- Bitcoin’s price hike has pushed spot trading volume to multi-year highs

- Market has seen an influx of new investors this year too

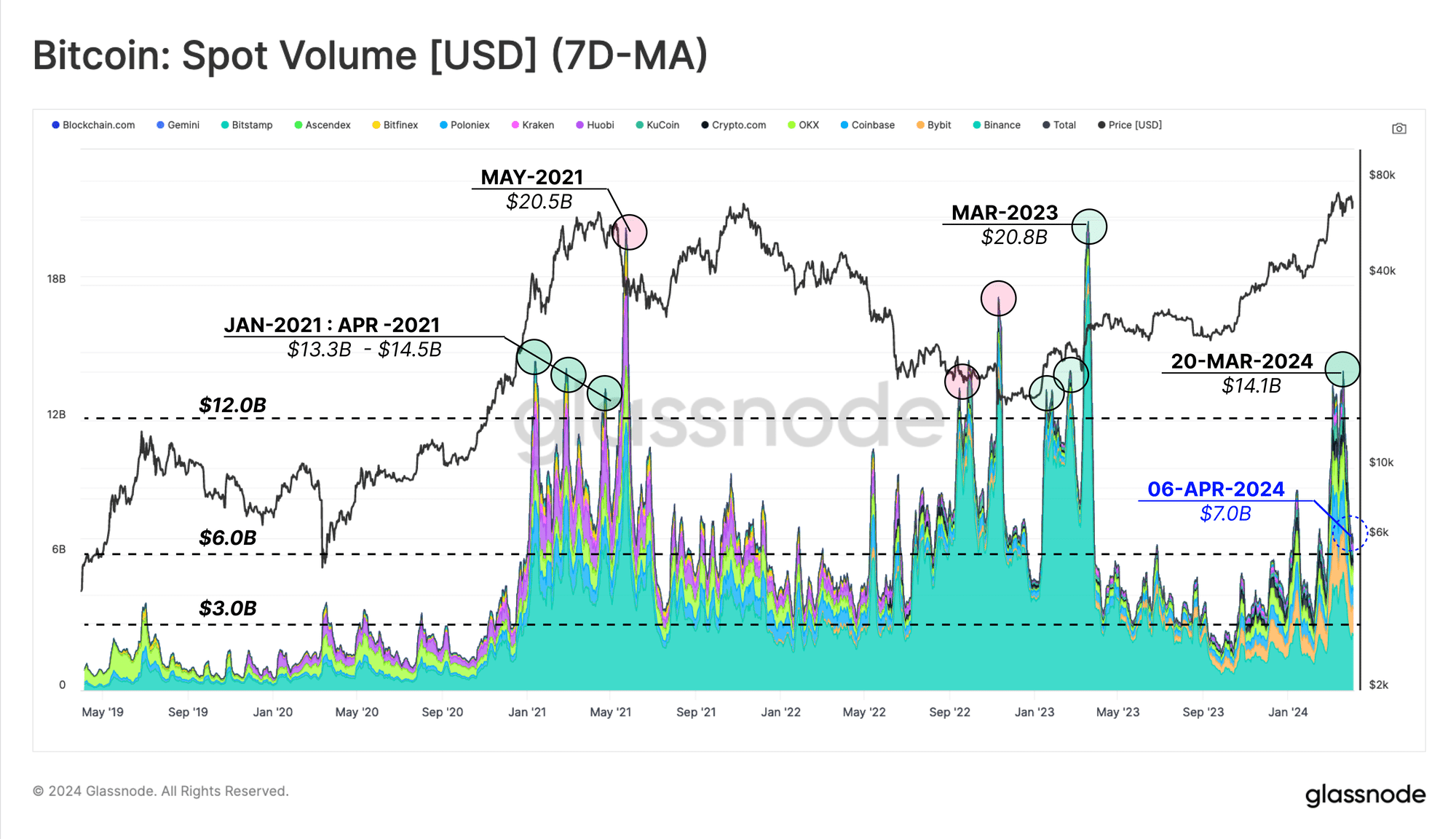

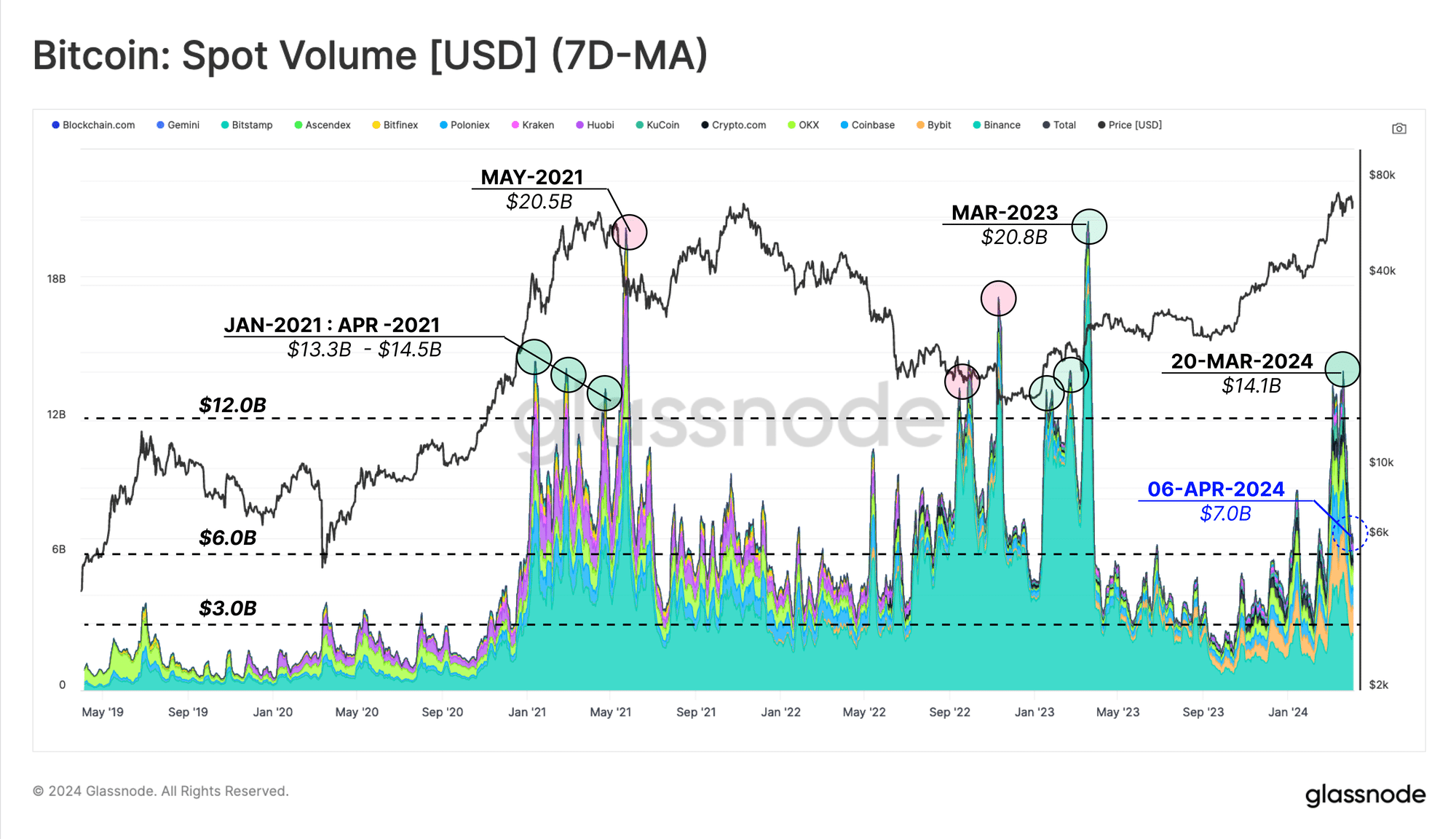

Bitcoin’s [BTC] price rally, which began in October 2023, has pushed its spot trading volume to the highs seen during the 2020-2021 bull market, according to a Glassnode report.

According to the on-chain data provider, while the recent headwinds faced by BTC’s price have led to a slight retraction, the coin’s daily spot trade volume is currently sitting at around $7 billion.

Source: Glassnode

Glassnode assessed the coin’s spot trade volume by comparing the metric’s 180-day moving average (slow) and its 30-day moving average (fast). This comparison showed that since the market rally began in October 2023, the BTC market “has seen the faster average trade significantly higher than the slower one.”

The on-chain data provider added that this indicates that the coin’s year-to-date growth is “supported by strong demand in spot markets.”

Furthermore, in addition to the surge in the coin’s spot trade volume, BTC’s price rally has resulted in an uptick in the flow of coins in and out of cryptocurrency exchanges. Glassnode said,

“The monthly average of total Exchange Flows (inflows plus outflows) is currently at $8.19B per day, significantly higher than the peak in the 2020-2021 bull market,”

Surge in new demand

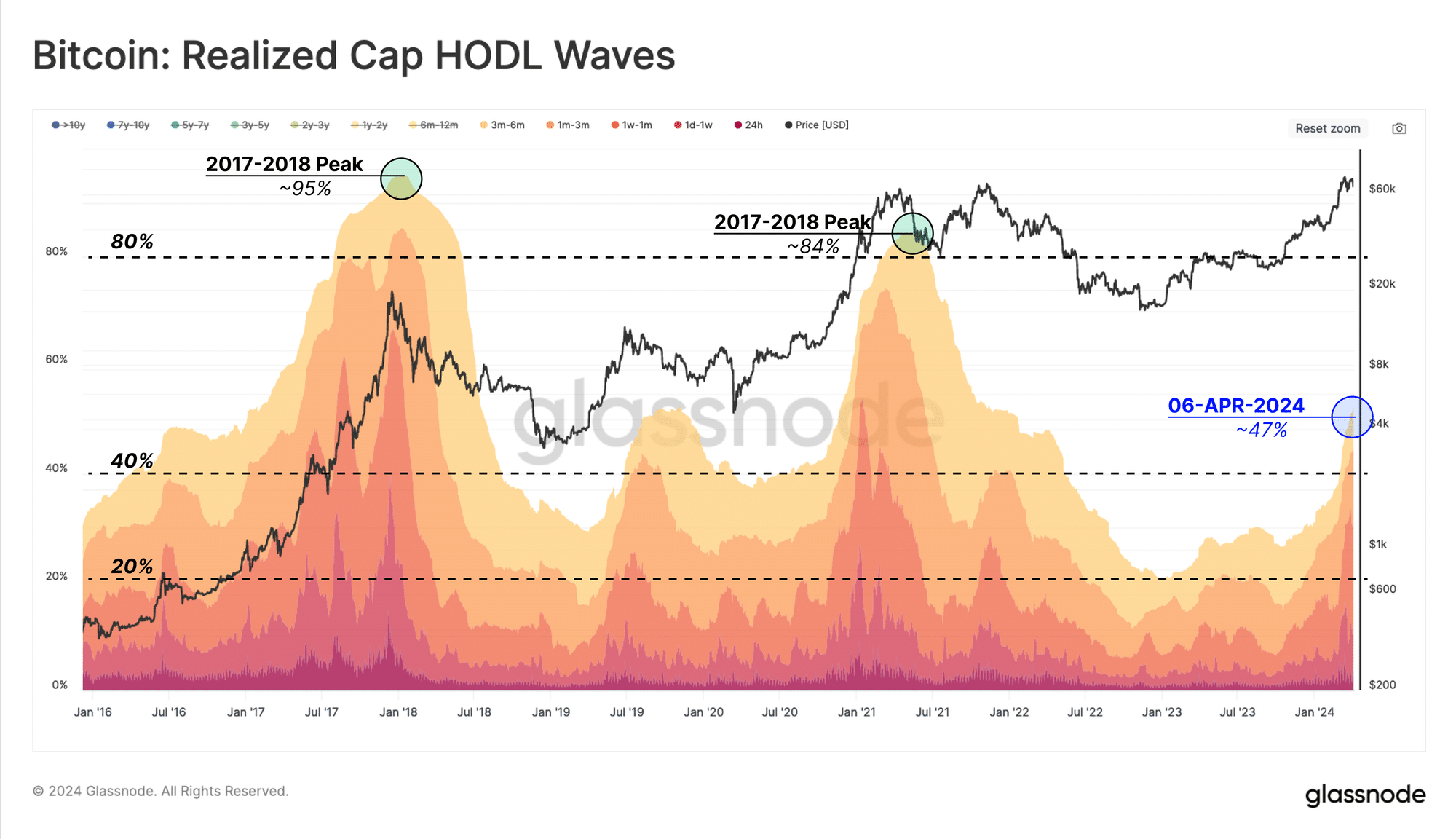

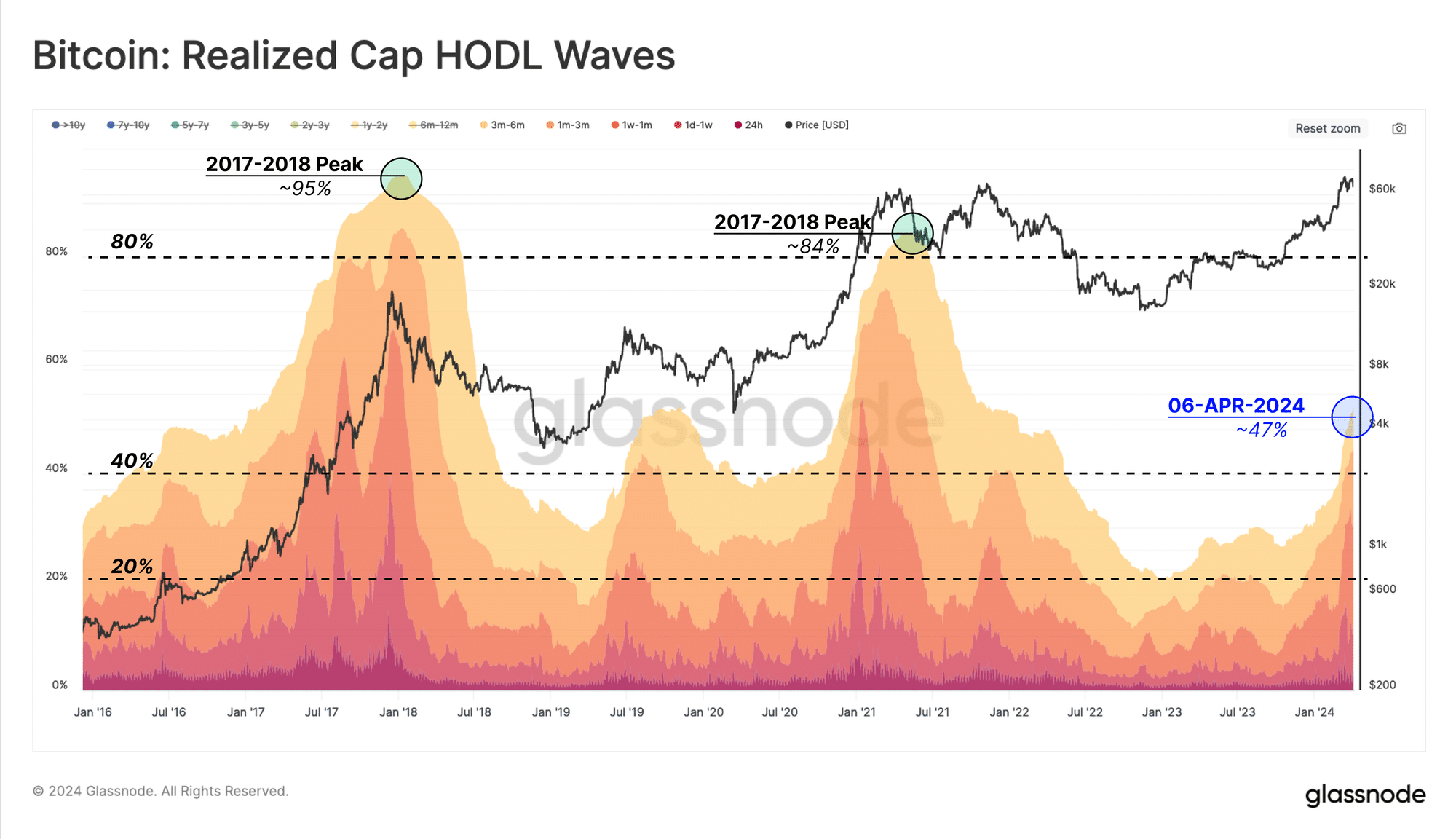

The ongoing rally has also led to a spike in the number of new investors holding BTC. As long-term holders distribute their long-held coins for gains, they have been scooped up by new investors who intend to profit from the market rally.

Glassnode assessed BTC’s Realized Cap HODL Waves and found that there has been a rally in the “share of wealth held by coins younger than six months.”

In fact, over the last year, BTC’s supply held by addresses younger than six months has grown significantly. The same had a figure of 47%, at press time.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to Glassnode,

“This suggests that the capital held within the Bitcoin holder base is roughly balanced between long-term holders and new demand.”

Finally, it’s worth pointing out that Glassnode also claimed that it is key to pay attention to the behavior of these new investors as “their share of the capital increases.”

This, because this cohort of BTC holders is typically more price-sensitive than long-term holders (LTHs). They have their coins easily accessible and are ready to offload once BTC’s price falls below their cost basis.

- Bitcoin’s price hike has pushed spot trading volume to multi-year highs

- Market has seen an influx of new investors this year too

Bitcoin’s [BTC] price rally, which began in October 2023, has pushed its spot trading volume to the highs seen during the 2020-2021 bull market, according to a Glassnode report.

According to the on-chain data provider, while the recent headwinds faced by BTC’s price have led to a slight retraction, the coin’s daily spot trade volume is currently sitting at around $7 billion.

Source: Glassnode

Glassnode assessed the coin’s spot trade volume by comparing the metric’s 180-day moving average (slow) and its 30-day moving average (fast). This comparison showed that since the market rally began in October 2023, the BTC market “has seen the faster average trade significantly higher than the slower one.”

The on-chain data provider added that this indicates that the coin’s year-to-date growth is “supported by strong demand in spot markets.”

Furthermore, in addition to the surge in the coin’s spot trade volume, BTC’s price rally has resulted in an uptick in the flow of coins in and out of cryptocurrency exchanges. Glassnode said,

“The monthly average of total Exchange Flows (inflows plus outflows) is currently at $8.19B per day, significantly higher than the peak in the 2020-2021 bull market,”

Surge in new demand

The ongoing rally has also led to a spike in the number of new investors holding BTC. As long-term holders distribute their long-held coins for gains, they have been scooped up by new investors who intend to profit from the market rally.

Glassnode assessed BTC’s Realized Cap HODL Waves and found that there has been a rally in the “share of wealth held by coins younger than six months.”

In fact, over the last year, BTC’s supply held by addresses younger than six months has grown significantly. The same had a figure of 47%, at press time.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to Glassnode,

“This suggests that the capital held within the Bitcoin holder base is roughly balanced between long-term holders and new demand.”

Finally, it’s worth pointing out that Glassnode also claimed that it is key to pay attention to the behavior of these new investors as “their share of the capital increases.”

This, because this cohort of BTC holders is typically more price-sensitive than long-term holders (LTHs). They have their coins easily accessible and are ready to offload once BTC’s price falls below their cost basis.

buying generic clomid can i buy cheap clomiphene no prescription get clomiphene for sale clomiphene cost australia where to buy cheap clomiphene pill can i buy generic clomid pill where can i get generic clomiphene no prescription

This is a keynote which is near to my verve… Numberless thanks! Exactly where can I upon the connection details for questions?

I am in point of fact enchant‚e ‘ to glitter at this blog posts which consists of tons of worthwhile facts, thanks towards providing such data.

buy rybelsus medication – purchase cyproheptadine sale periactin 4mg for sale

motilium 10mg for sale – buy flexeril paypal buy generic flexeril

order augmentin 1000mg online – atbioinfo.com buy acillin online

esomeprazole us – nexiumtous order nexium 40mg pills

buy generic deltasone – inflammatory bowel diseases prednisone 20mg cheap

generic ed pills – generic ed drugs online ed medications

amoxil tablets – cheap amoxicillin pills amoxicillin without prescription

buy diflucan 100mg generic – click purchase fluconazole sale

buy lexapro generic – https://escitapro.com/# escitalopram 10mg cost

cenforce 100mg oral – https://cenforcers.com/# generic cenforce 100mg

cialis for sale over the counter – https://strongtadafl.com/# generic cialis online pharmacy

ranitidine 150mg cheap – https://aranitidine.com/# zantac online order

buy viagra no prescription canada – https://strongvpls.com/# order generic viagra online

More articles like this would remedy the blogosphere richer. este sitio

The thoroughness in this draft is noteworthy. https://buyfastonl.com/gabapentin.html

Thanks on putting this up. It’s well done. https://ursxdol.com/augmentin-amoxiclav-pill/

Thanks an eye to sharing. It’s outstrip quality. https://prohnrg.com/product/rosuvastatin-for-sale/

More articles like this would make the blogosphere richer. https://aranitidine.com/fr/acheter-propecia-en-ligne/

More peace pieces like this would create the интернет better. https://ondactone.com/simvastatin/

This is the big-hearted of writing I in fact appreciate.

https://doxycyclinege.com/pro/warfarin/

Thanks on putting this up. It’s well done. http://seafishzone.com/home.php?mod=space&uid=2293990

dapagliflozin 10 mg drug – dapagliflozin 10mg without prescription forxiga 10mg tablet