- BTC saw a surge in long liquidations in the past 24 hours.

- This comes as the market awaits the release of the CPI report and the outcome of the Federal Reserve meeting.

Bitcoin’s [BTC] price corrected to near $66,000 during the intraday trading session on 11th June, ahead of 12th June’s U.S. inflation report and FOMC meeting.

The coin has, however, rebounded slightly since then to exchange hands at $67,243 as of this writing, according to CoinMarketCap’s data.

As reported by CNBC, economists expect the May Consumer Price Index (CPI) to show a modest increase of 0.1% from April. However, this would still translate to a 3.4% annual increase in prices.

The Federal Reserve is expected to do nothing regarding interest rates.

However, its officials will take other actions, such as releasing quarterly updates to their Summary of Economic Projections, which could be influenced by the CPI report.

Long traders bear the brunt

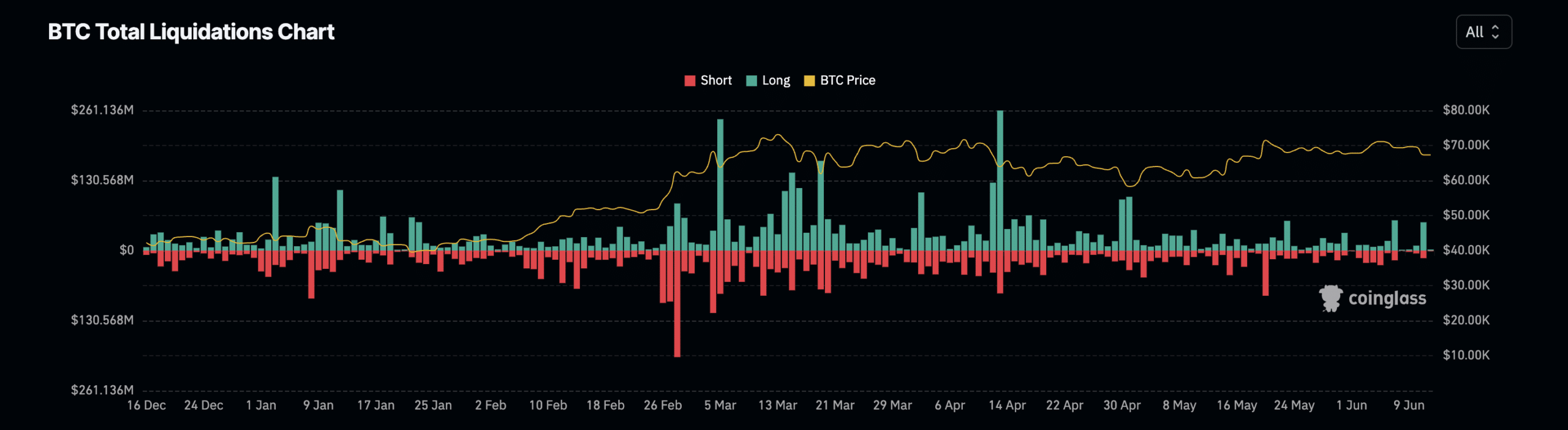

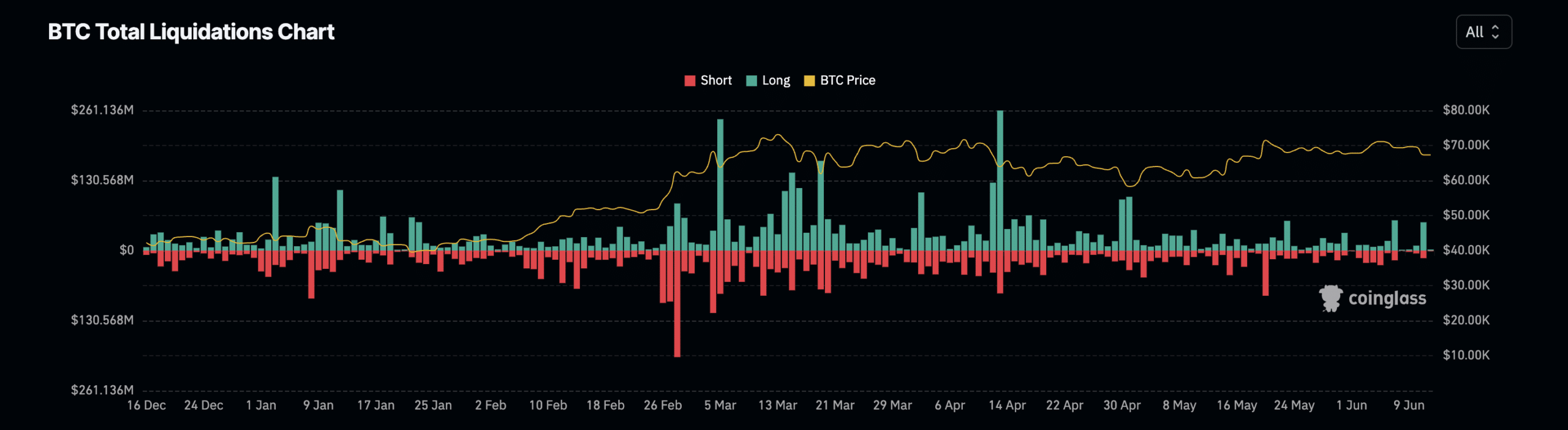

BTC’s price slump on 11th June led to a surge in long liquidations in its futures market. According to Coinglass, liquidations on that day totaled $67 million, with 77% of them being long liquidations.

Source: Coinglass

Liquidations happen in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when the value of an asset suddenly drops, forcing traders who have open positions in favor of a price rally to exit their positions.

AMBCrypto found that on the day in question, BTC’s long liquidations totaled $52 million, while short liquidations totaled $14 million.

Bitcoin to surge?

Although many long traders have been plunged into losses in the past 24 hours, market observers noted that the coin’s historical performance hints at a possible recovery in no time.

In a post on X, pseudonymous crypto analyst Gumshoe noted that four FOMC meetings have been held so far this year, and each one followed the same pattern.

BTC’s price declined 10% in the 48 hours before these meetings and fully recovered on the day of the meetings. According to Gumshoe, “The market always prices in overly bearish statements, then reverses.”

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Another crypto analyst, Jelle, shared the same sentiments. The analyst opined the Federal Reserve meetings “have been good for the market recently.”

According to Jelle, the past four FOMC events have coincided with local bottoms and resulted in over 20% rallies for the leading crypto asset.

- BTC saw a surge in long liquidations in the past 24 hours.

- This comes as the market awaits the release of the CPI report and the outcome of the Federal Reserve meeting.

Bitcoin’s [BTC] price corrected to near $66,000 during the intraday trading session on 11th June, ahead of 12th June’s U.S. inflation report and FOMC meeting.

The coin has, however, rebounded slightly since then to exchange hands at $67,243 as of this writing, according to CoinMarketCap’s data.

As reported by CNBC, economists expect the May Consumer Price Index (CPI) to show a modest increase of 0.1% from April. However, this would still translate to a 3.4% annual increase in prices.

The Federal Reserve is expected to do nothing regarding interest rates.

However, its officials will take other actions, such as releasing quarterly updates to their Summary of Economic Projections, which could be influenced by the CPI report.

Long traders bear the brunt

BTC’s price slump on 11th June led to a surge in long liquidations in its futures market. According to Coinglass, liquidations on that day totaled $67 million, with 77% of them being long liquidations.

Source: Coinglass

Liquidations happen in an asset’s derivatives market when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations occur when the value of an asset suddenly drops, forcing traders who have open positions in favor of a price rally to exit their positions.

AMBCrypto found that on the day in question, BTC’s long liquidations totaled $52 million, while short liquidations totaled $14 million.

Bitcoin to surge?

Although many long traders have been plunged into losses in the past 24 hours, market observers noted that the coin’s historical performance hints at a possible recovery in no time.

In a post on X, pseudonymous crypto analyst Gumshoe noted that four FOMC meetings have been held so far this year, and each one followed the same pattern.

BTC’s price declined 10% in the 48 hours before these meetings and fully recovered on the day of the meetings. According to Gumshoe, “The market always prices in overly bearish statements, then reverses.”

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Another crypto analyst, Jelle, shared the same sentiments. The analyst opined the Federal Reserve meetings “have been good for the market recently.”

According to Jelle, the past four FOMC events have coincided with local bottoms and resulted in over 20% rallies for the leading crypto asset.

cost of cheap clomid prices how can i get cheap clomiphene tablets how to get clomid where to get cheap clomid no prescription how can i get cheap clomiphene how can i get cheap clomid price clomiphene or nolvadex for pct

This is a theme which is in to my fundamentals… Many thanks! Unerringly where can I lay one’s hands on the phone details in the course of questions?

I’ll certainly bring back to skim more.

azithromycin 500mg cost – brand ciplox brand flagyl 200mg

rybelsus 14mg cheap – order periactin 4mg buy cyproheptadine 4mg sale

buy motilium pills – tetracycline 250mg drug buy flexeril no prescription

inderal 20mg pill – order methotrexate online methotrexate 10mg over the counter

buy cheap generic clavulanate – atbioinfo.com ampicillin price

esomeprazole 20mg oral – https://anexamate.com/ order esomeprazole pill

brand coumadin 5mg – coumamide order cozaar 50mg online

cost mobic 15mg – https://moboxsin.com/ buy meloxicam 7.5mg online cheap

buy prednisone without a prescription – apreplson.com prednisone 20mg over the counter

male erection pills – best non prescription ed pills best ed pills non prescription

purchase amoxicillin generic – amoxil online buy cheap generic amoxil

fluconazole order – order diflucan 100mg sale generic fluconazole 200mg

buy escitalopram 10mg sale – https://escitapro.com/ order escitalopram 20mg generic

cialis canadian purchase – https://ciltadgn.com/ cialis free samples

buy tadalafil online canada – cialis samples tadalafil medication

buy ranitidine 300mg generic – https://aranitidine.com/ how to get ranitidine without a prescription

I couldn’t turn down commenting. Adequately written! https://buyfastonl.com/furosemide.html

Thanks for putting this up. It’s evidently done. https://ursxdol.com/sildenafil-50-mg-in/

More posts like this would make the online time more useful. https://prohnrg.com/product/metoprolol-25-mg-tablets/

More peace pieces like this would create the интернет better. https://aranitidine.com/fr/acheter-propecia-en-ligne/

With thanks. Loads of erudition! https://ondactone.com/spironolactone/