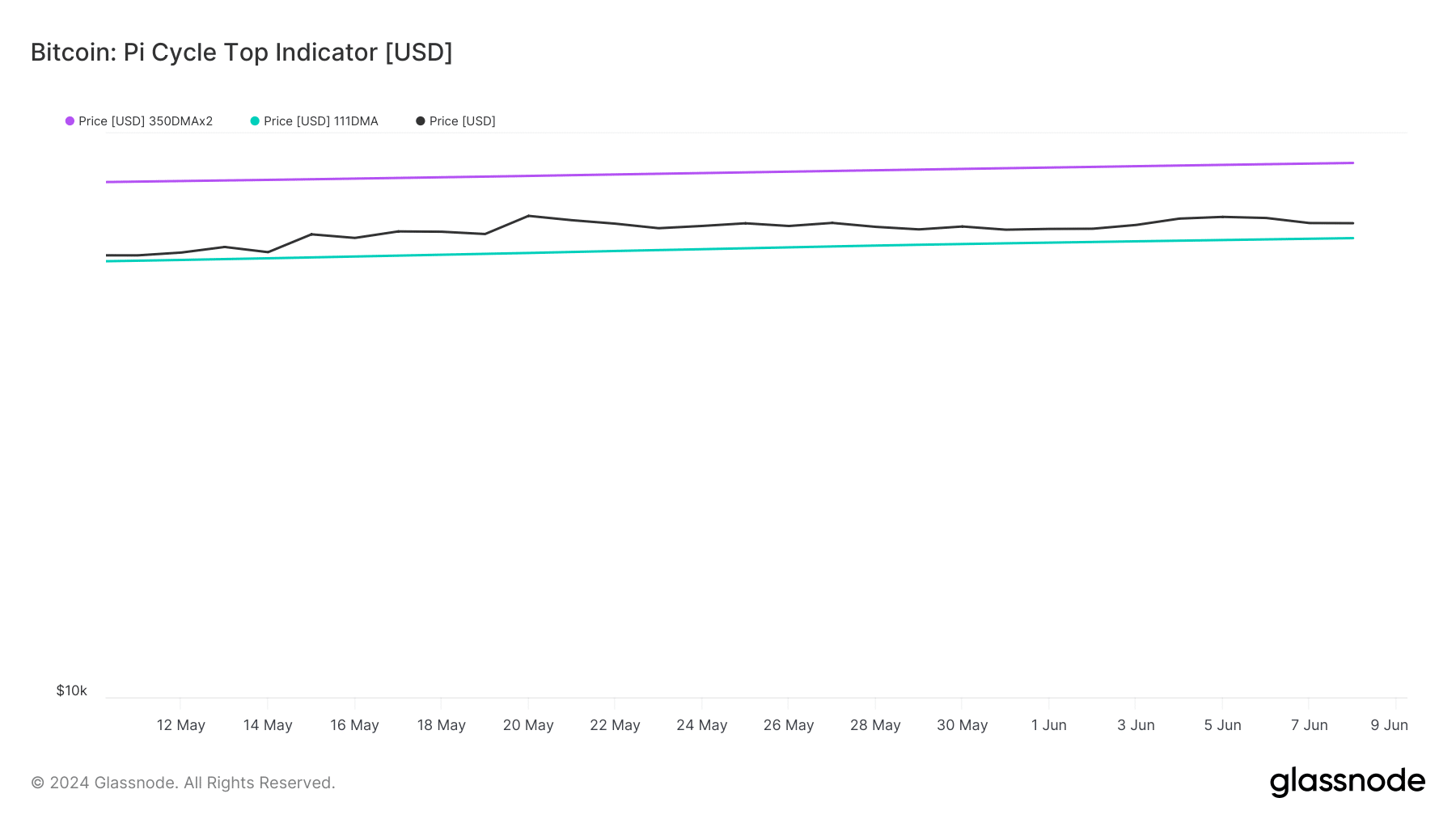

AMBCrypto’s look at Glassnode’s data revealed that BTC had the potential to surge substantially.

To be precise, BTC’s Pi cycle top indicators revealed that BTC was nearing its market bottom, and a price could allow the coin to go above the $88k mark.

For the uninitiated, the Pi Cycle indicator is composed of the 111-day moving average (111SMA) and a 2x multiple of the 350-day moving average of Bitcoin’s price.

Source: Glassnode

AMBCrypto then analyzed CryptoQuant’s data to better understand whether BTC could reach $88k. We found that buying pressure on BTC was high, as its exchange reserve was dropping at press time.

Its Binary CDD remained green, meaning that long-term holders’ movements in the last seven days were lower than average. They have a motive to hold their coins.

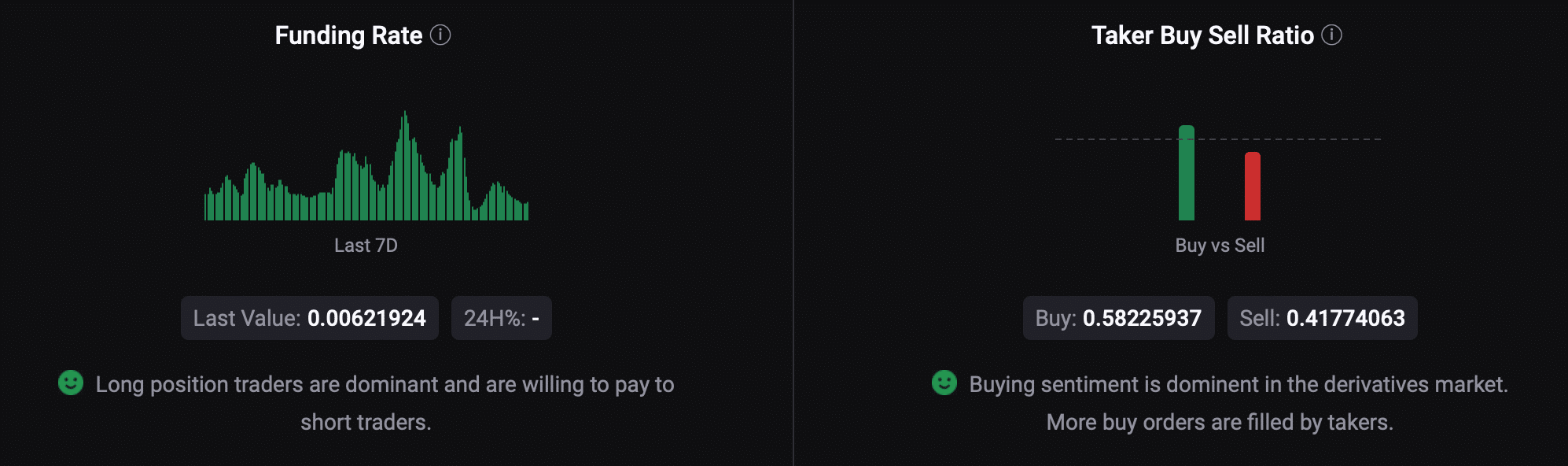

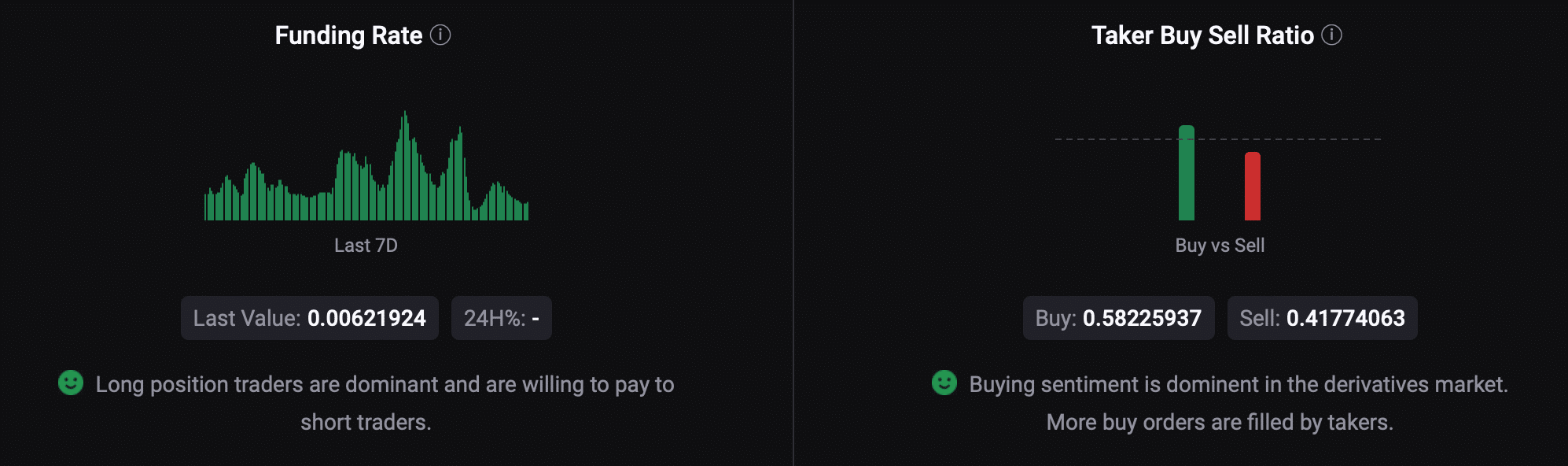

Things in the derivatives market also looked pretty optimistic. BTC’s Funding Rate increased, meaning that long-position traders are dominant and are willing to pay short-position traders.

Buying sentiment among derivatives investors was also high, which was evident from its green Taker Buy Sell Ratio.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

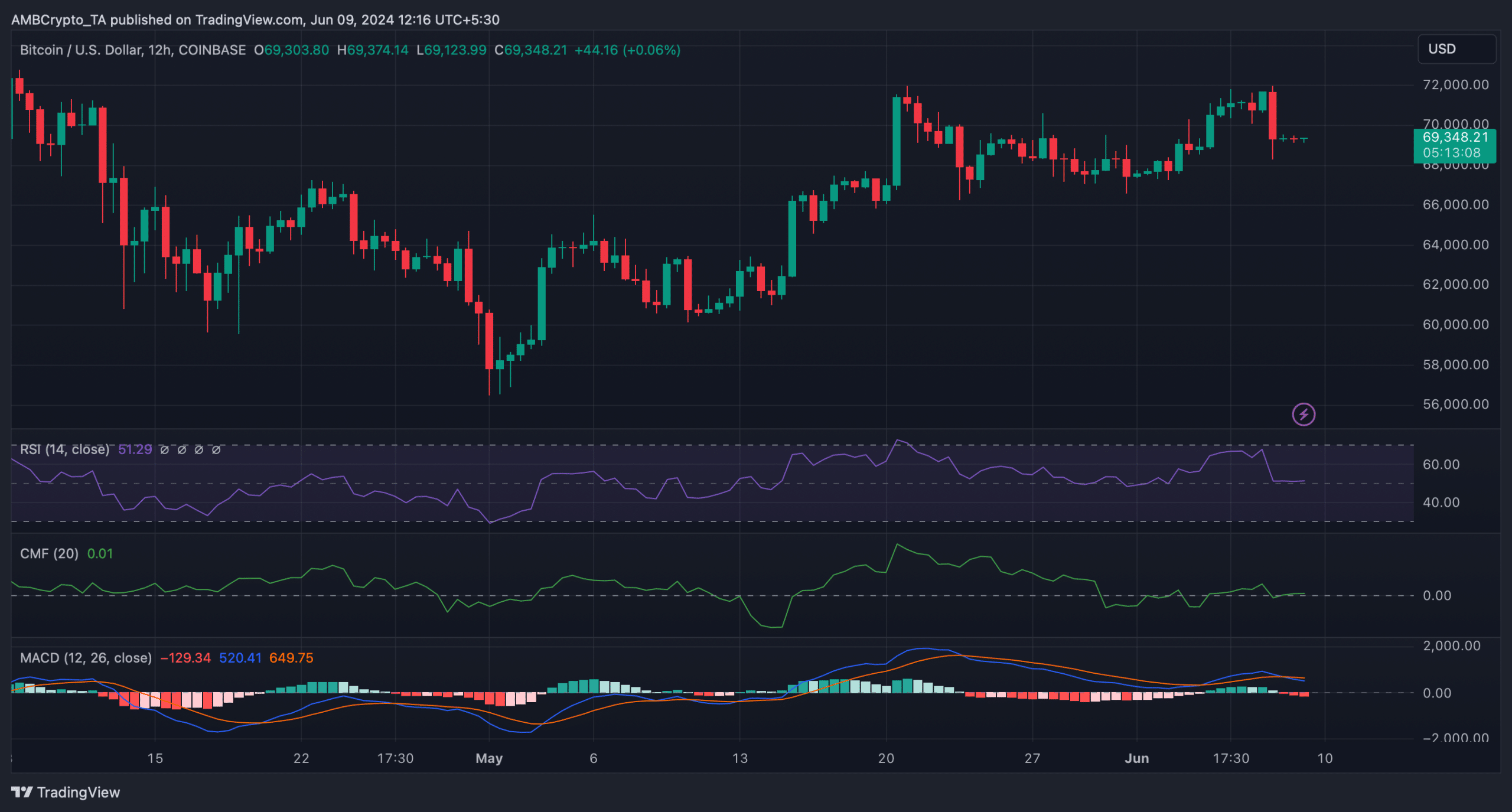

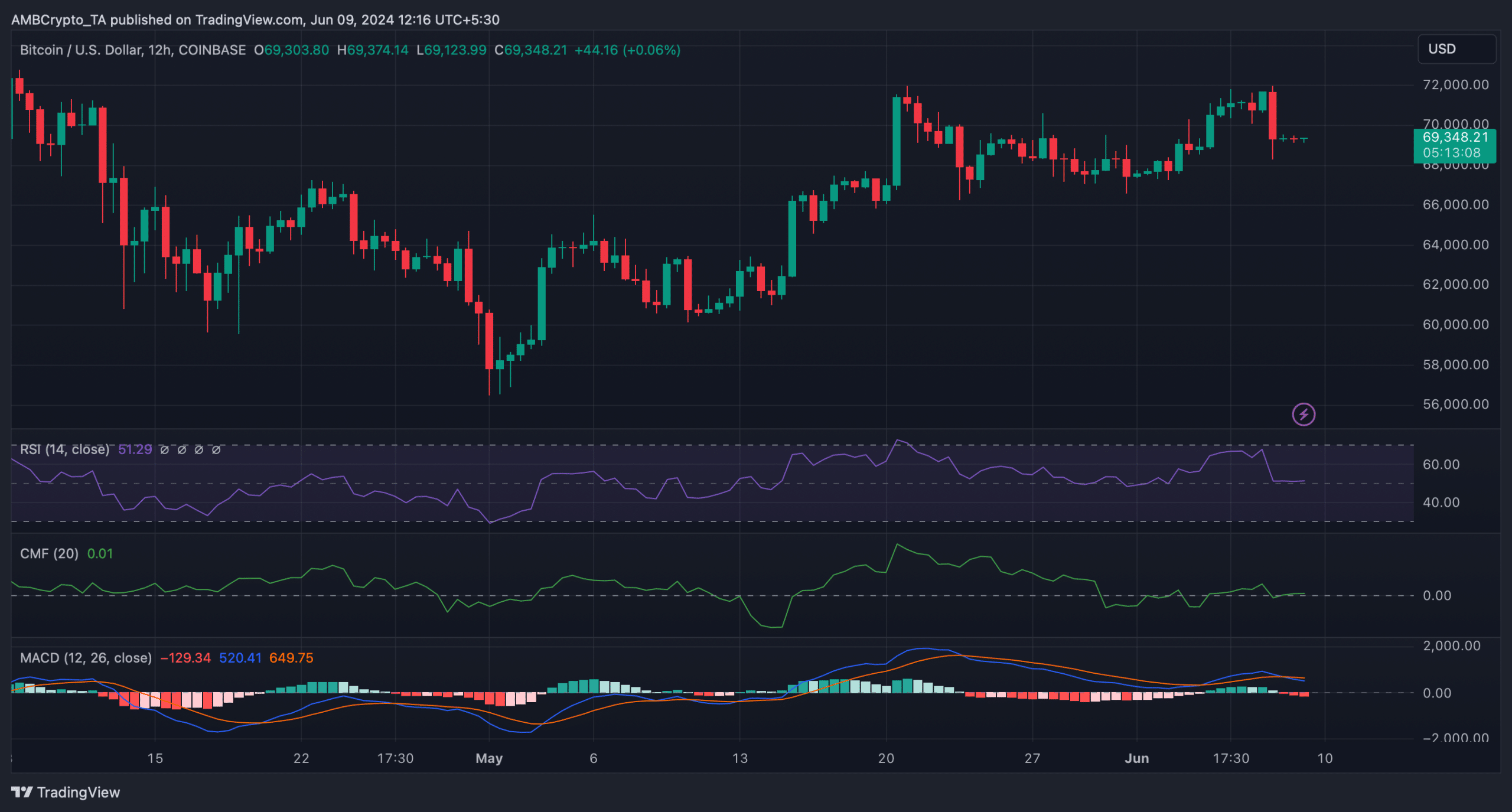

However, investors might have to wait a bit longer to see a Bitcoin pump, as a few indicators hinted at a few more slow-moving days. Notably, the coin’s MACD displayed a bearish crossover.

Moreover, its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both moved sideways near their respective neutral zones.

Source: TradingView

- Bitcoin’s price increased by more than 2% in the last seven days.

- Most metrics looked bullish on Bitcoin.

Bitcoin [BTC] has not performed per expectations, as the king of cryptos continued to trade under $70k at press time, despite a positive weekly chart.

But there was more to the story, as BTC’s slow-moving price action might be a prelude to a massive price hike in the coming days.

Bitcoin is set to pump

CoinMarketCap’s data revealed that BTC’s price had increased by more than 2% in the last seven days. At the time of writing, BTC was trading at $69,329.89 with a market capitalization of over $1.3 trillion.

Though BTC continued to trade under $70k, the king of cryptos had a trick up its sleeves, which might soon result in a massive bull rally.

Trader Tradigrade, a popular crypto analyst, recently posted a tweet highlighting an interesting development. As per the tweet, BTC’s price was consolidating inside a bullish pennant pattern.

A breakout above could allow BTC to touch new highs.

So, the recent sluggish price movement could just be a result of this consolidation phase.

BTC to $88k?

AMBCrypto’s look at Glassnode’s data revealed that BTC had the potential to surge substantially.

To be precise, BTC’s Pi cycle top indicators revealed that BTC was nearing its market bottom, and a price could allow the coin to go above the $88k mark.

For the uninitiated, the Pi Cycle indicator is composed of the 111-day moving average (111SMA) and a 2x multiple of the 350-day moving average of Bitcoin’s price.

Source: Glassnode

AMBCrypto then analyzed CryptoQuant’s data to better understand whether BTC could reach $88k. We found that buying pressure on BTC was high, as its exchange reserve was dropping at press time.

Its Binary CDD remained green, meaning that long-term holders’ movements in the last seven days were lower than average. They have a motive to hold their coins.

Things in the derivatives market also looked pretty optimistic. BTC’s Funding Rate increased, meaning that long-position traders are dominant and are willing to pay short-position traders.

Buying sentiment among derivatives investors was also high, which was evident from its green Taker Buy Sell Ratio.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, investors might have to wait a bit longer to see a Bitcoin pump, as a few indicators hinted at a few more slow-moving days. Notably, the coin’s MACD displayed a bearish crossover.

Moreover, its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both moved sideways near their respective neutral zones.

Source: TradingView

cost of clomid tablets can i get cheap clomiphene can i buy cheap clomid without prescription clomiphene 50mg for sale can you buy clomiphene online where can i get clomid without dr prescription can i order clomid online

Thanks for sharing. It’s first quality.

Thanks on putting this up. It’s well done.

azithromycin usa – purchase flagyl online cheap order metronidazole 400mg sale

buy generic domperidone – flexeril pills cheap cyclobenzaprine

buy propranolol generic – oral methotrexate 10mg where to buy methotrexate without a prescription

buy clavulanate cheap – atbio info ampicillin brand

buy nexium 40mg – https://anexamate.com/ buy nexium 40mg without prescription

buy coumadin sale – blood thinner order cozaar 25mg without prescription

mobic cheap – moboxsin order meloxicam 7.5mg generic

buy deltasone 20mg for sale – https://apreplson.com/ deltasone 20mg uk

mens ed pills – site best ed drugs

amoxil medication – https://combamoxi.com/ brand amoxil

diflucan buy online – https://gpdifluca.com/ purchase fluconazole generic

buying cialis online safely – cialis dapoxetine australia buy cialis online without prescription

order generic ranitidine – https://aranitidine.com/# cheap ranitidine 300mg

cialis is for daily use – strongtadafl buying generic cialis online safe

This website positively has all of the low-down and facts I needed there this case and didn’t comprehend who to ask. para que sirve el amoxil 500 mg

buy viagra online legit – https://strongvpls.com/# viagra 50 mg pill

More posts like this would create the online space more useful. https://ursxdol.com/amoxicillin-antibiotic/

Thanks on sharing. It’s first quality. https://buyfastonl.com/amoxicillin.html

This is the compassionate of writing I in fact appreciate. https://prohnrg.com/product/metoprolol-25-mg-tablets/

I am in point of fact enchant‚e ‘ to glance at this blog posts which consists of tons of worthwhile facts, thanks for providing such data. https://ondactone.com/product/domperidone/

This is the tolerant of enter I recoup helpful.

sumycin generic

Greetings! Jolly productive suggestion within this article! It’s the petty changes which wish obtain the largest changes. Thanks a a quantity towards sharing! http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44793

order forxiga 10mg sale – https://janozin.com/ purchase dapagliflozin generic