- Traders holding Bitcoin for 1-3 months recorded the highest level of inflows as Bitcoin approached $69,000

- Profit-taking by short-term holders could delay Bitcoin’s ATH, despite strong bullish trends

Bitcoin (BTC) was trading at $68,388 at press time after 9% gains within just seven days. On 18 October, Bitcoin hit a two-month high above $68,900, strengthening the market’s optimism for further gains.

Several factors aligned together can support Bitcoin’s rally to an ATH. These include the market pricing in the outcome of the U.S elections and high inflows to Spot Bitcoin exchange-traded funds (ETFs).

However, short-term holders remain the key to how long Bitcoin will take to reach record highs. Consider this – After Bitcoin spiked to a two-month high, on-chain metrics showed that this cohort started selling.

Analyzing short-term holder behavior

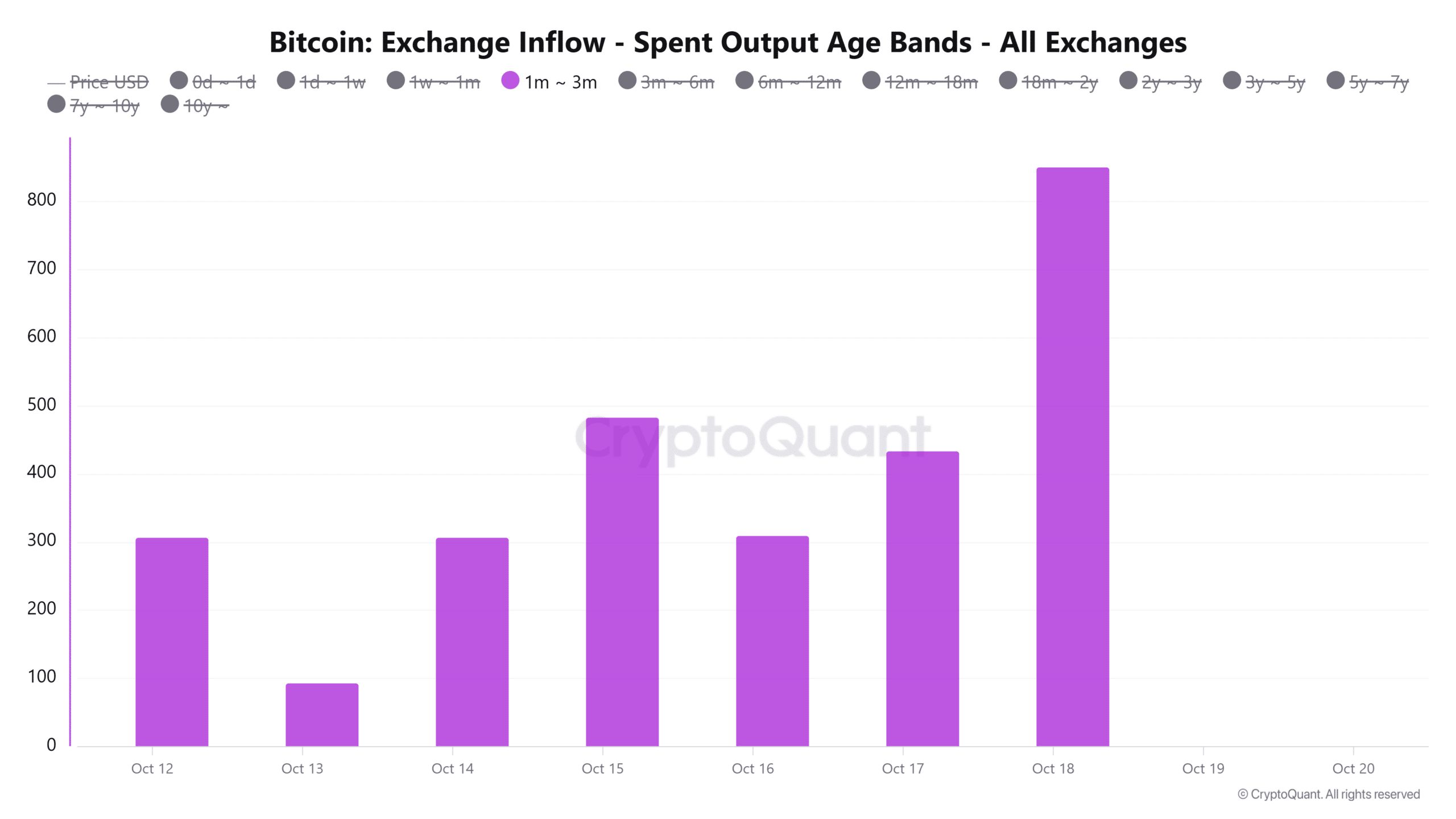

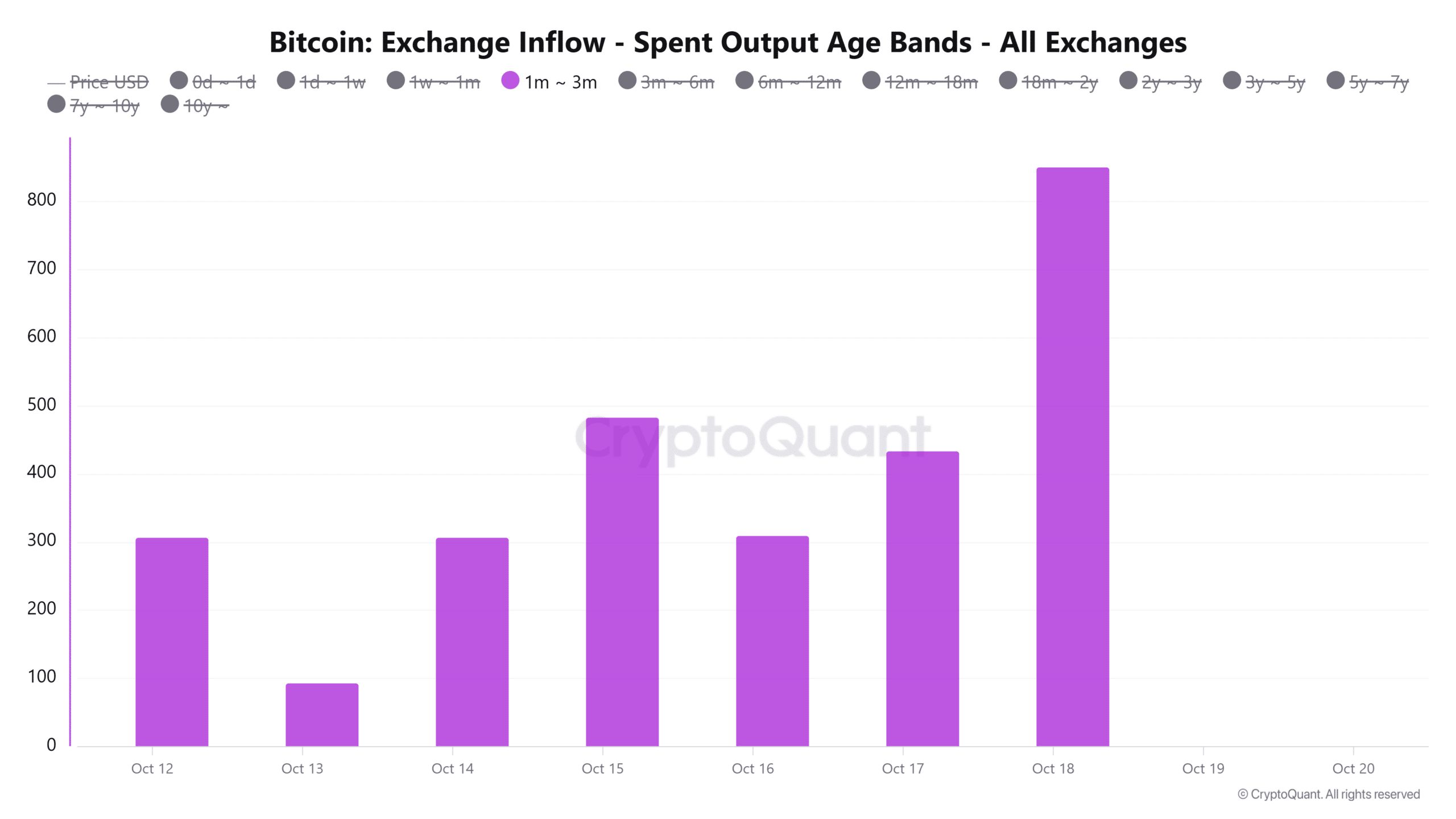

Data from CryptoQuant revealed an increase in Bitcoin exchange inflows from traders who held Bitcoin for between one and three months. The exchange inflow Spent Output Age Bands for this cohort jumped to a weekly high as BTC approached $69,000 on the charts.

(Source: CryptoQuant)

This spike can be seen as a sign of profit-taking behavior as short-term traders look to capitalize on the favorable market conditions.

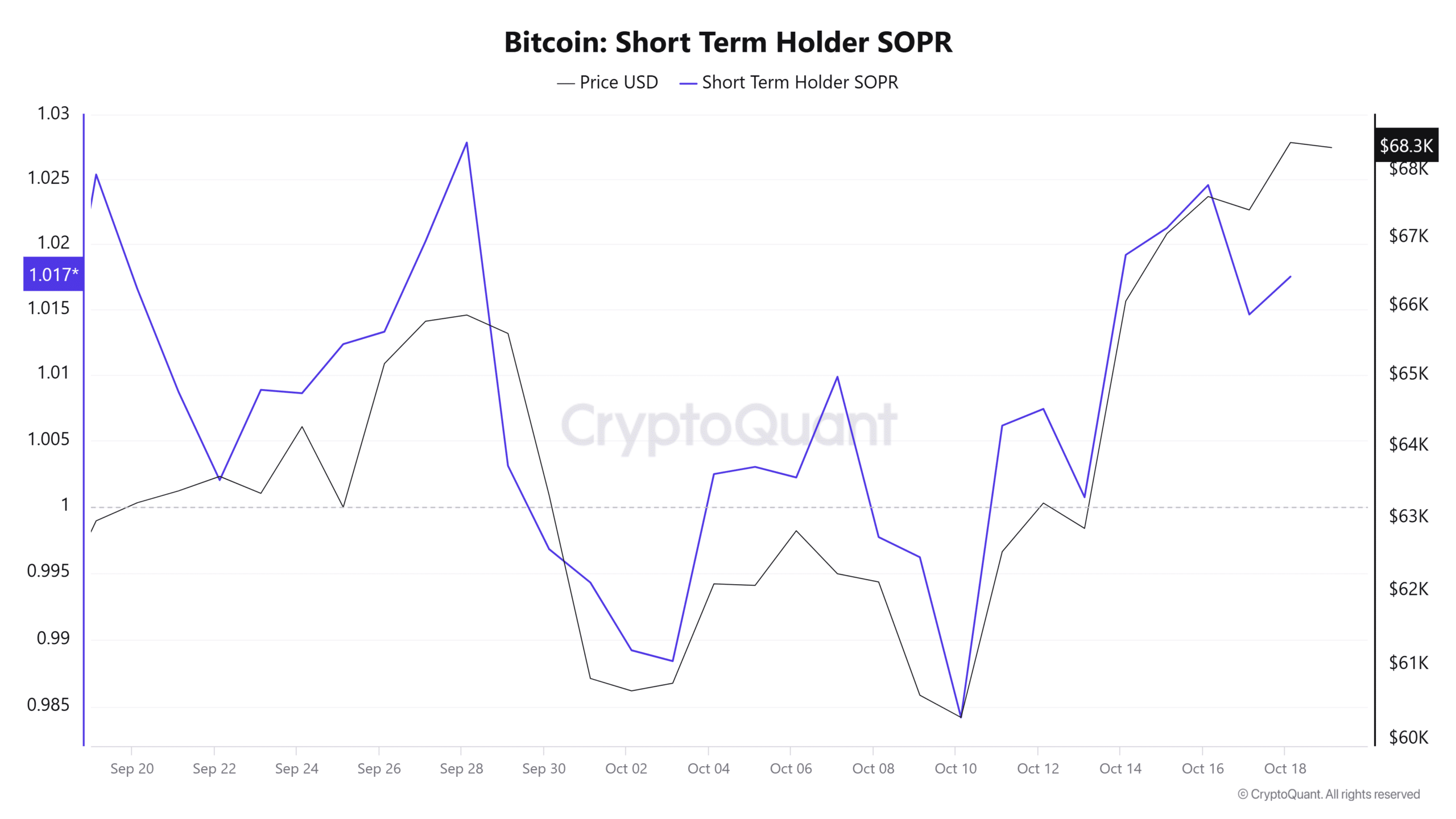

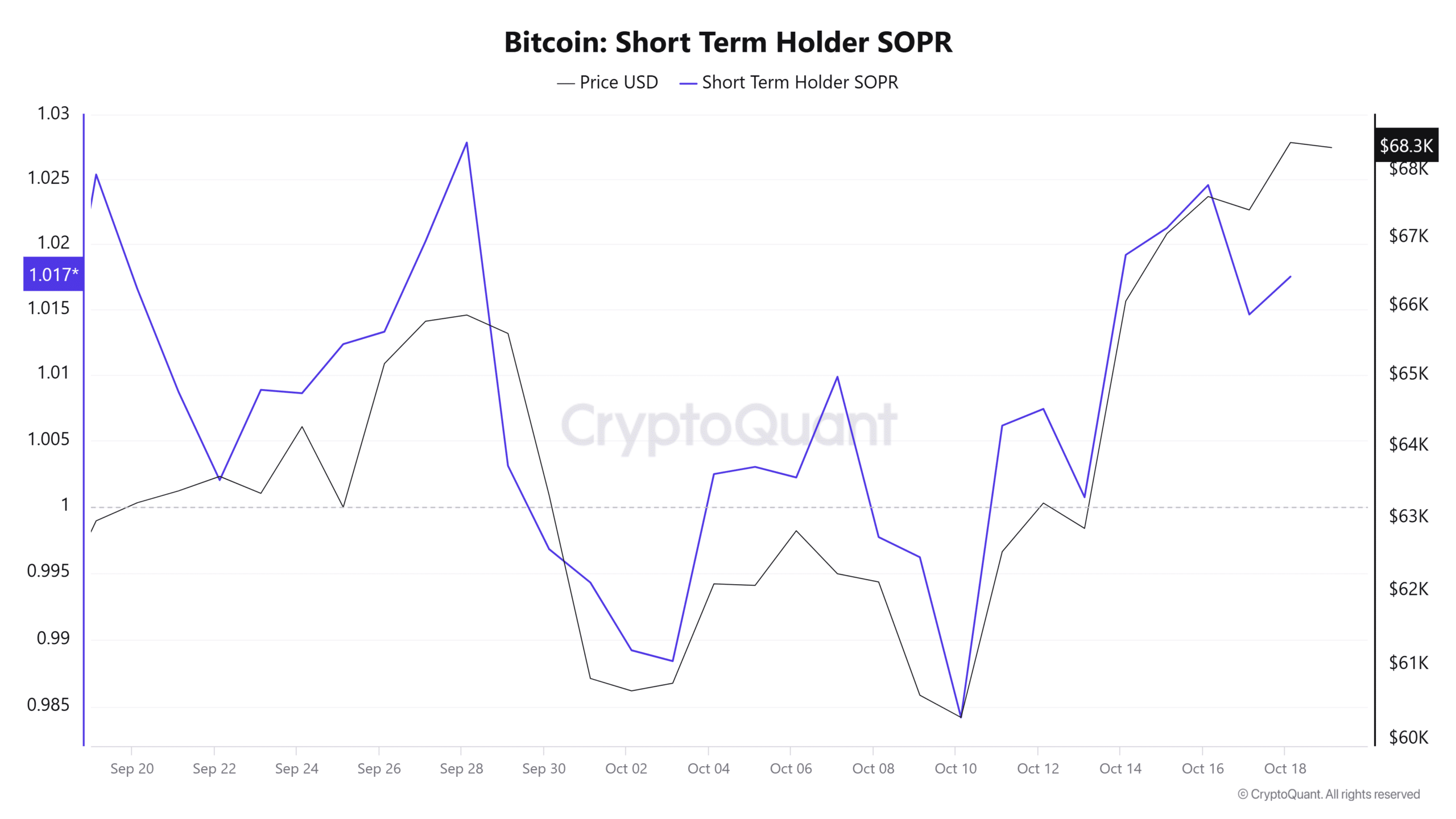

The short-term holder Spent Output Profit Ratio further highlighted that these traders have been selling BTC at a profit. Especially since the metric has been above 1 for over a week now.

Source: CryptoQuant

While an SOPR ratio above 1 suggests that the general market sentiment is positive, it could also mean a high likelihood of profit-taking. If Bitcoin’s uptrend shows signs of weakness, this cohort will likely start selling more, causing a price reversal.

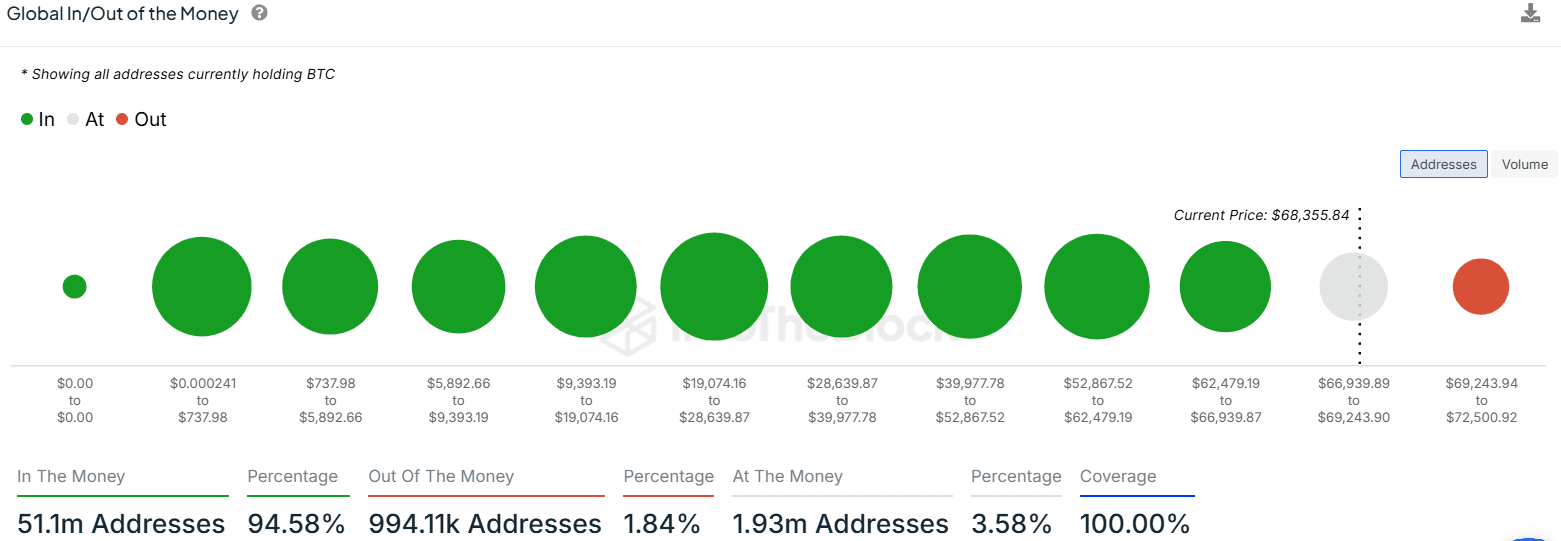

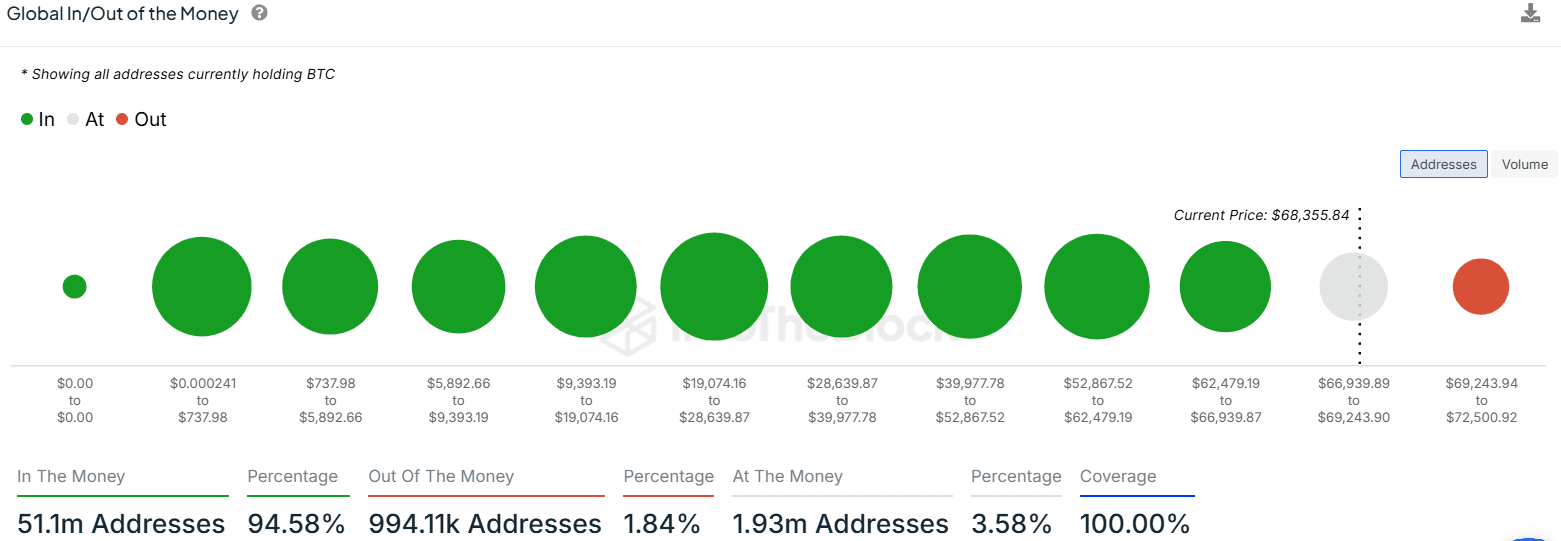

Besides short-term holders, the other group that could delay a Bitcoin ATH are the 1.9M addresses that bought BTC between $66,900 and $69,200. According to IntoTheBlock, these addresses, at press time, were at a break-even point.

(Source: IntoTheBlock)

Bitcoin is bound to face resistance as it approaches $69,000 as these addresses might start selling once they turn in a profit.

Nevertheless, short-term holder behavior is unlikely to dampen market sentiment around Bitcoin. Especially since it is only 7% shy of its ATH now.

Technical indicators show bullish signs

Bitcoin’s daily chart projected strong bullish momentum, at the time of writing. The Relative Strength Index (RSI) at 68 indicated that buying pressure was strong. The RSI has also been making higher highs, further suggesting that the uptrend may be gaining strength.

On-balance volume has also been tipping upwards and trending above the smoothing line. This seemed to reinforce the bullish sentiment as it showed capital has been flowing into Bitcoin. This could spike buying activity and stir gains.

Source: Tradingview

If these bullish signs persist and Bitcoin breaks above $69,000, the next resistance level would lie at $75,250, at which point Bitcoin will have formed a new ATH. Conversely, if profit-taking activities continue, the asset will likely drop to test support at the 0.618 Fibonacci level ($65,130).

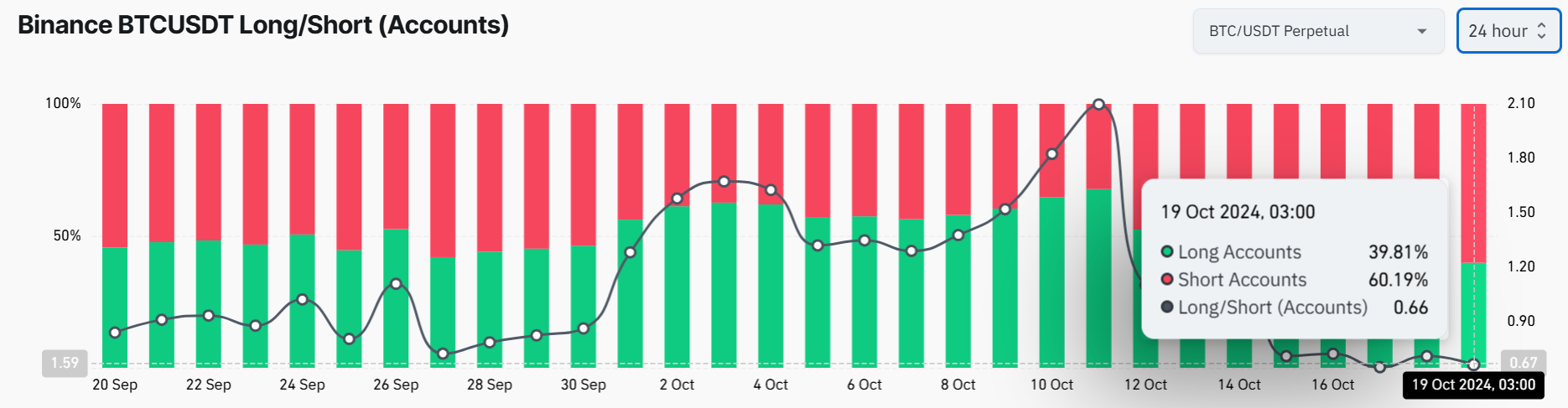

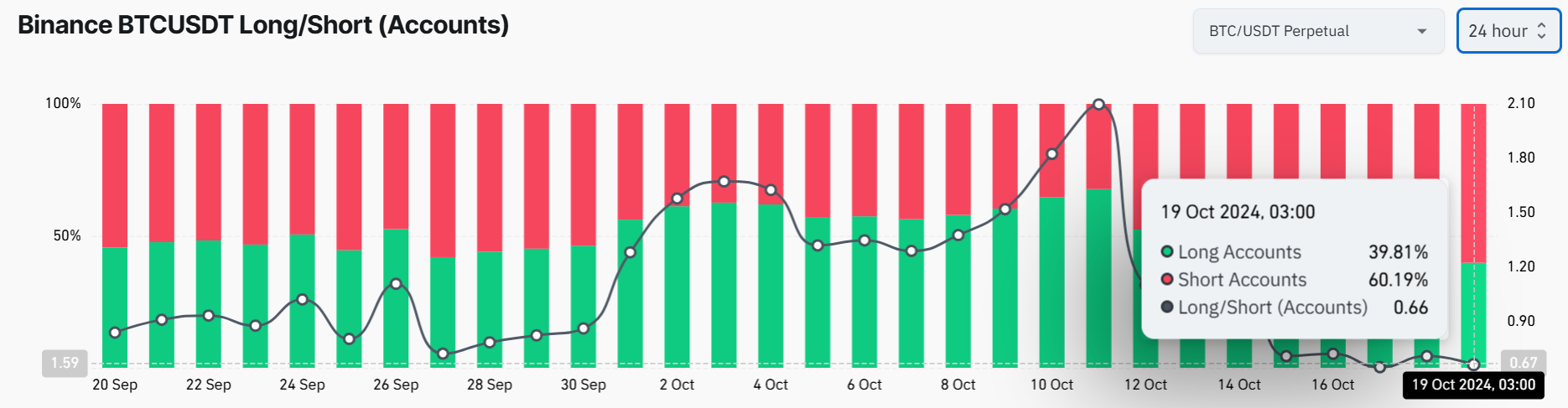

In fact, some traders are already anticipating such a drop. For example – Data from Coinglass revealed that 60% of open positions are short sellers betting on a failed uptrend.

(Source: Coinglass)

- Traders holding Bitcoin for 1-3 months recorded the highest level of inflows as Bitcoin approached $69,000

- Profit-taking by short-term holders could delay Bitcoin’s ATH, despite strong bullish trends

Bitcoin (BTC) was trading at $68,388 at press time after 9% gains within just seven days. On 18 October, Bitcoin hit a two-month high above $68,900, strengthening the market’s optimism for further gains.

Several factors aligned together can support Bitcoin’s rally to an ATH. These include the market pricing in the outcome of the U.S elections and high inflows to Spot Bitcoin exchange-traded funds (ETFs).

However, short-term holders remain the key to how long Bitcoin will take to reach record highs. Consider this – After Bitcoin spiked to a two-month high, on-chain metrics showed that this cohort started selling.

Analyzing short-term holder behavior

Data from CryptoQuant revealed an increase in Bitcoin exchange inflows from traders who held Bitcoin for between one and three months. The exchange inflow Spent Output Age Bands for this cohort jumped to a weekly high as BTC approached $69,000 on the charts.

(Source: CryptoQuant)

This spike can be seen as a sign of profit-taking behavior as short-term traders look to capitalize on the favorable market conditions.

The short-term holder Spent Output Profit Ratio further highlighted that these traders have been selling BTC at a profit. Especially since the metric has been above 1 for over a week now.

Source: CryptoQuant

While an SOPR ratio above 1 suggests that the general market sentiment is positive, it could also mean a high likelihood of profit-taking. If Bitcoin’s uptrend shows signs of weakness, this cohort will likely start selling more, causing a price reversal.

Besides short-term holders, the other group that could delay a Bitcoin ATH are the 1.9M addresses that bought BTC between $66,900 and $69,200. According to IntoTheBlock, these addresses, at press time, were at a break-even point.

(Source: IntoTheBlock)

Bitcoin is bound to face resistance as it approaches $69,000 as these addresses might start selling once they turn in a profit.

Nevertheless, short-term holder behavior is unlikely to dampen market sentiment around Bitcoin. Especially since it is only 7% shy of its ATH now.

Technical indicators show bullish signs

Bitcoin’s daily chart projected strong bullish momentum, at the time of writing. The Relative Strength Index (RSI) at 68 indicated that buying pressure was strong. The RSI has also been making higher highs, further suggesting that the uptrend may be gaining strength.

On-balance volume has also been tipping upwards and trending above the smoothing line. This seemed to reinforce the bullish sentiment as it showed capital has been flowing into Bitcoin. This could spike buying activity and stir gains.

Source: Tradingview

If these bullish signs persist and Bitcoin breaks above $69,000, the next resistance level would lie at $75,250, at which point Bitcoin will have formed a new ATH. Conversely, if profit-taking activities continue, the asset will likely drop to test support at the 0.618 Fibonacci level ($65,130).

In fact, some traders are already anticipating such a drop. For example – Data from Coinglass revealed that 60% of open positions are short sellers betting on a failed uptrend.

(Source: Coinglass)

where to get cheap clomiphene order generic clomid online can i get clomiphene pills cost of cheap clomiphene without insurance where to get clomid without dr prescription cost clomiphene without rx buy generic clomid

This is the type of advise I unearth helpful.

More articles like this would make the blogosphere richer.

generic zithromax 250mg – ofloxacin 400mg brand flagyl 200mg price

order semaglutide online – periactin usa buy cyproheptadine 4mg pill

motilium canada – buy motilium 10mg generic order cyclobenzaprine 15mg pill

zithromax order online – order nebivolol 5mg generic buy nebivolol 5mg pills

augmentin pill – https://atbioinfo.com/ buy acillin medication

buy generic medex over the counter – https://coumamide.com/ cozaar 25mg drug

buy generic meloxicam 7.5mg – https://moboxsin.com/ order mobic 15mg online

generic prednisone 20mg – corticosteroid where to buy prednisone without a prescription

buy ed pills – best ed drugs buy ed pills us

purchase amoxicillin online cheap – https://combamoxi.com/ cost amoxil

order diflucan 200mg for sale – https://gpdifluca.com/ fluconazole 100mg pill

cenforce 100mg uk – cenforcers.com order cenforce 100mg generic

online cialis no prescription – https://ciltadgn.com/# generic cialis 5mg

is tadalafil peptide safe to take – https://strongtadafl.com/# cialis coupon walmart

buy ranitidine pill – https://aranitidine.com/# zantac drug

viagra sale online pharmacy – strong vpls buy viagra online

I couldn’t weather commenting. Well written! nolvadex without prescription

Greetings! Extremely gainful advice within this article! It’s the little changes which liking make the largest changes. Thanks a portion towards sharing! prednisone and fibromyalgia

This website positively has all of the bumf and facts I needed about this thesis and didn’t comprehend who to ask. https://ursxdol.com/cialis-tadalafil-20/

Thanks for sharing. It’s outstrip quality. https://prohnrg.com/product/lisinopril-5-mg/

More articles like this would remedy the blogosphere richer. https://aranitidine.com/fr/viagra-professional-100-mg/

More posts like this would make the blogosphere more useful. https://ondactone.com/simvastatin/

Greetings! Extremely gainful recommendation within this article! It’s the scarcely changes which liking obtain the largest changes. Thanks a a quantity quest of sharing!

topamax tablet

I couldn’t hold back commenting. Adequately written! http://www.gtcm.info/home.php?mod=space&uid=1158207

forxiga cost – https://janozin.com/ dapagliflozin buy online

buy xenical generic – on this site orlistat over the counter