- Bitcoin’s hash rate has risen sharply since the halving

- BTC’s price decline adversely affected mining profitability too

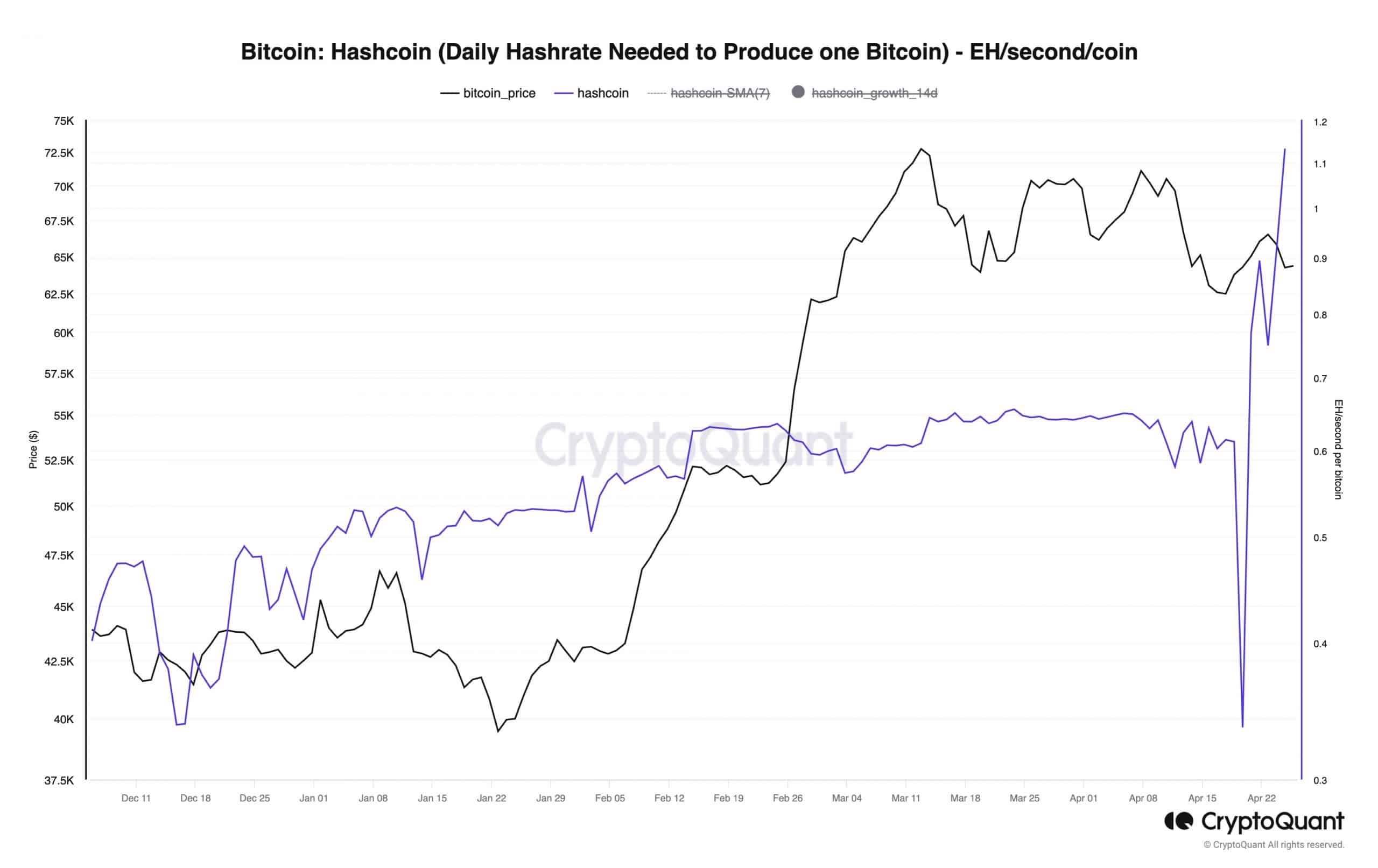

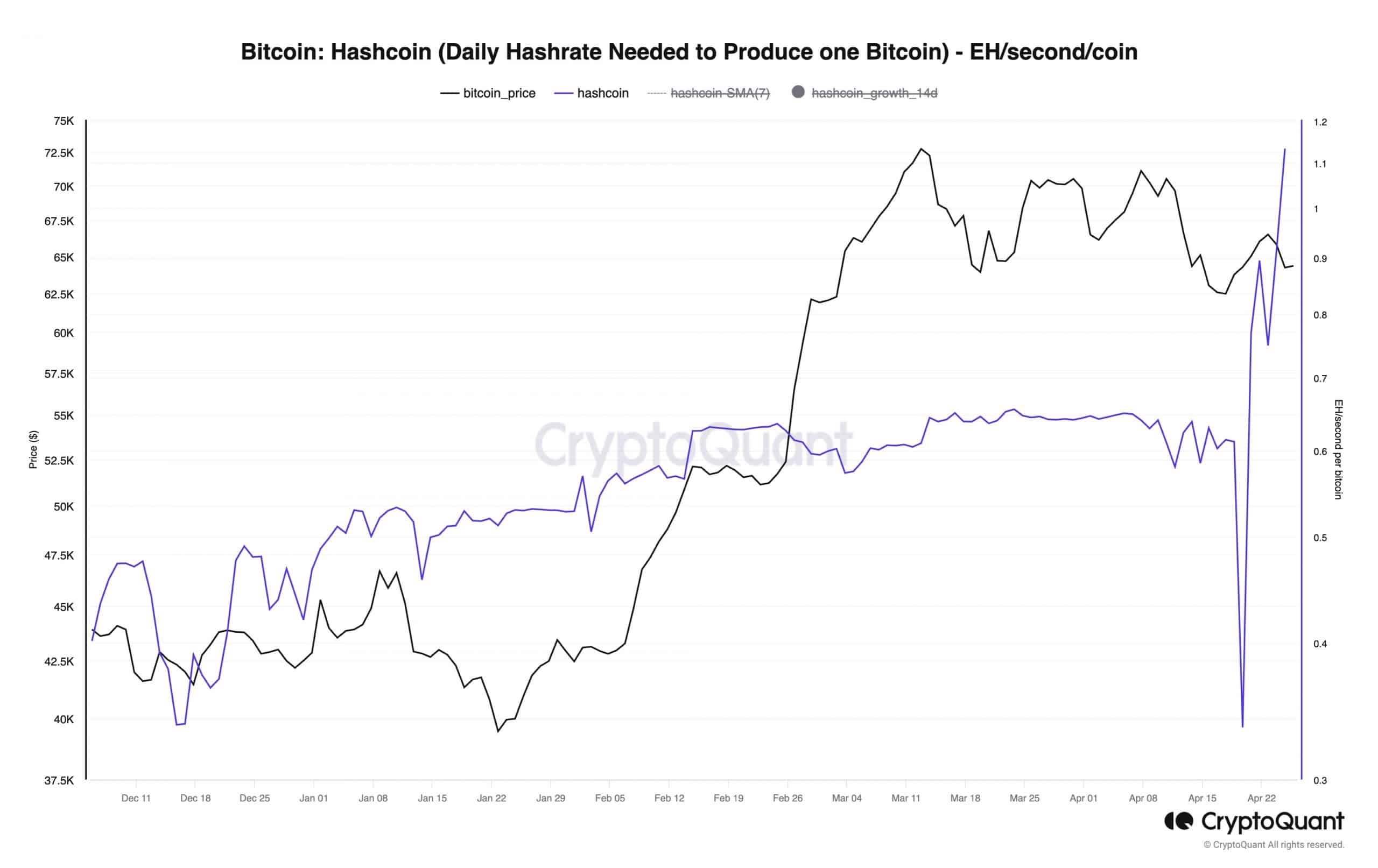

As expected, the cost of Bitcoin [BTC] mining has risen sharply since last week’s halving, creating problems for an industry already suffering from declining profit margins.

According to Julio Moreno, Head of Research at on-chain analytics firm CryptoQuant, the hash power required to produce one Bitcoin per day has now surpassed 1 exahash per second (EH/s) for the first time in history.

Source: CryptoQuant

Halving increases miners’ expenses

Halvings attack a vital component of miners’ revenue – Fixed block rewards. The latest one slashed the incentives from 6.25 BTC to 3.125 BTC per block. In simpler words, after each halving, miners have to double their mining investments to break even.

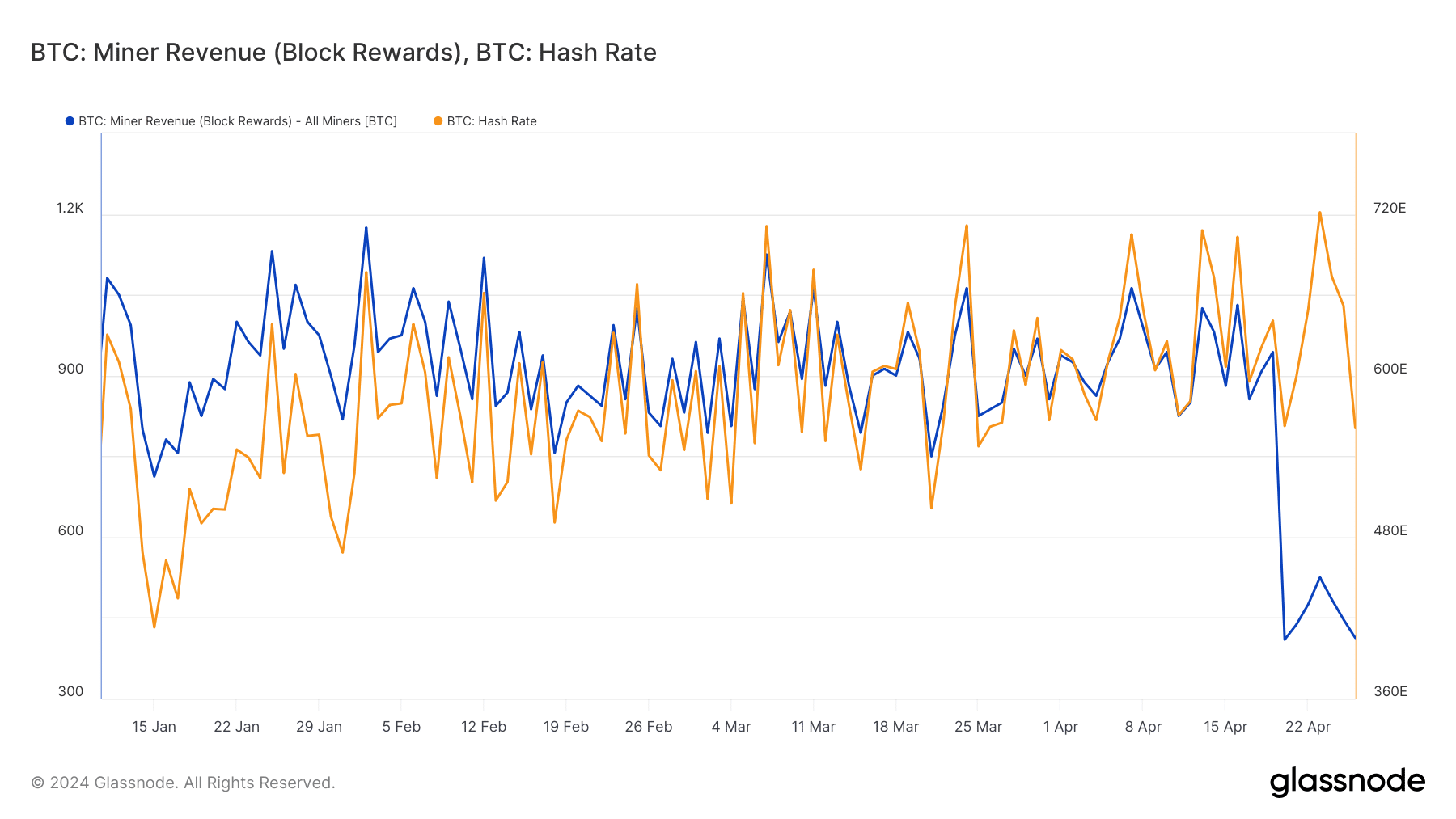

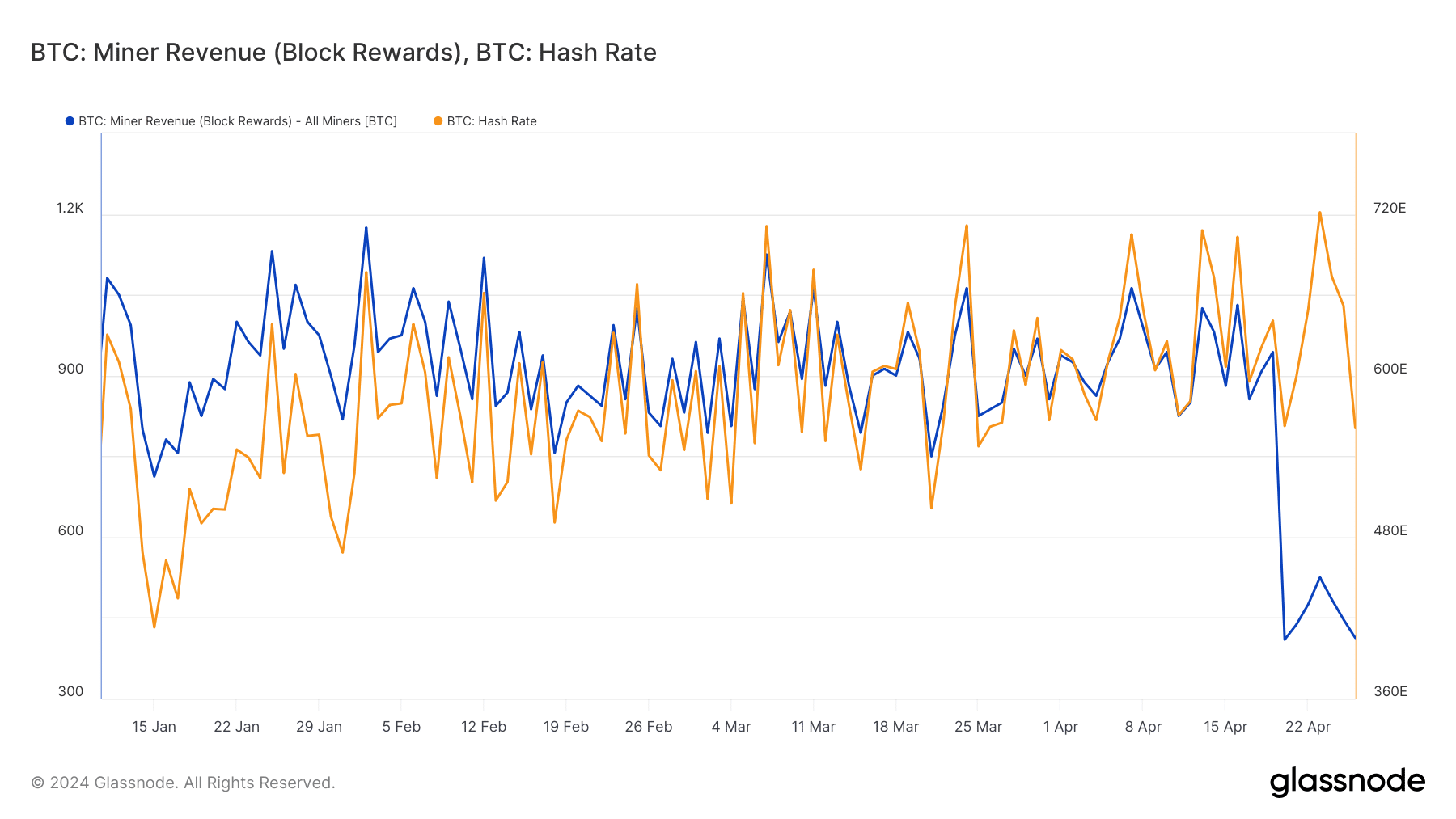

This was further scrutinised by AMBCrypto with the help of Glassnode data. The total number of Bitcoins produced fell from an average of 900/day before the halving to between 400 and 500 since the event.

Alongside the same, the hash rate (The computational power needed to create new blocks and add them to the Bitcoin ledger) rose significantly, hitting 721 EH/s earlier in the week.

Source: Glassnode

Bitcoin’s price decline has a bearing

What has added to their woes is Bitcoin’s unimpressive show on the price charts. After a brief bullish impulse, the king coin slipped, with the crypto down 1.63% at press time, according to CoinMarketCap.

In fact, because of the aforementioned slump, hashprice, which is a barometer of Bitcoin mining profitability, fell by 72% over the week.

Source: Hash Rate Index

Is your portfolio green? Check out the BTC Profit Calculator

Will fees come to the rescue?

While block rewards may be becoming an unviable revenue stream for miners, there is much to look forward to from transaction fees.

AMBCrypto reported previously how the Runes protocol led to an astronomical surge in fees immediately after the halving, helping offset the losses from the halving. In fact, around 3/4th of the cumulative miner earnings from halving day were composed of fees paid by users.

- Bitcoin’s hash rate has risen sharply since the halving

- BTC’s price decline adversely affected mining profitability too

As expected, the cost of Bitcoin [BTC] mining has risen sharply since last week’s halving, creating problems for an industry already suffering from declining profit margins.

According to Julio Moreno, Head of Research at on-chain analytics firm CryptoQuant, the hash power required to produce one Bitcoin per day has now surpassed 1 exahash per second (EH/s) for the first time in history.

Source: CryptoQuant

Halving increases miners’ expenses

Halvings attack a vital component of miners’ revenue – Fixed block rewards. The latest one slashed the incentives from 6.25 BTC to 3.125 BTC per block. In simpler words, after each halving, miners have to double their mining investments to break even.

This was further scrutinised by AMBCrypto with the help of Glassnode data. The total number of Bitcoins produced fell from an average of 900/day before the halving to between 400 and 500 since the event.

Alongside the same, the hash rate (The computational power needed to create new blocks and add them to the Bitcoin ledger) rose significantly, hitting 721 EH/s earlier in the week.

Source: Glassnode

Bitcoin’s price decline has a bearing

What has added to their woes is Bitcoin’s unimpressive show on the price charts. After a brief bullish impulse, the king coin slipped, with the crypto down 1.63% at press time, according to CoinMarketCap.

In fact, because of the aforementioned slump, hashprice, which is a barometer of Bitcoin mining profitability, fell by 72% over the week.

Source: Hash Rate Index

Is your portfolio green? Check out the BTC Profit Calculator

Will fees come to the rescue?

While block rewards may be becoming an unviable revenue stream for miners, there is much to look forward to from transaction fees.

AMBCrypto reported previously how the Runes protocol led to an astronomical surge in fees immediately after the halving, helping offset the losses from the halving. In fact, around 3/4th of the cumulative miner earnings from halving day were composed of fees paid by users.

how can i get cheap clomiphene pill where to get cheap clomiphene pill how to get clomiphene no prescription where can i get generic clomiphene pill can you buy clomid pills clomid uk buy can i buy generic clomiphene

This is the big-hearted of writing I truly appreciate.

I am in truth delighted to coup d’oeil at this blog posts which consists of tons of profitable facts, thanks representing providing such data.

buy zithromax 250mg pills – order metronidazole 400mg sale buy flagyl 200mg generic

buy semaglutide paypal – rybelsus 14mg brand brand cyproheptadine 4mg

domperidone 10mg us – order sumycin 250mg online cheap where to buy cyclobenzaprine without a prescription

propranolol without prescription – clopidogrel online order methotrexate 5mg for sale

purchase amoxil online cheap – order ipratropium without prescription buy ipratropium 100mcg without prescription

azithromycin over the counter – buy tindamax generic brand nebivolol 20mg

purchase amoxiclav for sale – https://atbioinfo.com/ cost acillin

buy cheap generic nexium – anexa mate nexium tablet

buy warfarin without prescription – https://coumamide.com/ purchase cozaar for sale

purchase meloxicam generic – moboxsin mobic 7.5mg sale

deltasone 40mg pills – https://apreplson.com/ generic prednisone 20mg

top rated ed pills – https://fastedtotake.com/ best pills for ed

order escitalopram 20mg generic – order escitalopram online cheap lexapro without prescription

cenforce for sale online – https://cenforcers.com/ buy cenforce 100mg generic

buy tadalafil online no prescription – tadalafil tablets 20 mg side effects cialis 20 mg from united kingdom

us pharmacy prices for cialis – buy cialis no prescription overnight canada cialis for sale

buy zantac for sale – https://aranitidine.com/ buy zantac without a prescription

This is the kind of enter I turn up helpful. este sitio

This website really has all of the information and facts I needed adjacent to this subject and didn’t identify who to ask. https://buyfastonl.com/isotretinoin.html

More articles like this would frame the blogosphere richer. https://ursxdol.com/doxycycline-antibiotic/

Palatable blog you have here.. It’s hard to find great status script like yours these days. I truly recognize individuals like you! Withstand vigilance!! https://prohnrg.com/product/atenolol-50-mg-online/

This is the compassionate of scribble literary works I positively appreciate. aranitidine

This is the stripe of topic I enjoy reading. https://ondactone.com/simvastatin/

More text pieces like this would create the web better. buying motilium

This is the description of topic I have reading. http://forum.ttpforum.de/member.php?action=profile&uid=425020

dapagliflozin cheap – https://janozin.com/# buy forxiga 10 mg online

buy xenical for sale – click xenical price

More posts like this would force the blogosphere more useful. https://myrsporta.ru/forums/users/aliki-2/