- Bitcoin was down by over 1% in the last 24 hours.

- Market indicators looked bearish on the coin.

While Bitcoin’s [BTC] price gained upward momentum, the short-term holders acted interestingly.

Therefore, AMBCrypto then planned to take a closer look at the king of cryptos’ state to better understand where it was headed.

Short-term holders are accumulating

Crazzyblokk, an analyst and author at CryptoQuant, recently posted an analysis highlighting interesting activity. Notably, in recent months, short-term holders have accumulated significant amounts of Bitcoin.

The post mentioned,

“Based on this metric, now 50% of the realized Bitcoin cap belongs to short-term holders, who tend to hold onto their Bitcoins for longer periods.”

Apart from this description, the Bitcoin market, assessed by RC value, was approaching a risky area akin to the 2019 price cycle.

This might be troublesome as it suggests the increased value held by short-term holders may lead to a tendency to take profits or exit, causing market volatility.

Bitcoin’s value is dropping

The analysis turned out to be true, as after a week-long bull rally, the king of cryptos’ value witnessed a slight correction. According to CoinMarketCap, BTC’s value dropped by over 1% in the last 24 hours.

At press time, it was trading at $70,015.84 with a market capitalization of over $1.38 trillion.

The drop in value happened at a time when the king of cryptos was expecting its next halving in just a few weeks. To be precise, BTC’s next halving is scheduled to happen in April 2024.

Despite the recent drop in price, investors seemed to have still been accumulating more BTC.

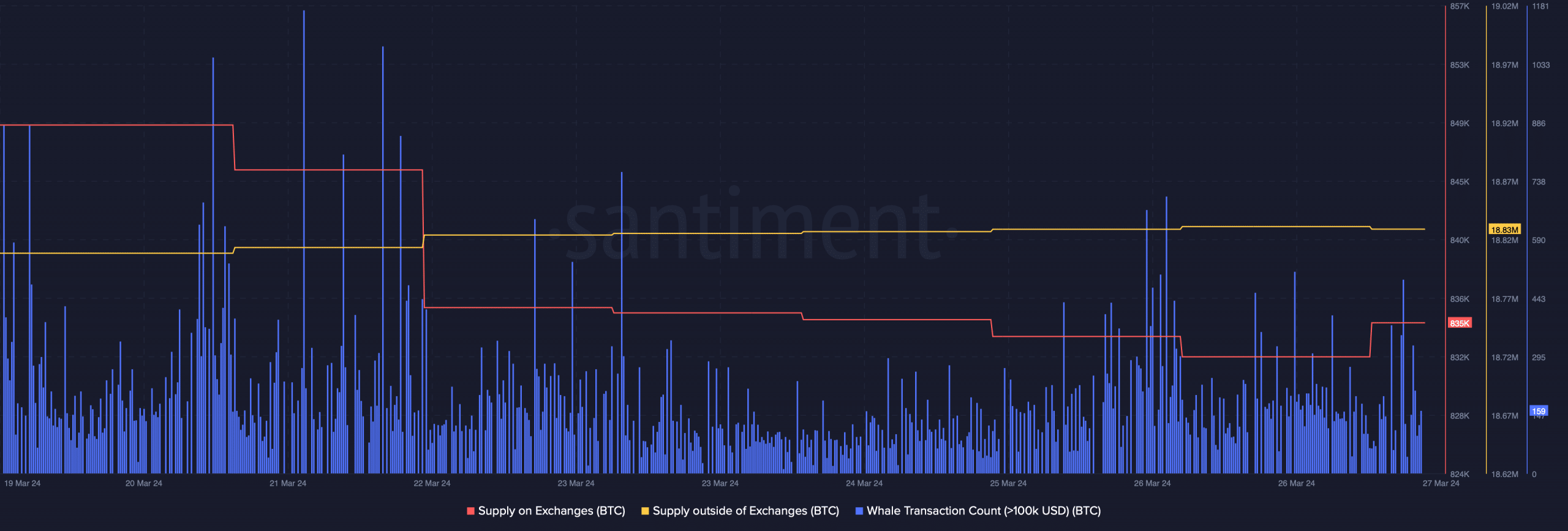

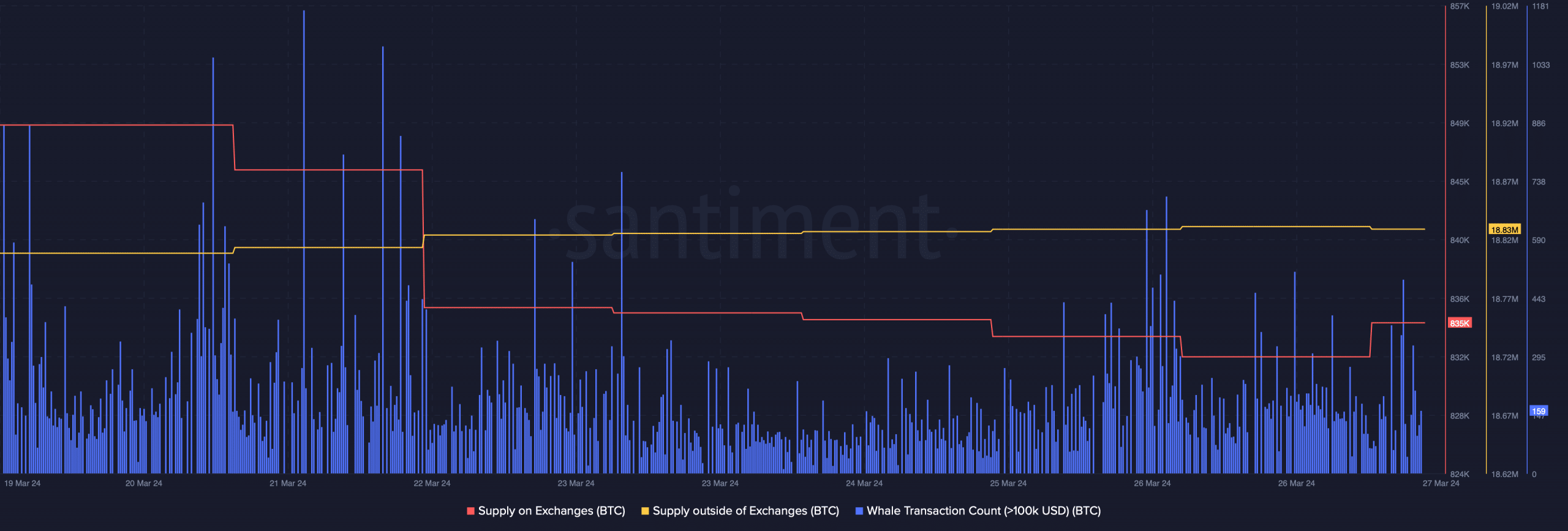

Our analysis of Santiment’s data revealed that BTC’s Supply on Exchanges dropped last week, while its Supply outside of Exchanges rose slightly.

Whale activity around the coin was also relatively high, which was evident from its Whale Transaction Count.

Source: Santiment

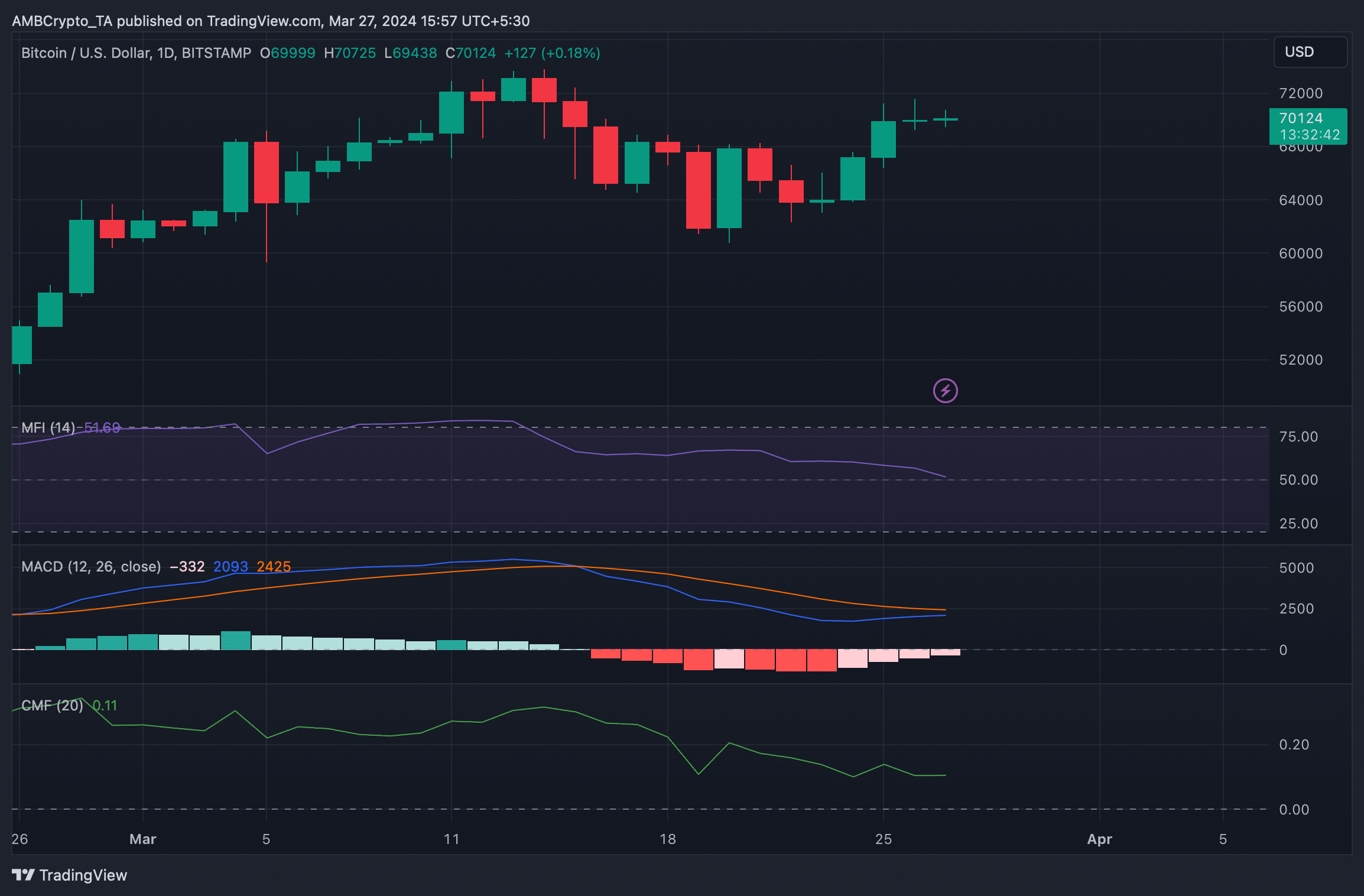

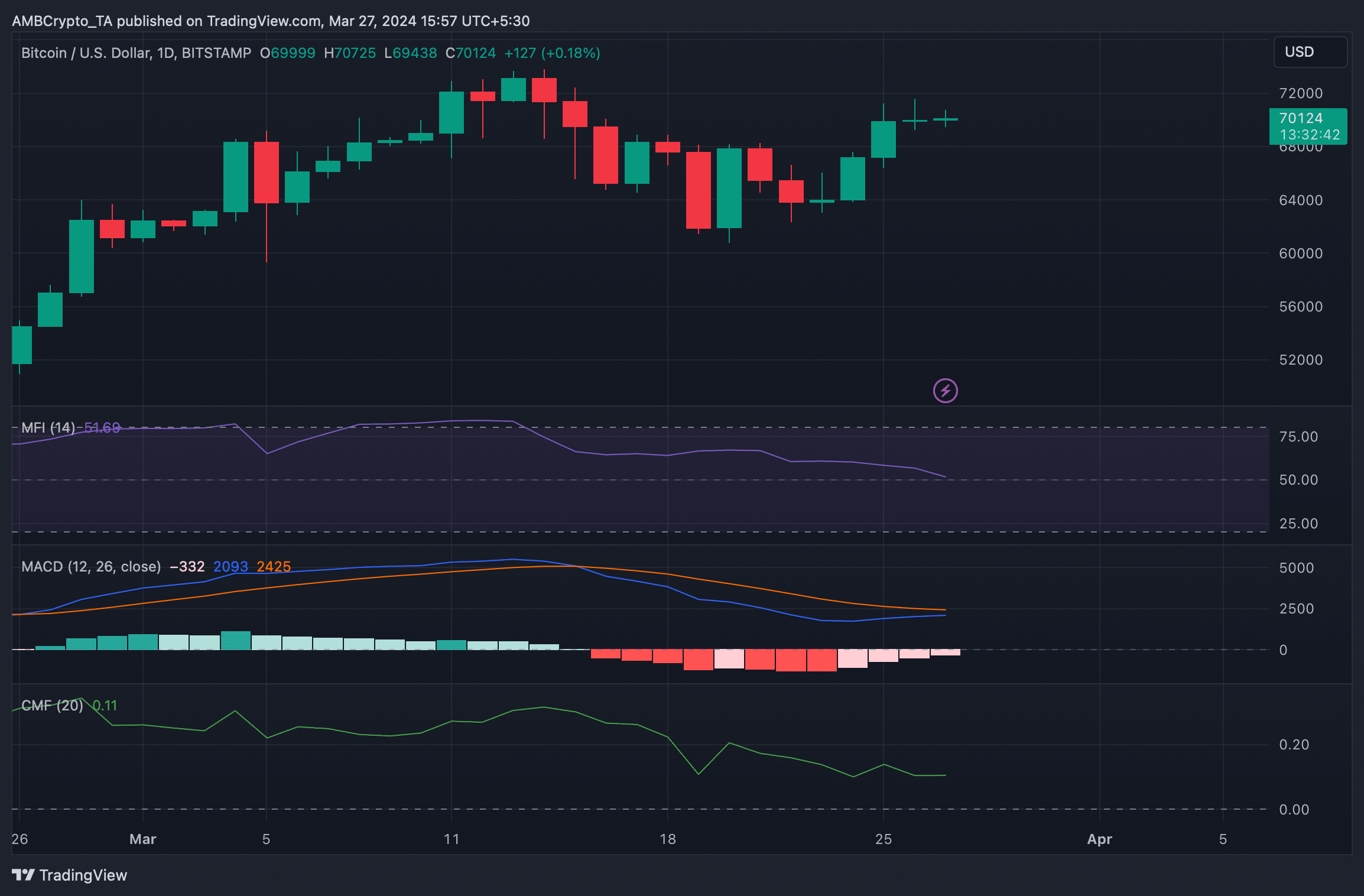

AMBCrypto then checked the coin’s daily chart to see whether this downtrend would last longer. We found that Bitcoin’s Money Flow Index (MFI) registered a downtick.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Its Chaikin Money Flow (CMF) also moved sideways in the last few days. These indicators suggested that the chances of a continued price decline were high.

However, it was interesting to note that the MACD supported buyers, as it displayed the possibility of a bullish crossover.

Source: TradingView

- Bitcoin was down by over 1% in the last 24 hours.

- Market indicators looked bearish on the coin.

While Bitcoin’s [BTC] price gained upward momentum, the short-term holders acted interestingly.

Therefore, AMBCrypto then planned to take a closer look at the king of cryptos’ state to better understand where it was headed.

Short-term holders are accumulating

Crazzyblokk, an analyst and author at CryptoQuant, recently posted an analysis highlighting interesting activity. Notably, in recent months, short-term holders have accumulated significant amounts of Bitcoin.

The post mentioned,

“Based on this metric, now 50% of the realized Bitcoin cap belongs to short-term holders, who tend to hold onto their Bitcoins for longer periods.”

Apart from this description, the Bitcoin market, assessed by RC value, was approaching a risky area akin to the 2019 price cycle.

This might be troublesome as it suggests the increased value held by short-term holders may lead to a tendency to take profits or exit, causing market volatility.

Bitcoin’s value is dropping

The analysis turned out to be true, as after a week-long bull rally, the king of cryptos’ value witnessed a slight correction. According to CoinMarketCap, BTC’s value dropped by over 1% in the last 24 hours.

At press time, it was trading at $70,015.84 with a market capitalization of over $1.38 trillion.

The drop in value happened at a time when the king of cryptos was expecting its next halving in just a few weeks. To be precise, BTC’s next halving is scheduled to happen in April 2024.

Despite the recent drop in price, investors seemed to have still been accumulating more BTC.

Our analysis of Santiment’s data revealed that BTC’s Supply on Exchanges dropped last week, while its Supply outside of Exchanges rose slightly.

Whale activity around the coin was also relatively high, which was evident from its Whale Transaction Count.

Source: Santiment

AMBCrypto then checked the coin’s daily chart to see whether this downtrend would last longer. We found that Bitcoin’s Money Flow Index (MFI) registered a downtick.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Its Chaikin Money Flow (CMF) also moved sideways in the last few days. These indicators suggested that the chances of a continued price decline were high.

However, it was interesting to note that the MACD supported buyers, as it displayed the possibility of a bullish crossover.

Source: TradingView

can i buy clomid without dr prescription cost generic clomiphene pills clomiphene only cycle get clomiphene for sale can i get clomid for sale can you get generic clomid prices how to buy cheap clomid pill

I couldn’t weather commenting. Well written!

More posts like this would prosper the blogosphere more useful.

buy generic zithromax for sale – order floxin without prescription brand metronidazole 400mg

rybelsus 14 mg cost – rybelsus 14 mg sale cheap cyproheptadine 4 mg

domperidone 10mg for sale – sumycin 250mg sale buy cyclobenzaprine 15mg generic

buy cheap propranolol – order methotrexate 5mg pill methotrexate 5mg canada

buy augmentin pill – atbio info order ampicillin pills

order coumadin 2mg generic – coumamide.com buy losartan 25mg pill

buy generic mobic 7.5mg – https://moboxsin.com/ order mobic 7.5mg for sale

brand prednisone 40mg – arthritis prednisone 5mg ca

best over the counter ed pills – site ed pills

buy forcan pills – click buy fluconazole 200mg generic

buy cenforce 50mg generic – https://cenforcers.com/ cenforce over the counter