- Bitcoin remained above a crucial support level at press time.

- Indicators revealed that BTC was trading under its possible market bottom.

Bitcoin [BTC] bulls have taken a backseat over the past few days as the king of cryptos’ volatility dropped. It was interesting to note that while BTC consolidated, it managed to remain above a crucial support level.

This suggested that if things fall in place, then the coin might begin an upward rally in the coming days.

Bitcoin’s crucial support level

As per CoinMarketCap, Bitcoin’s weekly chart remained red, and its price only moved up marginally in the last 24 hours.

At the time of writing, the king of cryptos was trading at $59,443.16 with a market capitalization of over $1.17 trillion.

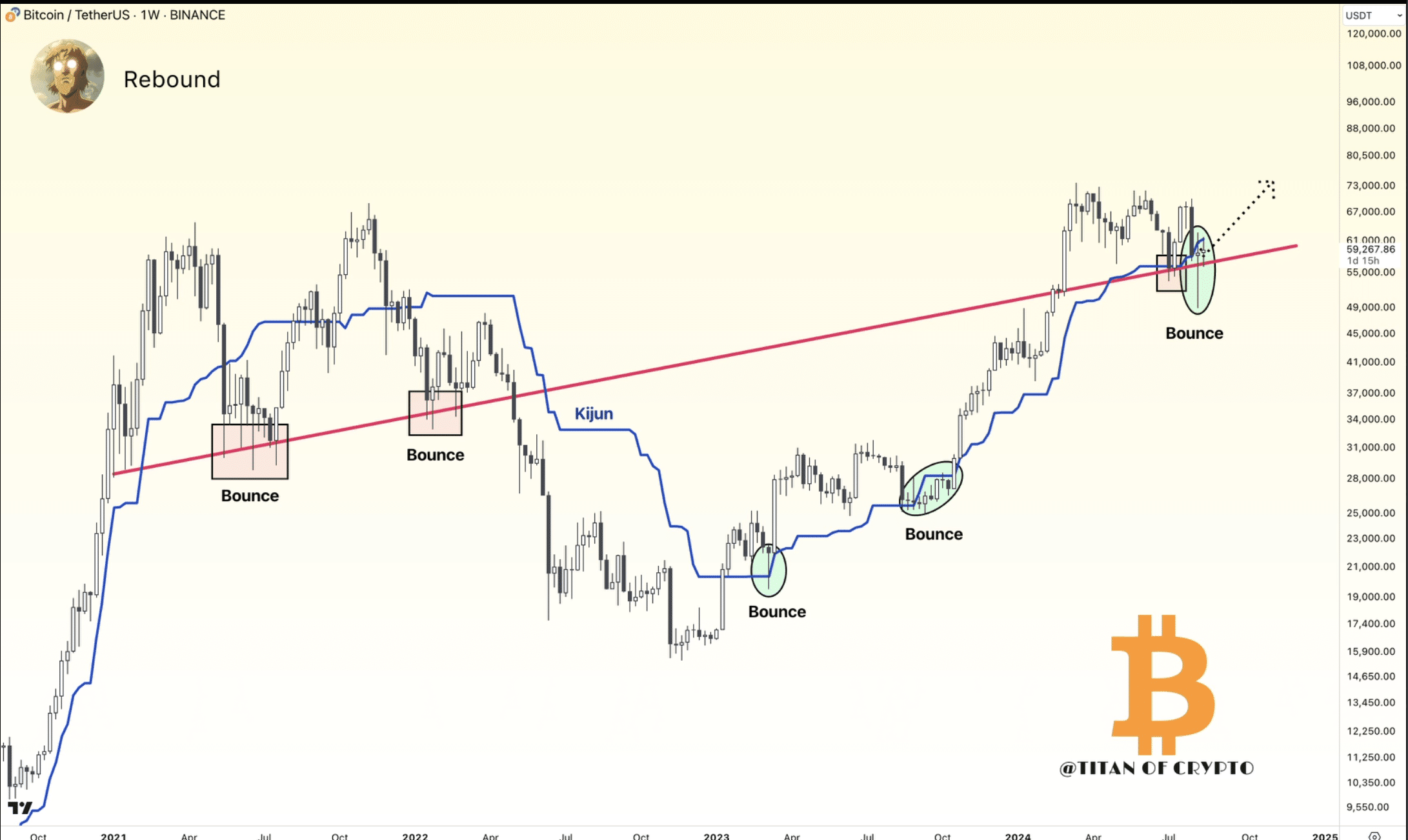

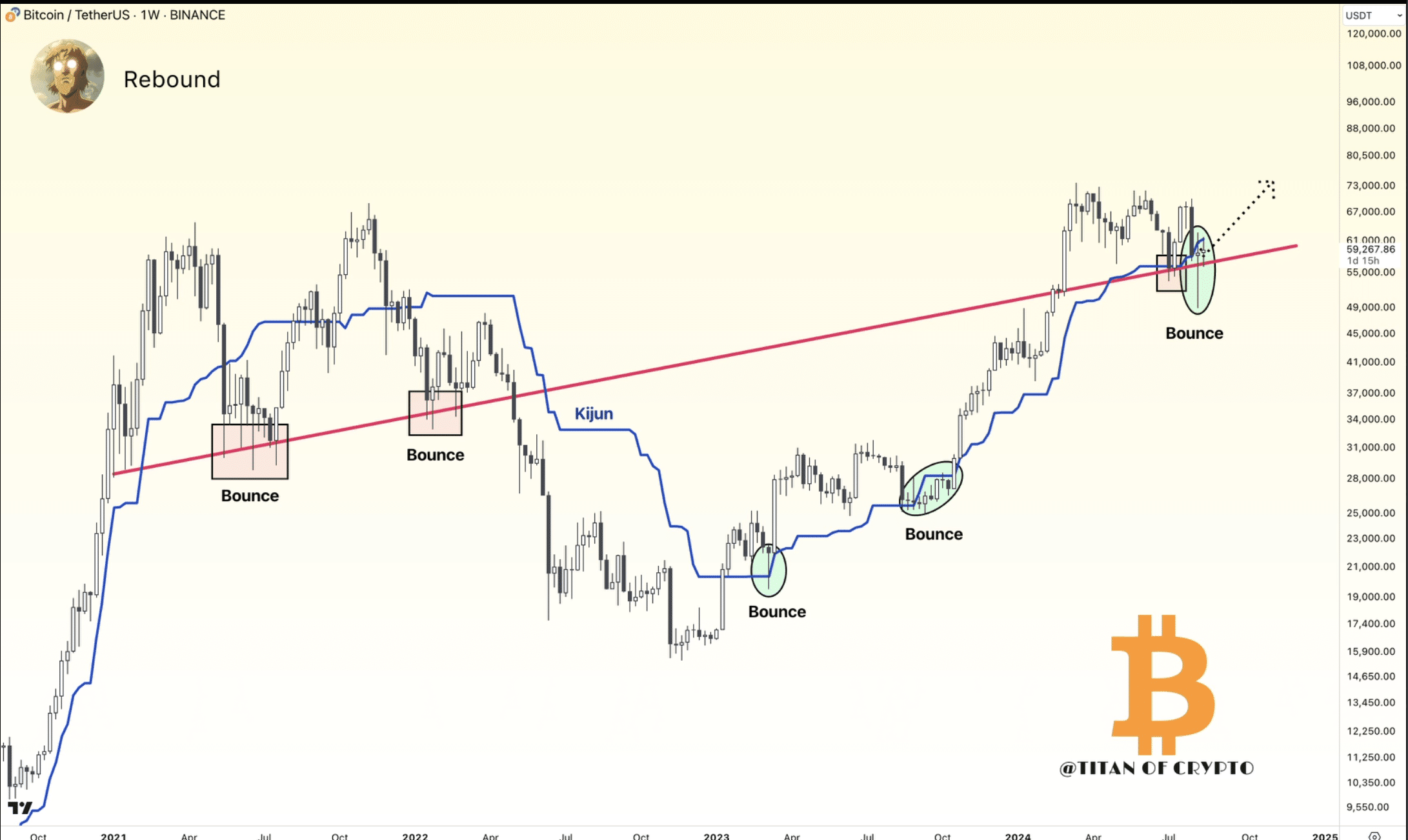

Meanwhile, Titan of Crypto, a popular crypto analyst, posted a tweet pointing out an interesting development — BTC’s price has been trading just above a critical trendline (red).

Source: X

Notably, BTC hasn’t closed a candle below the red line. Similar episodes happened back in 2021 and 2022. During those events, Bitcoin registered promising bounce backs after touching the same red line.

If history repeats itself, then investors might soon witness BTC gaining bullish momentum.

Will history repeat itself?

AMBCrypto then assessed the coin’s on-chain data to see what they suggested regarding a bounce back.

As per our analysis of CryptoQuant’s data, BTC’s exchange reserve was dropping, indicating a rise in buying pressure.

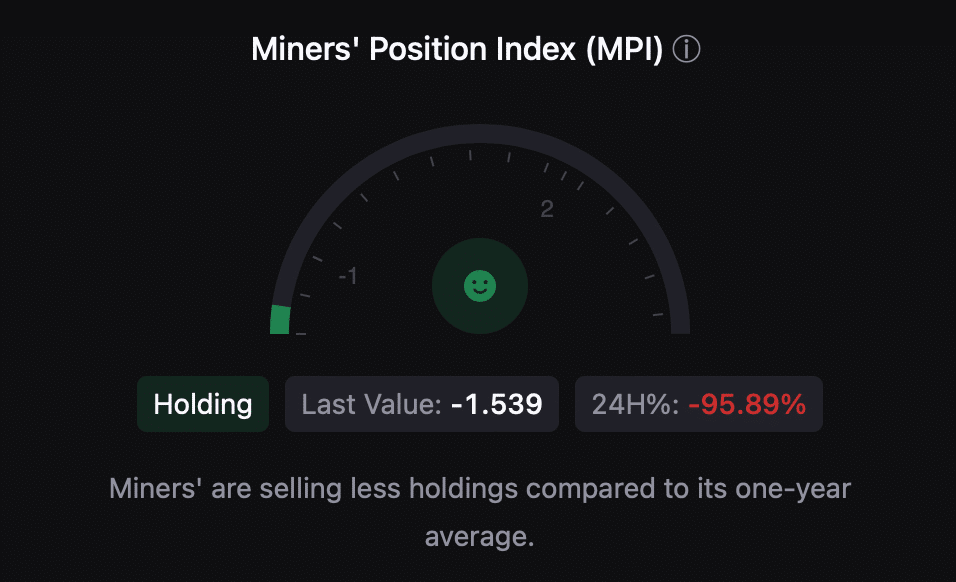

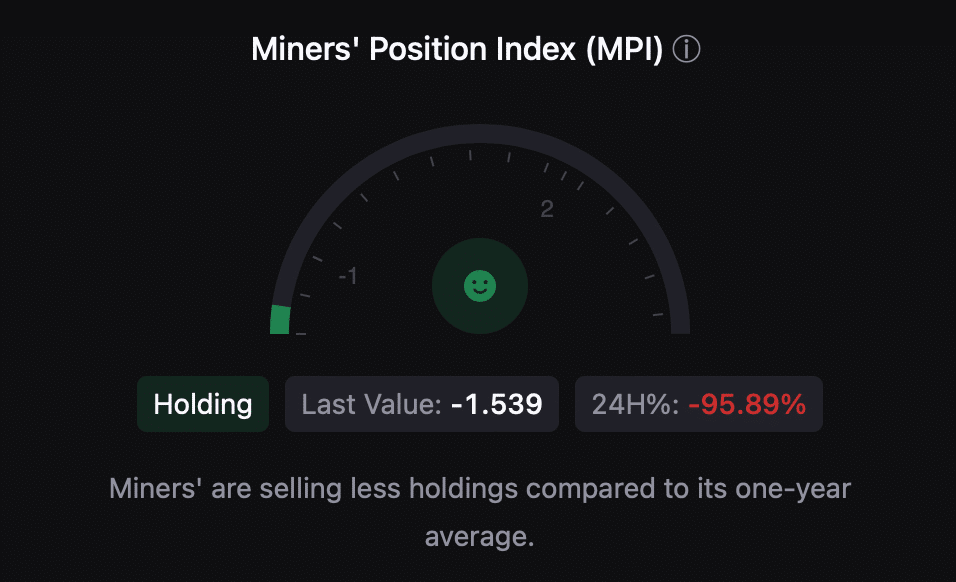

The king coin’s Miners’ Position Index (MPI) suggested that miners were selling fewer holdings compared to its one-year average.

This meant that miners were confident in BTC and were expecting its price to rise in the coming top.

Source: CryptoQuant

On top of that, BTC’s Binary CDD was also green, meaning that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

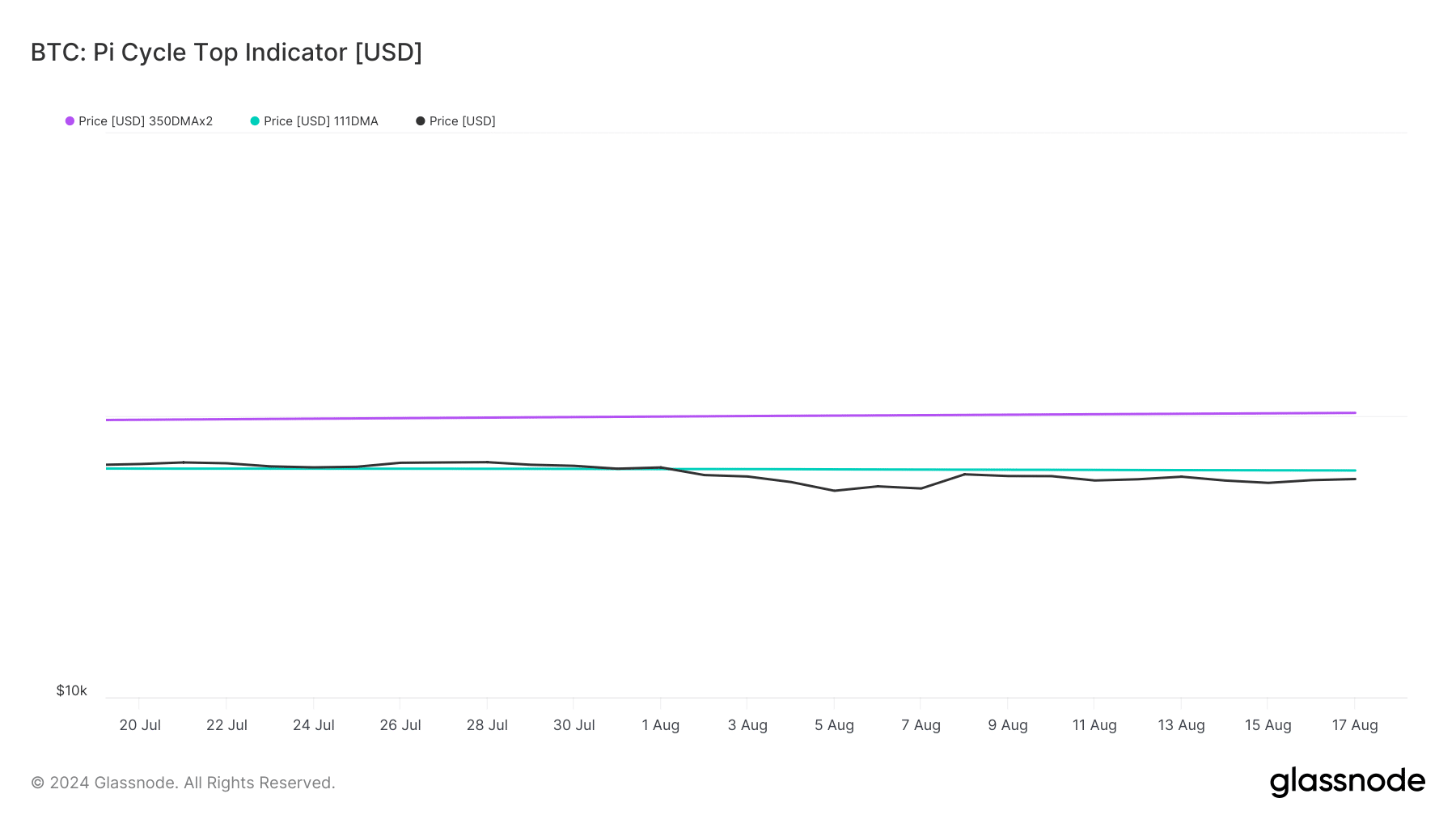

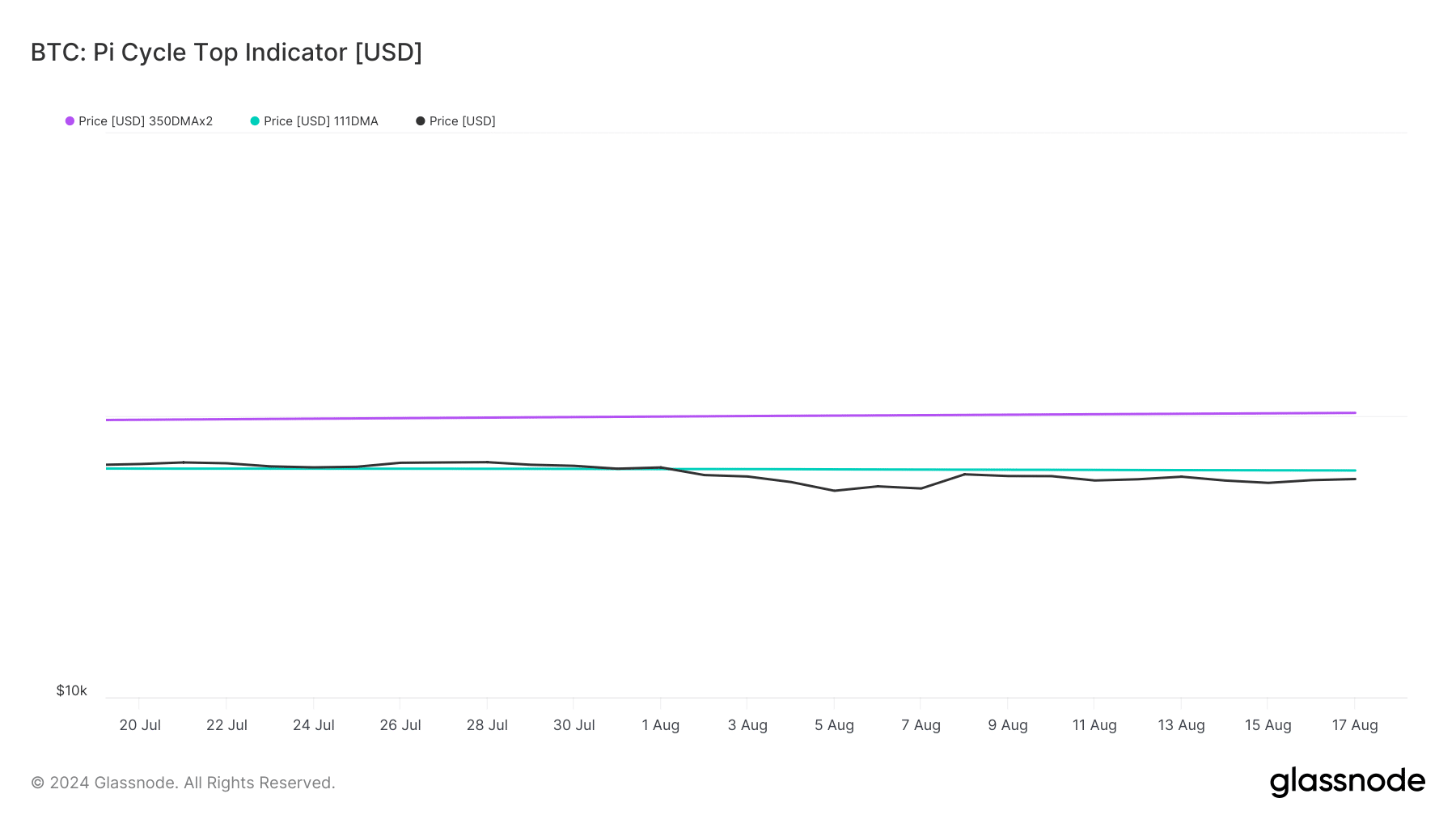

Our look at Glassnode’s data revealed yet another bullish indicator. BTC’s Pi Cycle Top indicator pointed out that BTC’s price was resting under its possible market bottom of $63.7k.

This indicated that the chances of BTC reaching that mark were high.

AMBCrypto reported earlier that BTC was also following another historical trend, which might result in a massive bull rally in Q4 2024.

Source: Glassnode

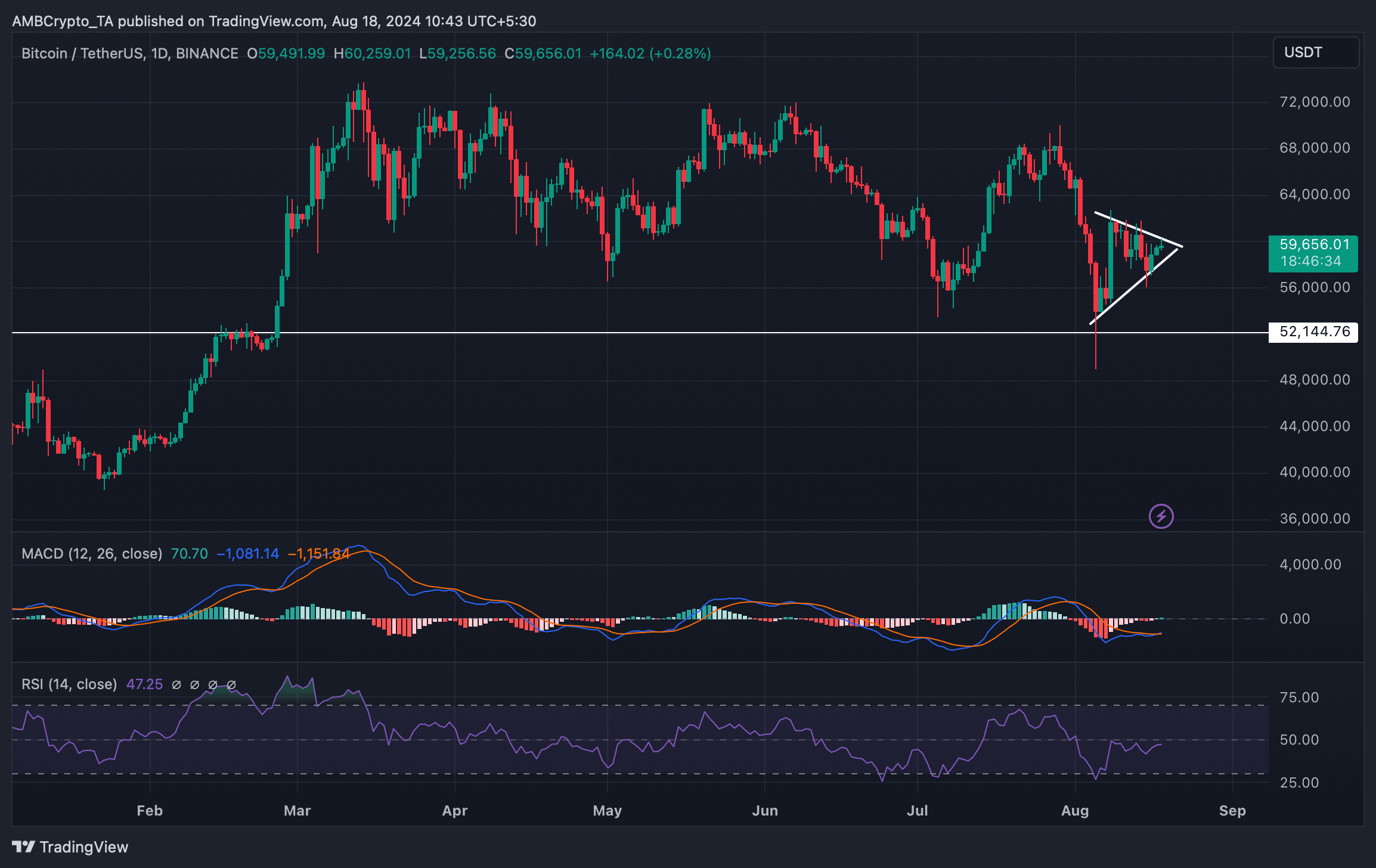

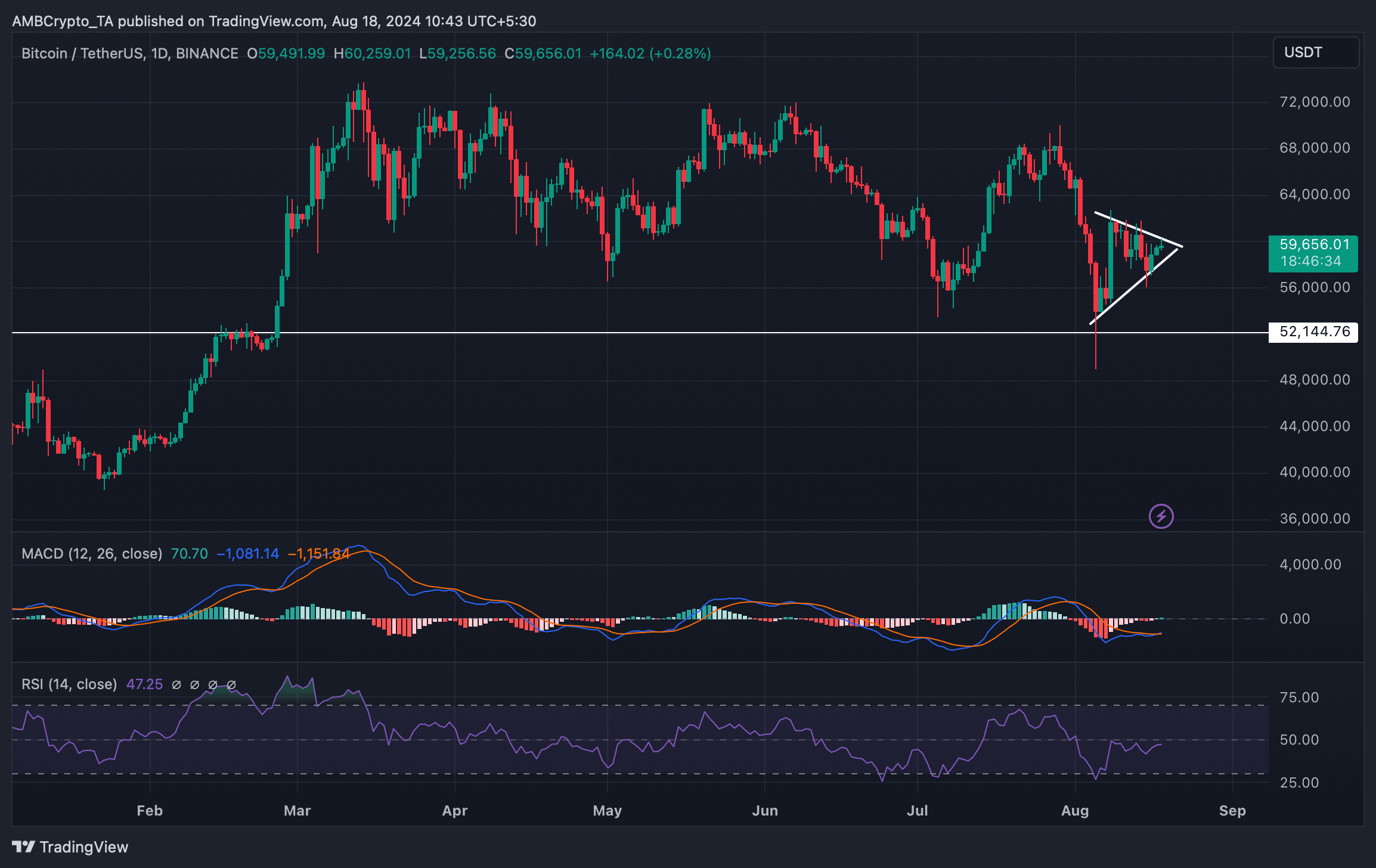

AMBCrypto then took a look at Bitcoin’s daily chart to better understand what to expect in the short-term. Our analysis revealed a bullish symmetrical triangle pattern on BTC’s chart.

The technical indicator MACD displayed a bullish crossover.

Is your portfolio green? Check out the BTC Profit Calculator

The Relative Strength Index (RSI) also registered an uptick, suggesting a successful breakout above the pattern.

However, if BTC fails to close above the aforementioned red line support, then it might plummet to $52k.

Source: TradingView

- Bitcoin remained above a crucial support level at press time.

- Indicators revealed that BTC was trading under its possible market bottom.

Bitcoin [BTC] bulls have taken a backseat over the past few days as the king of cryptos’ volatility dropped. It was interesting to note that while BTC consolidated, it managed to remain above a crucial support level.

This suggested that if things fall in place, then the coin might begin an upward rally in the coming days.

Bitcoin’s crucial support level

As per CoinMarketCap, Bitcoin’s weekly chart remained red, and its price only moved up marginally in the last 24 hours.

At the time of writing, the king of cryptos was trading at $59,443.16 with a market capitalization of over $1.17 trillion.

Meanwhile, Titan of Crypto, a popular crypto analyst, posted a tweet pointing out an interesting development — BTC’s price has been trading just above a critical trendline (red).

Source: X

Notably, BTC hasn’t closed a candle below the red line. Similar episodes happened back in 2021 and 2022. During those events, Bitcoin registered promising bounce backs after touching the same red line.

If history repeats itself, then investors might soon witness BTC gaining bullish momentum.

Will history repeat itself?

AMBCrypto then assessed the coin’s on-chain data to see what they suggested regarding a bounce back.

As per our analysis of CryptoQuant’s data, BTC’s exchange reserve was dropping, indicating a rise in buying pressure.

The king coin’s Miners’ Position Index (MPI) suggested that miners were selling fewer holdings compared to its one-year average.

This meant that miners were confident in BTC and were expecting its price to rise in the coming top.

Source: CryptoQuant

On top of that, BTC’s Binary CDD was also green, meaning that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

Our look at Glassnode’s data revealed yet another bullish indicator. BTC’s Pi Cycle Top indicator pointed out that BTC’s price was resting under its possible market bottom of $63.7k.

This indicated that the chances of BTC reaching that mark were high.

AMBCrypto reported earlier that BTC was also following another historical trend, which might result in a massive bull rally in Q4 2024.

Source: Glassnode

AMBCrypto then took a look at Bitcoin’s daily chart to better understand what to expect in the short-term. Our analysis revealed a bullish symmetrical triangle pattern on BTC’s chart.

The technical indicator MACD displayed a bullish crossover.

Is your portfolio green? Check out the BTC Profit Calculator

The Relative Strength Index (RSI) also registered an uptick, suggesting a successful breakout above the pattern.

However, if BTC fails to close above the aforementioned red line support, then it might plummet to $52k.

Source: TradingView

where buy clomiphene without prescription can i get clomiphene pills can you buy clomid pills cost cheap clomid without a prescription clomid without insurance can i get generic clomiphene without insurance generic clomid without prescription

Thanks for putting this up. It’s well done.

Proof blog you procure here.. It’s hard to find high quality script like yours these days. I truly appreciate individuals like you! Take vigilance!!

buy azithromycin 250mg pills – tindamax 500mg uk cost flagyl 200mg

buy generic semaglutide for sale – where can i buy periactin order generic cyproheptadine 4 mg

oral motilium – order flexeril cyclobenzaprine cheap

buy inderal no prescription – order clopidogrel for sale order methotrexate generic

azithromycin over the counter – order generic tinidazole buy generic bystolic for sale

order augmentin online cheap – atbioinfo.com where can i buy acillin

order nexium pills – https://anexamate.com/ nexium pills

coumadin 2mg cost – https://coumamide.com/ purchase losartan online

prednisone 5mg oral – corticosteroid buy prednisone 10mg generic

buy ed pills fda – https://fastedtotake.com/ home remedies for ed erectile dysfunction

oral amoxicillin – https://combamoxi.com/ order amoxil online

order diflucan 200mg online – click buy generic diflucan over the counter

order cenforce 50mg pills – cenforce 100mg pill cenforce 50mg ca

cialis from canadian pharmacy registerd – on this site cialis 10mg ireland

cialis for daily use reviews – https://strongtadafl.com/ cialis high blood pressure

order ranitidine 150mg for sale – https://aranitidine.com/ zantac where to buy

cheap viagra 100mg – https://strongvpls.com/# viagra sale leeds

This is the type of advise I unearth helpful. actavis doxycycline

Greetings! Extremely productive advice within this article! It’s the petty changes which liking obtain the largest changes. Thanks a lot in the direction of sharing! https://buyfastonl.com/azithromycin.html

More articles like this would make the blogosphere richer. https://ursxdol.com/amoxicillin-antibiotic/

More delight pieces like this would insinuate the web better. https://prohnrg.com/product/orlistat-pills-di/

This is the description of glad I take advantage of reading. fildena double 200

More articles like this would make the blogosphere richer. https://ondactone.com/simvastatin/

With thanks. Loads of knowledge! can i get cheap motilium without a prescription

This is the kind of literature I in fact appreciate. http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44796

order generic forxiga 10mg – click dapagliflozin 10mg usa