- Historically, Bitcoin has noted a 50% correction after reaching a new high in Open Interest.

- It is the beginning of a new cycle- is this reason enough for Bitcoin to not repeat history?.

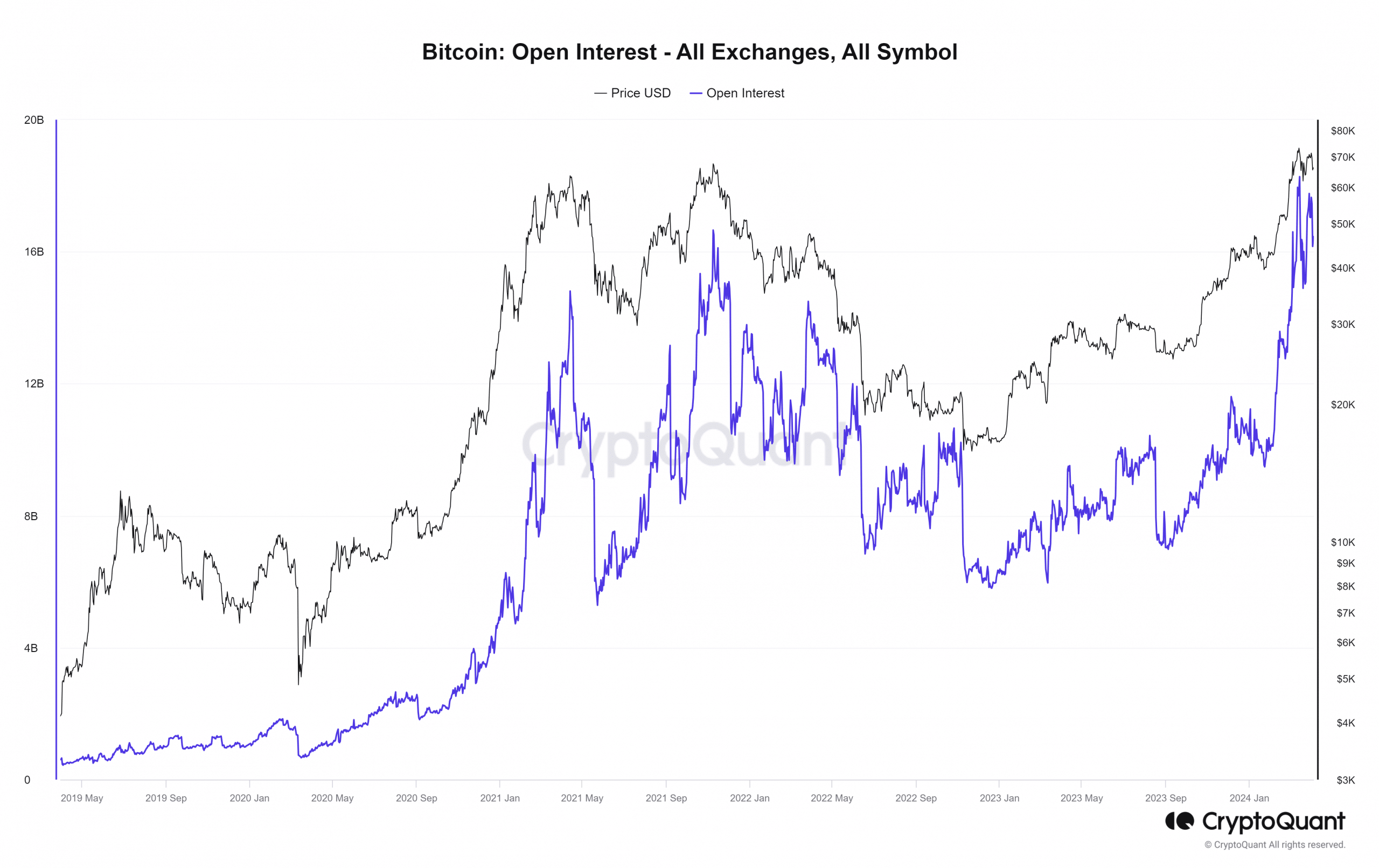

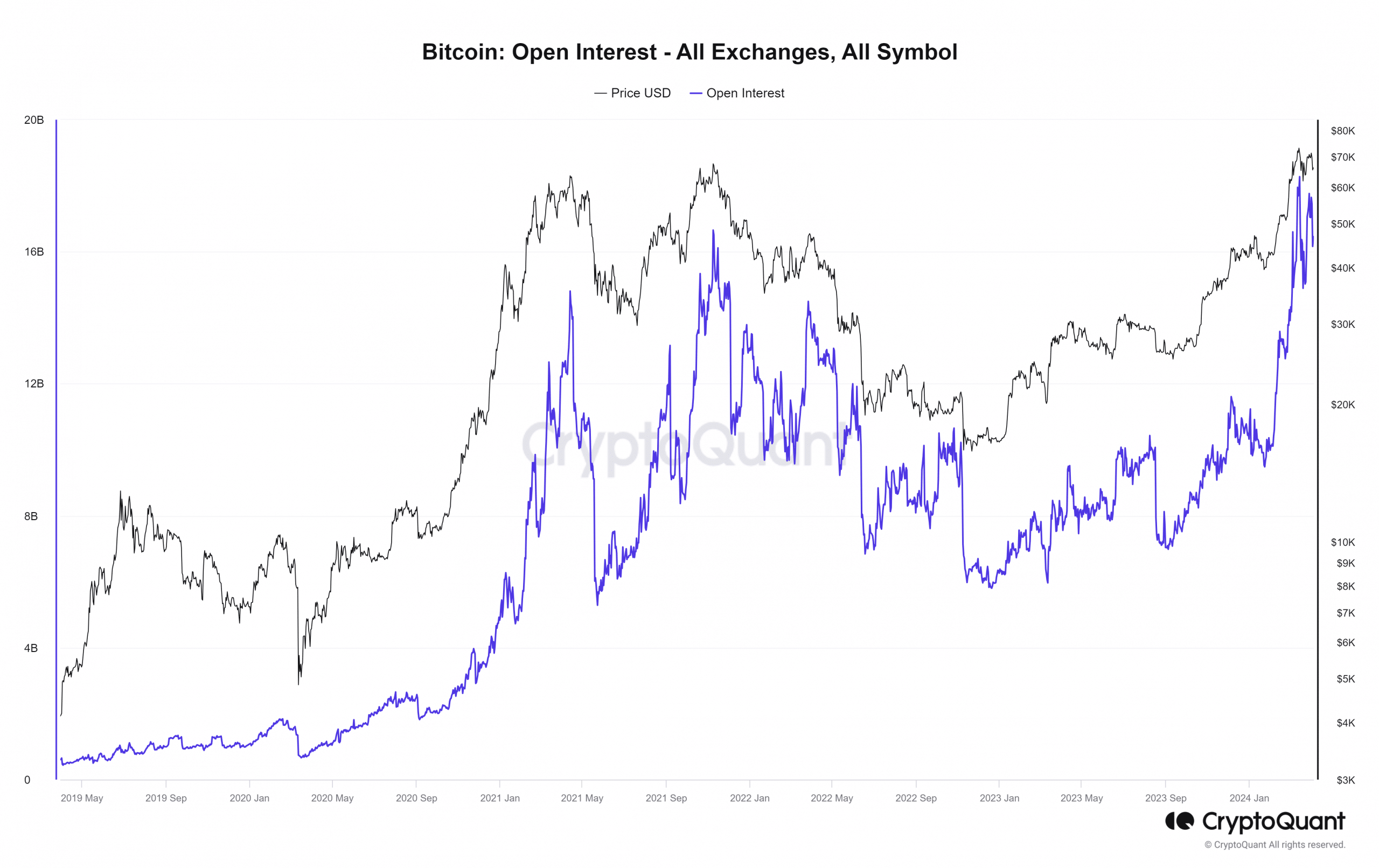

Bitcoin [BTC] noted a 6.8% drop in the past two days even after accounting for the bounce from $64.5k to $66.5k. An Insights post on CryptoQuant drew attention to the fact that each time the Open Interest (OI) pushed above the $13 billion mark, the Bitcoin market witnessed significant corrections.

The OI reached $17.7 billion on the 28th of March. This was followed by the losses we saw in the past few days. With a good chunk of retail participants purged from the futures markets, will BTC see a recovery, or trend downward for the next two months?

Bitcoin Open Interest past the $13 billion mark once more

Source: CryptoQuant

As the Insights post points out, whenever BTC OI climbs past $13 billion, we see a major correction. This was because the extreme highs in OI are achieved when the market is in a state of euphoria or has grown considerably larger.

The 2021 Open Interest peaks reached $14.8 billion in April 2023 and $16.6 billion in November 2021. Both times, BTC witnessed a 50% retracement in the next 70 days.

The recent OI surge measured $18.2 billion, but that does not automatically mean we would see a 50% drop in the next two months. During the 2020 rally, the OI breached previous highs convincingly. This implied the capital inflow was multiple times greater than it was before.

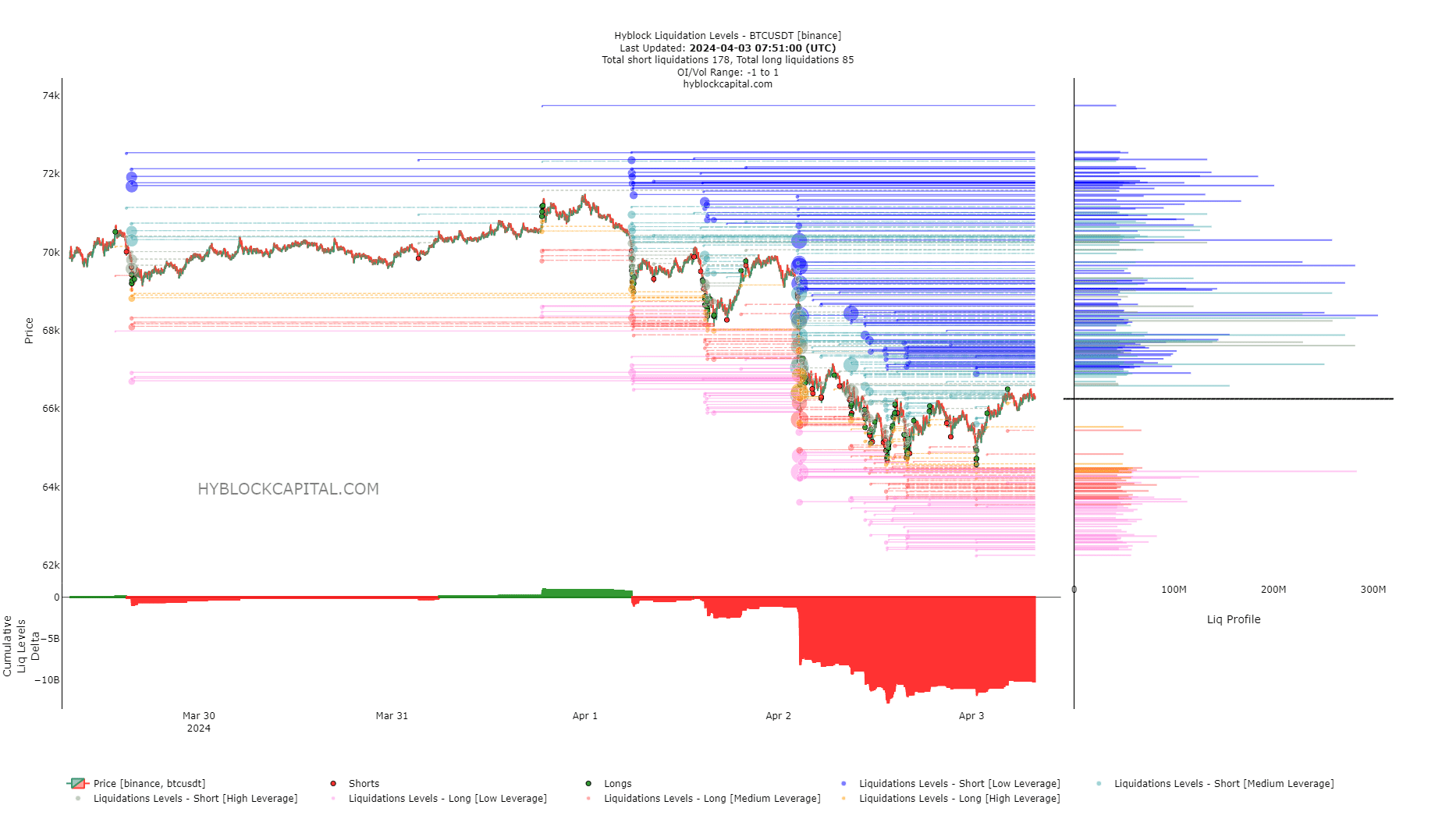

The liquidation charts argue for a bullish short-term reversal

Source: Hyblock

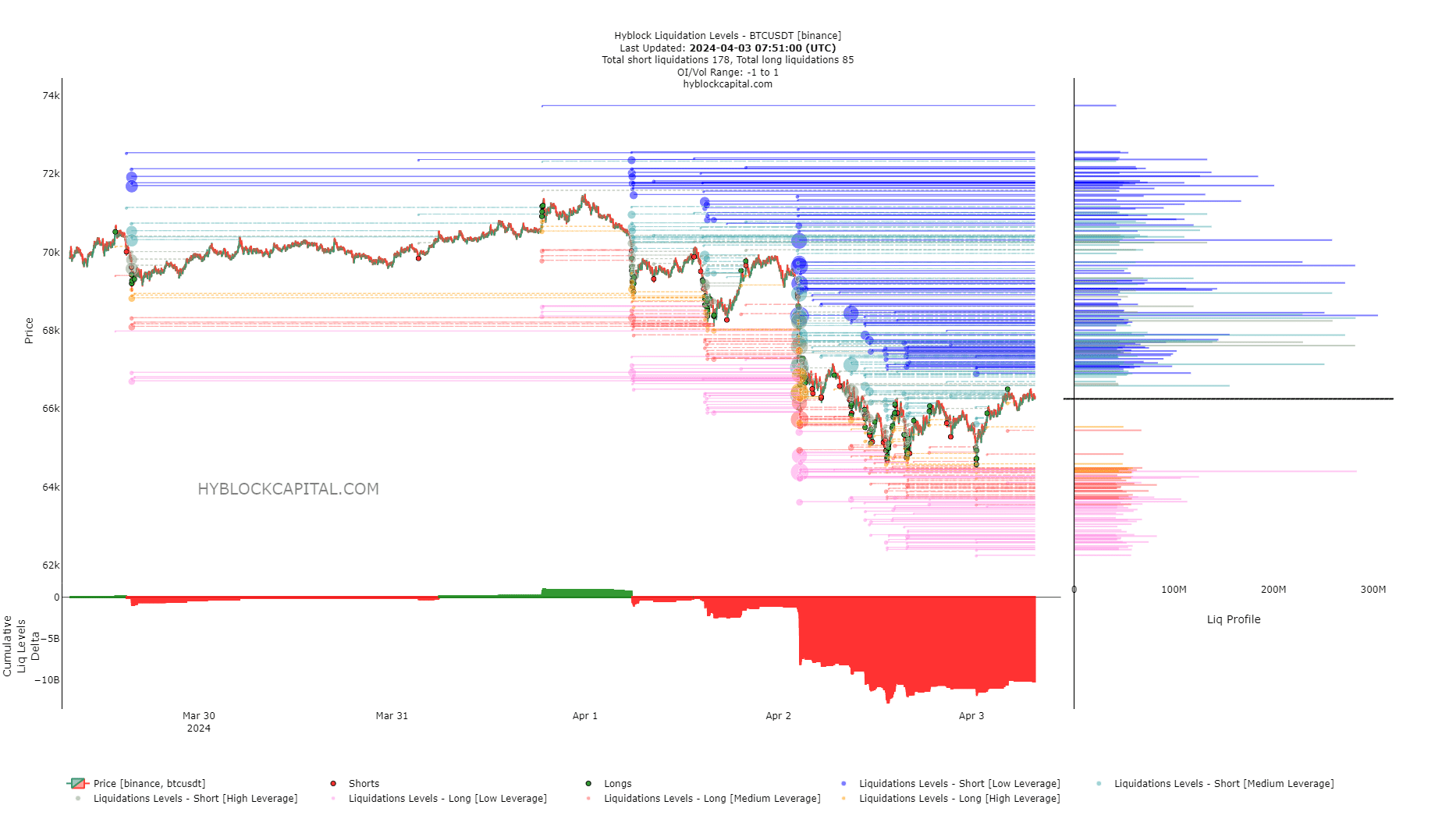

The reason high OI sees large volatility is because price is attracted to liquidity. When a market is propped up by demand from the spot market, significant volatility in a short amount of time is hard due to the spot market orders.

When the market is near a local top, and prices are pushed higher by interest in the futures market but much less spot demand, the possibility of liquidation cascades vastly increases. This is something participants should be aware of.

At press time, the cumulative liq levels delta was highly negative. Short liquidations outnumber long liquidations by a good margin. Therefore, prices could be attracted higher to wipe out the bears.

The $68.2k, $69.6k, and $70.3k are levels that BTC could rally to in the coming days. There was a huge concentration of short liquidations at these levels that could be swept.

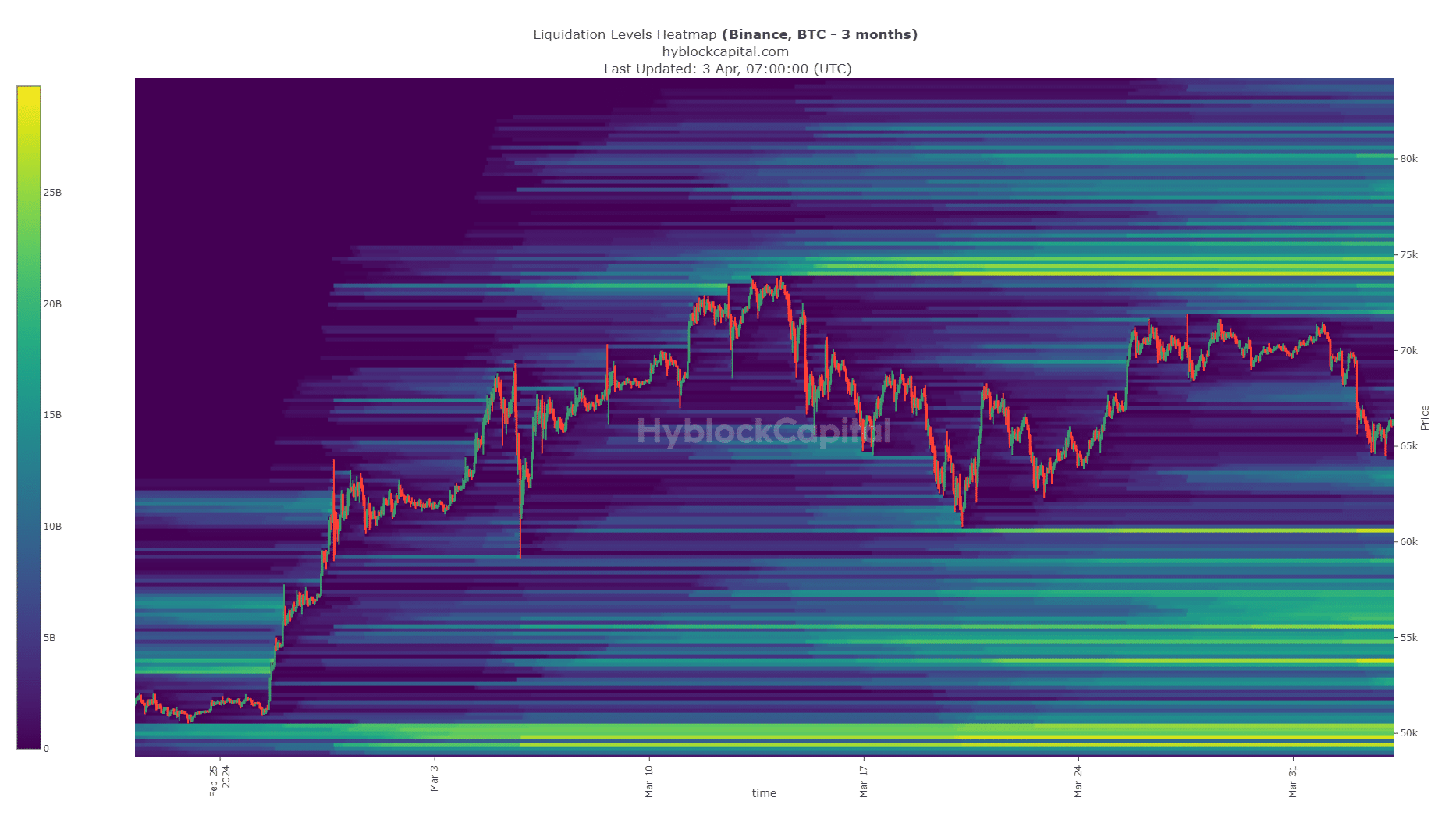

Source: Hyblock

Is your portfolio green? Check the Bitcoin Profit Calculator

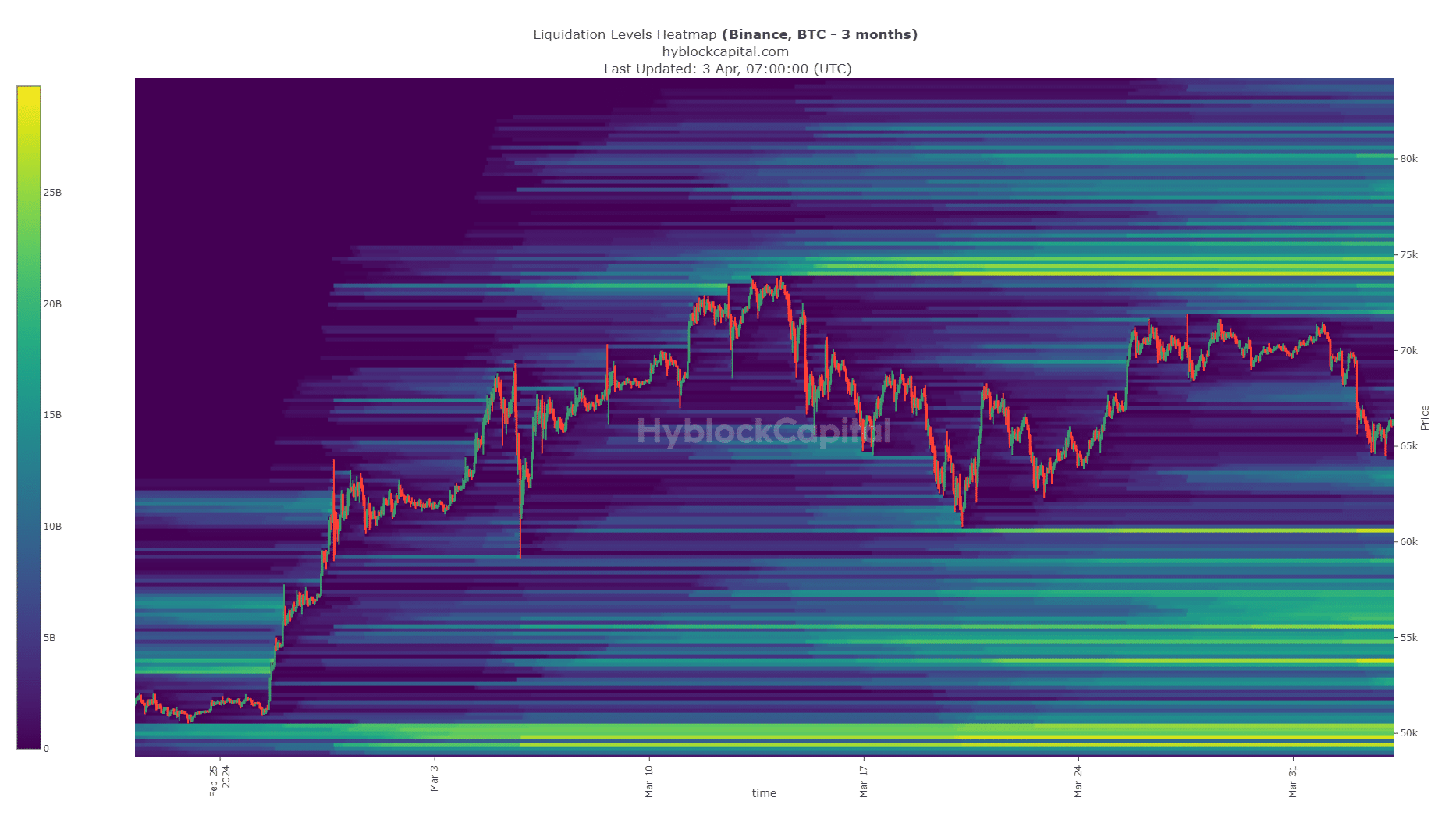

The longer-term outlook for Bitcoin highlighted two areas of interest. To the south, it was the $60.6k region while the $74k-$74.6k zone to the north would prove key.

With the Bitcoin halving event just under three weeks away, we could be in for more volatility before the true bull run begins.

- Historically, Bitcoin has noted a 50% correction after reaching a new high in Open Interest.

- It is the beginning of a new cycle- is this reason enough for Bitcoin to not repeat history?.

Bitcoin [BTC] noted a 6.8% drop in the past two days even after accounting for the bounce from $64.5k to $66.5k. An Insights post on CryptoQuant drew attention to the fact that each time the Open Interest (OI) pushed above the $13 billion mark, the Bitcoin market witnessed significant corrections.

The OI reached $17.7 billion on the 28th of March. This was followed by the losses we saw in the past few days. With a good chunk of retail participants purged from the futures markets, will BTC see a recovery, or trend downward for the next two months?

Bitcoin Open Interest past the $13 billion mark once more

Source: CryptoQuant

As the Insights post points out, whenever BTC OI climbs past $13 billion, we see a major correction. This was because the extreme highs in OI are achieved when the market is in a state of euphoria or has grown considerably larger.

The 2021 Open Interest peaks reached $14.8 billion in April 2023 and $16.6 billion in November 2021. Both times, BTC witnessed a 50% retracement in the next 70 days.

The recent OI surge measured $18.2 billion, but that does not automatically mean we would see a 50% drop in the next two months. During the 2020 rally, the OI breached previous highs convincingly. This implied the capital inflow was multiple times greater than it was before.

The liquidation charts argue for a bullish short-term reversal

Source: Hyblock

The reason high OI sees large volatility is because price is attracted to liquidity. When a market is propped up by demand from the spot market, significant volatility in a short amount of time is hard due to the spot market orders.

When the market is near a local top, and prices are pushed higher by interest in the futures market but much less spot demand, the possibility of liquidation cascades vastly increases. This is something participants should be aware of.

At press time, the cumulative liq levels delta was highly negative. Short liquidations outnumber long liquidations by a good margin. Therefore, prices could be attracted higher to wipe out the bears.

The $68.2k, $69.6k, and $70.3k are levels that BTC could rally to in the coming days. There was a huge concentration of short liquidations at these levels that could be swept.

Source: Hyblock

Is your portfolio green? Check the Bitcoin Profit Calculator

The longer-term outlook for Bitcoin highlighted two areas of interest. To the south, it was the $60.6k region while the $74k-$74.6k zone to the north would prove key.

With the Bitcoin halving event just under three weeks away, we could be in for more volatility before the true bull run begins.

I got what you mean ,saved to bookmarks, very decent internet site.

Appreciate it for this post, I am a big fan of this web site would like to keep updated.

I was examining some of your posts on this site and I conceive this web site is real instructive! Continue putting up.

buy clomid cost of generic clomid prices where buy cheap clomid can i purchase clomid for sale where to buy cheap clomid pill how can i get cheap clomid can i order cheap clomiphene without a prescription

The vividness in this tune is exceptional.

I couldn’t turn down commenting. Well written!

buy generic azithromycin 250mg – order ciprofloxacin 500 mg online cheap buy flagyl 400mg pill

semaglutide medication – semaglutide online buy cyproheptadine pill

motilium oral – order sumycin 250mg generic order flexeril 15mg generic

buy inderal no prescription – methotrexate order methotrexate sale

buy amoxil paypal – buy generic valsartan 160mg buy combivent medication

cost augmentin 1000mg – atbioinfo.com buy cheap generic ampicillin

nexium over the counter – nexium to us esomeprazole 20mg drug

warfarin medication – https://coumamide.com/ purchase losartan sale

mobic 7.5mg generic – https://moboxsin.com/ order meloxicam 7.5mg online

Great blog! I am loving it!! Will be back later to read some more. I am taking your feeds also.

buy prednisone generic – allergic reactions prednisone 40mg cheap

pills for erection – https://fastedtotake.com/ generic ed pills

amoxil online order – buy amoxicillin without a prescription amoxicillin over the counter

diflucan usa – https://gpdifluca.com/ fluconazole pills

order escitalopram 10mg pills – this cheap lexapro

buy cenforce tablets – on this site order cenforce 50mg generic

india pharmacy cialis – https://ciltadgn.com/# cialis 5mg daily

side effects of cialis – on this site buy tadalafil no prescription

cheap ranitidine 150mg – https://aranitidine.com/# ranitidine cheap

Thanks on putting this up. It’s understandably done. https://gnolvade.com/

With thanks. Loads of knowledge! order neurontin 600mg pills

Thanks on sharing. It’s first quality. https://ursxdol.com/furosemide-diuretic/

Thanks for putting this up. It’s evidently done. https://prohnrg.com/

I¦ll immediately seize your rss as I can not to find your email subscription hyperlink or newsletter service. Do you have any? Please permit me understand so that I may just subscribe. Thanks.

This is the type of delivery I turn up helpful. https://aranitidine.com/fr/prednisolone-achat-en-ligne/

Its great as your other articles : D, regards for posting.