- Most addresses continued to hold Bitcoin despite the market drawdown.

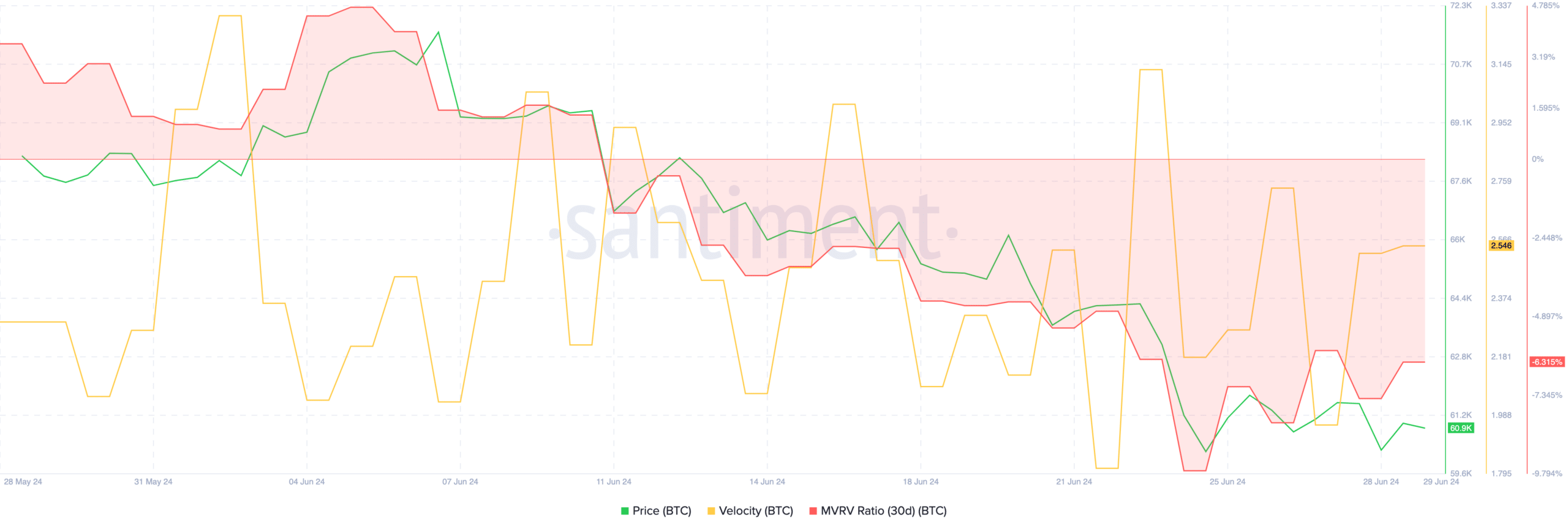

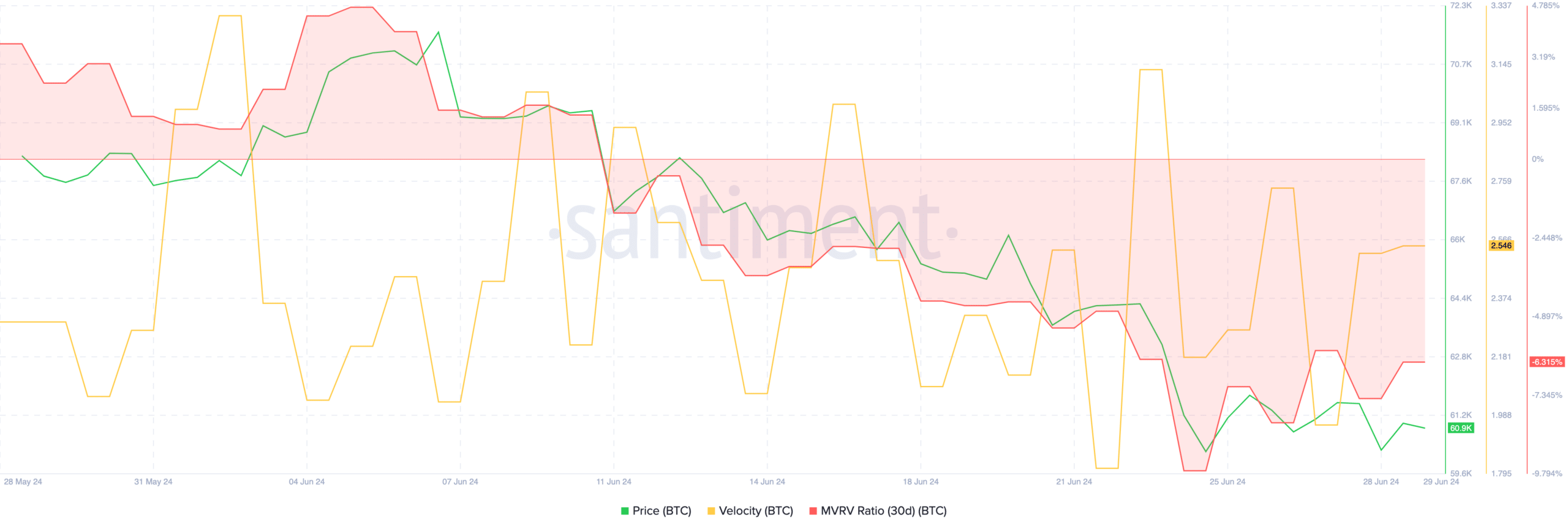

- The velocity at which BTC was trading had surged materially.

Bitcoin’s [BTC] recent decline in price has sent shockwaves across the crypto sector. However, despite the decline in price, HODLers remained positive.

Will HODLers stay put?

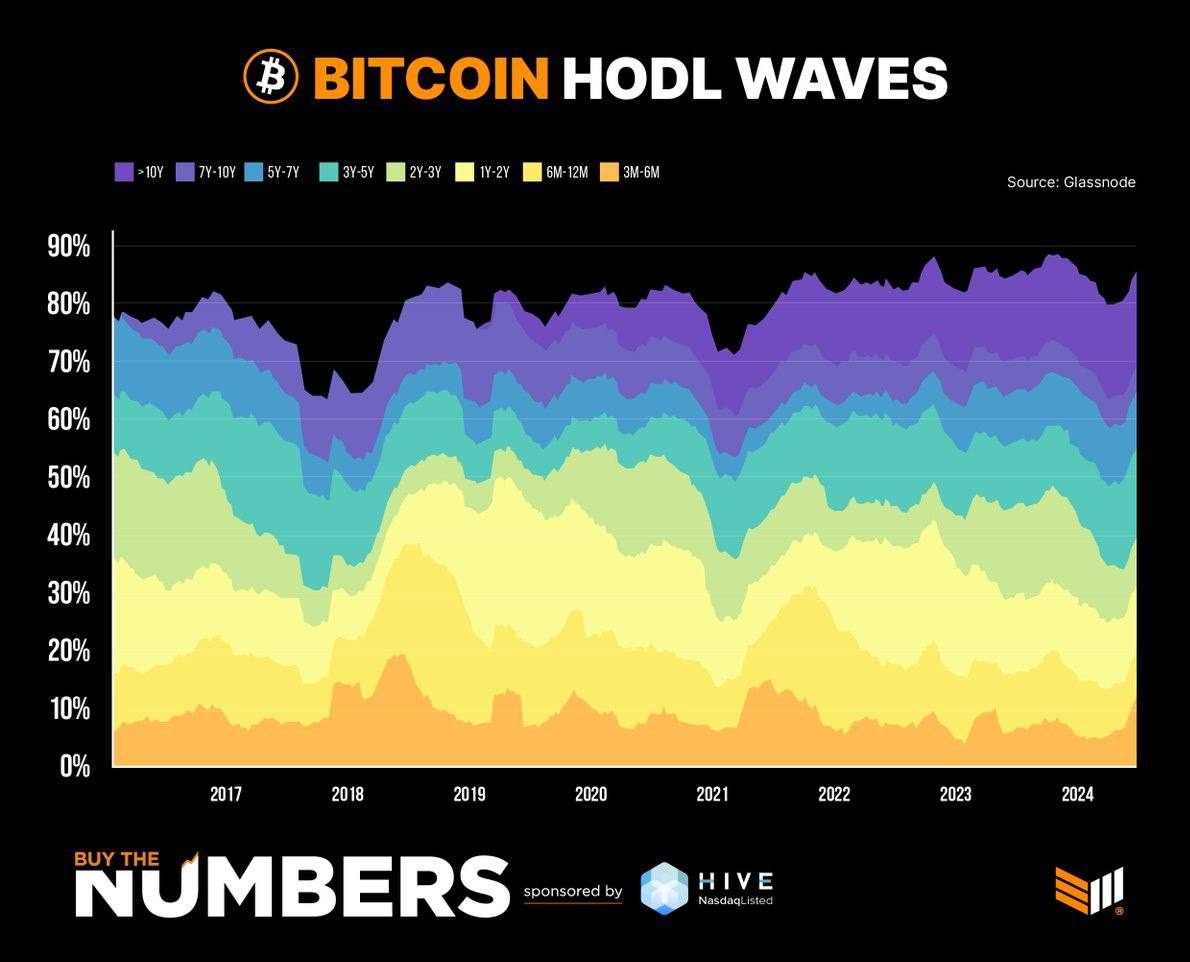

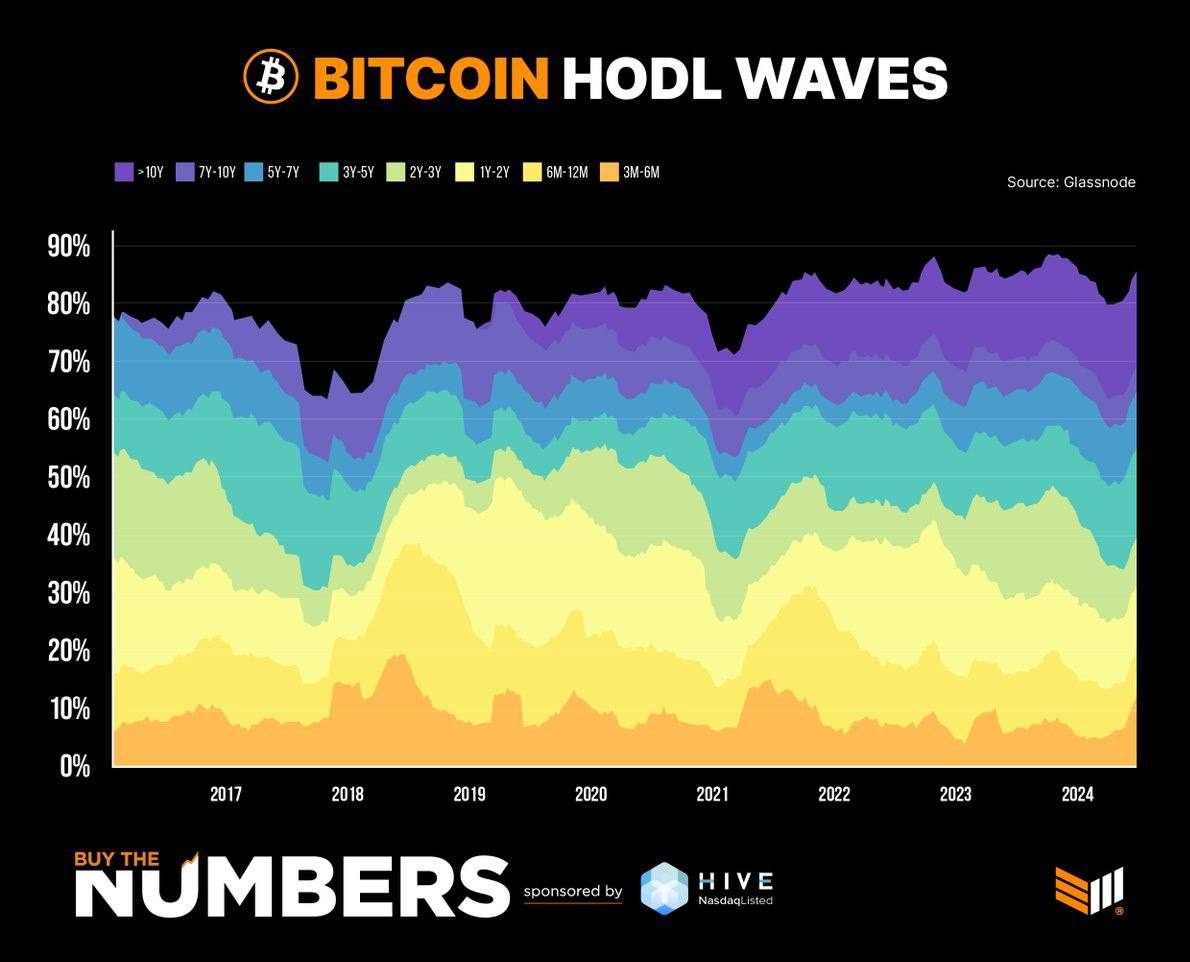

Bitcoin HODL waves indicated that Only less than 10% of Bitcoin had been moved in the last months, the majority of the tokens were being HODLed by the addressees.

This could be interpreted in a few ways. On one hand, this indicated long-term confidence amidst addresses. Holders might believe that this is a temporary dip and that the king coin’s price will recover in the long run.

On the other hand, this could also mean that investors may be unwilling to sell their Bitcoin at a price lower than what they bought it for and are reluctant to sell their BTC at a loss.

Source: X

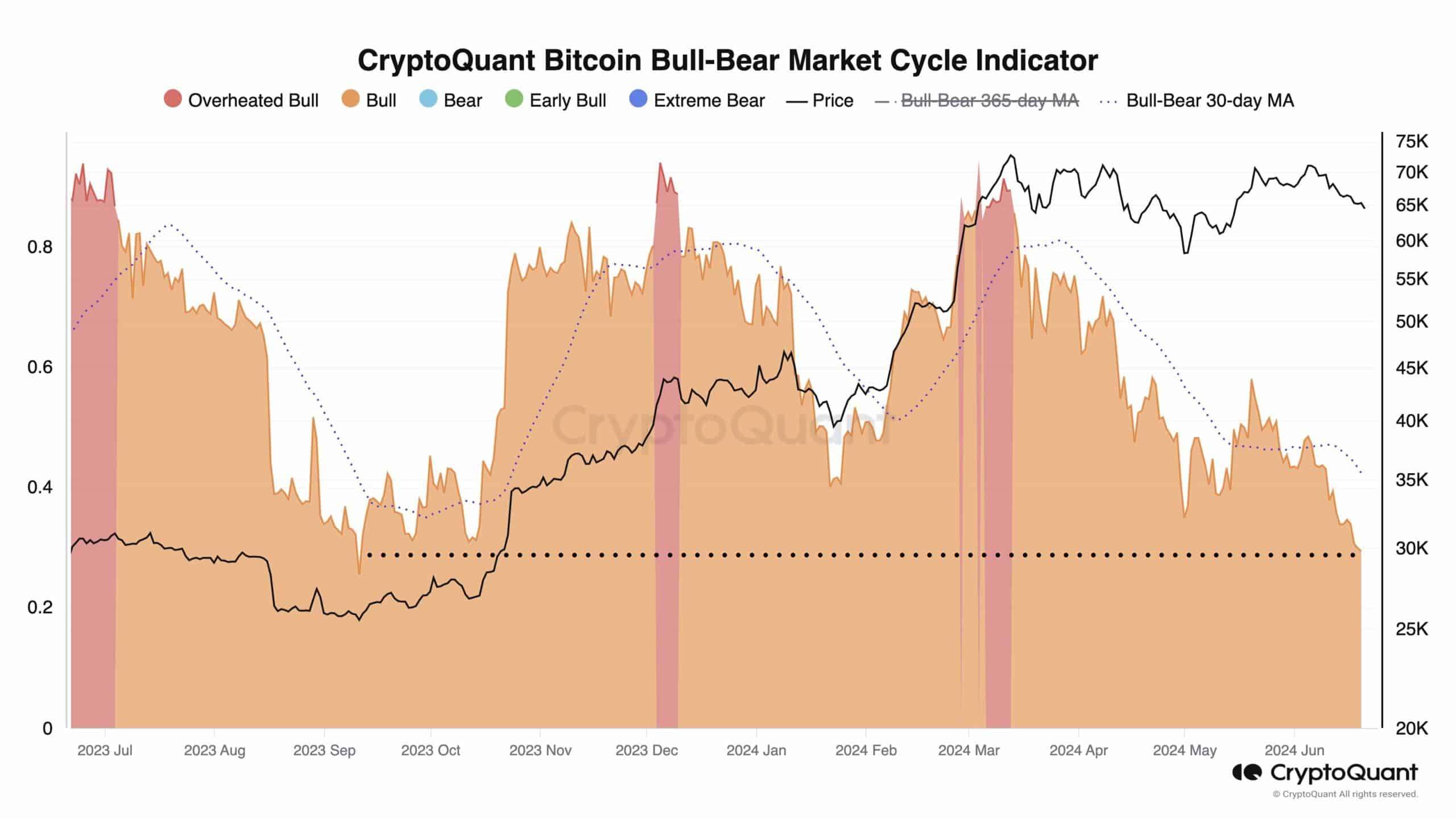

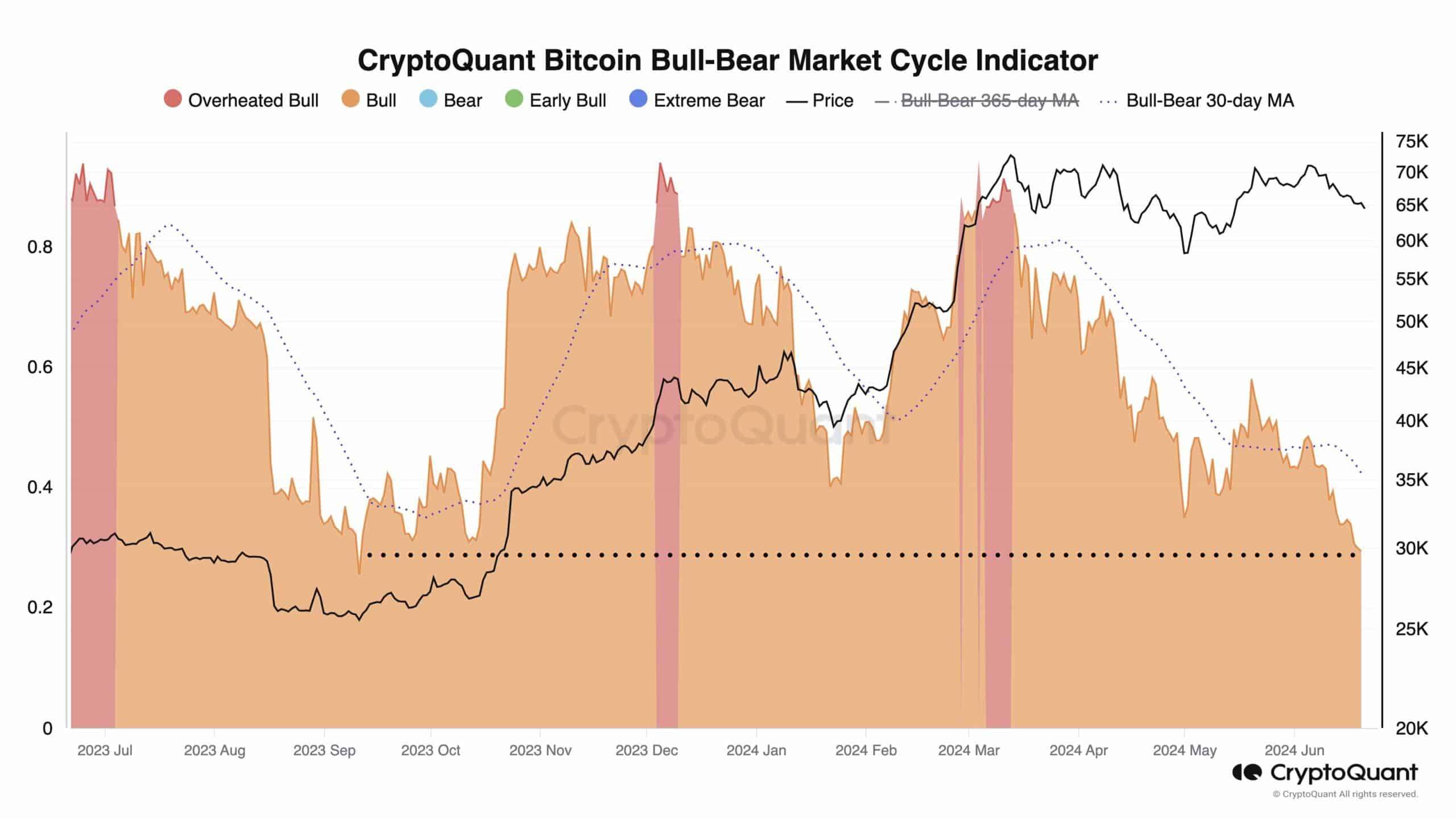

However, according to the Bitcoin cycle indicator, the market is the least bullish it’s been since September 2023.

The indicator suggested that we might be in the late stages of a bull run, transitioning into a bear market characterized by declining prices.

It could also indicate a decrease in overall investor optimism about Bitcoin’s price in the near future.

Source: CryptoQuant

How are Bitcoin miners holding up?

Another factor that can impact Bitcoin’s price in the long run, would be the state of miners.

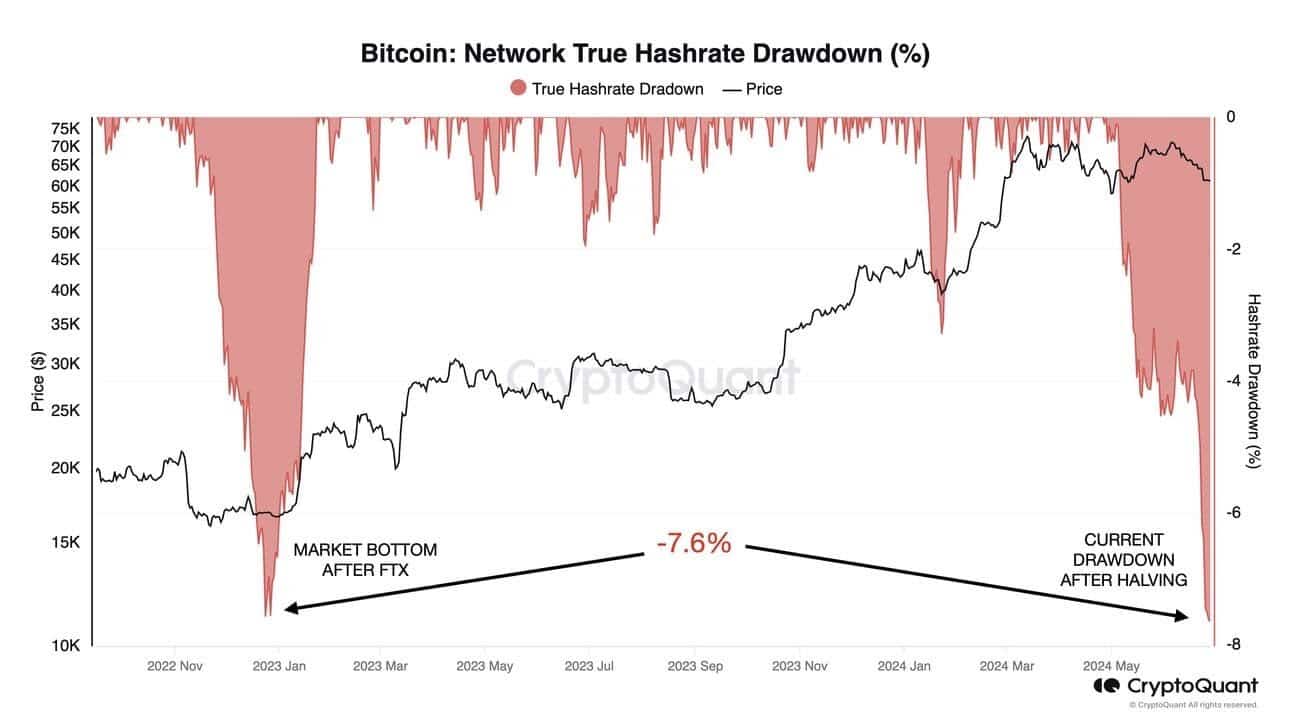

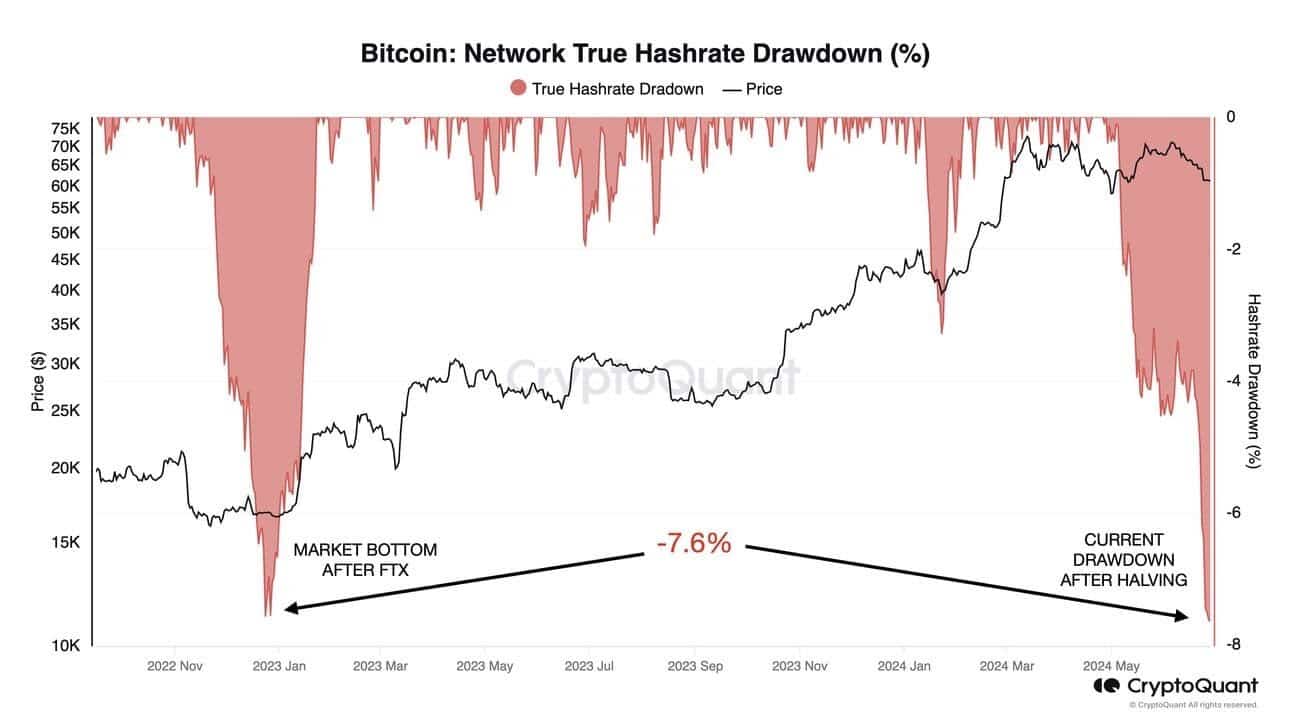

Recent data indicated that the current decline in hash rate is as severe as the one observed during the collapse of the FTX exchange in late 2023.

A significant drop in hash rate could weaken the security of the Bitcoin network, making it more centralized.

Moreover, this can also result in miner capitulation. If miners start selling their Bitcoin in large quantities to remain profitable, it could create additional downward pressure on the price.

However, a network hashrate drawdown is also indicative of a market bottom. If history repeats itself, the price of Bitcoin could rally in the future.

Source: X

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the time of writing, BTC was trading at $61,596.57 and its price had grown by 1.79% in the last 24 hours.

The velocity at which BTC was trading at had grown materially, indicating that the frequency at which BTC was trading at had surged.

Source: Santiment

- Most addresses continued to hold Bitcoin despite the market drawdown.

- The velocity at which BTC was trading had surged materially.

Bitcoin’s [BTC] recent decline in price has sent shockwaves across the crypto sector. However, despite the decline in price, HODLers remained positive.

Will HODLers stay put?

Bitcoin HODL waves indicated that Only less than 10% of Bitcoin had been moved in the last months, the majority of the tokens were being HODLed by the addressees.

This could be interpreted in a few ways. On one hand, this indicated long-term confidence amidst addresses. Holders might believe that this is a temporary dip and that the king coin’s price will recover in the long run.

On the other hand, this could also mean that investors may be unwilling to sell their Bitcoin at a price lower than what they bought it for and are reluctant to sell their BTC at a loss.

Source: X

However, according to the Bitcoin cycle indicator, the market is the least bullish it’s been since September 2023.

The indicator suggested that we might be in the late stages of a bull run, transitioning into a bear market characterized by declining prices.

It could also indicate a decrease in overall investor optimism about Bitcoin’s price in the near future.

Source: CryptoQuant

How are Bitcoin miners holding up?

Another factor that can impact Bitcoin’s price in the long run, would be the state of miners.

Recent data indicated that the current decline in hash rate is as severe as the one observed during the collapse of the FTX exchange in late 2023.

A significant drop in hash rate could weaken the security of the Bitcoin network, making it more centralized.

Moreover, this can also result in miner capitulation. If miners start selling their Bitcoin in large quantities to remain profitable, it could create additional downward pressure on the price.

However, a network hashrate drawdown is also indicative of a market bottom. If history repeats itself, the price of Bitcoin could rally in the future.

Source: X

Read Bitcoin’s [BTC] Price Prediction 2024-25

At the time of writing, BTC was trading at $61,596.57 and its price had grown by 1.79% in the last 24 hours.

The velocity at which BTC was trading at had grown materially, indicating that the frequency at which BTC was trading at had surged.

Source: Santiment

Hello,

Private FTP FLAC/Mp3/Clips 1990-2024.

Music Club/Electro/Trance/Hardstyle/Italodance/RnB/Rap/: https://0daymusic.org/rasti.php?ka_rasti=-FR-

List albums: https://0daymusic.org/FTPtxt/

New 0-DAY scene releases daily.

Sorted section by date / genre.

Music videos: https://0daymusic.org/stilius.php?id=music__videos-2021

Regards

Matthew Jon

Зарабатывай бабло в лучших казино! Топ слотов, акции, стратегии для победы! Подписывайся

Игровые автоматы: фишки, тактики, бонусы! Заработай с нами! Реальные обзоры.

https://t.me/s/official_izzi/1116

Выигрывай реальные деньги в лучших казино! Обзоры слотов, бонусы, советы для победы! Подписывайся

Игровые автоматы: секреты, тактики, бонусы! Заработай с нами! Реальные обзоры.

https://t.me/Official_1win_1win/746

Окунитесь в мир азарта с 7k casino! Вас ждут захватывающие игры, щедрые бонусы а также шанс выиграть по-крупному! Попробуйте свои силы уже сегодня!

https://7k-off.online

https://t.me/s/official_1go_1go

https://t.me/s/win1win777win

https://t.me/vavadaslot_777/212

https://t.me/s/Rus_CasinoTop

https://t.me/s/wwwinwinwini1

https://t.me/s/Official_1win_1win

buying generic clomiphene price cost of generic clomid without a prescription clomiphene tablet price where can i get cheap clomid no prescription get generic clomid prices can i buy cheap clomid without dr prescription cost cheap clomid prices

More text pieces like this would create the web better.

This is the stripe of glad I take advantage of reading.

order generic zithromax 500mg – tinidazole medication buy flagyl 200mg pills

rybelsus price – cyproheptadine 4 mg price buy periactin 4mg pill

motilium for sale online – buy cheap generic tetracycline cyclobenzaprine cheap

buy azithromycin 500mg – tinidazole 300mg over the counter order bystolic

buy augmentin for sale – https://atbioinfo.com/ order ampicillin generic

order esomeprazole sale – anexamate.com nexium price

buy prednisone 40mg generic – aprep lson buy deltasone 40mg pill

buy ed pills sale – https://fastedtotake.com/ buy ed medication online

amoxicillin order online – order amoxicillin sale where to buy amoxil without a prescription

order forcan sale – https://gpdifluca.com/# buy fluconazole 100mg generic

whats the max safe dose of tadalafil xtenda for a healthy man – https://ciltadgn.com/# where can i buy cialis online

cialis 10mg ireland – https://strongtadafl.com/ letairis and tadalafil

where can i buy zantac – https://aranitidine.com/ buy zantac 150mg online

viagra buy over counter – strong vpls real viagra 100mg

With thanks. Loads of expertise! que es prednisolona y para que sirve

This is a keynote which is in to my heart… Myriad thanks! Quite where can I upon the contact details for questions? https://buyfastonl.com/furosemide.html

More posts like this would create the online time more useful. https://prohnrg.com/product/omeprazole-20-mg/

Thanks recompense sharing. It’s top quality. https://aranitidine.com/fr/sibelium/