- Bitcoin has climbed to a 20-week high above $71,000 amid positive market sentiment.

- With 98% of holders in profits, FOMO could propel BTC to a new ATH before the end of Uptober.

Bitcoin [BTC] has been trending up this month and recently reached a 20-week high above $71,500. At press time, BTC traded at $70,900 and was only 3.7% shy of its all-time highs.

Several bullish indicators currently suggest that Bitcoin could form a fresh ATH before the end of “Uptober” amid positive market sentiment.

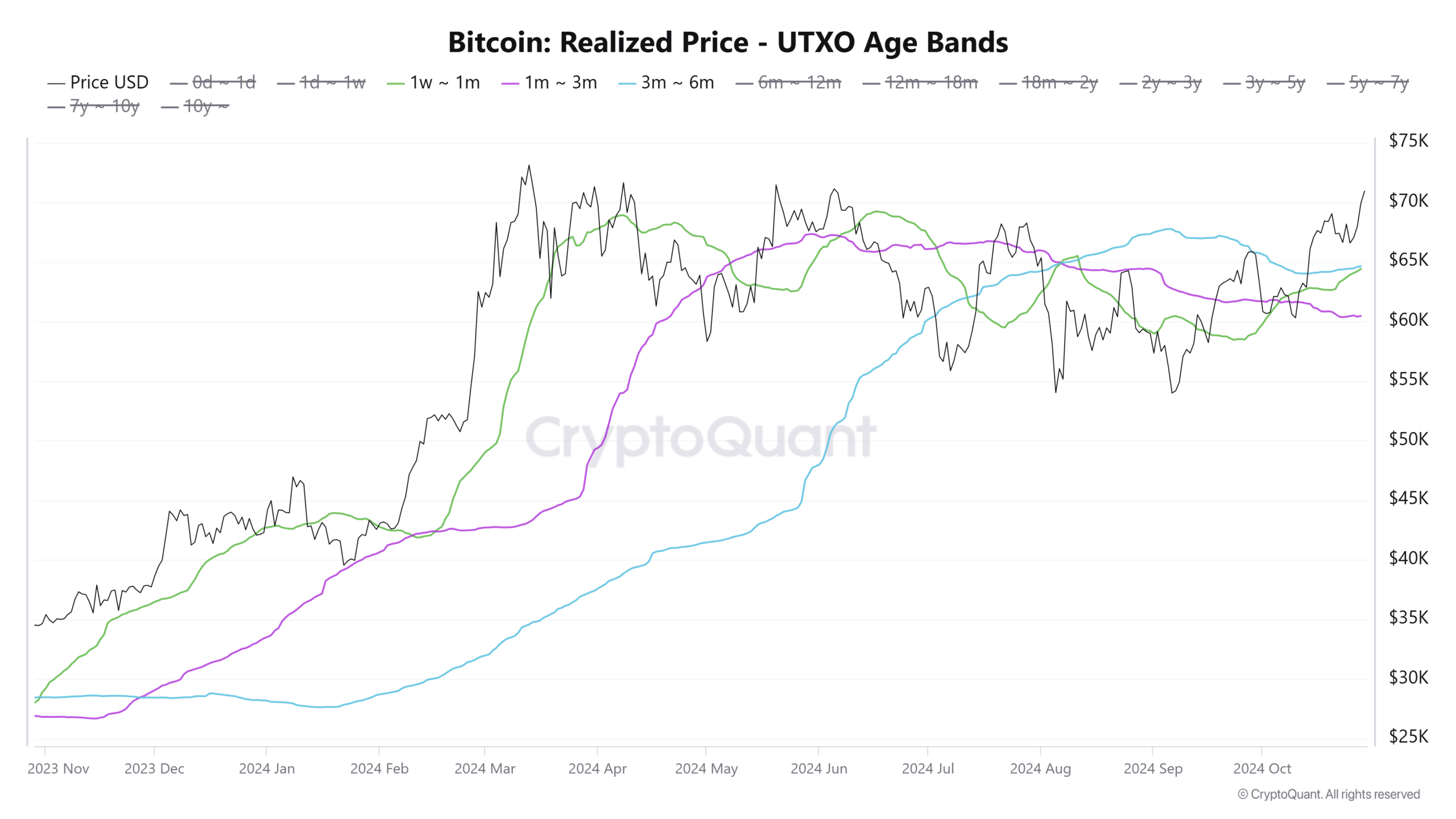

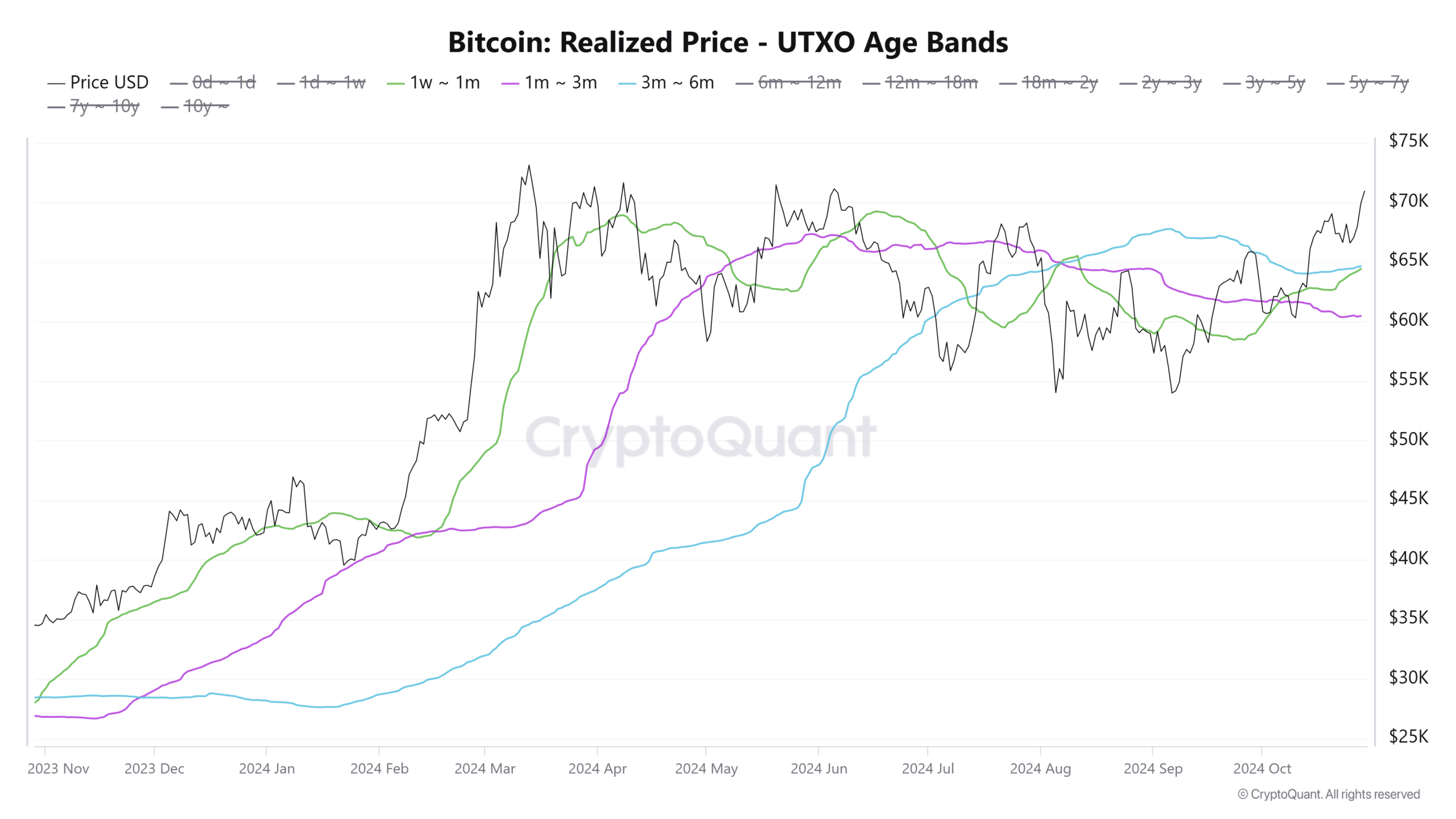

Bitcoin UTXO Realized Price

A look at the Bitcoin UTXO Realized Price for short-term holders suggests that prices could continue to rise in the short term.

Per CryptoQuant, the UTXO Realized Price for wallets that have held BTC for under a month is close to surpassing that of wallets that have held Bitcoin for between three to six months.

Past crossovers have often preceded significant price increases. A similar crossover is about to happen, which could strengthen the bullish narrative around BTC.

Source: CryptoQuant

Short-term holders usually determine the sustainability of a rally. Therefore, if new transactions start occurring at higher prices, it will boost market sentiment and pave the way to an ATH.

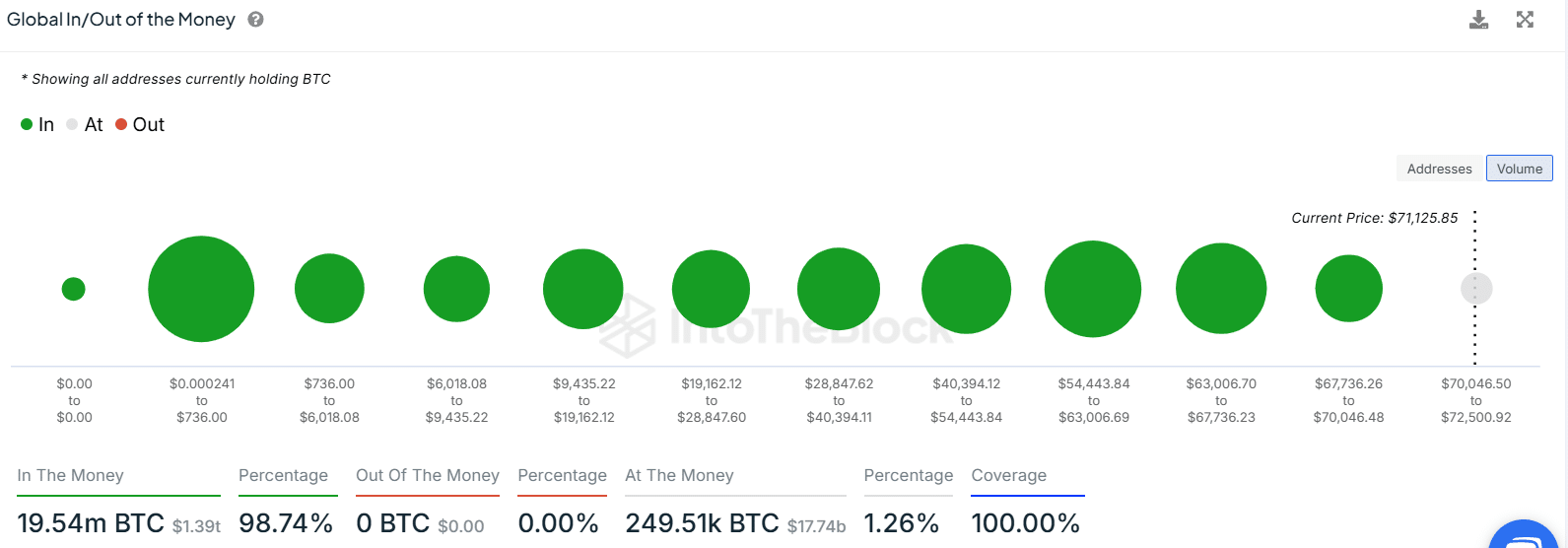

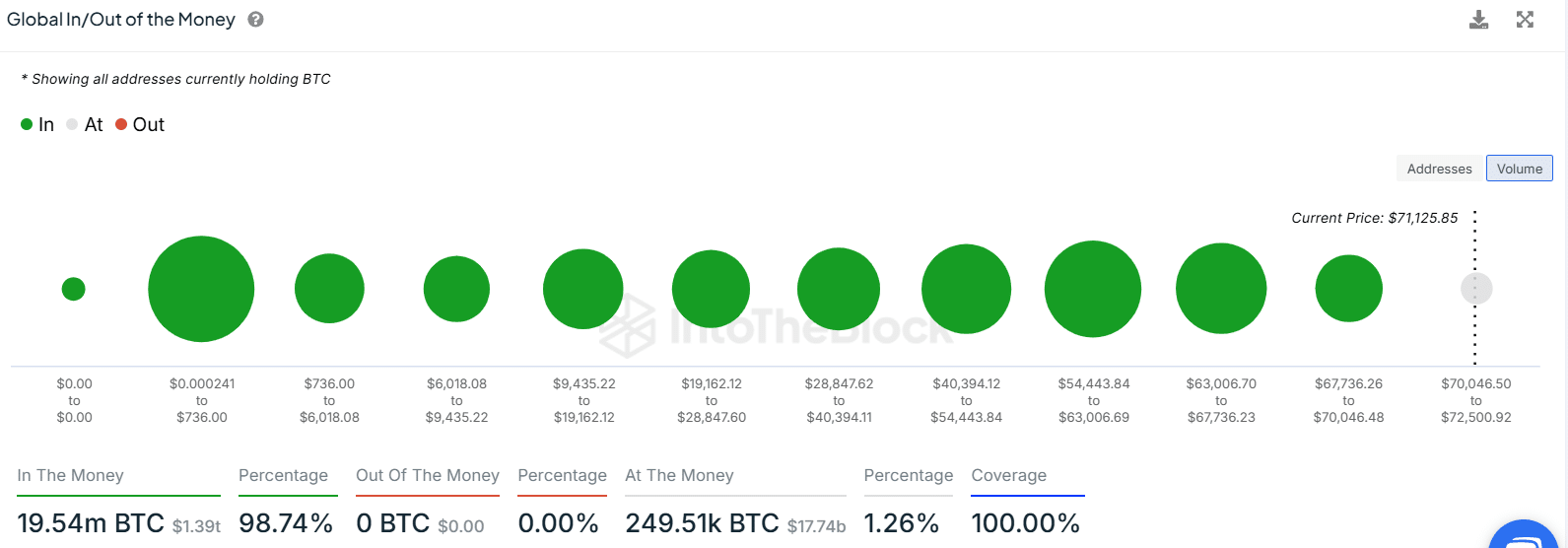

98% of holders are in profits

Data from IntoTheBlock shows that 98% of BTC holders are sitting in profits while 1.26% are at a break-even point.

Source: IntoTheBlock

When wallet profitability increases, it boosts investor confidence as holders become more willing to hold their assets rather than sell. This scenario can also stir the fear of missing out (FOMO). As a result, new buyers could enter the market, reinforcing the uptrend.

FOMO is already evident as the Fear and Greed Index sits at 72. This shows that the market is in a state of greed.

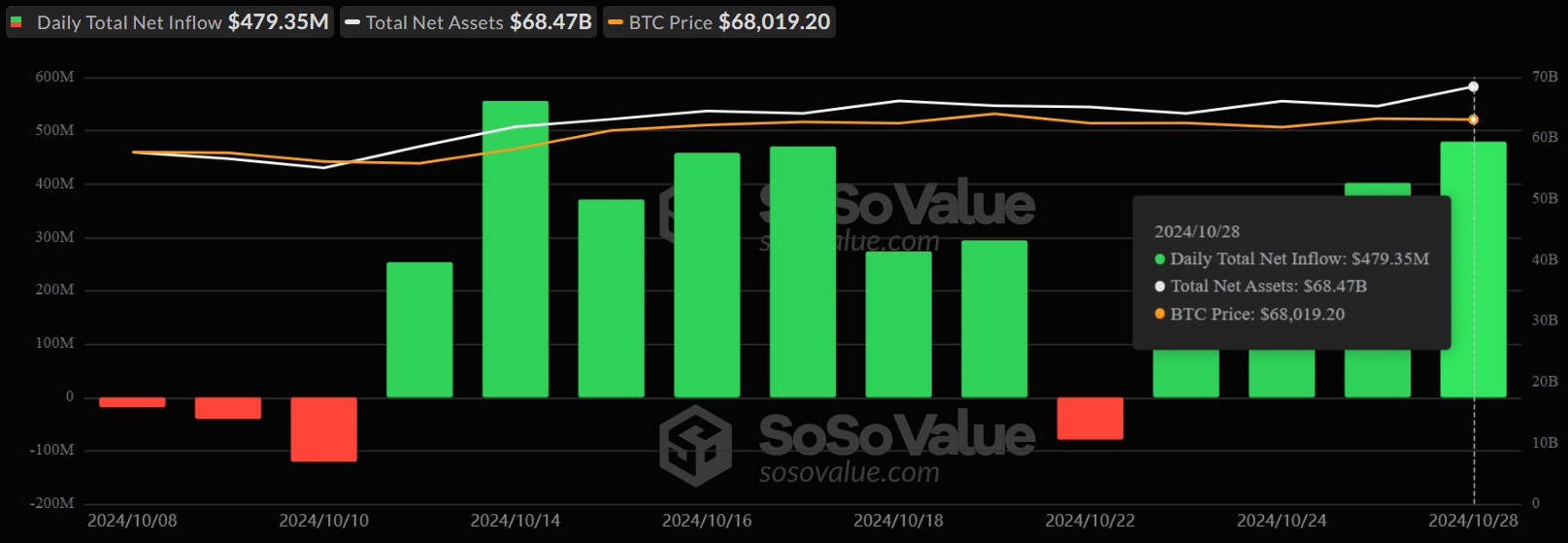

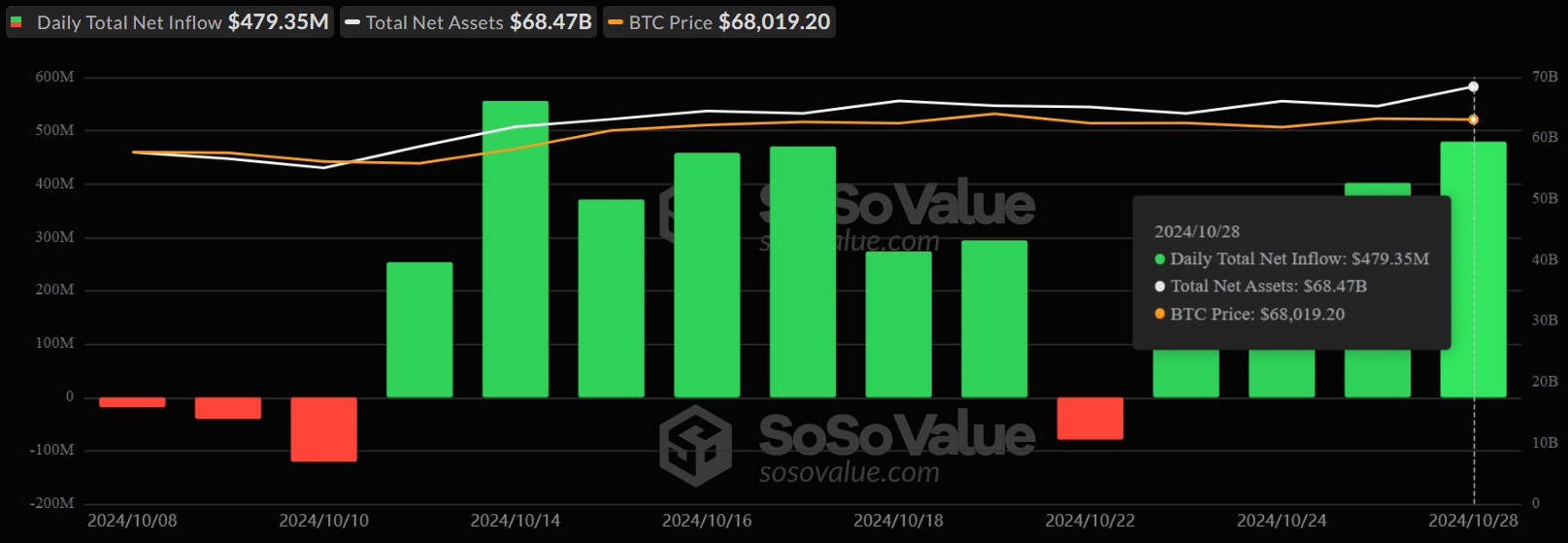

Rising demand for BTC ETFs

On 28th October, US spot Bitcoin exchange-traded funds (ETFs) recorded their highest inflows in two weeks. Per SoSoValue, inflows during the day came in at $479M, with Blackrock taking the largest share with $315M inflows.

Source: SoSoValue

As AMBCrypto reported, BlackRock’s BTC holdings have surpassed 400,000 coins, with the asset manager being on track to flipping Satoshi and becoming the largest Bitcoin holder.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

US spot Bitcoin ETFs collectively hold $68.47 billion worth of assets, which is 4.9% of Bitcoin’s supply. In just two weeks, these ETFs have recorded $3 billion in netflows.

As Bitcoin attracts new interest from both retail and institutional investors, its market dominance over altcoins has continued to soar. At press time, Bitcoin’s dominance stood at 60% while the altcoin season index had dropped to 27.

- Bitcoin has climbed to a 20-week high above $71,000 amid positive market sentiment.

- With 98% of holders in profits, FOMO could propel BTC to a new ATH before the end of Uptober.

Bitcoin [BTC] has been trending up this month and recently reached a 20-week high above $71,500. At press time, BTC traded at $70,900 and was only 3.7% shy of its all-time highs.

Several bullish indicators currently suggest that Bitcoin could form a fresh ATH before the end of “Uptober” amid positive market sentiment.

Bitcoin UTXO Realized Price

A look at the Bitcoin UTXO Realized Price for short-term holders suggests that prices could continue to rise in the short term.

Per CryptoQuant, the UTXO Realized Price for wallets that have held BTC for under a month is close to surpassing that of wallets that have held Bitcoin for between three to six months.

Past crossovers have often preceded significant price increases. A similar crossover is about to happen, which could strengthen the bullish narrative around BTC.

Source: CryptoQuant

Short-term holders usually determine the sustainability of a rally. Therefore, if new transactions start occurring at higher prices, it will boost market sentiment and pave the way to an ATH.

98% of holders are in profits

Data from IntoTheBlock shows that 98% of BTC holders are sitting in profits while 1.26% are at a break-even point.

Source: IntoTheBlock

When wallet profitability increases, it boosts investor confidence as holders become more willing to hold their assets rather than sell. This scenario can also stir the fear of missing out (FOMO). As a result, new buyers could enter the market, reinforcing the uptrend.

FOMO is already evident as the Fear and Greed Index sits at 72. This shows that the market is in a state of greed.

Rising demand for BTC ETFs

On 28th October, US spot Bitcoin exchange-traded funds (ETFs) recorded their highest inflows in two weeks. Per SoSoValue, inflows during the day came in at $479M, with Blackrock taking the largest share with $315M inflows.

Source: SoSoValue

As AMBCrypto reported, BlackRock’s BTC holdings have surpassed 400,000 coins, with the asset manager being on track to flipping Satoshi and becoming the largest Bitcoin holder.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

US spot Bitcoin ETFs collectively hold $68.47 billion worth of assets, which is 4.9% of Bitcoin’s supply. In just two weeks, these ETFs have recorded $3 billion in netflows.

As Bitcoin attracts new interest from both retail and institutional investors, its market dominance over altcoins has continued to soar. At press time, Bitcoin’s dominance stood at 60% while the altcoin season index had dropped to 27.

buy clomid without prescription can i order cheap clomiphene pills order clomid pills clomid order clomid bula homem where to get cheap clomid without prescription how to buy cheap clomid without dr prescription

Thanks on putting this up. It’s well done.

azithromycin generic – buy sumycin paypal buy generic flagyl online

rybelsus 14 mg cost – purchase cyproheptadine periactin for sale online

buy domperidone online cheap – buy motilium generic flexeril for sale online

how to get zithromax without a prescription – bystolic 5mg price order bystolic 5mg online cheap

order augmentin – at bio info ampicillin ca

buy generic esomeprazole – https://anexamate.com/ nexium capsules

warfarin canada – https://coumamide.com/ order cozaar 50mg generic

how to buy mobic – moboxsin mobic 7.5mg over the counter

best male ed pills – erection pills ed remedies

amoxil cost – buy amoxil pills order amoxicillin pills

buy cheap fluconazole – flucoan order fluconazole 100mg without prescription

buy cenforce 100mg pill – cenforce rs cenforce 100mg ca

cialis canada prices – what happens when you mix cialis with grapefruit? mint pharmaceuticals tadalafil

tadalafil citrate – cialis tadalafil tablets india pharmacy cialis

order zantac 150mg – https://aranitidine.com/# ranitidine 150mg cost